RECORD SHORT FUNDS, SOUTH AMERICA, & MANAGING RISK

Overview

Grains mixed to end the week following yesterdays USDA report.

Corn made yet another new low, while both soybeans and wheat have traded completely sideways the entire week.

Overall, the USDA report was bearish. Prices didn’t reflect that however because the CONAB numbers that came out before the USDA report were very friendly.

Today corn and beans were pressured from the rains in Argentina as well some possible after effects of the report.

Soybeans had the most bearish report, yet we were able to close higher yesterday. Even with the USDA barely lowering Brazil beans and with both the US and world carry out numbers coming in higher. This was a good sign, but for now we are still stuck in a complete sideways range as we gave back those gains today.

Click Here for Yesterday’s Report Breakdown if you missed it.

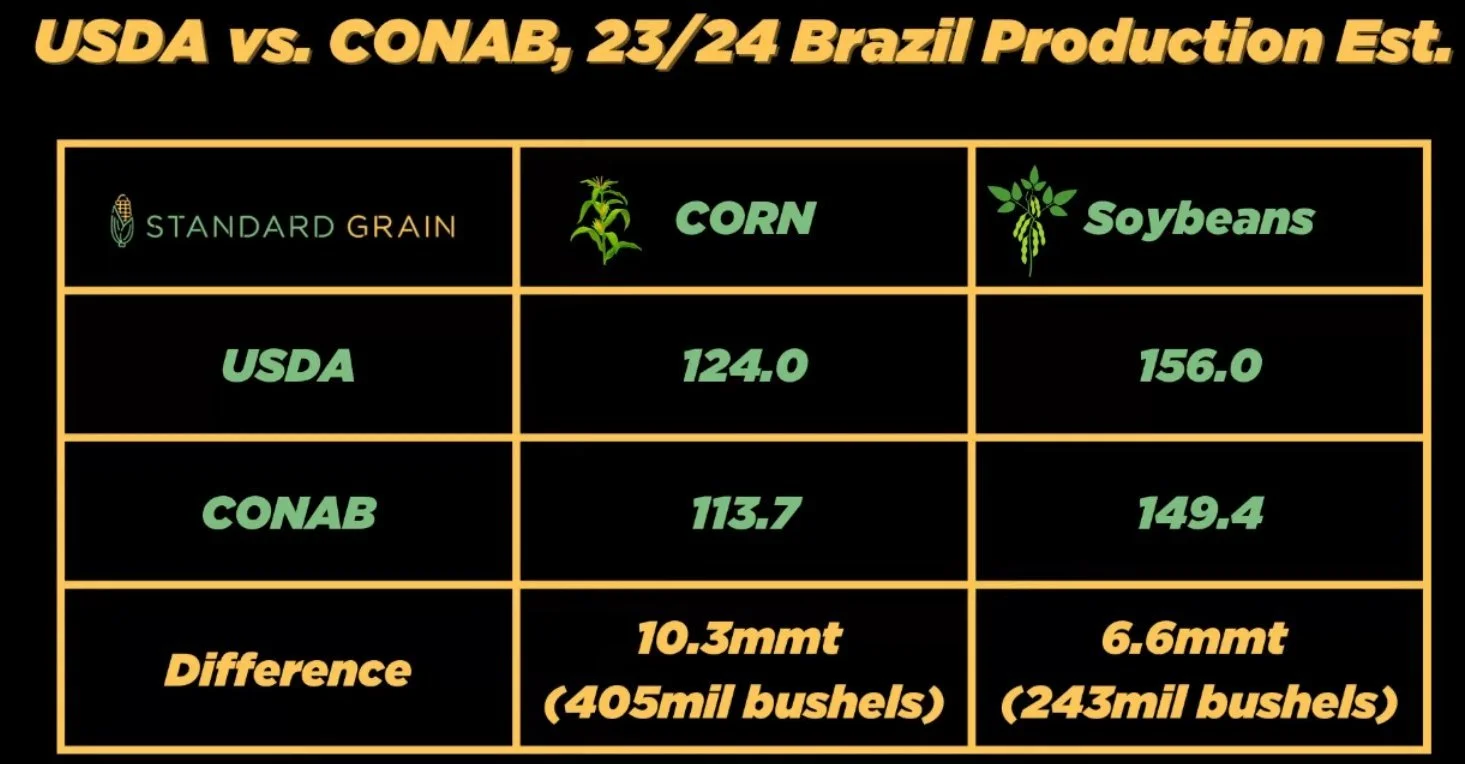

Here were the numbers again in case you missed them:

Now the real kicker here and what the traders are trying to wrap their heads around is the massive difference between the USDA and the CONAB numbers for Brazil.

Here is a chart from Standard Grain that shows the differences.

CONAB sees the soybean crop nearly -7 million smaller and the corn crop is a whopping -10.3 million smaller.

The CONAB numbers if true, are a big deal. Because if you take the USDA or CONAB numbers from where they started months ago vs now, the amount they have cut the bean crop by is nearly the size of our entire US carryout.

At that same time, Brazil has gotten smaller and smaller yet our exports have decreased. That doesn’t line up.

Now yes, the USDA almost always has bigger numbers than CONAB. But 10 million metric tons?? That is such a wide discrepancy. You would think Brazil's USDA would have a far better understanding for their crop than the US's does.

Last year, the USDA was +5 million higher when it was all said and done compared to CONAB.

CONAB had 132 for corn, and 155 for beans. The USDA had 137 and 160.

So will the USDA come to game? Hard to say. They always come to the game late. But no we can’t rely on that. They are the one who dictates these things whether we like it or not.

