BEANS FALL APART

MARKET UPDATE

Still getting used to making the video updates, so bare with me.

You can still scroll to read the usual update as well. As the written version is the exact same as the video.

(Charts & Main Takeaways at 4:53 min)

Prefer to Listen? Audio Version

Futures Prices Close

Overview

Corn & soybeans lower as beans get hammered while the wheat market was slightly higher.

Soybeans are now -58 cents off their highs from Sep 27th and have given back 50% of the rally.

There were 3 main reasons for soybeans getting hammered:

China stimulus news (or lack there of)

Rains in forecast for Brazil

Harvest pressure

As I mentioned last week, this week was likely going to bring some harvest pressure.

The heavy fund buying was offsetting the harvest pressure, but now the funds are potentially taking a more balanced approach as they have essentially removed their entire short position.

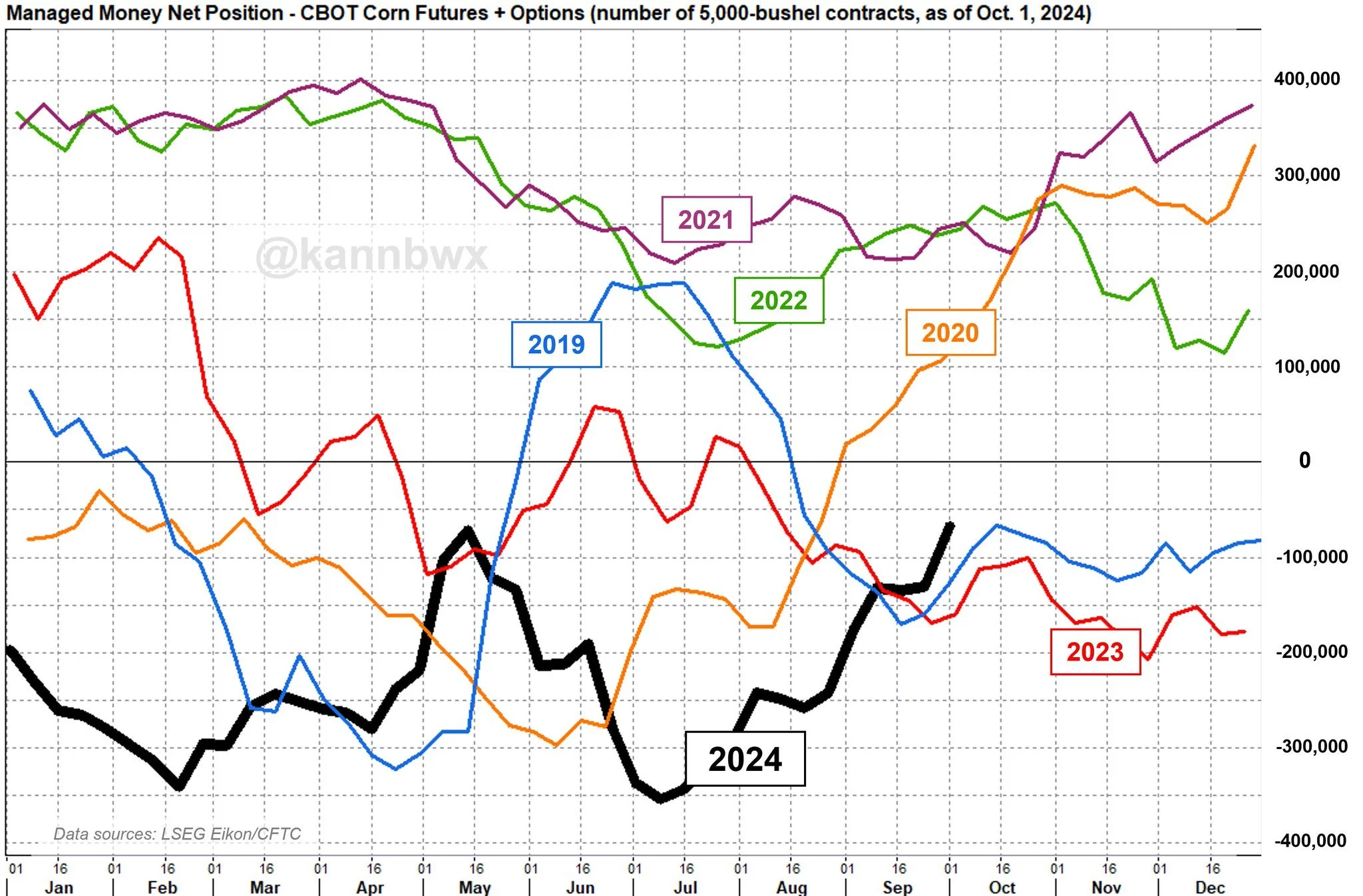

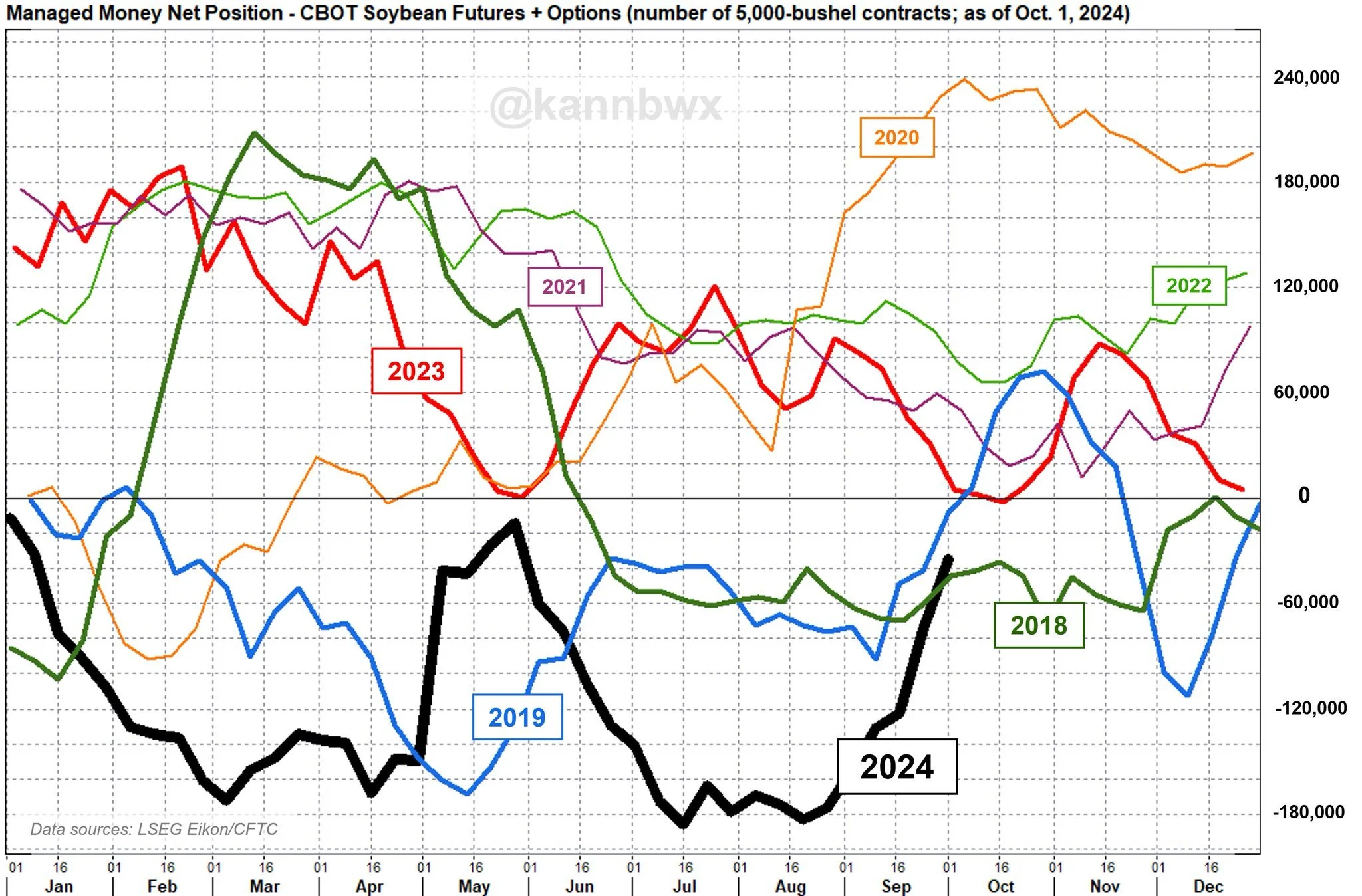

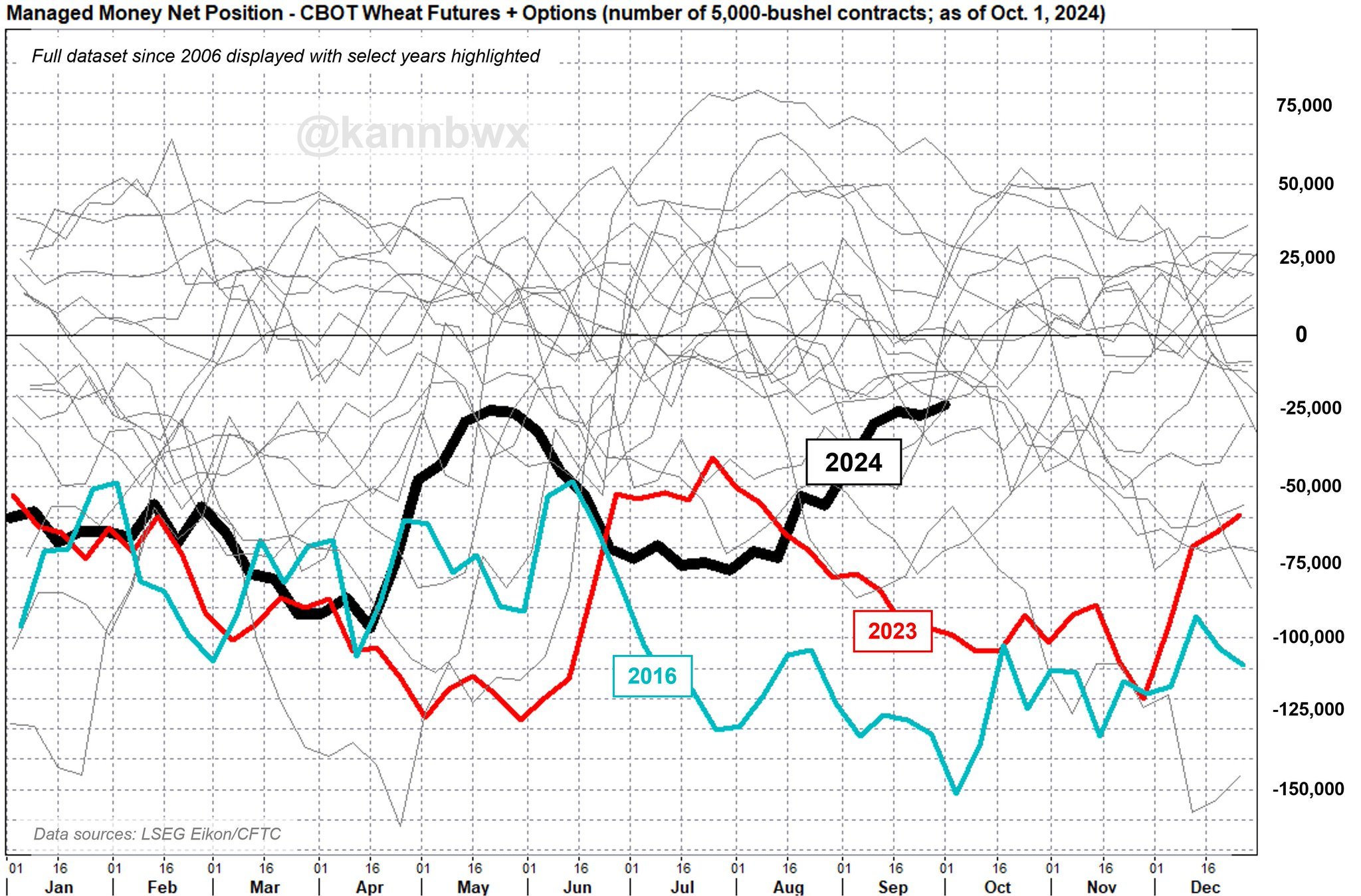

As of October 1st the funds are now only short:

Corn: -72k (-356k record this year)

Beans: -32k (-186k record this year)

Wheat: -24k

For corn, this is the smallest the short position has been in 14 months. This is the smallest short in beans since May. This is the smallest SRW wheat short since October 2022.

The funds went from record shorts, to almost not bearish at all across the entire ag complex.

All of these charts are courtesy of Karen Braun.

