HARVEST PRESSURE

Overview

Grains pressured heavily across the board, as soybeans lead the way down for the second session in a row following Friday's weakness. Beans are now down over 40 cents the past two sessions, while corn made new lows. The wheat market was also down pretty hard today, but still managing to hold those lows from the reversal the day of the USDA report. The weakness across the board was mostly due to harvest pressure.

We had another sale of beans to China this morning. Not a huge sale, just 123k MT. But more business is always good.

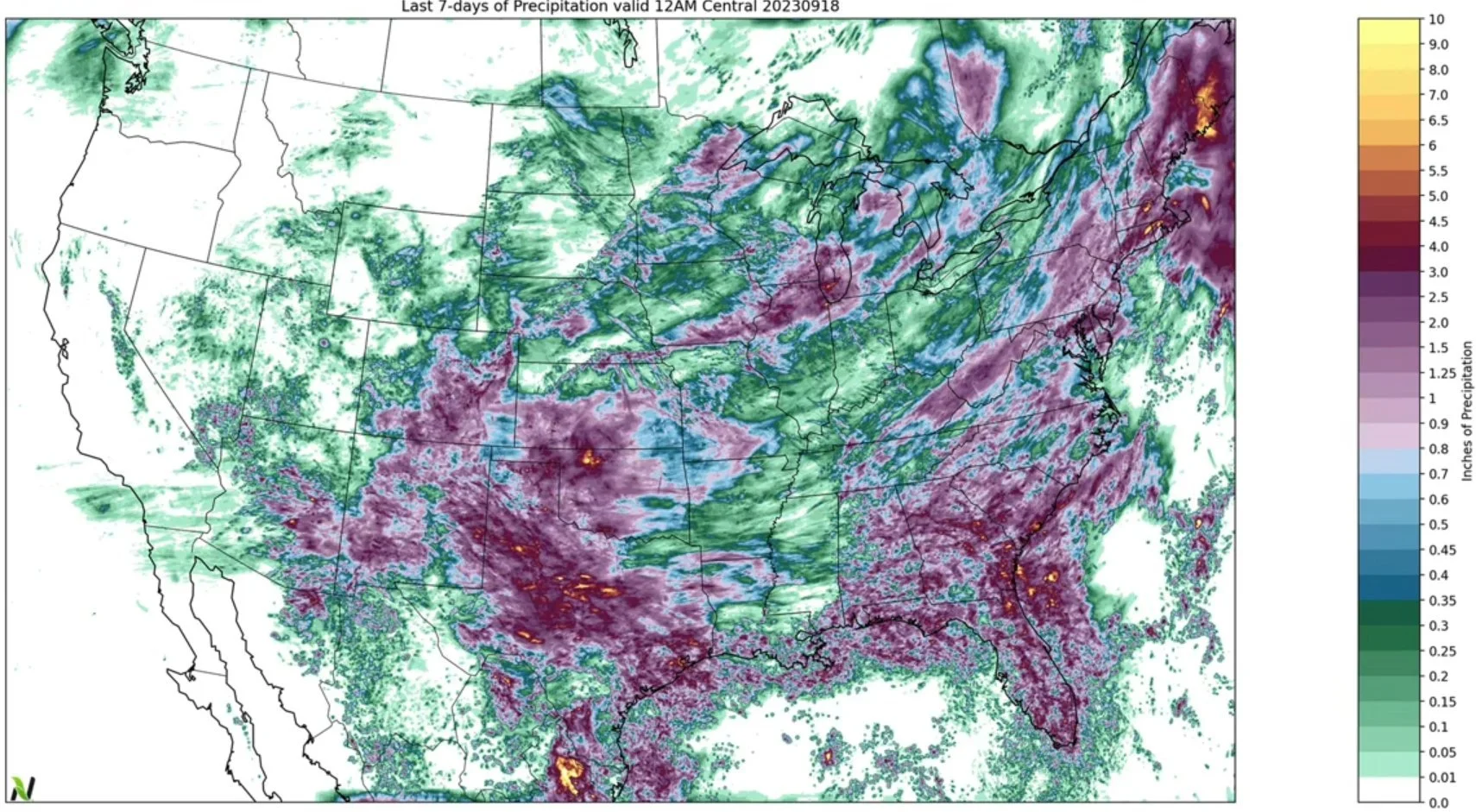

We had some fairly good rains across the entire corn belt, aside from the Dakota's and Minnesota. These rains weren’t enough to slow harvest down as that begins to get rolling here.

