BEANS LOWER DESPITE DROUGHT TALK

Overview

Poor day for the grains. Despite corn & wheat ending the day higher, all close well off their highs for the 2nd day in a row.

The big talk today is the potential "flash drought" talk for the western corn belt.

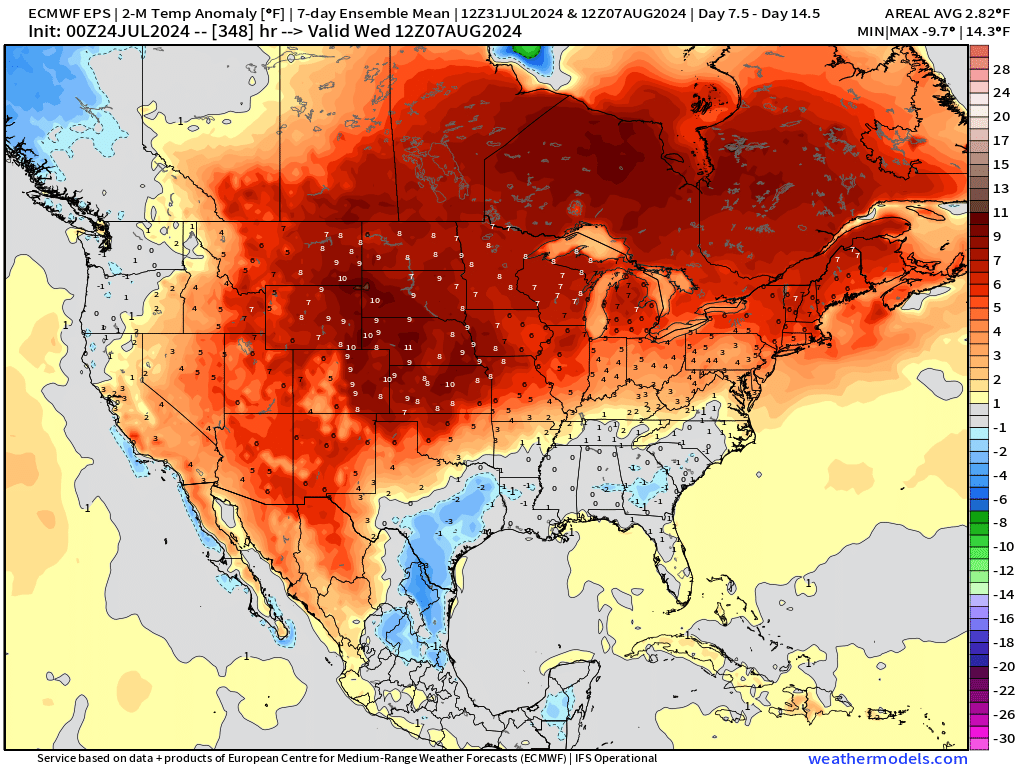

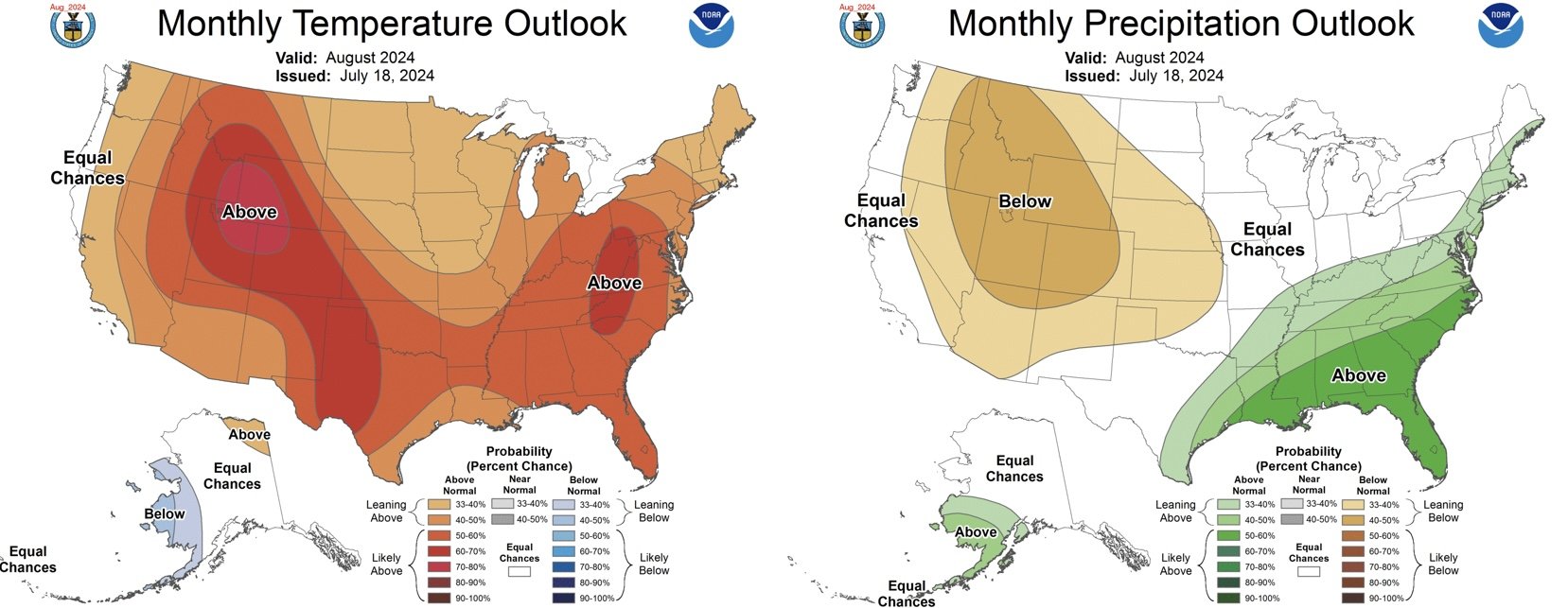

Overall the western corn belt will remain dry with very hot temps. Many areas +10 degrees hotter than normal.

