PLANTING DELAY STORY VANISHES. BUT IS REAL STORY OVER?

Overview

Grains pressured heavily with a risk-off day across all markets. This included a broad sell-off from everything from stocks to energy futures, spilling over into the grains. As the US dollar rallied, crude oil and the US stock market sold off.

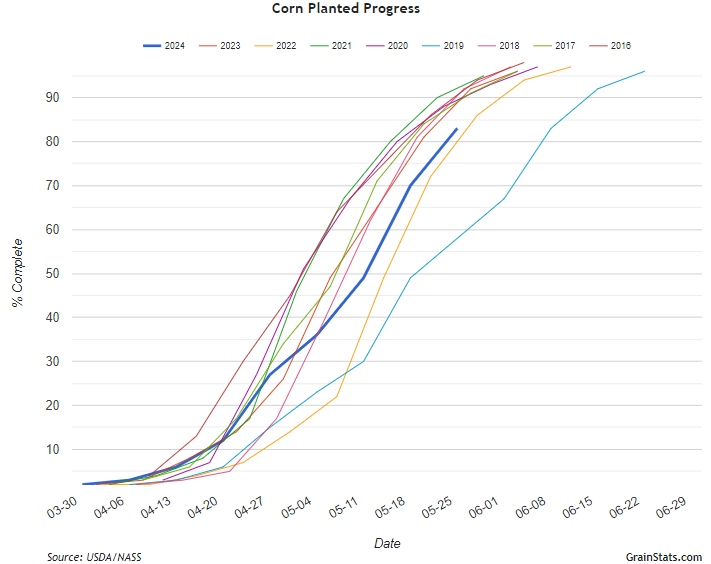

To add on to this, the delayed planting story is gone.

Yesterday's crop progress showed no concerns as corn was 83% planted vs the 82% 5-year average. (Keep in mind if you remove 2019 from this, the average jumps to 90%.)

Soybeans came in at 68% planted, ahead of the 64% average and faster than the estimates of 67%. Last year were at 78%.

The corn and soybean market are now going to lose interest in planting progress and will very soon start paying attention to the actual crop developments and crop conditions. As we get the USDA's first conditions next Monday. Most expect strong initial ratings.