Here is the past 7 days of precipitation.

Here is the next 7 days of precipitation forecast.

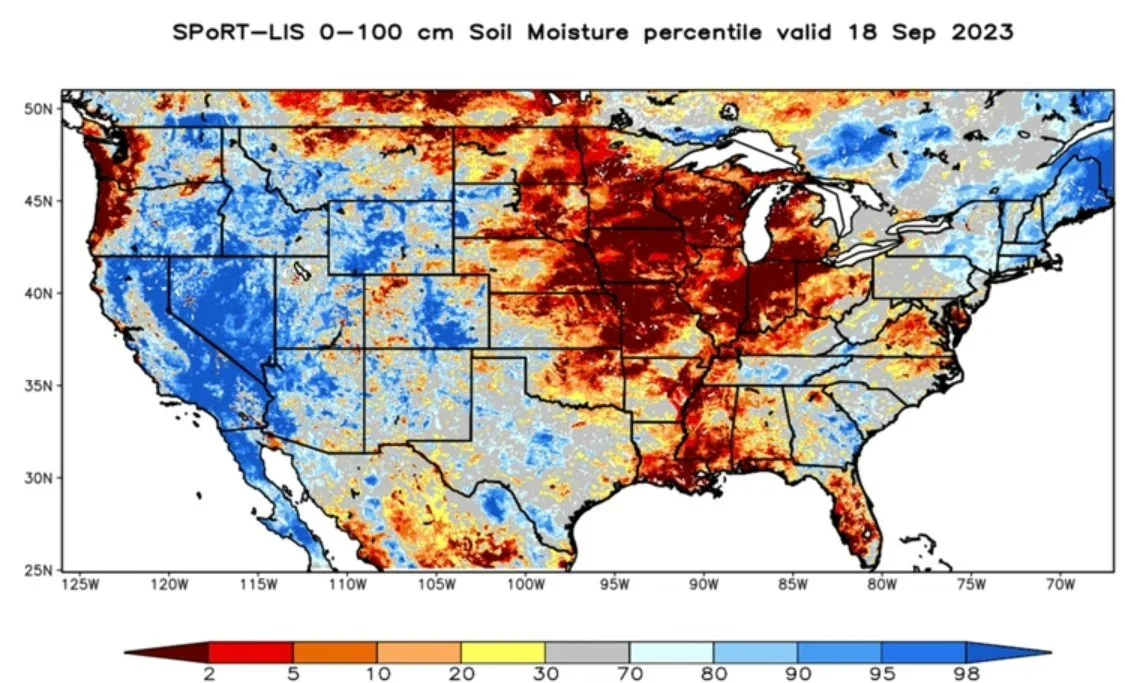

However, if we take a look at our current soil moisture situation, we still have a big problem.

US weather headlines are mainly in the review mirror from here. No rain is going to save this crop, and lack of rain isn’t going to do much damage.

The trades weather focus is starting to shift to South America.

Currently Brazil is facing some extreme heat and dryness, which is a problem as they just start to plant their soybeans.

Early yield reports showing things we already know. Areas that got rain aren’t in bad shape, while areas that didn’t have some pretty bad damage. So will we see a yields be what the USDA currently has, with corn at 173 and beans at 50? I highly doubt both of those numbers. When it's all said and done I think we are sub-170 on corn and closer to 48 or even lower on the beans. But we will have to wait until these combines start rolling more.

The funds are still heavily short corn. Now sitting short 134k contracts, the shortest they have been dating all the way back to August of 2020. The funds remain short wheat and long beans.

The bottom line here is that we don’t want this negative price action to scare us. We are simply in a time where we are going to see some harvest pressure. This will probably last another week or two. Once we get through harvest, we should see prices rally, especially if the crops aren’t there.

If you are worried about the downside, grabbing a cheap put and establishing a floor is never a terrible idea. Every operation has different needs. If you want to go over yours or have specific questions shoot us a call anytime at (605)295-3100.