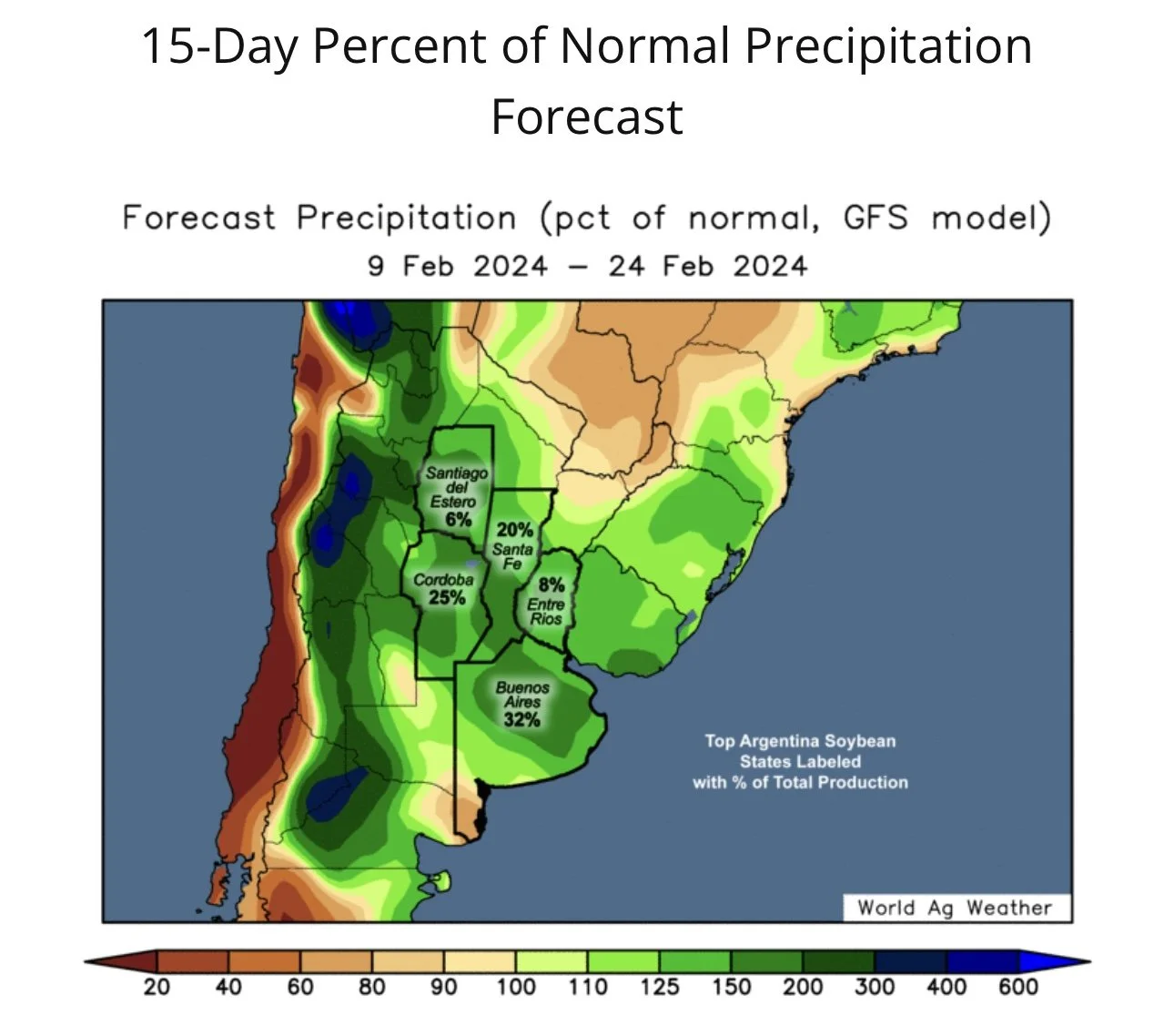

Then we had Argentina, nearly all the numbers came in line with the estimates. But these numbers could very well be taking a step back rather than forward.

They are suppose to get some good rains. But keep in mind, this is a critical key time frame in their growing season.

