HOW TIGHT IS THE CORN SITUATION?

MARKET UPDATE

You can scroll to read the usual update as well. As the written version is the exact same as the video.

Timestamps for video:

Overview: 0:00min

How tight is corn situation?: 2:00min

Corn: 4:10min

Soybeans: 7:00min

Wheat: 9:30min

Want to talk or put together a market plan?

(605)295-3100

Futures Prices Close

Overview

Very little fresh news today which has the grains under pressure.

The wheat market recently caught a bid off the back of a winter kill story, but it looks like both Russia and the US will be receiving some snow cover.

Then to go along with this, the US plains are suppose to warm up fast next week. Going from lows of -20 tomorrow to highs of +70 degrees next Monday.

Yesterdays Sell Signal

Yesterday we alerted a sell signal for old crop KC wheat & old crop corn.

If you missed it: Click Here

Here is the audio where we went into more detail: Click Here

Why did we alert this signal?

For corn, it was simply a technical target and only for those who feel like they are behind in marketing.

For KC wheat we hit my targets I had been patiently waiting a while for. Then of course part of this rally was simply weather driven with the cold snap.We all know just how quickly a market can give back a weather rally.

So combining my targets hitting as well as the forecasts getting very warm next week, warranted a sell signal.

Here is KC March Wheat. We exactly tapped that 38.2% retracement to the May highs. Right at the target.

This level also just happens to be a big resistance level and those October highs. (I circled instances where it acted as resistance).

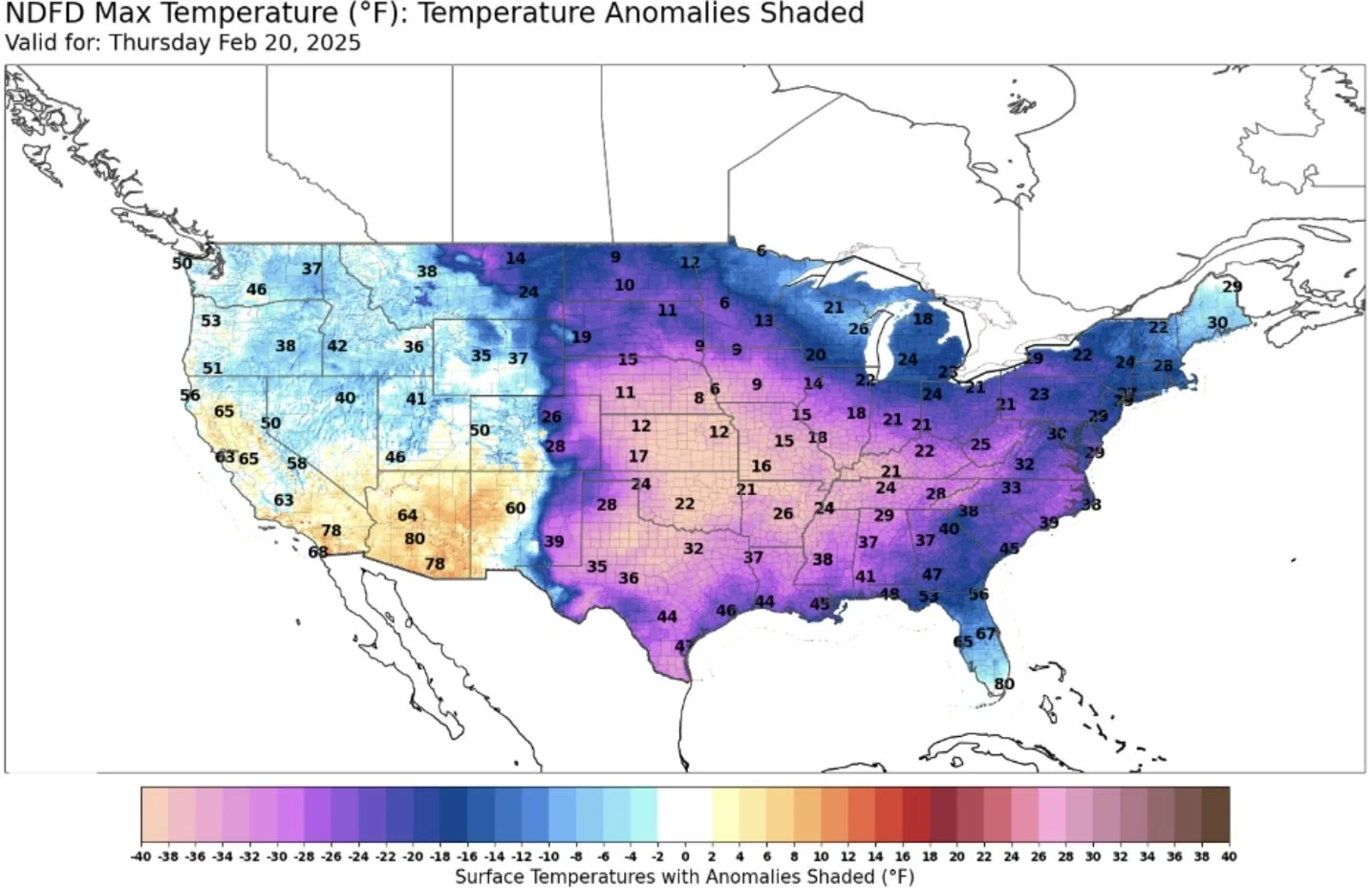

Here are the temps for tomorrow.

It is suppose to be brutally cold with most wheat regions getting as cold as -10 to -20 degrees.

Min Temp

Max Temp

However, here is the temps for next Monday.

It is going to warm up really fast with temps in the 60's to 70's.

That is a whopping +80 degree swing in some areas. Another reason for the sell signal.

Min Temp

Max Temp

How tight is the corn situation?

The balance sheets for the US and world corn are bullish.

