RALLY AHEAD OF USDA REPORT

Overview

Grains strong across the board, led by an impressive day in soybeans and a continuation rally in wheat ahead of tomorrow USDA WASDE report where we will get a look at if the USDA opts to change the Brazil crop or not.

The strength in wheat came from mostly short covering as they continue their rally and spook the funds. Trading higher for the 8th day in a row. The longest daily streak since April of 2022. Now +85 cents off their lows from last week.

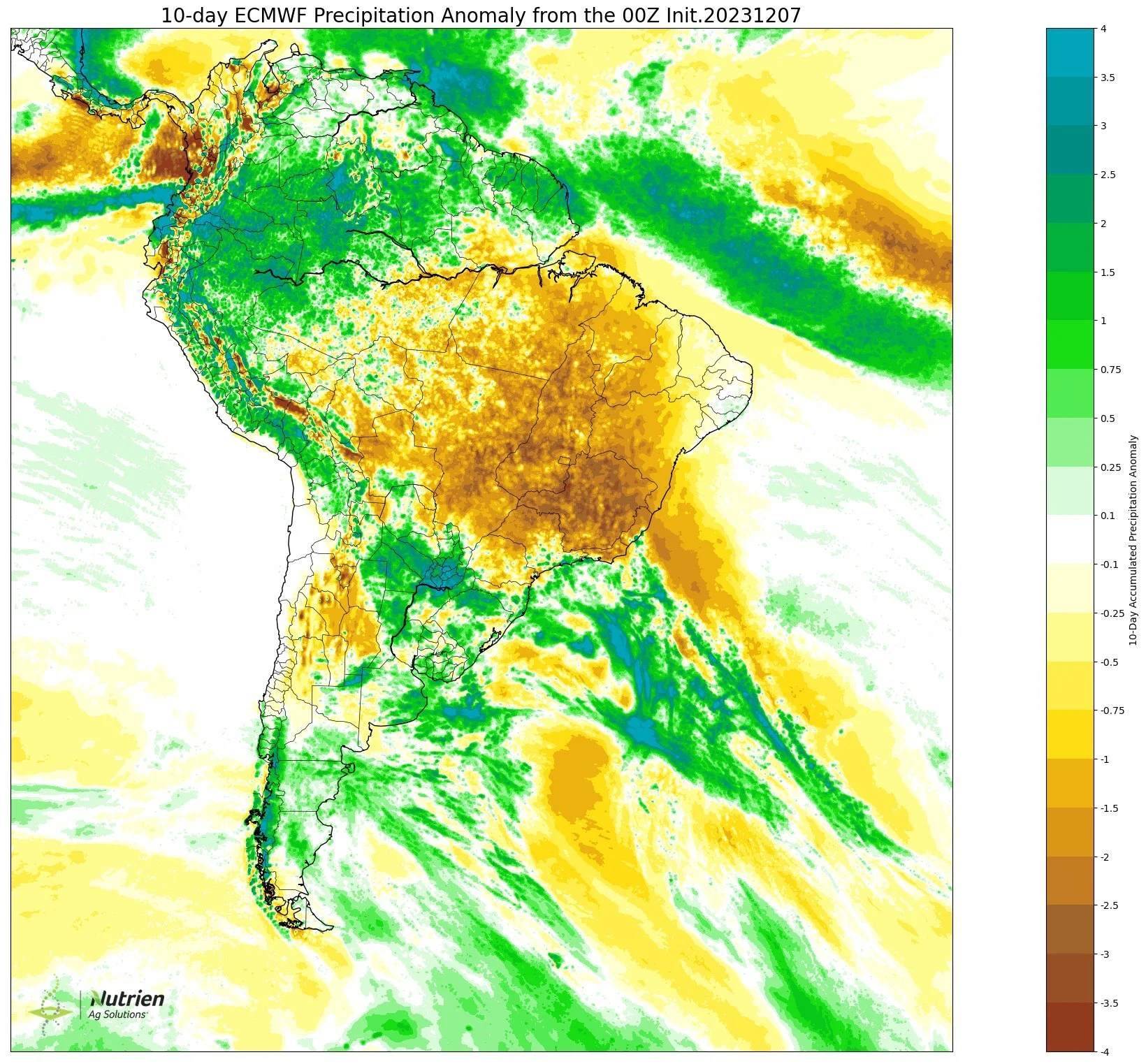

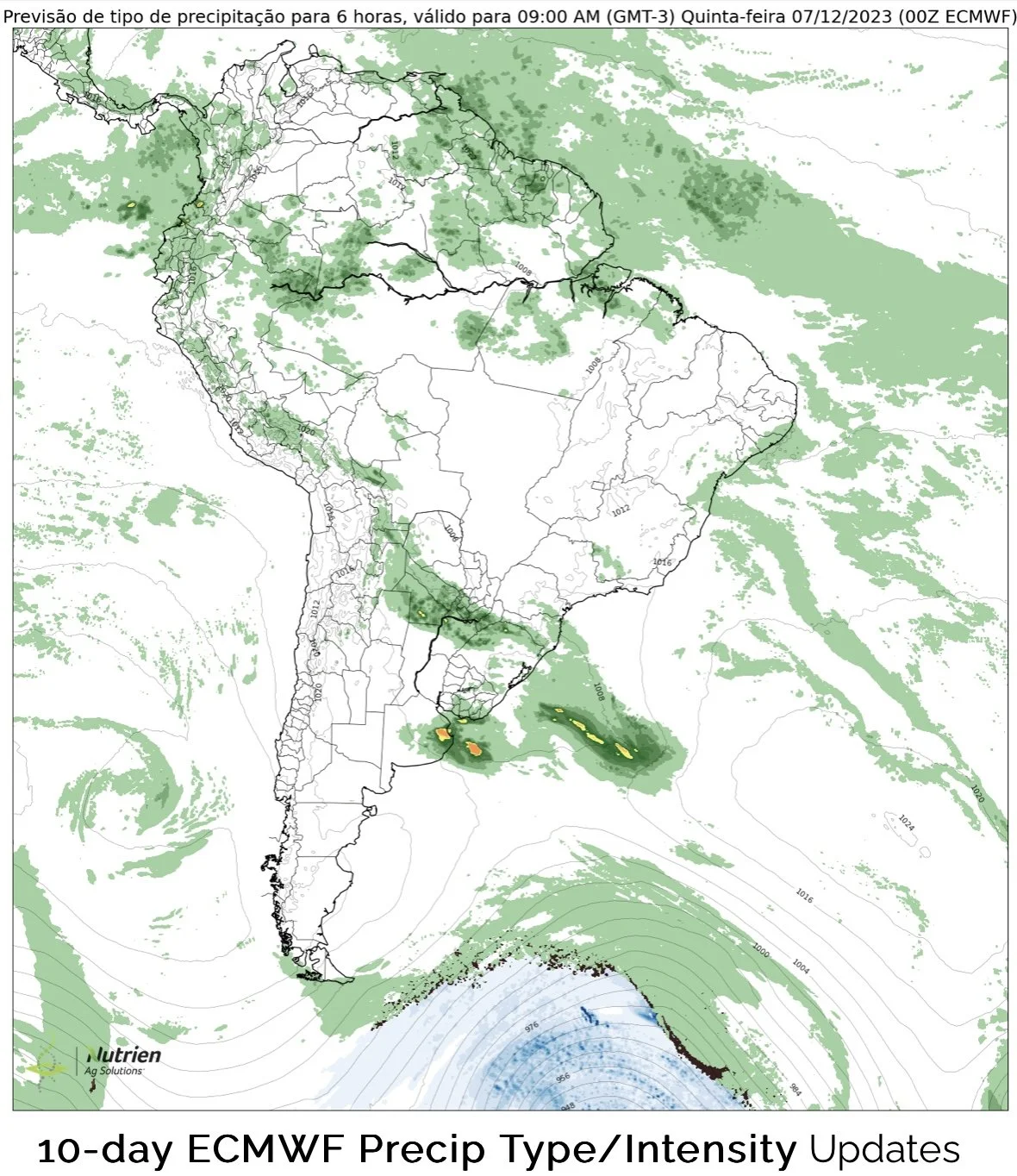

Soybeans are higher on drier Brazil forecasts and some profit taking following the sell off. The next few weeks look awfully dry. Remember, December is the absolute critical key month for their production.

