$12 OR $3 CORN? WHICH WILL MOTHER NATURE GIVE US

WEEKLY GRAIN NEWSLETTER

Here are some note so fearless comments for www.dailymarketminute.com

"In Gratitude: A Tribute to our Heroes this Memorial Day"

As we gather with our families and friends this Memorial Day, let us take a moment to remember and honor the brave individuals who have made the ultimate sacrifice for our nation. We cherish the freedom and peace they have secured for us with their lives, and today we commemorate their heroism with deep reverence and gratitude.

In the heartland of America, amid the golden waves of grain, we find another kind of hero - our farmers. Their tireless dedication and unwavering resilience often echo the values that our service members uphold. Farming, like service to the country, requires a commitment to the greater good, a love of the land, and a deep-seated belief in the future.

Farmers rise before dawn, tending to the fields come rain or shine, nurturing the crops that feed our nation. They, too, are warriors in their own right - battling the elements, overcoming adversity, and constantly innovating to ensure our food security. Their ceaseless dedication to their craft is a testament to the same spirit of service and sacrifice that our heroes in uniform embody.

Just as our brave servicemen and women stand on the front lines to protect our freedom, farmers stand on the front lines of food production, their labor fostering the prosperity of our nation. And just as we owe our liberty to our fallen heroes, we owe our sustenance and livelihood to the diligent hands of our farmers.

This Memorial Day, as we pay our respects to those who have fallen in defense of our nation, let us also honor our farmers, whose quiet heroism nourishes our nation from its very roots. The fruits of their labor grace our tables each day, reminding us of the noble spirit of service that binds our nation together.

As we bow our heads in tribute, let's not forget the fields that stretch out under the vast sky, whispering the story of our land. A story of sacrifice and service, of hardship and triumph, of love for the land and the people it sustains. It is the story of our soldiers. It is the story of our farmers. It is the story of America.

May we forever remember and honor our heroes, those in uniform and those in the fields, for their service and sacrifice. On this Memorial Day, we extend our heartfelt thanks to you all.