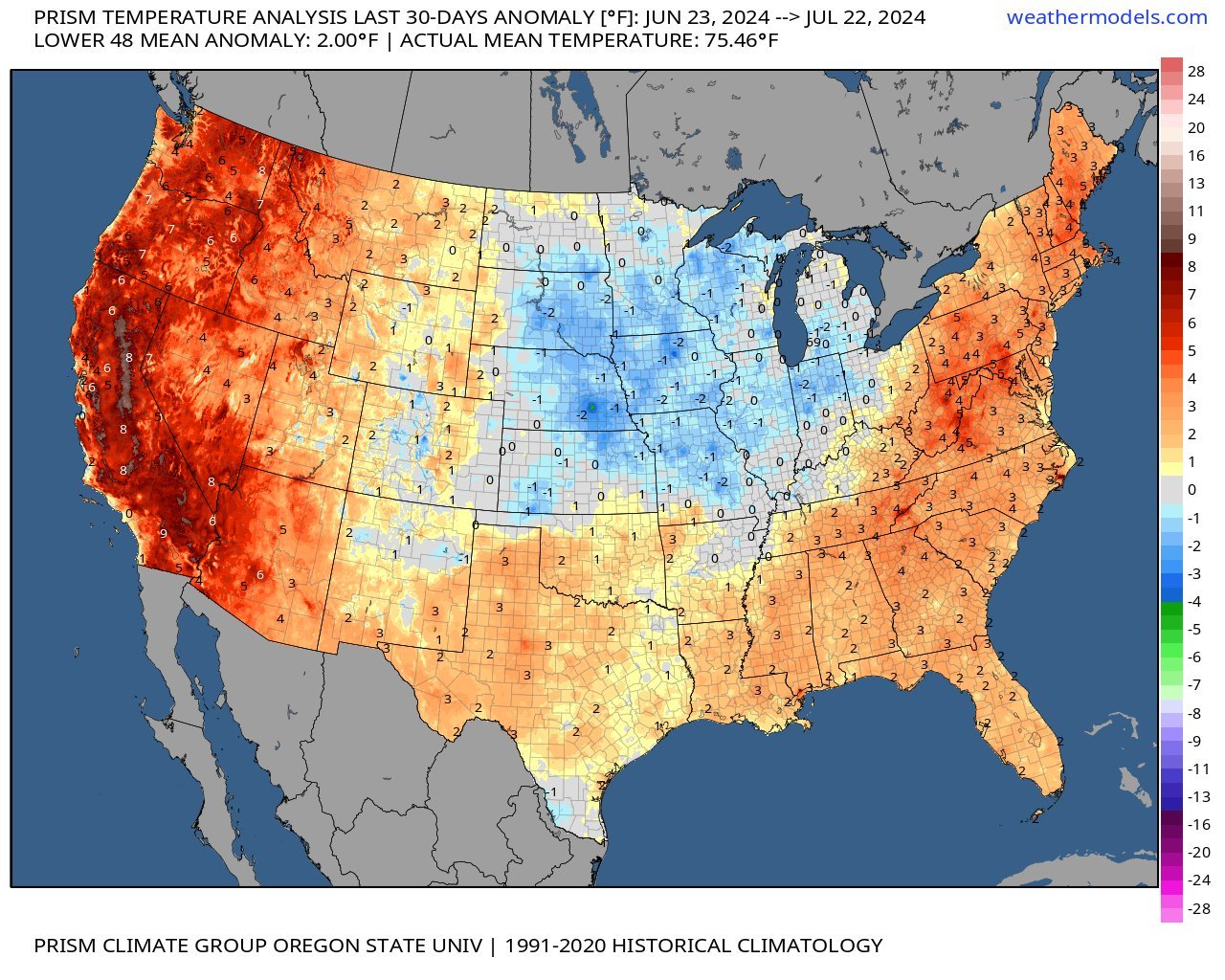

Take a look at the temp differences from the next 2 weeks vs the past 30 days. Huge heat swing.

This heat is expected to continue throughout the month of August.