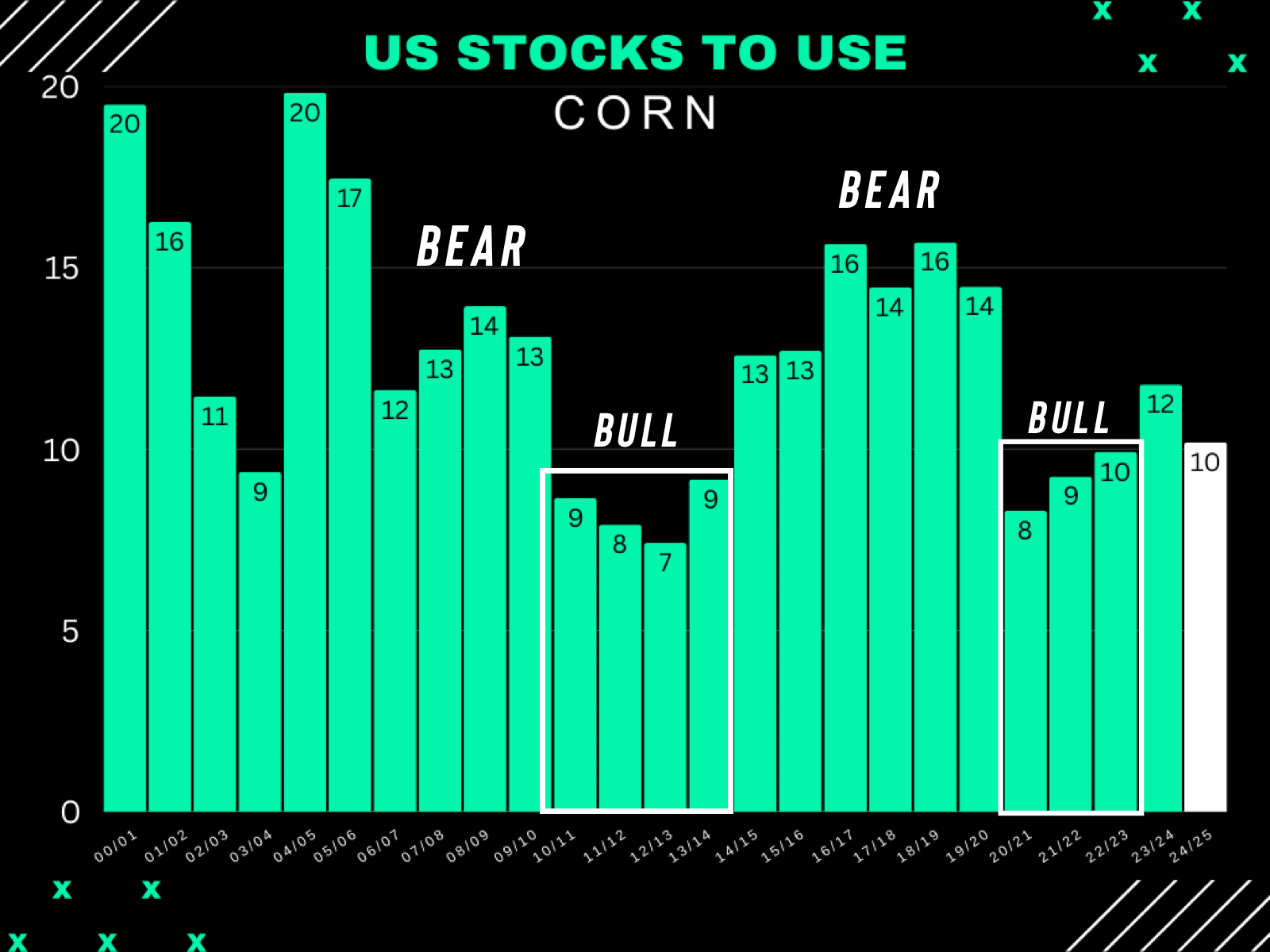

I've shown this several times, but again here is the US stocks to use ratio.

Not full blown bull market territory but one could easily argue this number could fall below 10%.

