MORE PAIN FOR GRAINS

MARKET UPDATE

You can still scroll to read the usual update as well. As the written version is the exact same as the video.

(Main Takeaways: Corn 3:20min, Beans 7:10min, Wheat 10:38min )

Futures Prices Close

Overview

Another ugly day for the grains as corn leads us lower.

Now off their highs:

Corn: -33 cents (-7.54%)

Beans: -79 cents (-7.21%)

Wheat: -36 cents (-5.83%)

Why are the grains falling?

For starters, Friday the USDA confirmed big crops. Which means the demand side of the equation will have to do the heavy lifting.

We have harvest pressure. Fund selling. Less geopolitical tension. China has failed to provide any more details on their stimulus. Brazil is getting rain.

Harvest Pressure & Funds

The dry conditions in the US have ramped up harvest fast. Which means more harvest pressure. Many producers aren’t super interested in paying interest & storage fees. Which leads to more farmer selling off the combine. Thus pressuring prices.

Outside of that, the biggest thing is the funds.

Just like I mentioned in my updates on Oct 3rd & Oct 4th, this rally was due mostly to short covering.

We saw a HUGE short covering event. But now that the funds are near even they are taking a more balanced approach.

When the funds were buying, it was offsetting all of that hedge pressure. But the moment they stopped buying is the moment the markets succumbed to that hedge pressure.

From Oct 4th's Update

Make it stand out

Whatever it is, the way you tell your story online can make all the difference.

The funds simply do not see reasons to flip long here. Like I mentioned 2 weeks ago, for them to flip long it is going to take a real market moving factor.

Something such as a Brazil weather scare. Massive Chinese buying. etc. But we just do not have that.

It is a lot easier to make the argument that they could flip long corn given how much friendlier the balance sheet outlooks are for corn rather than beans. Corn has a potential solid demand story going for it.

For beans it would likely take an outside factor such as Brazil given how bearish the global balance sheet is.

Fund Postions from Advanced Trading Inc

China & Brazil

The other big reason for the sell off in beans was China.

China artificially pumping their economy with stimulus money was one of the biggest reasons for the rally along with fund buying. But this headline has faded and China has provided zero additional details on the stimulus.

When China isn’t pumping money into the bean market, the trade looks at the awfully bearish global situation to go along with the harvest pressure we are seeing.

