BEARISH WEATHER, RECORD SHORTS, & CHINA

Overview

Corn & beans slightly higher while wheat finishes lower. Overall quiet day with little volume in the markets as it is a holiday week. So expect the markets to stay quiet until next week.

Grains tried to rally early in the day off the back of some short covering, but ultimately closed well off our highs as weather in the US looks pretty ideal for the crops and bearish for the markets the next week or so.

Wheat was pressured from rains in Australia to go along with reports of better yields out in Russia.

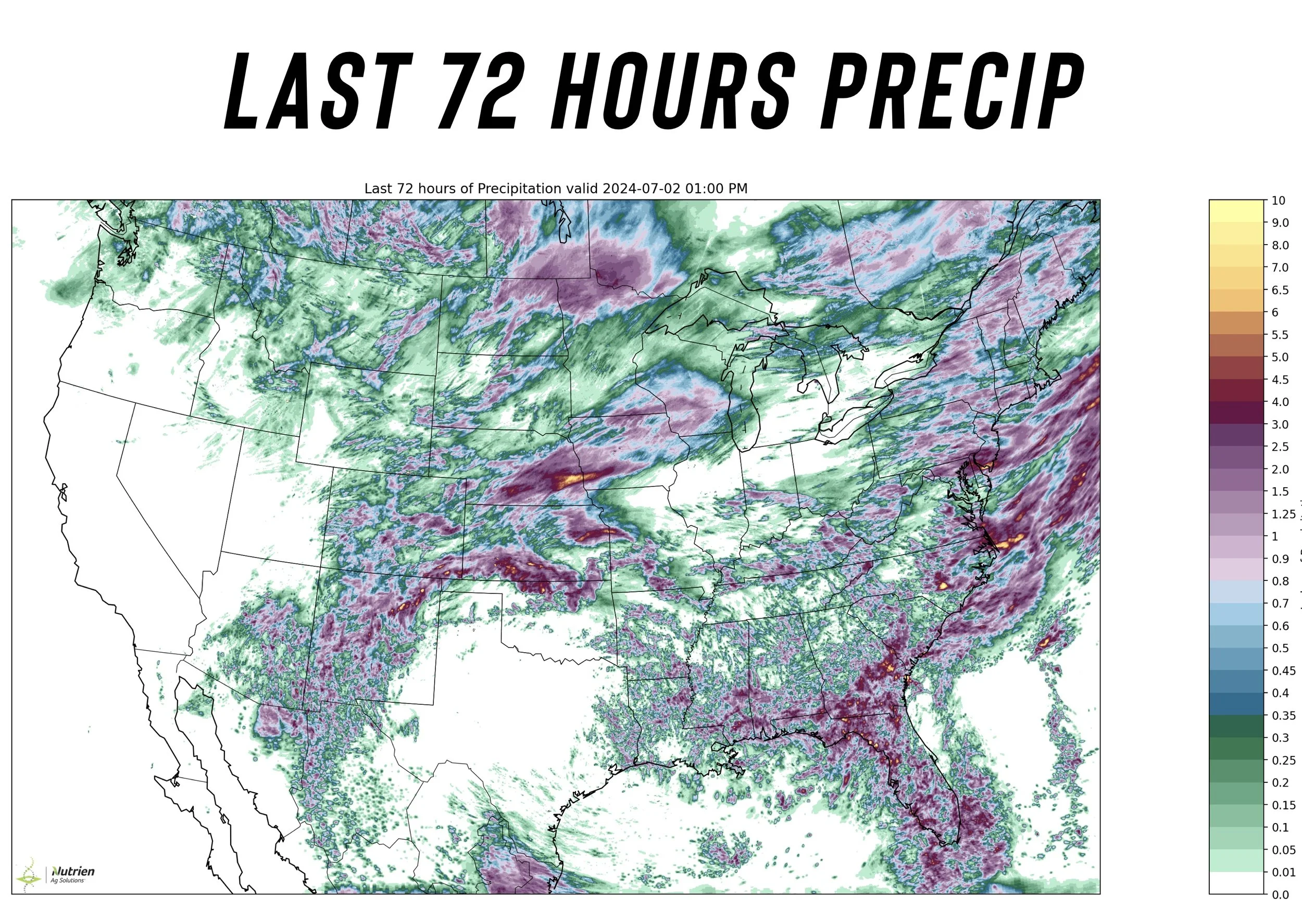

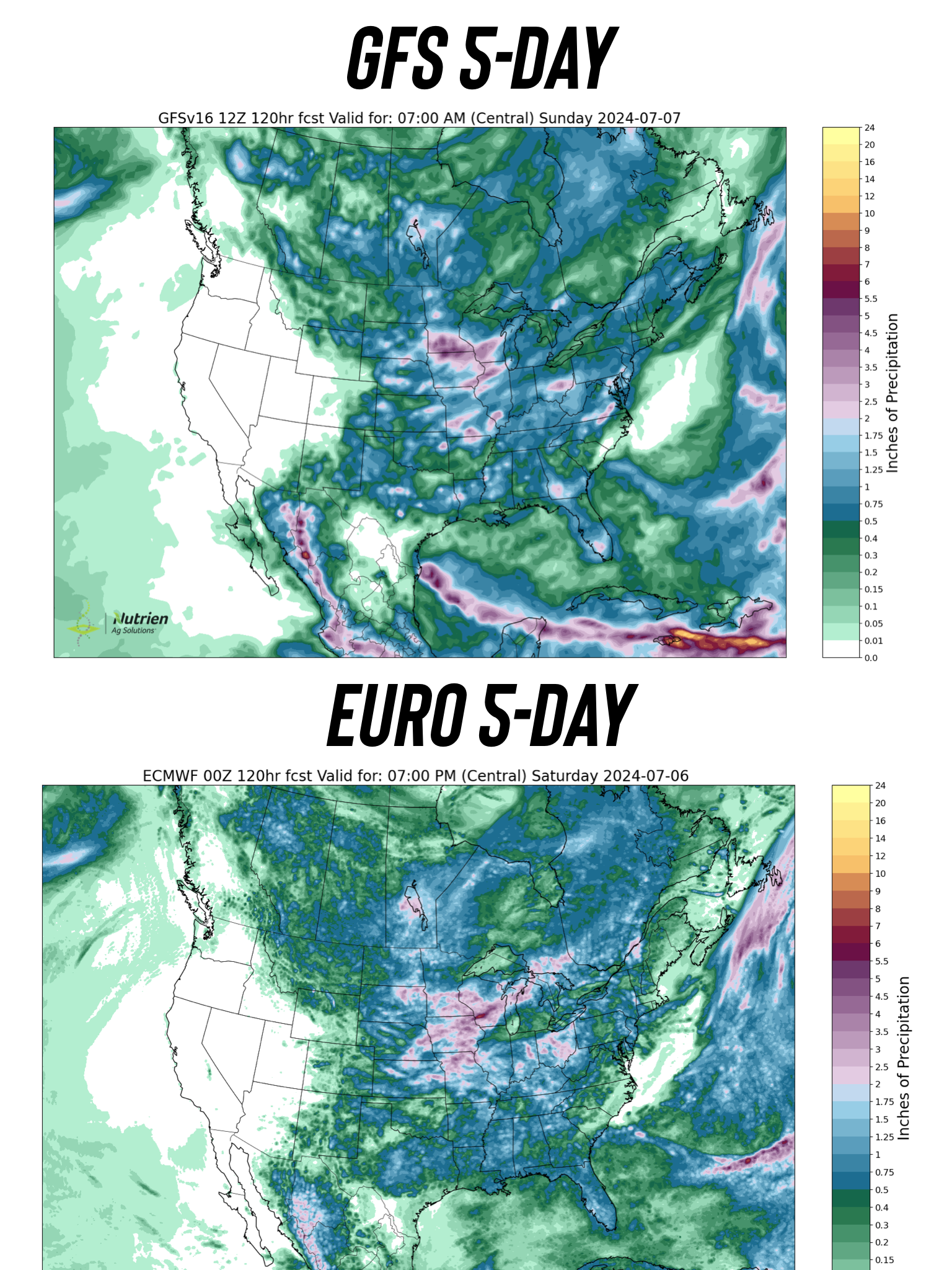

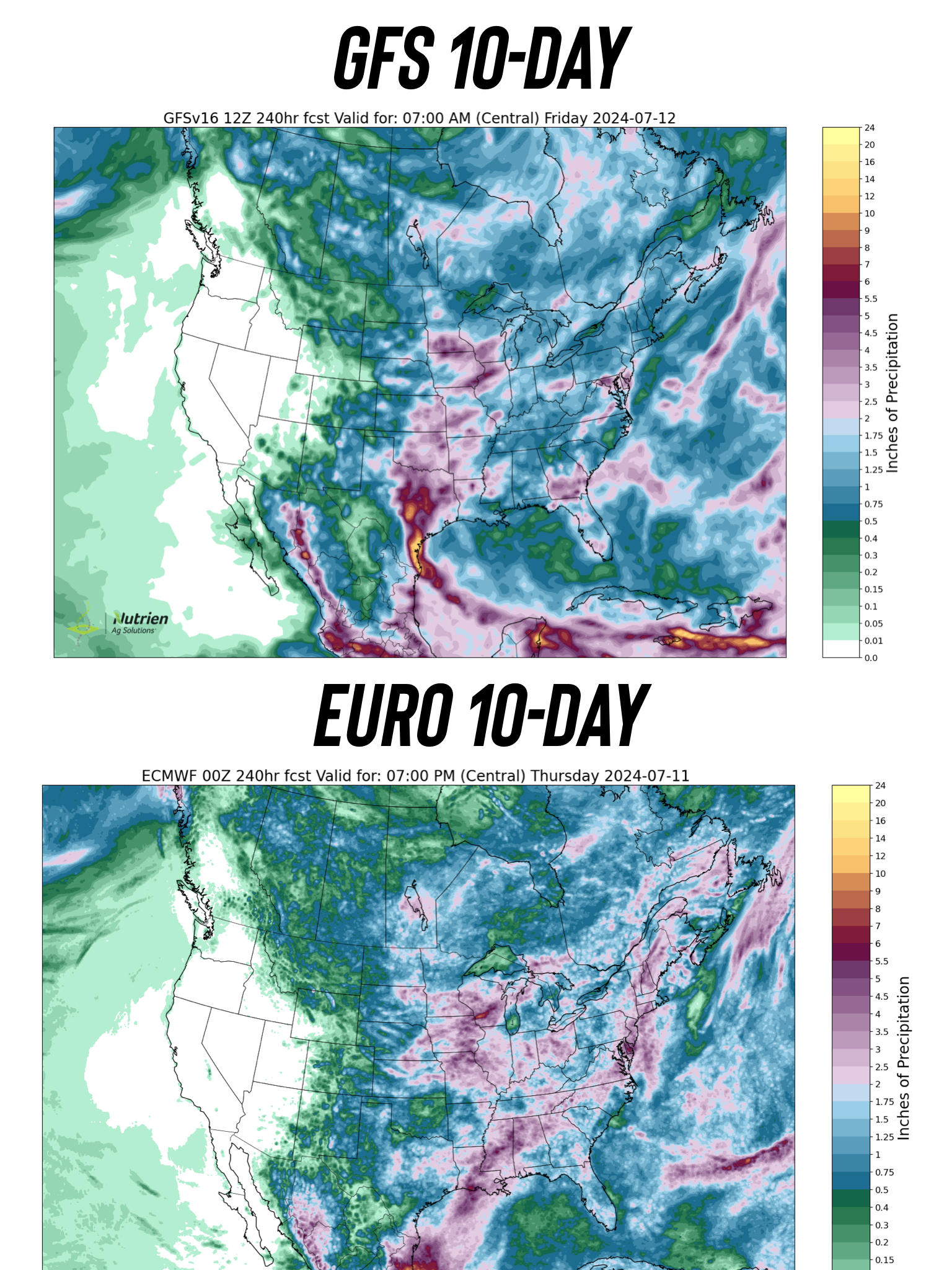

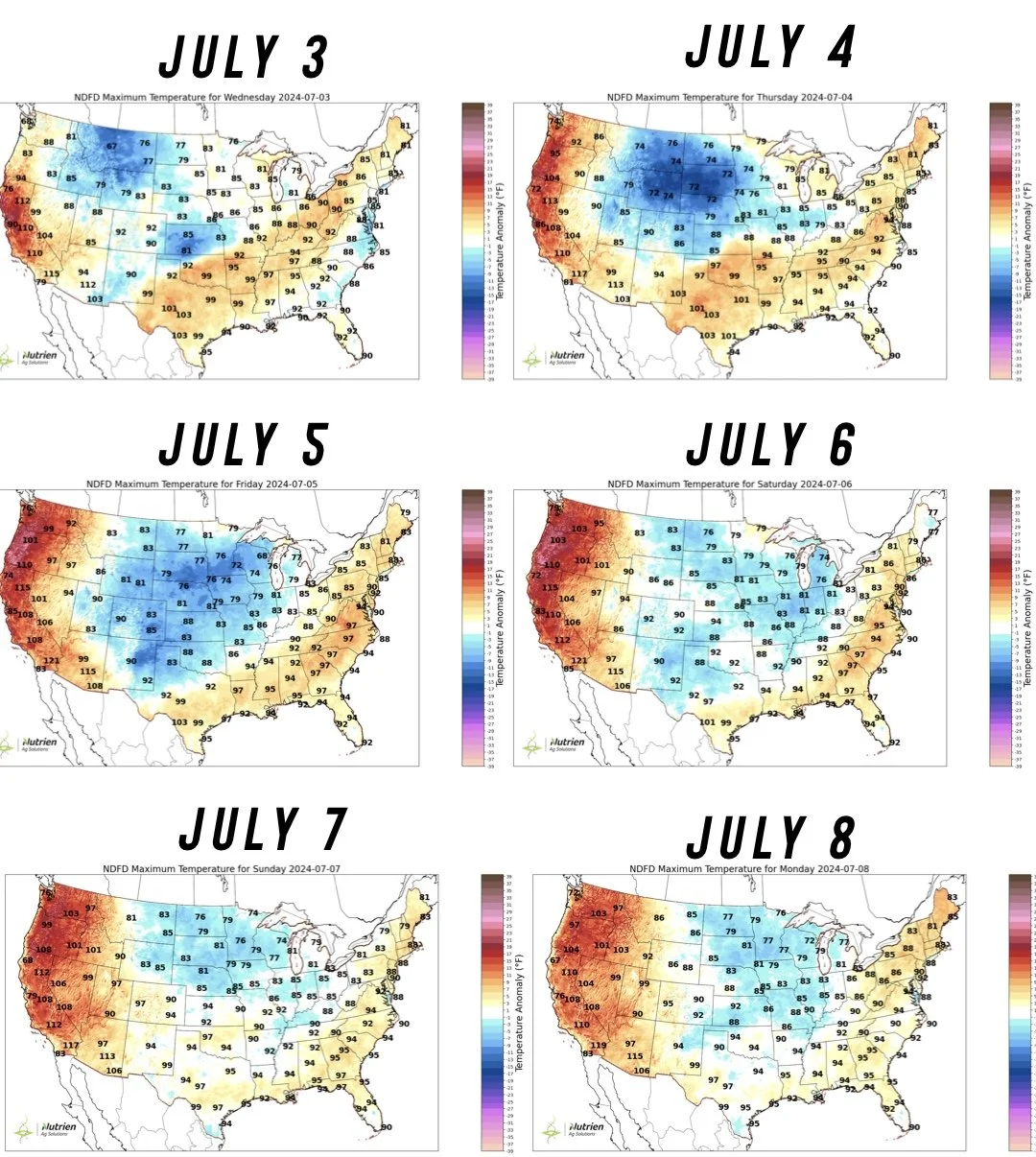

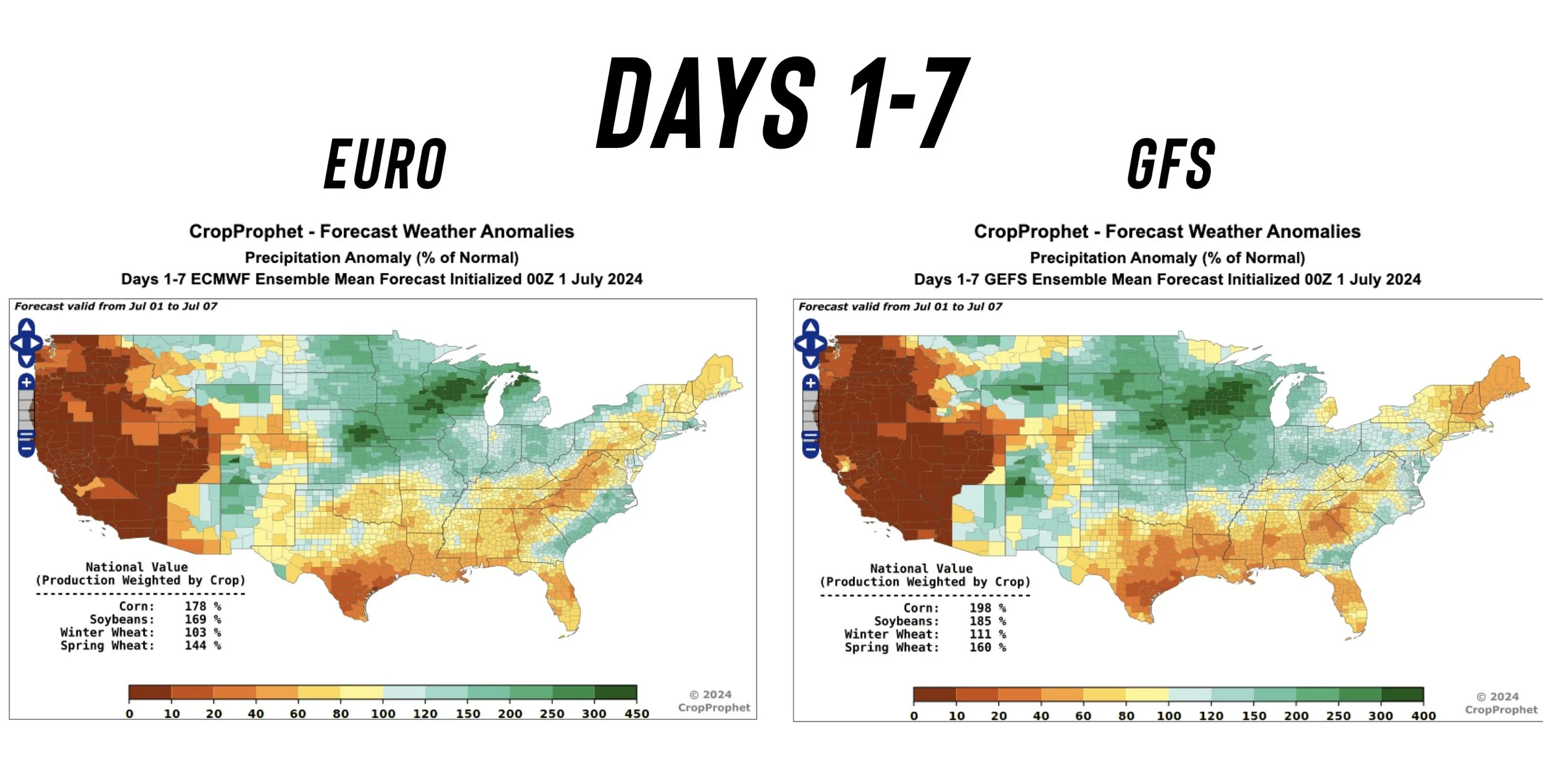

Here is the US forecasts.

They are pretty wet and are showing below average temps. Both of which are bearish for futures.

Despite areas such as Iowa, South Dakota, Minnesota getting even more unneeded rain, the markets thought process is that rain makes grain. Sure, some areas are getting too much. But even more areas are getting a perfect amount.

The eastern corn belt has been dry in comparison, but they too are expected to get decent rains.

Despite the bearish forecasts, the corn market has found some strength the past 2 days which is a friendly sign. Negative news but positive price action.

What might be even more important to the crops is that the next week is cooler than normal. Crops can handle some lack of moisture if the heat is not there.

