6TH STRAIGHT DAY OF LOSSES

Overview

Grains tried to push higher overnight, but ultimately take it on the chin again, now sitting with 6 straight days of losses. The funds apparently are looking to do anything expect get long the grains. In the meantime we have China and the commercials trying to get grain as cheap as possible which has added pressure to this sell off.

Outside markets also see some heavy pressure, as crude oil drops nearly $3 a barrel and fills the gap lower from March 31st when the OPEC cut production and led to a rally. Along with the Dow Jones getting hit hard as well.

Putin continues to threaten to exit the Black Sea agreement but the market doesn't seem to care. The wheat market continues to be pressured by favorable weather and rains in dry areas.

I think the grains are all due for at the very least a relief bounce and small rally to close out the week following the heavy selling we've seen the past six sessions. We will have to see what the funds decide to do here, but all of the recent bearish news is mostly priced in and I think we are in the process of making our spring lows. But we could see some more pressure into May before we get that bull market rally we have been talking about all year long, as we expect much higher prices over the course of the next few months.

***

In case you missed yesterday's audio, we talked about rolling basis contracts, making sure you aren’t getting screwed on basis contracts, risk management tools, and more. You can listen to that here

Sunday's Weekly Grain Newsletter

Do You Have Enough Patience to Wait for All-Time Highs

Read Here

Today's Main Takeaways

Corn

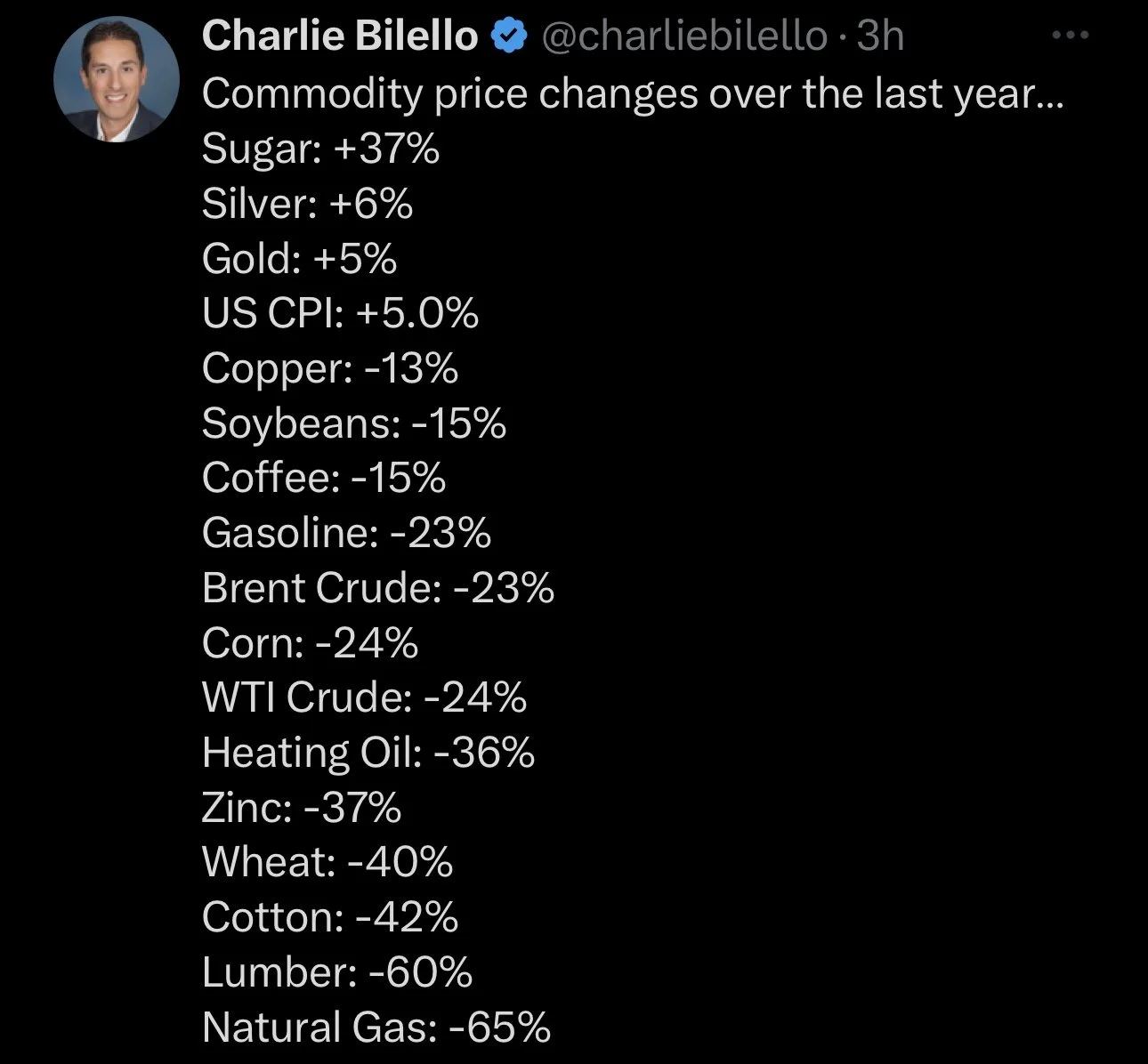

Corn closes down 6 3/4 cents at $6.01, as we continue to add on to our recent sell off.

The story bears keep looking at is the increasing concerns surrounding our economy due to a weaker macro landscape. To add on to a recently stronger dollar and the energy markets also taking it on the chin.

