GRAINS TAKE A BREATHER. IS CORN IN A BULL OR BEAR MARKET?

MARKET UPDATE

You can scroll to read the usual update as well. As the written version is the exact same as the video.

Timestamps for video:

Corn: 5:09min

Beans: 9:06min

Wheat: 10:58min

Want to talk or put together a market plan?

(605)295-3100

Futures Prices Close

Overview

Grains all lower today as it looks like the market simply needed a breather. With today's action none of the charts were broken and corn specifically is the most overbought it has been in a year. So a correction is not surprising.

Once again old crop led us lower.

This is something we have been talking about for a quiet some time. When this market takes a breather, old crop should lead us lower just like it leads us higher when the markets are going up here.

Old Crop vs New Crop Today:

Mar-25 Corn: -5 3/4

Dec-25 Corn: -1/4

Mar-25 Beans: -11 1/2

Nov-25 Beans: -3

This is why we like protecting new crop with old crop puts when we alerted the recent hedge signal. As we are protecting what is overvalued and sitting on what is undervalued.

Again do NOT use old crop futures to hedge new crop. Only consider using puts with a game plan of execution.

Brazil & China Story

As for news, the biggest news came out of Brazil. As soybean shipments of 5 firms from Brazil to China have been halted due to contamination.

In the Reuters article it states that:

China the world's biggest soybean buyer has stopped receiving Brazilian soybean shipments from 5 firms after cargoes did not meet sanitary requirements. It is unclear how long this will last but most seem to think it is only a short term issue.

It doesn’t look like this will be a big issue moving forward, but does make you question how this affects the trade relationship between China and Brazil. As Brazil is already behind on their bean loadings and this create more issues.

This was likely the biggest reason for the bean rally yesterday along with disappointing rains in Argentina and fairly dry forecasts for the next few days.

Link to the full article: Click Here

China Wants Corn?

The other big rumor out there is China.

People are saying that China is on the hunt for US corn.

China has bought zero US corn this far.

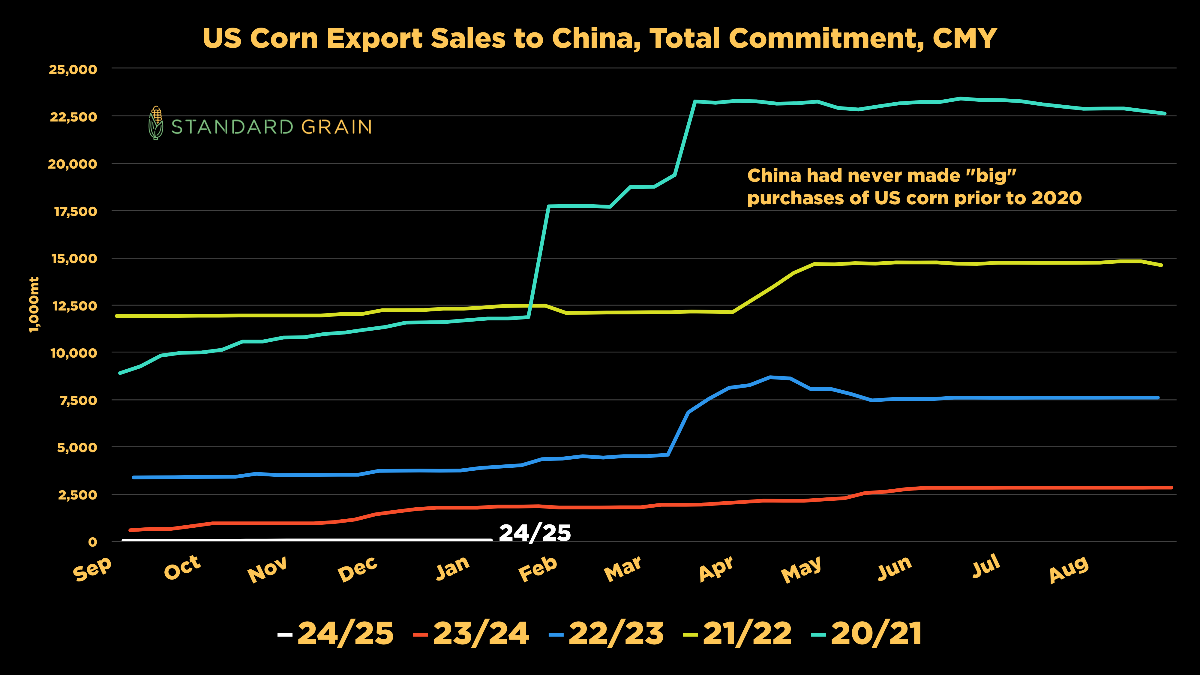

Here is a great chart from Standard Grain show cases the past few years of purchases to China.

