WET SPRINGS DON’T CREATE RECORD YIELDS, DO THEY?

Overview

Grains higher to end the week ahead of the 3-day weekend. Soybeans lead the way, making a new high close and highest close since January 24th. While corn and wheat both bounce well off their early lows. Wheat manages to close above $7 for the first time in 287 days.

Weekly Price Change (July Contracts):

Corn: +12 1/4 (+2.71%)

Soybeans: +20 (+1.63%)

Chicago Wheat: +51 (+7.23%)

KC Wheat: +59 1/2 (+8.99%)

MPLS Wheat: +41 1/4 (+5.80%)

The long weekend added some uncertainty to the funds. As we have plenty of factors. We have US planting, with some nasty storms on the way in areas such as Iowa who have been hammered with rain.

This weekend is going to bring some rains, but after that the outlook turns a little more favorable. We are quickly approaching the point where weather for the crops in the ground is going to matter more than the ones not yet planted.

Wheat continues to find support from the supply scares with Russia and Ukraine's wheat crop. As estimates continue to fall for both. Weather in Russia is expected to remain dry for essentially most of June in the key growing areas. There is plenty of talk that this crop could wind up sub-80 MMT. The estimates back in March were 93. From a technical standpoint this close over $7 opens the door to higher prices.

Soybeans look very strong. Today we posted our highest close since January. Almost breaking past that key $12.50 resistance. Once we break above that, I think we run higher fast.

Earlier this week, China beans traded to new highs equivalent to $15.27. The rumors now are that China is looking for US soybeans, and that loads of US beans are on their way to China. Nothing yet confirmed.

Those were some of the things going on. Now let's jump into the good stuff…

Today's Main Takeaways

Corn

Corn didn’t scream higher, but the recent price action has been very friendly.

Today they tried to pound us lower but we crawled back. Now posting 5 straight days of higher lows.

Did you know that if you bought corn today and sold it on June 9th, you would’ve had a winning trade the past 12 of 15 years?

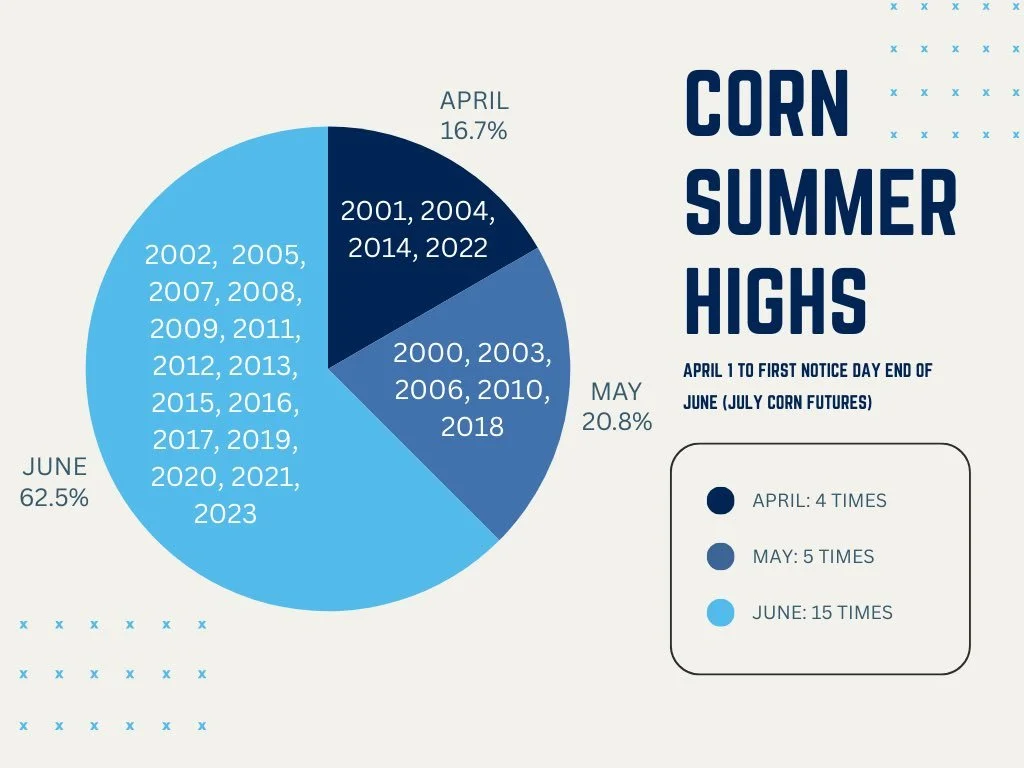

Let's look at when July corn typically makes it's summer highs (from April 1st until first notice day in June).

