RALLY TAKES A PAUSE

Overview

Grains mostly lower but we rebounded well off our lows.

Corn was down a few cents but closed just 1/2 a cent lower. Soybeans were down -10 cents but managed to close a penny higher to the highest level in a month. Chicago wheat was down -13 cents but rallied back to close just -3 cents lower.

Since the first notice day lows the markets have been grinding higher. Corn is now +33 cents off it's lows while soybeans are +68 cents off their low. Wheat is currently +20 cents off the lows made this Monday from the China cancellations.

Overall the past few days including today have been good price action. The markets are just pausing the recent rally. The charts are still looking pretty friendly.

We have had a lack of demand news for the markets with no sale announcements, but we also haven’t gotten anymore cancellations out of China.

The funds still remain heavily short. Short roughly 260k corn, 110k beans, and 60k wheat. Still plenty of room to cover those shorts.

It would make sense for the funds to start lightening up those heavy short ahead of that huge report at the end of the month, upcoming planting here in the US, and the uncertainty in Brazil.

Yesterday the Brazil CONAB numbers came out lower than the market expected. Here is a comparison for the CONAB vs USDA numbers.

CONAB

Corn: 112.7

Beans: 146.9

USDA

Corn: 124

Beans: 155

Difference

Corn: 11.3

Beans: 8.1

Today's Main Takeaways

Corn

Corn slightly lower today, but the price action wasn’t negative at all.

This is the 4th day in a row where corn has traded lower but rallied back.

It just looks like this market is taking a breather, we just had the biggest weekly gain in 5 months. A pause is healthy.

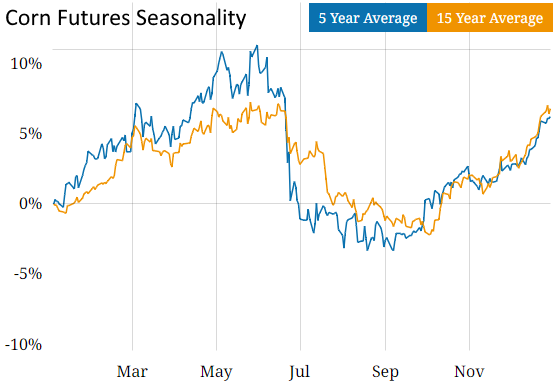

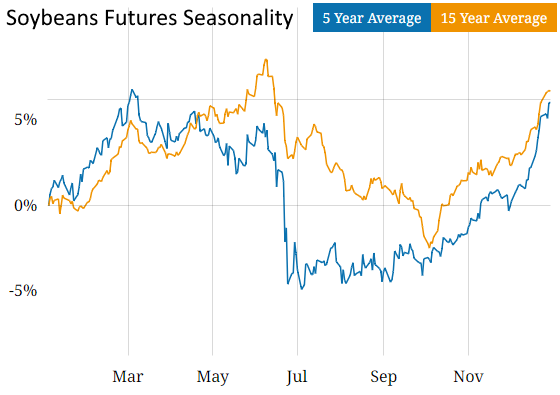

This week is seasonally the week that corn tends to make it's highs for the month of March. As seasonally we trend lower for a few weeks but turn higher into late spring.

Despite this, corn has never once made it's top in March.

Here is the seasonal chart:

Despite what the seasonals say, I still think we likely grind higher from here short term. At least for the next few weeks.

Then if it stays warm and dry, we have been talking about early planting a lot lately. But that is a risk this market faces. Early planting leads to more acres which in turn is negative for prices. So be prepared if this happens.

We had a dry harvest and dry winter. So why would it start to rain after we get this crop in the ground?

