GRAINS LOWER AS TRADE PREPARES FOR USDA

Overview

Grains end the day lower across the board.

At one point beans were up 15 cents, but ultimately broke 23 cents off those highs but managed to close down just a penny.

The corn market continues to chop around near the bottom of it's recent range. As we barely fight off new lows yet again today, making today the 3rd time we haves tested $4.68.

Wheat takes it on the chin following it's 4th straight day of gains yesterday.

Yesterday harvest came in at 81% complete for corn, 91% for beans.

Outside of South America weather, there isn’t much fresh news. So don’t be surprised to see choppy action be the theme until Thursday's USDA report. Along with the USDA report, we will also get fresh estimates from CONAB (South America's USDA).

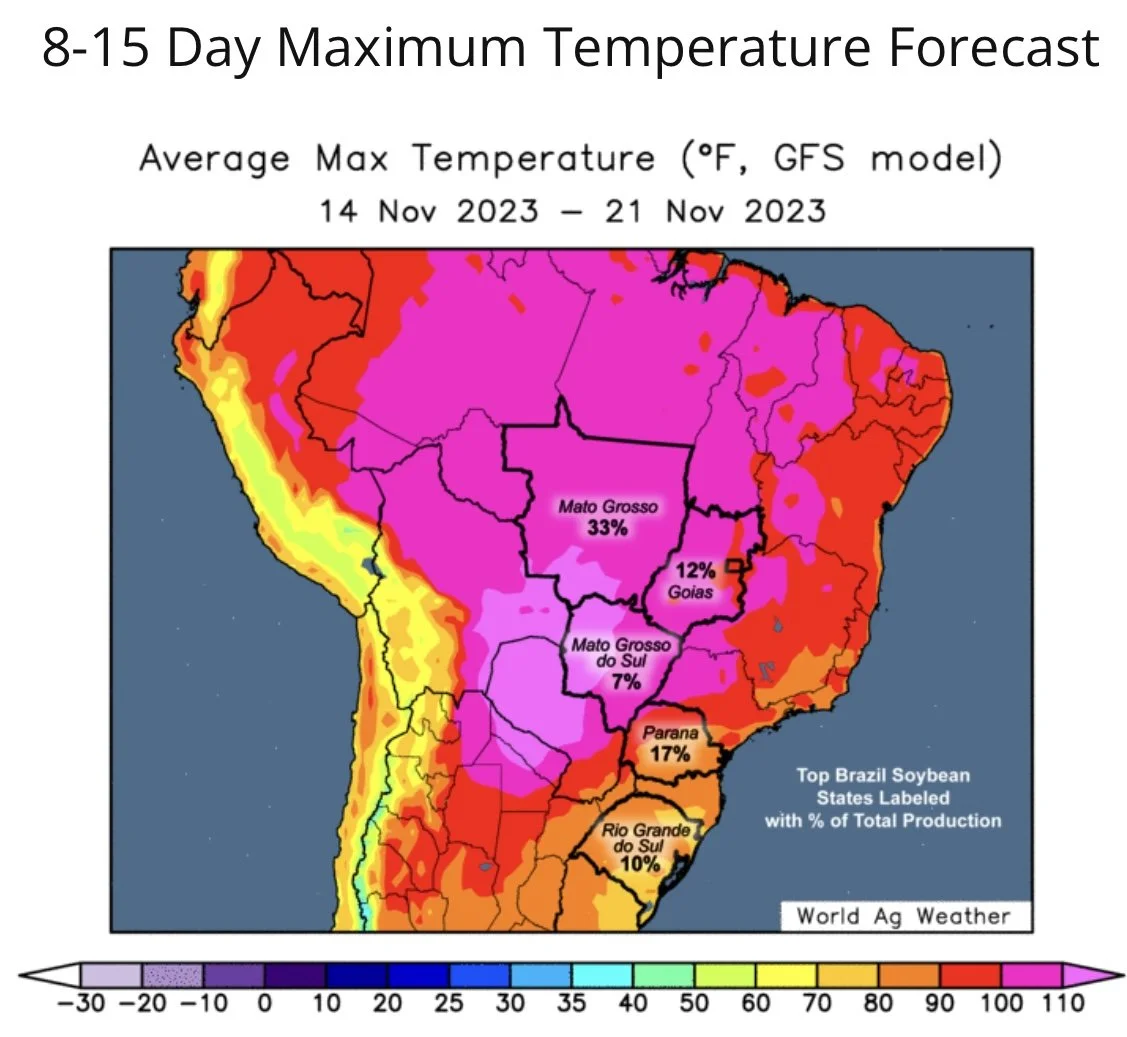

When we take a look at these two reports, yes it's early to make any major changes to Brazil. But we cannot forget just how poor the weather in Brazil has been for the past 2 months.