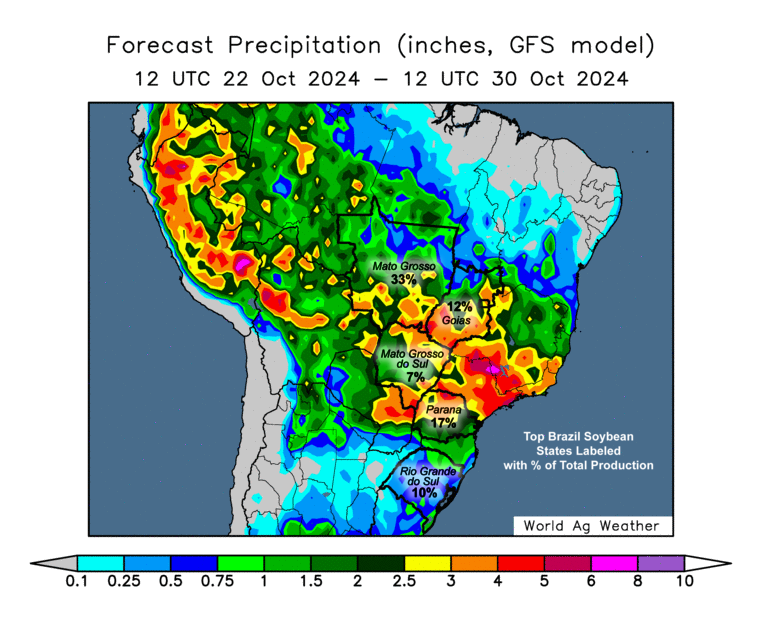

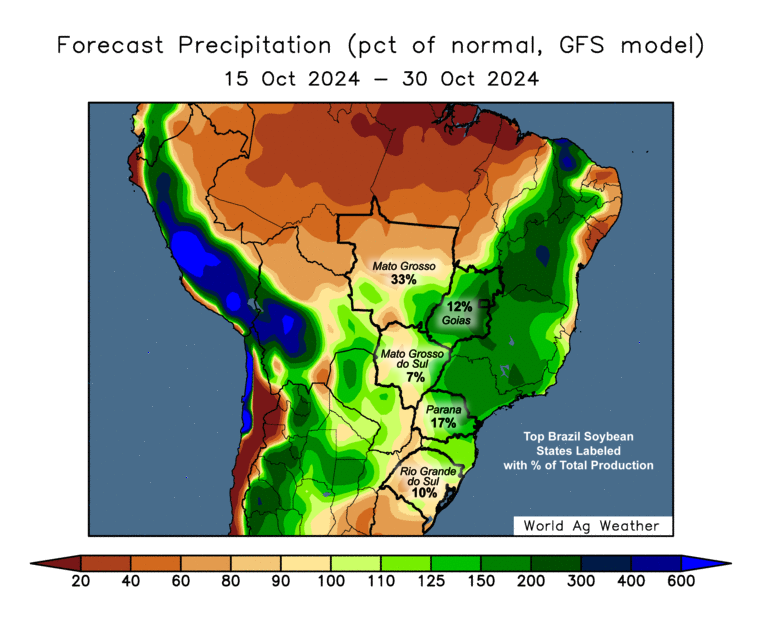

Brazil is getting rain which hasn’t helped prices, but that premium is completely removed. Brazil getting rain did not have a massive influence on this sell off.

Brazil bean planting is at 9.3% complete vs 17.4% last year. But this is not a threat.

Brazil has a long growing season. When these rains come planting will catch up very fast.

So now the weather market is going to move into that Nov-Jan time frame. That is the period where you can get a possible weather scare.

What the late planting did negatively impact is the 2nd crop corn however. As late bean planting pushes that 2nd corn into a less favorable growing window. According to Dr. Cordonnier: If Brazil's beans aren’t 60% planted by the end of Oct it will push a big portion of that 2nd corn into less than ideal window.

Next 2 Weeks

Now let's jump into the rest of today's update where we go over short term & long term outlooks and what is going to drive these markets....

Today's Main Takeaways

Corn

First let's look at the chart.

Awful action in corn today.

We are no longer in an uptrend on the chart.

On the positive side we held $4.00

This is a huge spot for corn to hold. If we do not hold $4.00 there is not much holding us back from testing those lows. I would be lying if I said a re-test of $3.85 was impossible.

Short term, it looks like we could be getting more harvest pressure just like I had mentioned we likely would 2 weeks ago.

The problem I see short term is that there is no fund short covering here to meet the farmer selling. We have a lot of farmer selling & supply hitting the market.

Long term, there is a very strong argument to be made for corn that demand could lead us higher.