White line is this year and the teal line is 2021 after the trade war.

Tariffs

Tariffs are of course the other big headline.

Yesterday this added some strength as Trump didn’t go full tariff mode right away and is taking a more cautious approach.

Instead he delayed them until Feb 1st and asked the government to review trade policies with China, Canada, and Mexico.

Basically he wants to make sure he has everything figured out before just straight implementing them.

Right now he has "talked" about 10% tariffs on China and 25% tariffs on both Mexico and Canada.

They also said that they are going to try and push China to purchase more ag products because they did not meet their requirements from the Phase 2 of the trade war back in 2020. So he pretty much just want them to honor their trade agreements from last time.

If this is the case, it would be friendly. As it would require China to buy a certain amount of our products.

Corn Exports

Corn exports came in at a new marketing year record.

Looks like we might have started export season early.

Look at that blue line. FAR above the 5 year average.

Demand once again continues to impress.

Chart from GrainStats

Brazil & Argy Update

Mato Grosso (Brazil's #1 growing state) is having it's slowest harvest since 2011 due to too much rain.

Sitting at 1.7% complete last years 6%.

Big deal? Probably nothing major.

But this could be a friendly factor for corn. As this could push back that 2nd corn crop. Right now it is only 0.3% planted vs 4.9% last year.

Looking at Argentina, the rains over the weekend disappointed. And it looks like it will be dry for another few days.

Big deal? On a big picture scale, friendly but not a game changer.

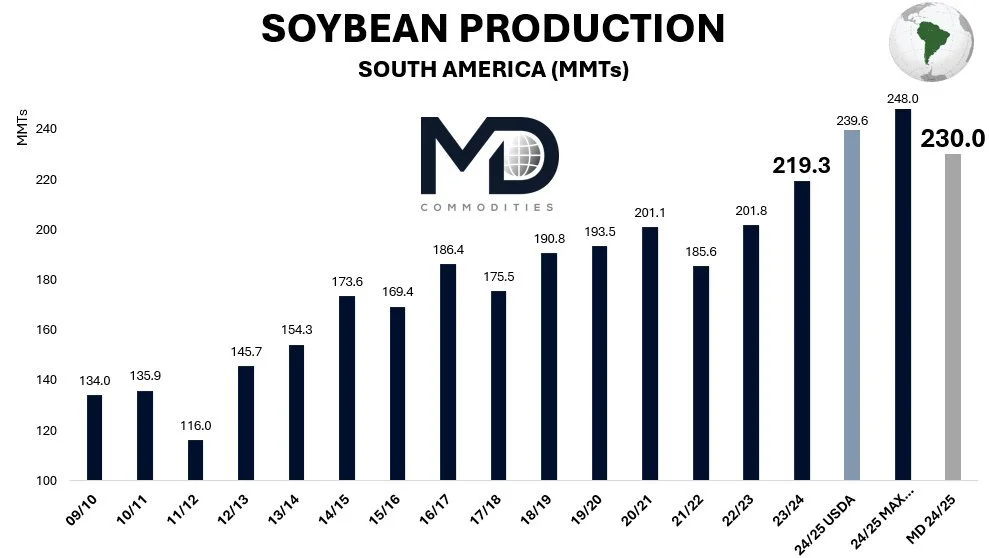

Even if Argy bean production were to drop 10%, South America as a whole likely still producers a record crop with Brazil's monster crop.

Below is a good visual from Pedro Dejneka show casing SA production. The USDA has them beating last year's record by 21 MMT. (240 this year vs 219 last year)

For context, the USDA projects Argentina to produce 52 MMT and Brazil 170 MMT.

The market is aware of this, but we almost always see some pressure when Brazil's crop comes online. Which starts soon.

