CORN & WHEAT HOLD LAST WEEK’S LOWS

Overview

Grains were higher most of the week, however on today’s lower action we gave back some of those gains. On the week, corn and wheat were able to close higher while beans were slightly lower.

Weekly Price Change:

🌽 Corn: +15 1/4

🌱 Beans: -9

🌾 Chicago: +26 3/4

🌾 KC: +10

🌾 Minneapolis: +11 1/4

Corn had a 5-week high settlement, while soybeans had a 3-month low settlement.

A week from today we get the October USDA report.

Here are all the price changes for this week:

Weekly Price Change

Effects of US Dollar

The recent rally in the US dollar has been negatively effecting grains and harming our exports. As it has rallied for 12 consecutive weeks now. But at what point does the higher dollar stop putting pressure on prices?

When people think the dollar will continue to go higher, or until it actually goes lower.

From Wright on the Market this morning:

If the dollar index closes above 106.17 today, it will be it's 12 consecutive weekly higher settlement, which would be a record streak. Do 12 weeks make a trend? Yes, and soon buyers of US products (including farm products) will figure out they need to buy ahead now before the dollar goes higher.

Now the dollar closed just shy of 106.17. As it closed sharply lower for the 3rd day in a row. If the dollar continues to break, it will entice money to come back into the grain casino.

From Commodity Trader Brian Wilson:

"Fridays during harvest have to have a 90% chance of breaking. After disappointing numbers at the elevator for whatever reason. Mondays rally in my opinion."

From Mark Gold of Top Third:

I think the move today was overdone. We should be getting close to 40% complete on the corn and bean harvest. We are getting toward the 50% mark where we generally see the hedge activity back off. Some of the analysts are looking for the report to be a little bit bearish. I'm not sure I agree with that, I think production should be down.

Corn

Yesterday, corn reached a new 1-month high and had it's highest close on the board in nearly 2 months (since August 8th).

Today corn had it's highest weekly settlement in 5 weeks.

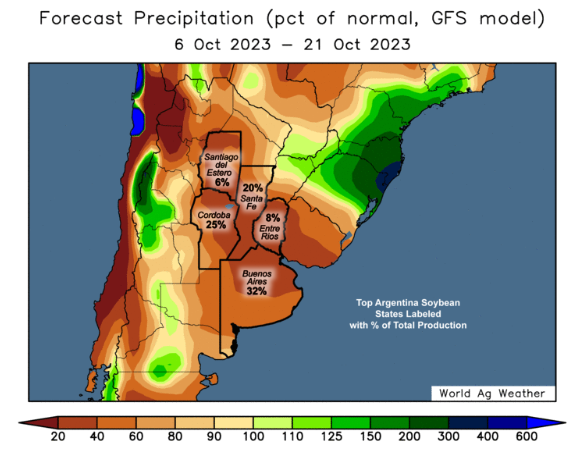

Buenos Aires Grain Exchange warned that Argentina corn plantings for 2023-24 could be less than intended if they don’t get some serious rain soon. They went on to say "Rain will be necessary over the next two weeks to meet planting goals."

What's the outlook for the next two weeks?

This is a long term bullish factor for corn.

Bottom line, the big thing to watch for is the USDA report next week.

Last year the report was a nonfactor.

In 2021, the report came out and it was the start of a major rally.

In 2020 it was also the start of a major rally.

Taking a look all the way back to 2010, it was what saved the day from the downfall from the September stocks report.

Guess we will have to see where this year takes us.

Unless we get some unrealistically bearish report, I believe we have put in our harvest lows.

Recommendation (No Change from Last Week)

Livestock users need to cover all needs for the next 6 months ASAP. Give us a call for which solution would fit best for your operation. 605-295-3100

Those Making Cash Corn Sales (No Change from Last Week)

For anyone that has been forced to make sales in the past 30 days or will have to make new sales in the next 30-45 days. Find a way to participate when China decides to come in and buy our corn, which will be happening before the end of the year.

We recommend utilizing a re-ownership strategy that fits with your operational risk/reward. Please give me a call to go over the different possible tools that might make the most sense for you. These recommendations are not one size fits all, it is imperative that you give us a call to make sure that you are utilizing the correct tool for your unique situation. 605-295-3100

Bottom line, a Friday during harvest, a lot of times you are going to close lower.

Taking a look at our chart, we have created a small uptrend from our recent lows. Yesterday's rally stopped out at $4.99. Yesterday was the first day since August 28th where we closed above $4.90. Even with today’s pullback, we are still over that $4.90 level. I think today was a healthy 50% pullback from yesterday's rally, and we should see some more technical buying here as the funds look to cover.

I believe the lows are in ($4.68). The next upside target is our 100-day moving average around $5.10. Then we look at our 38% and 50% retracements of $5.30 and $5.49, both of which are reasonable targets moving forward.

As mentioned yesterday, we could still stall out here short term with harvest. But the technicals and seasonals both point higher. I think it will be much easier to sustain a rally after harvest reaches 50-60% complete.

If we can get a break above $5, it should open the door to higher prices.