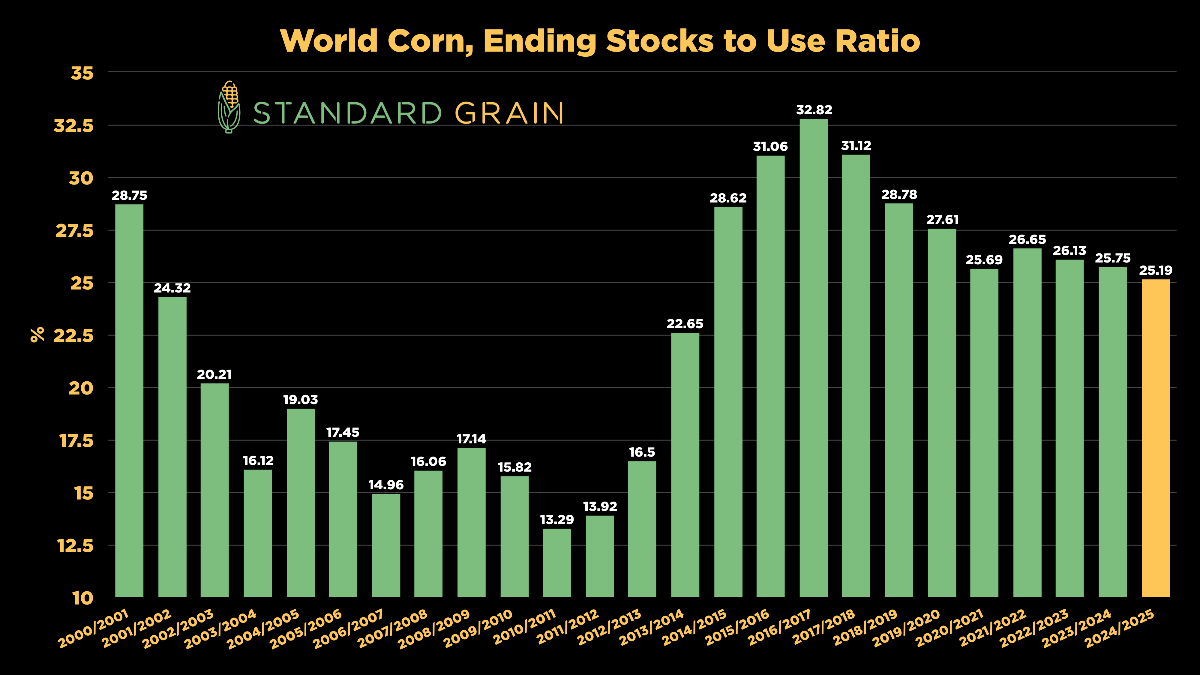

When you look at the supply & demand situations for corn & beans they are complete opposites.

The USDA currently projects soybeans to have the most bearish global outlook of all time. It is about as bearish as it possibly can get without a production flop in Brazil.

Corn on the other hand.. demand is very solid. Exports are strong. Ethanol demand is stout.

If ethanol demand continues at it's current pace, it alone could add an additional 100 million bushels of corn demand.

We have seen our yield bumped every single USDA report.. yet our carryout has continued to shrink report after report.

Yield is going to be up +7 bpa this year.

Yet our carryout could very possibly shrink YOY due to demand. (Current carryout is 1.99 vs 1.81 billion last year).

Next year we could very well plant less acres as high fertilizer & costs of production aren’t going to be incentiving extra acres. Then we are going to be adding all of this built up demand on top.

Corn definitely has a story going for it long term. Let's just hope beans don’t act as anchor.

Looking at risk management, I hope we hold $4.00. If we do not, there is a chance we test those lows once again.

If you are someone who followed our protection signal at $4.23-26 and still has that protection, I like keeping it until you make a sale.

If you are someone who does not have protection, but is going to have to move something off the combine then your best bet would be to grab puts now. It is called hedging, not guessing.

In my opinion, corn likely doesn’t start to move up out of here until harvest is out of the way. Altough I don’t see us continuing to scream lower like we have, there is definite downside risk here. A lot of corn is hitting the market right now, so a rally is going to be hard until harvest is over with.

*Our $4.23-26 protection signal: (CLICK HERE TO VIEW IT)