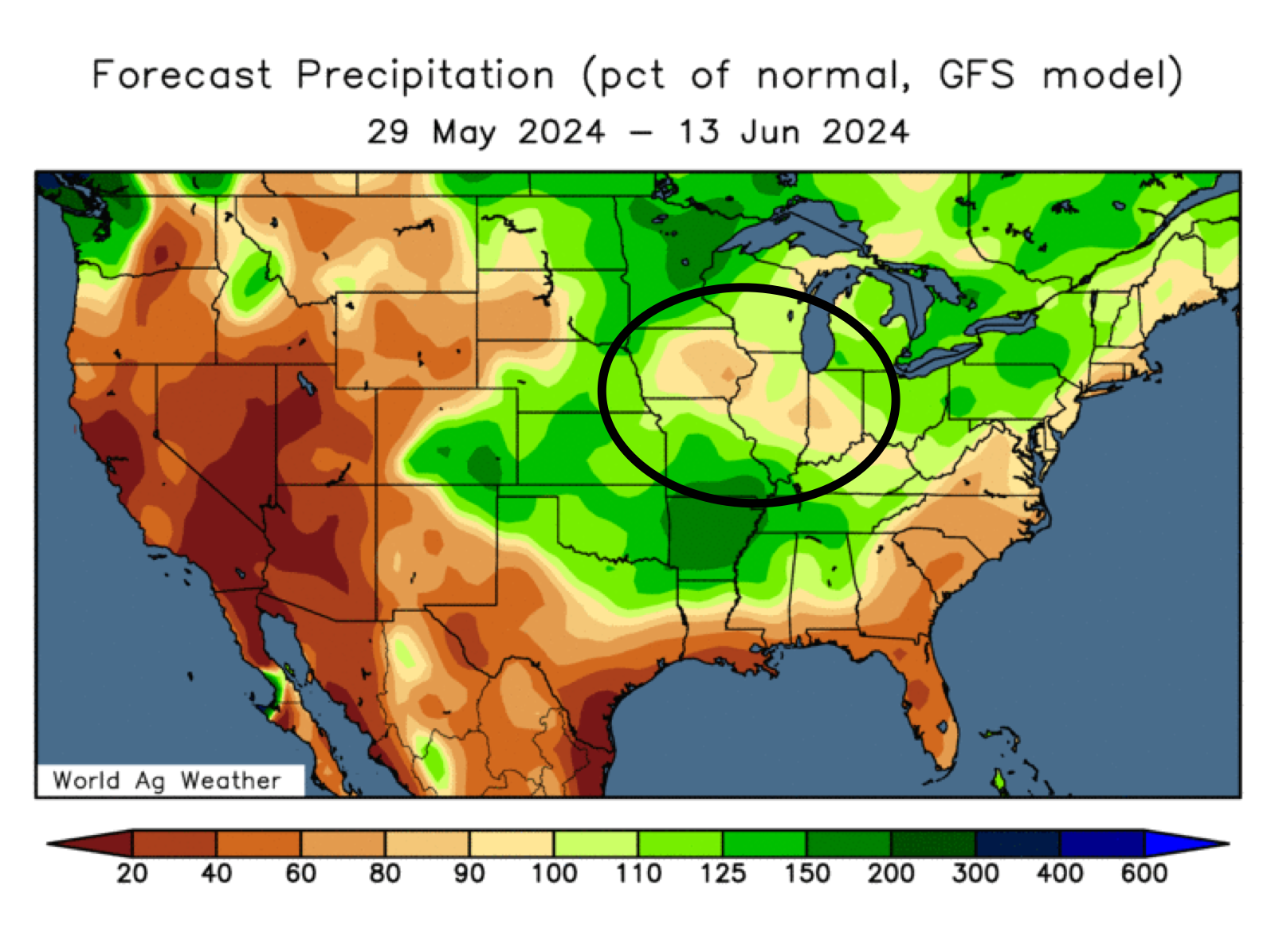

With planting delays gone, the market is looking for something to chew and without a bullish story to get behind for now as the US will be looking at it's driest outlook of spring this week and help finish planting those crops.

Overall just a lack of bullish news leading to the path of least resistance being lower.

Yesterday's action in grains was awful as we failed to break out on the charts. In yesterdays audio we said this would likely result in some more follow up selling before finding support.

Russia and Ukraine wheat areas are still suffering from dryness and the global wheat concerns have not gone anywhere, but the market has priced this in for now.

India is going to start importing wheat for the first time in 6 years, but this wasn’t a major factor as no one knows if it will be anything major or not. India also announced they are taking off their wheat import tax, but it looks like Russia will get most of the business. However, with Russias smaller crop some are asking how much they will be able to supply.

Argentina announced they are going to start exporting corn to China in July as they settled their trade disputes, so this doesn’t help the US corn market.

There just is not a clear story in these markets to make the funds have a risk on mentality like they had the past month. We initially had the possibility for major delayed planting, so they covered their shorts due to that possibility. That possibility is now gone, so they are pausing as we head into the time of year where these crops will be made or broken in the actual growing season. We do still however have the seasonal trend and technical trend in favor...

Today's Main Takeaways

Corn

Corn posts it's second big red day in a row, down nearly a dime to start the week.

As I mentioned, the planting delay story is no longer a thing.

But what if I said that was never the big story to begin with?

We all knew this year wasn’t going to be a repeat of 2019. Not even close.

But what we do know is that we had some major rain this spring. Iowa the #1 corn producer had the wettest spring on record.