We have made our highs in June the past 15 of 24 years (63%). 7 times in the past decade (70%).

We have only made them in May 5 times since 2000 (21%). And ONLY ONE time in the past 14 years (7%). That being 2018.

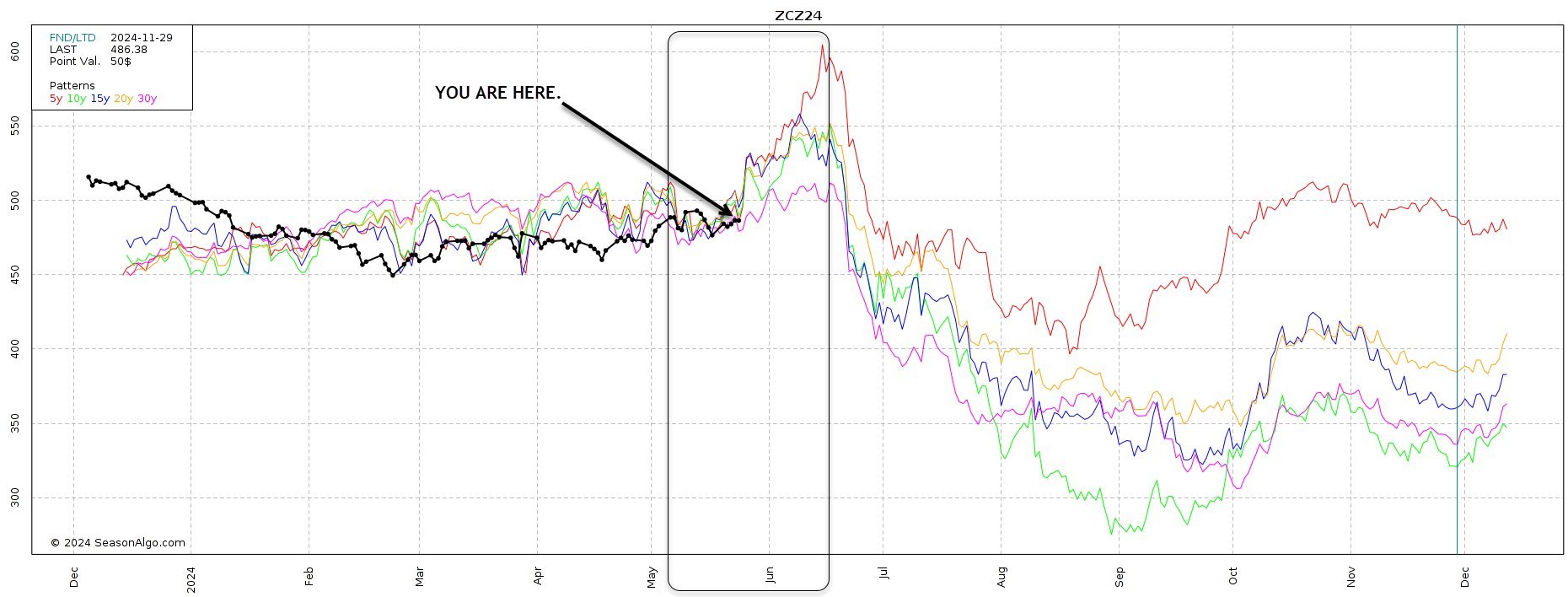

Now here is a seasonal chart from Darrin Fessler. As you can see, the 5yr, 10yr, 15yr, 20yr, and 30yr averages all point higher into June.

Do seasonals always work? Of course not. There will be years where corn doesn’t go higher in June.

But why do I think this year will not be one of those?