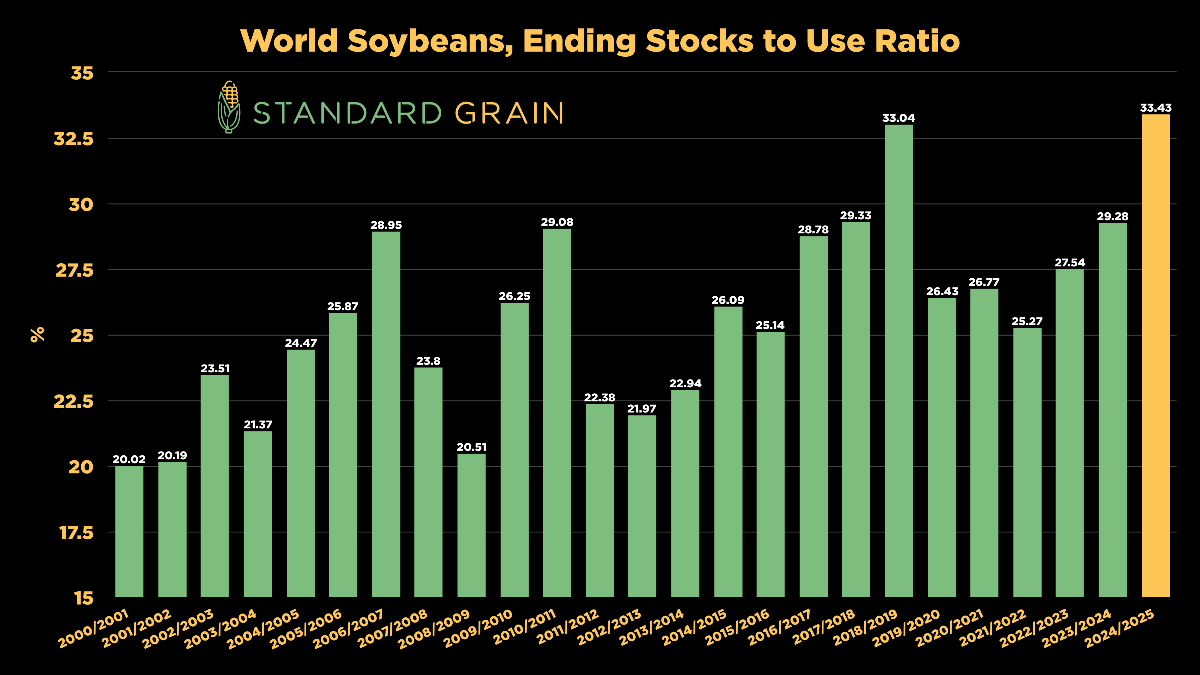

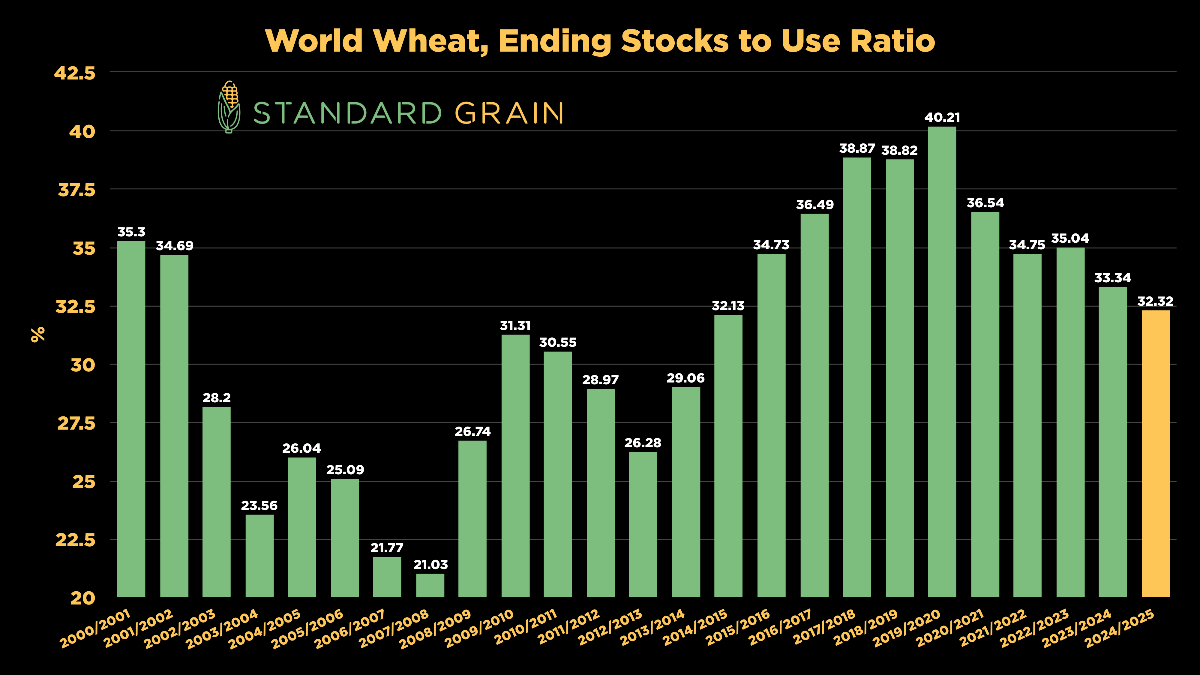

World Stocks to Use Ratio Visual

To help give you a better visual on how much more bearish the global bean situation is vs the corn one, here is a chart comparison from Standard Grain.

As you can see, corn is in line with other years. The number isn’t considered "bullish" but it's not burdonsome like the bean one.

If you look at beans, you can see that our global stocks to use ratio is at an all time high.

It is even higher than it was during the trade war when we saw $9.00 beans. This number alone is something to be cautious of when looking at beans. The only real thing that can change that is likely going to be a Brazil problem.

(Something to note: global corn numbers are not as important as global bean numbers. The US is by far the #1 corn player. For beans we are player #2 behind Brazil)

Jason Britt, President Central States Commodities:

"End users probably could look at a few things down here in corn. Keep in mind that USDA's global stocks to use ratio Friday was the lowest in 11 years"

Soybeans

Soybeans continue to fall.

First let's look at the chart.

We have broken several layers of support. As we took out $10.00

There is not much support between here and those old lows.

On the bright side, we had an amazing daily candle & close.

We were down -15 cents at one point (@$9.81) but rallied back +10 cents leaving a nice looking doji.

This gives me "optimism" that perhaps we are due for a bounce, but we did not make a reversal or anything that would further indicate a bottom.

I do not know whether we will make new lows or not. That is why I had been preaching keeping a floor under unpriced grain especially if you had to move it off the combine.

I'll be flat out honest, the soybean outlook is bearish.

As I mentioned, our global stocks to use ratio is the highest ever and indicates $8-9 beans.

BUT that "can" change.