River Level Situation

The current water levels in the Mississippi are lower than the lows we saw back in October 2022 that interrupted river traffic. Freight costs are high and will likely continue to be that way for a while.

Crop Progress & Harvest

(Released After Close)

Corn 🌽

Matured: 54%

Last Week: 34%

Last Year: 38%

Average: 44%

Harvested: 9%

Trade: 10%

Last Week: 5%

Last Year: 7%

Average: 7%

Good to Excellent: 51%

Trade: 51%

Last Week: 52%

Last Year: 52%

Beans 🌱

Dropping Leaves: 54%

Last Week: 31%

Last Year: 39%

Average: 43%

Harvested: 5%

Trade: 4%

Last Year: 3%

Average: 4%

Good to Excellent: 52%

Trade: 51%

Last Week: 52%

Last Year: 55%

Spring Wheat 🌾

Harvested: 93%

Trade: 94%

Last Week: 87%

Last Year: 93%

Average: 93%

Winter Wheat 🌾

Planted: 15%

Trade: 15%

Last Week: 7%

Last Year: 19%

Average: 16%

Today's Main Takeaways

Corn

Corn nearly a nickle lower here today, seeing some spillover weakness from wheat and beans amid some harvest pressure. Despite the minor losses, December corn futures did make new lows, breaking that recent double bottom.

Here is what the bears are looking at. We had the USDA lower yield to 173.8 but the USDA balance sheet remains burdensome at +2.2 billion bushels. They are arguing that demand is just simply not enough to combat the balance sheets.

At the same time, we have the dollar continuing it's rally, making multi-month highs. Then we also have the river level situation. As the Mississippi river levels remain very low and are making it so barges are unable to move large amounts of exports through the Gulf.

So what are the bulls looking at? For starters we have the sustainable aviation fuel situation and the recent ruling could certainly spark more demand. Along with the recent drop in ethanol stocks. Both of these help create a more optimistic long term demand story. We also still have the massive spread between China and US prices, which should ultimately lead to China looking to be a bigger buyer from the US.

As for the yield story. Right now, it is still far too early. Bulls think we are sub-170, which I agree with.

As the trade shifts away from US weather headlines, they will begin to pay much more attention to what is going on over in South America. Brazil is facing some problems currently. They have extremely dry conditions to the north, and overly wet conditions to the south. This isn't a huge market mover just yet, but will be as we start getting crops in the US out of the field.

Bottom line here is to be patient. Seasonally this is where we make our lows. The funds are holding a historically large short position right now. Eventually they will be forced to puke out of those short positions, but today isn’t that day.

I noticed a few other adivors such as Roach Ag had placed buy signals in both corn and beans. So livestock producers, now is a great opportunity to purchase feed. Grain producers, now is a great time to look to take re-ownership of recently sold bushels.

We do not want to be selling here at 2 year lows. Harvest is not the time to be making sales. We do not want to supply a market when he market is going to have the most supply it has all year long.

The road for corn isn’t going to be a smooth one, so keep that in mind. A major rally here probably won’t happen looking short term. Long term however, I fully expect us to be much higher than where we are at today. Short term we have harvest pressure and a lack of demand. When the combines start rolling and yields aren’t there, we will be going higher. Demand isn’t there today, but there is reason to believe we will start to see much more down the line.

These harvest lows will be in soon.

Taking a look at the chart, as we mentioned we did make new lows, as we broke that $4.73 level and that double bottom. In our audio update following the report, we said there was a good chance we made one more low before putting in that harvest low. I wouldn’t be too surprised to see us test the $4.63 level before putting in our lows over the next 1 to 2 weeks.

Corn Dec-23

Soybeans

Beans take it on the chin for the second session in row. Losing another 24 cents today, on top of Friday's 20 cent loss.

Today's lower action was simply some harvest pressure as harvest begins to get under way.

One thing bears are pointing out is that the USDA lowered both it's domestic and crush numbers.

