SOLD RALLIES & HISTORICAL HIGHS

Overview

Markets disappoint following our mini rally. As wheat gives up half of it's recent gains and soybeans continue their weakness from yesterday.

Despite the weakness, all of the grains have held their recent lows and are only slightly lower or even higher on the week. Here was the changes:

March Corn: +3/4 cents

March Beans: -4 cents

March Wheat: +7 cents

The grains are mostly lower due to weaker demand, some rains thrown in the forecast for Argentina.

South America weather is going to remain the hot topic of the grains for a little while with the wide range of estimates being thrown out for both crops.

The weather looks somewhat cooperative, but Argnetina is still seeing some brutal heat and dryness which is suppose to continue for the next week. However they are suppose to see more rains in the 10 to 15 day window.

If they get rain in the next week or so, there won’t be much damage and the talk is that the subsoil moisture levels can handle this heat and dry spell as long as it does not extend much farther than next week or two. If they do not get rain, keep in mind this is Argentina's July. They are in a very key pollination time. So we will have to see how it shakes out and how much rain they get or don’t get.

Buenos Aires Grain Exchange rated the Argentina soybean and corn crop conditions down slightly from last week, but far better than last year's disaster of course.

Beans:

44% G/E vs 55% last week vs 7% last year

8% poor/very poor vs 2% last week vs 53% last year

Corn

41% G/E vs 46% last week vs 12% last year

6% poor/very poor vs 3% last week vs 38% last year

Another thing that is pressuring the bean market is the continuation of weaker basis on Brazil. Some say that perhaps this is an indication of a large crop. Nobody knows yet, but this could also just simply be harvest pressure. Seeing basis drop at harvest is nothing unusual.

Wheat saw additional pressure from China approving imports of wheat from Argentina. Creating more global competition for business from China.

Being in the top 5% of the market

We mentioned this recently in one of our audio updates. A guy asked why do you seem to always be bullish?

There is 252 trading days a year.

If you wanted to be in the top 5% of the market, do you know how many days you had to do so?

Corn in 2023: 15 days

Corn in 2022: 5 days

Beans in 2023: 4 days

Beans in 2024: 1 day

So to be in the top 5% of the market, prices are going higher 95% of the time eventually. After we have made our highs, you can lock in puts to make money on the way down and might actually outperform the market.

Now let's dive into today's update..

Today's Main Takeaways

Corn

Corn gives up a portion of it's recent mini bounce. Closing red for the first time in a week and a half.

We mainly traded lower because of Argentina seeing rains in the forecasts, as well as the current Brazil outlook appearing more favorable, which helps the second corn crop.

As mentioned, it's July in Argentina, so we will have to see what unfolds.

When should you typically be selling corn? Usually spring and summer time. Because we will typically get a weather scare rally when supply is at it's lowest vs during harvest time when we have the most supply.

So when is historically the best month to sell corn?

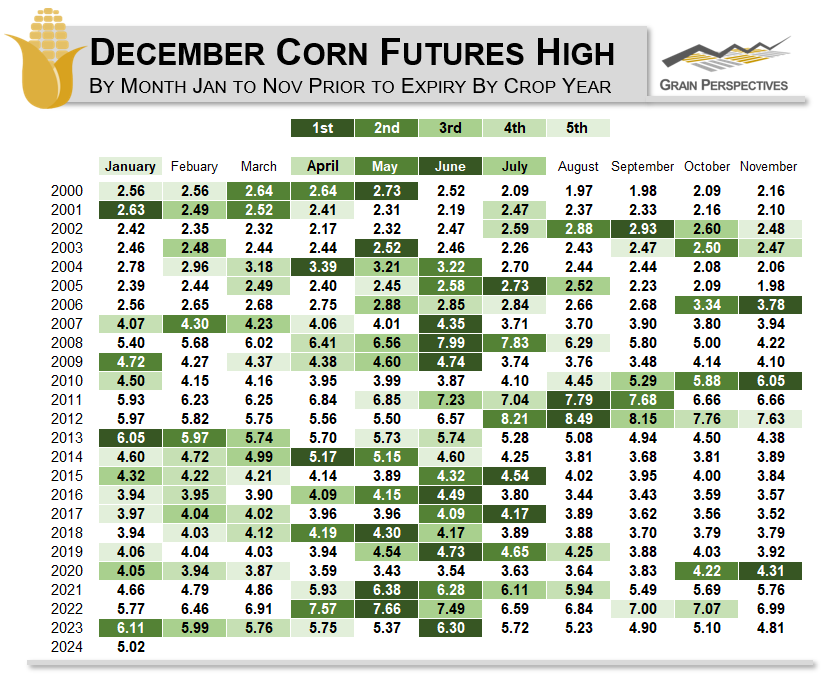

If we take a look at this chart from Matthew Pot of Grain Perspectives, they outline what months December futures have made their highs each year.