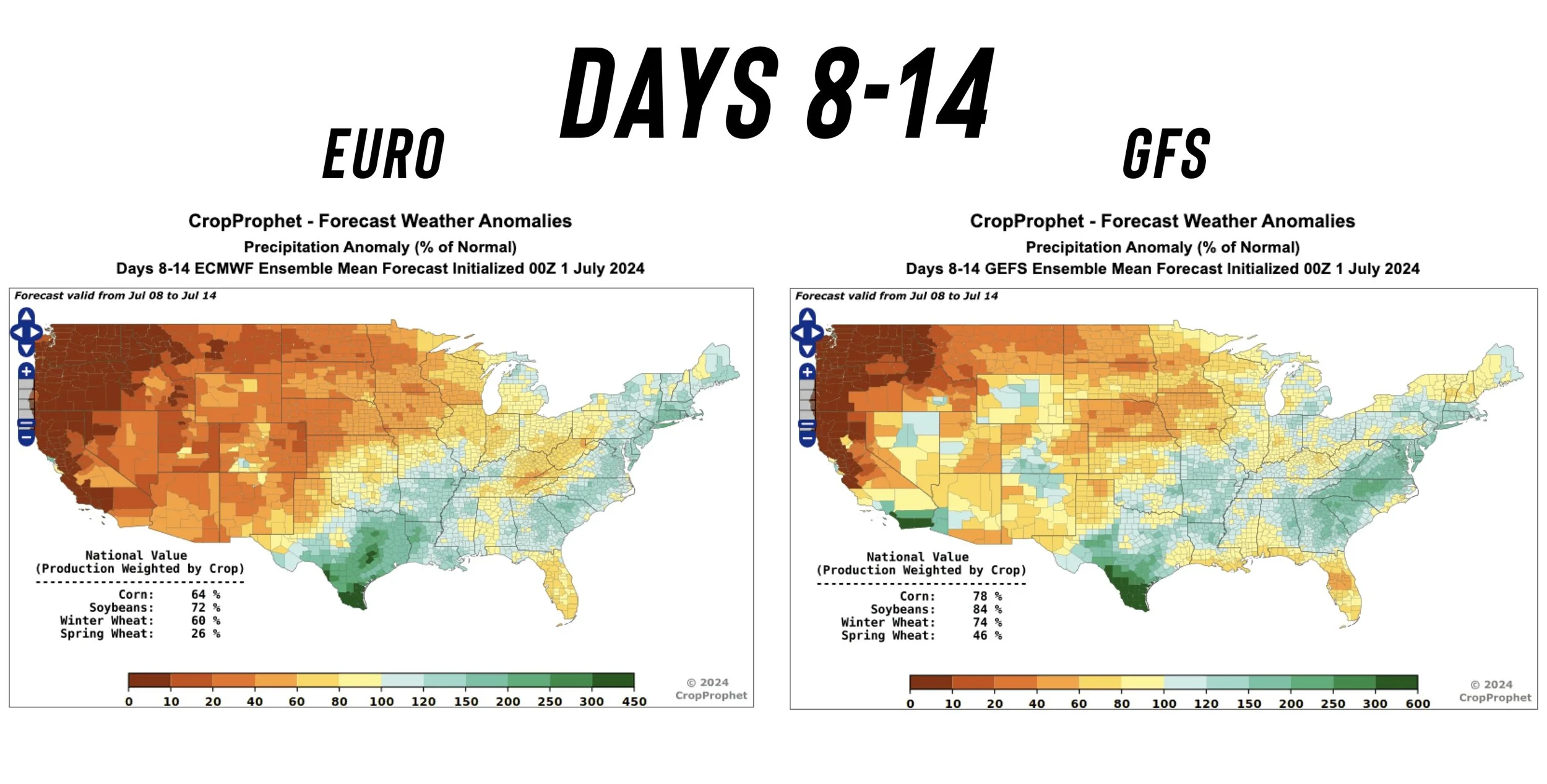

Here is a closer look from CropProphet. The next week is wet, after that it does look like it will dry out some.

These timely rains are making the likelihood of seeing that usual summer drought or weather driven scare very unlikely here. Which short term means unless we do get some weather event or demand story, we don’t have a reason to scream higher soon.

It is now July. Rain in the forecast is always going to be bearish.