These are the potential factors that can change the outlook on beans:

1). We get a Brazil scare or production flop.

Just a simple weather scare will not create a bull market. But it will create a rally & pricing opportunity. Now if Brazil actually sees a flop in production, then things could get interesting. As if their actual production falls it will change the global balance sheets & create a more demand-led rally rather than a short-term supply-driven one.

For now Brazil rains look like they are there stay. But forecasts as we all know can be unreliable.

*One positive I do potentially see is the fact that Brazil is expected to export less beans than last year, despite being expected to have a lot higher production. It tells you that perhaps their domestic demand is solid.

2) China Stimulus

We rallied hard on this. Now we are selling off hard on the lack of it.

When China tries to boost their economy it means consumers are going to be spending more money. Which will ultimately lead to more demand for soybeans.

I do not think China is done trying to boost their economy, but it is a wild card.

3) China decides to buy a sh*t ton of beans

We are at the time of year where export sales to China should start to ramp up.

China is the one buyer who can come in and save this market.

Spread Action:

One potential friendly factor we have is the spreads.

They continue to firm up. For example, Nov-24 beans were down -5 cents today while Nov-25 beans were down -11 1/4 cents.

This isn’t something you typically see in a market that is going to continue to fall. Usually in a downtrending market the front month will lead us lower.

Could be a good sign.. or maybe it's just wishful thinking.. Will see if they continue to firm or not.

Nov-24 & March-25 Spread

The spread action was one of the things that made me very cautious back in my Oct 3rd update when we were trading at $10.45.

Prices jumped $1.00 yet the spreads didn’t move.