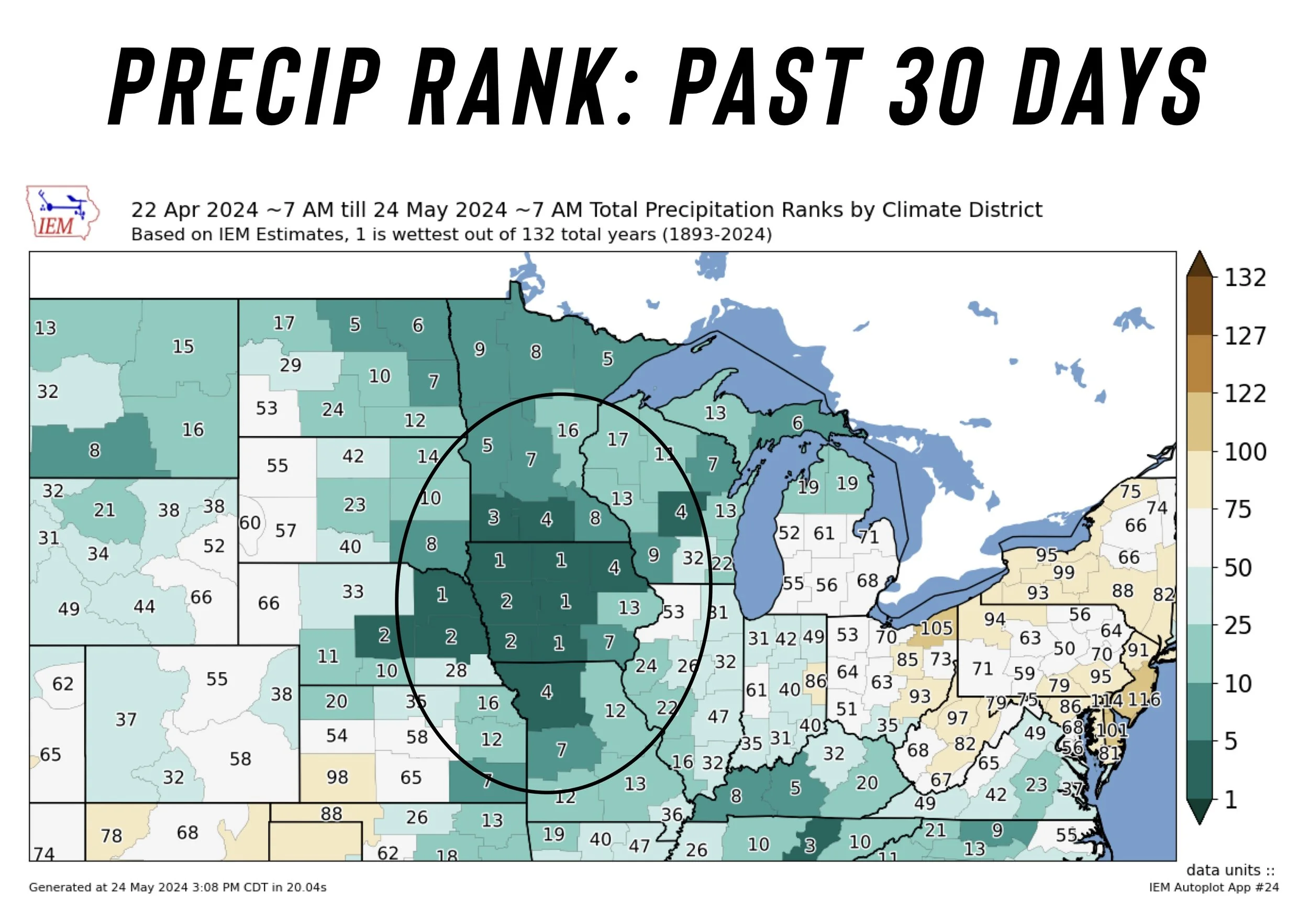

Just look at Iowa the past month. The most rain since 1893 for a majority of the #1 corn growing state.