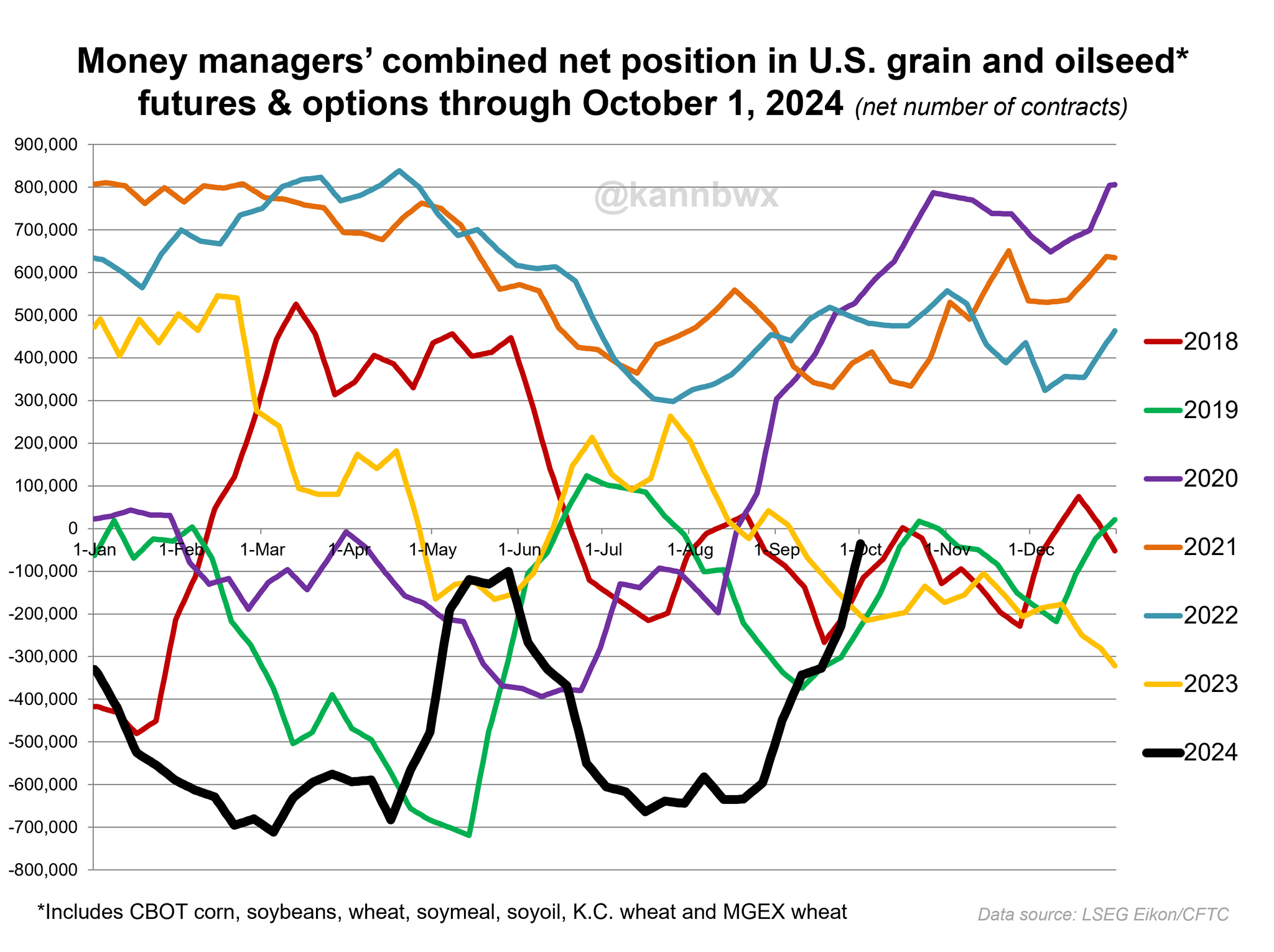

Combined Fund Position

Corn

Beans

Wheat

Now with the funds nearly even, and harvest in full swing, we could very well see more harvest pressure just like I mentioned we probably would see this week.

As the window for harvest is wide open with zero weather problems getting in the way.

Harvest is going to move fast.

Typically, you start to see less harvest pressure when harvest reaches over 50% complete. So we should start seeing less within the next 2 weeks.

Current Harvest Progress:

Corn: 30% (27% avg)

Bean: 47% (34% avg)

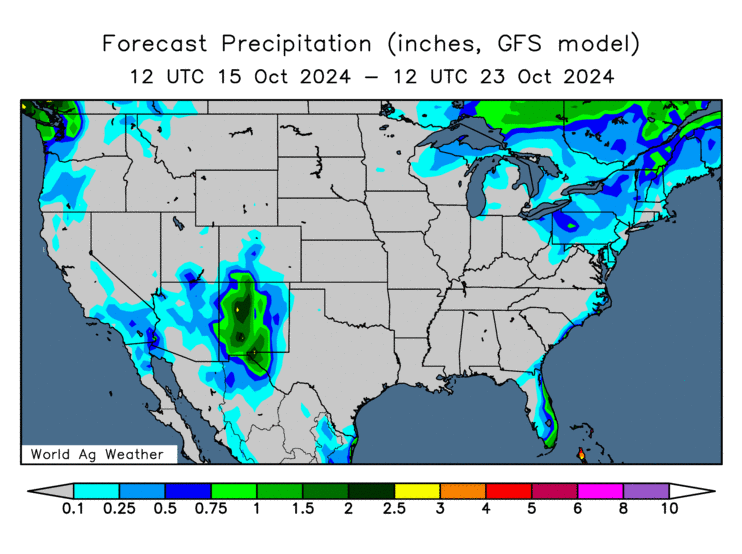

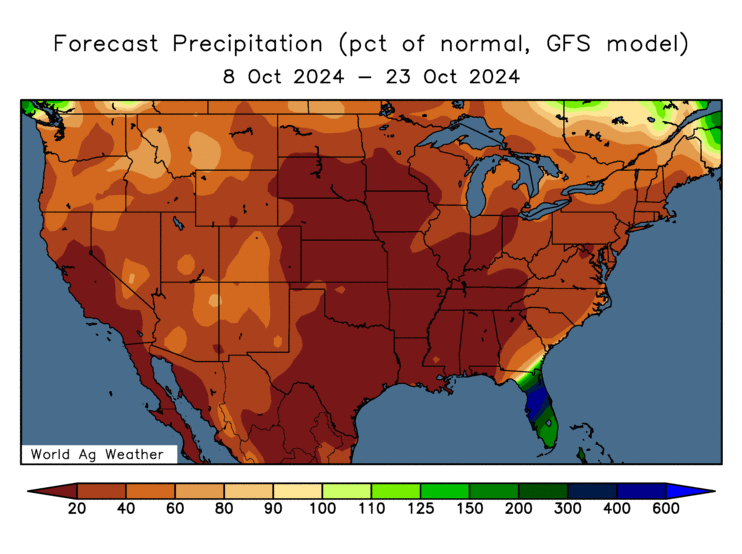

2 Week Forecasts

China Stimulus

Despite harvest pressure being there, the #1 reason for the absolute fall apart in soybeans today was China.

Going into last night, the trade was expecting China to release more details on their economy and the entire stimulus deal. But they did not. They provided very little details on it.

So the trade was disappointed that perhaps they are done trying to boost their economy for now. (Although I don’t think this is the last we will hear of it).

It definitely still has the potential to be a very beneficial factor. It could lead to China's economy improving. Which leads to more producer spending. Which leads to greater demand for grains.