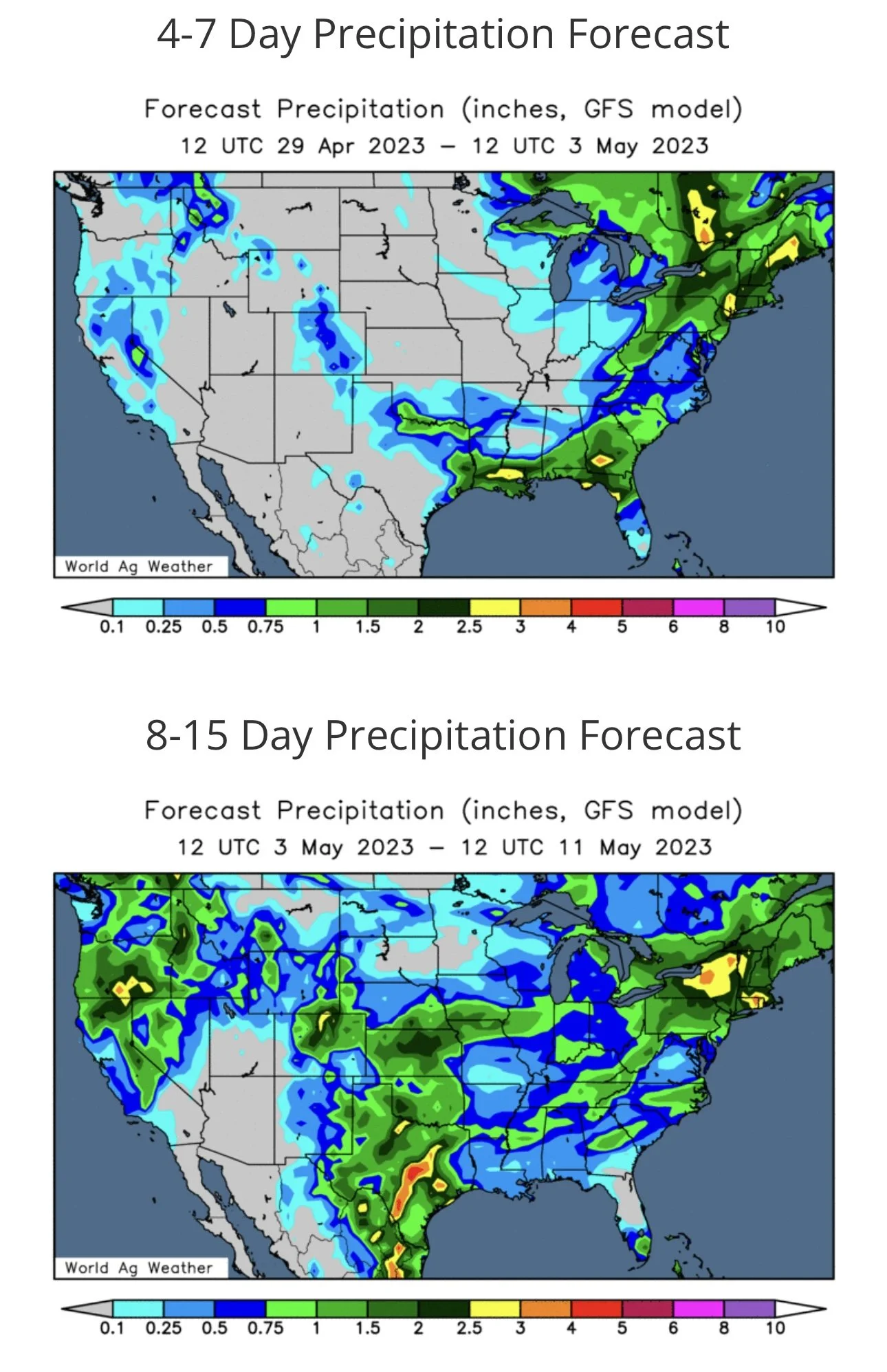

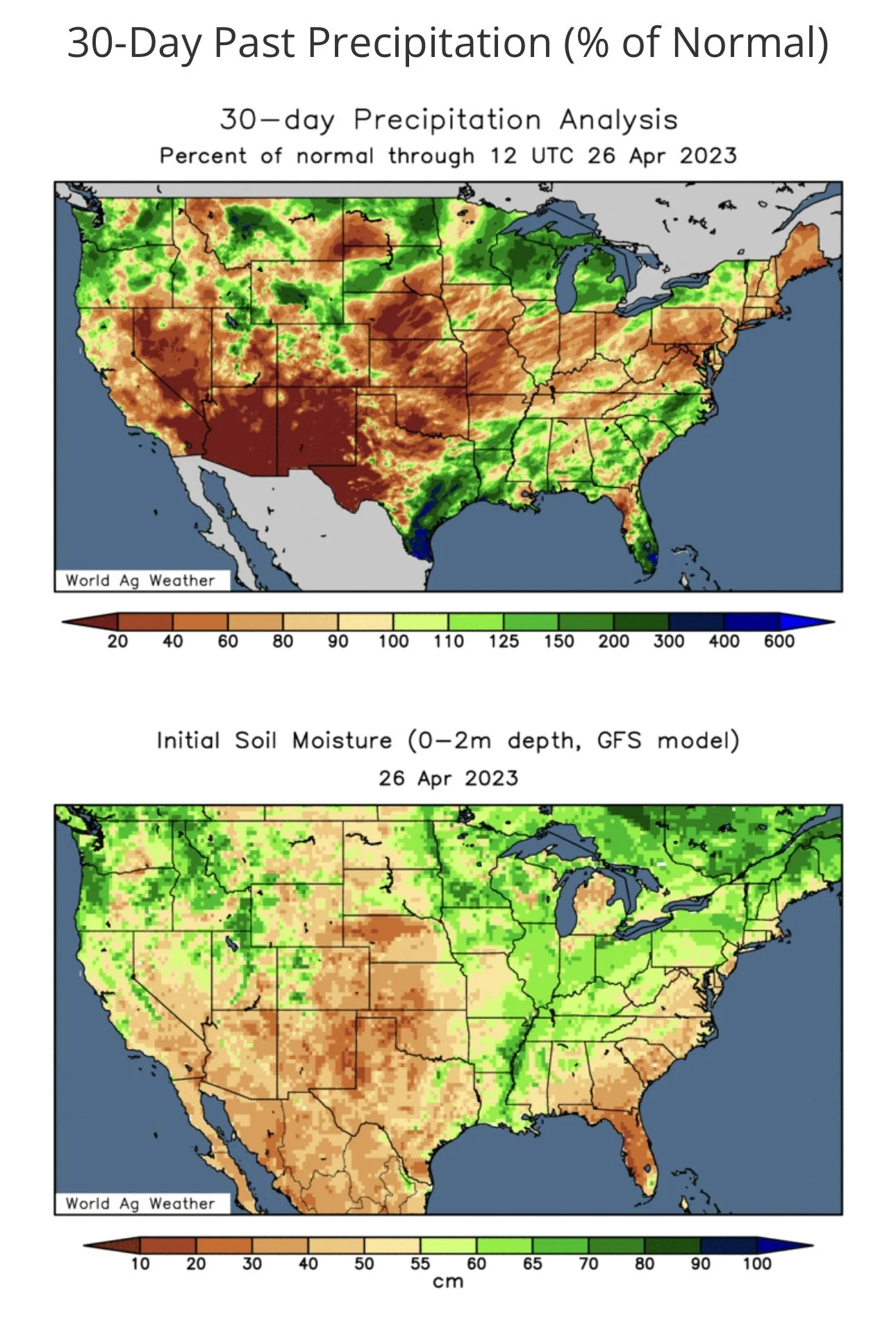

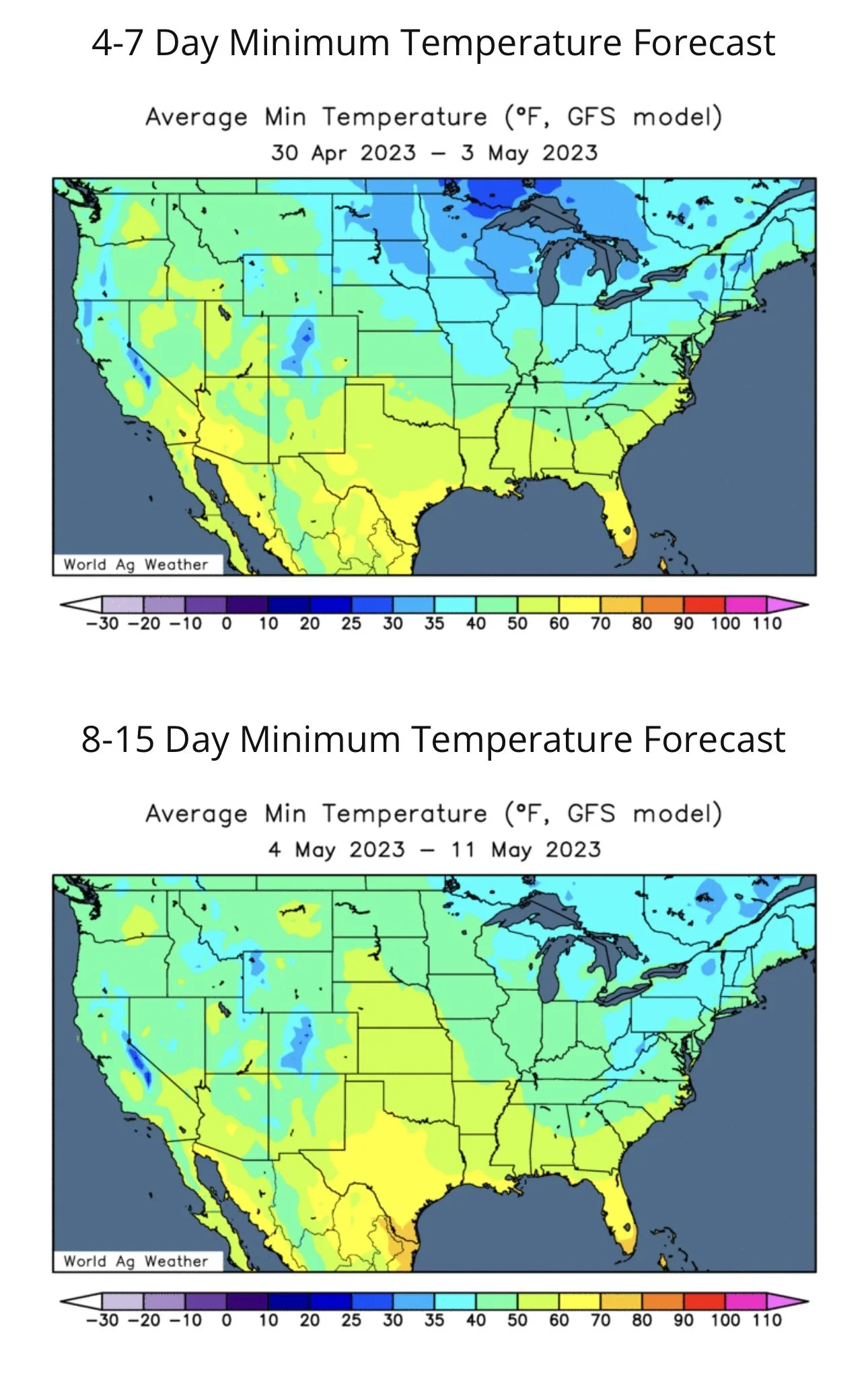

Taking a look at the weather, we did see some frost in some growing areas, but the market seems to not think it did much damage. The forecasts appear to remain fairly cool throughout the end of the month and perhaps for the next few weeks. These cold temps could put a damper in planting progress. Bulls make the argument that we see a bigger number than expected for preventive plant acres. Keep in mind that everyone including the USDA was thinking we'd see a big jump in acres up north, but that was before this whole late winter weather we've had.