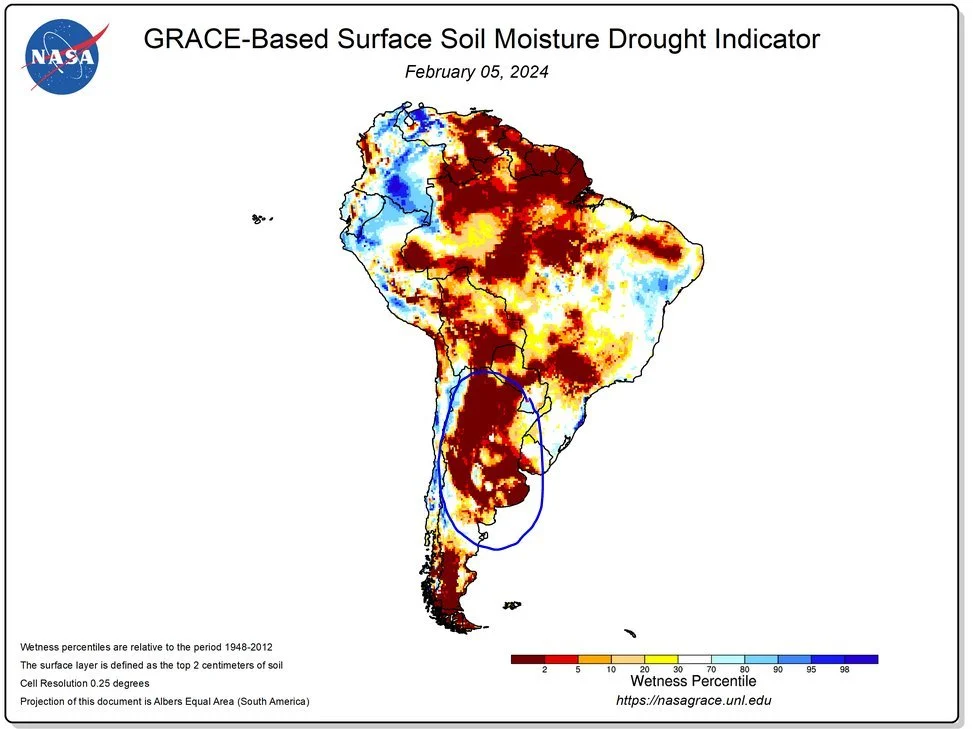

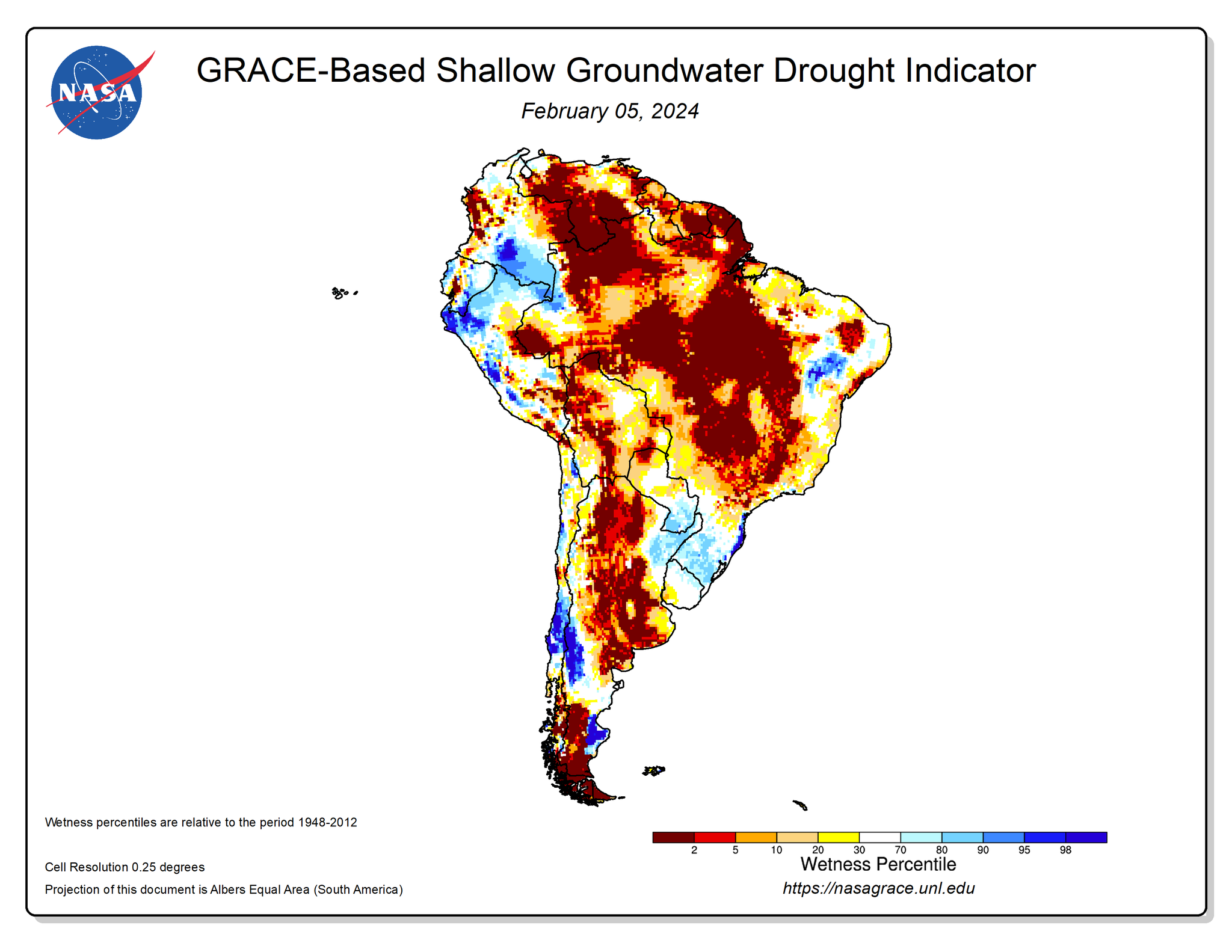

Take a look at how their soil moisture is holding up, despite seeing plentiful rain up until mid-January.

Gro Intelligence said:

"Our machine learning based Argentina yield forecast models show corn yield projections have dropped by more than -10%, and soybean yields are down about -8% since mid-January."

But.. they are suppose to get rain. Below are the forecasts.

How much of this is too late?

I guess we will find out over the next few months.

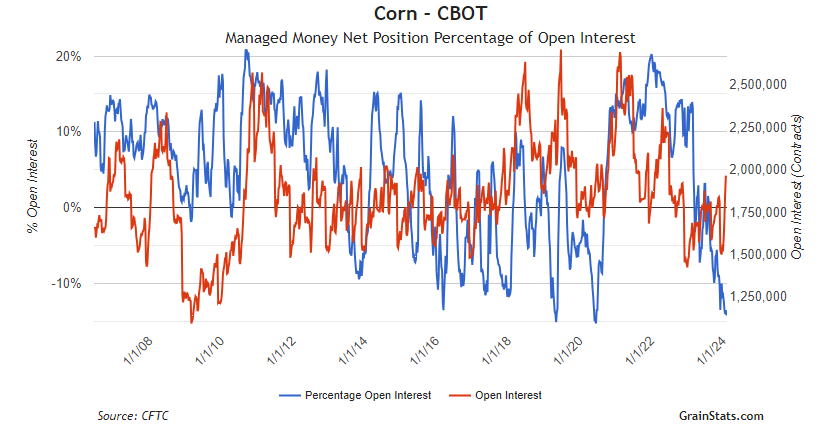

Now let's take a look at the short positions in the funds along with open interest.

Positoning for shorts by the funds is very low as a percentage of open interest. It is rare for the funds to hold such a massive position for an extended period of time.

(Meaning the difference between the red line, and the blue line. They do not stay that far apart for very long usually).