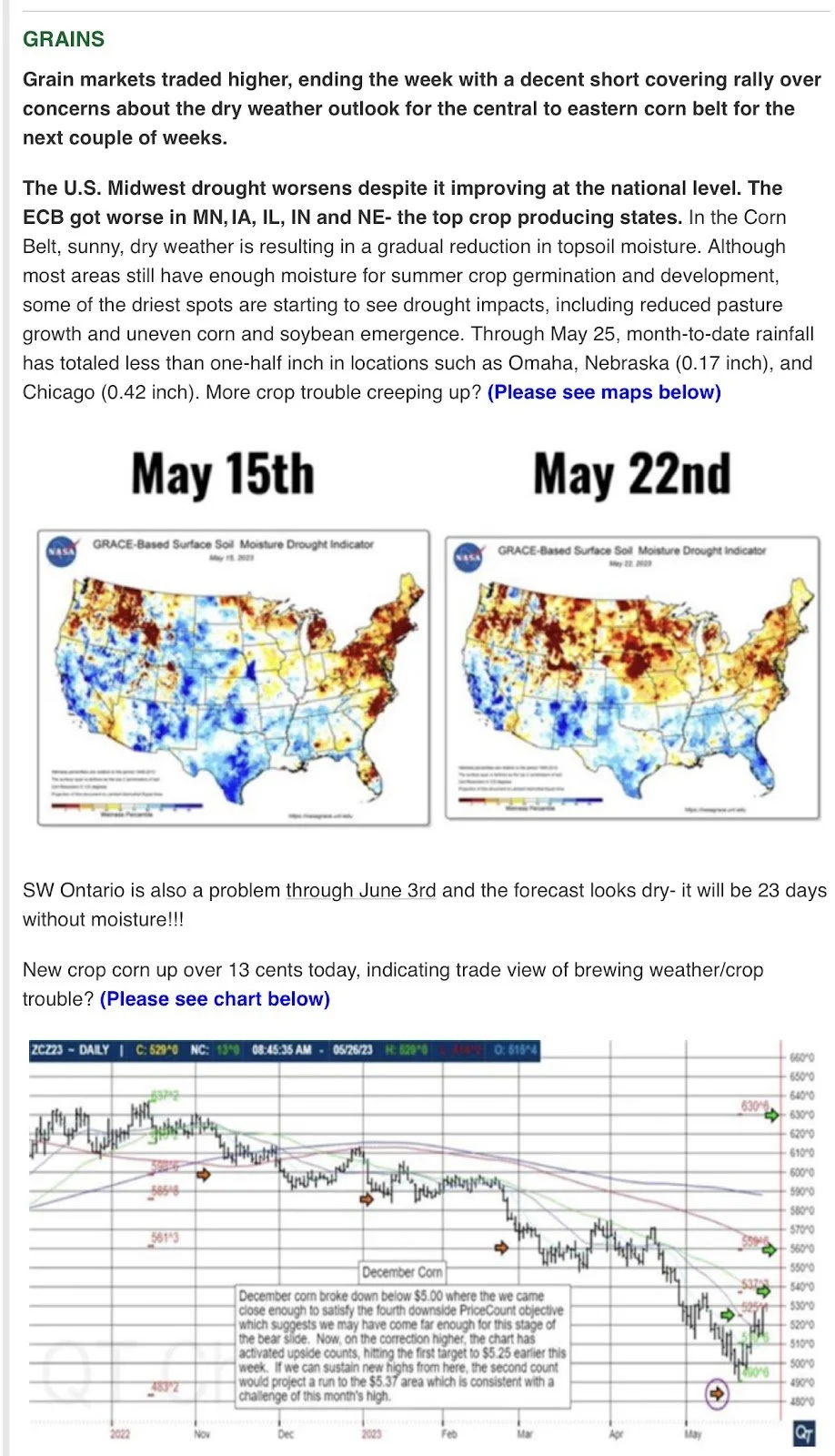

If rain makes grain, what does limited rain do to production?

That’s the big billion dollar question, when does it have to start raining to save this crop. We have never killed a corn crop before with a drought in May. Heck we have never killed a corn crop before with a drought in June? Have we?

Now are we about to experience the first time? With the lack of subsoil moisture, how long can the crop survive without being damaged? How much damage can be done in early June? Can it be offset by better July weather?

I ask these questions making an assumption that we are going to send out our newsletter on Sunday of the three day weekend. Knowing very well that forecasts will change and perhaps dramatically over the next 24-48 hours. So will what I write make an ass out of me, if I assume wrong? It might, so just be aware as you read this that we are in a weather market and sometimes weather changes fast and without warning.

Let’s start off with a couple precipitation outlook maps. These are bullish. Very bullish with the dry weather forecasted for the corn belt and in particular the I states.

Here are a couple of maps that show a possible trend change. The first is the 6-10 day temperature outlook. This itself is rather bullish, but when you add in the second map, you notice that the heat has moved and the coolness has expanded.

The two maps above when combined are mixed to bearish. Now by the time the markets open back up Monday night and probably more important will be forecasts come Tuesday night after we get the first crop condition report. So watch these maps, we will update requalry on social media and as we send out updates.

The bottom line is that these maps are indicating that we are having a possible trend change. What I will be watching is will this lead to moisture increasing in the eastern corn belt. As that is what some of the meteorologists that we follow are saying will happen. “By the middle of June it will start to rain and El Niño will make a big crop.”

These maps don’t make me want to panic sell, but they do remind me that I want to be prepared to protect this rally. So make sure you have a hedge account open and ready should you need to use it to help get comfortable.

Here is a link to open a hedge account with myself or Wade. Feel free to give us a call with questions. 605-295-3100 or 605-870-0091.