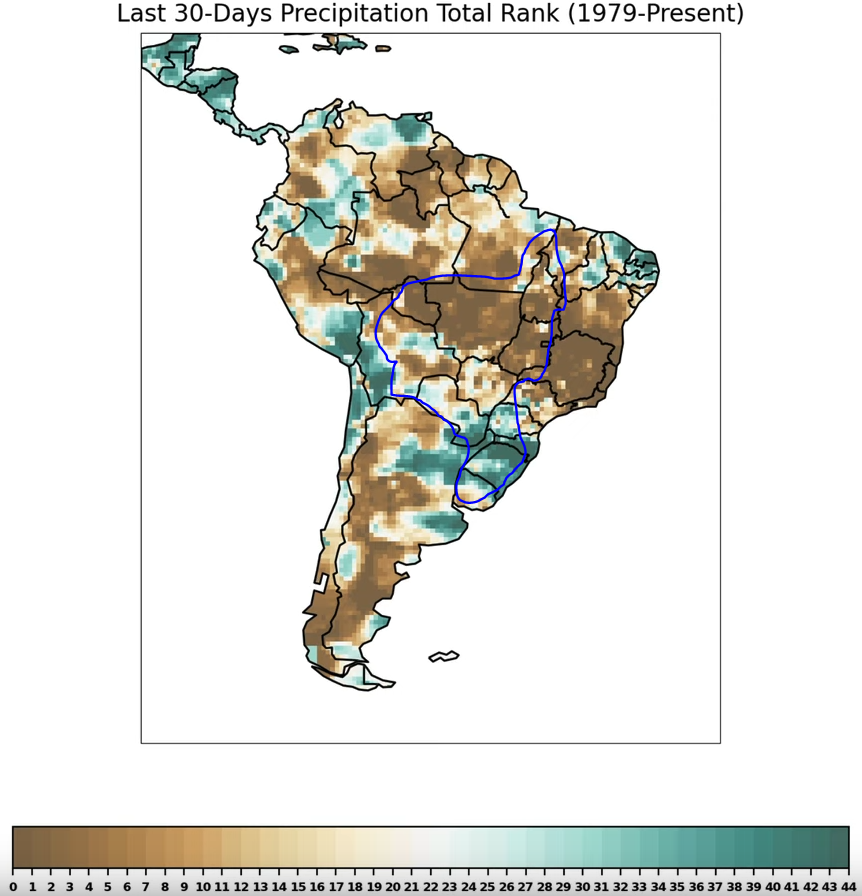

We have mentioned several times that November won’t be as important as December. But just look at how dry and wet the prime growing areas have been the past 30 days.

Areas to the north are some of the driest on record. This is also where the majority of their corn is grown, something to keep in mind as I do believe the corn situation will catch attention come January.

Areas to the South are some fo the wettest on record. Neither help out production.