Chart Credit: Grain Stats

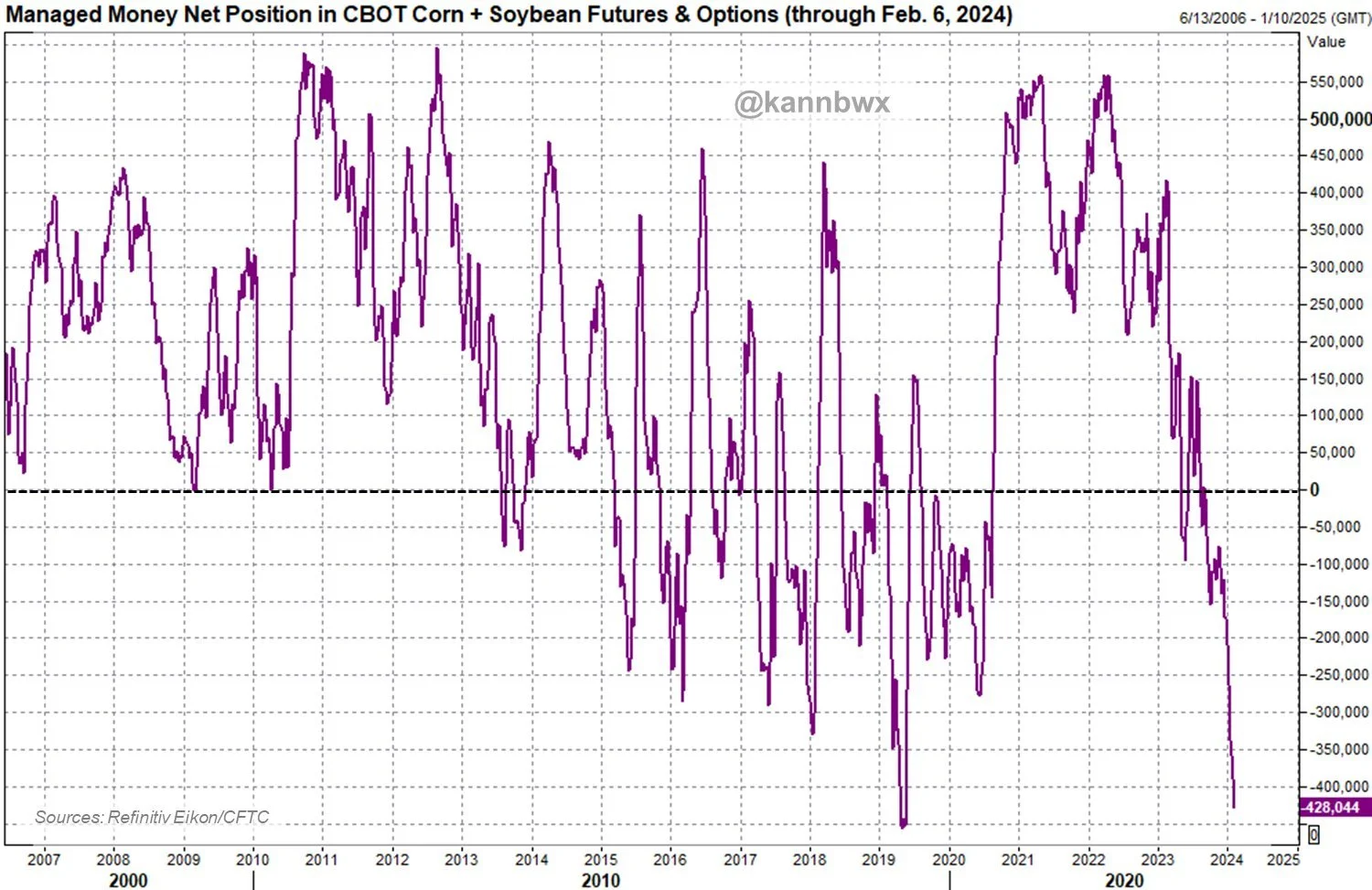

The funds are short a combined -428k corn and beans.

Very close to approaching the all time record from May of 2019..

Chart Credit: Karen Braun

Now what will it take for the funds to cover?

Well of course they could continue to pound the shorts for a while. But eventually they will have to cover.

When and how fast they decide to do so is what we don’t know.

A catalyst for them to cover could be a few things. We will need one, because without one they have no reason to cover. Here are the main ones that could cause them to do so:

South America weather scare

Planting season in US

Chinese buying

However keep in mind we do have the Ag Forum Outlook next week. This is almost always bearish and I can’t imagine they will have anything bullish to show. There could very well be talks about trend line yields, more acres, and bigger carryouts.

The funds will at least wait for that report to cover. Because they do not have a reason to cover yet, and the Outlook Forum will probably not be their reason. So they will wait for that report before doing any major short covering.

Let's jump into the rest of today's update..

Today's Main Takeaways

Corn

Corn makes another contract low closing at $4.29. For the week we are down -13 3/4 cents.

Nobody knows how the recent heat and dryness in Argentina has effected this crop. Some say yields have dropped -10% the past two weeks alone. Some say this upcoming rain will save the crop. Nobody knows. You can only play the cards you are dealt and realize what factors can move this market.

The funds are holding a record short. They will have to cover. But it might not be on your time table.

If China comes in and starts buying, it would be great to get prices going higher. But right now they are on holiday, so don’t expect that right this second.

We have the possibility for South America to shake things up. Overall most think their crops are getting smaller, not larger. So their somewhat large crop is already priced into this market. A major cut or scare is not. This has a far greater chance to be a bullish wild card than it does a bearish one.

I think Brazil will have less second crop corn acres, but we won’t have a great idea on the South America situation until we see actual results from the fields.

CONAB is probably expecting a lot less second crop corn acres as well. Hence why their number was -10 million less than the USDA.

After we know what South America looks like, attention is going to soon shift to the US planting season.