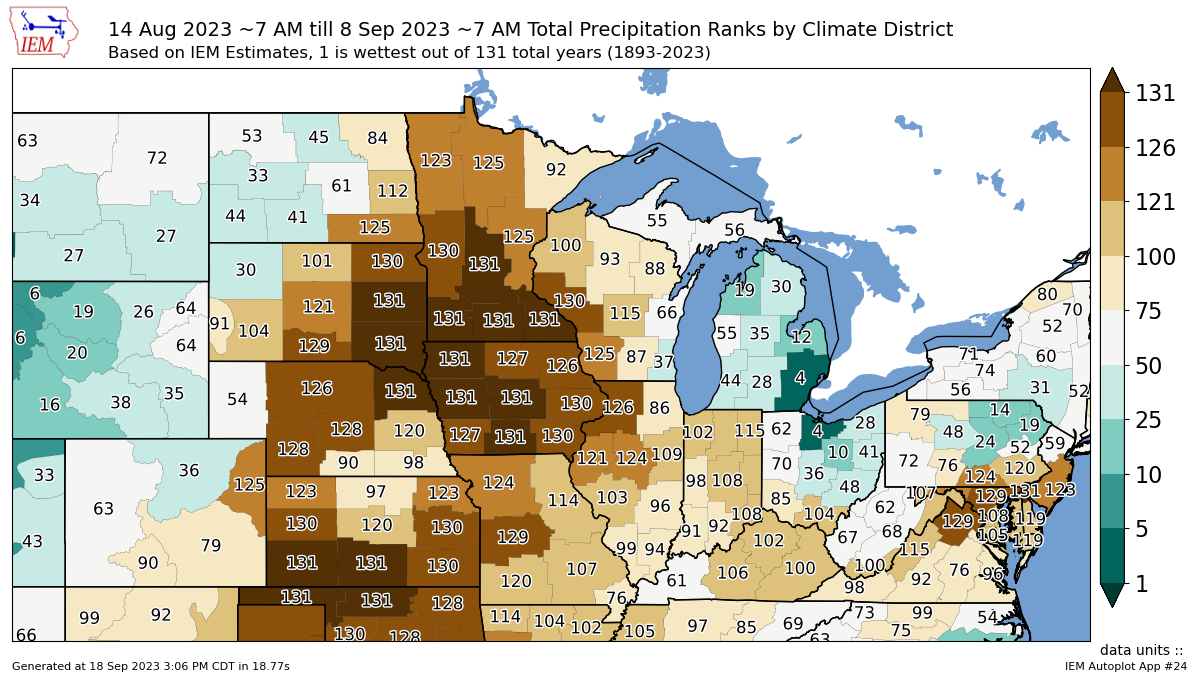

Bulls argue that our yield is going to continue to get smaller, I'd have to agree. Just take a look at how dry the second half of August and first week of September was. This was a prime stage in development for beans. Beans absolutely need moisture the second half of of August.

Looking at our number 2 producing state of Iowa, nearly the entire state had it's driest second half of August ever.

You can’t have record yields with a finish to a crop like this. I look for lower yields to continue.

I think we are going to see some disappointing results after the combines get rolling. Beans can’t afford to lose bushels with an already tight situation. If we lose bushels we will be going higher.

South America weather is going to start playing a bigger and bigger role as the year moves on. Brazil is facing some drought issues. There is talk they may continue to battle some weather complications and their planting may get pushed back. Another thing to keep in mind is that Brazil's planting window is already open as they are starting to plant beans.

From Chris Robinson of the Robinson Report,

Any price north of $13.33 still puts you in the top 1/3 of available prices this year. It's not $14.35, but it's also not $11.30. Remember that if you are in a bad position. We do not want to see us get to the 100-day moving average at $13.04, especially without a protective put-on to defend revenue.

It is never a bad idea to keep a put under your remaining unpriced bushels, but make sure it is a cheap. Establishing a floor might make sense for a lot of you, but not for everyone. So if you have questions on that shoot us a call.

