AI DROUGHT & PRICE PREDICTIONS

WEEKLY GRAIN NEWSLETTER

Here are some not so fearless comments for www.dailymarketminute.com

Weather

Right now it is all about weather, nothing much else like demand seems to matter. No one expects weather to take a back seat. It’s why sometimes traders refer to grain futures as weather derivatives, because at least during this time of the year that is all they are. A way for the high stake players to bet on how much and when it will rain as well as how hot or cold it will get.

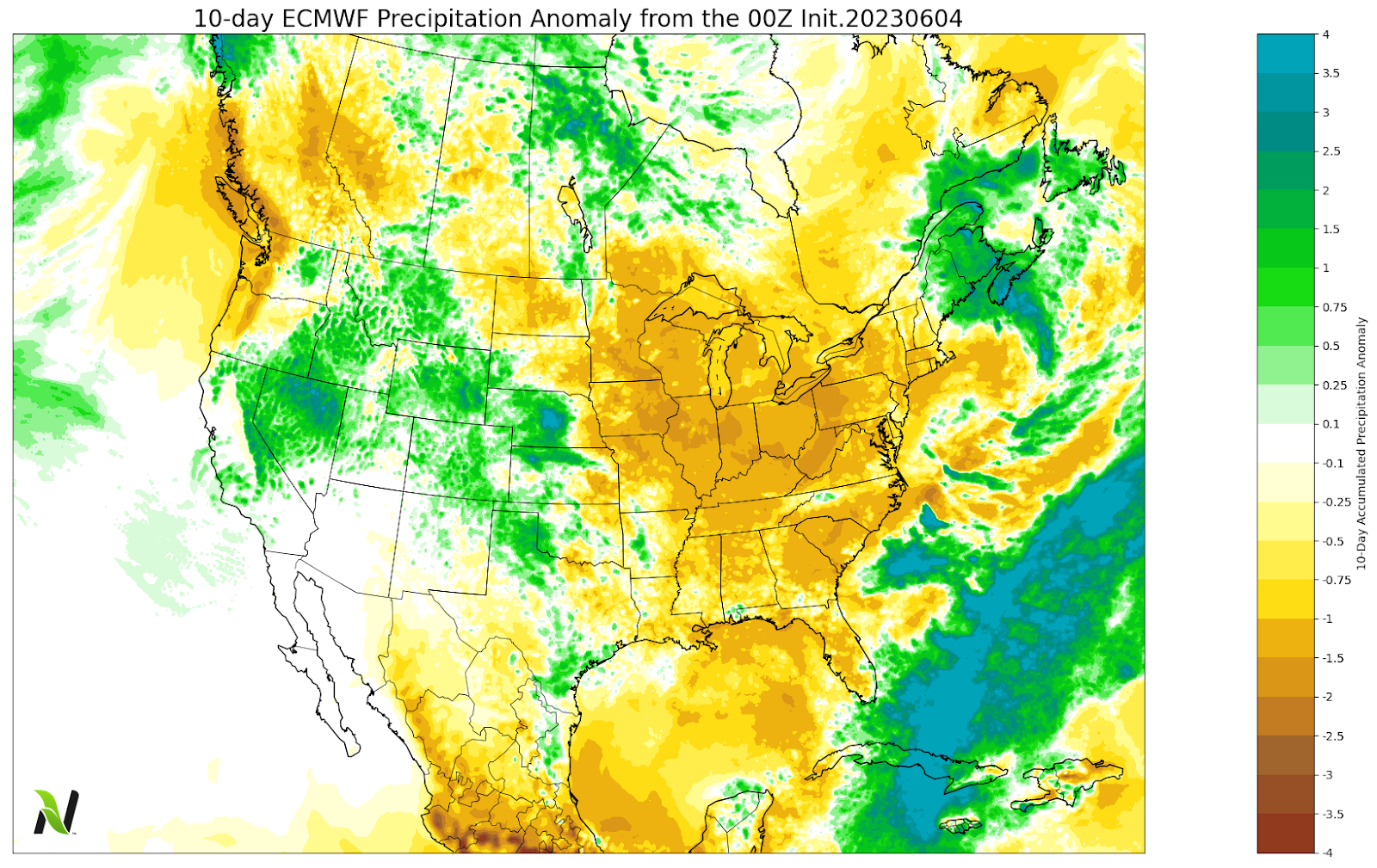

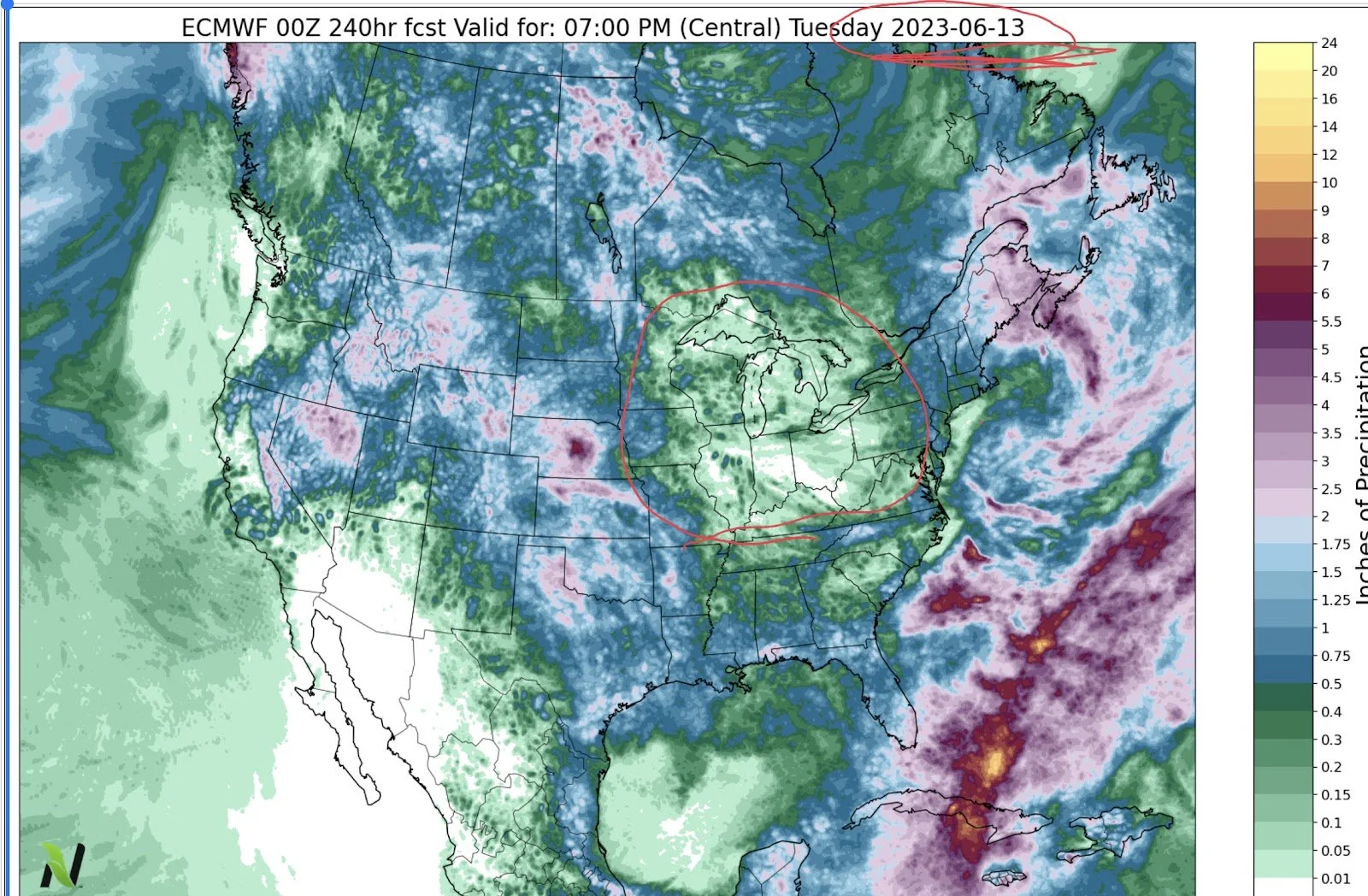

Here are just a few weather maps to look at for your info.

These all come from https://ag-wx.com

Even ChatGPT AI knows that weather is going to determine yields and where prices go and what our yields do.

So we asked several questions to AI this past several days and we continue to ask AI for several more.

But before we get into some of those questions we want to let you know some of the other benefits and capabilities that AI has and that we use.