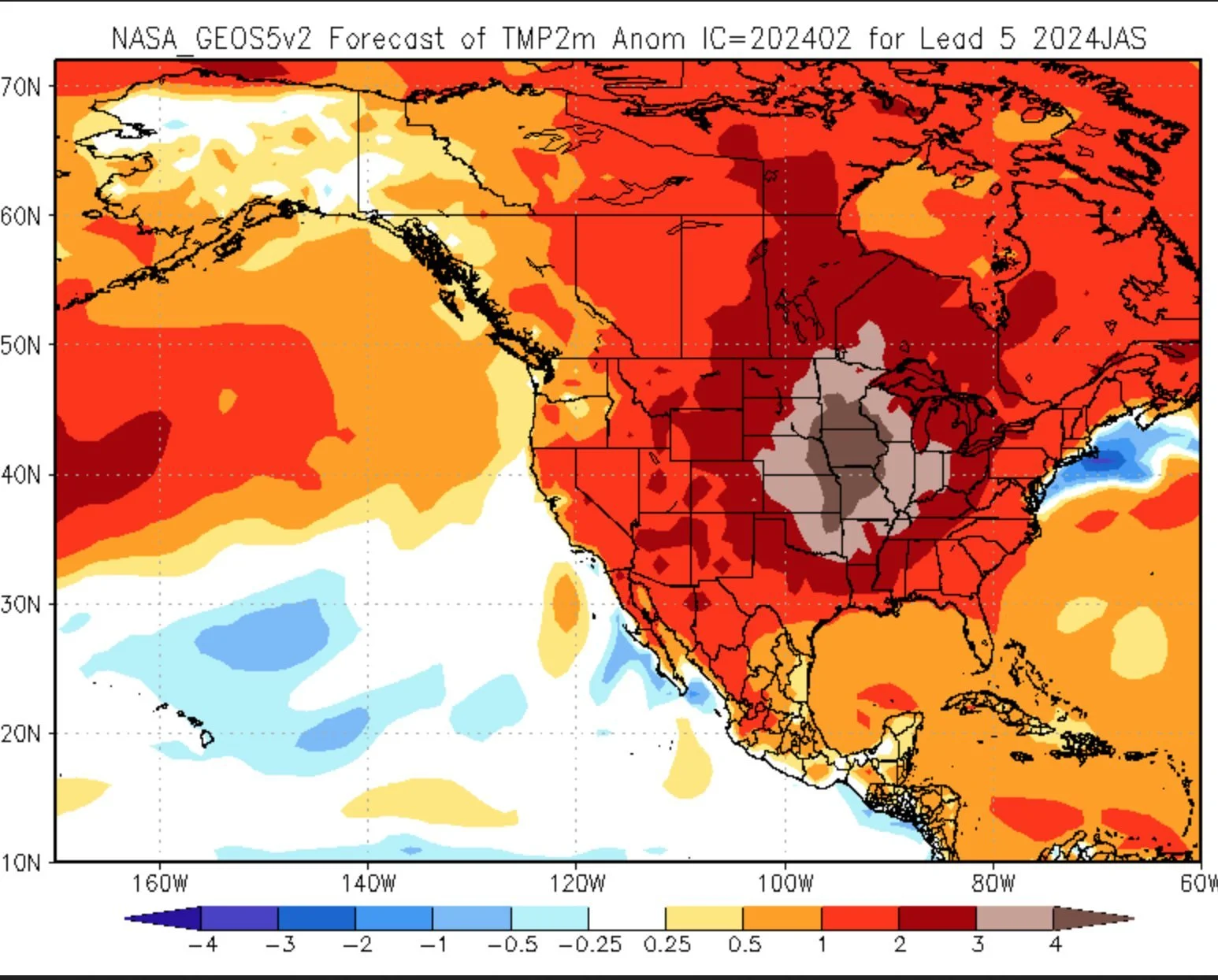

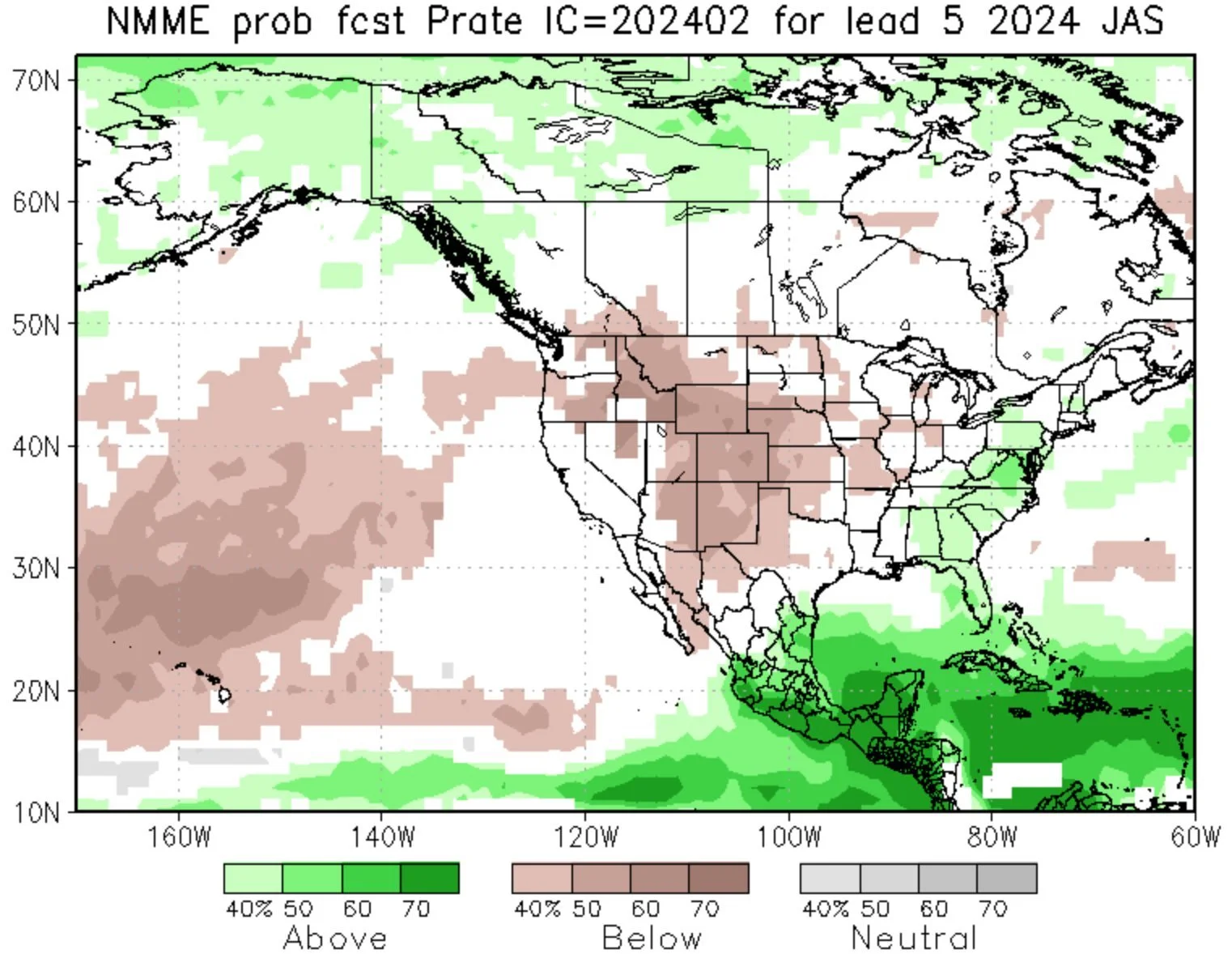

Still WAY too early to make any bold predictions. But take a look at how hot this year has been so far.

Now here is the current temperature and precipitation outlook for July, August, September time frame. Again, this is a long ways out so we will have to see how much merit it actually has.

