RAIN OR NO RAIN FOR EAST CORN BELT?

Overview

Grains absolutely destroyed today. Down double digits across the board, trading to our lowest levels since April for most of the grains. Taking out some technical support along the way.

Why did we get hammered so hard?

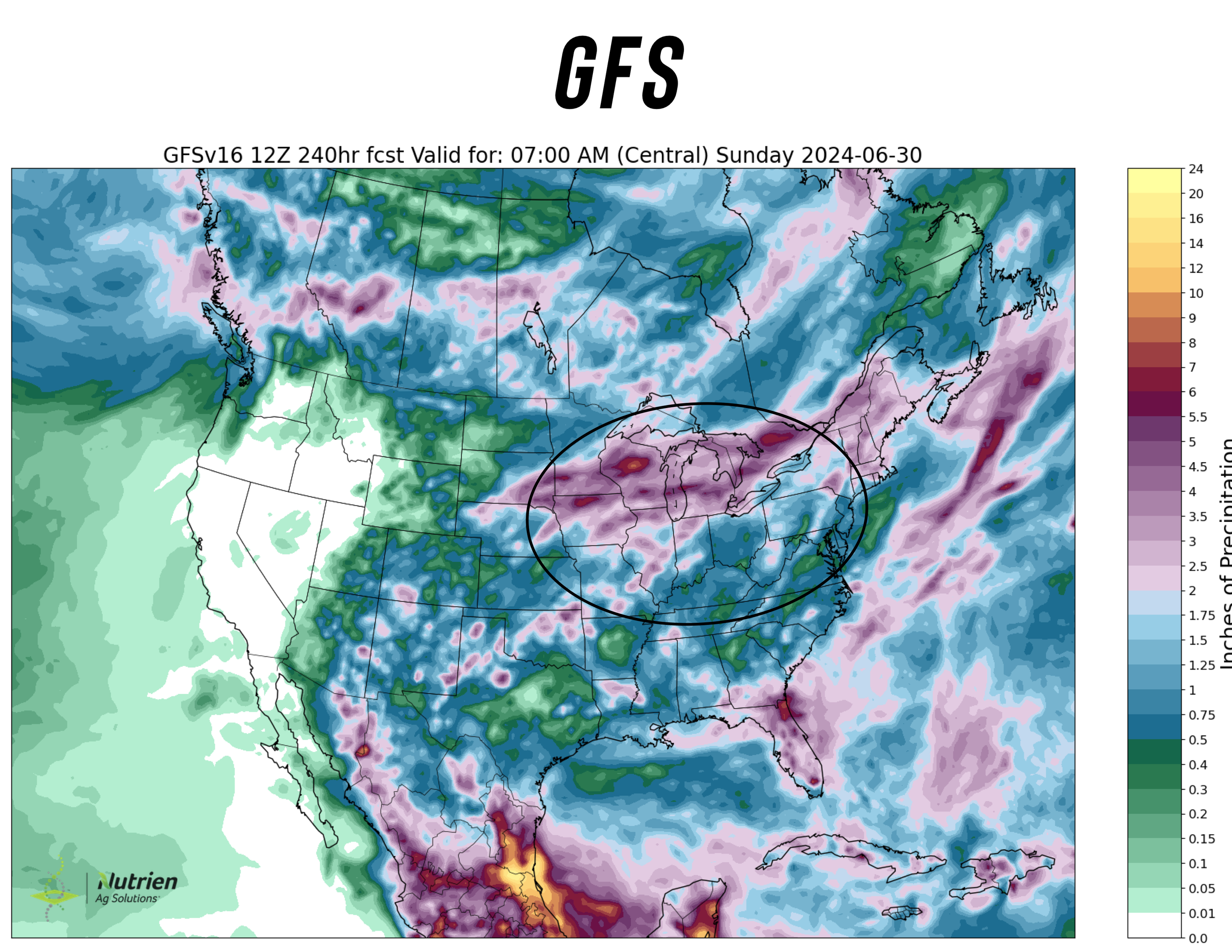

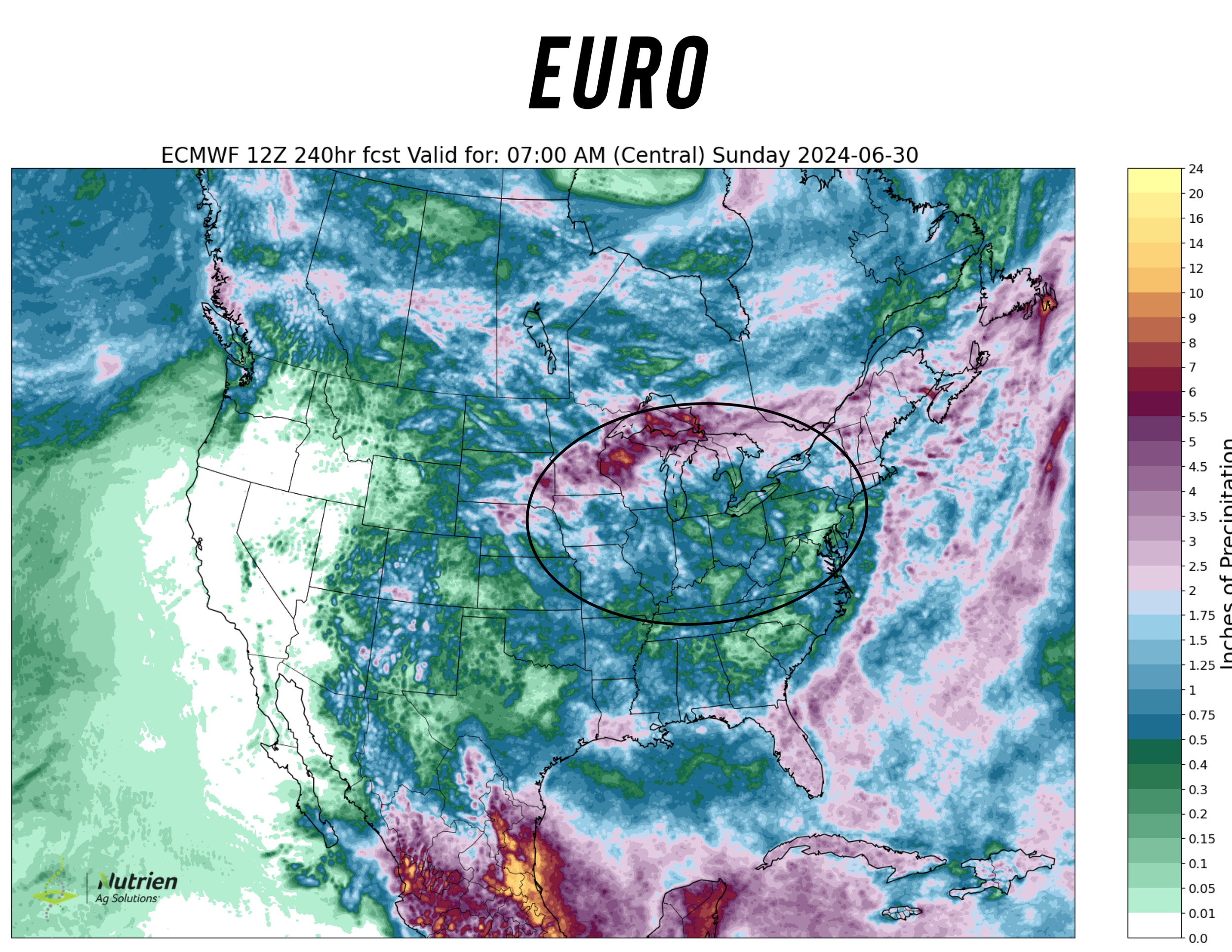

There are always two forecasts. The GFS and the Euro model.

Right now the GFS is saying that the eastern corn belt is in for some rain, while the Euro model says the eastern corn belt will stay dry.

The trade seems convinced that the GFS is the more accurate one.

Here is the difference between the two:

Whether that rain falls or not, will determine if we get that weather scare.

If the rain stays away or misses, corn prices will go probably go higher as it will likely create a scare.

If those rains hit like the GFS predicts, it becomes more unlikely that we will get a weather scare at all.

These rains (or lack there of) will be VERY IMPORTANT.