The concern was never "we aren’t going to get this crop in" or "this crop is going to get pushed into a less favorable window".

The concern has always been the problems that occur later down the road when you "mud" a crop in. You get the nitrogen losses, you get the compaction issues that all ultimately drag yield.

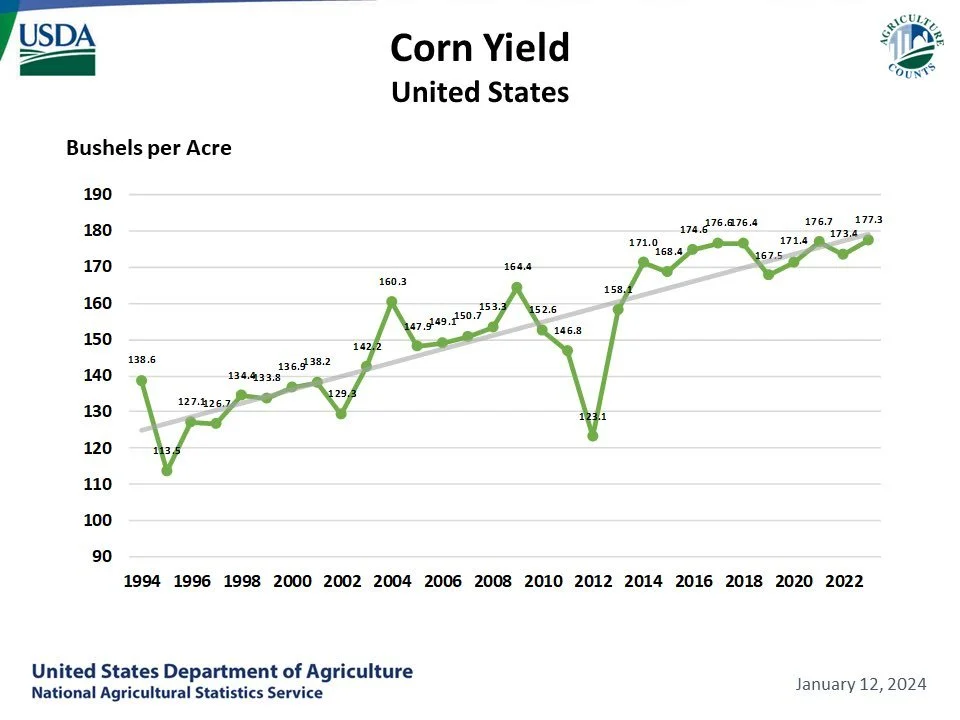

Could we raise a 180 yield? Possible but I wouldn’t bet money on it. Trying to predict yield in May is absurd and impossible, but saying 180 is likely off the table isn’t a wild guess.

There has never been a year where we see a record corn yield when planting was less than 50% as of May 12th. This year we were less than 50%.

In all reality, we have struggled to get 177 and trendline yield has been stagnant for a decade. With these early issues, why would we magically get a 180?

Planting this year is actually very similar to that of 2022, yield that year fell below trendline.

Typically when we get the early stress like this, we will need timely rain the rest of the summer.

Yes, if we do get timely rain there is a chance we still raise an amazing crop perhaps in the high 170's. However, if we do not get those rains we could quickly run into bigger issues.

One thing this rain has done is super charge our sub soil, which makes us better able to handle a drought. But on the other hand, mudding a crop in ruins the root structure and brings compaction issues.

This wet spring does bring the chance that we look at a lot lower prices come fall. IF we raise a great crop. It is far too early to make any bold assumptions either way.

This recent rally has been a supply driven rally. However, this isn't the typical supply rally you look for and look to sell. Usually these come in June and July and are a more explosive type of rally because it is going to occur in that critical pollination time frame where if we miss some rains yield can fall.

Supply rallies go up fast, and crash down fast. Last year for example, we rallied +$1.00 in a month before crashing down. We are probably in that same situation this year. So I am looking for a supply rally.

