CORN & BEANS TALE OF 2 STORIES. BEANS REJECT OLD SUPPORT

AUDIO COMMENTARY

Beans reject right at old support (chart below)*

Sometimes price action distorted in thin markets

Tale of 2 different markets: corn & beans

Corn spreads continue to firm while bean spreads weaken

Corn demand is still great

Demand equation & presidency effects

South America weather still hasn’t helped

Huge USDA report upcoming. Be prepared

Ways to play options via basis outlook

Corn could draw some producer selling

Beans “could” still fall $1.00 (chart below)*

Those that have to move grain in X months vs those that have time

Pretty good price action in wheat

Crucial spot for KC wheat (chart below)*

Still have no interest selling wheat here

Wheat still feels very undervalued here

Listen to today’s audio below

Want to talk? (605)295-3100

CHARTS

March Corn 🌽

Corn looks very solid. We bounced right in that golden zone & breakout point from the symmetrical triangle we had been talking about the past 2 weeks.

Next target is $4.67

It isn’t going to be a straight line, but ideally we hold that blue uptrend. My bias remains higher unless we break below the black upward trendline.

Notice the purple line curling higher. That’s the 100-day MA. That is a friendly sign signalling a longer term uptrend.

Jan Beans 🌱

Just like I mentioned Friday, the late week rally could have very well just simply been a case of a re-test before heading back lower.

We broke a significant support, so we came back to test it as new resistance and rejected right off of it.

Unless we break that downward trend we’ve been trapped in since May (green downward line) the chart looks like it wants to go lower.

We could turn at any point, but you have to be cautious that the implied move to the downside is still $8.63. So that is your risk.

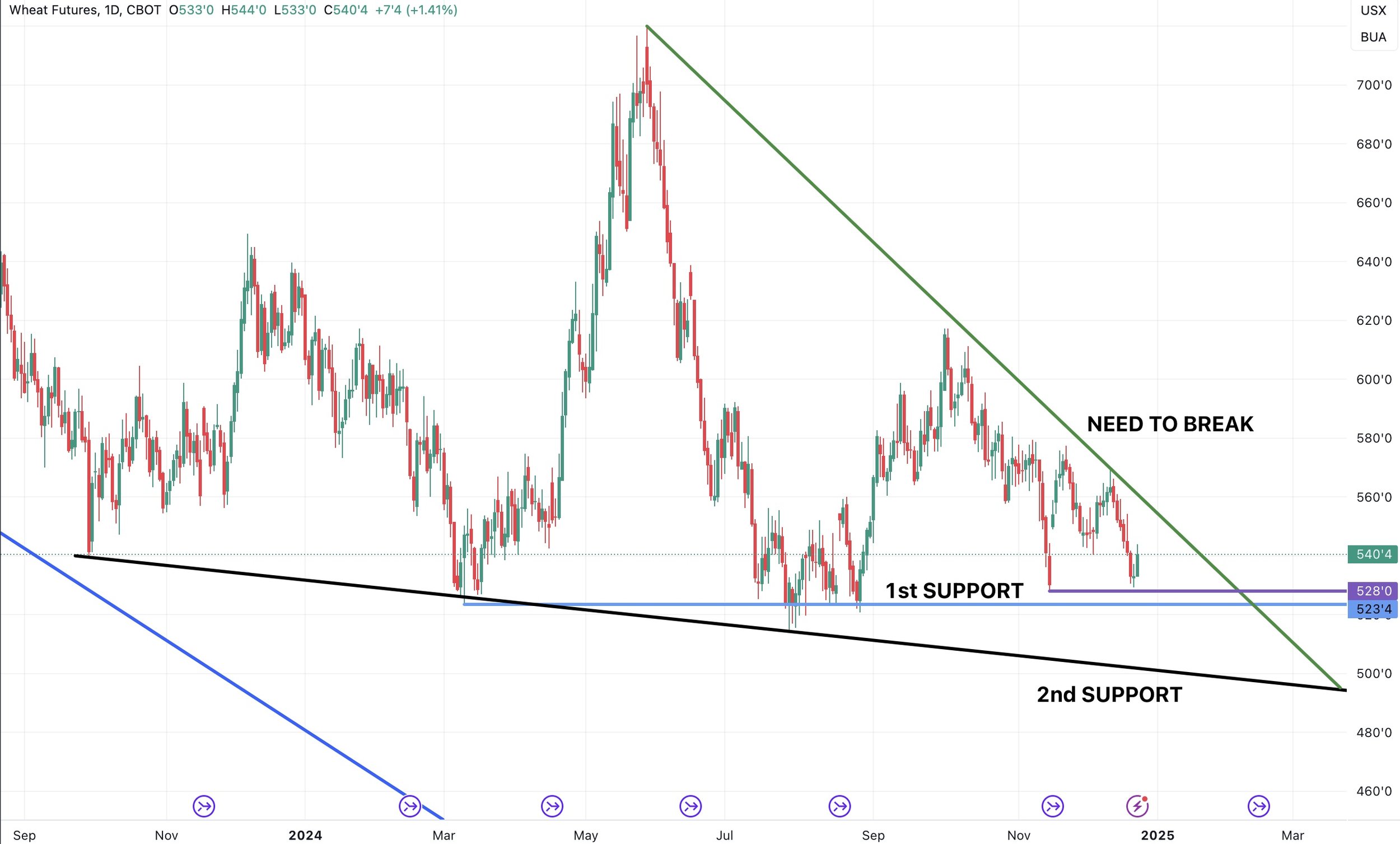

Continuous Wheat 🌾

If we bust that green downward trendline, we likely break out higher.