Here is a breakdown of how many times we have made our highs in each month since 2000.

January: 2 (2001, 2013)

February: 0

March: 0

April: 2 (2004, 2014)

May: 4 (2000, 2003, 2018, 2021)

June: 6 (2007, 2008, 2009, 2016, 2019, 2023)

July: 3 (2005, 2015, 2017)

August: 2 (2011, 2012)

September: 1 (2002)

October: 0

November: 3 (2006, 2010, 2020)

As you can see from this data, there have only been 2 years where the December contract did not make it's high after January.

June led with 6 of the 23 years.

If you add up April, May, June, and July (spring & summer time) it's 15 of the 23 years.

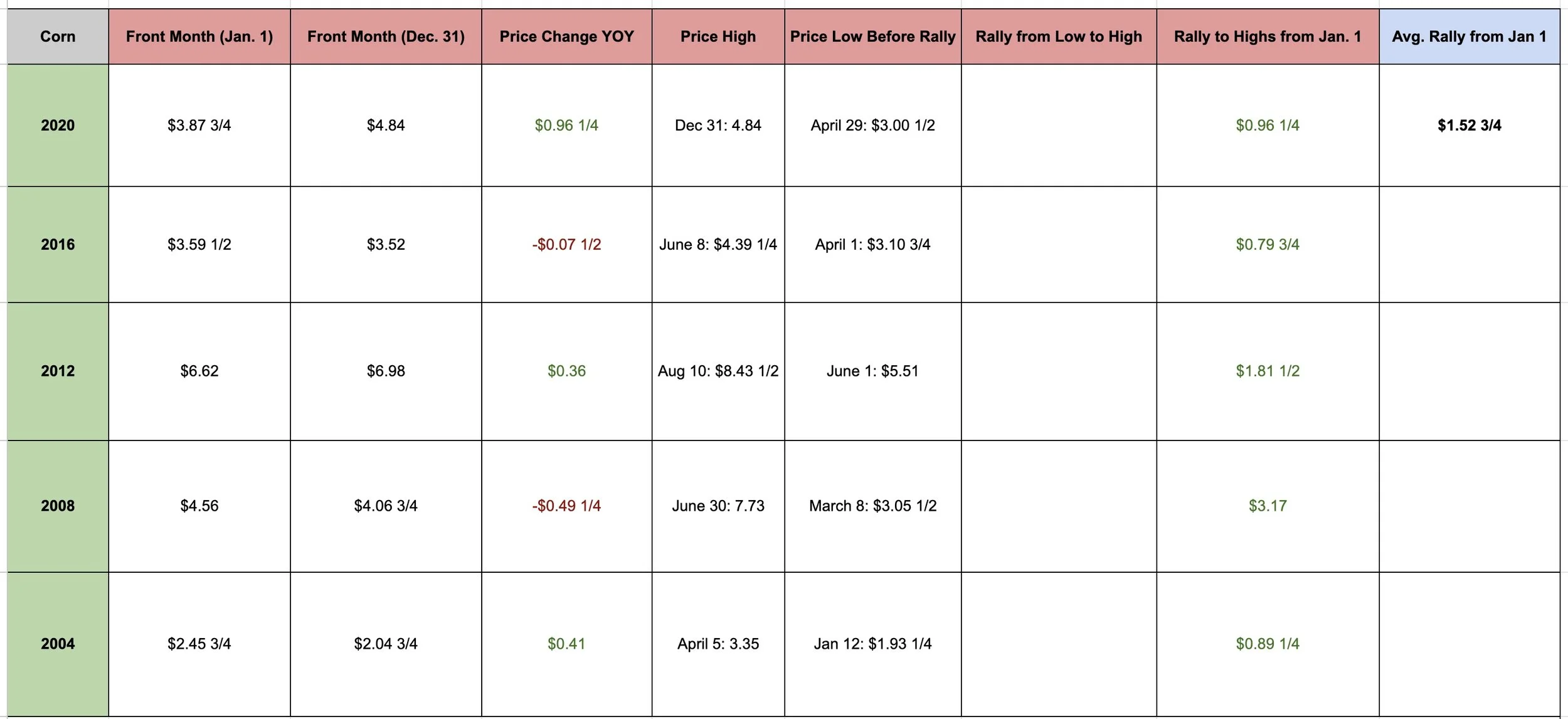