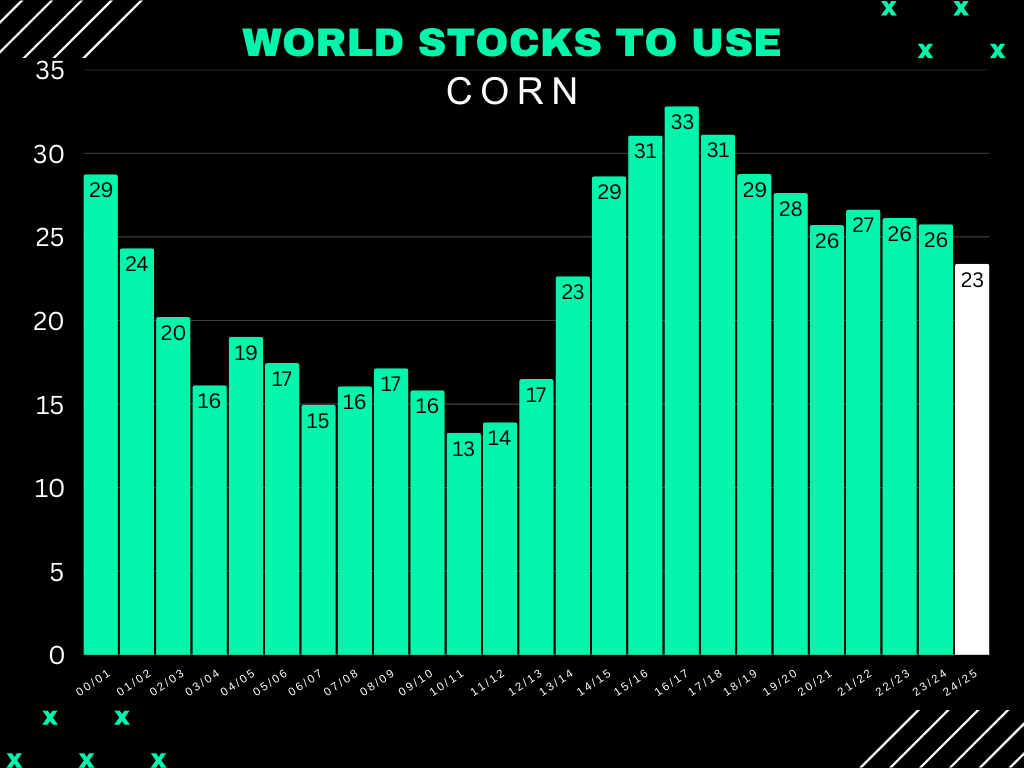

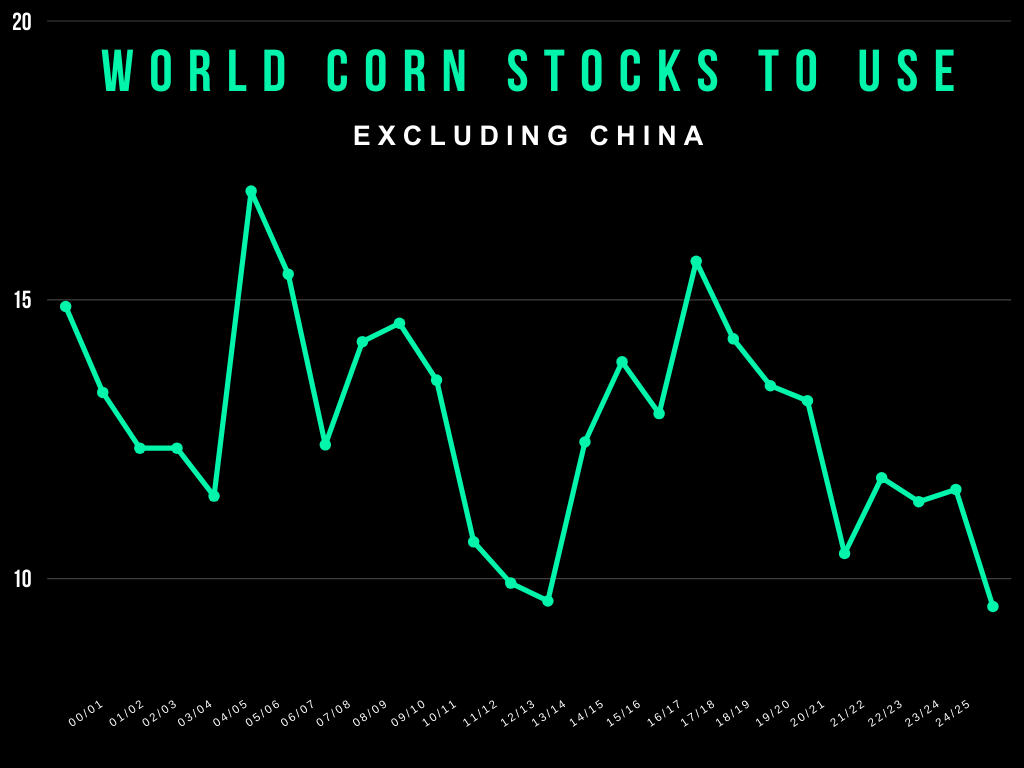

Here is the world situation.

The tightest in a decade.

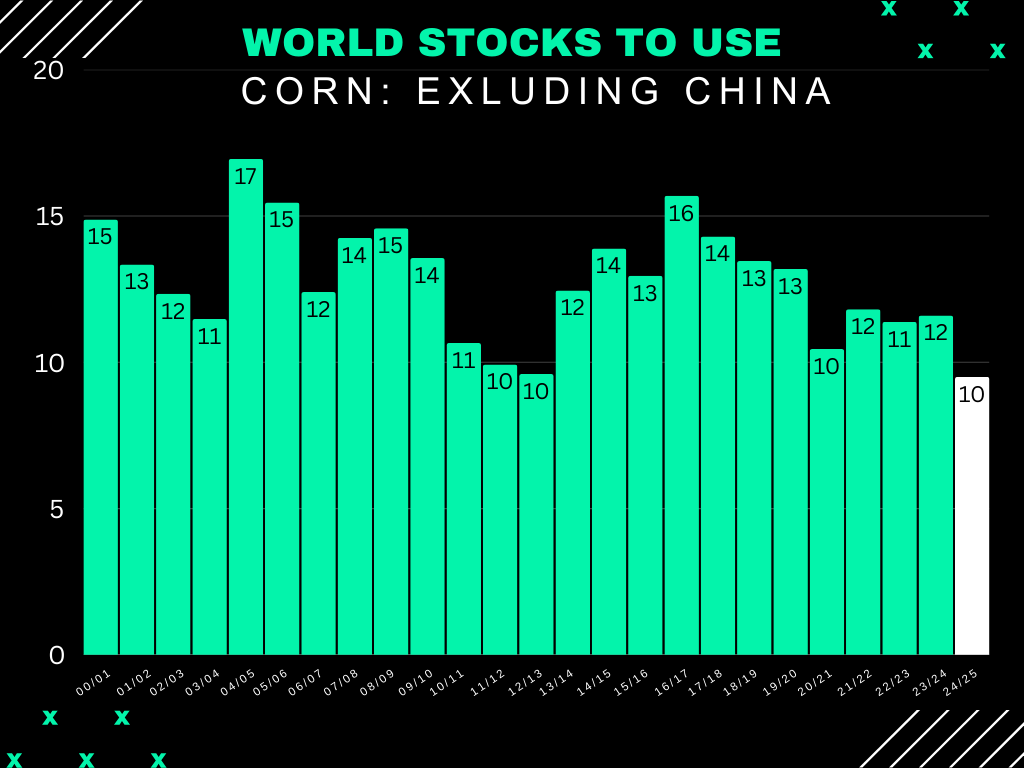

But what happens if you remove China from the equation?

The world balance sheet becomes the tightest of all time.

Why did we exclude China?

Well, China has been stockpiling corn for years.

If you noticed, China hasn’t been buying any US corn. Because they really do not need corn.

But the rest of the world does.

Here is another bullish global balance sheet.