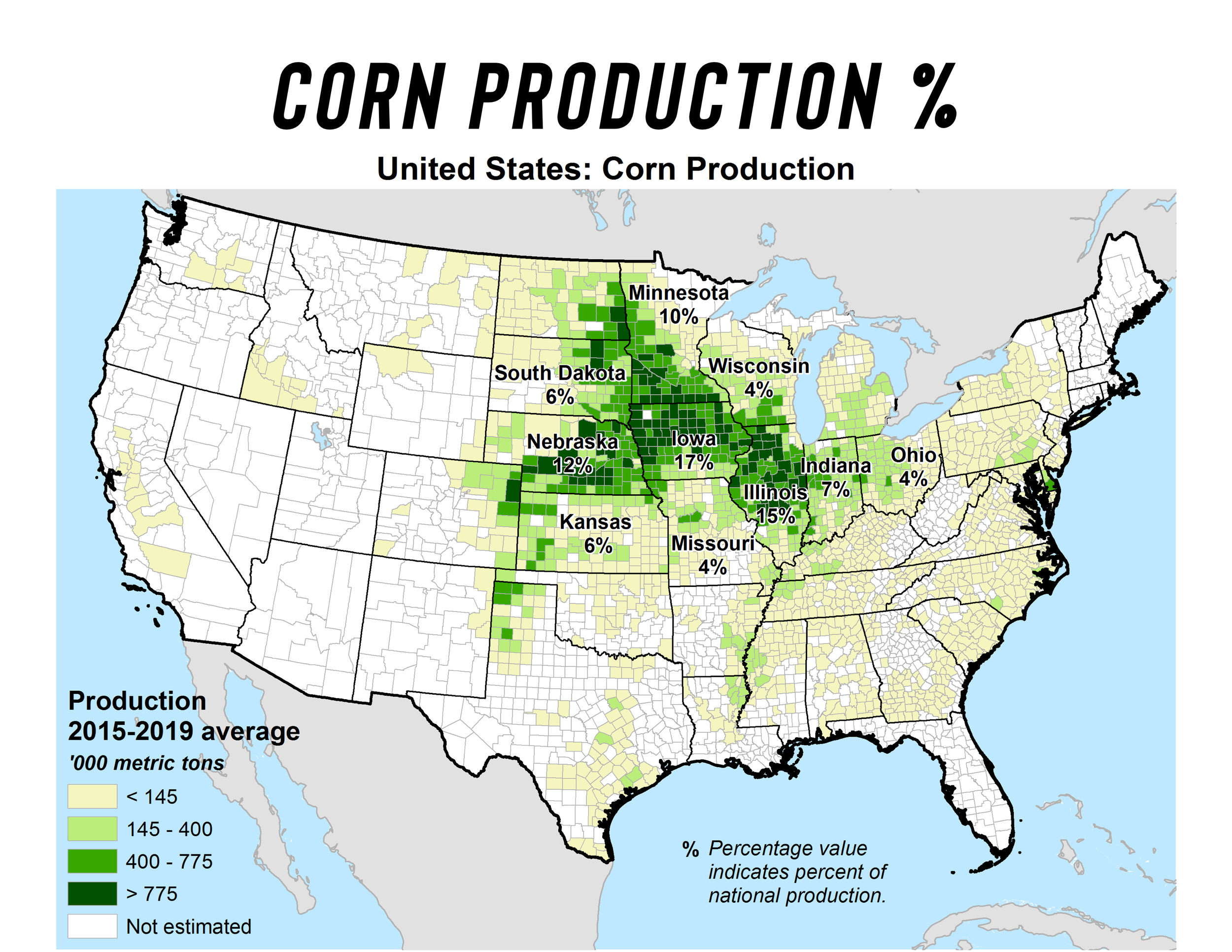

Iowa makes up for 17% of total US corn.

Outside of Illinois and Indiana, almost every major corn area has been swimming.

A lot of planting got done last week. But at least 25% or so of this corn crop got planted in less than ideal conditions. A lot of guys are just trying to get the seed in the ground by any means possible, and with that could come a yield penalty.

With the genetics, nearly everyone would rather have a dry year than a wet year. With a dry year you can at least get your work done. All of this new technology we have has been developed to combat drought and get root structure. You get the opposite when it's wet. Your root system is not going to develop right. You are going to get a lot of compaction issues. This becomes even a worse issue if it dries out later in the growing season. (The forecasts suggest that right now).

Could we raise a 180 crop? Possible, highly improbable. Weather would have to be perfect. If the weather gets dry this year we could get a disaster.

That is actually worse case scenario for a corn crop. To get this heavy rain and suddenly the shower turns off. If that happens and we get a hot summer like they are calling for, the impact of dryness and heat will be all that more severe than it typically would in a year like last year.

Last year we got the crop in fast in great conditions. No compaction. The root structure was massive and could soak up anything.

Bottom line, yes I do believe we will see higher prices from here. However, some of you should be using different option strategies or perhaps scaling into some sales because its simply good risk management. Some of you should be taking advantage of the huge carry as well.

Give us a call if you want to go through things 1 on 1. (605)295-3100.

Either way, we are getting close to that time frame to scale heavier into sales. Not yet, but soon. Typically by mid-June and before July 4th in most years we want to be done with old crop and anything that you can’t store for new crop.

Once we get these crop conditions and they start coming in lower than last year, I think the market will notice.

If you want a target, my first target to scale into a few sales is $4.85. As that is the implied upside move from our 2-month chop breakout between $4.35-$4.60 (+25 cents). So you add another +25 cents to $4.60 you get $4.85.