Weather is going to be the most likely reason for the rally, but it could come from a multitude of things such as demand, inflation, the funds jumping ship, or election year chaos. Along with the technicals and seasonals.

So bottom line, I think we are going to get that rally when these crop conditions in states like Iowa start coming in lower than they were last year.

Looking towards fall, if we don’t get a weather event we could be a lot lower come fall. That is just the risk that no one knows.

You have to be prepared for every scenario. If some of these bearish folks are right and corn does drop below $4.00, what is your plan?

I am not guessing that will happen, but it is called hedging not guessing. I don't like being super aggressive here, but I also don't want to sit around and do nothing.

Right now there is no major reason for prices to fall out of bed as we still have to keep some weather premium in this market as we wait for June and July. I think prices are going higher, but most of you should have some protection especially if you are undersold. But it depends on your situation, give us a call to talk it through (605)295-3100.

If you make sales and want to participate in the upside, consider re-owning with calls. Or you can replace a sale by simply buying a put on some unpriced bushels.

The two unknowns are weather and demand. The biggest bear we are facing in a large US carryout. The next update we get from the USDA outside of crop ratings is June 12th.

All we need for a supply rally to happen is the market to think even for a moment that the crop isn't going to be there. Just a scare to create a supply rally. It does not even have to come to frution. A scare and a crop failure are two different things. Last year was a scare. 2012 was a failure. Both create opportunities.

When we start rallying, for those that don’t have new crop storage you are going to have to be more aggressive, start selling into it, and have most sales done by mid June and typically July 4th at the latest for what needs to be delivered in fall. Or at the very least have protection in place.

Give us a call if you want to go through things 1 on 1. (605)295-3100.

Nutrien Ag Solutions, one of the top 2 nitrogen fertilizer manufacturers, said that they see US 2024 corn acres at 87 million acres vs the USDA March intentions of 90 million acres and 94.6 million acres of corn in 2023. If Nutrien is correct, that would be extremely bullish. (Something to keep an eye on).

A side note:

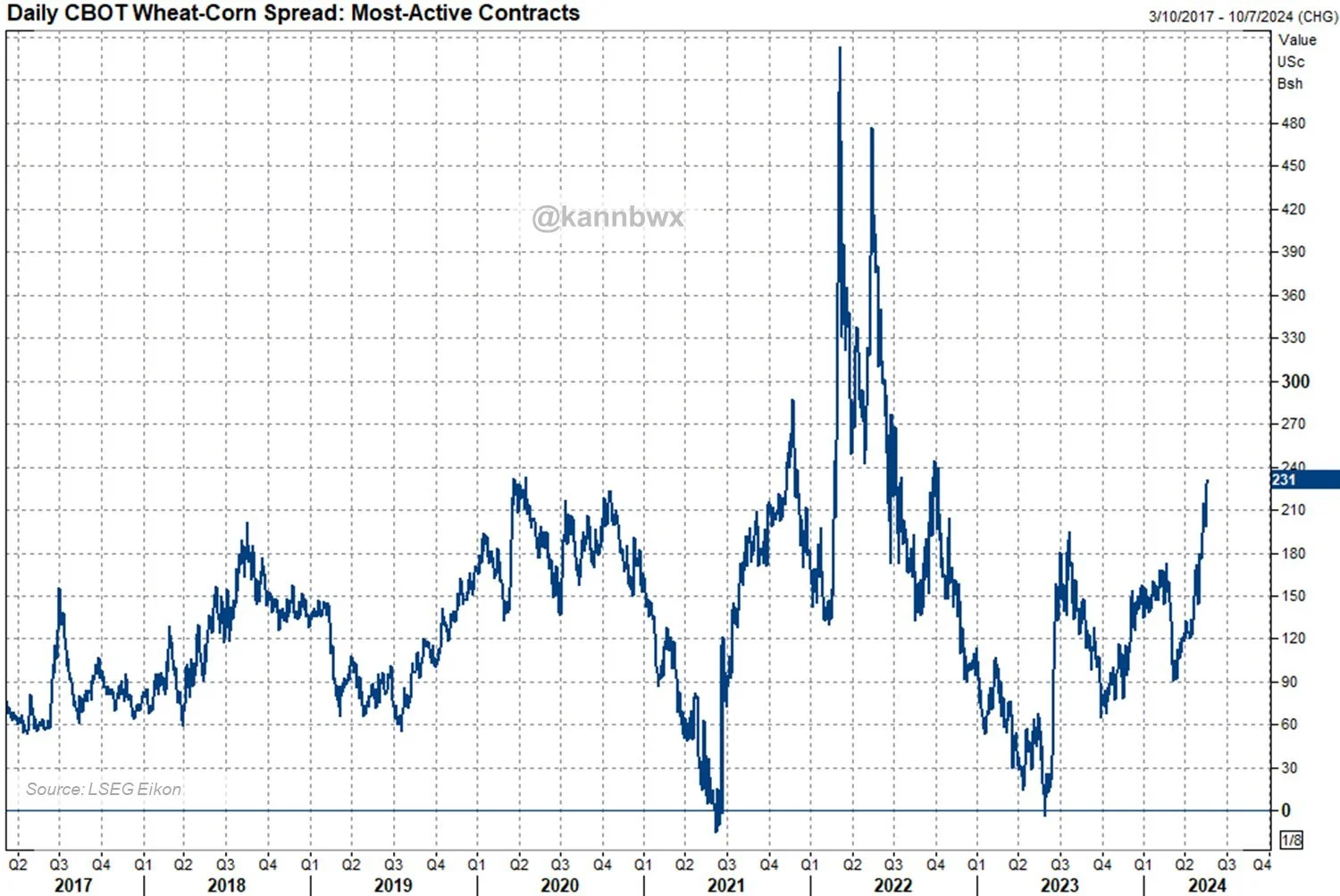

Keep in mind you want to sell what is overvalued and store what is undervalued, provided you have that flexibility. Take a look at corn vs wheat. So if you are trying to decide between selling corn vs wheat, corn is undervalued and wheat is overvalued. We have the highest wheat to corn spread since 2022.

July Corn

Dec Corn

Soybeans

Soybeans continue to sell off to start the week.

The fall off in meal has dragged beans lower. Some of the blame is from China demand worries and demand isn’t showing up as strong as they forecasts showed earlier this year.

We also have harvest wrapping back up in South America following the floods that slowed harvest and sparked the ideas of potential yield losses.

We have a similar situation in corn. There is just no real risk right now in the crops as the planting delay story is out the window.

The same concept I talked about in corn is true for soybeans.

I think prices are going higher and I do expect that summer supply rally, but if we get timely rains there is a possibility we see a high yield in beans come fall followed by lower prices.

Overall our bean fundamentals are still fairly bullish, as supply is still pretty tight in the US and Brazil's crop is 20 million less than expected.

We are now that in time frame where the funds are pausing. I think we still still have a ton of "potential" upside and $13.00 doesn’t sound like a crazy target.

It seems like everyone is extremely bearish. Often times when all you hear about how the sky is falling is when we reverse and go higher.

Not much else to say as my thoughts for beans are essentially the same as corn. But one thing beans do have going for them is a tighter US carryout. One that if we lose a few bushels could spice things incredibly fast.

Just like corn, even though I see higher prices you should still be managing your risk. Whether that is small incremental sales or simply adding puts for protection.

(I like defending with puts and hoping they become worthless for a lot of you guys. Soybeans have more upside potential than corn, but also far more downside risk).