This is Brazil's corn stocks to use ratio.

The tightest of all time once again.

This means Brazil doesn’t have much corn, again making the world situation that much tighter.

Overall, the world balance sheets can’t afford a big failure in either the US crop or Brazil's 2nd corn crop.

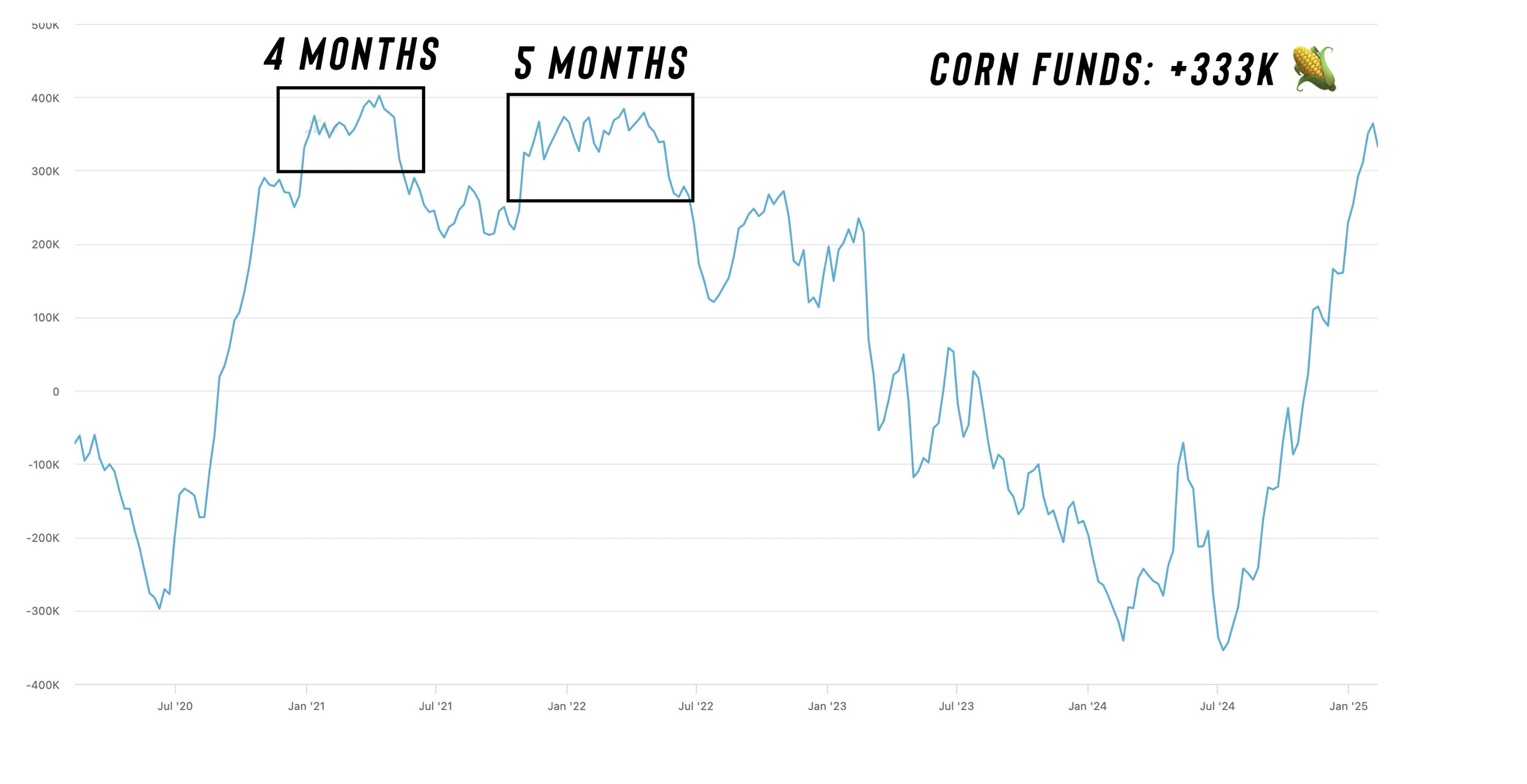

The funds are well aware of this. Hence why they have taken such a bullish stance on corn.

The funds are willing to wait and see what happens because they know the world situation could get extremely tight if the right cards fall.

This brings me to my next point..

The funds will not give up until 1 of 2 things happen:

1) The technicals tell them to

2) They get a fundamental reason to do so

They will not sell this near record long position without a battle.

Yes in the last CTFC report it showed the funds reduced their gross longs slightly. If you heard anyone say recently "the top is in because the funds are selling".. well private reports say they already bought back those shorts.

The last few times they were this long, they defended the position for several months.