https://www.dormanaccounts.com/eApp/user/register?brokerid=332

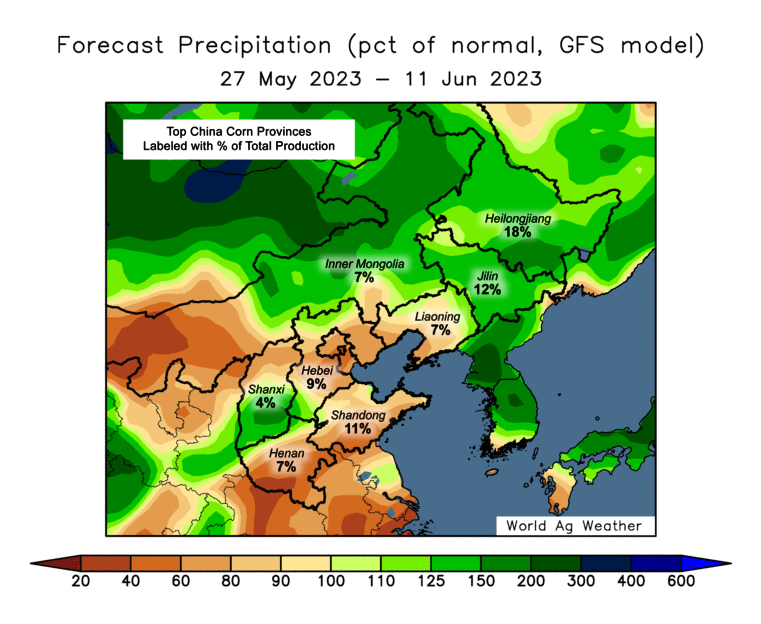

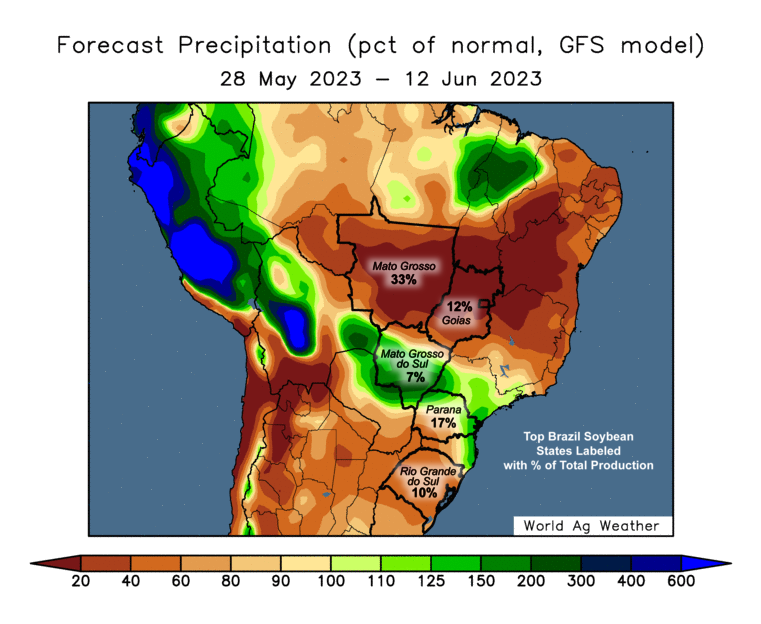

Here are a couple more maps that are rather bullish. First is the forecast which is bullish, but this is part of the reason we have rallied. So the real question becomes. Will we damage the crop over the next few weeks and will the trend change like the temperature forecast indicates could happen?

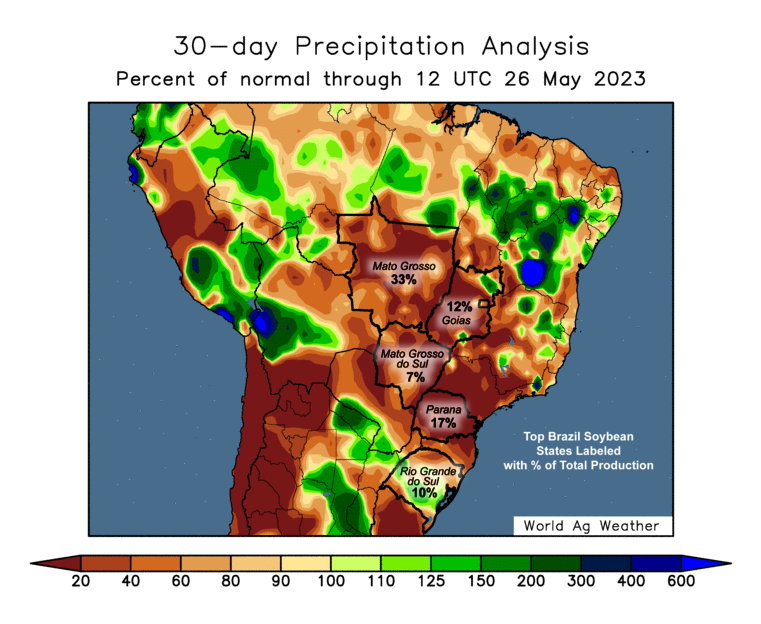

Here is the past 30 days of precipitation versus normal. If a month from now is map still has brown and tan in the I states we will be tremendously higher then we presently are.

If the map above has got darker tint and the map below is also darker with more brown and less green we will be north of 7.00 corn on our way to new all time highs.