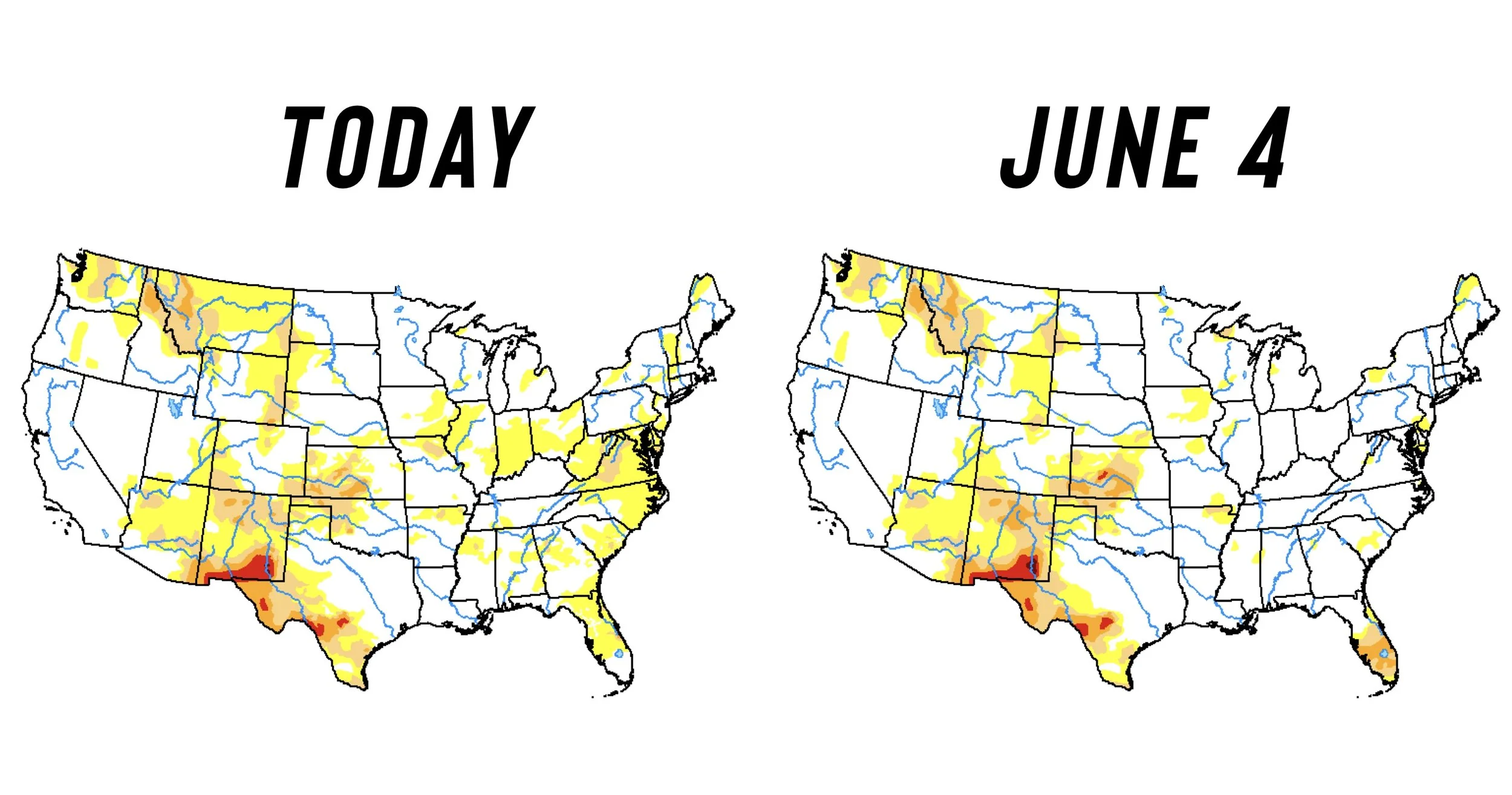

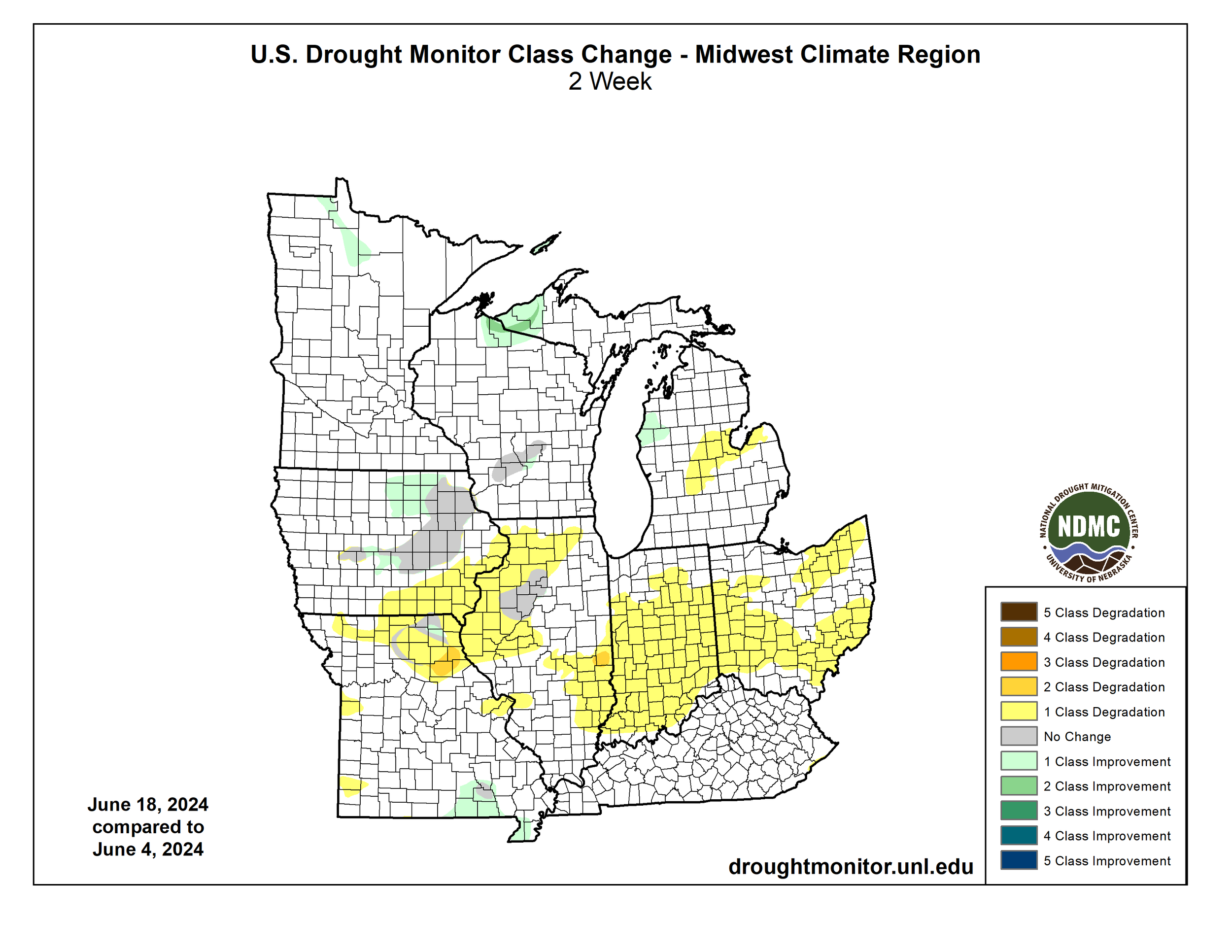

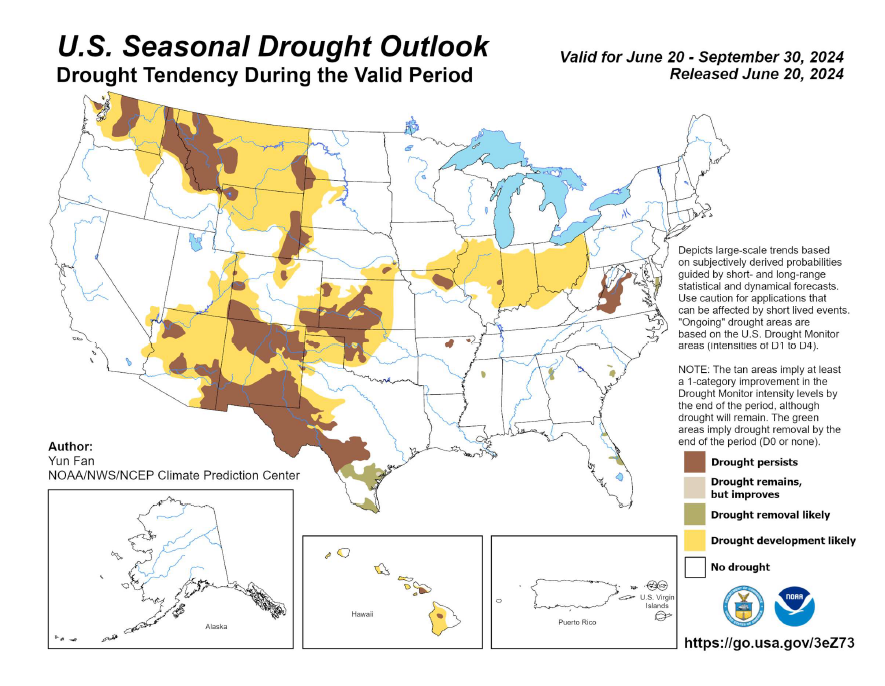

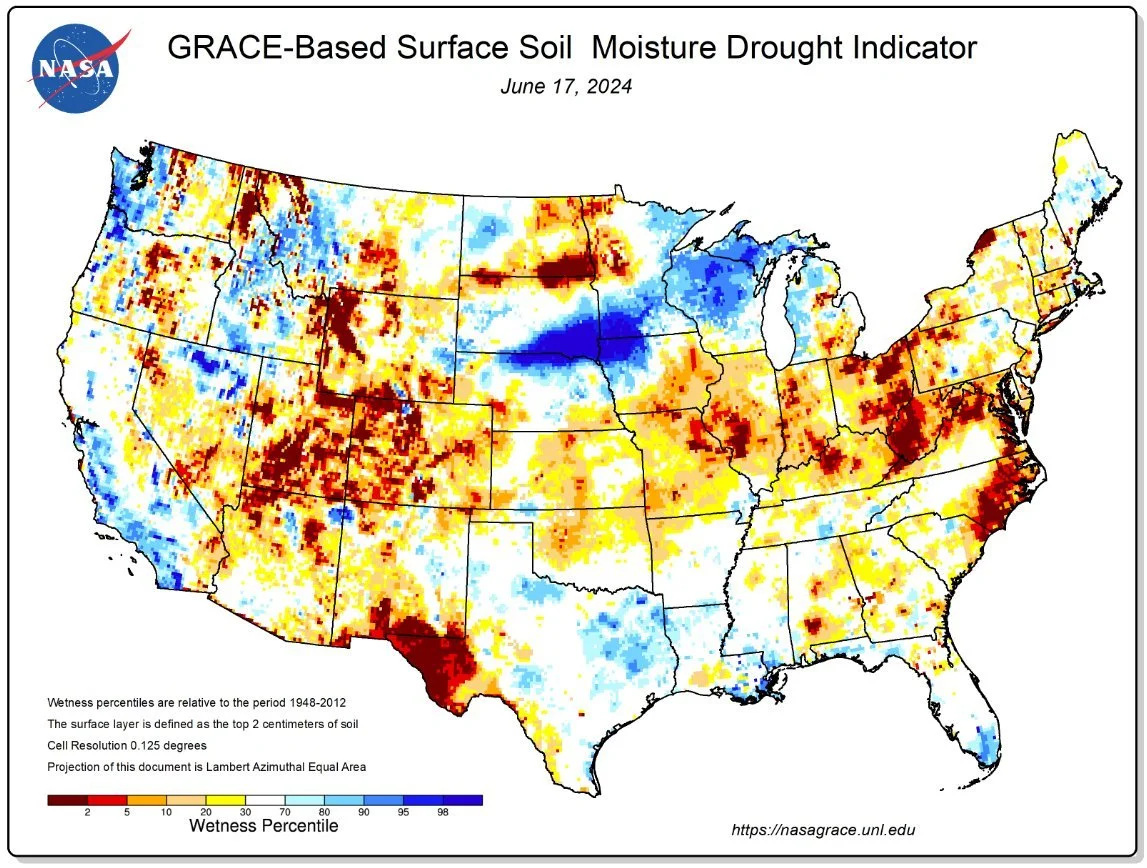