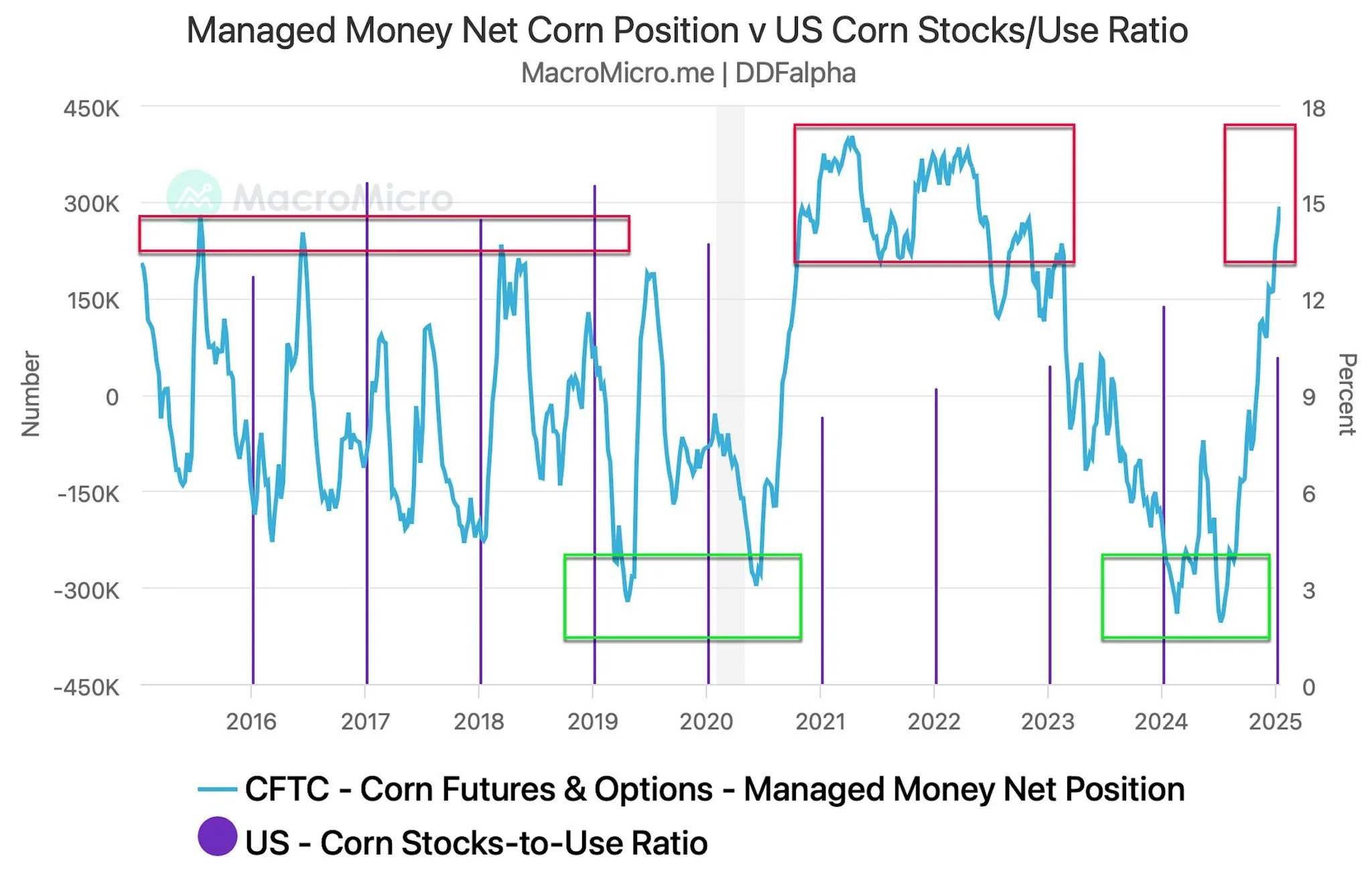

The Funds

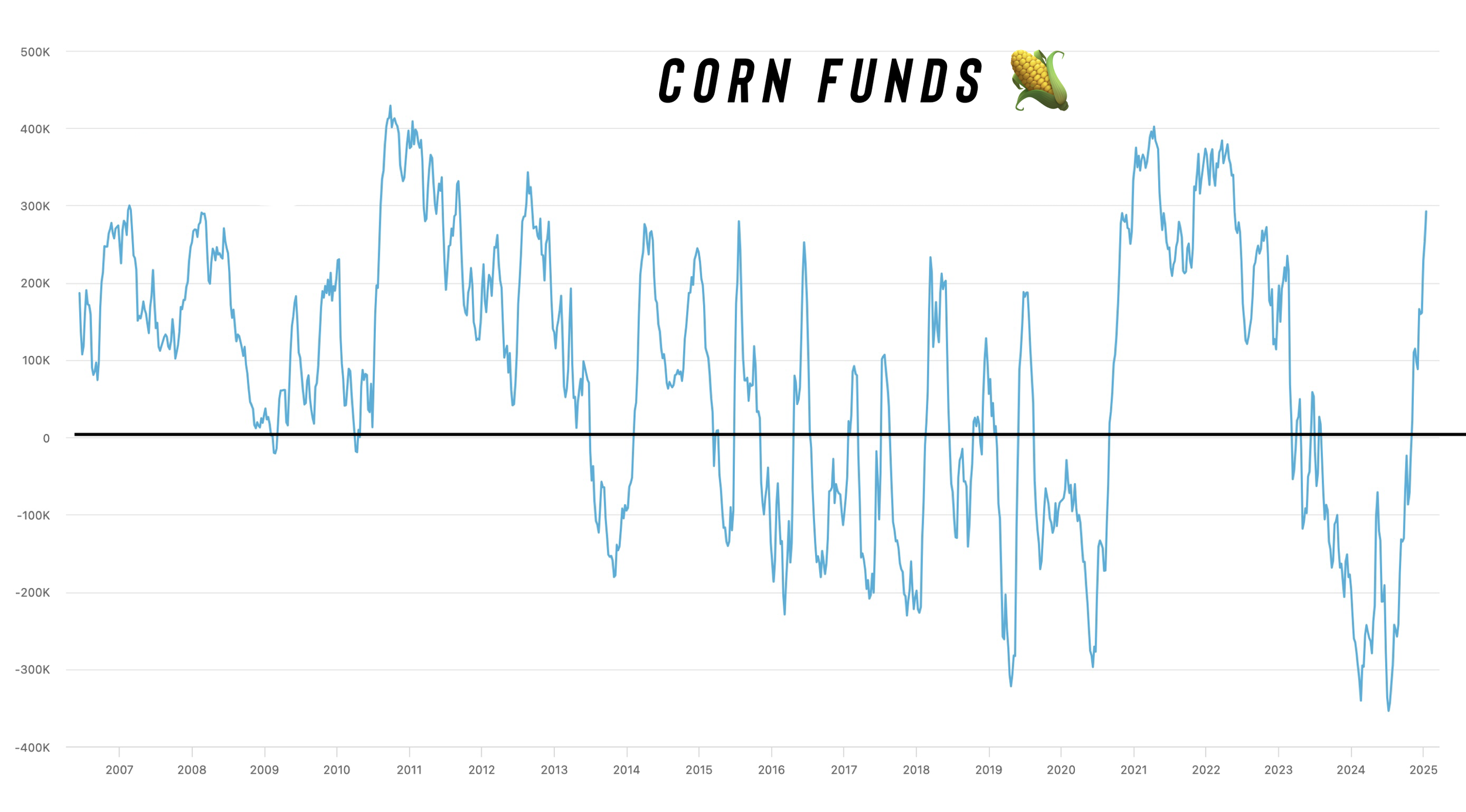

The funds are long nearly 300k contracts of corn. They have not been that long since 2022..