Next 2 Weeks

Past 30 Days

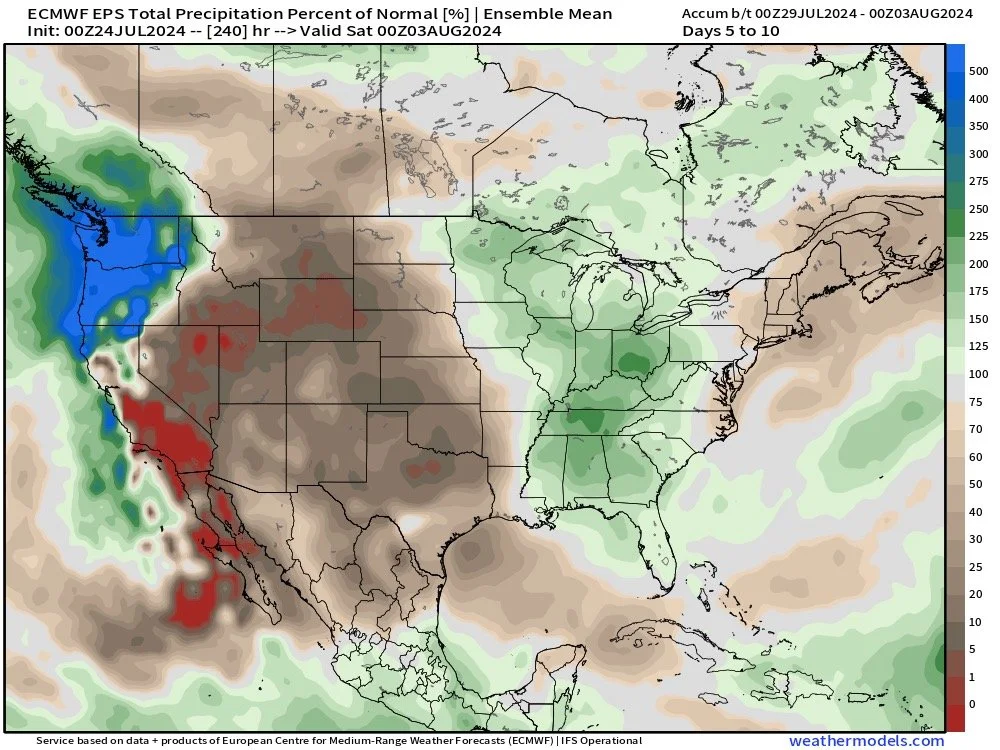

However, despite the western corn belt remaining dry. The eastern corn belt will likely get some timely rains again the next week.