On Dec corn, I'm looking at that $5.03 gap. Before gapping lower, we chopped around in that area for months.

July Corn

Dec Corn

Soybeans

Soybeans continue higher. It looks like this market is ready to take off soon.

We have these rumors about China being hungry for US beans as their beans hit new highs.

Bears will argue about our larger carryout and how we are going to be swimming in beans, but in all reality if you trim a few bushels off our yield things can still get extremely tight in a hurry.

As matter of fact, in the past 28 years the USDA's final soybeans carryout has only come in higher than the May estimates 4 times.

The biggest thing in this soybean market right now is the technical price action and the funds.

The funds went from RECORD shorts just a few months ago to now long soybeans with plenty of room to buy more.

Why would they want to buy? Because they see risk in being short.

A few weeks ago we had the single week record for most short covering. Big money thinks we are going higher.

Not much else to say for soybeans today.

We continue to coil up right under $12.50 and it's just a matter of time before we through. Once we do that, I think we are going to run higher and the funds and algos are going to buy this thing right up.

The chart simply looks amazing in my opinion. I could see us having a breakout next week.

We haven’t closed above $12.50 since January. Today we closed at $12.48

I do think we are going to see $13.00 beans again this year. Which is my target to start scaling heavier into taking risk off the table. But there is still nothing wrong with taking some risk off here. We are $1.10 off the lows from February 29th. Some should be using courage calls, other adding protection with puts. It all comes down to your needs. Give us a call if you have questions.

July Beans

Wheat

Chicago wheat breaks $7 while KC wheat clears new highs.

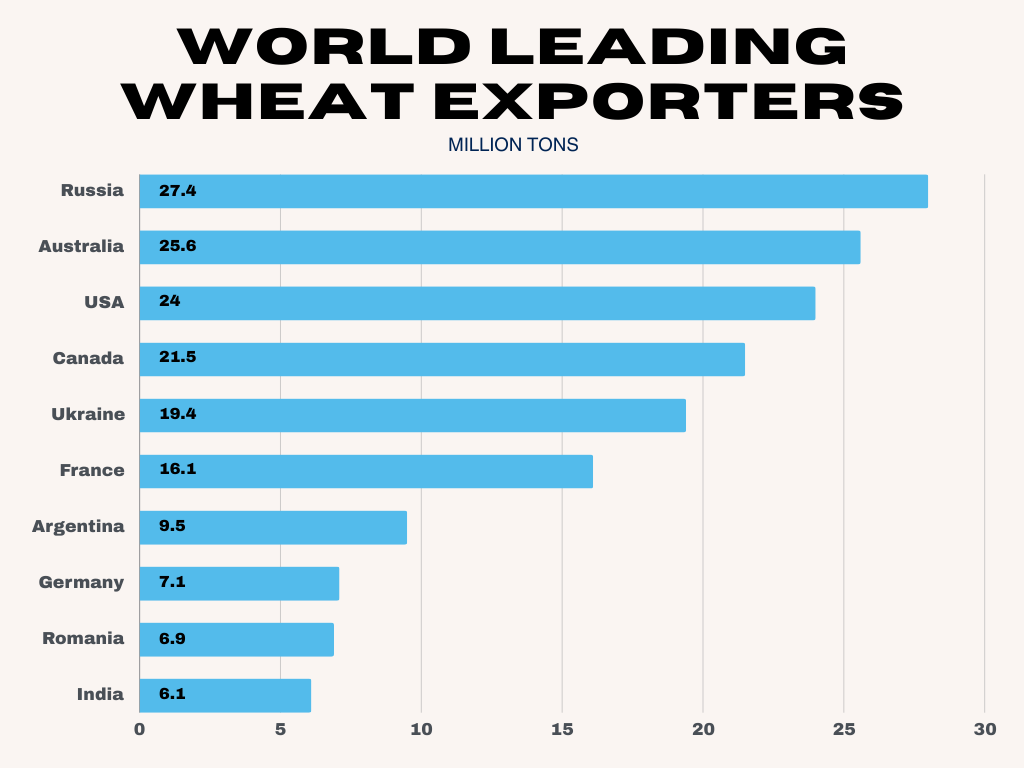

Look at the worlds top wheat exporters:

We have concerns across the world.

First Russia & Ukraine.

Two of the top 5 leading exporters have major problems. Russia is the worlds #1 wheat grower.