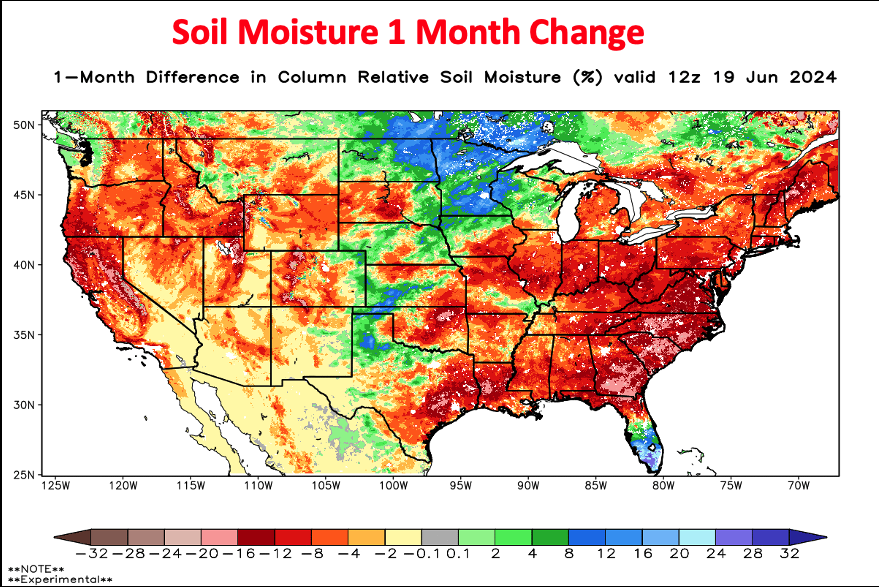

After being completely removed, drought has already started to pop back up in the eastern corn belt. It has only been a week or so..

Illinois crop ratings dropped 8% and 9% last week. The #1 bean & #2 corn growing state. IF that were to continue, the market would get excited.