I do think we are going to see $13.00 beans again this year. Which is my target to start scaling heavier into taking risk off the table. But there is still nothing wrong with taking some risk off here. We are still nearly $1 off the lows from February 29th. Some should be using courage calls, some making small sales, other adding protection with puts. It all comes down to your needs. Give us a call if you have questions.

You cannot control the market, only your market plan.

The price action on soybeans turned from very bullish Friday to pretty bearish today. But we have not fully broken the charts. If we can get back over $12.50 this chart opens right back up. Look for the funds and algos to continue driving us up and down, setting both bull and bear traps.

July Beans

Wheat

Wheat down hard again for the second day in a row, but is still relatively close to the highs. Sitting at $6.93.

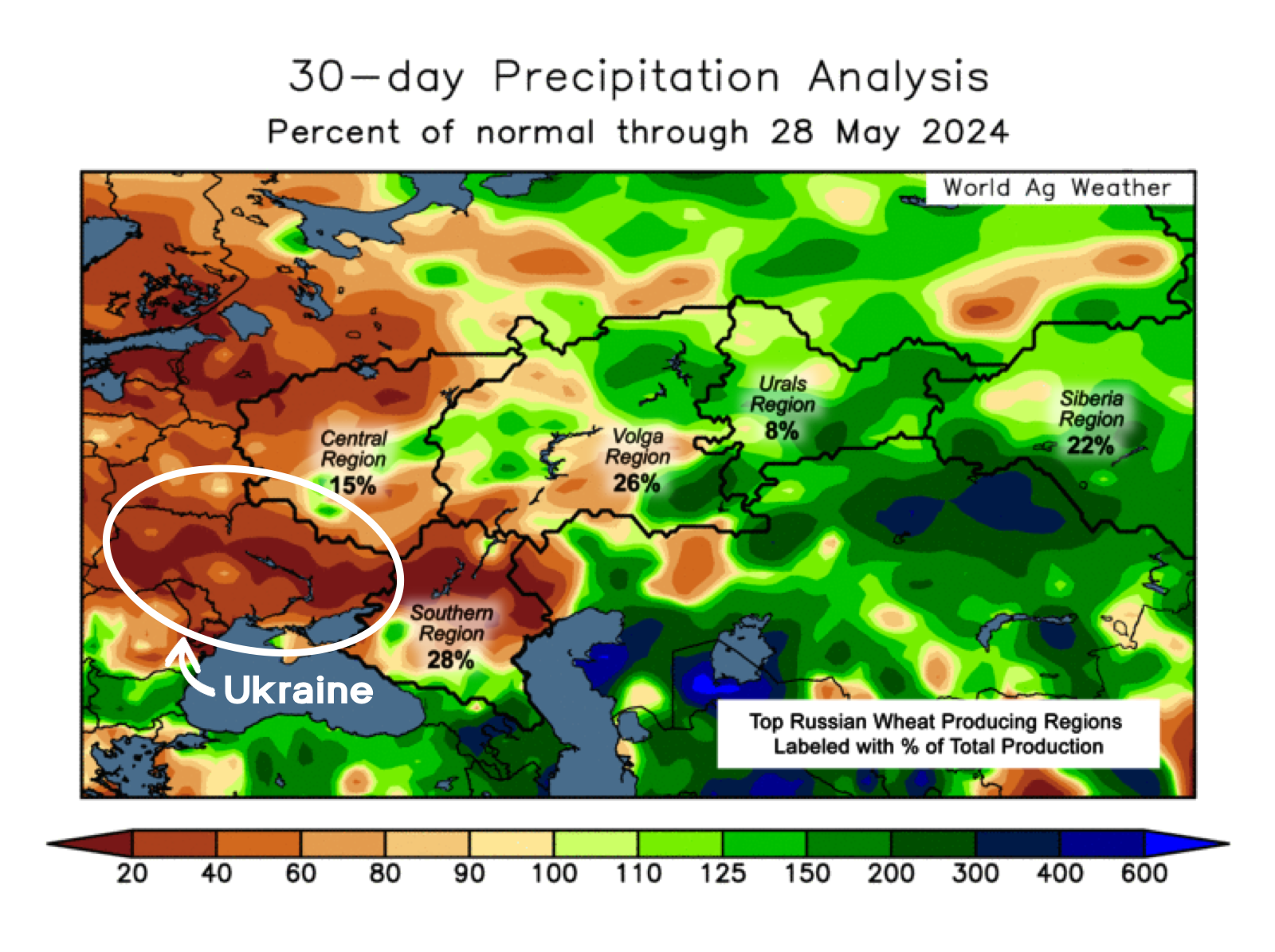

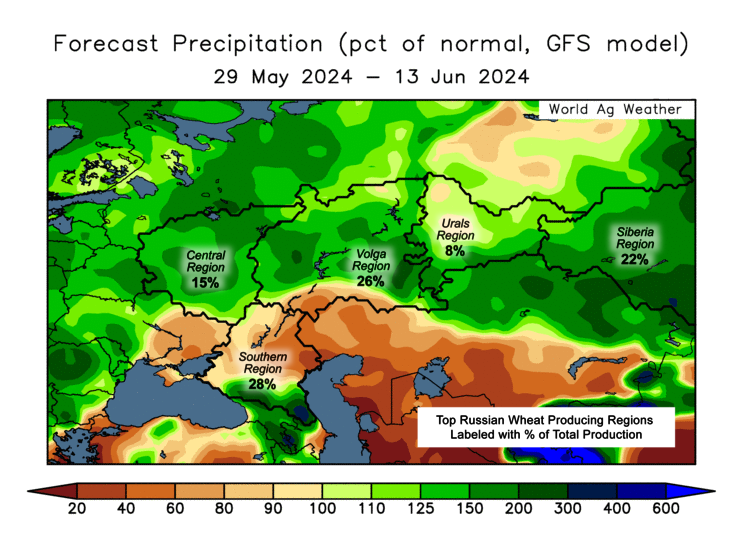

The initial rally came from Russia. They had these major freezes that caused damage. But the bigger thing is Russia and Ukraine being dry. Ukraine just had it's driest month in 45 years.

The estimates for Russias crop are now saying that this crop is -10% or more smaller than what the USDA currently has it at.

Here is a look at IKAR's Russian crop estimates (MMT):

Feb/March: 93

May 3rd: 91

May 10th: 88

May 13th: 86

May 21st: 83.5

May 28th: 81.5

That is a -12.5% drop in the matter of a month. That is a pretty big deal, as Russias giant cheap wheat supply had been keeping a lid on wheat futures the past year.

Although this crop is shrinking, keep in mind that the Russian crop is made or destoryed in June. So there is still time for this crop to stabilize or get a lot worse. The current outlook still trends drier for now.

We now have India importing wheat for the first time in 6 years.

The global production scare hasn’t went away.

However, the market has priced a lot of this in for now. So the market saw some profit taking today following the near $2 rally from our lows.

Does this wheat market still have crazy stupid potential? Yes I believe so.

But it would be foolish not to at the very least consider rewarding part of this rally for a good majority of you. Especially those who will have to move stuff off the combine or know you're going to need cash flow.

If you are someone who can remain patient and sit on wheat +1 year than I am comfortable with staying more patient and being less aggressive than those who do not have time on their hands.

At the end of the day would you be more mad if you sold and we rallied another $1.00 or you didn’t sell and this market gave back half of the rally?

Be prepared for both situations.

You can either make a sale and grab a call option in case we go higher. You either make a great sale and lose the value of your call, or still make a sale well off the lows and make money on your call option. Better than doing nothing with the possibility that we could give back a good chunk of this rally even with the potential upside out there.