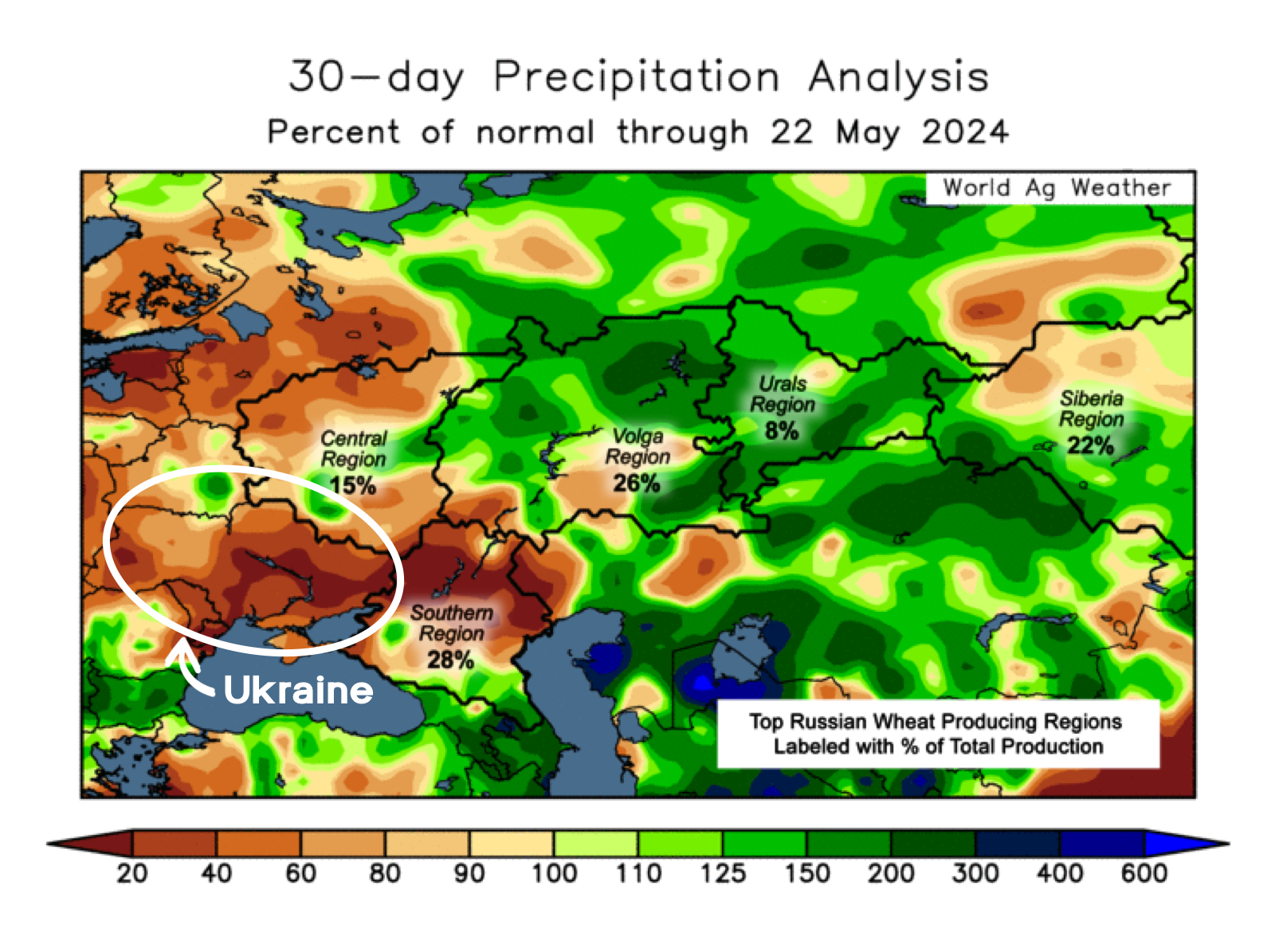

Russia has obvious concerns. They have had 4 states declare emergencies due to frost. They are having one of the worst droughts on record.

This crop was pegged at nearly 95 million metric tons a few months ago. Now the main argument is whether this crop is below 80 million or not. A massive change to the global wheat market.

A cheap ample supply of wheat from Russia is what has kept a lid on wheat the past year.

Ukraine just had it's driest past 30 days in 45 years, as that crop moves into it's critical reproductive stage.