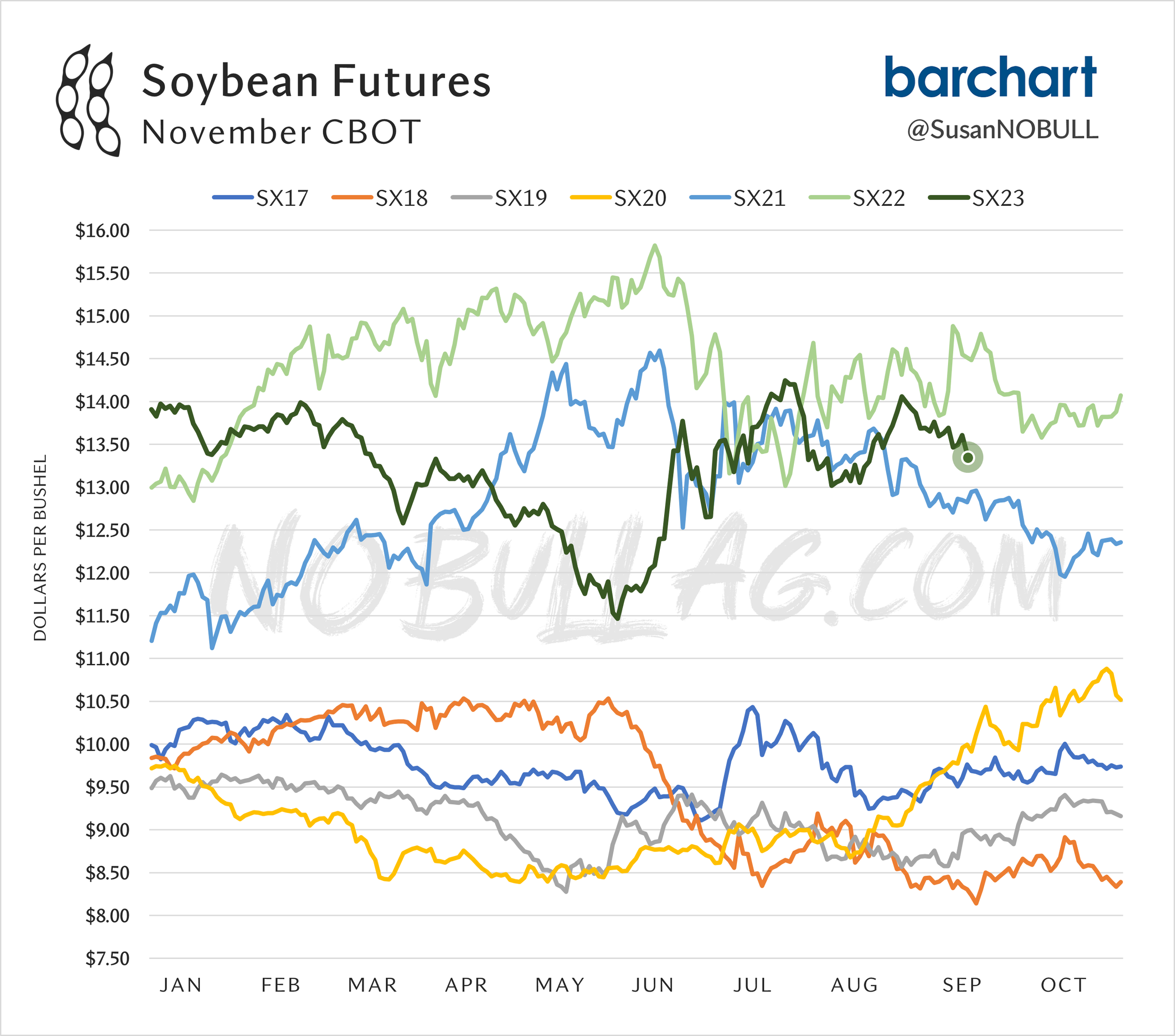

Long term, the bean situation remains very bullish. We still have a chance to see $15 beans later in the year or perhaps next year. But not everyone can hold on to their crops that long. If you are someone in that situation, shoot us a call and we would be more than happy to help you out. (605)295-3100. We also need to keep in mind that the downside in beans is certainly there. Remember when we were trading $11.30? We are still $2 higher than that. So just be comfortable.

So yes, long term, I think the sky is really the limit for beans. But short term we could still definitely see some more harvest pressure. Remember, it is often difficult for beans to rally throughout harvest.

I look for higher prices into late 2023 or into early 2024.

If you take a look at years where we had similar prices. In both 2022 and 2017 we did continue lower from here before finding a bottom in October. This chart is from NoBullAg.com.

Taking a look at the chart, we did break that uptrend from July. I wouldn’t be too surprised to see us test the $13 range. Bulls need to hold that level or we could look to test our August 8th lows of $12.82.