We have gotten off to a pretty hot start in planting, which has me concerned that we do possibly see corn take it on the chin a little more looking short term. But this alone might not be a good enough reason for the funds to continue to look to sell. I wouldn’t be totally surprised to see us continue to chop around or perhaps trickle a little lower the next few weeks or possibly even throughout May before we get that massive bull rally we have been looking for.

Comparing 2012 vs 2023

The funds continue to sell. But taking a look back at 2012, the funds were late to the game. We expect them to again join the party late here in 2023. Just taking a look at the charts, we see some similarities between 2012 and 2023. Remember in 2012, we came well off our late summer and early fall highs, we continued lower through out April and May, then we bottomed out the first week of June before rallying $3 into August. I’m not saying we are going to see an exact situation to 2012, but we can’t ignore the similarities and possibilities we have. (2010 to 2023 Continuous chart below for comparison)

So the bottom line for corn is, short term we could definitely see some pressure. Especially given the fact that planting is off to a hot start. But we will soon be making our spring lows and believe we get that seasonal rally to the upside.

Taking a look at the July chart, we are testing that upward bottom trendline. We will have to see if we can hold that line and the $6 psychological support level.

Corn July-23

Soybeans

Beans tried to rally, after being up over a dime early on. But we eventually followed the rest of the markets lower. Ultimately closing down 2 3/4 cents.

July beans have lost nearly 90 cents on this massive sell off where we flirted with the $15 resistance level just a week ago.

One thing bulls continue to point at is the deteriorating crop in Argentina along with inflation in Argentina soaring and sitting at nearly 104%. Sure, plenty of the Argentina stuff is priced in, but I think we could see some of these problems further arise down the road when it matters.