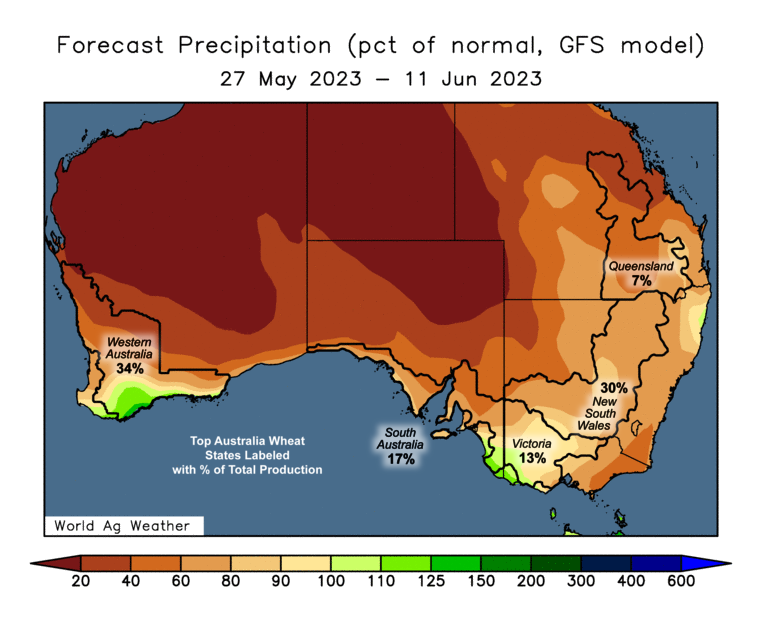

Here are a couple other maps that are on the radar. Australia has had a couple of back to back record crops.

Look at the next couple of maps.