From Oct 3rd Update

Make it stand out

Whatever it is, the way you tell your story online can make all the difference.

Harvest:

I wanted to note that harvest came in at 67% complete. Usually you start seeing less harvest pressure once we accelerate past 50% complete. So perhaps the hedge pressure will subside slightly here soon.

Risk Management:

Taking a look at risk management, nobody is smarter than the markets. All you can do is play the cards you are dealt.

If you did not follow our sell signal at $10.65, there is still a LOT of downside risk in this market.

So keep a floor under unpriced grain. Especially if you have to move it off the combine.

If you have questions, give us a call or text (605)295-3100. As you are all in different situations.

*Friday Sep 27th's sell signal: (CLICK HERE TO VIEW)

Wheat

Wheat takes another hit, but has held up far better than corn & beans on the charts. As we are still somewhat in an uptrend.

We are sitting right at that key $5.80 support. I would like a bounce here.

If this level fails, the next support is $5.65

I do not have a ton of wheat today.

It looks like we got a buy the rumor sell the fact out of Russia. As Russia set a price floor for wheat. They are basically trying to limit wheat exports as domestic inflation is soaring.

The middle east war wasn’t a major market mover, but the de-escalation isn’t helping prices.

Russia is going to be the #1 market mover.

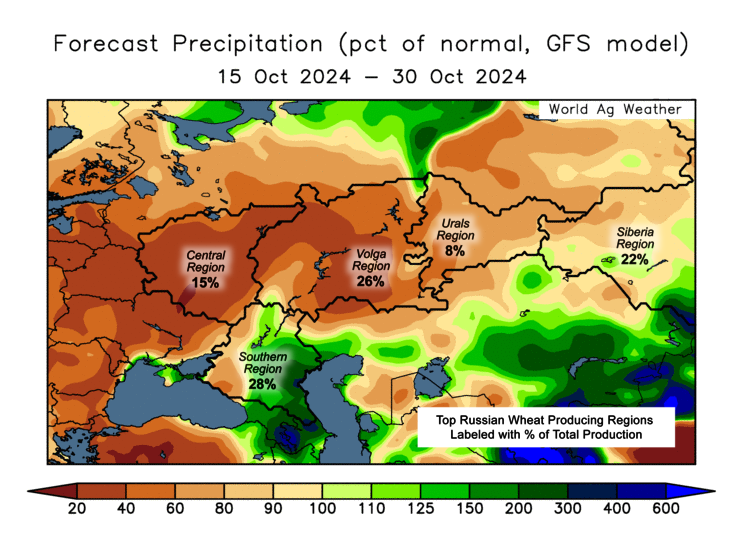

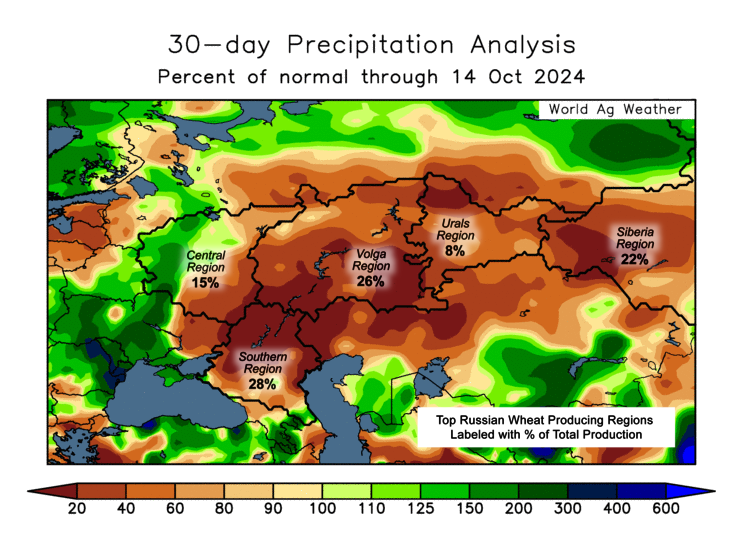

Their wheat carryout is projected to drop to just 9 MMT next summer. That is about half the size it was last year. This is also before even factoring in the poor start to the 2025 crop. World supplies are going to get tighter when the world's leading exporter's carryout get smaller.