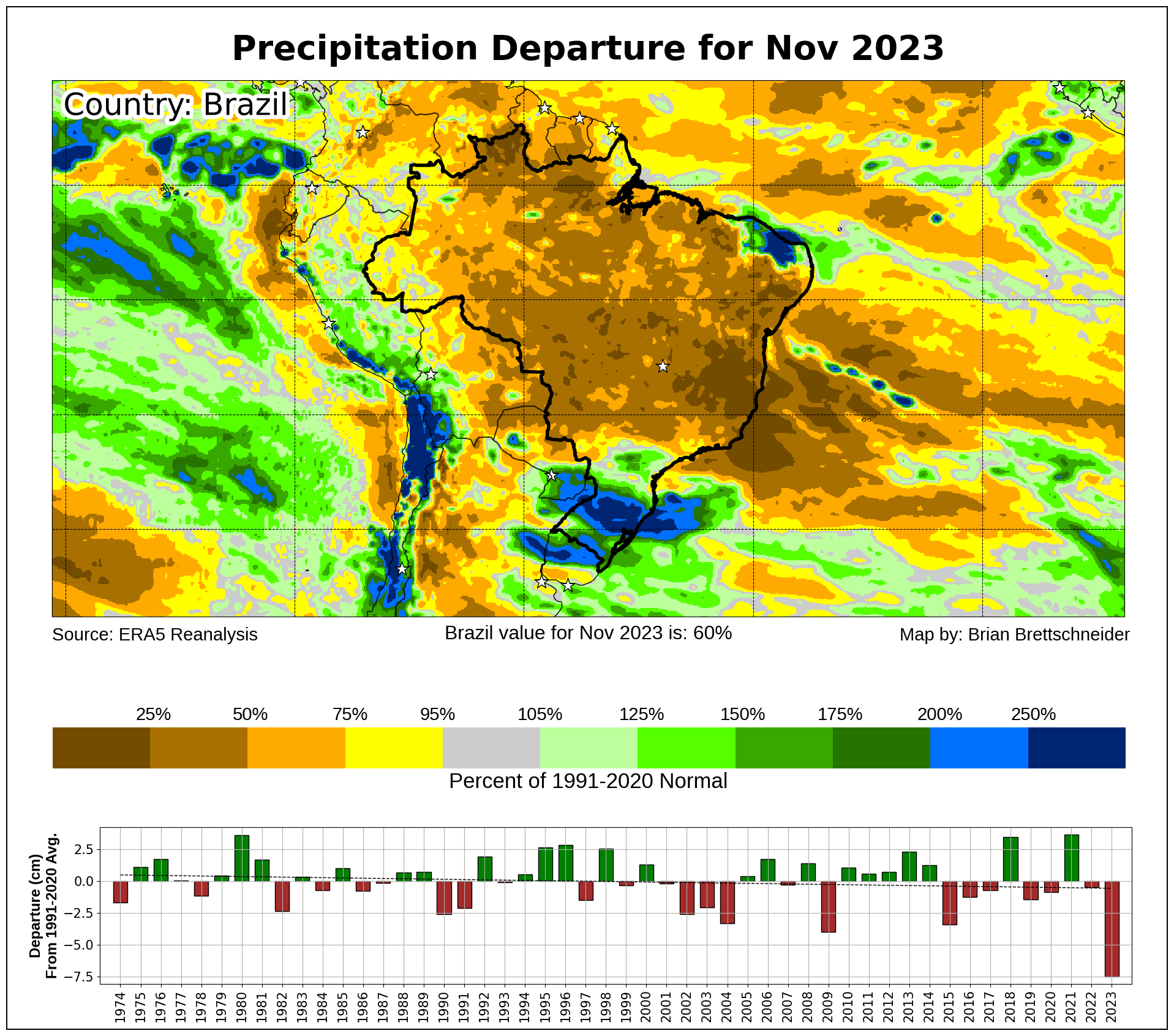

How dry has Brazil been overall this year to compared to average?

Let's take a look at this map from climatologist Brian Brettschneider.

November was the 5th consecutive month where it was the driest of the last 50 years, while June was the 2nd driest.

So the second half of 2023 has been the driest on record.

Look at the bottom chart and you can see just how drastically different this year has been.

I simply think the Brazil crops are getting smaller. But is the USDA going to take that into consideration in tomorrow’s report?

The answer is probably not. It is possible, but I wouldn’t bet the house on them lowering the Brazil crop here. Even though I think they should, there is a good chance they kick the can down the road as they are often slow at making these changes.

Another thing to be prepared for is the possibility that they will be slow at increasing wheat exports even with the solid business from China as well as soybean crush.