Until we do so, the next support is $5.28 to $5.23

If that support level fails, our next support is in the realm of $5.00

Over the course of the past year, this area has offered a bottom a few times. Back in March and September we bounced around here.

Overall, I think wheat has more upside than downside here.

March KC 🌾

KC wheat chart actually looks surprisingly decent here. On the verge of possibly breaking that downward trend we’ve been under since May (green line).

We do need to hold this $5.40 level however.

Pretty crucial spot on the chart here for KC.

A break above green likely triggers more upside, a break below purple likely brings more downside.

Past Sell or Protection Signals

We recently incorporated these. Here are our past signals.

Dec 11th: 🌽

Corn sell signal at $4.51 200-day MA

CLICK HERE TO VIEW

Oct 2nd: 🌾

Wheat sell signal at $6.12 target

Sep 30th: 🌽

Corn protection signal at $4.23-26

Sep 27th: 🌱

Soybean sell & protection signal at $10.65

Sep 13th: 🌾

Wheat sell signal at $5.98

May 22nd: 🌾

Wheat sell signal when wheat traded +$7.00

Want to Talk?

Our phones are open 24/7 for you guys if you ever need anything or want to discuss your operation.

Hedge Account

Interested in a hedge account? Use the link below to set up an account or shoot Jeremey a call at (605)295-3100.

Check Out Past Updates

12/20/24

PERFECT BOUNCE IN CORN. SIMPLE BEAN BACKTEST BEFORE LOWER?

12/19/24

THE SOYBEAN PROBLEM. NEW WHEAT LOWS. CORN UPTREND

12/18/24

BEANS BREAK SUPPORT & OPEN FLOOD GATES

12/17/24

SINK OR SWIM TIME FOR SOYBEANS

12/16/24

SOYBEANS & WHEAT FIGHTING LOWS. WILL CORN DEMAND CONTINUE

12/13/24

POST USDA COOL OFF

12/12/24

CORN CORRECTION. WHY WE ALERTED SELL SIGNAL YESTERDAY

12/11/24

USDA PRICED IN? FAIR VALUE OF CORN? BEAN BREAKOUT?

12/11/24

CORN SELL SIGNAL

12/10/24

USDA BREAKDOWN

12/9/24

USDA TOMORROW

12/6/24

CORN TRYING TO BREAKOUT. MAKING MARKETING DECISIONS

12/5/24

OPTIMISTIC BOUNCE IN GRAINS

12/4/24

WHEAT UNDERVALUED? MOST RISK IN BEANS. HAVE A GAME PLAN

12/3/24

BEANS HOLDING DESPITE LACK OF BULLISH STORY

12/2/24

TRUMP & BRAZIL HURDLES

11/27/24

CORN SPREADS, CRUCIAL SPOT FOR BEANS, SEASONALITY SAYS BUY

11/26/24

TARIFF TALK PRESSURE

11/25/24

HOLIDAY TRADE, SEASONALS, TARGETS & DOWNSIDE RISKS

11/22/24

CORN TARGETS & CHINA CONCERNS

11/21/24

BEANS NEAR LOWS. CORN NEAR HIGHS. 2025 SALE THOUGHTS

11/19/24

WHAT’S NEXT FOR GRAINS

11/18/24

WHEAT LEADS THE GRAINS REBOUND

11/15/24

BIG BOUNCE, FUNDS LONG CORN, DOLLAR & DEMAND

11/14/24

3RD DAY OF GRAINS FALL OUT

11/13/24

GRAINS CONTINUE WEAKNESS & DOLLAR CONTINUES RALLY

11/12/24

ANOTHER POOR PERFORMANCE IN GRAINS

11/11/24

POOR ACTION IN GRAINS POST FRIENDLY USDA

11/8/24

USDA FRIENDLY BUT GRAINS WELL OFF HIGHS

11/6/24

GRAINS STORM BACK POST TRADE WAR FEAR

11/5/24

ALL ABOUT THE ELECTION & VIDEO CHART UDPATE

11/4/24

ELECTION TOMORROW

11/1/24

GRAINS WAITING ON NEWS

10/31/24

ELECTION & USDA NEXT WEEK

10/30/24

SEASONALS, CORN DEMAND, BRAZIL REAL & MORE

10/29/24

WHAT’S NEXT AFTER HARVEST?

10/25/24

POOR PRICE ACTION & SPREADS WEAKEN

10/24/24

BIG BUYERS WANT CORN?

10/23/24

6TH STRAIGHT DAY OF CORN SALES

10/22/24

STRONG DEMAND & TECHNICAL BUYING FOR GRAINS

10/21/24

SPREADS, BASIS CONTRACTS, STRONG CORN, BIG SALES

10/18/24

BEANS & WHEAT HAMMERED

10/17/24

OPTIMISTIC PRICE ACTION IN GRAINS

10/16/24

BEANS CONTINUE DOWNFALL. CORN & WHEAT FIND SUPPORT

10/15/24

MORE PAIN FOR GRAINS

10/14/24

GRAINS SMACKED. BEANS BREAK $10.00

10/10/24

USDA TOMORROW

10/9/24

MARKETING STYLES, USDA RISK, & FEED NEEDS

10/8/24

BEANS FALL APART

10/7/24

FLOORS, RISKS, & POTENTIAL UPSIDE

10/4/24

HEDGE PRESSURE

10/3/24

GRAINS TAKE A STEP BACK

10/2/24

CORN & WHEAT CONTINUE RUN

10/1/24

CORN & WHEAT POST MULTI-MONTH HIGHS

9/30/24