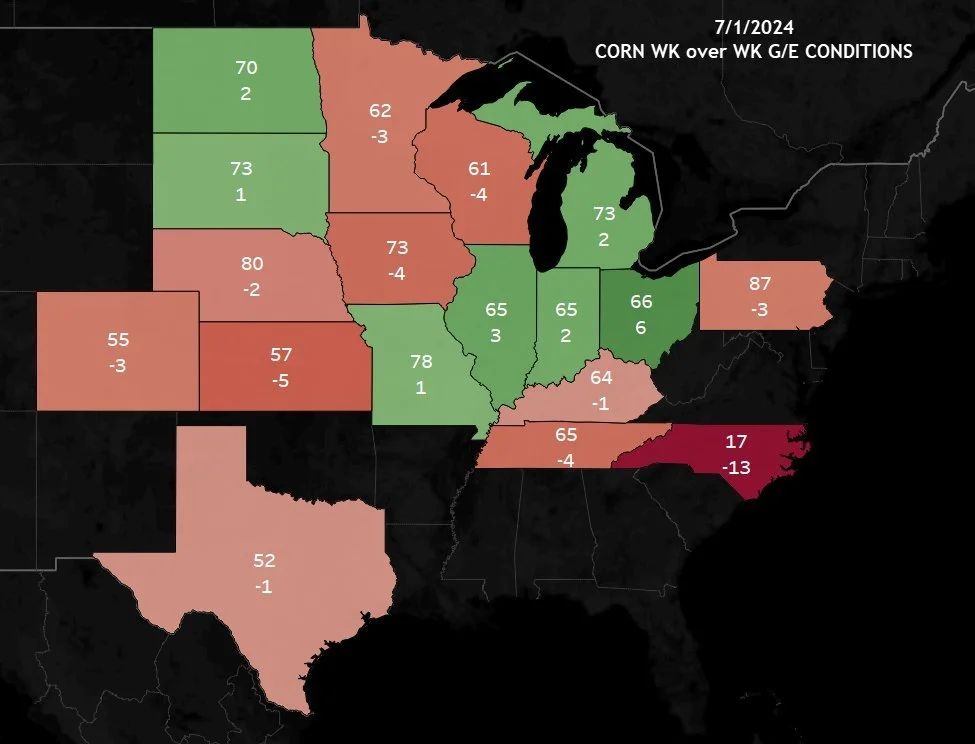

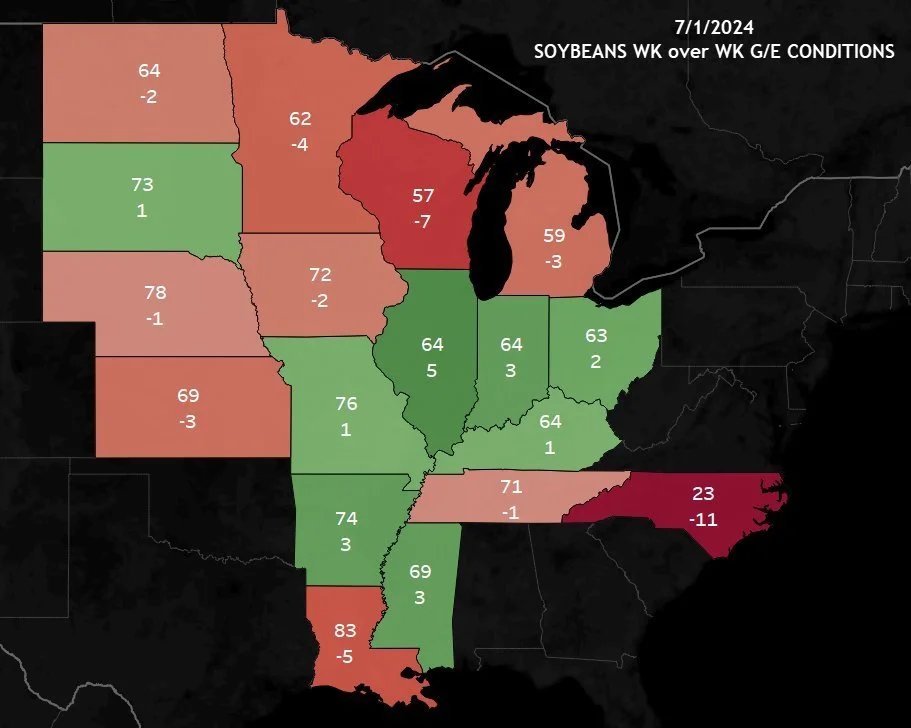

Crop Conditions

These were not much of a market mover.

Corn came in 1% worse than expected, beans 1% better than expected. Both came in at 67% G/E.

The areas that got too much rain such as Iowa and Minnesota are seeing some negative effects, while the eastern corn belt is seeing some improvements.

Both corn & bean ratings are the best for this week since 2020.

67% G/E is above average and is giving the markets some thoughts that perhaps trendline yield isn’t completely off the table. Although most would agree 180 isn’t happening.

Chart Credit: Darrin Fessler

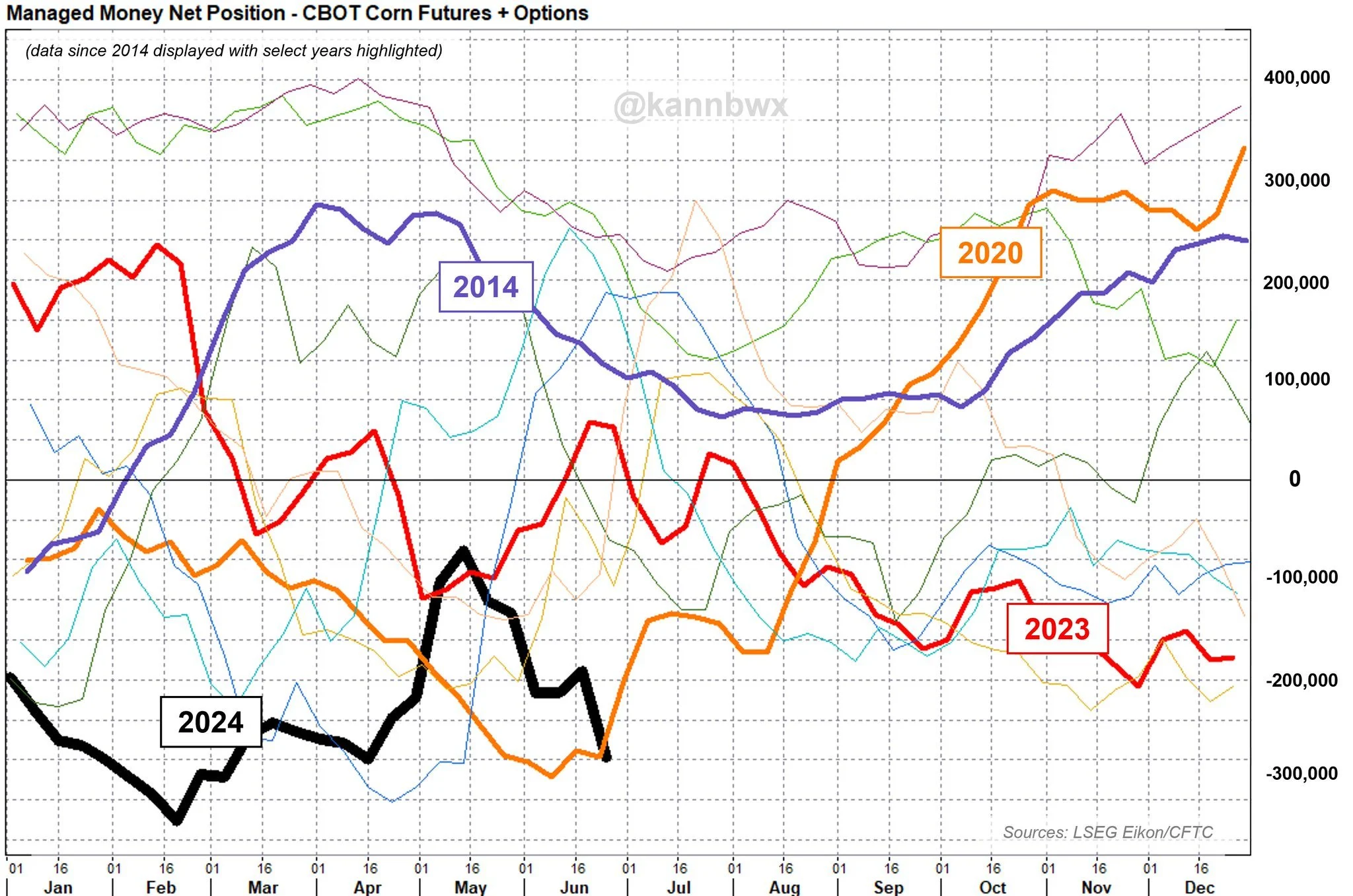

The Funds

The funds are holding massive short positions.

Prior to the report this was the positions:

Corn: -300k contracts

Beans: -130k contracts

Wheat: -70k contracts

This was before the report. So the funds are a lot shorter than that today.

Reports are saying the funds could be as short as -350k contracts of corn. This is a RECORD SHORT.

The previous record is -344k back in 2019.

I am not saying we are going to rally, but most think this is about as short as they can get.

The problem is they simply have no risk here with weather not being a risk.