Today's Main Takeaways

Corn

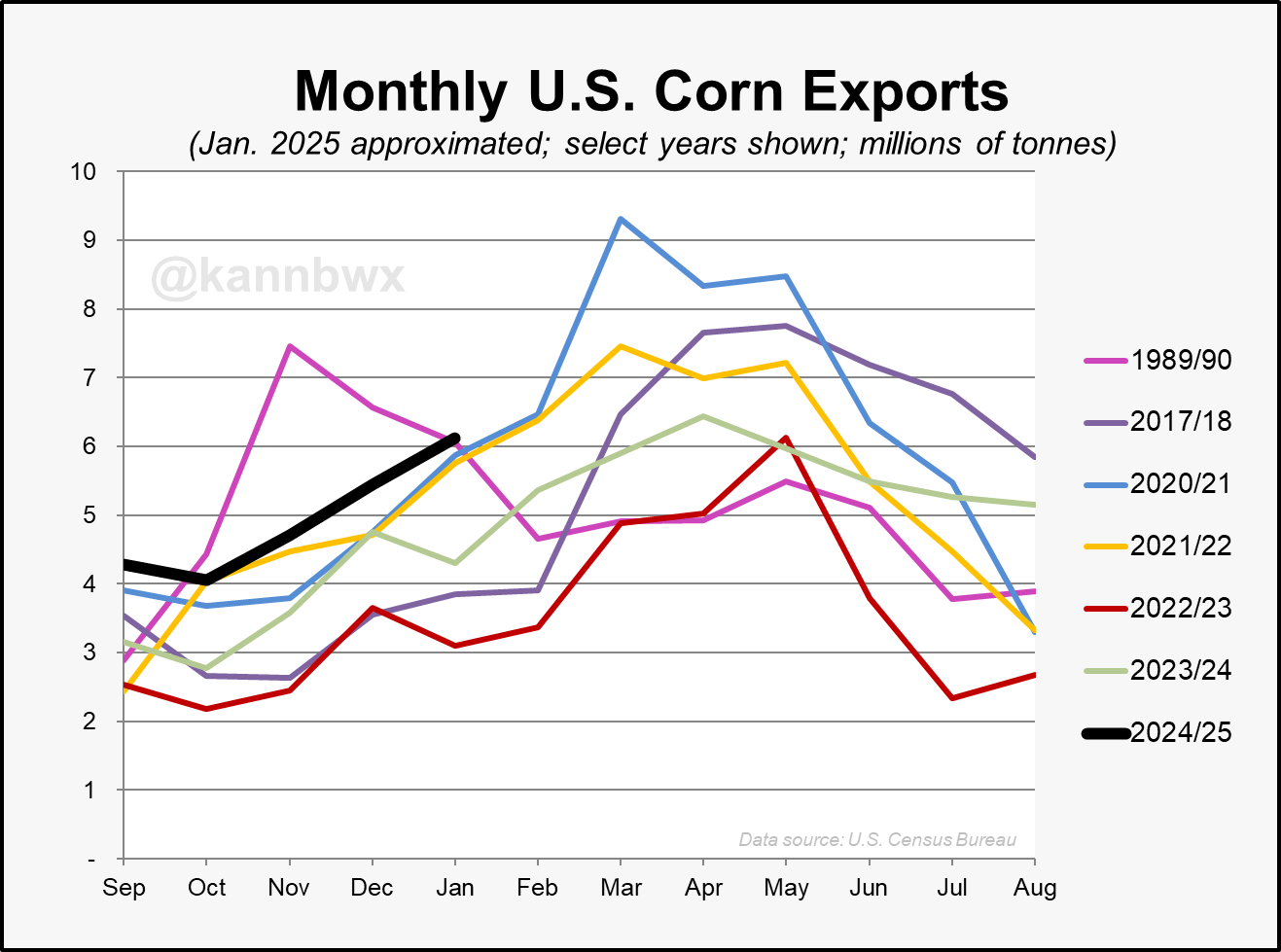

One of the biggest bullish arguements for corn?

The fact that exports are on pace to be up +35% vs last year.

Yet.. the USDA only projects them up +7%.

I imagine the export demand numbers will be bumped, and this alone could cut down the US balance sheet by quiet a bit.

Bears biggest arguement?

Big acres.

Yes. We will get more acres than last year. But I would like to think the market has already priced in bigger acres. Perhaps 94 to 95 million already.

Look at how much new crop has underperformed. The July to Dec spread is at nearly +40 cents. Back in October this was actually in a carry.

Part of this is due to the expectation of large acres.

If we get a number closer to 96-97 million, then I'm sure it will weigh on the market. But the market is already pricing in more acres either way.

Overall my bias still remains higher for corn towards spring & summer.

The market rarely makes a significant top in February (outside of 2013).

Yesterdays old crop sell signal was only for those who felt behind. For new crop, I am still remaining patient. I am only 10% priced on my generic sales tracker.

Looking at the charts, as long as corn holds those lows from February 3rd there really isn’t anything to worry about.

Below that, you do have a giant gap of air to the downside.

Looking at May corn, we hit that first target of $5.14 (61.8% of the contract highs).

Next target is the $5.40 area.

Looking at weekly corn, we are trying to get a weekly close above this blue line.

This would be a big win for the bulls and likely bring more upside.

This was a very key resistance and support level in the past.

Next big target is again the $5.38 level.

Same exact story for monthly corn.

A close above here and there is little resistance to the upside.

Looking at Dec-25 corn.

We are sitting right at this down trend resistance we have respected since November 2023.

Rejecting here would make sense.

If bulls can bust above, it should bring more upside.

Next target if we do so if $4.84

Soybeans

It is still hard to make a super bullish argument for soybeans.

However, they have held up decently well despite the on going Brazil harvest.

Not too long ago all the talk was about how tariffs could be so bad for soybeans, but that hasn’t been the case. As tariffs do not seem like a big issue anymore. And they won’t matter to the market unless China mentions the word "soybeans".

Overall, Brazils monster crop will somewhat limit the upside on rallies. But at the same time, there isn’t reason to get overly bearish either.