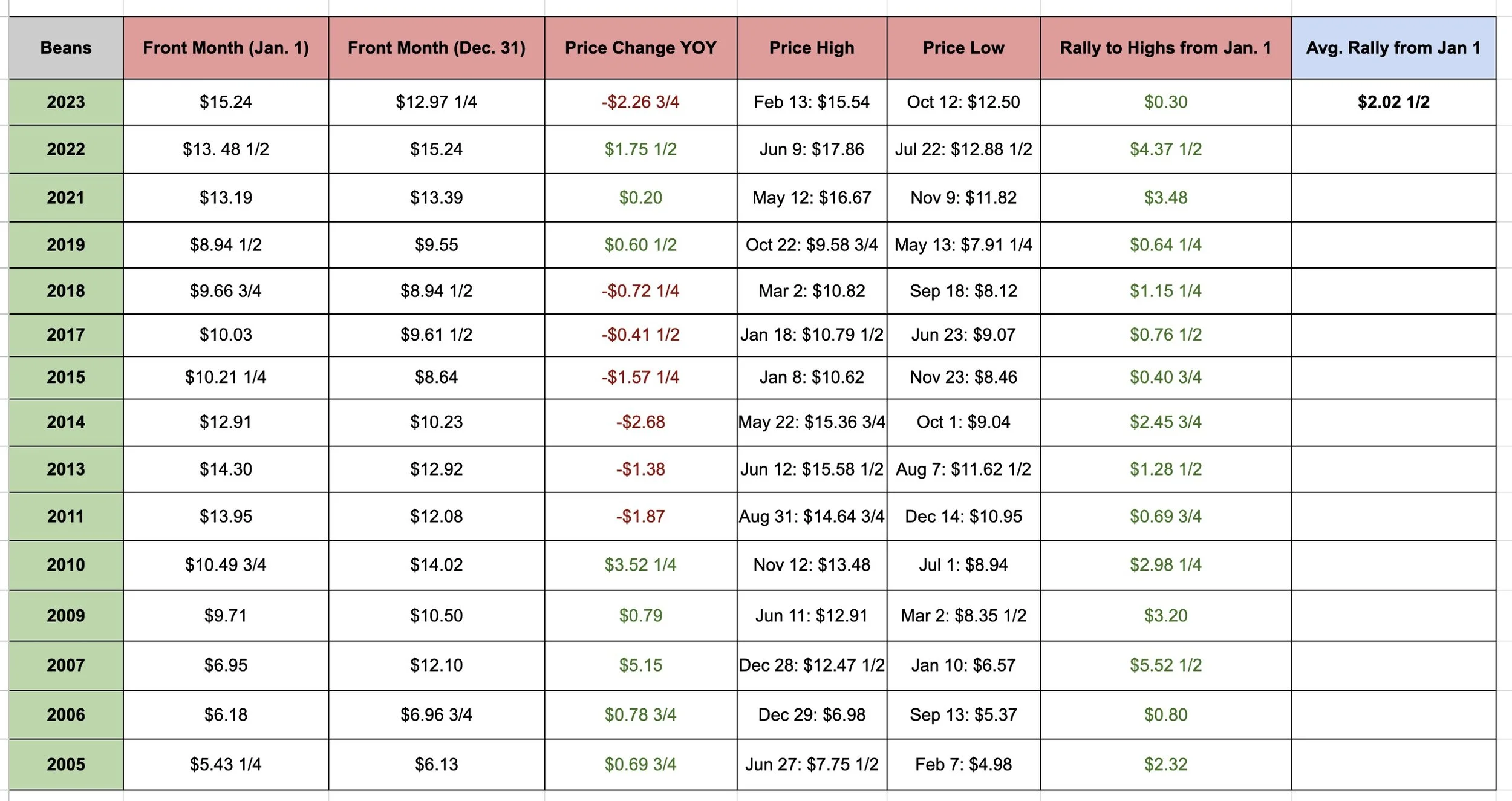

Now remember these next two charts? I shared them over the course of the past week. This chart shows the front month highs. So for example, right now our front month is March corn.

Only 1 time did we have the front month make it's highs in January. Which was last year, even though December corn made it's highs in June.

Election & Non-Election Year Data

My point is that there is a good chance prices will be higher towards spring and summer. We "almost" always get a seasonal rally. Typically the size of this seasonal rally comes down to South America production and if we get a weather scare for our crops here in the US.