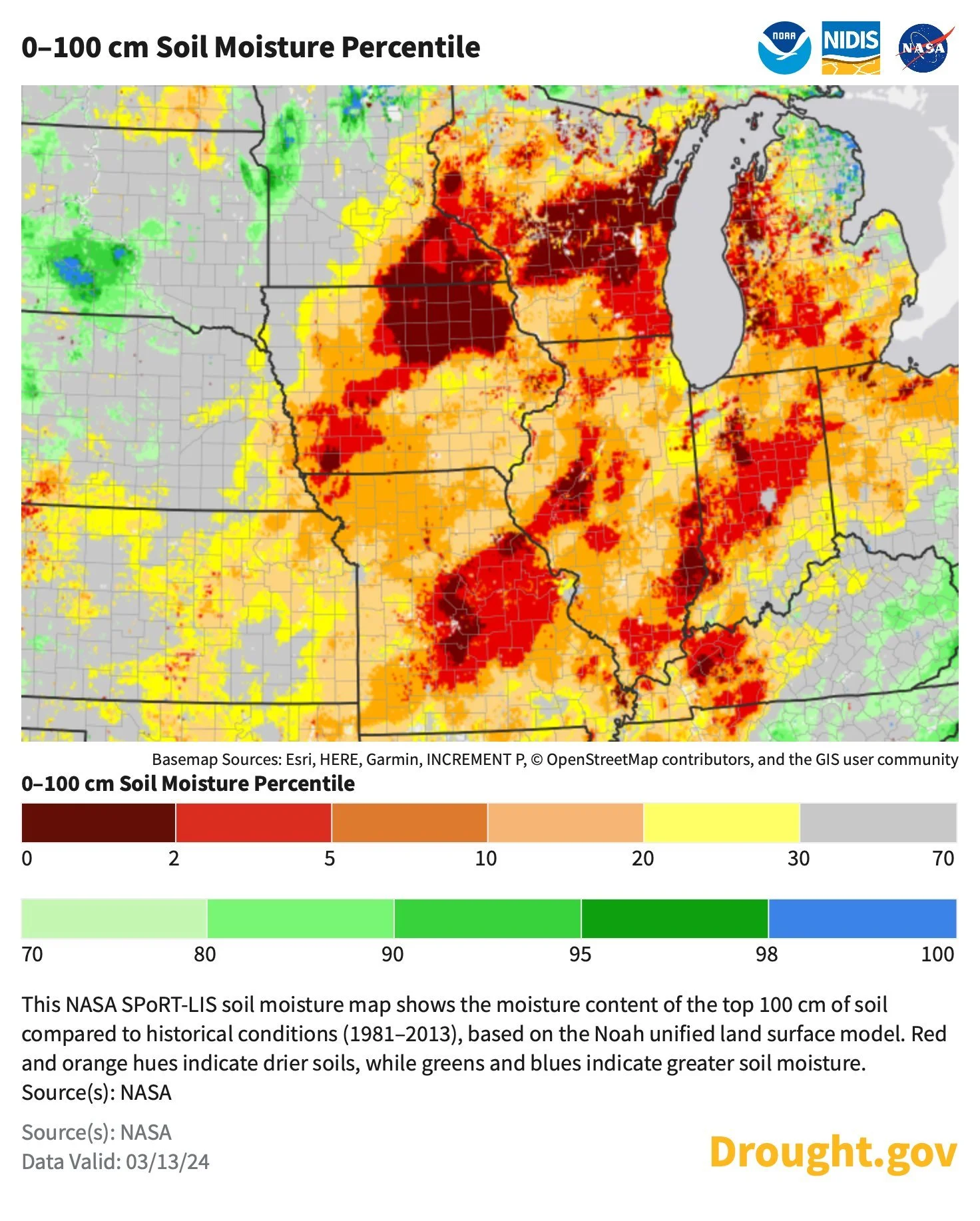

Check out how the moisture situation in the I-states looks right now. Not good if we don’t get rain.

This brings the possibility for that summer drought scare rally we have been talking about.

Some say this "warmest winter on record" doesn’t mean much.

It kind of does.. For starters, this depletes our soil moisture.

Secondly, this warm winter could hint at a warmer summer.

World-Grain.com did some research and found that the top 10 warmest Februarys were all followed by hotter July's than normal. The upcoming La Nina probabilities also suggest a hotter and drier summer.

Brazil weather is supportive right now. It looks like Brazil will be dry for another few weeks. Right at their key time frame for that second corn crop as roughly 87% of that crop is planted now.

If this situation gets worse, we might not even get that big early planting price pullback that we think will happen.

CONAB has this crop a whopping 11 MMT smaller than the USDA. The USDA hasn’t quiet come to the game yet, and they might not ever get a number as small as CONAB's. But this crop is getting smaller.

Here is the outlook. I just don’t see this being enough to make a difference their already very poor soil moisture situation.

Funds still heavily short with room to exit more positions. I see at least a small rally from here. How price action shakes out come spring will be determined by how small the Brazil crop is and if we see early planting pressure.

Bottom line, there are more potential friendly wild cards than negative ones heading into the upcoming US growing season. I believe we will get some sort of weather scare, we almost always do. It might not happen until late June like last year.

I still do not like making sales here. If we wind up having good planting then we do get all this rain and raise a bumper crop, there is a chance we see $3 later this year, but probably not before a weather scare type of rally. Typically we want to make sales in the spring or summer or when you don’t know what you are going to raise.

If you are in the situation where you have to make sales here soon for one reason or another, please give us a call and we will walk you through different strategies you could be utilizing.