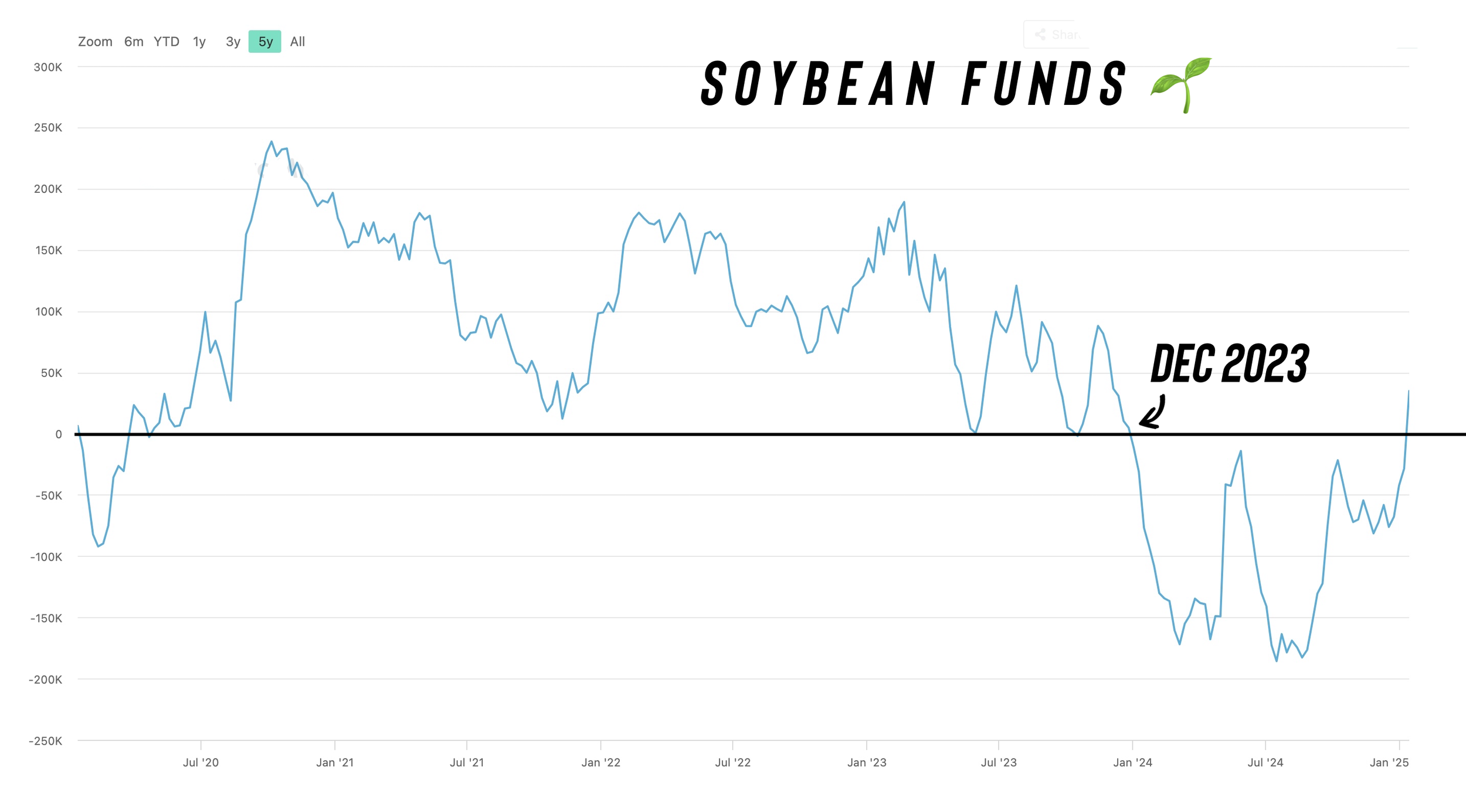

The funds are now actually long soybeans despite all of the bearish tailwinds.

This is their first time being long since December 2023.

More often than not, the funds aren’t wrong. They simply follow the trend.

Here is a chart from Darrin Fessler comparing the funds corn position to the stocks to use ratio.

Funds are blue line.

Stocks to use ratio is purple line.

The funds are actually probably close to being long 320k or so by now.

Historically they max out around 400k.

Which means they could be close to maxing out for now unless we get another catalyst.