I still believe that Brazil's second crop corn could very well be a lot smaller simply due to the late planting of beans potentially leading to less acres and pushing the crop into a non favorable time frame. But of course I could be completely wrong.

My biggest concern is still our already massive +2 billion bushel carry out. If we were to raise a bumper crop this year, that carryout could continue to grow. So that is the biggest risk to not seeing higher corn.

As we have mentioned since last week, for some of you now might be a good time to get courage calls. They will help you remove the emotion of making a sale when we do rally and also add to your bottom line if we rally.

For some of you, it might make sense grabbing some cheap puts. However, I am not the biggest fan of protecting mutli-year lows. So if you do decide to do so, make sure you do not overspend on your protection.

Some of you should be sitting on your hands. If you want to know what YOU should be doing and want to know what makes the most sense for your operation. Please give us a call and we would gladly help you completely free. (605)295-3100.

Taking a look at the chart, we need to protect those lows if we don’t want to see a leg lower. We also need to take out our highs from the day of the USDA report to confirm more upside.

The funds are short -260k contracts, which is one of the largest on record. So I do not believe they will become much more aggressive sellers at these levels. But that doesn’t mean we can’t go a little lower from here.

Yesterday actually marked the first time the entire year that the funds did not add to their short corn position.

Bottom line, this isn't the place to be making sales. Seasonally we go higher from here. The funds hold a record short, which is usually followed by a wave of buying. We just need a reason for the funds to cover that massive short position. How big of a rally we see when they decide to do so is still to be determined.

We want to be making sales when we get that seasonal rally or weather scare. In the meantime, unless you have plenty of storage, you should be being proactive. Again, if you need help developing a plan of attack please reach out to us. (605)295-3100.

We need to hold $4.40, if we break below that we could see additional bleeding.

Corn March-23

Soybeans

Beans continue yesterday's lower price action.

Beans are getting smacked pretty much just because of South America. They put some rains in the forecasts for Argentina, Brazil weather looks good, and basis continues to weaken in Brazil.

Farmers in Brazil have started selling as early harvest gets underway, so this has also added pressure.

All of this led to profit taking following the recent +40 cent rally.

