GOVERNMENT CONCERNS & PREPARING FOR USDA REPORT

Overview

Grains end the up and down day mixed. At one point, all the grains were trading higher with both beans and Chicago wheat up a dime. However, we gave back most of those gains as beans still finished 5 cents higher, while corn and wheat see minor losses of 1 to 4 cents.

The biggest concern right now is the looming potential government shut down this weekend. If congress cannot come to a budget agreement, the government will be shutting down Sunday. This also means the USDA reports and data collections will also stop. Which means if the government shuts down we will not be getting our October WASDE report. This is certainly something to aware of. Markets do not like uncertainty. So we need to see a budget deal to prevent this, if they come to an agreement it will make it a lot easier for the grains to rally and put in harvest lows.

The dollar also put in a new contract high as it trades higher for the 10th week in a row, trading at it's highest levels since last year. This is making our exports even harder.

Friday is likely going to be an event filled day. Not only do we have the USDA report, but it is also the end of the week, the end of the month, and end of the 3rd quarter. With Monday being the start of the 4th quarter.

So with all of this doom and gloom in the outside markets, don’t be surprised if some of this concern leaks over into the grains. This could cause a lot of choppy trade the rest of the week. I’m not expecting much to happen until Friday's report.

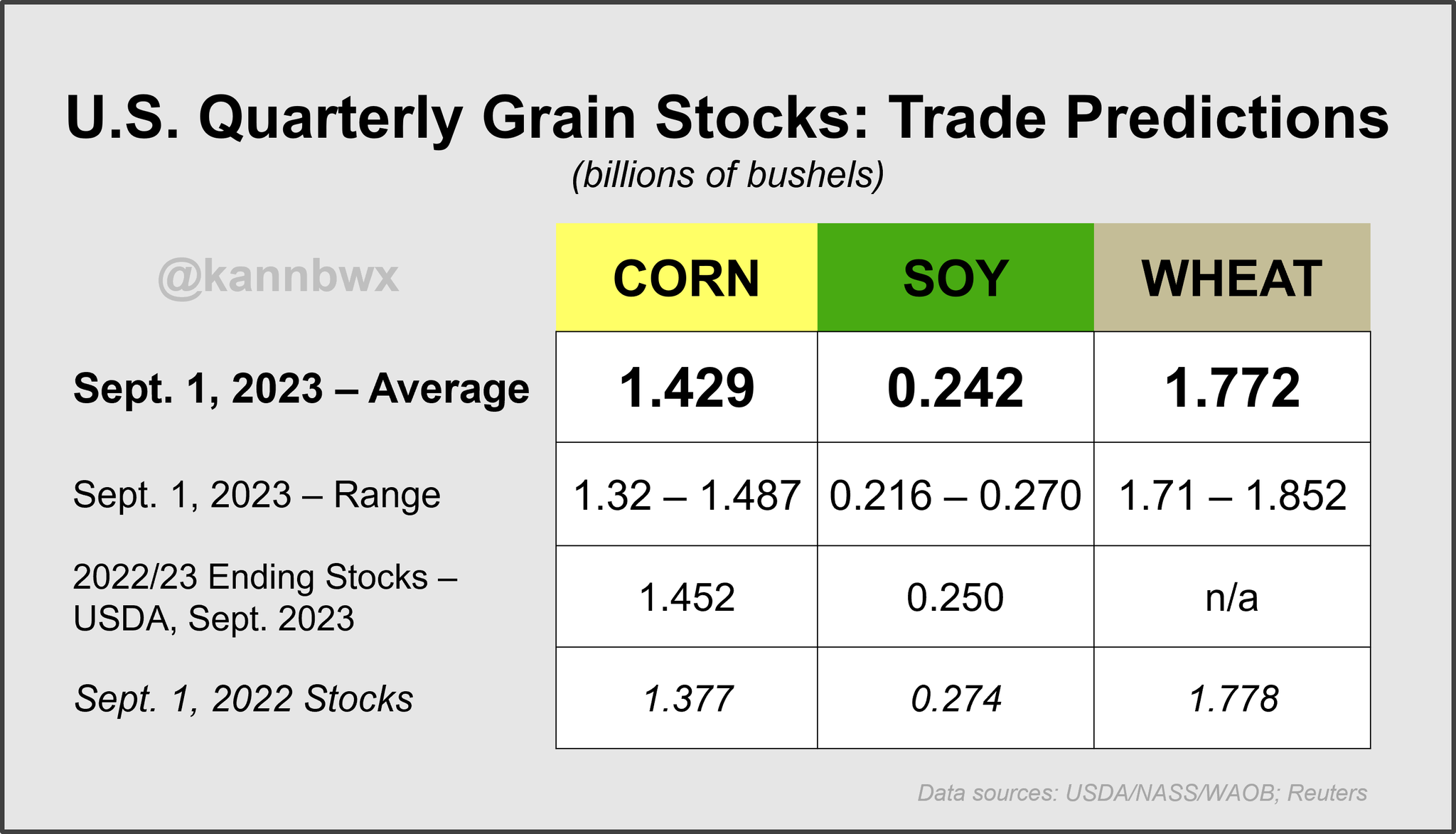

For Friday's report, the trade is looking for some slightly lower stocks. However, corn would be a 3 year high, but beans would be a 7 year lows. Wheat is looking for 16 year lows but almost identical to that of the past 2 years.

Chart Credit: Karen Braun

The funds still remain heavily short corn and wheat. So if the report is friendly corn or wheat, the funds could have some problems and be forced to cover those shorts.

In yesterday's crop progress and conditions report, we saw harvest moving along faster than normal. But slightly slower than the trade was expecting. We also saw corn conditions improve by 2% while soybeans deteriorated by 2%.

Overall, I'm expecting some choppy sideways trade through most of the week. We could certainly see more downside, but I think once we get the USDA report out of the way we will be putting in our lows sometime within the next week or so barring the government shutting down and creating some more problems.

Today's Main Takeaways

Corn

Corn slightly lower here today as it continues to chop around in this recent range it's traded the past 2 months.

Harvest pressure and the largest funds short position in 3 years is holding corn near it's recent lows

As mentioned, yesterday's report had corn ratings improving by 2%, while the trade was expecting these to be left unchanged. Harvest moved to 15% through Sunday, slightly lower than the estimates of 27%, but up 9% from last week and last year's 11%.