Brazil's rainy season is officially a month late, and absurdly dry to to the north. Planting has been delayed in several areas, so there is potential for a lot of acreage shifting.

Here is what some local Brazil producers had to say:

"The weather has been very challenging for this season in brazil. In Mato Grosso, the planting is delayed by the lack of rain, and in the south it is delayed by access. A lot of areas must be re-planted. The yields are already affected."

"The weather in Mato Grosso, Brazil is very dry with many sunny days ahead. Soybean planting is delayed. Difficult year to produce soybeans."

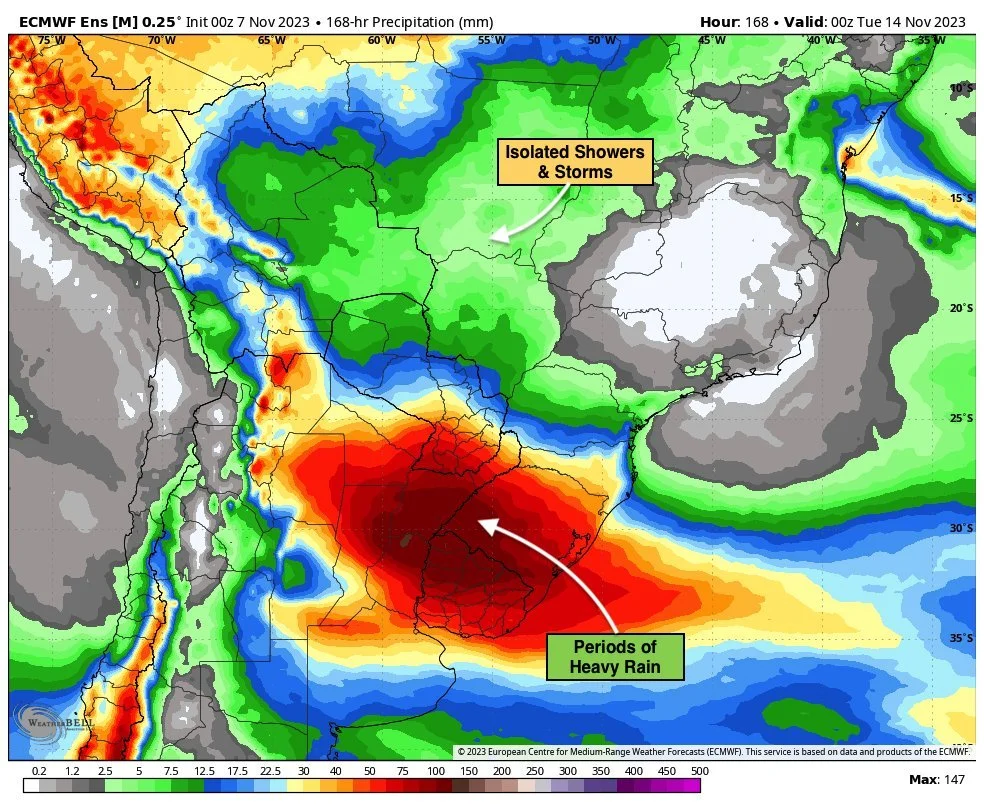

What's the current outlook? They added yet more rain to the south which is already drowning in rain. There is a few scattered showers up north, but totals for the next few weeks would only add up to 30% of normal at the most. Not ideal, at all.