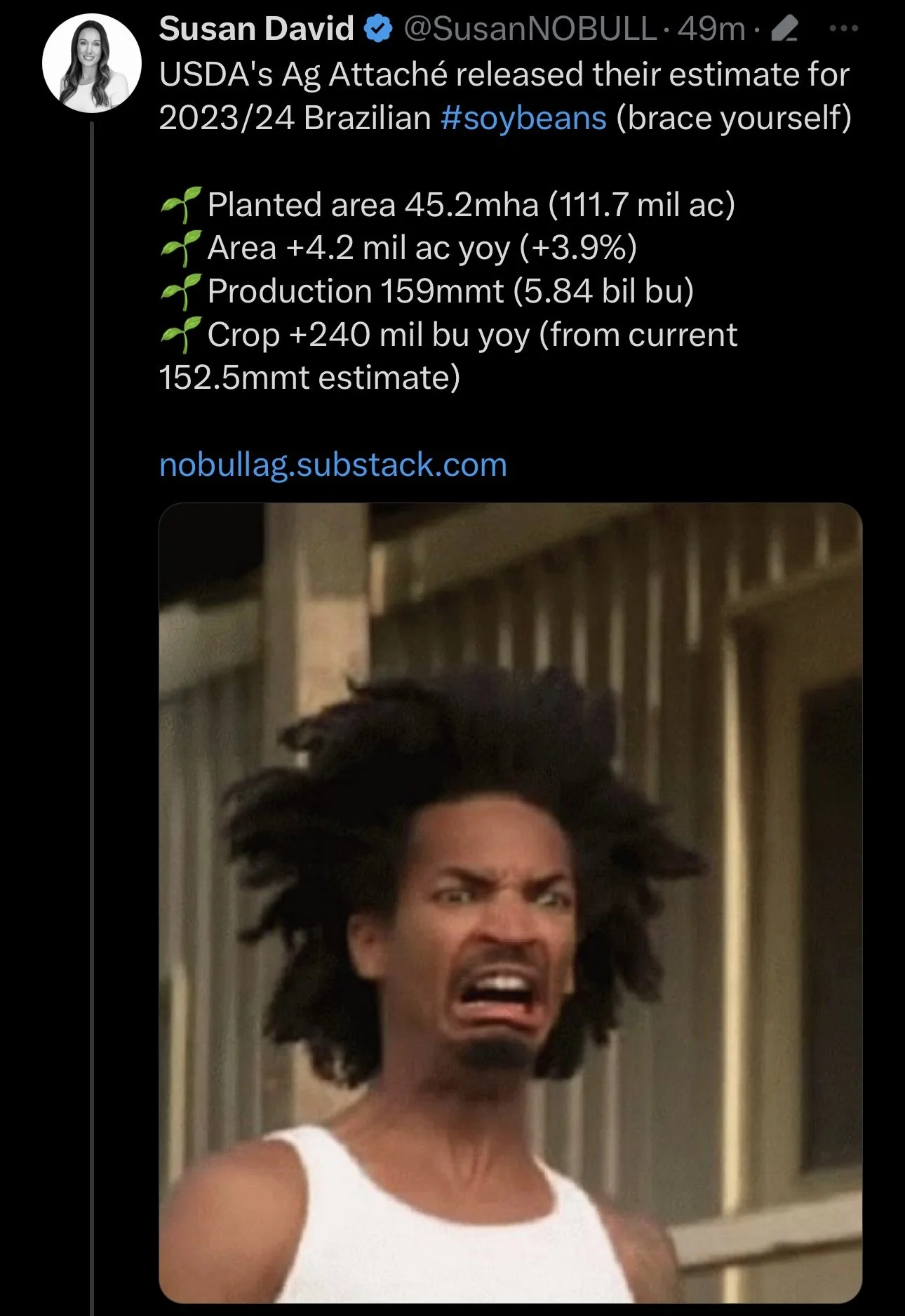

Taking a look at Brazil, this is still where our biggest issues lie within the bean complex. Brazil still has a massive crop and is offering it to a discount compared to that of the US. Which has continued to create massive competition for US exports. On the other hand, bulls make the argument that they still have a ton of logistic issues and getting the actual crop out of the country. There is an arguement that the big crop doesn't matter if it can't be moved.

We did however see Brazil's soybean basis firm up yesterday for the first time in nearly 4 months, which is good for fundamentals amongst all this selling.

Chinese demand remains an unknown and has let bulls down as of recent. As they had hoped that we would see a spark in appetite following China coming back from their multi year long lock downs, but that just hasn't been the case yet.

Currently, similar to corn, planting is ahead of pace. Which could cause some additional pressure looking short term. But looking long term, our fundamentals are actually really bullish and there is a definite possibility we see some bullish catalyst down the road to push us higher into summer.

Looking at our chart, our next level of support is the $14.11 range. If we don’t find support there we could look to test the bottom of that upward trend line.

Soybeans July-23

Wheat

Wheat bulls continue to take a beating, as we continue to make new lows. With double digit losses across the board in wheat today. As Chicago loses 11 cents, KC down nearly 20, and Minneapolis down 23 1/2 cents.

The main thing that continues to pressure the wheat market is the rains in southern Kansas, Oklahoma, and Texas. But Kansas got a lot less rain than both Oklahoma and Texas. The market is trading like these were crop saving rains. When the crop is as poor as it is, it's tough to say whether these rains will make much of a difference or not. I don’t think anyone thinks this is going to be enough to save the crop, but the market begs to differ. Looking down the road, I don’t think these rains will have quite as big of an impact as the trade seems to think.

Additionally adding pressure, we had Stats Canada show that Candian farmers intend to plant the most wheat in 22 years. As it is estimated they will sow 27 million acres of wheat, up 1.6 million (+6%) from last year.

We don’t have any major updates or changes surrounding Russia and the Black Sea agreement. The current outlook is that Russia might not extend the deal, as they have hinted that they won't be renewing it. But the market doesn’t seem to care that the deal might not get renewed. Whether we see the deal renewed or not, Ukraine wheat production is forecasted to be down 40%.

Looking forward, we could definitely see a bullish catalyst for KC wheat when crop tours get rolling along and the trade realizes all of the problems we've had with the crop, especially in the overly drought stricken areas.

With the massive losses the last week due in part to the rain and forecasts, these factors are now all priced in. So one could expect the wheat market to start finding some support here.

Despite us continuing to make new lows, bulls still argue that we could ultimately see a few more bullish war or weather wild cards left down the road. With the funds being as short as they are, all we might need is one bullish catalyst to catch them off guard and create a short covering rally.

Chicago July-23

KC July-23

MPLS July-23

When Will We Make Our Lows & When Will We Rally?