From Mark Gold of Top Third:

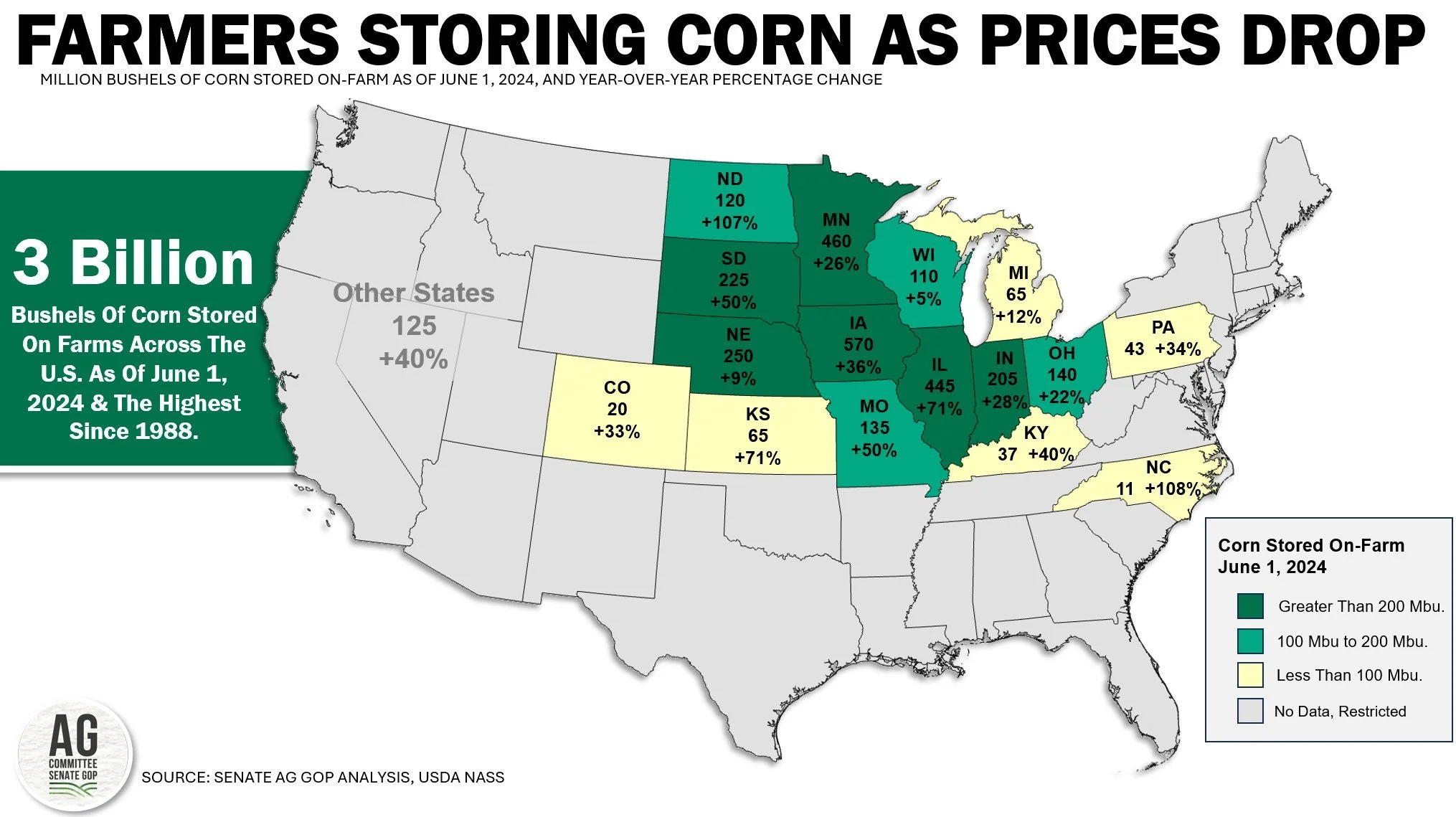

"The funds are short -500k contracts of corn & beans going into growing season, they feel comfortable about it because the US farmer is holding 3 billion bushels of corn. They are betting on the American farmer dumping this in July when they know they have a crop made. That's when they are going to start buying".

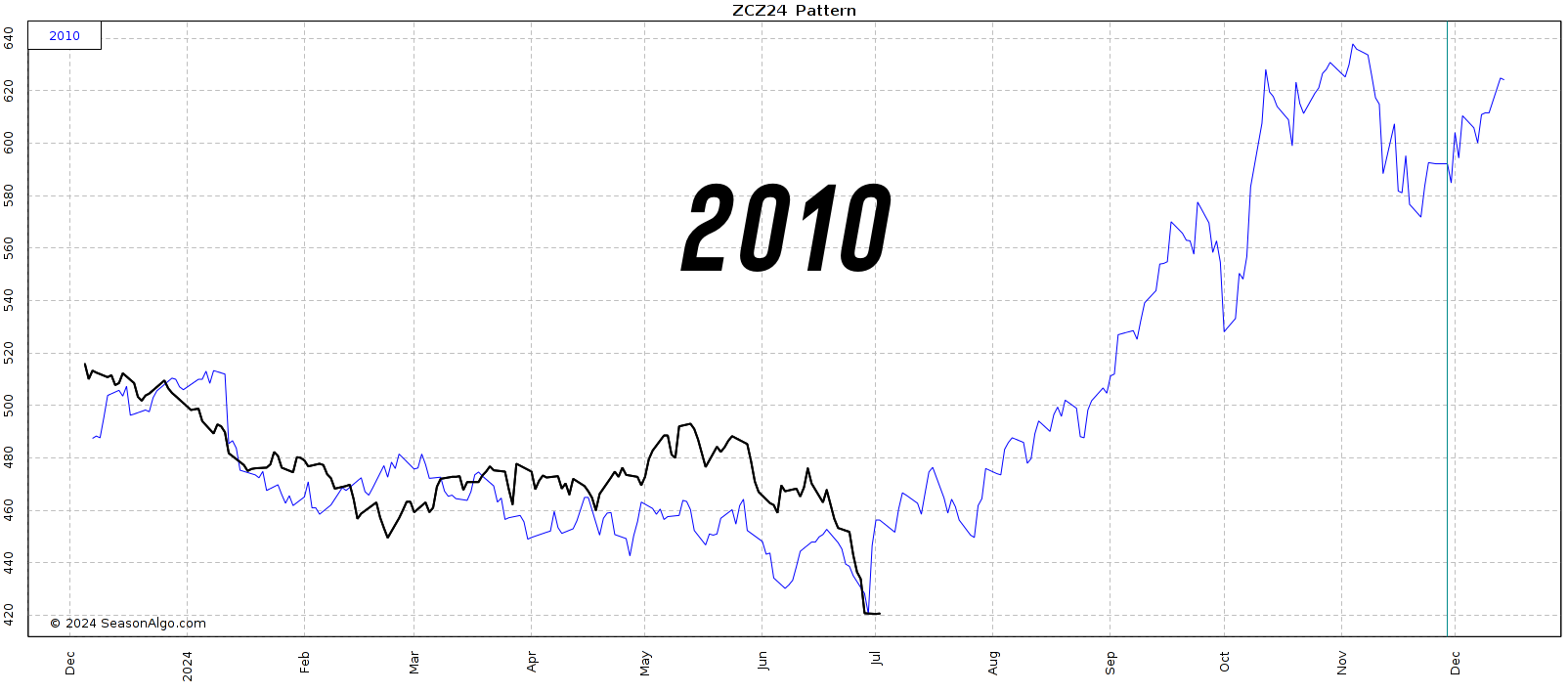

The last time the funds were this short corn for this time of year was 2020. It was about this time of the year where they started buying back. We all know what happened to prices at the end of 2020.