Ahead of USDA reports, we do tend to see the funds and algos often times try to push prices closer to moving averages to mitigate risk from surprises in the report. Corn is currently below it's moving averages, beans are above. Not sure it will shake out this way with the Brazil forecasts, but perhaps we see corn slightly higher and beans slightly lower ahead of Thursday.

Tomorrow we will be going over some things we could see in the USDA report as well as preparing. So stay tuned for tomorrow’s update or audio.

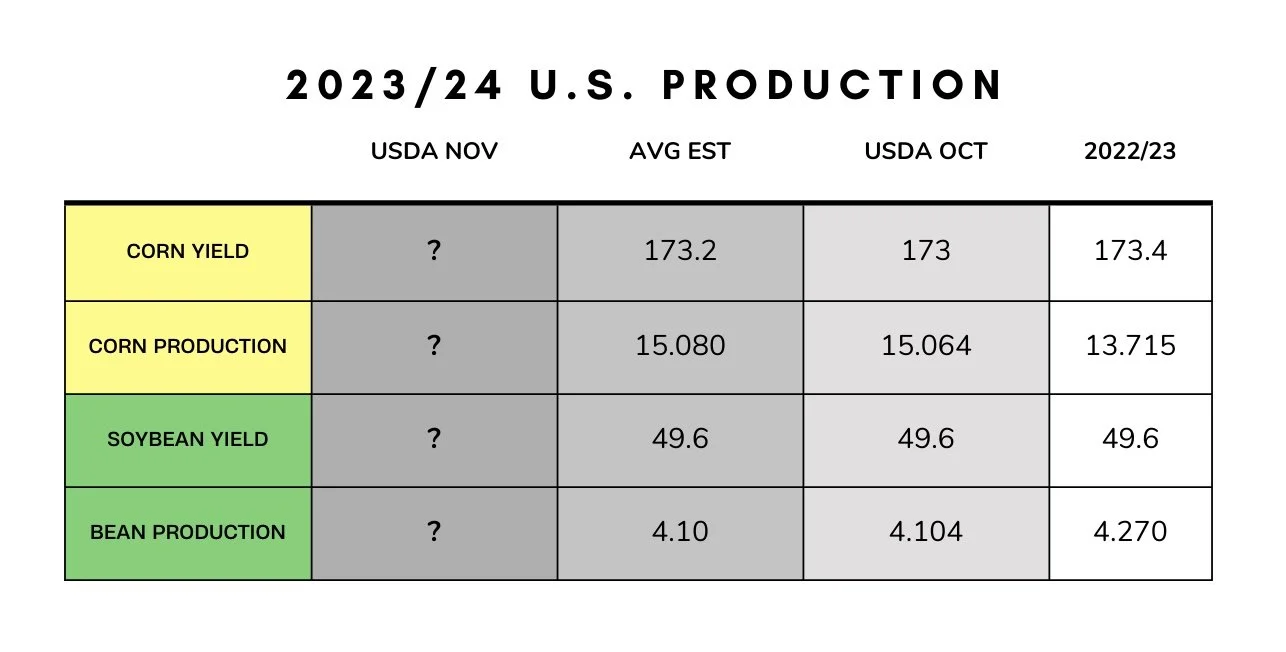

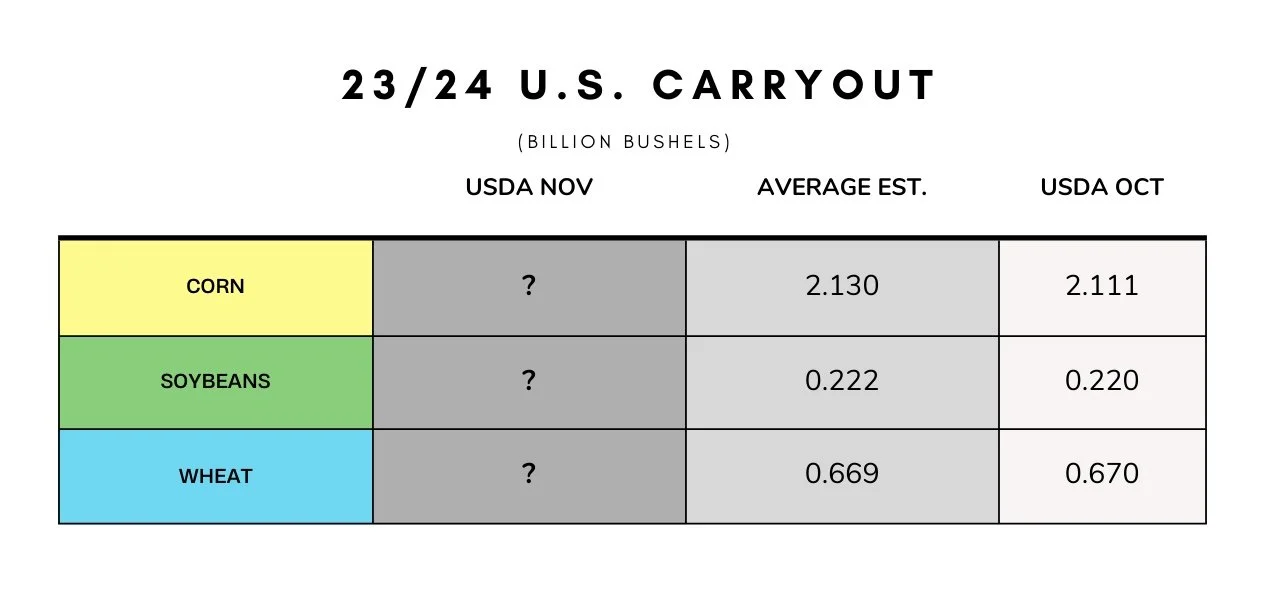

Here is the estimates for Thursday's report.

Today's Main Takeaways

Corn

Corn attempts to make a new low yet again, but bulls were able to fight off new lows for the 2nd time in 3 days. As corn hovers just half a cent above it's $4.68 lows.

We said last week, there was a good chance we tested those lows or perhaps made new lows. We somehow haven’t broke $4.68 yet, perhaps this is a triple bottom? Guess we will have to see.

Short term, we are likely in for a lot of choppy action as the trade prepares for the report. However, the market seems to gravitate towards moving averages ahead of reports. So perhaps we see corn try to rebound towards those average that sit 10 cents higher. The funds are still short a whopping 145k contracts of corn. So perhaps they want to take some of their risk off the table ahead of the report.

However, the other scenario would be that the funds decide it's time to stop playing games and push us to a new low, which I could also see happening given that the USDA report isn’t "expected" to be a super bullish one with this US crop being a top 3 biggest crop and ending stocks still forecasted to be 2 billion bushels. But you never know what surprises we could see.