Brazil Rain

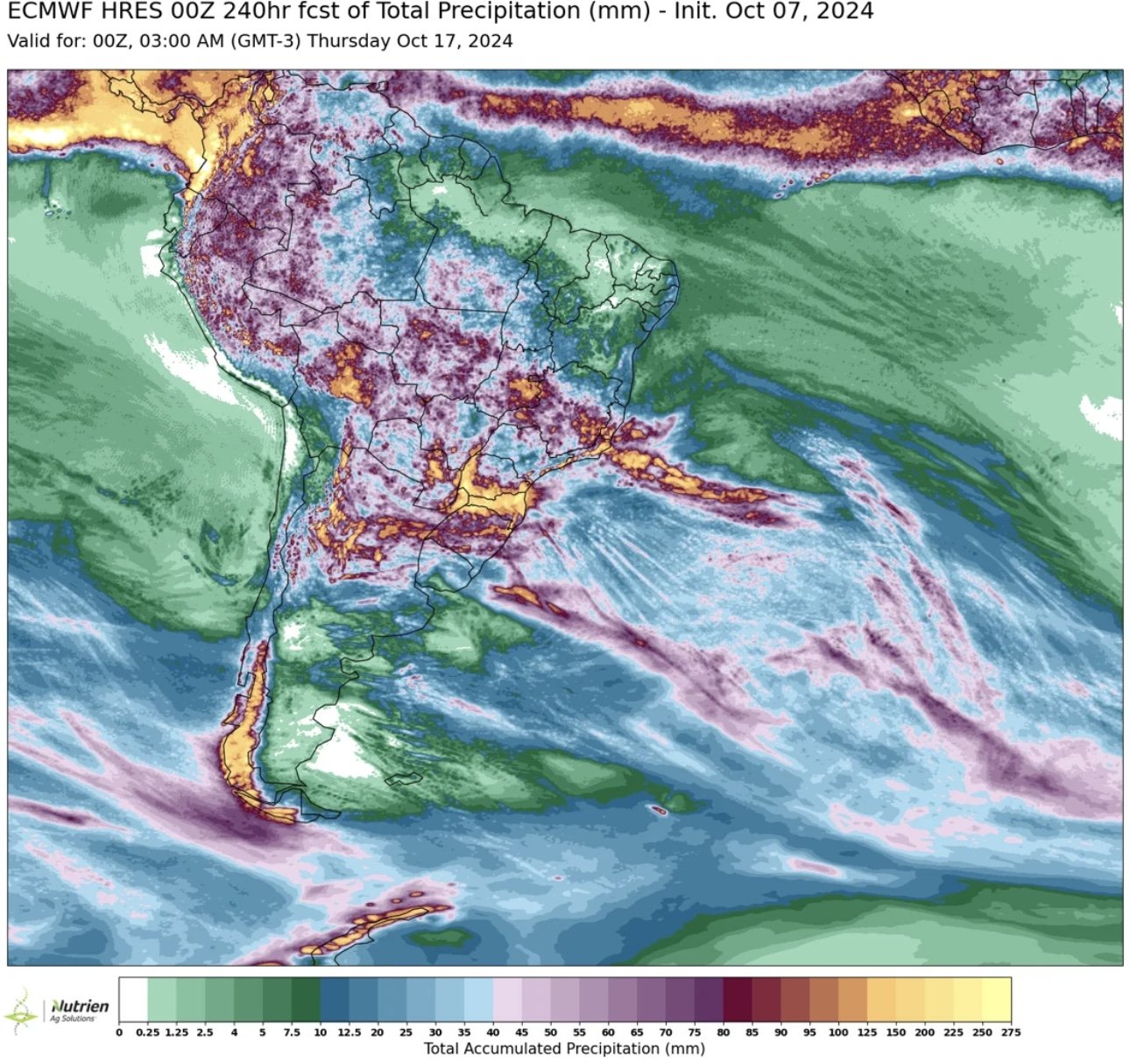

The rains in the forecast didn’t help beans.

The next 5 days look dry.

But all forecasts consensually call for rain within the next 10 days.

So it looks like rain will be coming and the bean crop will be planted. So no major concerns as of now.

Right now, bean planting is the slowest in 9 years. Only at 4.5% complete vs 10% last year.

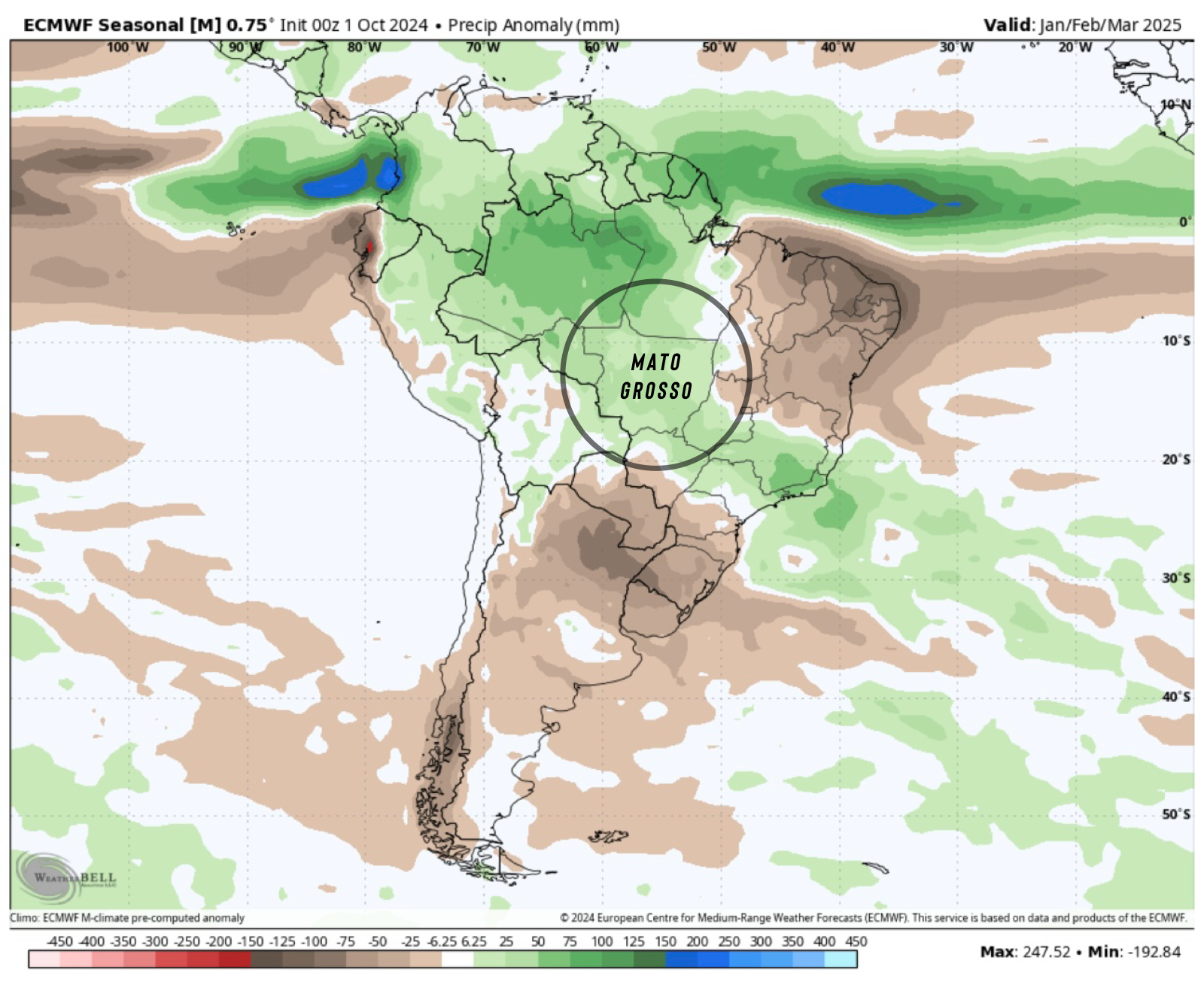

The forecasts also currently suggest wet through mid-November as well as a wetter pattern for Jan-March.

A weather scare is always possible. But the current forecasts don’t suggest so.