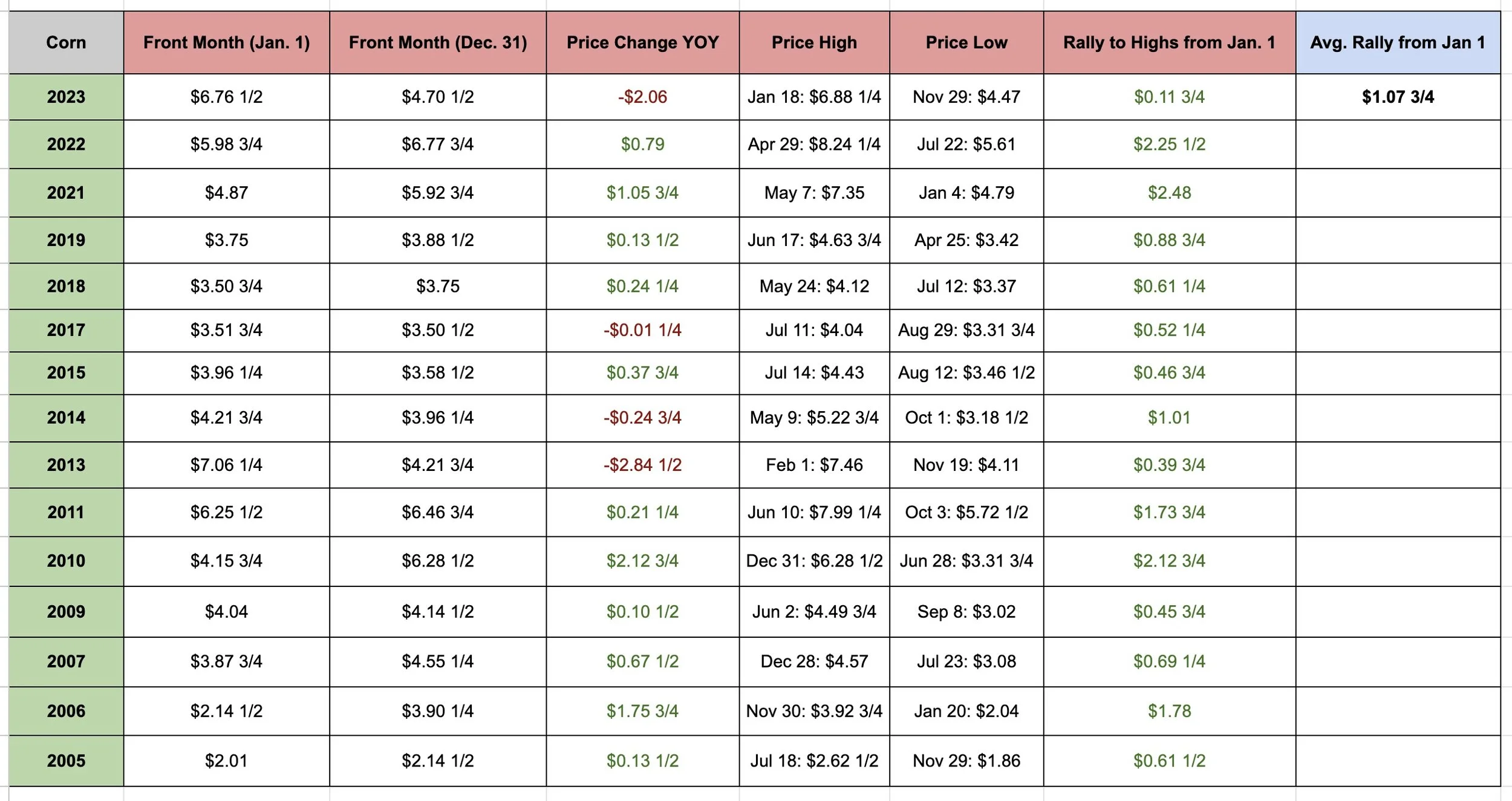

When do soybeans typically make their highs?

If we use the front month, there have only been 2 years where soybeans made their highs in January. We did so in 2015 and 2017.

Here is the number of times we have made our highs in each month:

January: 2 (2015, 2017)

February: 1 (2023)

March: 1 (2004, 2018)

April: 0

May: 2 (2014, 2021)

June: 5 (2005, 2009, 2010, 2013, 2022)

July: 1 (2008)

August: 1 (2011)

September: 1 (2012)

October: 1 (2019)

November: 1 (2010)

December: 3 (2006, 2007, 2020)

Election & Non-Election Year Data

Now these numbers are little more sporadic than the corn ones. But the point still remains the same. Typically we will see much higher prices after January. Our average rally from January 1st is still well over $2 even if you take out the years 2008 and 2012.

So seasonally, this is not the time to be making sales. We want to be making them when we get that scare.

I do not like making sales here. But if you are forced to make a sale and have to choose between corn or beans right now, it probably makes more sense to make some in the beans because of the carry, cash, and more downside risk if Brazil's crop turns out larger than expected.

If you have unpriced bushels or are behind on sales, and are nervous about the downside, it is never a bad idea to lock in a floor here. Especially with our downside risk if we happen to break below $12 or if Brazil's crop gets bigger. Both are possible. Make sure your puts are cheap.

For some of you, it's days like today where you may want to look at courage calls. It's the same situation for corn. Courage calls help you make sales and remove the fear and greed.

Not all of you should be getting puts. Not all should be getting calls. For some of you, you shouldn’t be doing anything. Please give us a call with questions or if you do not have a hedge account and would like to set one up. (605)295-3100.

So far we have still held the lows. Don’t be surprised at all to see soybeans fractionally take out those lows before reversing higher. A lot of times big money and algos will do that to fake out traders and hit everyones stops.

I believe we will see higher prices long term. But that doesn’t mean we can’t take a trip lower in the meantime. The technical situation has turned bearish. We need to hold $12. If we fail to do so, there is still a giant pocket of air to the downside. The next big levels of support would be $11.75 and $11.45

Soybeans March-23

Wheat

The wheat market sees a little bit of profit taking, technical selling, and outside news pressuring the markets.

Earlier this week we got a little boost from Black Sea tensions, but as always, that rally was sold.

We also have expected moisture to fall over key growing areas here in the US the next two weeks. This also added pressured.

The biggest news today for wheat was China approving Argentina imports. This is negative for US wheat because it creates even more competition than we already have.

The problem for wheat is that we just have an abundant amount of supply in the world right now.

However, we do have lower acres projected here in the US as well as some global weather issues. The funds are short around -40k contracts of wheat. So if they are going to cover anything, I could very easily see them look to cover first.

Bottom line, now is still the time of year where wheat news is lacking.