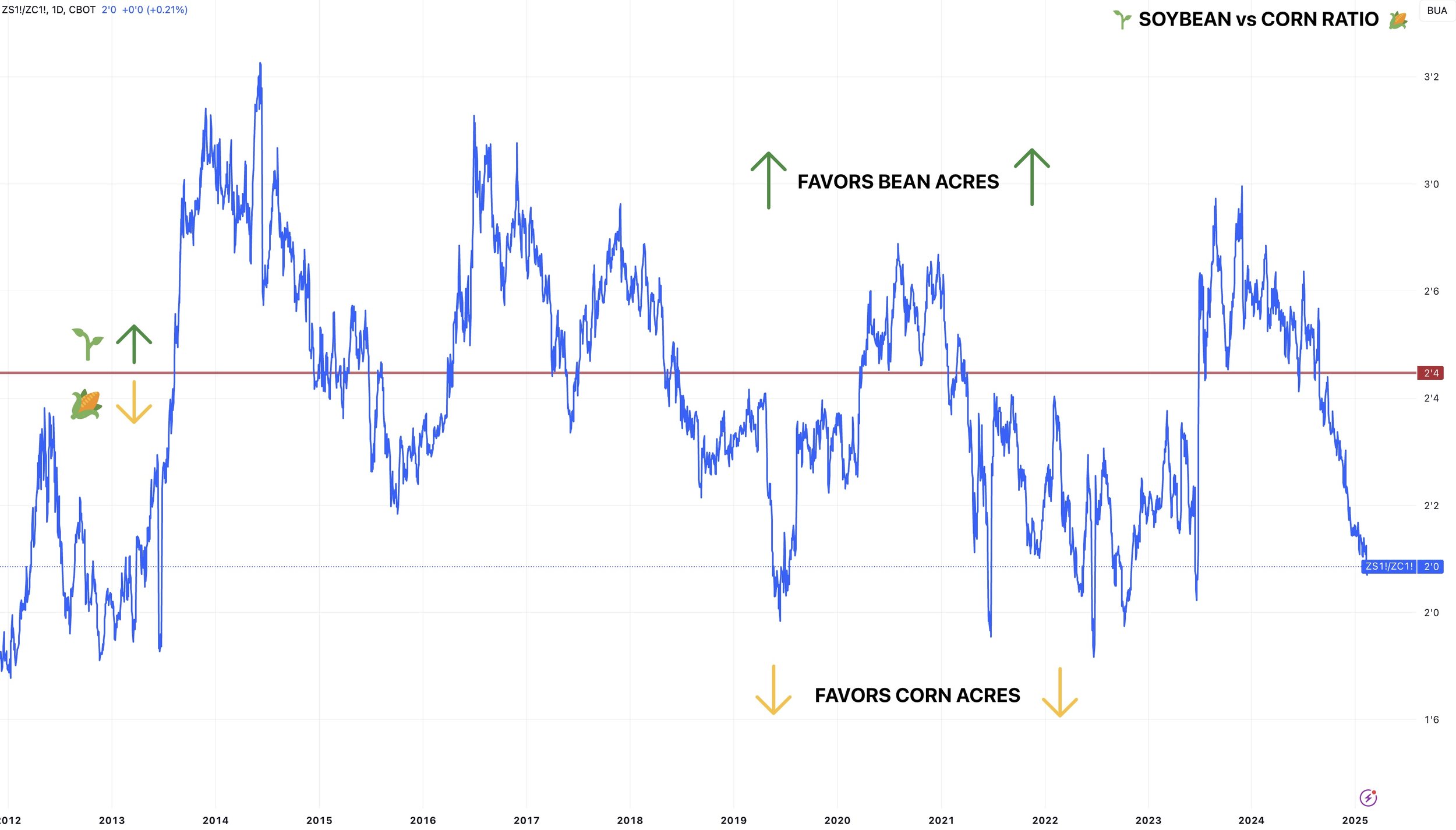

We are going to be looking at less acres here in the US.

Right now it feels like the boat is completely tipped to "bullish corn" and "bearish soybeans" which is justified right now. But eventually this narrative will change like it always does. Soybeans are very undervalued relative to corn.

Not much to add on beans. Bottom line, I am just simply waiting to seize opportunities when we get them.

Looking at the charts short term, I am watching the 100 & 200-day moving averages. Soybeans are trapped between the two. Whichever gives out first will likely dicate which direction we go from here.

A break below and beans likely retest $10.00. A break above and it sets the path for higher prices.

Here is a big picture weekly view of soybeans.

The $9.50 level was resistance during the trade war. It was now support on the lows from last year.

The $10.75 level was resistance several times in past years, which is the level we currently are struggling at.

If we break above that level, the next big area would be $12.00. (top of blue box) $12.00 is a big old support & resistance area.

$12.00 is currently roughly the ceiling for soybeans in my opinion given these exact fundamentals. (of course subject to change and eventually will).

We are currently battling a downward trend we have been trapped in since the 2022 highs. If we break above that, it would be the bulls first step in changing the trend.

For new crop, next target is still $10.82 with a bigger picture target of $11.50

Wheat

I still think wheat has all of the upside in the world moving forward.

The global balance sheets are the tightest in a decade.

Russia has an awful winter wheat crop that will be verified later this year.

But wheat did just have a nice little weather rally.

Weather rallies are supply driven rallies. Not demand driven ones.

So this means they will go fast and hard, but eventually they will take the elevator down.

Unlike the demand driven rally we have seen in corn.

This little rally in wheat is comparable to that usual summer drought scare rally in corn.

I think wheat has a chance to see $7 at some point, but a $1.00 rally from a winterkill story was enough for me to take some risk off the table.

Looking at the charts, first March KC. It exactly hit that $6.30 target before heading lower.

On May KC wheat, we also hit that first target of $6.35

The next target if we continue higher will be $6.63

This right here is a pretty big levell. Not only is it 38.2% of the May highs, but it also happens to be those October highs as well. Another reason for taking risk off here.

Looking at Chicago, it is behind KC wheat in terms of performance (because the winter kill story effects KC wheat the most)

First level I am looking to take risk off is still that $6.20 level

On May Chicago, we just missed that first target of $6.27 by about 5 cents.

Bulls would like to get back over that 200-day MA or it looks like we could once again reject off of it like we did back in October.

For May MPLS, the chart looks friendly. Bulls would like to hold the $6.37 level as it was a pretty big support level previously.