10-Day Rain

Rain Through Mid-Nov

Rain Through Jan-March

Short term these rains are important and will help planting. But it is still too early for the "weather market".

If we get into early November and it is still this dry, then there will be a real story. But rains are on the way for now and the forecasts suggest they will be staying.

This will be the #1 factor that could lead to beans being $1 higher or lower the next few months.

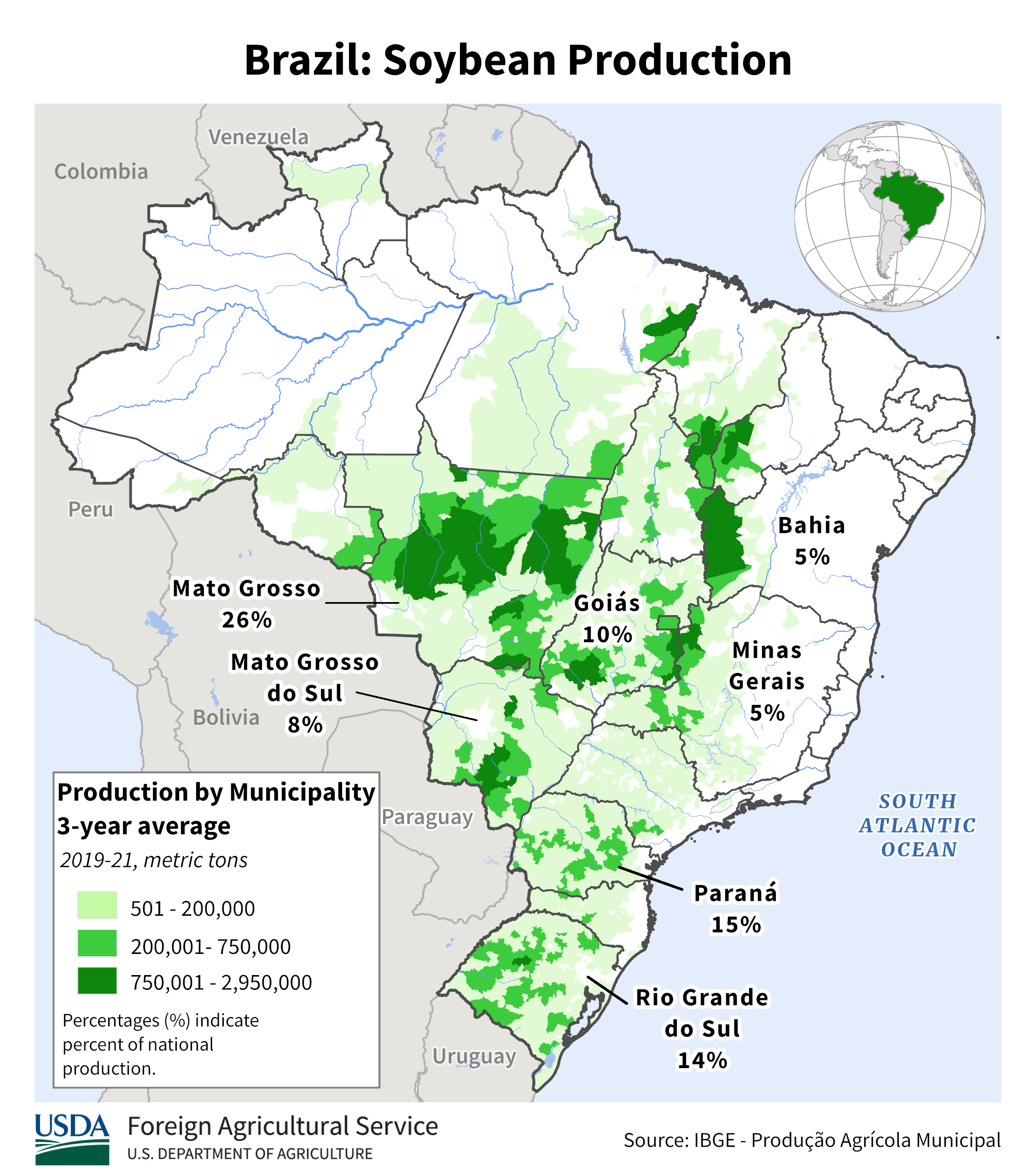

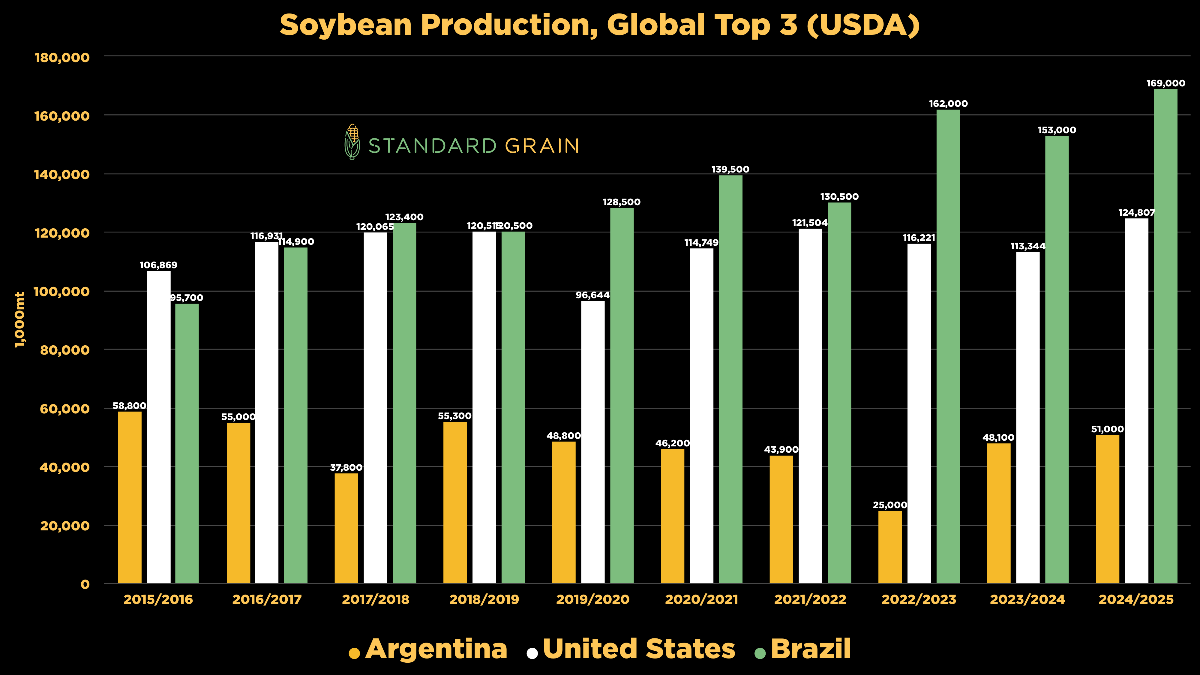

The USDA projects Brazil to produce 169 MMT of beans (Record 162 in 2022).