There are still plenty of factors globally that could possibly lead to higher prices later down the road.

We have a bullish world balance sheet. Where global ending stocks continue to fall year over year.

Chart Credit: Standard Grain

Russia & Ukraine have issues.

France has their smallest crop since 1986.

We have seen a little pressure due to rain in Russia. The rain is a good start, but not enough yet. If it stays dry the wheat market could grab some attention in the coming weeks or months.

Next 2 Weeks

Past 30 Days

Bearish argument from Grains Gorilla:

"The wheat market is ignoring the most important story around. Russia rains are here! Combined 43k net short across all 3 wheat classes is one of the smallest shorts all year. Market has pumped way too much premium into the Russia export story. It's a non issue."

Bullish argument from Black Sea Guru, Andrey Sizov:

"This is a bullish story for the value of wheat at the global price level, since - if put into practice - the pace of Russian exports is likely going to decrease significantly in the near future." (talking about Russia price floor)

"If your broker says the price floor didn’t work in the past and won’t work now he doesn’t know what he's talking about."

We alerted a few sell signals the past few weeks in wheat at $5.99 and $6.12. If you followed them, then I like being patient here.

Past Sell or Protection Signals

We recently incorporated these. Here are our past signals.

Oct 2nd: 🌾

Wheat sell signal at $6.12 target

Sep 30th: 🌽

Corn protection signal at $4.23-26

Sep 27th: 🌱

Soybean sell & protection signal at $10.65

Sep 13th: 🌾

Wheat sell signal at $5.98

May 22nd: 🌾

Wheat sell signal when wheat traded +$7.00

Want to Talk?

Our phones are open 24/7 for you guys if you ever need anything or want to discuss your operation.

Hedge Account

Interested in a hedge account? Use the link below to set up an account or shoot Jeremey a call at (605)295-3100.

Check Out Past Updates

10/14/24

GRAINS SMACKED. BEANS BREAK $10.00

10/10/24

USDA TOMORROW

10/9/24

MARKETING STYLES, USDA RISK, & FEED NEEDS

10/8/24

BEANS FALL APART

10/7/24

FLOORS, RISKS, & POTENTIAL UPSIDE

10/4/24

HEDGE PRESSURE

10/3/24

GRAINS TAKE A STEP BACK

10/2/24

CORN & WHEAT CONTINUE RUN

10/1/24

CORN & WHEAT POST MULTI-MONTH HIGHS

9/30/24

BULLISH USDA FOR CORN: RECOMMENDATION

9/27/24

UP-TOBER? SELL SIGNAL, TARGETS, & FACTORS

9/27/24

BEAN SELL SIGNAL

9/26/24

NEW HIGHS BUT CONCERNING CLOSE

9/25/24

HIGHEST CLOSES SINCE JULY. UPSIDE & SALES CONSIDERATION

9/24/24

GREAT START TO THE DAY, AWFUL FINISH

9/23/24

MASSIVE DAY FOR THE GRAINS

9/22/24

EARLY YIELD TALK, DROUGHT, BRAZIL, SEASONAL LOWS & MORE

9/19/24

GRAINS SEE TECHNICAL SELLING

9/18/24

FED DROPS RATES, BRAZIL STORY, 2025 SALES?

9/17/24

TARGETS & WHAT TO DO IF YOU BOUGHT PROTECTION

9/16/24

WAS TODAY HEALTHY CORRECTION BEFORE GRAIN RALLY RESUMES?

9/13/24

CORN & WHEAT BREAK OUT: EVERYTHING YOU NEED TO KNOW

9/12/24

USDA RAISES YIELD BUT REPORT WASN’T ALL THAT BEARISH

9/11/24

USDA TOMORROW. MAKE OR BREAK SPOT ON CHARTS

9/10/24