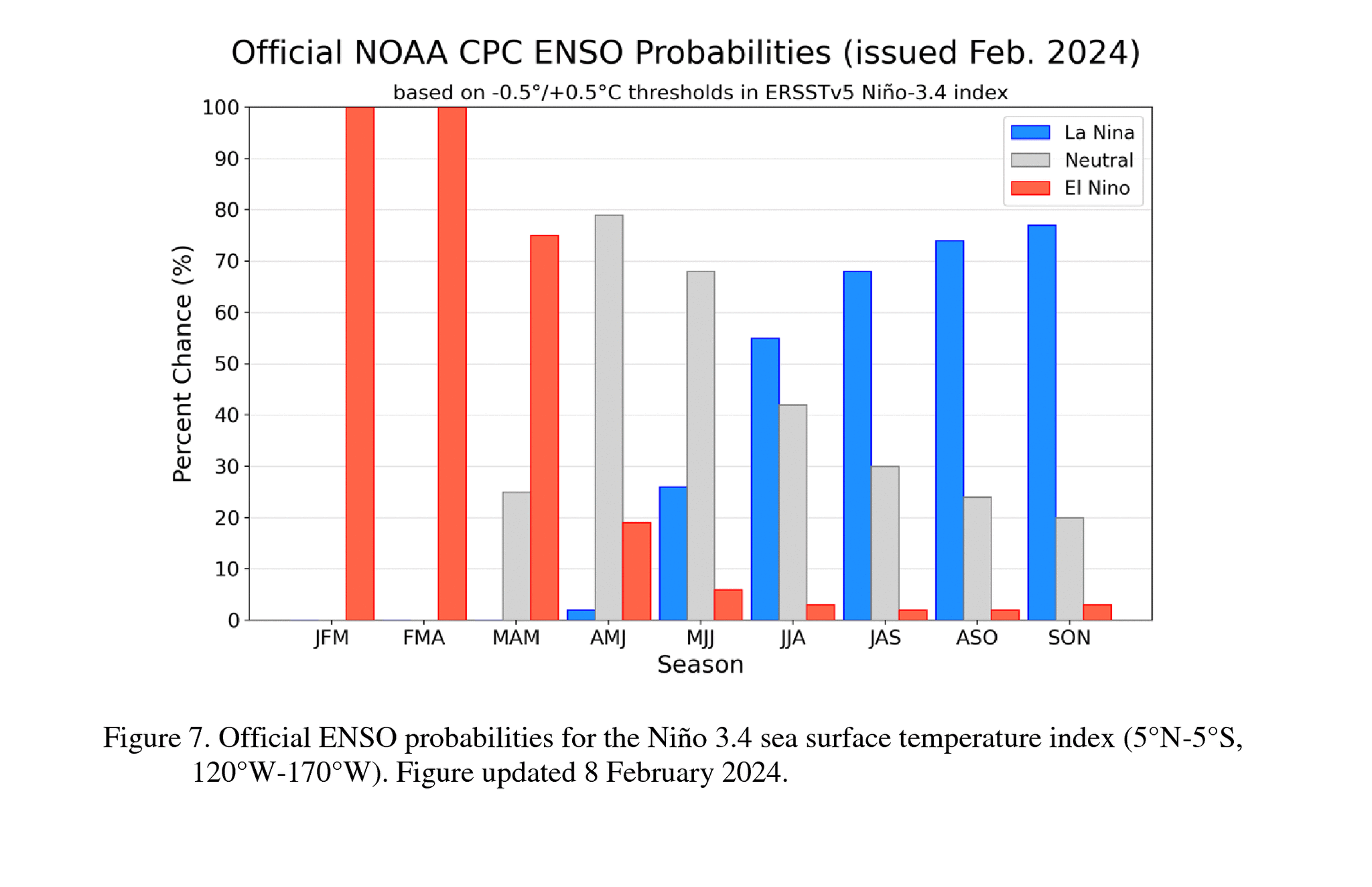

Lastly here is the El Nino and La Nina probabilities for this year from the US Climate Predictions Center.

It looks to be wet until April with El Nino, then the La Nina is supposed to kick in come May and bring hotter and drier weather.

Again, still too early. But something to watch.

Although yes I believe we will get a seasonal rally, looking long term there is still the risk that we raise a great crop here in the US this year. Add that to our large 2 billion carryout and it does not help prices looking later this year.

As I have been mentioning for the last few weeks, I could see us testing the $4.20 level before finding a definite bottom. That is the level where we originally broke out in 2020 and was prior resistance. I expect old resistance to turn into new support.

3 year lows is not the time to be making sales. We want to be making sales in spring and summer. When we get that weather scare type of rally and when the funds decide to cover.

How big of a rally we will get is still an unknown as there are plenty of factors at play such as the upcoming planting and growing season for the US. But $4.90 to $5 isn’t too unrealistic of a goal. If we get a major scare in spring or summer perhaps that target moves higher. But until we get one and know what we are all dealing with, my first target is $4.60. Which I think we should be able to reach. Followed by $4.90 to $5 looking a little longer term.

The highest we have traded this year is $4.70 which was the first day of the year. I have been saying this for weeks, but there have only been 2 years where we made our highs in January. Still being patient.

I still like courage calls here to give you the confidence to pull the trigger on sales when we get a rally. If you have unpriced bushels, adding some protection is never a bad idea. But make sure your puts are cheap. Do not overspend at these levels.

If you are late to getting a hedging plan together, you aren’t alone. American farmers have 2 billion bushels of old crop corn mostly unhedged and somewhere around 90% of producers for 2024 have nothing sold and nothing hedged.

We are at 3 year lows, so it can be easy to get emotional and overpay on downside puts. Or worse, you use a strategy where you get aggressively short in hopes of catching more downside action to catch up. This is a bad idea at these levels and you would be far better off getting the cheapest puts possible to defend yourself against prices falling further.

However, I still like courage calls more than defending multi year lows. Give us a call and we'd gladly help find the right marketing plan for you. Because it's not one size fits all. (605)295-3100

We never get puts in hopes of them making money (when prices are already low, a different story when we are near highs). But when they do make money and if we go lower, you are able to cash those in. Because if we get a reasonable rally, they will be worthless.

The last thing to keep in mind is that typically the front month contract leads us higher and to the downside. So courage calls and puts for protection isn’t always as simple as it seems. So if we are in a downward market, the front month will lead us lower meaning you may want to use your put on the front month rather than the deferred month in a downward market. Please give us a call if you have questions. We would be happy to help (605)295-3100.

Here is also an article where we went over spreads concepts as it relates to basis as well as to protection and ownership. Click here.

Corn March-23

Soybeans

Soybeans give back yesterday's gains. We have traded completely sideways the entire week. Only down -5 cents on the week.