If you don’t want to make a sale, add some protection with puts to give yourself a worst case scenario. If we go down, you won't make as good of a cash sale but will make money on your put. If we continue to rally you will make a better cash sale but lose the value of your put. Again a better option than watching the market go up and down hoping we go higher.

It’s all about managing risk. The factors are out there for us to go much higher, but it does not have to happen.

July Chicago

July KC

Want to Talk?

Our phones are open 24/7 for you guys if you ever need anything or want to discuss your operation.

Hedge Account

Interested in a hedge account? Use the link below to set up an account or shoot Jeremey a call at (605)295-3100 or Wade at (605)870-0091

Check Out Past Updates

5/28/24

GETTING COMFORTABLE WITH GRAIN MARKET VOLATILITY

5/24/24

WET SPRINGS DON’T CREATE RECORD YIELDS, DO THEY?

5/23/24

MANAGE RISK DESPITE STUPID PRICE POTENTIAL IN GRAINS

5/22/24

BEANS NEAR NEW HIGHS. WHAT TO DO WITH WHEAT?

5/21/24

BIG MONEY KEEPS DRIVING WHEAT HIGHER

Read More

5/20/24

ALGOS & BIG MONEY CONTINUE TO MOVE GRAIN PRICES

5/17/24

WEATHER MARKET VOLATILITY CONTINUES TO HEAT UP

5/16/24

SITUATIONAL GRAIN MARKETING

5/15/24

HEDGING VS GUESSING

5/14/24

CORRECTIONS ARE HEALTHY

5/13/24

FUNDS DON’T WANT TO BE SHORT GRAINS

5/10/24

PRICE ACTION TELLS DIFFERENT STORY FROM USDA REPORT

Read More

5/9/24

MARKET PRICING IN NEGATIVE REPORT. WHAT TO EXPECT FROM USDA

5/8/24

USDA IN 2 DAYS

5/7/24

WHO SHOULD WAIT FOR TRIGGERS NOT TARGETS

Read More

5/6/24

GRAINS HIGHEST IN 4 MONTHS

Read More

5/3/24

SEASONAL RALLY JUST BEGINNING OR BULL TRAP?

5/2/24

ARE THE TIDES STARTING TO TURN?

5/1/24

BE PATIENT & READY FOR THESE OPPORTUNITIES

4/30/24

FIRST NOTICE DAY SELL OFF

4/29/24

WHEAT TAKES A BREATHER

Read More

4/26/24

SHOULD YOU REWARD WHEAT RALLY?

4/25/24

WILL FUNDS BE FORCED TO COVER?

4/24/24

WHEAT CONTINUES BULL RUN & CORN FAILS BREAK OUT

4/23/24

FUNDS CONTINUE TO COVER & RALLY GRAINS

4/22/24

GRAINS CONTINUE 2-DAY RALLY

Read More

4/19/24

ONE DAY WONDER? EXTREME VOLATILITY & RALLY

4/18/24

GRAINS WAITING FOR WEATHER MARKET

4/17/24

NOT IN THE WEATHER MARKET QUITE YET

Read More

4/16/24

CHOPPY TRADE IN GRAINS CONTINUES

4/15/24

PLANTING PROGRESS & BRUTAL CHOP

4/12/24

MARKET DOESN’T BELIEVE THE USDA

Read More

4/11/24

GARBAGE USDA REPORT THAT DIDN’T MEAN MUCH

4/10/24

USDA & CONAB TOMORROW

4/9/24

USDA IN 2 DAYS. THINGS TO WATCH & HOW TO BE PREPARED

Read More

4/8/24

USDA REPORT THIS WEEK. WHAT YOU SHOULD BE DOING

4/5/24

STRATEGIES ELEVATORS COULD BE OFFERING THAT YOU SHOULDN’T BE USING

4/4/24

WEATHER, BIG MONEY, CHOPPY TRADE

4/3/24

EXPECT BIG PRICE SWINGS & VOLATILITY

4/2/24

RISK OFF DAY

4/1/24