Dr. Cordonnier lowered his Brazilian corn crop estimate by a pretty large 9 million tons this week due to reports that Brazilian farmers are reducing their first crop corn acres by 5% as well as their safriha acres by roughly 4 to 5%. He also lowered his US corn yield by 1.5 bushels, down to 171.5 bushels an acre.

Here is what bears are currently looking at. First of all, we have the economy situation which we mentioned. The dollar continues it's rally. But the biggest thing that bears continue to point at is simply weak overall demand as the funds continue to add to their historic short position.

Bulls argue, that with the funds this short, we could be in for a short covering rally and their might not be enough their for bears to chew on and cause the funds to continue piling on these short unless the report Friday comes out in the bears favor. We also have the seasonals working in the bulls favor. This is right around the time where we start to put in those harvest lows we have been talking about the past few weeks. Corn is currently 13 cents off it's lows made last Tuesday, if we get a bullish report those lows probably hold, if we get a bearish one we could certainly look to test those and perhaps make one more leg lower before definitively putting in a low for the year.

Overall, I think yield is closer to 170 and think we are very close to putting in our lows. Whether those lows be made Friday following the report, or next week.

From Farms.com Risk Management:

"When the US corn harvest gets to 50% complete (week of October 8th) is when history suggests a market low in futures."

I've started seeing several advisors recommending re-ownership strategies here. We also like the idea of re owning here. Here is what a few other guys in the industry are saying:

Mark Gold of Top Third:

"Re-owning some calls for anything you sold or to protect the insurance payment is well worth looking into."

Chris Robinson of the Robinson Report:

"It's time for producers who want to protect against a rally "taking away" a bigger insurance payout. For end users trying to lock in 5 months of risk of higher prices. For speculators who want to participate if corn has an unexpected 30 to 50 rally over the next 20 weeks.

What's the hedge?

Buy CH4 $5.20 calls for 12.5 cents;

Buy CH4 $5.30 calls for 10 cents

For $525 out the door. if you spend a dime

or $650 -if you spend 12.5 cents-

Coverage lasts until February 23. 2024. 149 days of potential.

Funds are bet short corn.

Commercials are long corn.

These calls defend against 6 separate USDA reports.

These calls defend against harvest surprises here.

Planting and early growing surprises in South America.

Argentina is dry again, entering its 3rd year of drought.

I can't and won't hold your hand in the moonlight- and tell you for sure these will pay off. That is not what I do as a risk manager and advisor. But, I do know, if we get any issues in the next 6 months that create a surprise rally in corn? Spending less than 13 cents for 6 months of participation in any potential rally is a good risk/reward.

No, you can not "lose" more than what you pay for the option.

Using a long call strategy, your downside risk is all up-front. The price of the option. No risk of margin calls. No risk of surprises after the fact.