Today's Main Takeaways

Corn

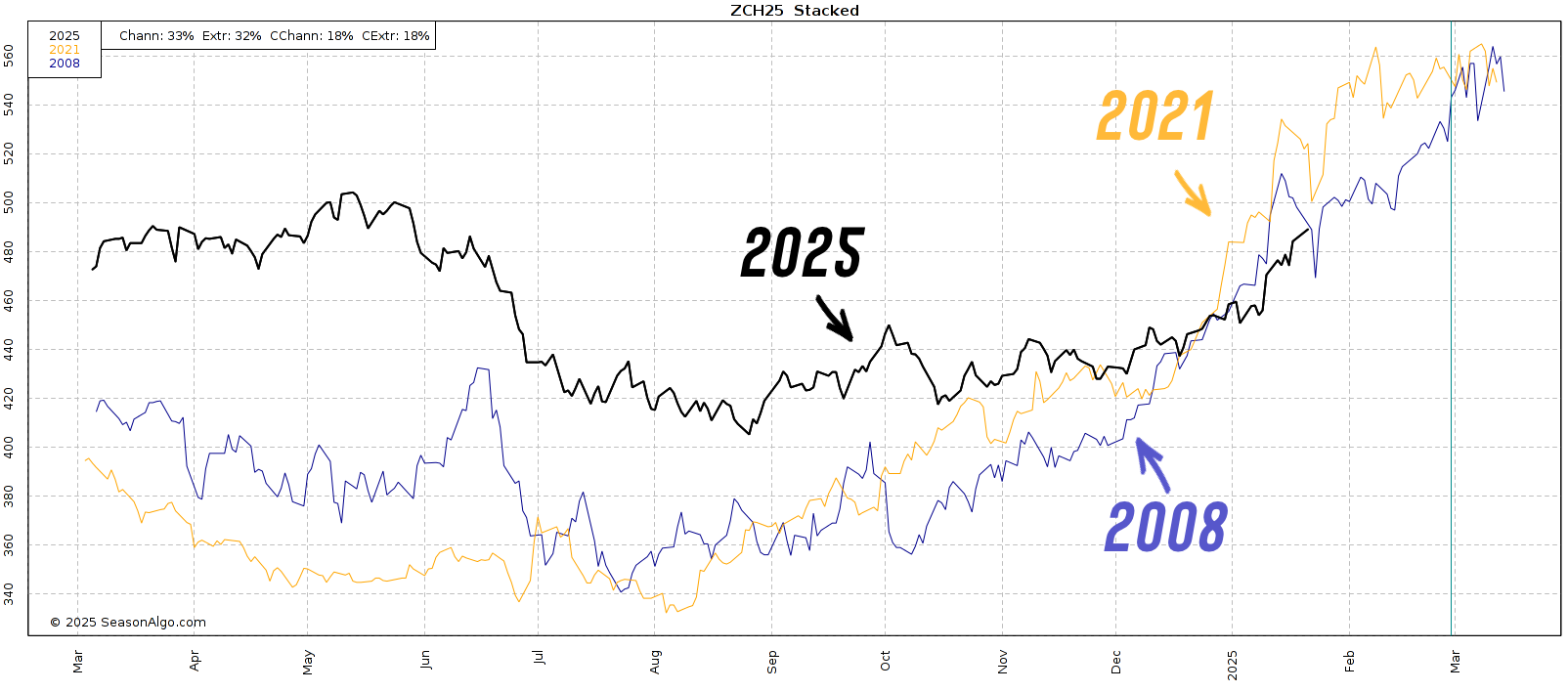

Only 2 years have had a stronger start to the year than 2025 for corn.

2008 and 2021.

In 2008 and 2021 we got a sizeable correction right about now but continued higher for the next few months.

No 2 years are the same, but some food for thought.

Is corn in a bull market or a bear market?

The answer: Both

When stocks to use ratio drops below 10% it is considered a bull market.

Right now we are at 10.19%

Stocks to Use Ratio:

2015: Bear

12.59%

2016: Bear

12.71%

2017: Bear

15.66%

2018: Bear

14.46%

2019: Bear

15.70%

2020: Bear

14.48%

2021: Bull

8.3%

2022: Bull

9.24%

2023: Bull

9.92%

2024: Bear

11.78%

2025: Both?

10.19%

We aren’t as high as the true bear market years, but aren’t as low as the bull market years. If this falls below 10% then we would be talking about a potential bull market.

Moving forward the biggest issue will be more acres. This is a big reason why new crop corn has been slacking.

Something to keep in mind is that with this inverse in the market, we are going to be very sensitive to weather markets in the future if this inverse is still here.

Overall, I still think corn has potential. I like making some old crop sales if you are behind.

I do not mind a few new crop sales but I do not love making them and do not want to be oversold at all. Personally I wouldn’t be more than 10% sold on new crop or more aggressively sold than you usually are at this time. I would rather be less sold than normal here.

Looking at the continuous corn chart first, we posted our first higher high since 2022 and are trading at our highest levels since Dec 2023.

The 38.2% retracement level from the 2022 highs sits at $5.37. That is my bigger picture target.

Looking at the charts, we hit my $4.85 target.

Next local target is $4.99. As that is the implied move for this ascending triangle that I showed you guys back in early December.

Today March corn had a golden cross.

This is a textbook bullish long term signal that indicates price trend is shifting bullish.

It occurs when the 50-day moving average crosses over the 200-day moving average.

It often marks the shift in sentiment from bearish to bullish.

When the 200-day starts to curl higher along with it, it usually gives a confirmation of an uptrend and signals the market is now bullish.

Well.. the 200-day has also started curling higher.

Great sign long term for corn.

Short term, I would not be surprised at all to see a correction.

The RSI shows that corn is the most overbought since May 2024.

However, today the RSI did take a nice cool off.