Now bulls argue that this South American weather is going to lead to some problems. Which I also agree with, but this South America weather story isn’t going to be one that has a major effect on corn until later in the year. So nearby, the Brazil story alone might not be enough to get the funds to cover. Another thing to note is that seasonals are negative for corn until about Thanksgiving.

Long term, we still have upside. Especially if these Brazil problems continue.

Short term, it is going to come down to the USDA report. This will dictate if we make a new low or bounce out of here. After the report, all eyes shift to South America. Which from my point of view is bullish for now.

Taking a look at the chart, if $4.68 does not hold, we will probably see the funds look to add even more on to their shorts and try to look for an old low to find support. Bulls need to see $5.00 if we want to get higher prices and convince these funds to cover.

Corn Dec-23

Soybeans

Soybeans started off the day screaming higher yet again, trading as high as $13.80 before falling off those highs and closing at $13.62.

Similar to corn, it is all about the USDA report Thursday and South American weather. For beans, the trade isn’t expecting any huge changes, as the estimates have yield unchanged.

I could see soybeans take a little pullback here ahead of the report. Soybeans just rallied around 55 cents in 5 days. So the funds might want to better position themselves ahead of the report. Currently they are long around 50k contracts and soybeans sit well above their moving averages which sometimes act as magnets ahead of reports.