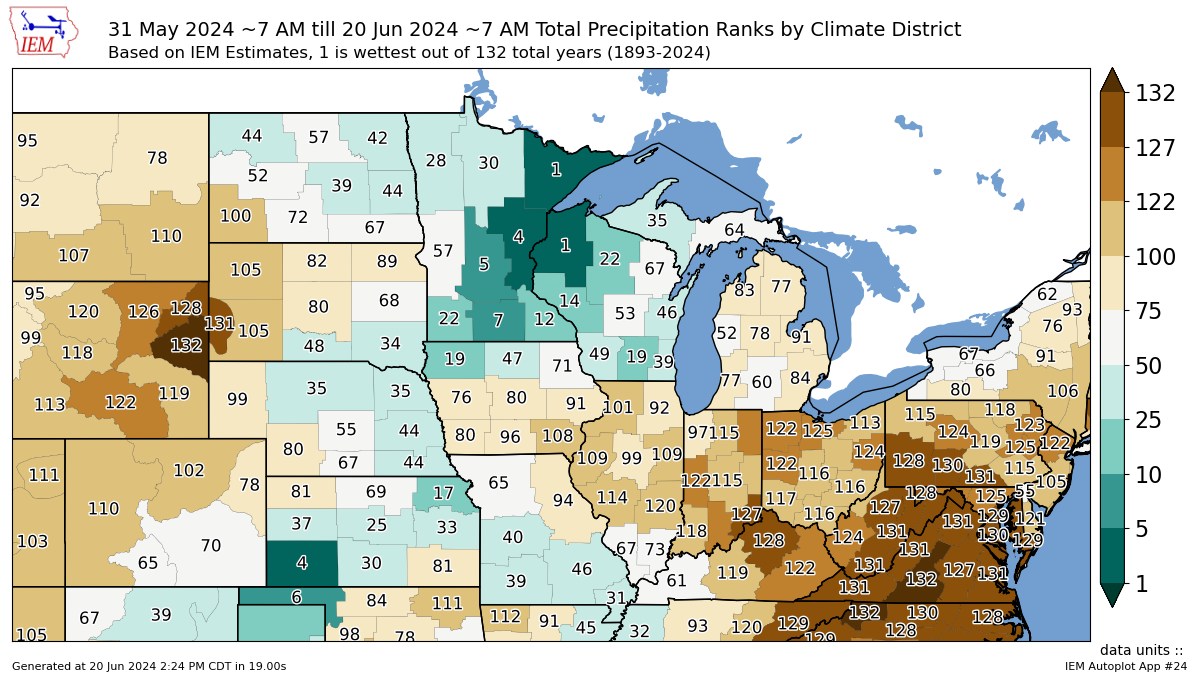

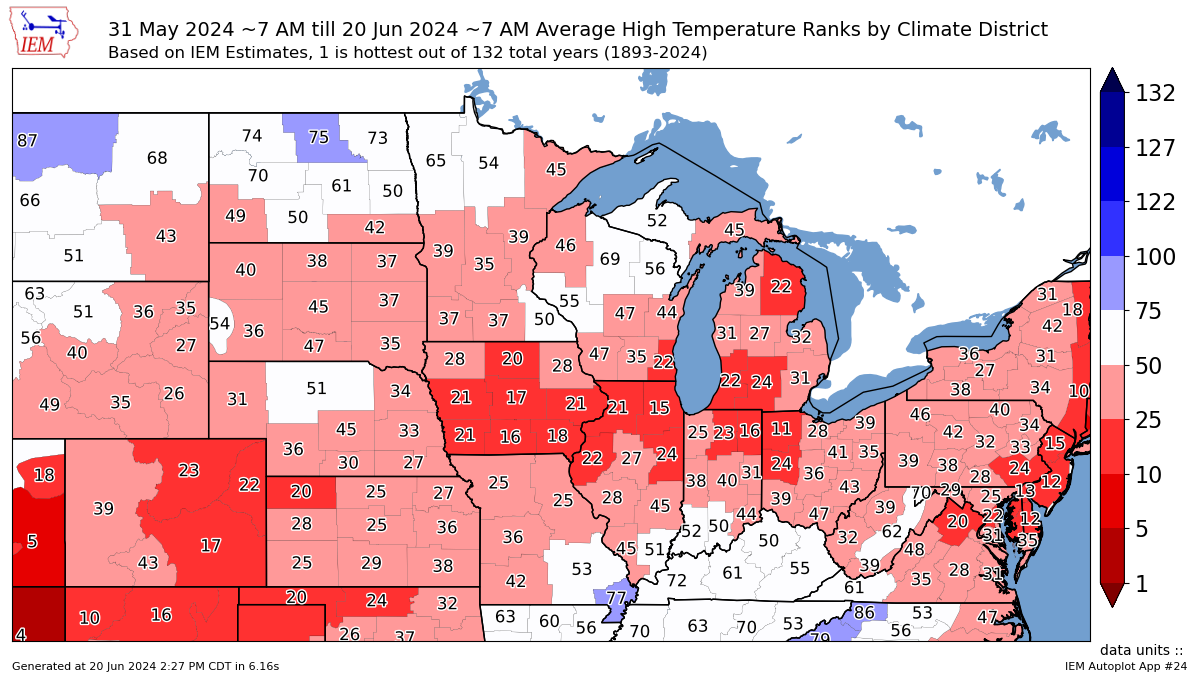

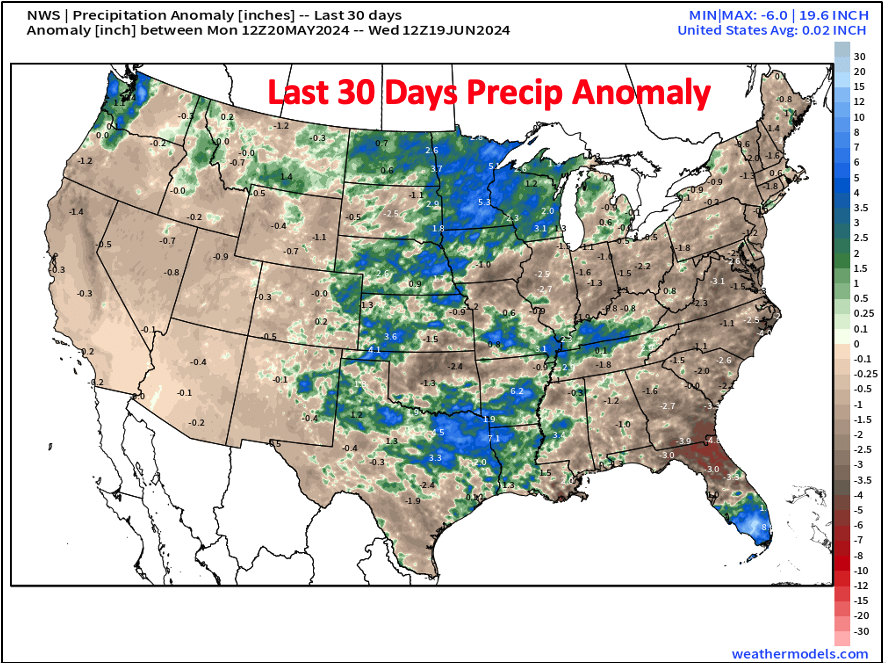

Here is how the month of June has shaped up so far.

This is the average precip & avg high temp.

Very dry & hot for the eastern belt.

Not only that, but July is expected to be even hotter and drier.

The eastern corn belt may be dry, but many other key growing areas are receiving a TON of rain.