If we get a correction, I am looking for a bounce in the green box. ($4.65 to $4.70)

We will eventually get a correction, but the higher we go before hand, the higher that green box moves.

Next targets for new crop are:

$4.64 then $4.72

Soybeans

Soybeans are caught between a bunch of headlines.

We have dryness in Argentina. This won’t make a huge dent in overall SA production but could spark a little weather market.

We have Mato Grosso's harvest at a stand still. But this isn’t a big issue yet.

We have Brazil shipments shutting down, but it could very well just be a short term issue.

We have the tariff news and trade war termoil. Tariffs are not friendly, but if Trump and China make an agreement where they will have to meet a certain number of purchases then that would be very friendly.

Brazil's crop is coming online soon, which could pressure this market short term. This is why we seasonally go lower at the end of January. But since Brazil's harvest is delayed, this pressure could also be delayed.

The funds are now long soybeans for the first time in over a year, so they must not be too concerned with Brazil's crop or the potential tariffs.

Acres will be a big potential positive for beans later this year.

Overall, if you are behind on old crop I like making a sale here and there over $1.00 off the lows. But just like corn, I really do not like touching much new crop at all.

Given that $10.50 isn’t even a profitable price level, it does not make any sense to get too carried away with sales that do not add to your bottom line.

Looking at the charts, first we have continuous beans.

We are getting really close to running into this long term downward trend from 2022. It comes in around $10.80

$10.80 just so happens to be my next upside objective.

As it would be a 3rd test of that downward black trendline.

Next targets for new crop beans are the 50-61.8% retracements levels of the May highs.

$10.82 and $11.11

Wheat

Wheat finally found some love yesterday.

It is pretty head scratching that the wheat market hasn’t had any buying especially since corn has rallied so hard.

Wheat still has plenty of bullish factors, but it looks like the funds have been using wheat as basically a short hedge in the grains.

Meaning they are buying corn, while simultaneously selling wheat as a hedge. Meaning that if the grains go up, they make money on their corn bet while at the same time suppressing wheat. If the grains fall, they make money on their wheat bet.

However, this hedge will not last forever, and yesterday might’ve been a good indication that.