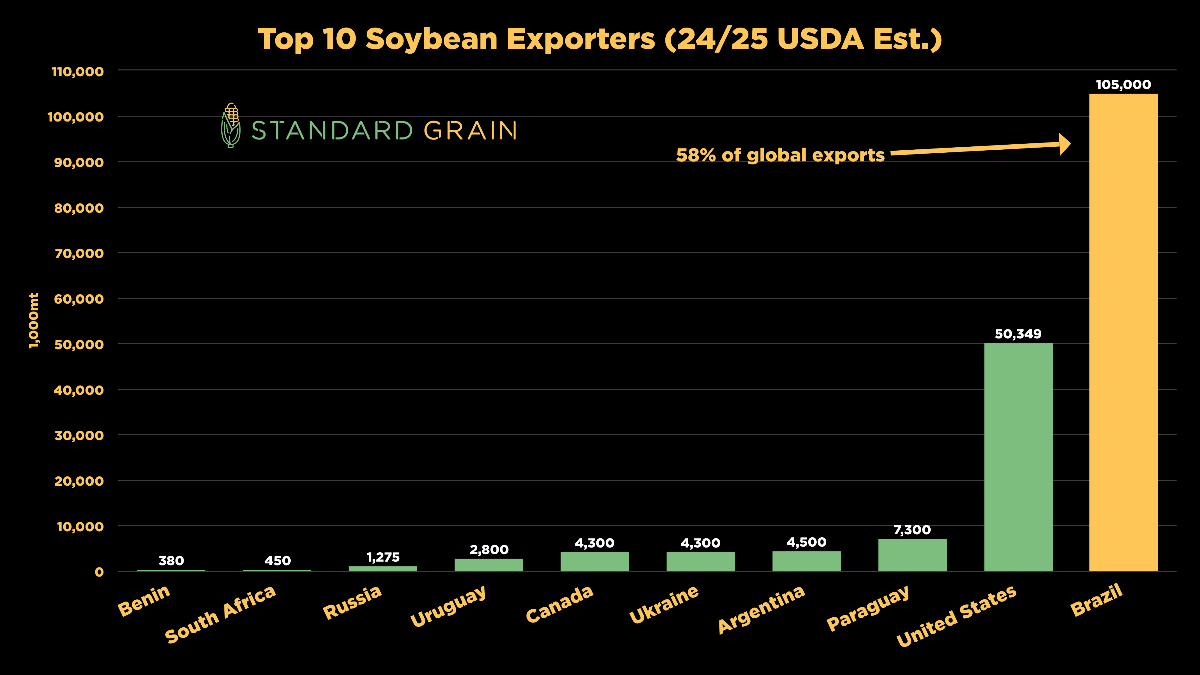

Brazil accounts for nearly 60% of global exports at 105 MMT. Double the US's bean exports of 50 MMT.

That is why this is so important.

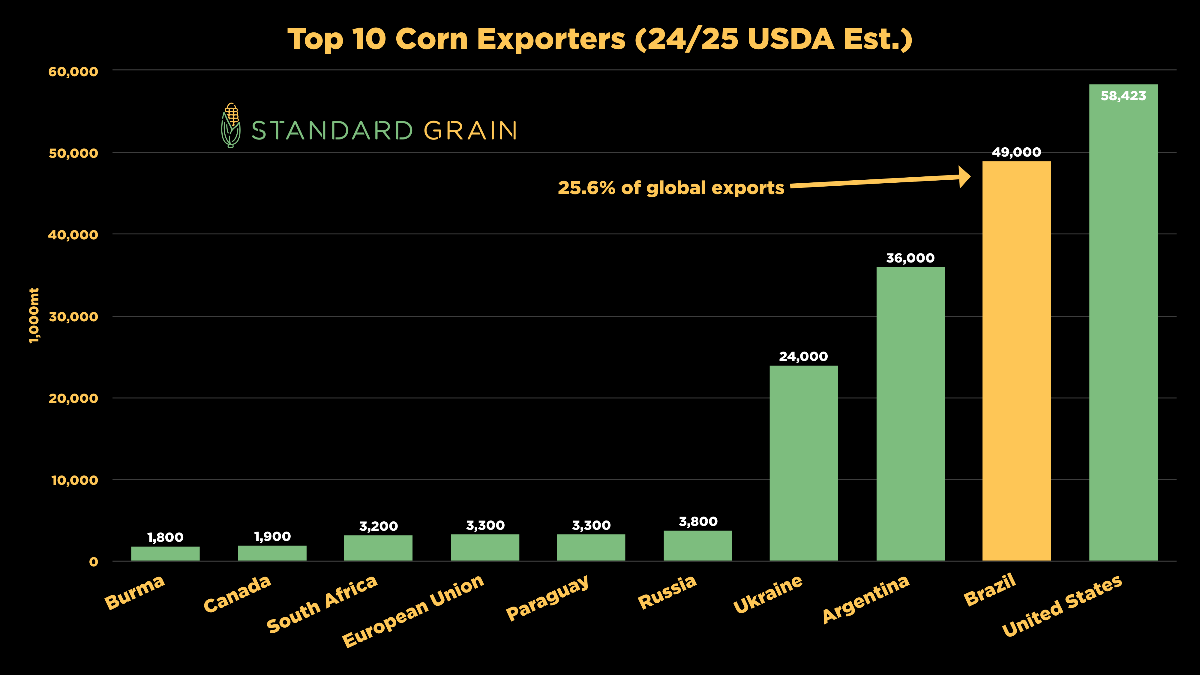

Here are some charts from Standard Grain to give you a better visual of how Brazil produces & exports vs the US.

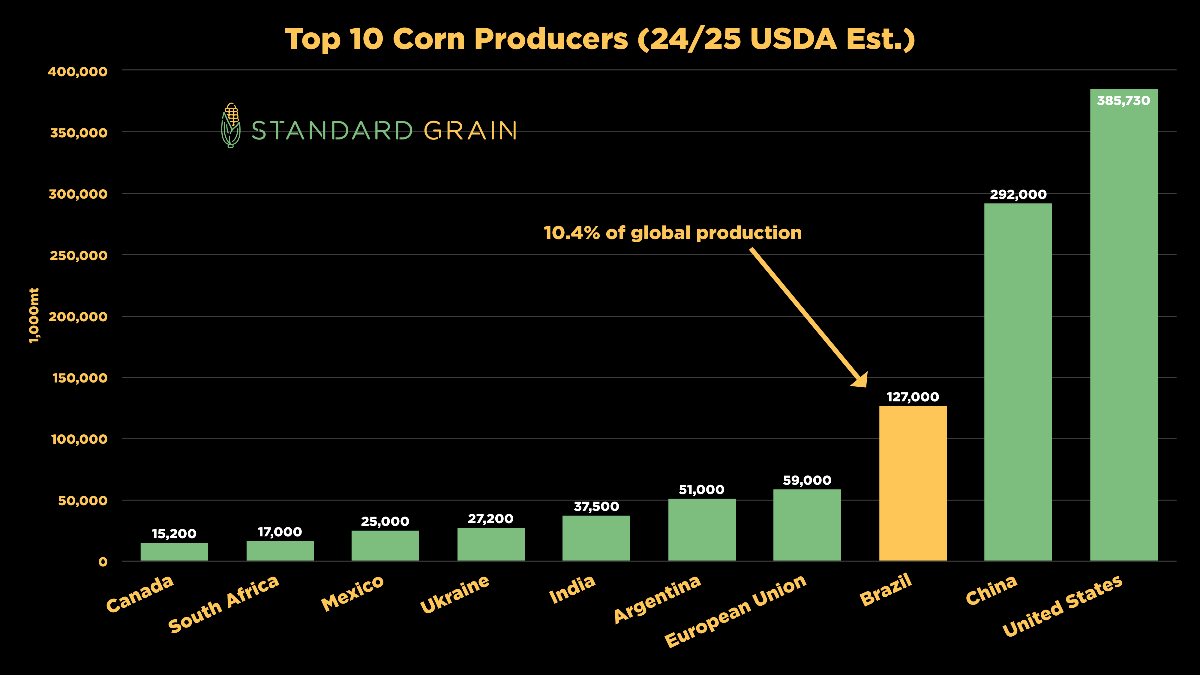

Brazil weather is still important for corn, but not nearly as important as it is for beans.