I still view wheat as a sleeper and could see prices much higher from here. But as always, the hardest thing to gauge in the wheat market is not "if" we go higher but "when". And how low do we have to go before making a meaningful rally. Seasonally, we do move higher from here.

With prices still at the bottom end of the range, this is not the place to be making sales. If you have unpriced bushels, want to lock in a floor, or are worried about prices falling. Consider cheap puts. Give us a call for exact recommendations or if you just want to talk about your operation. (605)295-3100.

One thing I did notice today is that KC wheat made a bearish key reversal which is negative, as we took out yesterdays highs then closed below yesterdays lows. Not a great sign there. We do still however remains +40 cents off the recent lows. We also saw the 5-day moving average cross over the 20-day in both Chicago & KC which is considered a buy signal for some other advisors.

For me to get extremely excited about KC wheat I need us to break out of this brutal range. Which would mean a break above $6.72 which is still a ways to go. For Chicago, I need a break above $6.38. Then that would really open the door to much higher prices.

Chicago March-23

KC March-23

MPLS Mar-24

Minneapolis Spot Floor

Here is the spot floor closes.Note that high pro spring wheat is trading very firm.

To calculate a fair offer to your local elevator, find out the freight rate to CHIC and beyond plus the margin that the elevator gets for handling the grain. Take it off of the spot floor bid.

As an example if you have an elevator on the RCPE you would look up the rate HERE.

Livestock

Cattle continues it's bull run. I have been saying for some time that I think we had some more room to run.

We could still certainly see more upside, but I am being aware that we could run into some resistance here. But for now, the charts look strong.

We continue to see strength from stronger cash markets and technical driven buying.

Expectations for the USDA cattle inventory report on Wednesday is for them to show further liquidation of the US beef cow herd. This looks to be supportive of both live and feeder cattle.

Feeder has also found some support with the recent weakness in corn.

We need to keep in mind that this market is very overbought.

Live Cattle April-24

Feeder Cattle Mar-24

Cotton

Some other advisors that focus on cotton have put in buy signals for cotton.

We had a big pullback today but still remain in an uptrend.

Cotton Mar-24

Want to Talk?

Our phones are open 24/7 for you guys if you ever need anything or want to discuss your operation.

Hedge Account

Interested in a hedge account? Use the link below to set up an account or shoot Jeremey a call at (605)295-3100 or Wade at (605)870-0091

Check Out Past Updates

1/25/24

DEVELOPING A GRAIN MARKETING PLAN WITH TECHNICALS

1/24/24

5TH GREEN DAY IN A ROW: WAYS TO OUTPERFORM THE MARKET

1/23/24

GRAINS CONTINUE TO BOUNCE

1/22/24

HAVE MARKETS FOUND A BOTTOM?

1/19/24

FAILED REVERSALS & ELECTION YEAR RALLIES?

1/18/24

UTILIZING TRENDS & TECHNICALS IN YOUR GRAIN MARKETING PLANS

Read More

1/17/24

FUNDS & CHINA

1/16/24

BEANS TRY TO BOUNCE FOLLOWING BEARISH USDA

1/12/24

FULL USDA REPORT BREAKDOWN

1/11/24

USDA REPORT TOMORROW. ARE YOU PREPARED?

1/10/24

PREPARING FOR THE USDA

1/9/24

TURNAROUND TUESDAY & USDA PREVIEW

1/8/24

HOW TO GET COMFORTABLE AHEAD OF USDA REPORT

1/5/24

FIRST WEEK OF NEW YEAR FLOPS

1/4/24

REALIZING POTENTIAL UPSIDE BUT BEING AWARE OF RISKS

1/3/24

RAINS & BRAZIL ESTIMATES

1/2/24

UGLY DAY: BRAZIL, RISKS, & MARKETING STRATEGIES

Read More

12/29/23

SHORT TERM RISK & LONG TERM UPSIDE

12/28/23

BRAZIL RAINS?

12/27/23

EFFECTS OF US DOLLAR COLLAPSE ON GRAINS & STRATEGIES TO CONSIDER

12/26/23

GETTING COMFORTABLE WITH ALL POSSIBILITIES

12/22/23

BEAN BASIS RECOMMENDATION TO TAKE BACK CONTROL FROM BIG AG

12/21/23

COMMODITIES ARE DIRT CHEAP VS STOCKS

12/20/23

ARE YOU COMFORTABLE WITH $3 CORN OR $6 CORN?

12/19/23

CORN FIGHTING NEW LOWS & BRAZIL RAINS

12/18/23