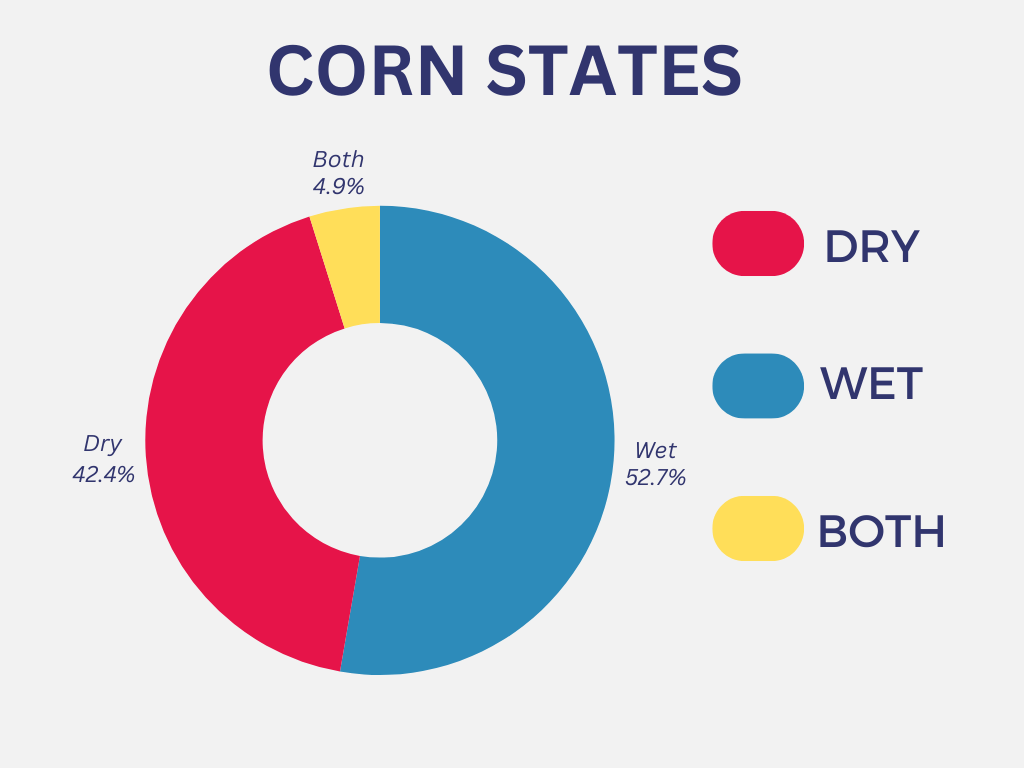

Dry vs Wet

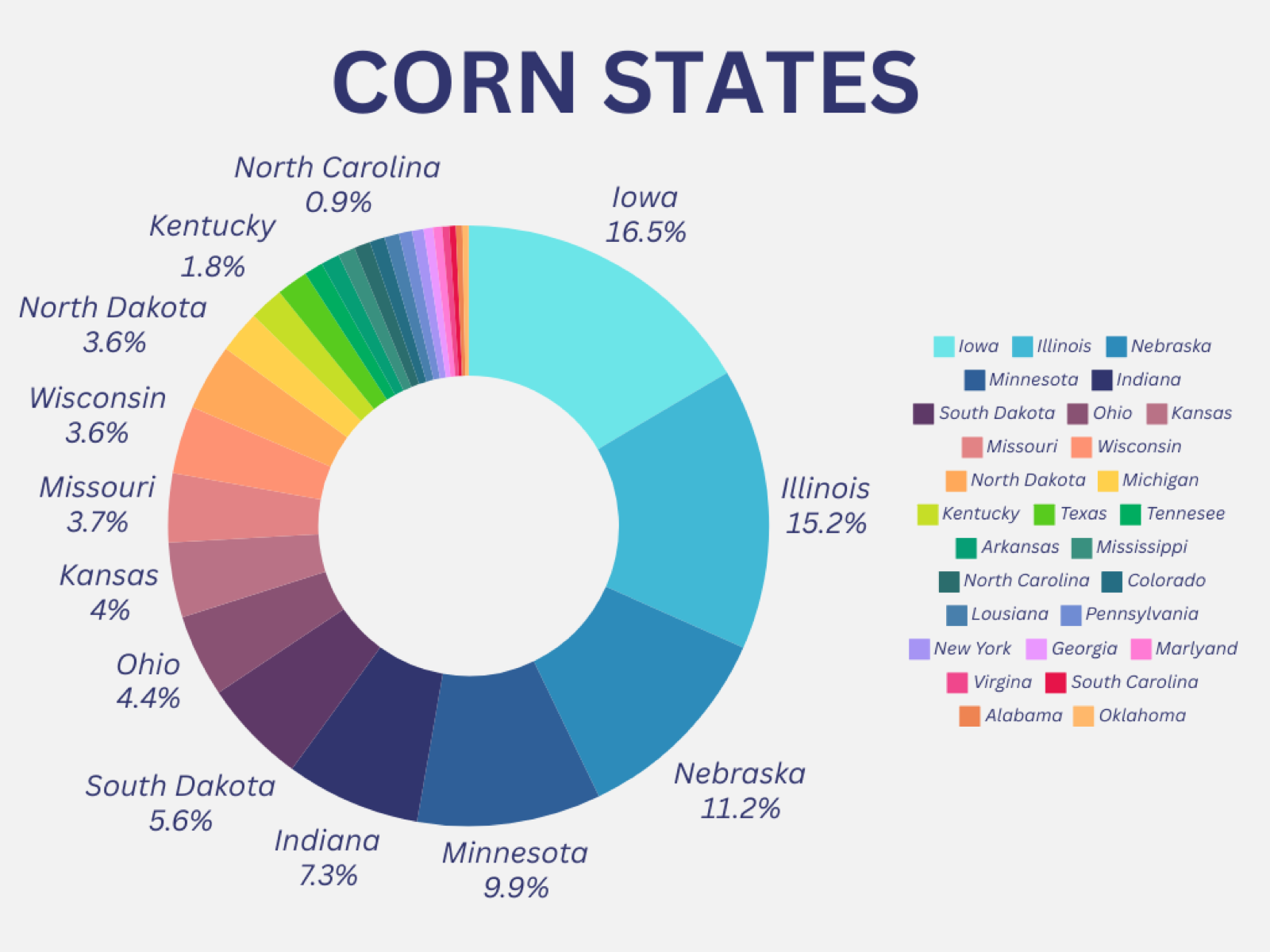

Take a look at these charts below.