Today marked a new low close, but we still have not taken out those lows from earlier in the week.

As mentioned, soybeans had the most bearish report. Yet we closed higher yesterday due to the CONAB numbers being bullish. That was a great sign for the bulls.

In the report we saw world ending stocks as US ending stocks come in higher. This was bearish.

As you know we also saw the USDA only drop Brazil production by -1 million to 156 million. Compared to CONABS 149.

There is plenty of people including myself who think the USDA will have to work that number lower.

However, the bears arugement is that it won’t matter because overall South America production will still be bigger than last year. Unless Argentina's crop magically takes a major hit, this is true. Total production will be bigger.

Short term, I could see us struggle. I could see us find some footing here, but I could also see us make another leg lower short term. I am not expecting a major rally right now come Monday.

So do not be surprised to see us struggle a little bit until the results from South America are more clear or until we start to see China come in here and buy.

Unlike corn, soybeans are not extremely oversold in comparison. So there is still downside risk.

One concern I have short term is the Ag Outlook Forum next week. This tends to always be bearish and farmers are expected to favor soybean plantings which will be bearish if true.

We could get a dead cat bounce, but we will really need to follow through strength to confirm higher prices.

If you are forced to make a decision, sell corn or sell soybeans here. You probably go with soybeans. The upside for soybeans is so much higher than corn, but the downside risk is also far higher. To go along with better cash flow. But we don’t want to be making sales here if you don’t have to.

Just like I said in the corn section, if you have unpriced bushels. Look at puts and protection. I like getting protection on beans more than I do corn simply due to the possible risks.

Please reach out if you have questions or want to discuss (605)295-3100.

Our next downside risk is $11.75 which I could very easily see happening and have been saying was possible for weeks.

Sure there could be more downside, as I am not trying to catch a falling knife. But looking long term I do see prices higher than they are today. Longer term I also think there will be a greater demand story for bulls to get behind. Just like corn, it is just a matter of when will we get seasonal rally or scare to push prices higher.

How low do we go before we get the rally is my biggest question..?

If $11.75 does not hold, the next big downside risk is our summer lows of $11.45. Just something to keep in mind. $11.45 would be a must hold level if we get down that far.

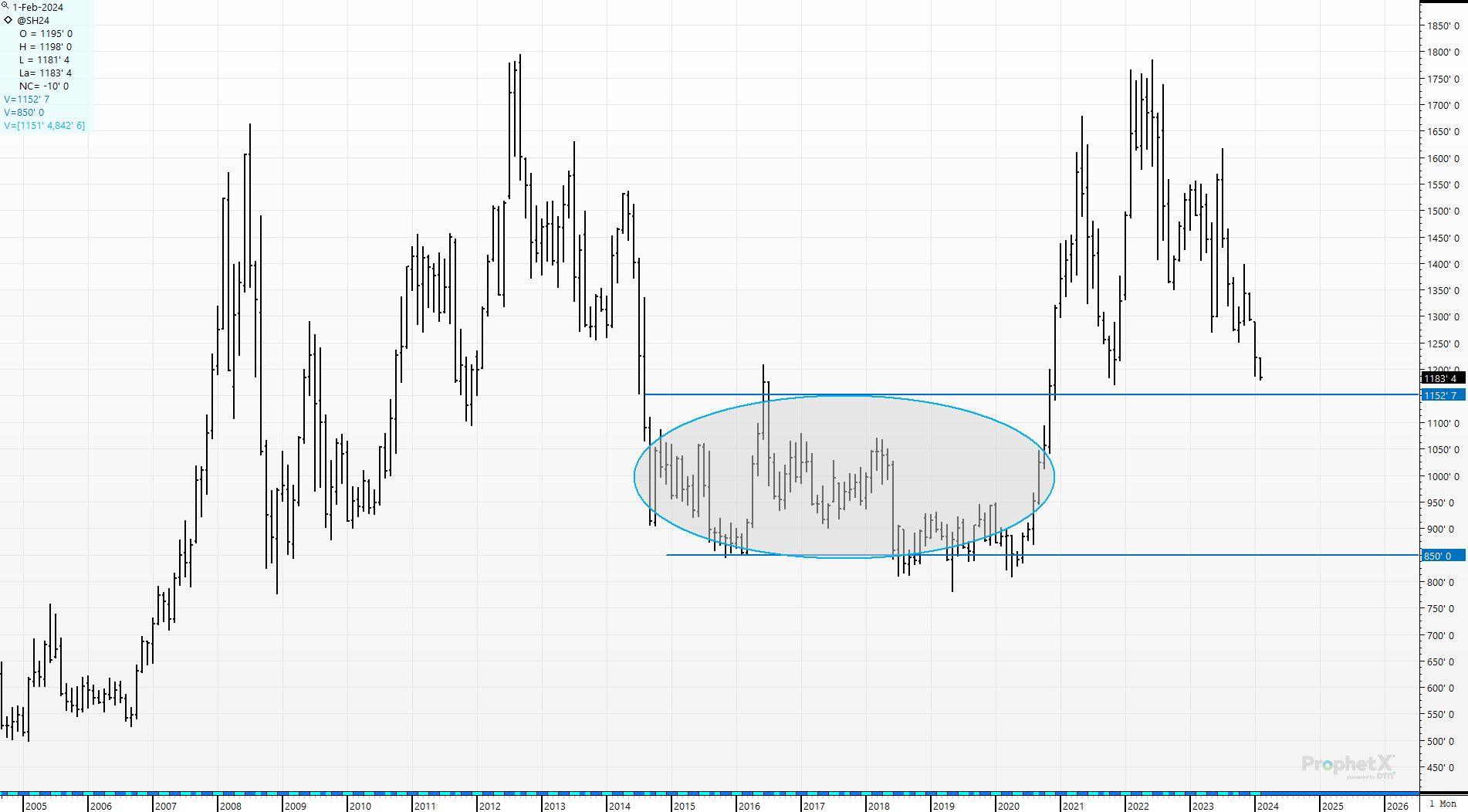

From Chris Robinson:

"2014 to 2020, $11.50 to $11.80 was 'expensive'. Now it is the battleground for 2024."

The concept I mentioned in corn of old resistance turning to new support lies truthfully in soybeans as well.

Soybeans March-23

Wheat

Wheat rallies today and takes back the losses from yesterday.