From Wright on the Market & Alan Bonifa,

Alan farms in Southeast Nebraska. He worked for a market analysis technician as a young man and has studied technical analysis ever since. Alan contacted Roger in December 2018 to discuss technical analysis and shared his projection that corn and beans would make a major low on Friday, May 10th, 2019 followed by a substantial rally.

He was predicting a major counter-seasonal downtrend. In the grain market business, it is pretty bold (and usually foolish) to buck the seasonal trend. Roger was quite sure Alan was just another technical guru who worked hard on his craft, but he was nuts to think he could be that accurate in a counter seasonal prediction.

On Monday, May 13th, 2019, one business day later than Alan predicted, July corn made its low of $3.43 with December corn at its low of $3.63¾. Five weeks later July corn was $1.21¼ higher and December corn was $1.10 higher. One had to be impressed Alan made that exact prediction five months before it happened. Well, ok, he missed the low by one business day, but wow!

In November 2019, he told Roger his “work” projected a major low the last half of April 2020 with a major high in September, probably late September.

For the second consecutive year, Alan predicted a counter-seasonal downtrend, but this time, to be followed by a massive price rally.

How did that work out?

The 2020 low was made April 21st. Spot month May 2020 corn traded to $3.01 a 14 year low, July 2020 corn traded down to $3.09 and December corn traded down to $3.22.

After trading sideways into the middle of August of 2020, prices took-off. In late December, spot soybeans futures were $13.21 and spot corn futures were $4.85.

The bean high in 2021 was $16.77; the corn high in 2021 was $7.76.

The bean high in 2022 was $17.84; the corn high in 2022 was $8.27.

In 2021 and 2022, Alan made some remarkably accurate timing calls of highs and lows. He missed some also, but no major busts. His track record is not only remarkable, it is amazing.

Since early winter, Alan has said his “work” did not identify when the 2023 high and low would be. All he could say was if the low was in the spring, the high would be in the fall and vice versa. He also said that, if the high was in the last half of the year, it would be higher than it would have been if the high was in the spring.

Yesterday, Alan said his work indicates the current downtrend will continue into May, possibly late May and then there will be a remarkable rally. His advice is for folks with corn and beans in the bin, leave it there because the basis will continue to firm as futures go down and farmers get busy in the field (because most farmers are cash prices sellers, not basis and futures sellers. Get the basis locked in on the old crop when futures are near the low and get out of the way for the futures rally of substantial magnitude.

Alan’s work is more about timing than price. To predict a price and the time it will occur is near suicidal. In the decades Roger has been in this business, he has learned timing is easier to get right than the price. Roger, none-the-less, asked Alan when he expected the high and what that high would be, Alan states:

July will be the high. I think December will get to $6.30, old crop corn futures $7+. But to me time is more important. I can't be certain of the exact price but I can usually pinpoint the time. I usually don't like to tell people what price as that is not that great of certainty.

The rest of us at Wright on the Market have been saying all winter and spring the lower prices go this spring, the higher prices will go later in 2023. Low prices discourage production and encourage consumption. That is why a late year high will be higher than a spring high.

Fundamentally, corn and beans are going to test or exceed last year’s highs.

*We highly recommend checking our Wright on the Market below*

Highlights & News

Russia threatened to pull out of the Black Sea agreement after accusing Kyiv of launching an attack on it's Black Sea fleet.

Hungary wants Ukrainian grain banned until the end of 2023.

Turkey imposed a 130% import tariff on some grains including corn and wheat. This takes place May 1st to protect the local farmers. Turkey has been the main beneficiary of cheap Ukrainian grain.

Some are saying East Africa is suffering its worst drought in 70 years.

Brazil's bean crop is estimated to be 92% planted as of last week. This is a 6% increase from the week prior.

Anticipation of a long awaited seasonal rally in hog & pork values seemed to surge today, as hogs and pork rallied.

A tornado watch has been issued for parts of Texas.

Roads in eastern Iowa are closing due to flooding.

Check Out Past Updates

4/25/23 - Audio Commentary

Can You Get $1.50 Better Than Best Price?

4/24/23 - Market Update

Funds Continue to Sell

4/23/23 - Weekly Grain Newsletter

Do You Have Enough Patience to Wait for New All-Time Highs

4/21/23 - Market Update

3-Day Sell Off Continues

4/21/23 - Audio Commentary

Ugly Day On the Surface, but Spreads Tell Different Story

4/20/23 - Audio Commentary