The US is still by far the #1 producer and exporter of corn.

Brazil is the #3 producer and #2 exporter of corn.

Again here is charts from Standard Grain to give you a better visual.

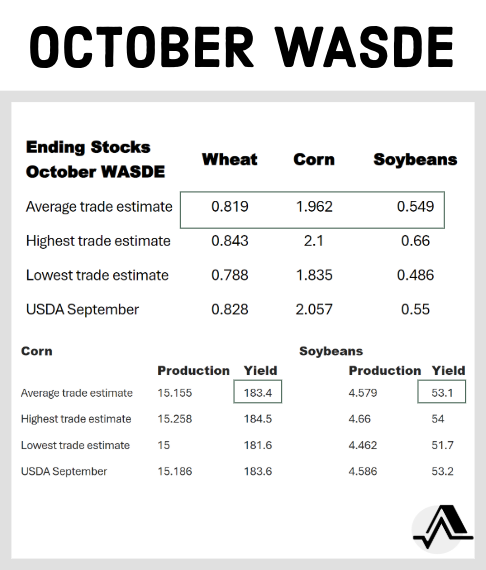

Upcoming USDA Report

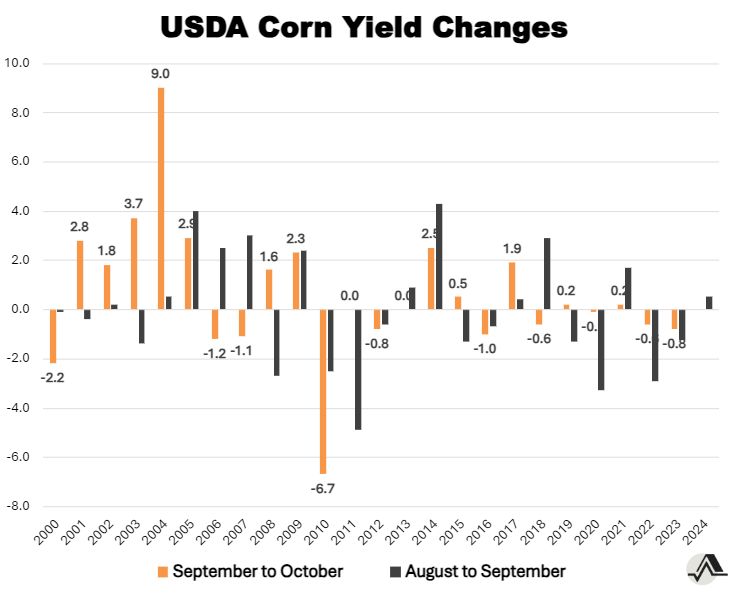

The trade is expecting slight cuts to both corn & bean yield.

Corn carryout is also expected to fall below 2 billion bushels.

Now you would think this report would be friendly on the carryout side, given that they will be incorporating last report's feed & usage increase.

But the biggest risk is of course if yield increases. Specifically for corn.

Most agree beans probably saw their highest print. But there is still a possibility that corn yield creeps higher.

Here is the past yield changes for corn from this report.

We haven’t got a big increase to the upside since 2017.

Today's Main Takeaways

Corn

Short Term Thoughts:

Short term I could still see a little more harvest pressure. As we are only 30% complete.

We also posted an outside down day (took out yesterdays highs, closed below yesterdays lows). This is often a bearish signal and indicates more downside.

I would not be surprised at all to see us test the bottom end of that channel on the chart.

That would also correspond with a good support level of $4.13 and a backtest of that pink line. (I will include a chart on that pink line).

(For those of you that haven’t been following for long, that pink line was a huge break through on corn. It was old support turned new resistance. It is now support)

The USDA report is really going to hold the keys.

If the numbers come right at estimates, I like our chances of grinding higher. If yield comes in high, we have downside risk.

Pink Line Chart

Long Term Thoughts:

Unless yield winds up being a monster 185+ when everything is said and done. I like our odds of going higher long term.

These low prices, high fertilizer costs & high cost of production aren’t going to incentivize extra acres. We could very well be looking at a lot less acres next year.

Like we had said in the past, low prices cure low prices. As these low prices are creating that much more demand.

What happens if acres fall? Then next year we produce a great 180 crop? Then we throw all of this created demand on top? Our carryout falls and the balance sheet likely improves from here.

We have seen yield increase in every USDA report of recent, yet our carryout has continued to fall due to demand increasing.

So I do believe demand can continue to lead us higher looking longer term.