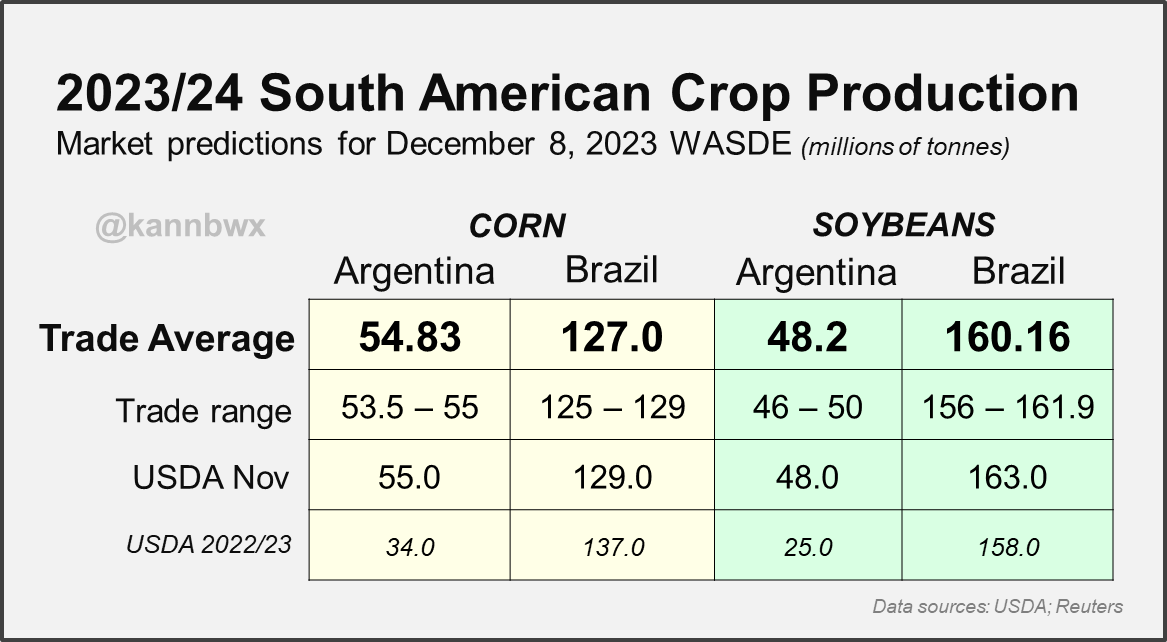

Here are the estimates for tomorrow.

Chart Credit: Karen Braun

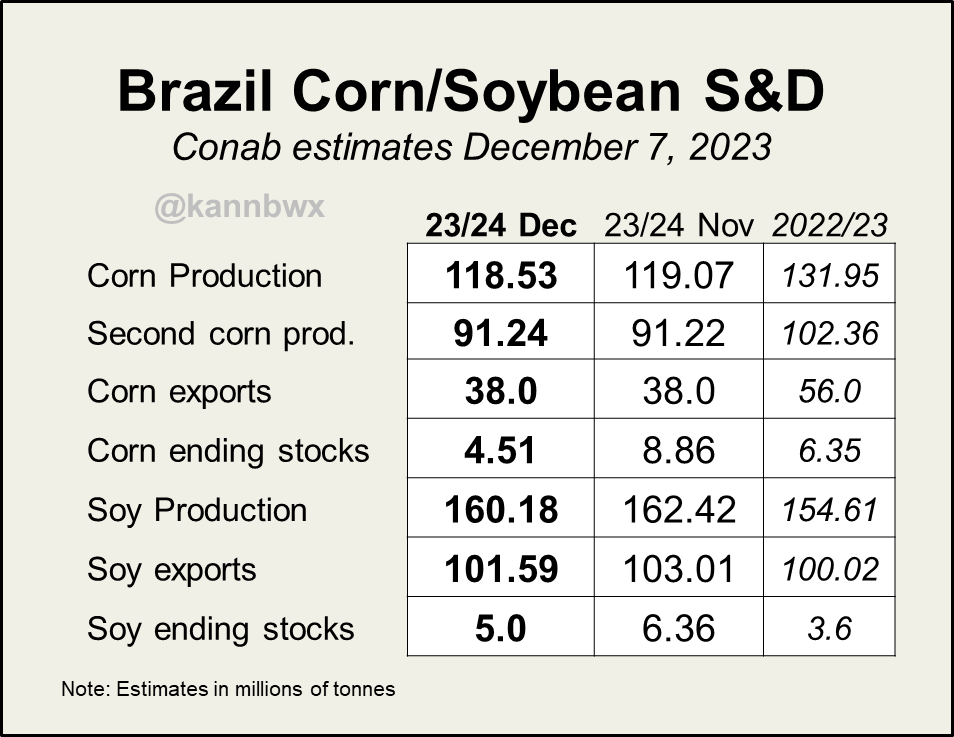

CONAB (Brazil's USDA) lowered their bean estimate from 162.4 million metric tons to only 160.2 million. Which would still be a record crop.

Here are the numbers from CONAB.

Chart Credit: Karen Braun

To put this into perspective, here are some other estimates from various sources.

Nov. USDA - 163

WASDE Est - 160.16

StoneX - 161.9

Ag Rural - 159

Dr. Cordonnier - 157

2022/23 Crop - 158

I am hoping we do, but this is another reason why we shouldn’t expect a massive drop in production estimates, just yet anyways...