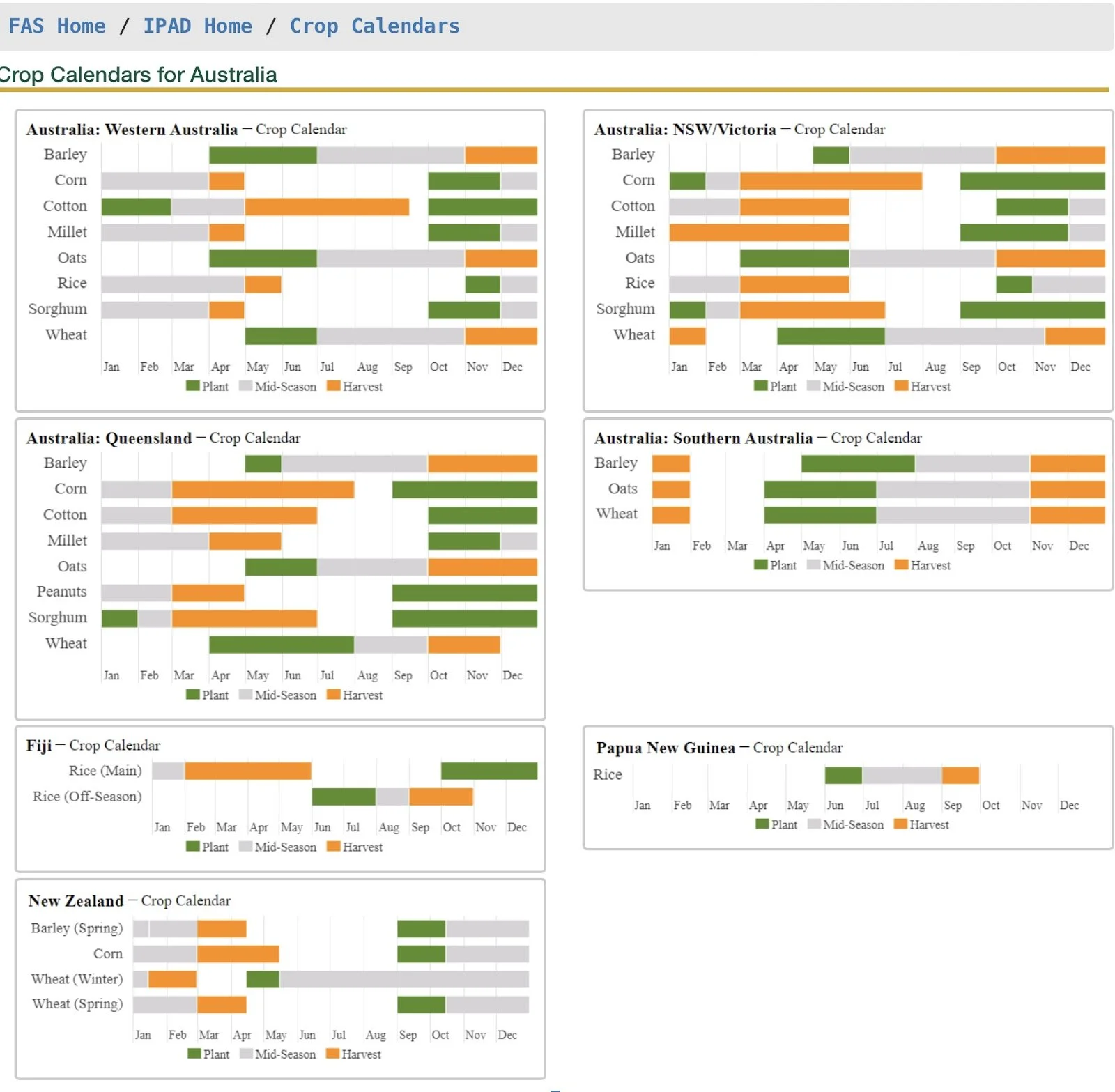

Here is a USDA crop calendar chart for Australia.

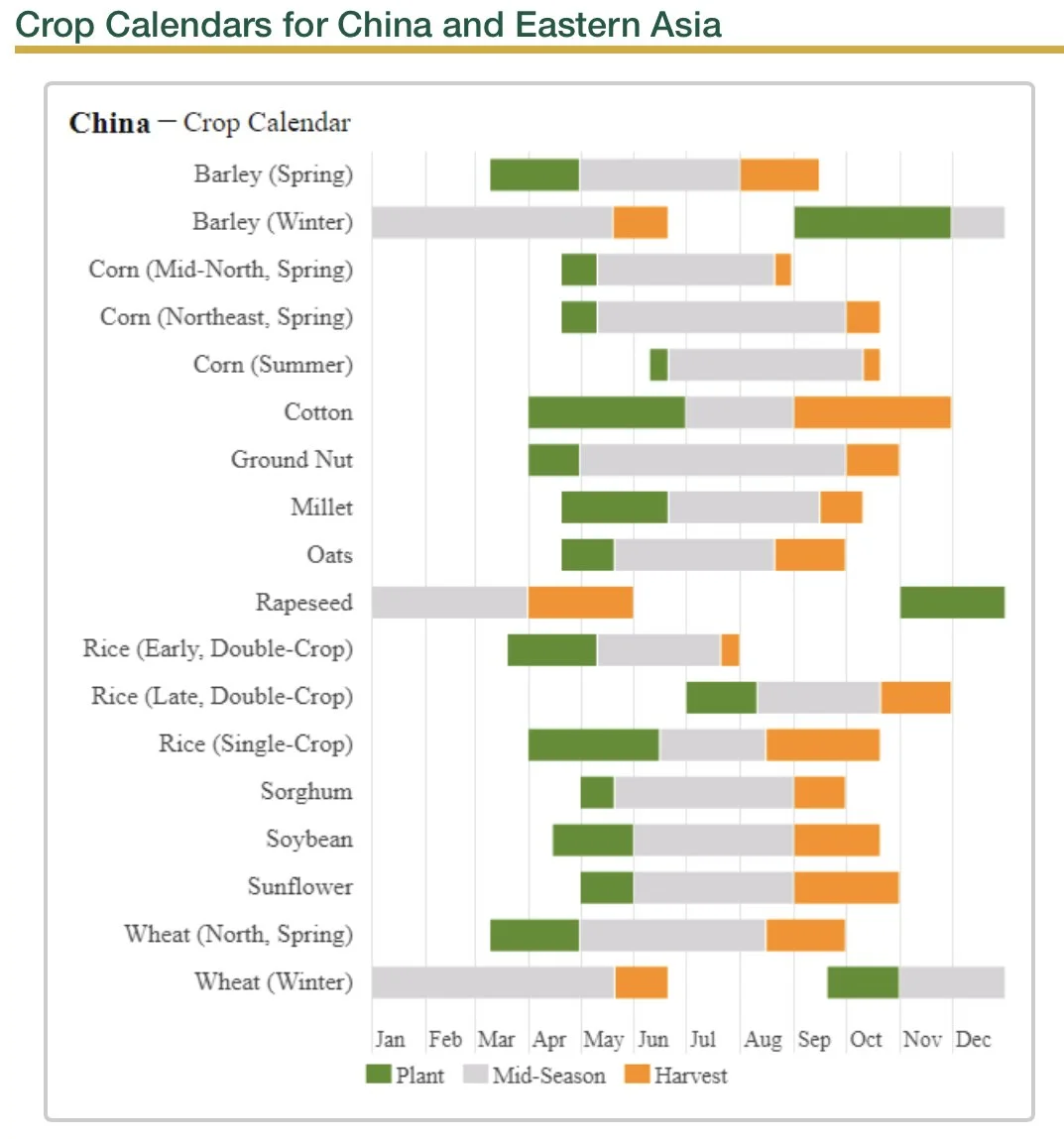

Here is one for China.