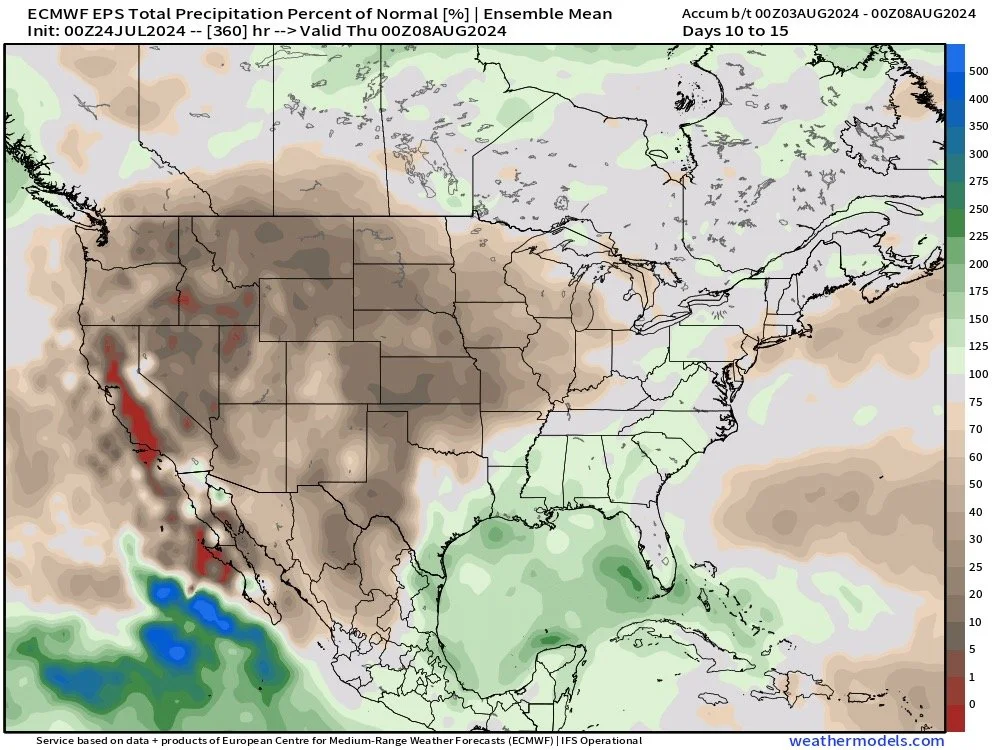

Towards the end of this 2 week period, the dryness out west could start spreading east. But for now they should be getting rain.

Here is how the rain should shake out the next week or two. East will start wet, but trend drier into August.

Days 5-10

Days 10-15

August Outlook

From BAM Weather: Key Notes to Watch

Trending hotter & drier across the western ag belt as we head into August

Timely rains, but still warmer for the eastern ag belt

Need to keep an eye on severe storm cluster risks in Midwest next week. Which could post more damaging wind threats.

End of growing season and early harvest looks hotter than normal for the ag belt overall, and could end on a drier not especially for the plains.

BAM had a great full weather breakdown this morning. If you want to watch it: Click Here

For BAM's direct weather updates: Click Here

Overall, there is some obvious concerns out west, but the rains to the east are enough for the market to "shrug off" the problems west.

As I have mentioned, the real weather market is behind us. If this happened in June rather than nearly August, it would be a completely different story.

These forecasts will not directly impact the corn market drastically.

For soybeans, dry & hot weather could still add support as beans are made in August, but it will not be this major market mover like weather in June/July is for corn. Weather in August matters to the actual outcome of the crop, but every little change in the forecast isn’t the only thing the market looks at here.

Right now the next week doesn’t look too threatening overall with the east getting rain, but if it does stay hot and dry throughout August and with the funds holding a record short, it could be a reason to see a small rally.