As we have noticed in the past, private forecasters often lower theirs before the government ones. An example of this is Ag Resource. As they lowered their Brazil estimates for both corn and beans.

They had beans at 155.44 and corn at 120.12.

Compared to the USDA pre-report estimates of 160 and 127.

Keep in mind this report won’t have US production update as final yield numbers will be in the January report.

Now let's dive into today's update...

Recommendations:

As far as recommendations go. For those of you that need to make sales in the next 60 days. Consider buying puts if you are uncomfortable should the market struggle. Keep in mind that plenty of producers have plenty of corn to move right after the first of the year. There is an old saying that the market can’t rally until enough farmers have sold. As for beans, same situation, we believe longer term higher prices are coming but if you have to have sold in the next 60 days consider buying puts to establish a floor or minimum price level. The same goes for wheat. Nothing wrong with rewarding a rally.

Those of you that have until next summer, be patient, wait for our weather scares around the world. Have hedge accounts set up should we get an opportunity to price or protect prices at good profitable levels. But don't be making sales if you have staying power. If you need help on a hedge account you can open one with Jeremey.

Here is a link: Hedge Account Link or like always give him a call at 605-295-3100

For those of you who want more than just generic recommendations you will have to give Jeremey a call and he will go over your situation and help the best he can.

Today's Main Takeaways

Corn

Corn slightly higher here today behind beans and wheat.

Nobody knows what tomorrow will bring, but what we do know is that Brazil's second corn crop is probably getting smaller, not larger.

The delayed soybean planting will lead to less acres and lower yields.

Now when will the market realize this?

I think it probably happens closer to January, but it could take until February until the market finally soaks up that realization that Brazil will be having a poor second corn crop.

Tomorrow could shake things up either way, so we will have to see.

But until the market realizes the problem with this Brazil crop a major rally likely won’t be the easiest task int the world. We still have a very large carryout here in the US.

So until then we could very well trade sideways or perhaps trickle lower if bulls don’t get anything to chew on.

The funds are still short over 200k contracts. So when they do find that reason to cover, there is a lot of buying that could take place.

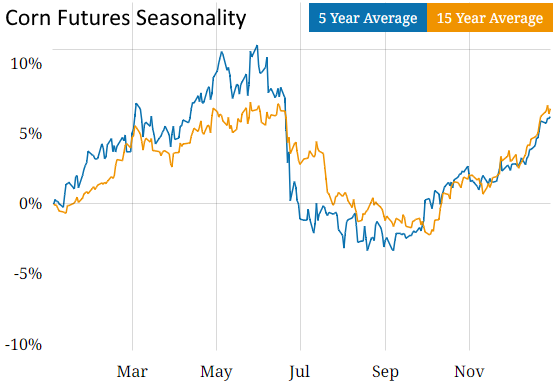

Seasonally we go higher until spring. Fundamentals are pretty bullish with exports higher than they were a year ago. Lastly I believe this Brazil situation is being underestimated and will play a bigger role in the future.

Taking a look at the chart, we are caught in this wedge. Personally I'd like a move past $4.96 to bring additional upside and short covering. Downside risk is last weeks lows of $4.70.

Corn March-23

Corn Seasonal Chart

Soybeans

Soybeans finally put together a rally following the brutal -60 cent downfall from last week. Intially we hit a fresh 2 month low but bounced back and rallied. Posting a pretty solid candle but not quiet key reversal on the charts.

The biggest thing everyone will be watching tomorrow is what the USDA decides to do with Brazil.

As mentioned, there is a risk the USDA slow plays this. I am hoping that is not the case, but we all know how these things usually work with the USDA kicking the can down the road.

There is a decent chance they wait to see how December rain shakes out. December is the most key month after all.

So what happens if they decide to leave things unchanged?

Intially we take it on the chin. Probably go back to $12.91 and if that doesn’t hold perhaps our October lows of $12.70.

However, if this dry trend continues, which it looks like will be the case. Them leaving things unchanged here gives us all the more power to see an even larger cut down the road.

If they come in right at the estimates, I see us going a little higher just based off of how bad the market has been beat up the past week. Could be a relief bounce and perhaps the funds stop jumping ship when they realize the crop is getting smaller.

If they come in below estimates, we rally of course.

No matter how this report shakes out, the next few weeks in Brazil will be the ultimate factor. In my opinion it doesn’t look favorable and I see beans higher in the future due to this.