First target is $6.68

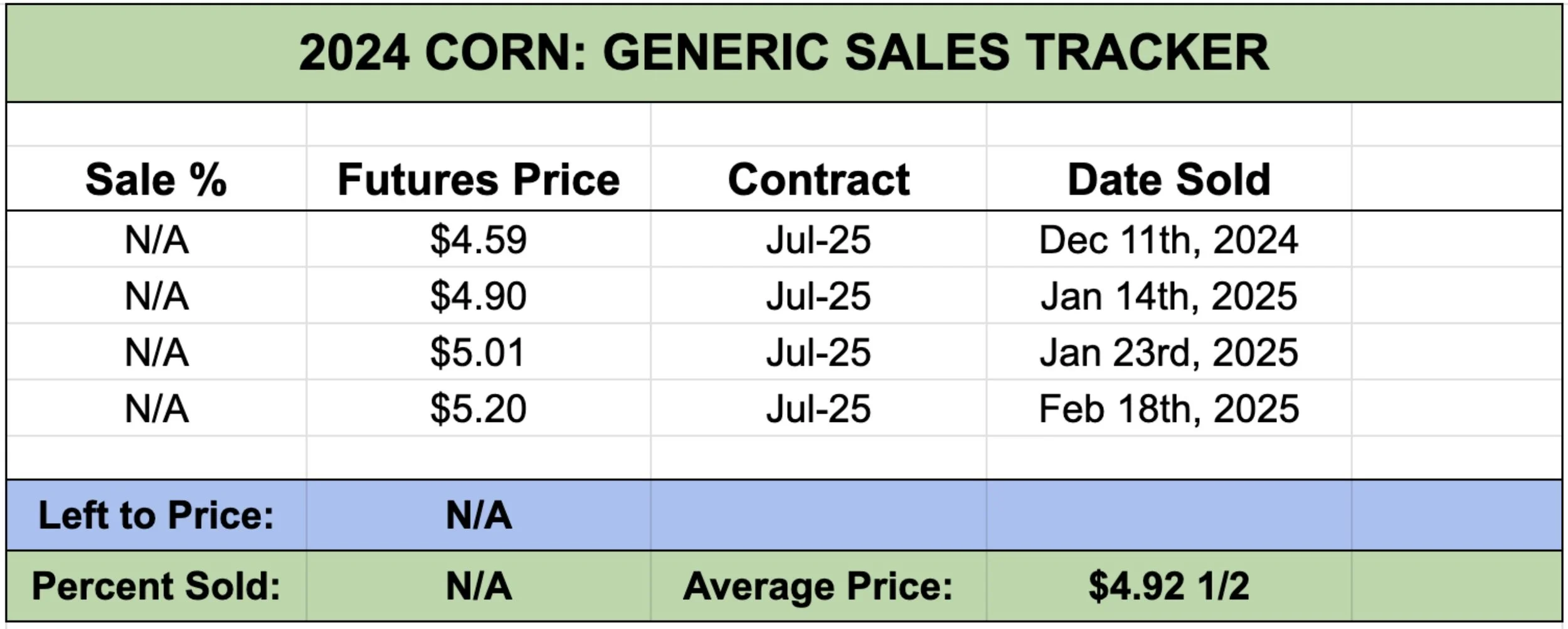

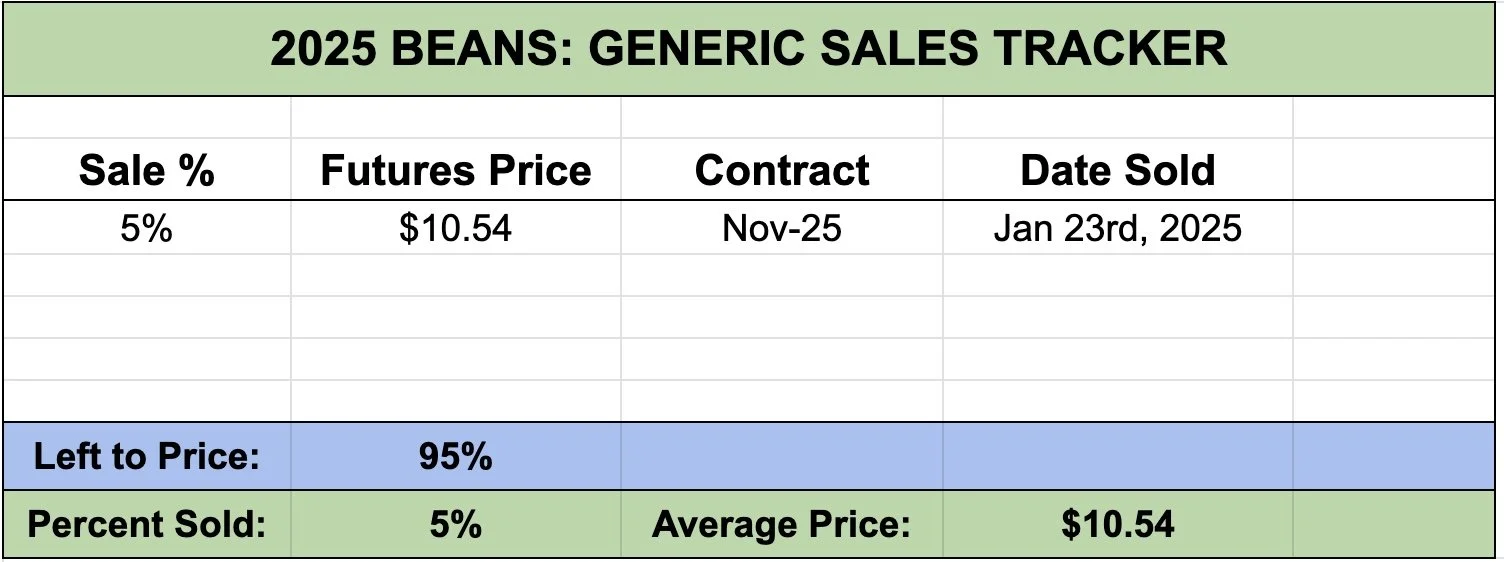

Generic Cash Sales Tracker

Due to requests here is our generic cash sales trackers.

This does not include any hedge recommendations etc. Simply cash.

This is futures prices.

For old crop there is no percentages as we only recently started tracking our generic sell signals. Future new crop sales will have percentages as we continue to make sales.

This will be included at the bottom of every update.

Past Sell or Protection Signals

We recently incorporated these. Here are our past signals.

Feb 18th: 🌽 🌾

Old crop KC wheat & old crop corn signal.

Jan 23rd: 🌽 🌱

Corn & beans old crop sell signal.

CLICK HERE TO VIEW

Jan 15th: 🌽 🌱

Corn & beans hedge alert/sell signal.