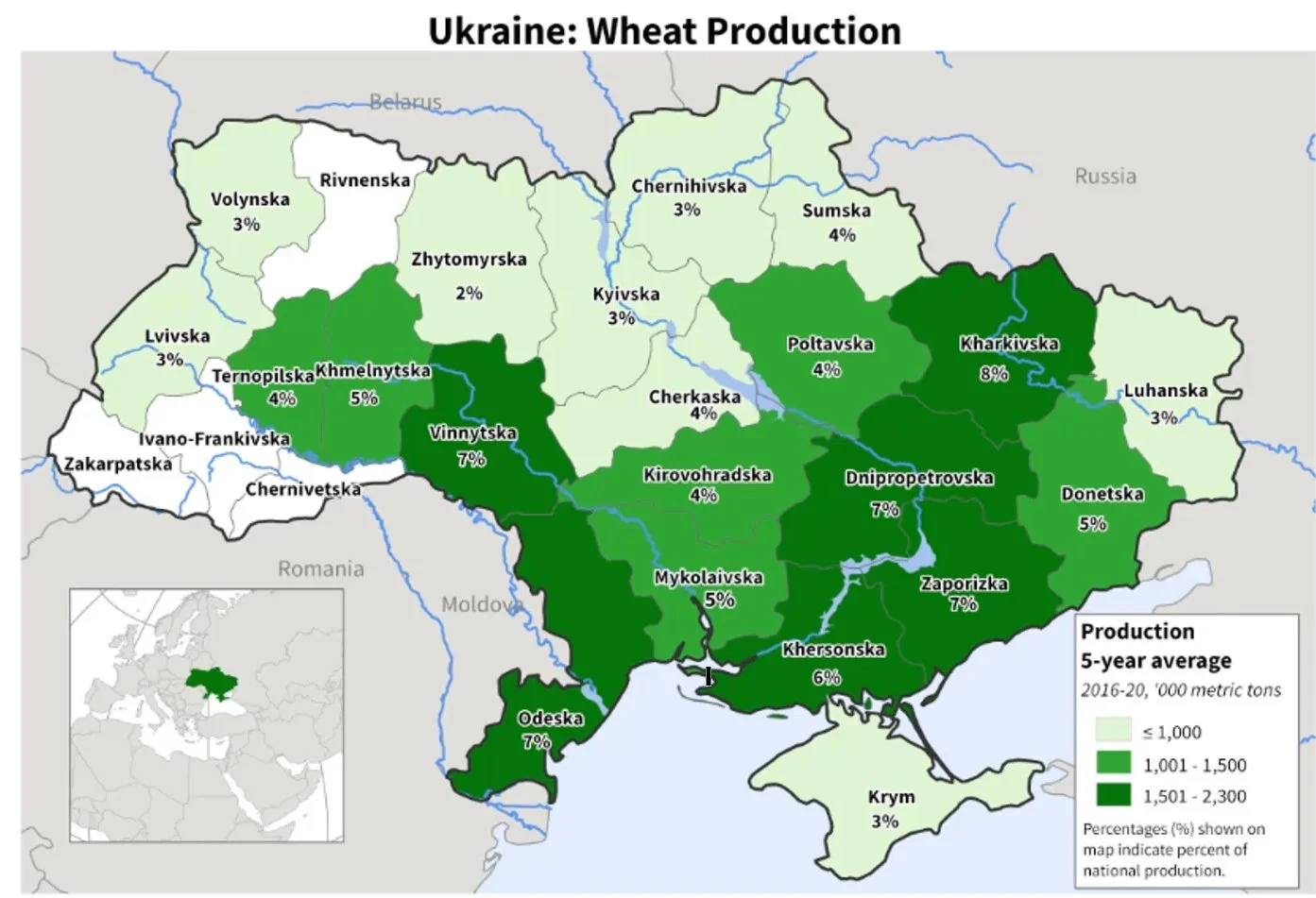

If you compare that first map with the two below, you can see that a massive portion of Russia's winter wheat is in those super dry areas just South West of the Black Sea.

And nearly all of Ukraine's production is in a drought, located just above the Black Sea.