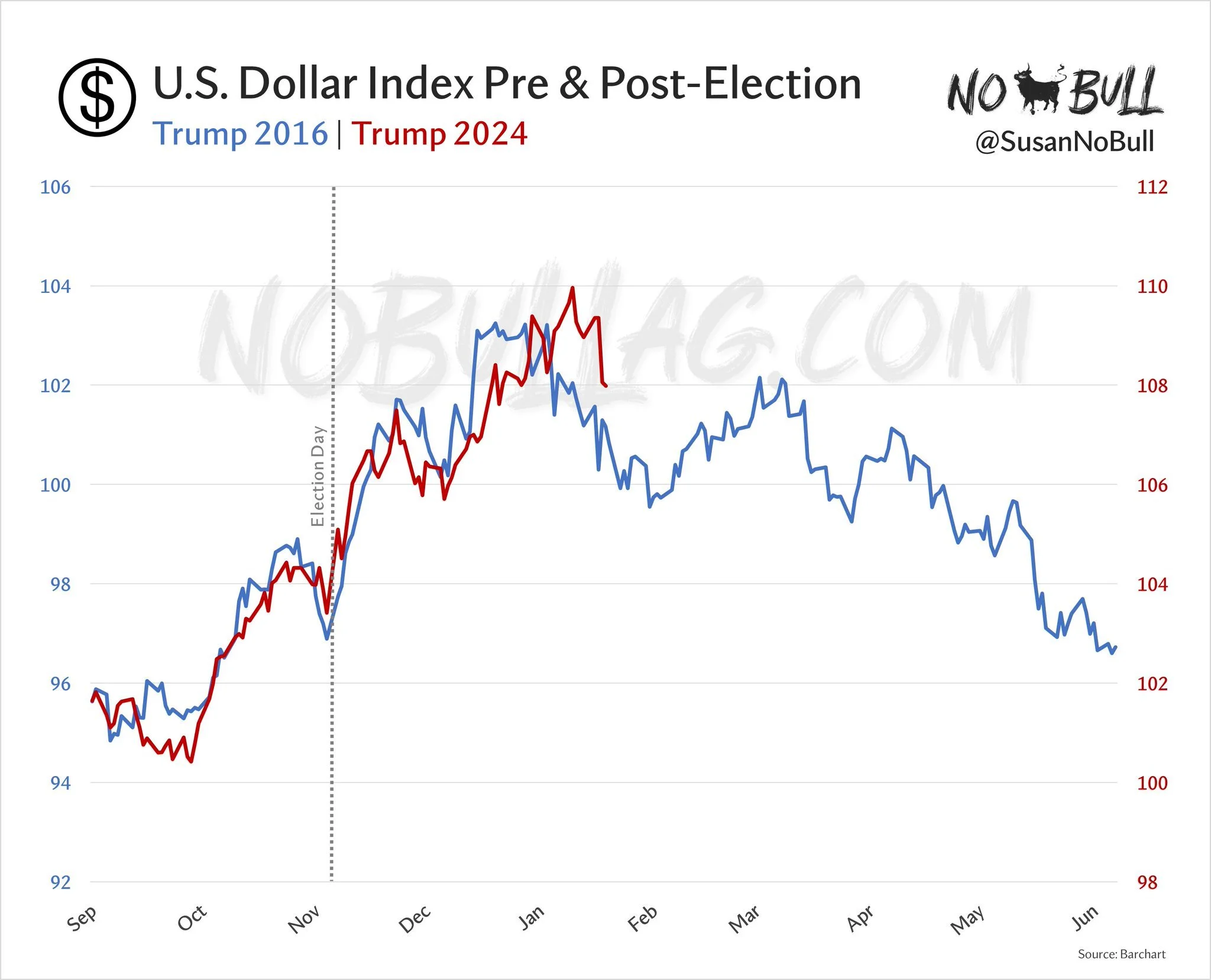

A lot of times speculators will also short wheat when they buy the US dollar, and buy wheat when they short the US dollar. A stronger US dollar also helps exports.

So if the dollar falls, it will help out wheat.

Here is a good seasonal comparison of the dollar from NoBULL Ag. It compared this years dollar to the last time Trump entered office. I also think the dollar likely starts to fall.

The world's leading wheat exporter (Russia) still has an awful crop.

The world balance sheet is still one of the friendliest it has been in years and it continues to get tighter year over year.

Bottom line, wheat has plenty of upside from here and is undervalued looking long term.

I have zero interest in making wheat sales anywhere near these levels.

Not much else for wheat today as I have went over why I see long term potential in wheat several times in past updates.

Looking at the chart, we finally are breaking out of this falling wedge we have been trapped in for months.

I would like to think it brings on more upside with our next big resistance at $5.84

KC also breaking out.

Next resistance is $5.89 which we nearly touched today.

A pretty ugly candle today however which could signal some short term downside.

MPLS also with a nice breakout, now testing that $6.10 resistance.

If we bust that red line, next resistance is the pink line.

(Sorry for the bad chart, my platform doesn’t have MPLS)

Past Sell or Protection Signals

We recently incorporated these. Here are our past signals.

Jan 15th: 🌽 🌱

Corn & beans hedge alert/sell signal.

Jan 2nd: 🐮

Cattle hedge alert at new all-time highs & target.

Dec 11th: 🌽

Corn sell signal at $4.51 200-day MA

CLICK HERE TO VIEW

Oct 2nd: 🌾

Wheat sell signal at $6.12 target

Sep 30th: 🌽

Corn protection signal at $4.23-26

Sep 27th: 🌱

Soybean sell & protection signal at $10.65

Sep 13th: 🌾

Wheat sell signal at $5.98

May 22nd: 🌾

Wheat sell signal when wheat traded +$7.00

Want to Talk?

Our phones are open 24/7 for you guys if you ever need anything or want to discuss your operation.

Hedge Account

Interested in a hedge account? Use the link below to set up an account or shoot Jeremey a call at (605)295-3100.

Check Out Past Updates

1/21/25

HUGE DAY IN GRAINS. WHAT TO DO WITH OLD CROP VS NEW CROP

Read More

1/20/25

VIDEO CHART UPDATE

1/17/25

TRUMP, CHINA, ARGY & USING THE SPREADS INVERSE

1/16/25

OLD CROP LEADS US LOWER. MARKETING THOUGHTS

1/15/25

SIGNAL & HEDGE ALERT QUESTIONS EXPLAINED. IS $6 CORN EVEN POSSIBLE?

1/14/25

MORE DETAILS ON TODAYS HEDGE ALERT & SELL SIGNAL

1/14/25

CORN & SOYBEANS HEDGE ALERT/SELL SIGNAL

1/13/25

USDA GAME CHANGER OR NOT?

1/10/25