On the week Chicago was only down -3 cents. But KC wheat was down -23 cents and Minneapolis was down -15 1/2 cents.

There wasn’t a specific reason for the rally. The funds probably just wanted something to buy, and with the report it wasn’t going to be corn and beans.

Yesterdays report showed very minimal changes to the wheat complex as expected.

However, one good thing we saw was that Russia's production was left unchanged at 91 million vs last year's record 92 million. Many were talking about Russia's crop potentially getting bigger, which doesn’t help the fact that they still have plenty of cheap wheat.

World ending stocks were also lowered to 259.4 million. Which is the lowest number since 2015/16.

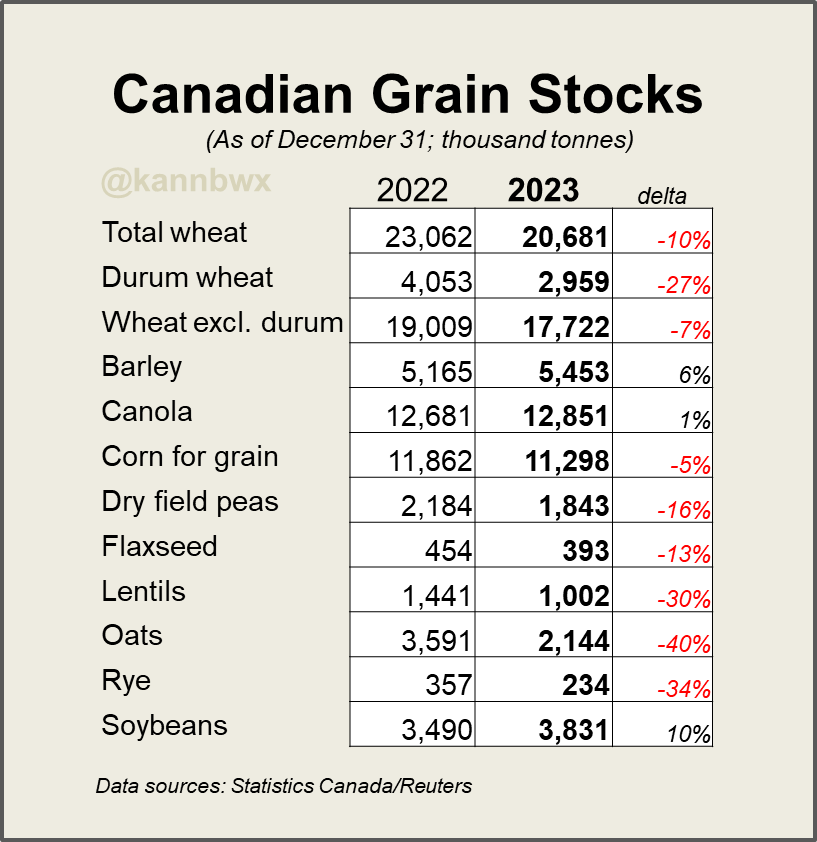

Stats Canada showed Candian wheat stocks at 20.7 million vs last year's 23 million. Which was a -10% drop and overall positive.

Here are the numbers from Karen Braun.

Bottom line, I sound like a broken record but the wheat market is still a sleeper.

For higher prices bulls want to see stronger demand or a wide spread weather worry, which we just haven’t got yet.

I am remaining patient for better pricing opportunities. I believe that time is coming, but I would be lying if I said I knew when. Could be weeks, or months. Nobody really knows.

If you have unpriced bushels, it might make sense to add protection. I don’t see a crazy amount of downside, and I would like to say we have more upside potential than downside risk, but the risk is still there. Remember to keep them cheap. The purpose of a put when prices are already low is to add protection. Unlike if you believe prices are near their highs, you get puts in hopes of adding dollars to your bottom line and making money on the way down. For others, perhaps you should be utilizing courage calls. Give us a call if you want to talk about your situation (605)295-3100.

I have been pointing out this wedge in the Chicago chart for weeks. We still remain stuck inside it. A break above or below could really accelerate things to the upside or the downside. But for now, we remain in no mans land.

I will look for Chicago to lead us higher when we do. KC wheat needs to defend those lows that are scary close if we don’t want to trigger more selling.

Mar-24 Chicago

Mar-24 KC

Cattle

We got 4 month highs in feeder cattle and have now recovered around 80% of the last years late sell off.

Live cattle has taken back 60% off the sell off.

Recommendation

You should be taking advantage of this recovery rally. Take advantage on paper with a hedge.

Yes prices could absolutely go higher.

Adding a hedge does not mean you think the highs are in. It is simply good risk management.

What are your options?

A long put is one option. This would give you a floor but keeps the upside completely open in case prices do higher. The only downside to this method is that you have to pay the put upfront.

Give us a call if you have questions. (605)295-3100.

Live Cattle

Feeder Cattle

Want to Talk?

Our phones are open 24/7 for you guys if you ever need anything or want to discuss your operation.

Hedge Account

Interested in a hedge account? Use the link below to set up an account or shoot Jeremey a call at (605)295-3100 or Wade at (605)870-0091

Check Out Past Updates

2/8/24

CONAB VERY FRIENDLY. USDA NOT. FULL BREAKDOWN

2/7/24

NEW LOWS IN CORN & USDA PREVIEW

2/6/24

WHAT IS EXPECTED FROM USDA & WAYS TO GET COMFORTABLE

2/5/24

STILL NO CLEAR DIRECTIONS IN THE MARKETS

2/2/24

NEW BEAN LOWS.. HOW LOW CAN CORN GO?

2/1/24

NO CONFIRMATION OF HIGHER OR LOWER PRICES IN GRAINS

1/31/24

HOW SHOULD YOU BE SETTING YOUR TARGETS?

1/30/24

OUTSIDE UP DAY IN ALL THE GRAINS

1/29/24

GEO POLITICS, CHINESE, BRAZIL, ALGOS, & BIG MONEY

1/26/24

SOLD RALLIES & HISTORICAL HIGHS

1/25/24

DEVELOPING A GRAIN MARKETING PLAN WITH TECHNICALS

1/24/24

5TH GREEN DAY IN A ROW: WAYS TO OUTPERFORM THE MARKET

1/23/24

GRAINS CONTINUE TO BOUNCE

1/22/24

HAVE MARKETS FOUND A BOTTOM?

1/19/24

FAILED REVERSALS & ELECTION YEAR RALLIES?

1/18/24