They give you an idea of what % of production each state produces

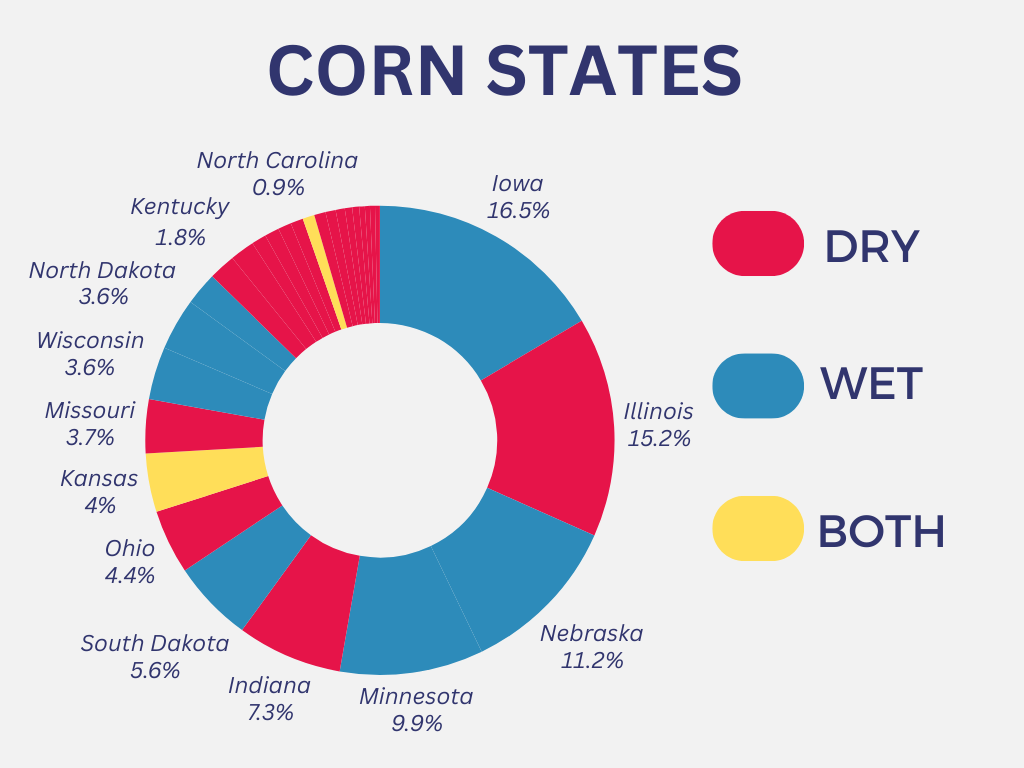

Here is that same chart categorized by wet, dry, or both.

As you can see, it is a lot of the bigger producing states that are receiving rain. Such as Iowa who accounts for nearly 17% of all production. Then you have Minnesota, Nebraska, and South Dakota.

4 of the top 6 producing states are receiving great amounts of rain.

Meanwhile, it is a lot of the smaller producing states that make up for the production areas that are dry.

Here is the last chart. It breaks down the dry vs wet areas based on % of production.

Nearly 53% of corn production is wet, where as 42% is dry.

Part of the reason why the market has not cared too much about the eastern dryness is that many of the big players are indeed getting good rain. Such as Iowa. To go along with some models like the GFS showing rain two weeks from now.

It really is this simple.. if the eastern belt gets rain we go lower. If they miss rain, we go higher..

Today's Main Takeaways

Corn

July corn nearing those April lows, while Dec corn actually took them out. Now just a dime off those contract lows from February.

The biggest thing the next 3 weeks will be weather.

It is going to be HOT. Record hot summer for many areas. BUT it might rain.

Like I just said. If it rains in the eastern belt we go lower, if it doesn't we go higher.

It really is that simple.

This upcoming heat could provide some support alone, but if it rains that heat won’t create a massive rally alone.

I have been saying for months that a wet spring needs a wet summer. Without it, you get a disaster. With it, you can raise a decent crop. We will know very soon which it is.

From BAM Weather:

"The problem from a yield perspective is the hot temps, lack of widespread consistent moisture, warm overnight lows, and the precip we do get might come in the form of severe weather (derechos etc)."

Looking past weather, this upcoming acre report have the "ability" to completely flip the corn argument from bearish to bullish. Instantly. 87 vs 93 million acres is a massive difference and the current low vs high guesses. (Could just as easily add bearishness if on high side)

***

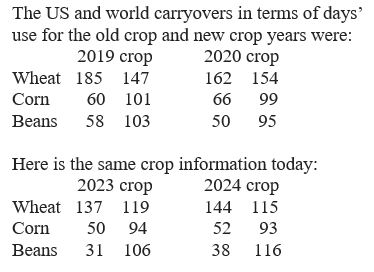

Here is a good little takeaway from something Wright on the Market had the other day (wrightonthemarket.com):

He said there are 4 ways to determine if you should make a sale.

Fundamental outlook, technical outlook, seasonal trend, and price profitability.

Fundamental Outlook from Wright:

Severe drought in Mexico, Spain, and 2 of 3 safrinha corn state in Brazil have serious drought, 40% of Chinas corn is in drought, as well as the eastern corn belt with many others being too wet. Ukraine & Russia have been dry months. US corn export pace has been increasing since November. Feed use is always low balled by USDA. Argy's corn crop has already been reduced 15-20% due to too much rain and disease. Interior Brazil corn prices are higher than the ports, so presently no corn exports from Brazil. Last year's high for Dec corn was $6.29 with a projected carryout of 2.257 billion bushels (which is a 57 day supply) on June 21st. This year's carryout projection is 2.102 billion (52 day supply). World carryout last June was a 95 day supply, this year it is 93. The US has never yielded more than 177.4 bpa. The USDA is using 181 on the S&D for the 2024 crop. That is not going to happen. Bullish. (Indicates don’t sell)

Technical Outlook from Wright:

We made our lows 4 months ago. That means the corn technical trend is sideways at worst. Corn always goes lower when it gets planted. yet we held the contract lows by 12 cents. (Indicates don’t sell)

Seasonal Outlook from Wright:

Seasonally the market goes lower from last Saturday. (Indicates sell)

Profitability from Wright:

Old and new crop prices are not profitable. (Indicates don’t sell)

3 of the 4 indicators say don’t sell vs sell. His recommendation is don’t sell until a profitable price is achieved, or the fundamental & technical outlook both turn bearish.

***

My Generic Recommendation:

I still like being patient overall, especially if you are not profitable (which virtually no one is at these levels). It doesn’t make sense locking in a loss for "most".

If you are undersold, I highly recommend still having puts for downside protection.

If you are oversold, consider courage calls.

It is never too late to place a hedge or add protection. You can always re-own at a later date if needed.

If weather turns out perfect, and that acre report is super bearish. There is no reason we couldn’t go a lot lower from here, $4.00 low. Consequently, if weather stays dry and acres surprise low, we could just as easily go a lot higher. Be comfortable with both scenarios.

Ask yourself if you'd be more upset if we saw $4.00 or $5.00 corn? That will typically answer what marketing strategies you should be using here.

In my opinion, the corn charts look ugly. As December corn took out some key support at $4.60. This could spark additional selling from big money and algos, but at the end of the day weather will always trump the charts.

As always give us a call if you want to go through your situation 1 on 1. (605)295-3100.

Marketing isn’t one size fits all. It's years like this where you have to be all that more proactive.

July Corn

Dec Corn

Soybeans

Soybeans hammered, giving back all of Tuesdays rally while November soybeans make a new low.