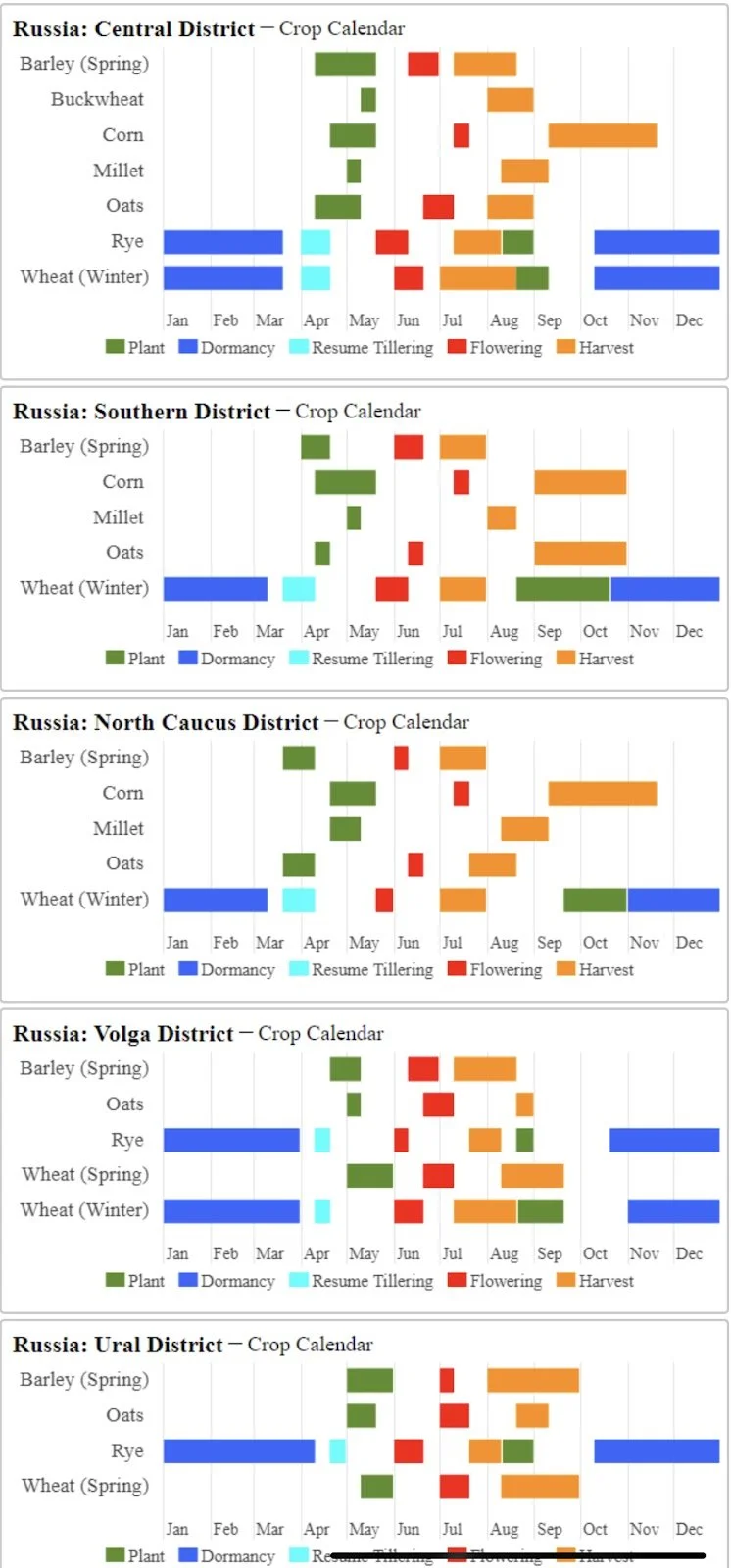

Here is the Russia crop calendar.

Below are a couple of weather maps for Russia.

How many times do you as farmers check the weather a day? I know the older I get and the more experience and humbleness that I get from my experiences in the grain markets the more one realizes that one needs to understand that we have global markets. Knowing that it isn’t just our own backyard, our own state, nor just the USA.

I am still trying to find “the best meteorologist or weather guru”, so please share with us who you use and why you like them.

The bottom line with all of the above is the fact that weather is bullish today. It is bullish in plenty of spots around the world.

Here are just a few more, Brazil's second corn crop should be feeling a little stress, especially the areas that got planted late.