If this dry pattern where every month is the driest in the past 50 years continue, things will get interesting.

From Farm Progress:

"Mato Grosso will replant at least 1.5 million soybean acres. The market does not fully comprehend the crop damage that has taken place."

Seasonally we go higher. Fundamentals are bullish. We have a tight carryout situation here at home. A record crush pace. And lastly Brazil.

Bottom line I think we will be going higher long term but we don’t want to be shocked if this report is bearish we take it on the chin and look to test $12.91 or even $12.70 before going higher late this year and early next. I hope that doesn’t happen but it’s definitely possible.

What do bulls need to see more upside? $13.26

Level we have to watch? $12.91 which is our 50% retracement level from this entire $3 move from July. That's the level bulls need to hold, if not we probably look to test the October lows of $12.70.

Soybeans Jan-23

Wheat

Wheat market rallies for the 8th day in a row as mentioned.

Intially we actually traded over a dime lower as the trade was slightly disappointed we didn’t get any more sales to China. We also had light weekly exports.

However, that dip was bought back fast as we rallied +23 cents off those early lows, posting a pretty bullish candle on the charts but failed to take out yesterday's highs.

So will the USDA spoil this recent rally?

Well, it's possible. Overall I am not expecting much from this report either which way.

But one thing I am being aware of heading into this report is the fact that the USDA may opt to leave wheat exports unchanged despite the recent business to China. Eventually they are going to have to lower exports but who knows if they decide to do it tomorrow.

As always for the report, we want to prepare for the worst and hope for the best.

Nobody knows how tomorrow will shake out, but long term there are still plenty of reasons to believe wheat will continue higher.

Will we see this rally take a breather and correct lower? Probably. Does that mean the bull party is over? No.

Seasonally we go higher from here. Fundamentals are bullish. We have global weather problems.

Now we have China coming to the US for wheat which doesn’t happen all that often.

China has bought over 25 million bushels of wheat the past 2 months. That is nearly 25% of the USDA's projected wheat exports for the entire year.

The funds remain short, and simply can’t continue to do so if China wants to continue to buy.

Bottom line, if you are in the situation where you have to make sales, then there is nothing wrong with rewarding a near $1 rally. But I still see a lot of upside in the wheat market looking long term.

Wright on the Market said:

"Fundamentals are bullish as the world is using more wheat than it has produced for the past 3 years and there is a war in the 'Bread Basket of The World."

On the charts we have broken some key resistance levels which is a good indicator that perhaps the funds look to continue to cover. My next upside targets on the chart are our 38% and 50% retracement levels of $6.53 and $6.83.

Will have to see what the report holds tomorrow.

Chicago March-23

KC March-23

Price Maker Program

Become a price maker and take your marketing to the next level.

Banghart Properties Grain Marketing is looking for black oil sunflowers

Call or text offers Jeremey at (605)295-3100 or Wade at (605)870-0091. Looking for black oil sunflower offers, both old crop and new crop as well as millet and milo.

Want to Talk?

Our phones are open 24/7 for you guys if you ever need anything or want to discuss your operation.

Hedge Account

Interested in a hedge account? Use the link below to set up an account or shoot Jeremey a call at (605)295-3100 or Wade at (605)870-0091

Past Updates

12/6/23

RISKS, FACTORS, & WHAT TO WATCH

12/5/23

WHEAT CONTINUES RALLY & BEANS BOUNCE BACK

12/4/23

IF CHINA IS BUYING, I’M NOT SELLING

Read More

12/1/23

BRAZIL, CHINA, FUNDS & SEASONALS

11/30/23

LOWS FINALLY IN OR ANOTHER SELLING OPPORTUNITY?

11/29/23

RISK & UPSIDE FACTORS

11/28/23

WHAT COULD CAUSE THE FUNDS TO COVER?

11/27/23

WHAT IS CORN BASIS CONTRACT DILEMMA TEACHING US?

11/24/23

POST THANKSGIVING MELT DOWN

11/22/23

WHAT’S THE BRAZIL STORY?

11/21/23

WHAT TO DO WITH YOUR CORN BASIS CONTRACTS

11/20/23

ARE YOU UTILIZING THE RIGHT STRATEGIES OR GETTING TAKEN ADVANTAGE OF?

11/17/23