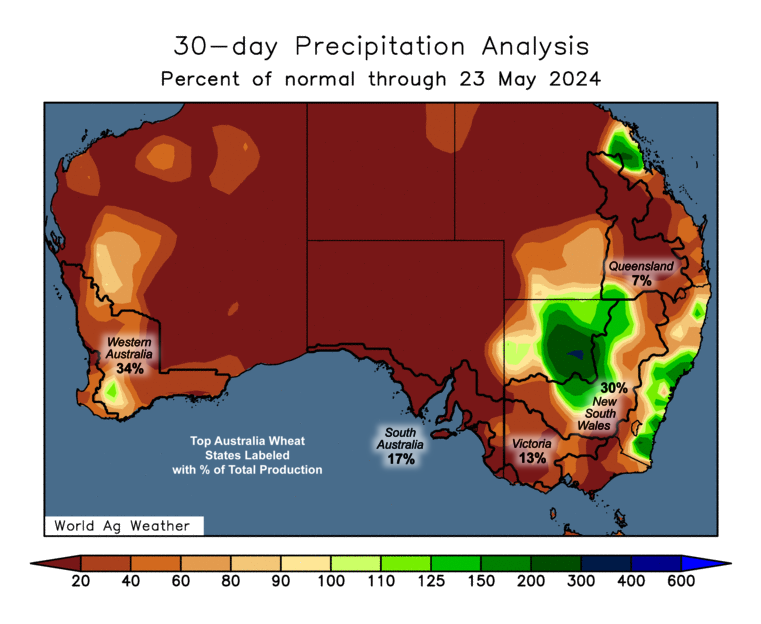

Then we have Australia..

Then France is having one of it's worst wheat crops in years. The crop rating there are -30% worse than they were last year.

The US is having a great winter wheat crop compared to last year, but I think actually having a crop to export will help us out.

Earlier this week we alerted our first sell signal for wheat.

For those that need to move wheat soon or off the combine, or need cash. Scale into some protection or sales at the highest levels in nearly a year on a near $2 rally.

I think wheat has so much "potential" upside it's unbelievable. But that doesn’t mean it has to happen. The cards are there for the possibility for us to run another $1.00. Again not saying it will happen, but there are factors that could send us there.

If you are someone who can sit on wheat for years for a time, you can make some small sales but we'd rather be patient here.

For those who can’t hold wheat for a variety of reasons, you have a few options.

If you don’t want to make any sales, you could simply grab puts and add a worse case scenario.

Another route is to make some sales but re-own with a call option if you think we are going higher and want to stay in the game.

If you are in a situation where you are selling because it is profitable or just to take some risk off, it might make more sense to sell the carry in the deferred contracts. Because there is a massive carry. To capture that carry you could sell the March 25 futures. Then 1.) wait for basis to improve, 2.) wait for the market to remove the carry, 3.) wait for the time period to ship.

This rally has been driven entirely by the funds, not commercials hence why we have a massive carry in the market.

Chicago closed over $7. From a technical standpoint that opens the door to higher prices and could cause the funds and algos to continue pouring money into wheat driving us higher.

July Chicago

July KC

Want to Talk?

Our phones are open 24/7 for you guys if you ever need anything or want to discuss your operation.

Hedge Account

Interested in a hedge account? Use the link below to set up an account or shoot Jeremey a call at (605)295-3100 or Wade at (605)870-0091

Check Out Past Updates

5/23/24

MANAGE RISK DESPITE STUPID PRICE POTENTIAL IN GRAINS

5/22/24

BEANS NEAR NEW HIGHS. WHAT TO DO WITH WHEAT?

5/21/24

BIG MONEY KEEPS DRIVING WHEAT HIGHER

Read More

5/20/24

ALGOS & BIG MONEY CONTINUE TO MOVE GRAIN PRICES

5/17/24

WEATHER MARKET VOLATILITY CONTINUES TO HEAT UP

5/16/24

SITUATIONAL GRAIN MARKETING

5/15/24

HEDGING VS GUESSING

5/14/24

CORRECTIONS ARE HEALTHY

5/13/24

FUNDS DON’T WANT TO BE SHORT GRAINS

5/10/24

PRICE ACTION TELLS DIFFERENT STORY FROM USDA REPORT

Read More

5/9/24

MARKET PRICING IN NEGATIVE REPORT. WHAT TO EXPECT FROM USDA

5/8/24

USDA IN 2 DAYS

5/7/24

WHO SHOULD WAIT FOR TRIGGERS NOT TARGETS

Read More

5/6/24

GRAINS HIGHEST IN 4 MONTHS

Read More

5/3/24

SEASONAL RALLY JUST BEGINNING OR BULL TRAP?

5/2/24

ARE THE TIDES STARTING TO TURN?

5/1/24

BE PATIENT & READY FOR THESE OPPORTUNITIES

4/30/24

FIRST NOTICE DAY SELL OFF

4/29/24

WHEAT TAKES A BREATHER

Read More

4/26/24

SHOULD YOU REWARD WHEAT RALLY?

4/25/24