Chart Credit: Karen Braun

Today's Main Takeaways

Corn

Weather is bearish, with cool temps & rains. Yet, corn held in there to start the week. Which is a friendly sign.

However, right now the weather supply scare potential rally is likely out of the window.

This year has been a tough year. No one has even gotten the chance to sell corn above cost of production.

With the weather scare chances getting smaller and smaller, what's left?

A counter seasonal rally led by demand is a very real possibility.

We said that if this USDA report was negative, it would support prices longer term. Because it will create more demand.

At a certain point, low prices cure low prices.

Just take a look China's corn market prices vs the US. Unlike the US, China's prices haven’t gone straight down.

China has been in an uptrend all year, we have not.

We are now trading at a large discount to China.

The last time we saw this big gap? The end of 2020.

From Grains Gorilla:

"China was asking for Brazil corn offers. Not a place I'd be short corn. Doesn’t matter if China buys US or Brazil corn. Futures will react."

Here is the next chart I want to show you.

Often times we see old resistance turn into new support.

Look at the chart, we saw that old resistance before 2008 turn into the new floor from the bear market of 2014 to 2020.

Right now we are sitting right at that old resistance from 2014 to 2020 hoping to turn it to a floor.

History doesn’t repeat, but it often rhymes.

Bottom line, no I don’t see us rallying today or tomorrow. It could be a brutal 2 more months.

We won’t get a better idea on acres lost or not lost with floods until August or September.

Unless we get a weather story (which is looking unlikelier by the day), demand will have to lead us higher.

I'd like to think we don’t go awfully lower from here, but that's the risk. Nobody thought that 50 cents ago either but here we are. We could see corn below $4.00, so get comfortable knowing that is a possibility.

I do think we will get a demand driven rally later this year and into next.

If you are someone who cannot afford to be wrong, knows you are going to have to price something off the combine, then please be proactive.

Lock in a floor with puts. Whatever you have to do to protect your bottom line. Not every operation is in the same situation, so please give us a call to walk your situation 1 on 1. (605)295-3100.

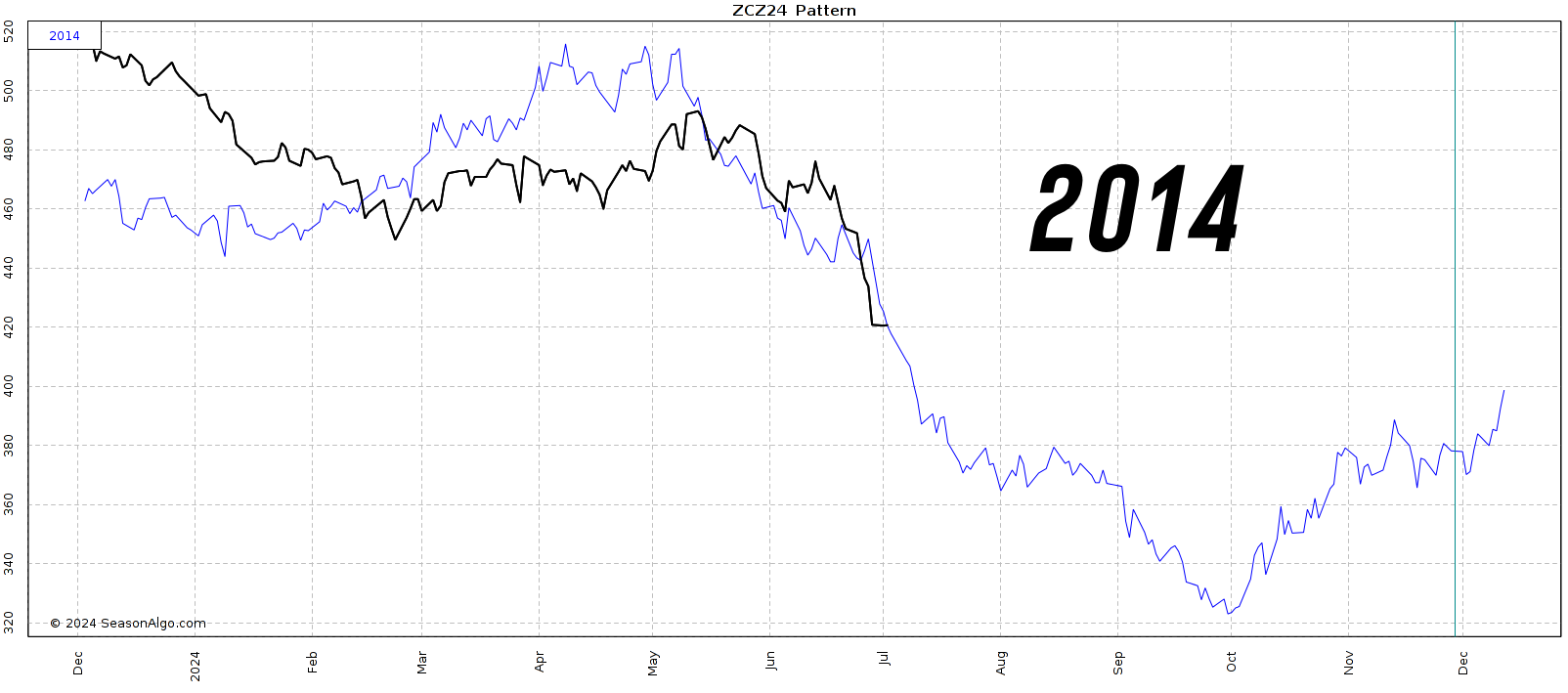

Have a game plan whether this is a repeat of 2014 where we go straight down for months, or something like 2010 or 2020 where we get a counter seasonal rally.

A lot of people are worried about a 2014 repeat, reasonably so.

Some food for thought: The funds were long the entire year in 2014, they were short the entire year in 2020.

Either way, have a game plan for both.

Lastly, the daily corn chart.

I have been sharing this potential head & shoulders pattern in corn since early June hoping it would be wrong, but so far it has played out.

The good news?

We completed the implied downside move for this pattern.

(The downside target is taking the range from the Head to the Neckline, then substracting that range from the Neckline)

From a technical standpoint, this head & shoulders suggests we could find a bottom here. I am not saying we will rally from here short term, just saying the heavy bleeding might be over.

Dec Corn

From 247 Ag:

"How long can you hold out? Everything is set up to keep prices depressed into the throws of harvest, forcing most producers to price old & new crop at levels below cost of production for most. The value of a bushel of corn made into ethanol is $7.12. They win.

Soybeans

The biggest news surrounding soybeans the past few days has been China.

There is rumors that China bought up to 8 cargoes of US soybeans.

The reasoning is because reports are saying that China is nervous about Trump getting re-elected and putting tariffs on Chinese imports. Starting another trade war similar to what he did in the past.

So the news says that China is booking some of beans now in preparation for the possibility of this happening.