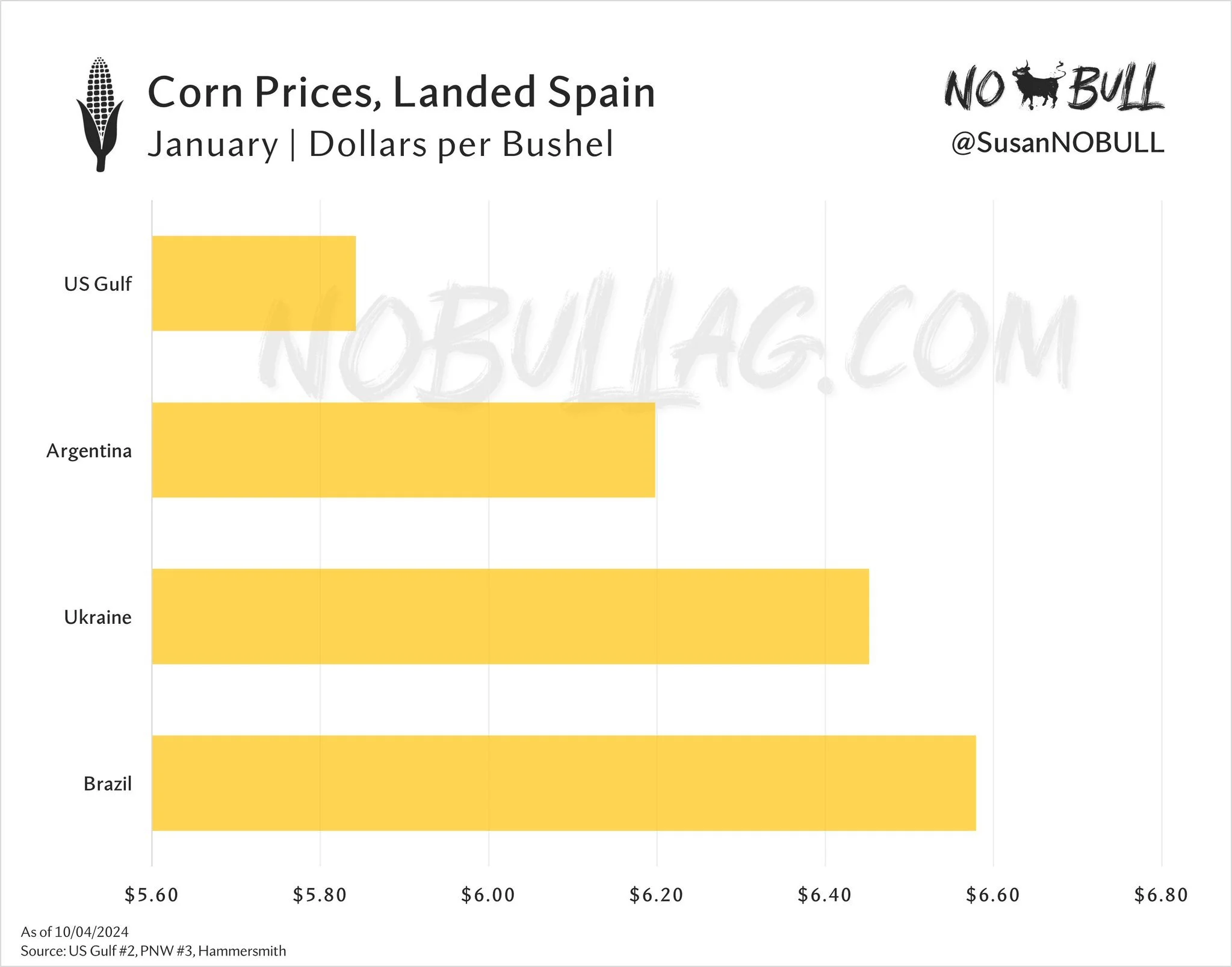

Corn is also very competitive on the global export market. Look at this chart from Susan of NO BULL AG.

Risk Management:

Last week we advised a protection signal. (CLICK HERE TO VIEW IT)

If you still do not have protection and have done nothing, still keep a floor under unpriced grain. ESPECIALLY if you have to move something off the combine.

I especially like protecting BEFORE the USDA report. As you never know if they will opt to raise yield or not.

We are still 35 cents off the lows. When you buy a put, you hope you lose on it and are able to price your grain at a higher price. But you will be thanking yourself if we fall back to $3.85 over the next few months even though I don’t see that happening.

Hedge. Don’t guess.

Soybeans

Short Term Thoughts:

Ugly day. Beans posted an outside down day just like corn.

But we also broke the bottom of that channel support.

From a technical standpoint, it looks like we could go lower.

We are sitting at a cluster of support between here and $10.00.

$10 is key. If we break that level, things will not look good.

We likely won’t be finding support from Brazil weather. But we should start to see less harvest pressure in a week or two.

The USDA report will important, but I don’t see how they could possibly raise bean yield. (of course never say never).

Long Term Thoughts:

There are plenty of moving factors that are impossible to guess.

China & Brazil are both potential ones that could support us. But they could just as easily send this market lower.

The US balance sheet for beans is a lot more burdensome than the corn one. As it is far easier to argue that the corn carryout will shrink.

For the bean carryout to shrink, we will either need to see yield come down. Or for a big boost of demand from China.

If Brazil produces what the USDA thinks they will, there is A TON of downside risk in beans.

Hence why we could be $1.00 higher or lower by the end of the year.

Risk Management:

We alerted a sell signal on Friday Sep 27th's highs. (CLICK HERE TO VIEW)

Since then, we have given back exactly 50% of the rally.

It took us 1 month to build this rally, and 7 days to give back half of it.

If you followed the signal and grabbed puts, it is never a horrible idea to lock in that profit. But many of you may want to wait until you make a physical sale to lock in that profit.

Traditionally, you want to wait until you make a sale to sell the puts. But an aggressive approach would be to lock in that profit now, then wait for a bounce to make that cash sale. The only risk is if that bounce doesn’t come.

If you are someone who did not do anything, and still does not have protection. Then you should get some ahead of the USDA report. ESPECIALLY if you have to move something off the combine.

If you have questions, give us a call or text (605)295-3100. As you are all in different situations.

Wheat

Short Term Thoughts:

We remain in this upward channel.

Until we break below it, my bias leans higher.

This is also the time of year where seasonally wheat does see some strength.

If we take out last week's highs, it will lead to technical buying. Potentially into that $6.40 area.

Long Term Thoughts:

Wheat isn’t gaining acres in the US.

We have global drought issues.

Russia exports are already expected to be down -10%.

This Russian drought is priced in for now, but if that drought continues the wheat market will pay attention.

Russian wheat prices hit 3-month highs due to the drought & supply cuts.

It looks like global export prices could have very well found their bottom.

This is very beneficial moving forward for wheat if this was indeed the bottom.

Risk Management:

We recently had a few wheat sell & protection signals.

One on Sep 13th at $5.99 and the other on Oct 2nd when we hit my first target of $6.12

If you have not took some risk off the table yet, now is still a good time to do so.

If you have taken risk off the table already, I like being patient from here.

Want to Talk?

Our phones are open 24/7 for you guys if you ever need anything or want to discuss your operation.

Hedge Account

Interested in a hedge account? Use the link below to set up an account or shoot Jeremey a call at (605)295-3100.

Check Out Past Updates

10/7/24

FLOORS, RISKS, & POTENTIAL UPSIDE

10/4/24

HEDGE PRESSURE

10/3/24

GRAINS TAKE A STEP BACK

10/2/24

CORN & WHEAT CONTINUE RUN

10/1/24

CORN & WHEAT POST MULTI-MONTH HIGHS

9/30/24

BULLISH USDA FOR CORN: RECOMMENDATION

9/27/24

UP-TOBER? SELL SIGNAL, TARGETS, & FACTORS

9/27/24

BEAN SELL SIGNAL

9/26/24

NEW HIGHS BUT CONCERNING CLOSE

9/25/24

HIGHEST CLOSES SINCE JULY. UPSIDE & SALES CONSIDERATION

9/24/24

GREAT START TO THE DAY, AWFUL FINISH

9/23/24

MASSIVE DAY FOR THE GRAINS

9/22/24

EARLY YIELD TALK, DROUGHT, BRAZIL, SEASONAL LOWS & MORE

9/19/24

GRAINS SEE TECHNICAL SELLING

9/18/24

FED DROPS RATES, BRAZIL STORY, 2025 SALES?

9/17/24

TARGETS & WHAT TO DO IF YOU BOUGHT PROTECTION

9/16/24

WAS TODAY HEALTHY CORRECTION BEFORE GRAIN RALLY RESUMES?

9/13/24

CORN & WHEAT BREAK OUT: EVERYTHING YOU NEED TO KNOW

9/12/24

USDA RAISES YIELD BUT REPORT WASN’T ALL THAT BEARISH

9/11/24

USDA TOMORROW. MAKE OR BREAK SPOT ON CHARTS

9/10/24

USDA THURSDAY

9/9/24