A lot of this heat and dryness is in spring wheat country, so it should provide some support. But some say it might be too late, as our spring wheat crop looks great. As the crop is rated 77% G/E vs the 5yr avg of 54%.

In other news, China dropped their interest rates from 1.8% to 1.7% Monday to boost their economy. Cutting rates for the first time this year. Some think this was part of the rally we have seen in corn & beans as rate cuts should result in more demand.

Today's Main Takeaways

Corn

Poor close in corn again, well off the highs for the 2nd day in a row. However, this is our 3rd day higher in a row. The first time we have seen that since May.

This potential drought scare will not have a major impact on corn itself.

Yes, if this provides a spark to soybeans, soybeans could help carry corn higher.

Until we get into harvest, the two biggest things to watch for are demand & technicals.

If we want to see higher prices we will need demand. These lower prices should be helping create more demand. We just had a flash sale of corn to China yesterday.

The USDA just added 250 million bushels of demand on our last WASDE report. So even though our production was higher, our carryout decreased. That is why demand alone can lead you higher.

At the end of the day, we will more than likely have a pretty good crop here in US despite all the problems we had. I am hesitant to say it'll be a record simply given the fact we had the wet start which alone can cause problems that do not pop up until later in the year.

The market is penicling in a 182 yield and I just don’t know if that’ll happen. If it does, we will of course struggle for a while and go lower. But I'd take the under.

Next the charts. Take a look at this hourly chart.

As you can see, we have been stuck in this 23 cent range since the June 28th USDA meltdown.

More recently, we have been stuck in a 13 cent range the past 2 weeks.

Yesterday, we finally broke out of the 13 cent range ($4.16) . A great sign, but not enough.

If we can break out of the 23 cent range (Above $4.26, our July 2nd highs) the chart would look promising. That would make me feel a lot more confident saying we have found a bottom. But until then, I am not confident we the bottom is in.

That $4.03 level is still a must hold level. We are now +15 cents off those lows, but if we were to break down below, the next implied downside target would be $3.80

$4.03 and $4.26 are the two levels to watch that decide where we are going next.