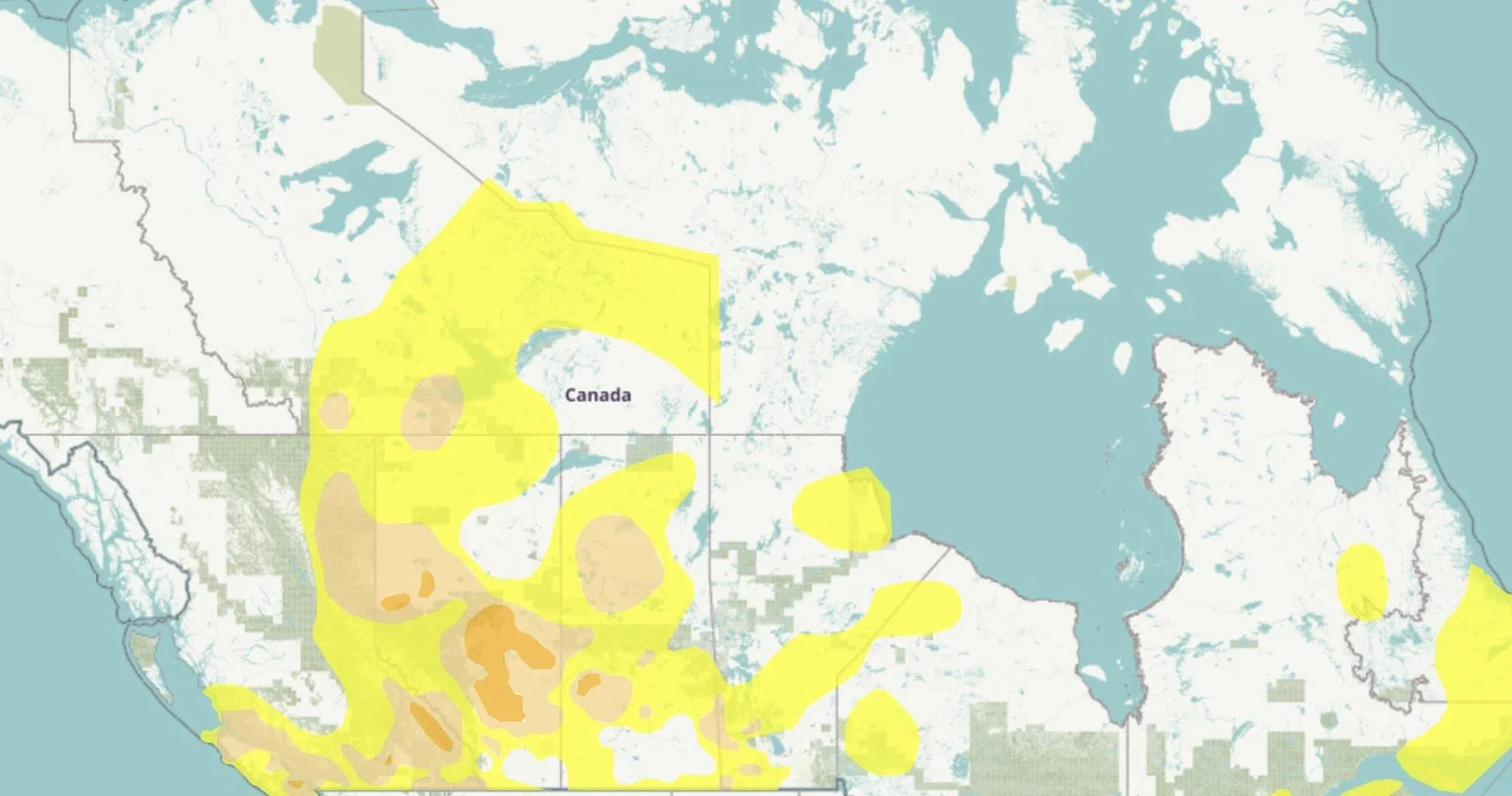

Here is Canadian drought monitor

I mentioned above how the weather is bullish today. The billion dollar question is will the weather be bullish come Monday night? Will it be bullish in a week or in a month?

I have publicly said that I think that we have a chance to see the corn market trade limit up on June 4th. I know that is a possibility but I also know that it is a possibility that we trade limit down and it’s more probable that neither happens. The next several Sundays could be volatile for prices and the longer the present dry trend continues the more volatile the price action should become with the ever changing forecasts.

Right now I see the possibility of the trend changing, but I am not convinced yet, so the trend change of weather is on my radar. But so is the possibility of the trend continuing. I can find “experts” that say the rain is coming. I find others that say it will be too little too late.