Jeremey: (605)295-3100

Wade: (605)870-0091

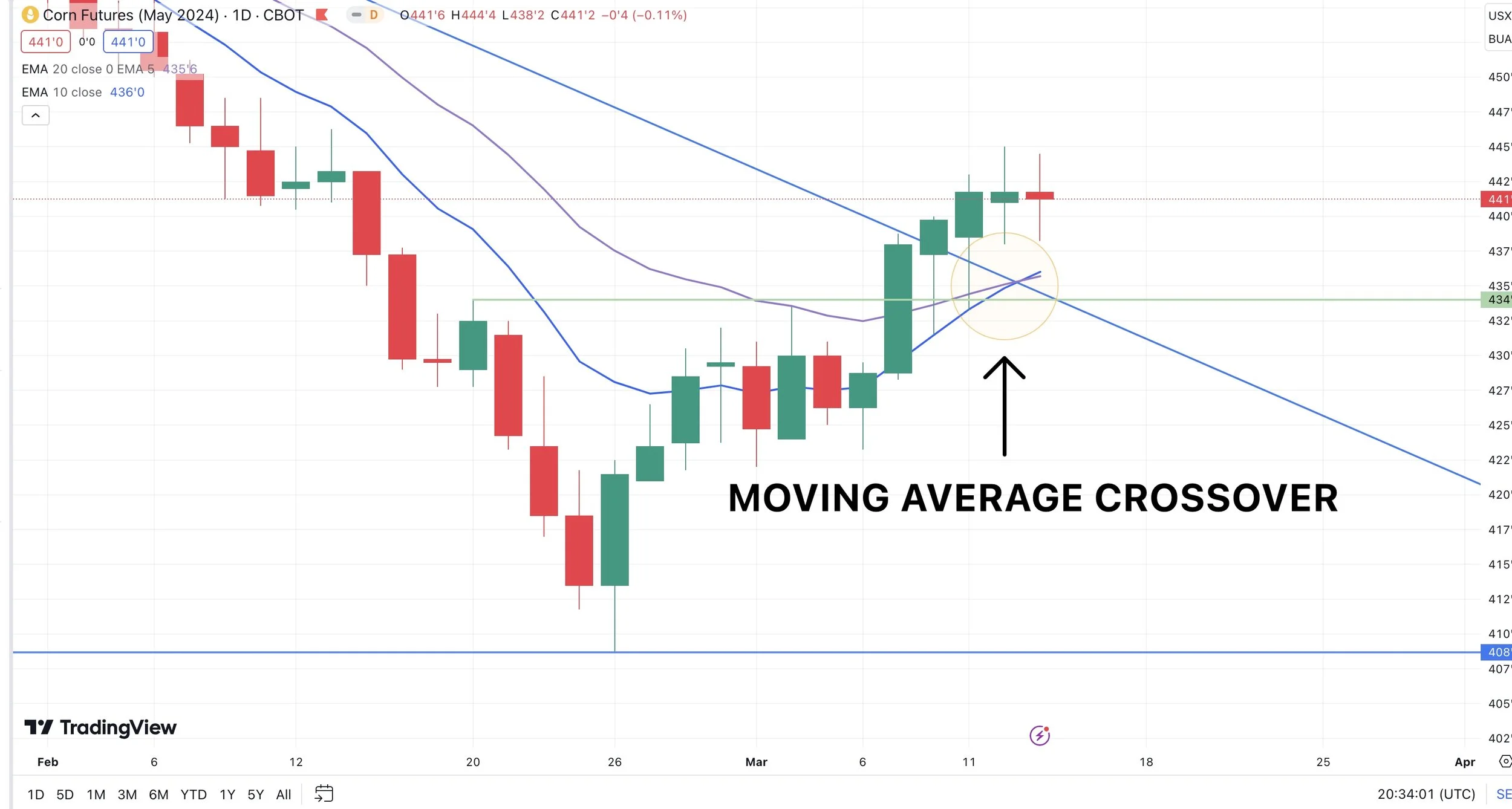

Charts look friendly. The 10-day MA (blue line) crossed above the 20-day MA (purple line), which is a bullish indicator. A lot of well respected advisors use these cross overs for their buy and sell signals.

First upside target is still our 23.6% retracement at $4.62

Corn May-24

Soybeans

Soybeans notch their highest close in a month, but still have failed to take out $12. Remember.. soybeans hate trading in the $11 range.

Weather in Brazil isn’t a huge factor for soybeans anymore, the main focus is the second corn crop. Although this recent heat and dryness is not helping the beans that haven’t been harvested yet.

The CONAB is still a lot lower than that of the USDA. That 8.1 MMT difference between the CONAB and USDA is nearly the size of the entire US carryout. That is a big difference. Although the USDA didn’t lower the crop as much as most think they should have, the trend is lower.

I think this crop is closer to 150 rather than the USDA's 155.

Now if we can get China to start coming in here and buy our beans, it would be a very friendly factor.