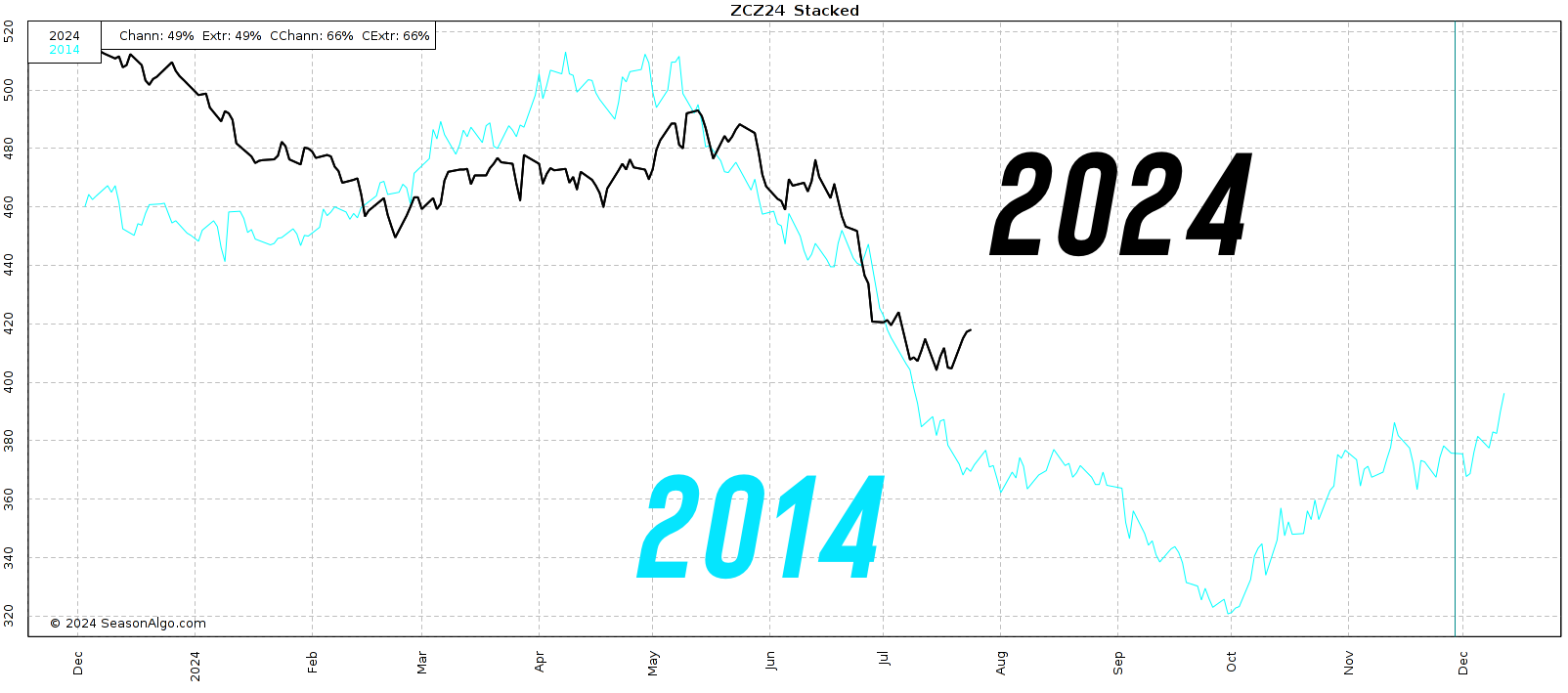

2014 vs 2024 Update

It looks like we may have finally broken the 2014 comparison. Still a little early to be certain, but good sign.

Keep in mind, the funds still hold record shorts. If the charts start moving against them, it would be one reason for them to look to start covering.

Seasonally we are suppose to go lower. But seasonally we were also suppose to get a big weather rally opportunity that we didn’t get. I still think we will see a rally led by demand. But it may take months to develop into something bigger.

If you are still sitting on some old crop, there is nothing wrong with cleaning up a few sales on this bounce. I do not like selling new crop here especially below the cost of production.

What this bounce did offer, is the chance to put your floors (puts) up a little higher for cheaper.

Rallies make puts cheaper, Giving you an even better opportunity to protect your downside risk. So if you do not have downside protection on new crop, I like adding some here. Use this little rally to your advantage.

So if you have unpriced grain, I still like protecting the downside until that $4.26 level is broken.

Dec Corn

Soybeans

Poor day for soybeans, at one point we were +15 cents off our lows but ultimately caved in and ended down double digits.

How big of an impact will this dryness & heat have?

For the crops out west, it could have a big impact. But right now the market is not too concerned because the east big production areas will get rain.

If the east drys out and stays hot, this could develop into a bigger story in August. However, weather rallies in August are not what we usually see. Up until this point, despite all the issues, growing season has been ideal and we have got timely rains every time we needed them.

So personally, I think this could provide some support and perhaps keep us from falling, but I don’t see this as a factor that will send us $1.00 higher tomorrow. If it gets worse then it's possible, but for now the market doesn’t think so.

The question is whether we have a 50 bpa or a 54 bpa crop, because the weather has been great for many and not perfect for others. Beans are made in August, so we could still add bushels or take some away. But the market does not react to every little forecast change and we had plenty of moisture before hand.

What could send this market higher is China. They still need to buy a lot of beans. They have zero new crop sales booked. If they think a trade war is going to happen, they should start buying now.

For some of you, you should be rewarding this rally. Those who need to move stuff off the combine or can not afford it if beans go lower. Either make some sales or add puts.

If you have unpriced beans, this is a perfect spot to add protection with puts as they are cheaper now.

If you have nothing sold, then reward part of this rally. If you do not want to make a sale, replace the sale with a put.

I have been preaching puts the past few weeks. For example, you could have grabbed a 5 cent put for protection. Futures rallied 50 cents. You lost 5 cents, but gained 45 cents. That is why you grab cheap puts. Because you would’ve been okay if the market dropped knowing your put would make money.