If we did happen to see another trade war, it was be very negative for soybean futures prices.

When this happened in 2018 we saw our lowest prices soybeans in ages.

Just like I pointed out in corn, I wanted to look at the possible old resistance turning to new support in soybeans.

In the past, we have seen the $10.75 range act as big resistance multiple times throughout the years.

Will that now turn into our new support?

Not much else to say for soybeans.

Bottom line, I think we are at price levels that will ultimately create more demand and lead us higher.

If you are someone who is nervous or is going to have to sell something off the combine, either lock in a floor with puts or give us a call to go through some other strategies. (605)295-3100.

Nov Beans

Wheat

As mentioned, global headlines in Russia and Australia added pressure.

As Australia is getting some rain after being very dry, and we still have no bull story out of Russia, as it appears that a lot of the frost & drought story was overblown by analysts over there.

This was something I had been saying since May, we would need another wild card headline from Russia to continue to rally but we didn’t get one and it doesn’t look like we will.

Here in the US, there isn’t anything bullish either as our crop looks amazing.

However, one positive is that wheat harvest in the US is now at 54% complete. Once we reach 50% we typically tend to start seeing less harvest pressure. So we should start seeing less soon.

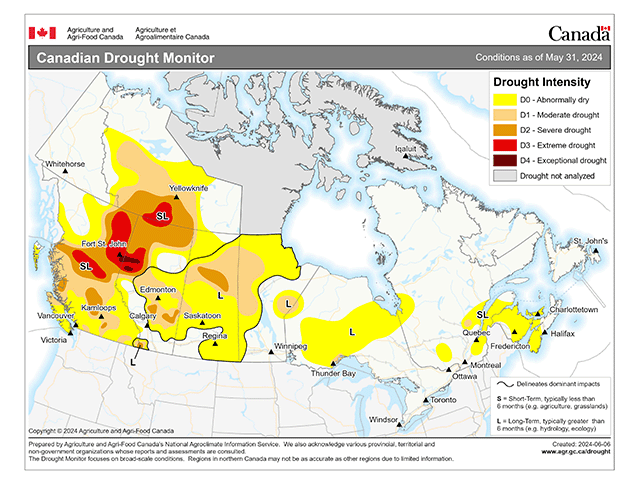

Another friendly factor is the drought in Canada.

Overall, there isn’t anything today saying "Wow that's bullish we have to go higher". But there also isn’t anything saying we have to go lower.

We gave back the entire Russia supply scare rally. We reached heavily oversold levels on the charts.

On May 22nd we issued a sell signal. If you are someone who made sales, we think now is a great time to look to re-own some of those sales. Which is why we issued a buy signal for wheat on June 27th.

Again, nothing wrong with walking away from a good sale near the top. But if you are someone who is looking to re-own, now is probably the time to do so.

If you are behind on sales or didn’t make any on the Russia rally, then you can either grab puts to lock in a floor (but I don’t love spending a ton of money down here) or simply ride out the storm and wait for a better pricing opportunity once we get this US harvest pressure out of the way.

Long term I see better pricing opportunities and think there is a good chance we finally found a bottom following the 30-day $2.00 sell off.

Sep Chicago

Sep KC

Want to Talk?

Our phones are open 24/7 for you guys if you ever need anything or want to discuss your operation.

Hedge Account

Interested in a hedge account? Use the link below to set up an account or shoot Jeremey a call at (605)295-3100 or Wade at (605)870-0091

Check Out Past Updates

7/1/24

SUPPLY WILL BE THERE, BUT CAN DEMAND LEAD US HIGHER?

6/28/24

GARBAGE USDA REPORT

6/27/24

BIGGEST USDA REPORT OF YEAR TOMORROW

6/26/24

USDA PREVIEW & COUNTER SEASONAL RALLIES?

6/25/24

POSSIBLE RISKS & OUTCOMES THIS USDA REPORT COULD HAVE

6/24/24

VERY STRONG PRICE ACTION: RAINS & USDA KEY

6/21/24

DON’T PUKE SELL. ARE YOU COMFORTABLE RIDING THIS STORM?

6/20/24

RAIN OR NO RAIN FOR EAST CORN BELT?

6/18/24

WEATHER MARKET ENTERING FULL SWING

6/17/24

SELL OFF CONTINUES DESPITE FRIENDLY FORECASTS

6/15/24

EXACT GRAIN MARKETING SITUATION BREAKDOWNS & WHAT YOU SHOULD BE DOING

6/12/24

USDA SNOOZE: WHAT’S NEXT?

6/11/24

USDA TOMORROW

6/10/24

IS USDA OVERSTATING CROP CONDITIONS? DOES IT MATTER?

6/7/24

WEATHER & USDA NEXT WEEK

6/6/24

ARE GRAIN SPREADS TELLING US SOMETHING?

6/5/24

GRAINS NEARING BOTTOM? 7 DAYS OF RED

Read More

6/4/24

HIGH CORN RATINGS, SCORCHING SUMMER, & RUSSIA CONCERNS

Read More

6/3/24

5TH DAY OF THE SELL OFF. ARE YOU COMFORTABLE?

5/31/24

4 STRAIGHT DAYS OF LOSSES IN GRAINS

5/30/24

I DON’T THINK SEASONAL RALLY IS OVER. WHAT IS THE PLAN IF I’M WRONG?

5/29/24

PLANTING DELAY STORY VANISHES. BUT IS REAL STORY OVER?

5/28/24

GETTING COMFORTABLE WITH GRAIN MARKET VOLATILITY

5/24/24

WET SPRINGS DON’T CREATE RECORD YIELDS, DO THEY?

5/23/24

MANAGE RISK DESPITE STUPID PRICE POTENTIAL IN GRAINS

5/22/24

BEANS NEAR NEW HIGHS. WHAT TO DO WITH WHEAT?

5/21/24

BIG MONEY KEEPS DRIVING WHEAT HIGHER

Read More

5/20/24

ALGOS & BIG MONEY CONTINUE TO MOVE GRAIN PRICES

5/17/24

WEATHER MARKET VOLATILITY CONTINUES TO HEAT UP

5/16/24

SITUATIONAL GRAIN MARKETING

5/15/24

HEDGING VS GUESSING

5/14/24

CORRECTIONS ARE HEALTHY

5/13/24

FUNDS DON’T WANT TO BE SHORT GRAINS

5/10/24

PRICE ACTION TELLS DIFFERENT STORY FROM USDA REPORT

Read More

5/9/24

MARKET PRICING IN NEGATIVE REPORT. WHAT TO EXPECT FROM USDA

5/8/24

USDA IN 2 DAYS

5/7/24

WHO SHOULD WAIT FOR TRIGGERS NOT TARGETS

Read More

5/6/24

GRAINS HIGHEST IN 4 MONTHS

Read More

5/3/24

SEASONAL RALLY JUST BEGINNING OR BULL TRAP?

5/2/24

ARE THE TIDES STARTING TO TURN?

5/1/24