Jan 2nd: 🐮

Cattle hedge alert at new all-time highs & target.

Dec 11th: 🌽

Corn sell signal at $4.51 200-day MA

CLICK HERE TO VIEW

Oct 2nd: 🌾

Wheat sell signal at $6.12 target

Sep 30th: 🌽

Corn protection signal at $4.23-26

Sep 27th: 🌱

Soybean sell & protection signal at $10.65

Sep 13th: 🌾

Wheat sell signal at $5.98

May 22nd: 🌾

Wheat sell signal when wheat traded +$7.00

Want to Talk?

Our phones are open 24/7 for you guys if you ever need anything or want to discuss your operation.

Hedge Account

Interested in a hedge account? Use the link below to set up an account or shoot Jeremey a call at (605)295-3100.

Check Out Past Updates

2/18/25

MORE DETAILS ON TODAYS SELL SIGNAL

2/18/25

OLD CROP KC WHEAT & CORN SELL SIGNAL

2/14/25

WHEAT BREAKING OUT ON WEATHER RISK. TECHNICALS & FUNDAMENTALS

2/12/25

GLOBAL GRAIN SITUATION, ACRE TALK, CHARTS & MORE

2/11/25

USDA: NOT A BEARISH REPORT. DISAPPOINTING PRICE ACTION

2/10/25

USDA TOMORROW. LONG TERM PATH FOR SUB 10% CORN STOCKS TO USE?

2/7/25

WHY WOULD THE FUNDS EXIT THEIR LONGS?

2/6/25

WHEAT FINALLY CATCHING A BID

2/5/25

COMPLETE THOUGHTS ON MARKETS: BACK & FORTH DISCUSSION

2/4/25

STRONG JANUARY LEAD TO STRONG YEAR? TARIFFS, CHARTS & MORE

2/3/25

TARIFFS PUSHED BACK

1/31/25

TARIFF NEWS ALL OVER THE PLACE. ARE YOU PREPARED FOR POSSIBILITIES?

1/30/25

WHEAT BULL ARGUMENT. TRUMP ADDS TARIFFS

1/29/25

CORN APPROACHES $5.00

1/28/25

TARIFFS, CORN FUNDS, SOUTH AMERICA & MORE

1/27/25

HEALTHY CORRECTION WE TALKED ABOUT & TARIFF NEWS

1/24/25

GRAINS DUE FOR SHORT TERM CORRECTION?

1/23/25

OUR ENTIRE NEW CROP SALES THOUGHTS & OLD CROP SELL SIGNAL

1/22/25

GRAINS TAKE A BREATHER. IS CORN IN A BULL OR BEAR MARKET?

1/21/25

HUGE DAY IN GRAINS. WHAT TO DO WITH OLD CROP VS NEW CROP

Read More

1/20/25

VIDEO CHART UPDATE

1/17/25

TRUMP, CHINA, ARGY & USING THE SPREADS INVERSE

1/16/25

OLD CROP LEADS US LOWER. MARKETING THOUGHTS

1/15/25

SIGNAL & HEDGE ALERT QUESTIONS EXPLAINED. IS $6 CORN EVEN POSSIBLE?

1/14/25

MORE DETAILS ON TODAYS HEDGE ALERT & SELL SIGNAL

1/14/25

CORN & SOYBEANS HEDGE ALERT/SELL SIGNAL

1/13/25

USDA GAME CHANGER OR NOT?

1/10/25

BULLISH USDA FOR CORN & BEANS

1/9/25

USDA OUT TOMORROW

1/8/25

2 DAYS UNTIL USDA. BE PREPARED

1/7/25

THE HISTORY OF THE JAN USDA & MORE

1/6/25

MAJOR USDA REPORT FRIDAY

1/3/25

UGLY DAY ACROSS THE GRAINS

1/2/25

LONG TERM CORN UPTREND? JANUARY DROP OFF IN BEANS? LONG TERM WHEAT FACTORS

1/2/25

CATTLE HEDGE ALERT

12/31/24

MASSIVE DAY FOR GRAINS. FLOORS? 2025 SALES? GAME PLAN? CHART BREAKDOWNS

12/30/24

GRAINS FADE EARLY HIGHS

12/27/24

STILL LONG TERM UPSIDE POTENTIAL, BUT TAKE ADVANTAGE OF 6 MONTH CORN HIGH

12/26/24

CORN ABOVE 200-DAY MA. ARGY DRY. BEANS +44 CENTS OFF LOWS

12/23/24

CORN & BEANS TALE OF 2 STORIES. BEANS REJECT OLD SUPPORT

12/20/24

PERFECT BOUNCE IN CORN. SIMPLE BEAN BACKTEST BEFORE LOWER?

12/19/24

THE SOYBEAN PROBLEM. NEW WHEAT LOWS. CORN UPTREND

12/18/24

BEANS BREAK SUPPORT & OPEN FLOOD GATES

12/17/24

SINK OR SWIM TIME FOR SOYBEANS

12/16/24

SOYBEANS & WHEAT FIGHTING LOWS. WILL CORN DEMAND CONTINUE

12/13/24

POST USDA COOL OFF

12/12/24

CORN CORRECTION. WHY WE ALERTED SELL SIGNAL YESTERDAY

12/11/24

USDA PRICED IN? FAIR VALUE OF CORN? BEAN BREAKOUT?

12/11/24

CORN SELL SIGNAL

12/10/24

USDA BREAKDOWN

12/9/24

USDA TOMORROW

12/6/24

CORN TRYING TO BREAKOUT. MAKING MARKETING DECISIONS

12/5/24

OPTIMISTIC BOUNCE IN GRAINS

12/4/24

WHEAT UNDERVALUED? MOST RISK IN BEANS. HAVE A GAME PLAN

12/3/24

BEANS HOLDING DESPITE LACK OF BULLISH STORY

12/2/24

TRUMP & BRAZIL HURDLES

11/27/24

CORN SPREADS, CRUCIAL SPOT FOR BEANS, SEASONALITY SAYS BUY

11/26/24