I did notice quite a few other advisors placed sell signals for soybeans. Although I still believe $14 to $15+ is in the cards, for some of you it might make sense to reward this near dollar rally. Most of the sell signals recommend going slow on a few sales and do not want to be selling new crop beans yet. With the recent rally, here is a decent spot to take off some risk. But not every operation should be doing so, give us a call for a specific recommendation tailored to your operation. (605)295-3100.

Short term, we could see this rally take a breather ahead of the report, but the day of the report is anyone's guess. One would have to argue that we see the USDA walk back it's Brazil numbers, but I'm not entirely sure they will do that Thursday.

We have US ending stocks tight, new crop production and yield aren’t certain, and now we have big question marks from Brazil.

Long term, there is so much upside in the bean market. $14 to $15 or even higher is not off the table.

Look at what this South America weather worry has done to beans. We are +55 cents higher just the last week alone. What happens if these worries actually materialize and the concerns get worse? The sky is the limit.

Technicals as well as seasonals both also remain supportive for beans here. Not only that, but the funds are only long 50k contracts. Which means they still have a ton of room to add on to their long position.

Bottom line, don’t be surprised to see some chop or lower action ahead of the report. Long term, I still see higher prices. But that doesn’t mean you shouldn’t be managing some risk here. Keep in mind, we are nearly a full $1.00 higher than we were on October 12th. Give us a call if you have questions or want suggestions on what would make the most sense for your operation.

The past two days we have closed right at my $13.63 target. The first level of support if we fall is $13.45. Next upside target is we can break $13.63 is $13.88.

Soybeans Jan-24

Wheat

After 4 days of small gains, the wheat market gives some of it back today. Chicago only ended the day down a few cents, but KC wheat got hit hard as it now sits about 7 cents off it's recent lows.

It's the same old story for wheat as bulls struggle to find any momentum.

Weekly export inspections were a new marketing year low and one of the lowest we've seen in years. Meaning that US exports is a concern for bulls.

Yesterday's crop conditions also favored the bulls as 50% of the US winter wheat was rated good to excellent.

Then bears argue we have some improved global weather weighing on the market. I would say global weather is still a bullish wild card that might be flipped over later in the year and into next.

But one of the biggest things keeping a lid on wheat is still the cheap wheat continuing to flow out of Russia.

Bottom line, there just isn’t much going on or anything for bulls nor bears to chew on. Which can often lead to sideways action. Long term wheat is still a major sleeper. Still a question of when rather than if we go higher. Staying patient for now, keeping in mind that a war or weather worry could trigger short covering at any moment.

Taking a look at the charts, Chicago doesn’t look terrible. We have created a short term uptrend if it holds. Currently sitting right at that $5.70 support. Bulls still need to see $6 if we want to get excited about anything.

KC on the other hand looks like it might look to test it's lows once again. As it just made another new low last week. Bulls need to hold if we don’t want to see yet another leg lower.

Chicago Dec-23

KC Dec-23

Check Out Past Updates

11/6/23

BEANS CONTINUE BULL RUN AS HARVEST WRAPS UP

11/3/23

BEANS RALLY & CORN HOLDS OFF NEW LOWS

11/2/23

EVENING THE PLAYING FIELD

Read More

11/1/23

CORN CONTINUES LOWER & BRAZIL CONCERNS

10/30/23

HOW TO BEAT BIG AG AT THEIR OWN GAME

10/27/23

WEEKLY WRAP

10/26/23

SEPARATING THE FUTURES & BASIS COMPONENT TO BECOME A PRICE MAKER

10/25/23

LONG TERM UPSIDE & BEING PATIENT

10/24/23

TECHNICAL SELLING, SA WEATHER, & MANAGING RISK

10/23/23

IS THIS CORRECTION A HEAD FAKE?

Read More

10/20/23

BIG WEEKEND CORRECTION

10/19/23

CORN BREAKS $5. IS WHEAT NEXT? - SOYBEAN RECCOMENDATION

10/18/23

BEANS BREAK $13. IS CORN NEXT?

10/17/23

DID BEANS CONFIRM REVERSAL?