The reality is I don’t know what one will be accurate, so I find myself not knowing how the weather will shake out. But I am comfortable knowing that, I realize the possibilities that if the rain comes and comes in a timely manner we could see corn very cheap. If the opposite happens and the dry weather continues we could see the price explode higher.

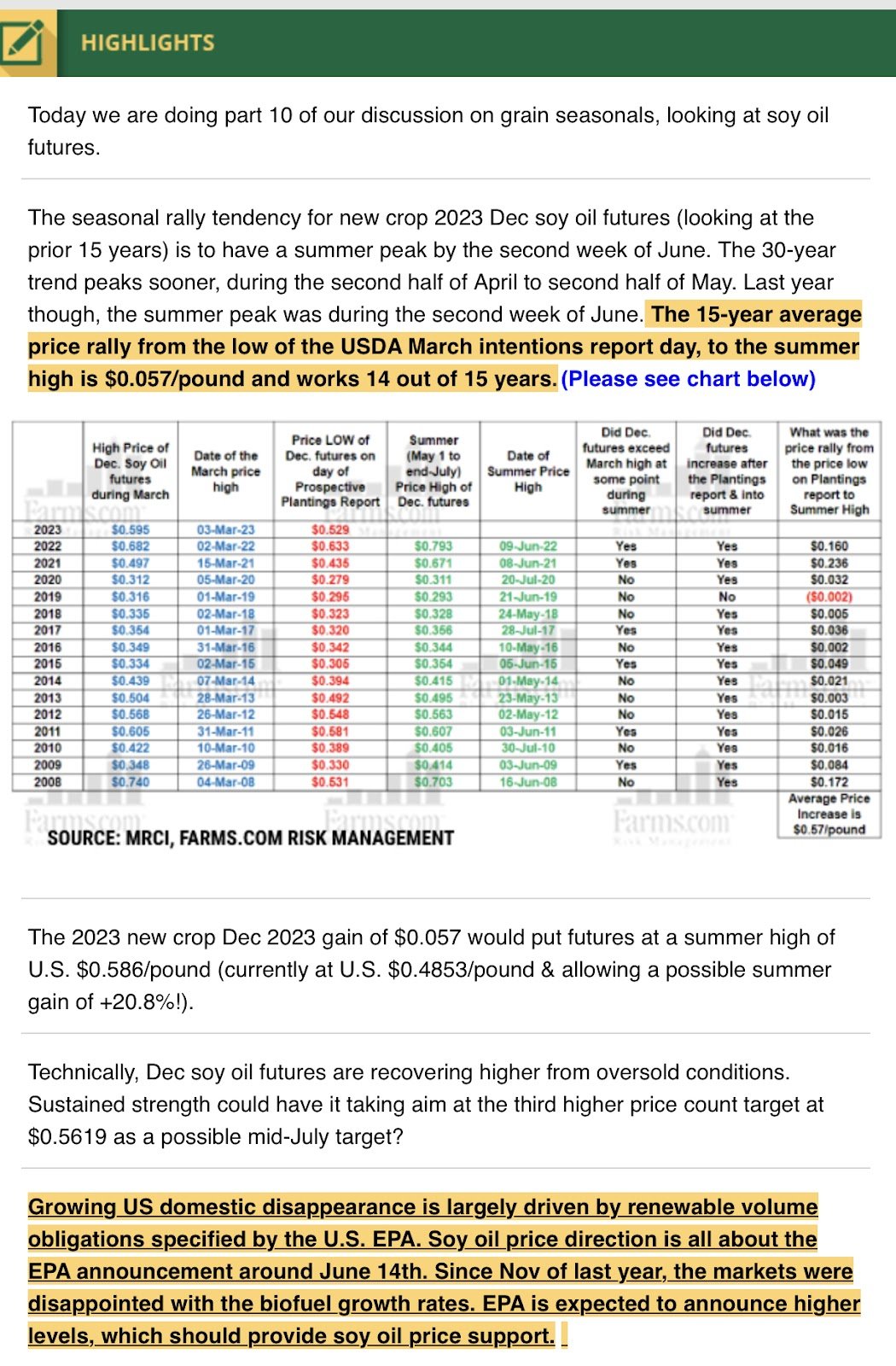

Sunflowers

The sunflower market has been a challenging ugly market. Below is from Farms.com risk management and it gives some hope for the bean oil market. (Based on seasonals that haven't worked well this year.) But the below does give some hope that bean oil has bottomed and will bounce. This wouldn’t hurt the sunflower market at all.