Just like corn, the upcoming weather and the acre report are really going to dictate where we go from here.

As we head into the acre report, here are some bullish arguments vs bearish ones.

Bullish

Spreads: The July-Nov spread is holding a massive inverse. Typically a sign that demand is greater upfront than most think.

We are cheaper than Brazil beans

Crush continues to set record after record

The potential Brazil tax situation

We just made a ton of old crop sales to China (have yet to make any new crop however)

Funds are now heavily short (not directly bullish, but gives them room to buy more later)

Bearish

More potential bean acres. Which some think is a guarantee due to the delays we had

Argentina & Brazil have decent crops. Argentina's is basically double last years

Our carryout is 450 million

Concerns about Trump & trade war with China if elected (not sure how much merit this has, but this argument has been thrown around)

The technical charts look AWFUL as of today, which could spur more selling

Unlike corn, soybeans are made in August. Later than the corn crop. The forecasts all indicate more heat and more dryness the closer we get to September.

I think we will have a better pricing opportunity than where we are at today, but if you are undersold please keep some downside protection.

Just like corn, if things fall perfectly for the bears we could go a lot lower from here.

Taking Advantage of Inverse:

The July-Nov spread is +40 cents. This is a friendly sign, but also something to note with this massive inverse between July & Nov beans is that it is never a bad idea to sell an inverse, then use some proceeds to stay long the deferred futures. The more the market inverts, the better the idea it is to lock in basis and the worse the idea is to use free DP. (We will talk about this more in tomorrow’s audio).

Call us to go over your specific situation. (605)295-3100.

Looking at the charts, July beans need to hold those April lows. For Nov beans, it is sink or swim time. Sitting right at those lows from last summer.

July Beans

Nov Beans

Wheat

Wheat continues to fall. Down 15 of the past 17 sessions. Now have given back 80% of the rally.

The rumor is that the damage to the Russian crops from the frost and drought might have been over exaggerated by analysts.

As IKAR raised their Russian wheat number by 500k MT to 82 MMT. Some were thinking they were going to lower it to as low as 75 MMT.

With this, Russian wheat cash prices continue to tumble and drag our futures lower along with it.

Like I have been saying for weeks, we will HAVE to see additional headlines out of Russia to put together a meaningful rally. Without one, there is no reason to get a major rally especially short term.

Altough I do think we will see another headline, I am not holding my breathe waiting for one. If we do get one, the odds of us creating a bigger rally than we had are slim

The bright side?

I do think we are nearing support here.

For starters, this is technical support on the charts. We bounced well off the lows today.

We are starting to get through harvest, so we should start seeing less and less harvest pressure.

But until we get through the bulk of that harvest, a rally will be tough (unless we get an unforeseen Russia headline). Because there is nothing bullish about the crops here in the US, they look great for the most part.

If you did not make any sales on this rally, or on our sell signal May 22nd.

Your best bet might be to stay patient and add downside protection with puts.

If you are someone who didn’t make sales, or is still undersold. Give us a call and we can walk you through the best strategy for your situation. (605)295-3100.

If you did make sales on this rally, we are $1.50 off the highs and now only $0.40 off the lows. Not a bad spot to test re-owning some of those sales if you think we will bounce. Although, there is never anything wrong with simply walking away and being done if you are happy with your sale.

July Chicago

July KC

Want to Talk?

Our phones are open 24/7 for you guys if you ever need anything or want to discuss your operation.

Hedge Account

Interested in a hedge account? Use the link below to set up an account or shoot Jeremey a call at (605)295-3100 or Wade at (605)870-0091

Check Out Past Updates

6/18/24

WEATHER MARKET ENTERING FULL SWING

6/17/24

SELL OFF CONTINUES DESPITE FRIENDLY FORECASTS

6/15/24

EXACT GRAIN MARKETING SITUATION BREAKDOWNS & WHAT YOU SHOULD BE DOING

6/12/24

USDA SNOOZE: WHAT’S NEXT?

6/11/24

USDA TOMORROW

6/10/24

IS USDA OVERSTATING CROP CONDITIONS? DOES IT MATTER?

6/7/24

WEATHER & USDA NEXT WEEK

6/6/24

ARE GRAIN SPREADS TELLING US SOMETHING?

6/5/24

GRAINS NEARING BOTTOM? 7 DAYS OF RED

Read More

6/4/24

HIGH CORN RATINGS, SCORCHING SUMMER, & RUSSIA CONCERNS

Read More

6/3/24

5TH DAY OF THE SELL OFF. ARE YOU COMFORTABLE?

5/31/24

4 STRAIGHT DAYS OF LOSSES IN GRAINS

5/30/24

I DON’T THINK SEASONAL RALLY IS OVER. WHAT IS THE PLAN IF I’M WRONG?

5/29/24

PLANTING DELAY STORY VANISHES. BUT IS REAL STORY OVER?

5/28/24

GETTING COMFORTABLE WITH GRAIN MARKET VOLATILITY

5/24/24

WET SPRINGS DON’T CREATE RECORD YIELDS, DO THEY?

5/23/24

MANAGE RISK DESPITE STUPID PRICE POTENTIAL IN GRAINS

5/22/24

BEANS NEAR NEW HIGHS. WHAT TO DO WITH WHEAT?

5/21/24

BIG MONEY KEEPS DRIVING WHEAT HIGHER

Read More

5/20/24

ALGOS & BIG MONEY CONTINUE TO MOVE GRAIN PRICES

5/17/24

WEATHER MARKET VOLATILITY CONTINUES TO HEAT UP

5/16/24

SITUATIONAL GRAIN MARKETING

5/15/24

HEDGING VS GUESSING

5/14/24

CORRECTIONS ARE HEALTHY

5/13/24

FUNDS DON’T WANT TO BE SHORT GRAINS

5/10/24

PRICE ACTION TELLS DIFFERENT STORY FROM USDA REPORT

Read More

5/9/24

MARKET PRICING IN NEGATIVE REPORT. WHAT TO EXPECT FROM USDA

5/8/24

USDA IN 2 DAYS

5/7/24

WHO SHOULD WAIT FOR TRIGGERS NOT TARGETS

Read More

5/6/24

GRAINS HIGHEST IN 4 MONTHS

Read More

5/3/24

SEASONAL RALLY JUST BEGINNING OR BULL TRAP?

5/2/24

ARE THE TIDES STARTING TO TURN?

5/1/24