I listened to a podcast from Ag Yield this morning. They said some of that recent pressure we saw in beans to start the year was concerns about a potential trade war with China if Trump were to get re-elected.

However, they threw this out the window and do not see this as a real risk moving forward. They said that is anything this could actually be friendly for the markets if Trump is re-elected because he might make China more accountable for things they agreed to. When the trade war in 2016 happened, everyone thought it was bearish. But soybeans quickly rallied $1.

Just like corn, the seasonal trend is lower for a few weeks for beans.

Long term I still see a ton of potential for this bean market.

We have a friendly balance sheet here in the US. Brazil's crop continues to get smaller despite the USDA refusing to make any major changes yet. And China is expected to import more beans than ever.

Soybeans have only topped out in March one time ever, which was 2004.

I do not like making sales here. We have gotten a nice bounce from the bottom, but there is still plenty of upside potential.

The technicals are starting to look pretty friendly for soybeans. Just like corn, that 10-day MA is crossing over the 20-day MA which is a good sign.

We found resistance right at that first target I had been mentioning. The 23.6% retracement of $11.98. Next upside target is the 38.2% level of $12.40.

Soybeans May-24

Wheat

Somewhat disappointing action in wheat today.

Following the 3 straight days of China cancellations, we haven't had any more thus far.

However, it does look like the same thing is happening to France. As they said that China is canceling some of their wheat as well.

One thing the market has seen some pressure from is due to the winter wheat crop being a lot better than it was last year. Here is some updated ratings, again far better than last year.

Winter wheat ratings:

Kansas unchanged at 53% G/E

Oklahoma unchanged at 65% G/E

Texas up +1% to 44% G/E

Overall, there just isn’t much else going on in the wheat market.

The world has consumed more wheat than it has produced for 4 straight years in a row now.

I still view wheat as a sleeper and don’t like making sales near these lows. It might take weeks, or months, but the day for wheat will come.

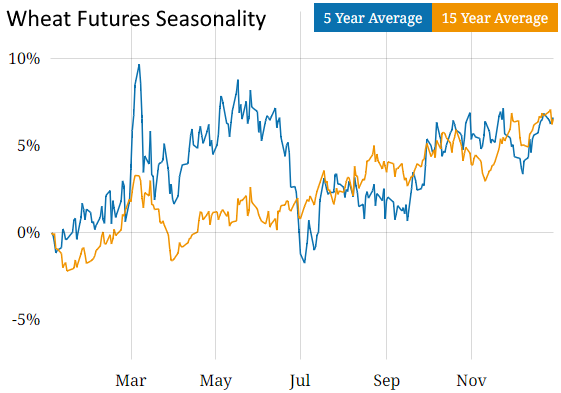

Seasonally we do trend lower from now and into April.

The charts don’t like terrible, but don’t look as good as they did after we made that key reversal. We are still holding that reversal so far.

We closed well off the lows which was friendly.

If you take a look at KC we are still struggling to break that downward trendline. Which we haven’t done since August. A break above would look great.

May-24 Chicago

May-24 KC

Cattle

Live cattle reached new highs today.

But overall the cattle market looks pretty sideways and still looks like it could be running out of steam.

We could very well have more room to run, but for some of you I like taking risk off the table.

Taking risk off the table does not mean you think the high is in, it is just smart risk management.

If you want to discuss different strategies to use please give us a call (605)295-3100.

On the feeder cattle chart, something I am watching is the potential moving averages cross over.

If the 10-day (blue line) crosses below the 20-day (purple line) a lot of people would look at that as a potential sell signal.

Live Cattle

Feeder Cattle

Want to Talk?

Our phones are open 24/7 for you guys if you ever need anything or want to discuss your operation.

Hedge Account

Interested in a hedge account? Use the link below to set up an account or shoot Jeremey a call at (605)295-3100 or Wade at (605)870-0091

Check Out Past Updates

3/12/24

CONAB A LOT SMARTER & SMALLER THAN USDA

3/11/24

CORN 4TH DAY HIGHER & KEY REVERSAL IN WHEAT

3/8/24

USDA RECAP: POOR REPORT, GREAT REACTION

3/7/24

CORN TECHNICALS TURNING BULLISH. PREPARING FOR USDA REPORT

3/6/24

CHINA CANCELS WHEAT? RUSSIA SELLING WHEAT TO FUND WAR

3/5/24

NEW LOWS IN WHEAT & USDA BRAZIL ESTIMATES

3/4/24

IS CHINA HUNGRY FOR CHEAP GRAIN?

3/1/24

FIRST HIGHER WEEK IN MONTHS

2/29/24

HOW TO USE TARGETS VS TRIGGERS

2/28/24

BIGGEST 3 DAYS IN CORN SINCE AUGUST

2/27/24

DID CHINA BUY CORN YESTERDAY?

2/26/24