If you have old crop beans, take advantage of the huge inverse. Do not give that inverse away. Lock in basis. After you ship the beans you could re-own with calls on the deferred month contract.

That is probably the best route for most of you. Don’t sit on old crop beans too long, because at some point that old crop will become new crop and you will lose the inverse.

Give us a call if you have questions or want to talk (605)295-3100.

If you look at the chart, we have had a nice bounce. However, we are still clearly in a downtrend.

For me to get confident saying the bottom is in, I need a break above $10.98. Until then the risk is to the downside.

Keep in mind, the funds are record short beans along with corn. They will need a reason to cover. Those reasons could be: technicals, demand, or possibly weather.

Nov Beans

Wheat

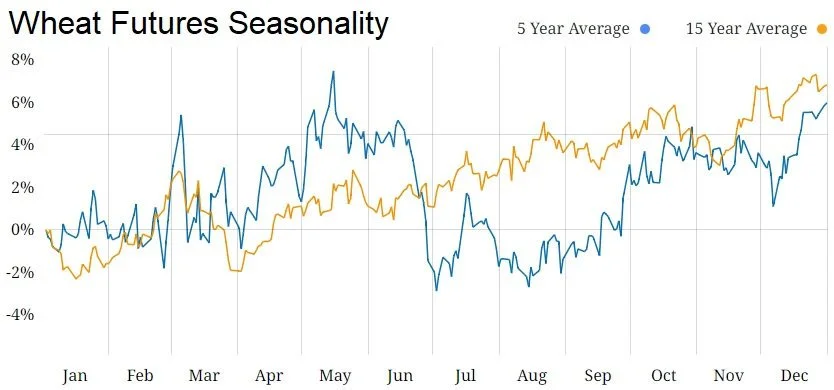

Wheat higher but has remained in a sideways chop the past week.

The estimates from the Russian crop continue to get bigger, which isn’t friendly but is now known.

This "drought scare" is in spring wheat country, so it could lead to Minneapolis wheat rallying a little bit but right now the market is not too concerned.

However, the scouts on the first day of the North Dakota crop tours found potential record yields in North Dakota. The first day of the tour showed yields of 52.5, that is 4 bushels higher than last years first day and a whopping 10 bushels higher than the average over the past several years. So a big crop out of North Dakota.

We also have spring wheat ratings very strong, at 77% G/E, way better than the 54% 5yr average.

I am no agronomist, but many also think we are starting to get to the point of weather being a little too late for the spring wheat crops.

This drought could definitely provide some life to the wheat market, but right now the market doesn’t care. Whether it will make a big impact or not is still unknown.

We haven’t seen much US business, but globally there has been a lot of buying. Which signals that lower prices are creating demand.

Not much else on wheat today.

We remain sideways. For me to think we found a bottom, I need a break above $5.67 which is +20 cents away. For KC wheat the key level is $6.00.

If you are behind on sales, I like keeping puts on. If you are caught up on sales, you don’t have to do anything but could look to take a stab at a long position if you like being aggressive.

I don't like moving wheat off the combine. If you are moving wheat with that huge carry, you're giving away money. A scenario where you need bins.

Seasonally wheat does find a bottom in August.

Sep Chicago

Sep KC

Want to Talk?

Our phones are open 24/7 for you guys if you ever need anything or want to discuss your operation.

Hedge Account

Interested in a hedge account? Use the link below to set up an account or shoot Jeremey a call at (605)295-3100 or Wade at (605)870-0091