Soybeans Nov-23

Wheat

Wheat gives back a good portion of it's gains from last week. As all classes trade double digits lower. However, that low we talked about following the USDA report is still in place.

The wheat situation remains pretty bullish looking long term.

Short term, sure Russia has a lot of wheat and continues to export cheap wheat. But how long can that last. We have the war which has been going on for a year and half, it isn't going anywhere. Even if it is resolved, there is still a ton of issues that would need to be fixed after the fact. So I think that is something that is being somewhat overlooked looking long term.

If we take a look at the global situations, it is anything but bearish.

For starters, we have Australia. Their wheat crop is somewhere around 35% smaller than last year.

Then the problems in Canada, the EU, the UK. The list goes on.

Here in the US we don’t have a ton of fresh news. Spring wheat harvest is wrapping up.

The rising dollar has created some tailwind, so bulls would like to see it take a breather to help out our export demand.

The funds are the 2nd the shortest they have been in over a decade for this time of year in wheat. Yet global ending stocks are at the lowest levels in over a decade. US all-wheat stocks/use ratio is 33%, the 3rd lowest in over a decade. I think it is safe to say the wheat market will see brighter days down the road.

Bottom line is that this wheat market is starting to turn around. I'm not expecting this major rally short term. But there is a ton of upside looking long term. Eventually there will be a reason for wheat rally. Especially when these global problems all unfold.

Seasonally this is when we put in the lows. We still think the lows are in for Chicago in particular ($5.70). We look for higher prices to come in the wheat market.

Chicago Dec-23

KC Dec-23

MPLS Dec-23

Other Markets

Feeder cattle markets see some profit taking after prices hit new all-time highs on Friday. As they were up another 2% the past week.

After oats recent bull run, they trade limit down today.

Crude oil continues it's bull run, as it trades at it's highest levels since last November.

Orange juice makes yet another new all-time high.

Hedging Account

No matter the situation you are in, our partners at Banghart Properties Grain Marketing can help you come up with a plan of attack to help you manage your risk. If you want help managing your risk you can give them a call anytime at (605) 295-3100 or set up a hedge account below.

Check Out Past Updates

9/15/23 - Audio

BECOMING COMFORTABLE IN THE MARKETS

9/14/23 - Market Update

YIELDS, DROUGHT, & CHINESE APPETITE

9/13/23 - Audio Commentary

$10 WHEAT/$6 CORN/$15 BEANS BY THE END OF THE YEAR?

Read More

9/12/23 - Audio & Report Recap

BEARISH REPORT, BUT SETS THE STAGE FOR HIGHER PRICES

9/11/23 - Audio Commentary

CHEAP PRICES CURE CHEAP PRICES

9/10/23 - Weekly Grain Newsletter

PREPARING FOR THE USDA REPORT

9/8/23 - Audio Commentary

WILL USDA REPORT BOOM OR BUST?

Read More

9/7/23 - Market Update

BEANS GIVE BACK GAINS, TRADE PREPARES FOR USDA

9/6/23 - Audio Commentary

BE PATIENT MAKING SALES AT HARVEST TIME

9/5/23 - Market Update

WEATHER IMPROVING, BUT DAMAGE WAS DONE

9/1/23 - Audio Commentary

HOW MUCH DAMAGE WAS DONE & WHAT IS MARKET EXPECTING

Read More

8/31/23 - Audio Commentary

THIS CROP HAS MORE DAMAGE THAN MOST REALIZE. DON’T PANIC SELL

8/30/23 - Audio Commentary

THIS VOLATILITY ISN’T GOING ANYWHERE

8/28/23 - Market Update

WEATHER REMAINS BULLISH BUT CROP CONDITIONS DISAPPOINT

Read More

8/27/23 - Weekly Grain Newsletter

ECON 101 APPLIED TO GRAIN SALES

Read More

8/25/23 - Market Update

BEANS CONTINUE BULL RUN

Read More

8/24/23 - Audio

BEAN DEMAND STORY CONTINUES TO GROW AS CROPS GETTING SMALLER

8/23/23 - Market Update

CROP TOURS, BRUTAL HEAT, & NO RAIN

8/22/23 - Audio