I'd get them on before Thursday's close at 1:15 PM. Don't pay up the day of the report when they pump up volatility and make everything more expensive."

We know every operation is different and has different needs. If you would like some specific advice or just want to go over things, shoot us a call or text at (605)295-3100 or email us.

Corn Dec-23

Soybeans

Beans close the day up a nickle while also ending a nickle off their highs.

Harvest moved to 12% complete but under the trade estimates 14%. Dropping leaves jumped from 54% last week to 70% this week, well over last year's 60% at this time.

Bulls were happy to see the ratings yesterday drop by 2% to now 50% rated good to excellent, the trade was expecting this to be unchanged. I think the USDA's 50.1 bpa estimate is still far too high. We had some key states such as Iowa who is rated just 47% good to excellent, Minnesota sitting at just 44%, and Kansas coming in all the down at just 20%.

It is looking like more and more are starting to think we will see a tighter US balance sheet.

Short term, yes we have the seasonal harvest pressure which could cause some more downside. We also have the talk about South America perhaps planting some extra acres, to go along with the fact that a lot of producers here in the US will likely be selling beans first while storing corn. Which could cause some additional short term pressure.

However, the long term picture for beans still has a ton of upside potential. Yield is likely coming down. Demand could very well surprise us later in the year, especially if Brazil runs into issues like some are suggesting they might. Whether those issues be due to weather, logistics, or perhaps even political.

Looking towards the end of this year and into next, the potential is still there for $15. Am I saying this "will" happen? No. I am just saying that there are cards left in the deck that could certainly make that happen if dealt right.

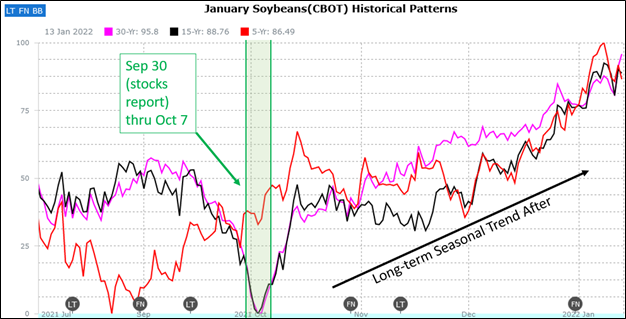

I noticed a few other advisors such as Roach Ag still had a buy signal in place for beans. I again wanted to show this chart from them. It is a historical price pattern chart. The green channel is the USDA report this Friday. As you can see, historically we enter a long-term upward trend following this report.

We are back above $13 which is a good sign. Bulls would like to see a break through the $13.18 level before the end of the week to confirm more upside.

$12.82 (our 50% retractement) is the level bulls need to hold if we don’t want to see more downside. We have tested that level twice now.

Soybeans Nov-23

Wheat

Wheat market closed well off it's highs, seeing slight losses in Minneapolis and KC while Chicago ended the day unchanged. Overall not a ton of fresh news.

We saw some more attacks on Ukraine from Russia, but the market didn’t have a huge reaction to the news. However, one could argue that we will eventually see this war result in both Ukraine and Russian exports ultimately seeing a negative impact.

Not only do we still have the war, but we have some serious global weather concerns. We have the Australia crop that's getting smaller. The concerns with the South American crop. We have India who may be going from a net exporter to net importer.

All of these are bullish factors that may not effect this market directly right now, or next week, or even next month. The wheat market is still a marathon, with a lot of upside once all of these bullish factors come out to play. The question is still "when"?

Taking a look at the Quarterly Stocks report Friday, most are thinking we will see a slight cut to production and a reduction to stocks. The trade estimates would put US September 1st stocks at their lowest in 16 years, but still right around where we have come in the past two years.

A war or weather wild card will eventually catch the bears and funds off guard, remaining patient for now

Seasonally wheat puts its lows in here. I think there is a still a good chance Chicago has put in it's lows, and I think we will be looking at much better pricing windows in the future.

However, taking a look at the chart, we do still remain in a downtrend. I’m hoping we can start to create a reversal here soon. Although I think we are in for higher prices in the future, if you have unpriced wheat and are worried about the downside, looking at some puts and establishing a floor is never the worst idea in the world.

Chicago Dec-23

KC Dec-23

MPLS Dec-23

Check Out Past Updates

9/25/23

HAVING A PLAN OF ATTACK

Read More

9/22/23

WEEKLY WRAP

9/21/23

HARVEST BASIS THOUGHTS

9/20/23

BUYING OPPORTUNITIES

9/19/23

CAN WE FIND DEMAND?

9/18/23

HARVEST PRESSURE

9/15/23