Check Out Past Updates

7/23/24

BACK TO BACK GREEN DAYS FOR CORN & BEANS: MARKETING DECISIONS

7/22/24

BEST DAY FOR GRAINS IN A LONG TIME

7/19/24

DULL MARKETS: STRATEGIES TO USE IN GRAIN MARKETING

7/18/24

DEMAND, CHINA, POLITICAL PRESSURE, & TECHNICALS

7/17/24

DIFFERENT GRAIN MARKETING SCENARIOS YOU MIGHT BE IN

7/16/24

RELIEF BOUNCE FOR GRAINS

7/15/24

GRAINS HAMMERED. TRADE WAR FEAR

7/12/24

USDA REPORT: LOW PRICES CREATING DEMAND

7/11/24

USDA TOMORROW

7/10/24

GRAINS CONTINUE TO GET HAMMERED

7/9/24

RAINS, RECORD FUND SELLING & 2014 COMPS

7/8/24

PUKE SELLING, RAIN MAKES GRAIN & FUNDS RECORD SHORT

7/3/24

THIN HOLIDAY TRADE FOR GRAINS

7/2/24

BEARISH WEATHER, RECORD SHORTS, & CHINA

7/1/24

SUPPLY WILL BE THERE, BUT CAN DEMAND LEAD US HIGHER?

6/28/24

GARBAGE USDA REPORT

6/27/24

BIGGEST USDA REPORT OF YEAR TOMORROW

6/26/24

USDA PREVIEW & COUNTER SEASONAL RALLIES?

6/25/24

POSSIBLE RISKS & OUTCOMES THIS USDA REPORT COULD HAVE

6/24/24

VERY STRONG PRICE ACTION: RAINS & USDA KEY

6/21/24

DON’T PUKE SELL. ARE YOU COMFORTABLE RIDING THIS STORM?

6/20/24

RAIN OR NO RAIN FOR EAST CORN BELT?

6/18/24

WEATHER MARKET ENTERING FULL SWING

6/17/24

SELL OFF CONTINUES DESPITE FRIENDLY FORECASTS

6/15/24

EXACT GRAIN MARKETING SITUATION BREAKDOWNS & WHAT YOU SHOULD BE DOING

6/12/24

USDA SNOOZE: WHAT’S NEXT?

6/11/24

USDA TOMORROW

6/10/24

IS USDA OVERSTATING CROP CONDITIONS? DOES IT MATTER?

6/7/24

WEATHER & USDA NEXT WEEK

6/6/24

ARE GRAIN SPREADS TELLING US SOMETHING?

6/5/24

GRAINS NEARING BOTTOM? 7 DAYS OF RED

Read More

6/4/24

HIGH CORN RATINGS, SCORCHING SUMMER, & RUSSIA CONCERNS

Read More

6/3/24

5TH DAY OF THE SELL OFF. ARE YOU COMFORTABLE?

5/31/24

4 STRAIGHT DAYS OF LOSSES IN GRAINS

5/30/24

I DON’T THINK SEASONAL RALLY IS OVER. WHAT IS THE PLAN IF I’M WRONG?

5/29/24

PLANTING DELAY STORY VANISHES. BUT IS REAL STORY OVER?

5/28/24

GETTING COMFORTABLE WITH GRAIN MARKET VOLATILITY

5/24/24

WET SPRINGS DON’T CREATE RECORD YIELDS, DO THEY?

5/23/24

MANAGE RISK DESPITE STUPID PRICE POTENTIAL IN GRAINS

5/22/24

BEANS NEAR NEW HIGHS. WHAT TO DO WITH WHEAT?

5/21/24

BIG MONEY KEEPS DRIVING WHEAT HIGHER

Read More

5/20/24

ALGOS & BIG MONEY CONTINUE TO MOVE GRAIN PRICES

5/17/24

WEATHER MARKET VOLATILITY CONTINUES TO HEAT UP

5/16/24

SITUATIONAL GRAIN MARKETING

5/15/24

HEDGING VS GUESSING

5/14/24

CORRECTIONS ARE HEALTHY

5/13/24

FUNDS DON’T WANT TO BE SHORT GRAINS

5/10/24

PRICE ACTION TELLS DIFFERENT STORY FROM USDA REPORT

Read More

5/9/24

MARKET PRICING IN NEGATIVE REPORT. WHAT TO EXPECT FROM USDA

5/8/24

USDA IN 2 DAYS

5/7/24

WHO SHOULD WAIT FOR TRIGGERS NOT TARGETS

Read More

5/6/24

GRAINS HIGHEST IN 4 MONTHS

Read More

5/3/24

SEASONAL RALLY JUST BEGINNING OR BULL TRAP?

5/2/24

ARE THE TIDES STARTING TO TURN?

5/1/24