From Go Farm Yourself:

A break above $4.99 will open the door to $5.25

Soybeans

Soybeans tried to rally, as they traded at their highest levels of the week today, but ultimately fell off those highs, ending the week at their lowest settlement since June 29th.

Soybeans have now closed lower on the week for 5 straight weeks in a row. The bean market is heavily oversold here, but it still might take some fresh bullish headlines to turn things around and put in that seasonal low.

As we have mentioned in the past, historically beans grind higher from last week's report through out the rest of the year.

Next week we have the USDA supply and demand report. Now there is some risk going into this report. That risk is that new-crop yield doesn’t come in much lower. There is also some chatter about estimates being higher, which would mean stocks might eventually be a tad bigger. We will have to see, I am still in the camp that yields will be working their lower.

Dryness in Argentina continues to be a supportive factor across the grains. As 15% of their crop is being heavily effected by this drought.

Short term, beans could still see some pressure and lower prices due to harvest pressure as well as South America being off to an okay start for now.

The fate of beans comes down to 2 things.

Next week's USDA report. Where do yields come in?

The second is Brazil. How will their production and weather pan out? Will they see hiccups or will they get yet another record crop? Still far too early to tell. But after the upcoming report, this will be the number one factor surrounding beans.

Bottom line, short term it is going to be the USDA report next week. If yields come in better than expected, we likely make another leg lower. If yields come up short, we likely put in that seasonal bottom. Long term, the bean story is still bullish.

Row crops typically make their lows when harvest reaches 50-60% complete. Which would put us at making our lows within the next week or two if we were to follow history.

Reccomendation (No Change from Last Week)

With the recent price break, we recommend having all feed needs cover for the next 6 months. Call us to go over strategies that might make the most sense for your operation. (605) 295-3100.

For those forced to sell beans, if you want to give us a call and we can help you come up with some re-ownership strategies. We believe beans have tremendous upside no matter if our yield ends up being 46-48-50-51. Demand is strong as are margins and we are just money flow and a SAM production scare away from much higher prices.

In the short term we could continue to struggle because US producers are selling plenty of beans off of the combine. But longer term the bean complex is very supportive.

Beans NEED to hold those lows of $12.56. If they can't, there is a pocket of open air that could lead to more technical selling.

Bulls need to close above our 50% retracement of $12.81 1/2, which we have tested and failed 3 straight days in a row. A break above could lead to more buying. The next target would be the 62% retracement of $13.17.

Wheat

The wheat market had bounced nicely off those lows from the USDA report. Yesterday we actually regained nearly all of what we had lost. On the week, Chicago was up over +25 cents while KC and Minneapolis were both up over a dime.

Dry weather is reducing both Argentina and Australia's wheat crops which will be harvested November to January.

Australia had their driest September on record.

Overall, there is still a ton of global issues when it comes to weather. Do these matter today? Nope. But down the road they will.

We have seen plenty of war headlines, and it looks like things could be starting to heat up. Now I’m not holding my breathe waiting for one of these headlines, as we all know how often these war headline rallies are sold. But it's definitely something to keep in mind.

One of the biggest tailwinds the wheat market is facing is the dollar. It continues to make US wheat less competitive on the world trade market, and Russia is still offering a big crop at a big discount.

Longer term, there are plenty of factors that could push wheat higher.

Seasonally, wheat goes from higher from here. Perhaps we printed our seasonal lows last week.

Recommendation (No Change from Last Week)

Don’t sell wheat if you don’t have to. If you have to realize the huge discount you are selling it at. Very hard when one sell’s low and buy’s high. We want to do it the opposite.

If you have been forced to sell wheat, find a way to stay in the game but realize it is wheat and when you trade wheat sometimes you sleep on the street. With the huge carry that wheat has why would we have less nearby stocks? We should have huge stocks that are holding wheat to capture the carry. So if you are forced to sell it is going to be painful and very few re-ownership strategies will work until we get some excitement under the market. A few weeks ago it looks like we had made multi-year lows in wheat. Then last Friday came and once we hit the stops, it was watch out below. Was it enough?

I will sound like a broken record, but we have more upside then downside, wheat is a sleeper.

How do you position yourself without going broke if you are a wheat farmer? Or if your long on the board? Call me and we can discuss your situation as the reality is wheat will go much higher, when and from where is the billion dollar question.

In the meantime if you are making sales try to capture the carry in CBOT SRW if at all possible. Once farmers have stopped selling nearby and find a way to sell the carry we will be ready for a nuclear market.

Looking at the charts, we have a created a slight uptrend this week. Bulls still need to hold those lows from the last USDA report if we don’t want to trigger more selling.

First upside targets are still our 23.6% retracement levels.

In Chicago that is $6.

In KC it's $7.26.

Check Out Past Updates

10/5/23

UPSIDE BREAKOUT IN CORN

10/4/23

ARE YOU A PRICE MAKER OR PRICE TAKER THIS HARVEST?

10/3/23

CHINA IS BUYING, ARE YOU?

10/2/23

WHY YOU SHOULD BE EXCITED ABOUT TODAY’S RALLY

10/1/23