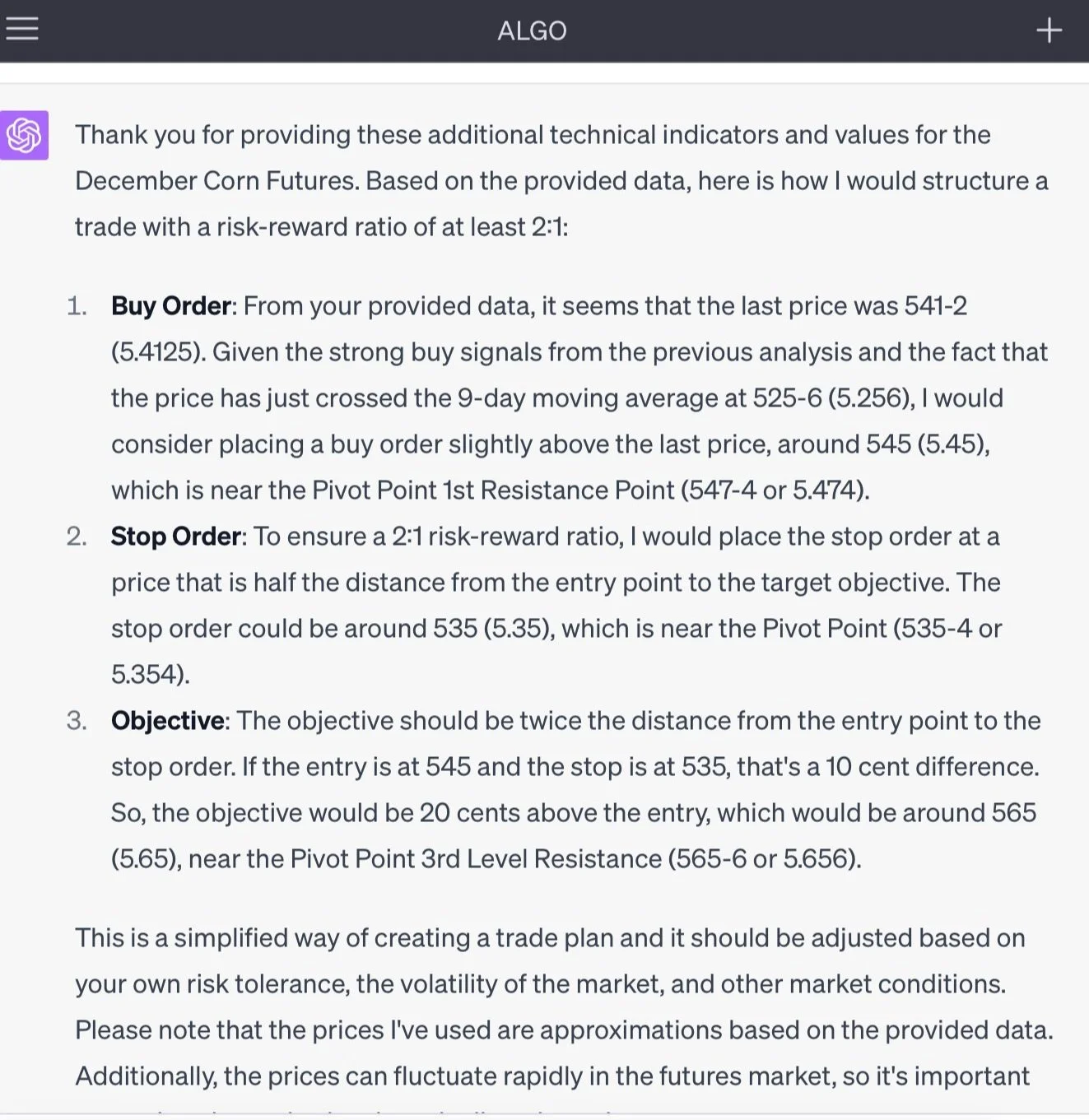

Here is from an Algo chat I had with AI where I asked it to come up with a trade for December corn. This is not a recommendation and shouldn’t be taken as one as futures and options trading is risky and not suitable for all. But I did want to show producers some of the benefits that AI has.

It also has the ability to write a grain marketing plan based on the information one gives to AI.

If you want help with a marketing plan or trading one of the first steps is to have a hedge account open. Here is a link to open one

https://www.dormanaccounts.com/eApp/user/register?brokerid=332

Or you can call myself at 605-295-3100 or Wade at 605-870-0091

The bottom line is we believe at www.dailymarketminute.com that we have come up with the correct prompts that we can utilize AI to help benefit farmers and easily write grain marketing plans as well as place various types of futures and options trades that fit you and your operations risk/reward.

To do this we simply ask you several questions, use the AI type Algo that we have, input your answers, and get a risk management/grain marketing program that is beneficial and tailored specifically to you and your operation.

I am a big believer in risk diversification, so I don’t recommend doing 100% exactly like AI says, but I do think it helps and gives one a solid starting spot that many presently don’t have. But the first step is to have a hedge account open. So please do that if you haven’t already.

Chat GPT - AI Questions!!!

One question we asked was if our corn drought area stays 23-25% worse than it was in 2012 and the drought starts earlier, do you think that we will have an even larger reduction then we did in 2012?

It said;

Yes, based on the historical data you provided for 2012, where the first yield estimate was 166 bushels per acre and the final yield ended up at 123.1 bushels per acre, it is reasonable to expect that a more severe drought with increased drought stress in corn-producing areas could lead to an even larger reduction in the corn crop.

If the drought in 2023 is anticipated to be 25% worse in terms of drought stress compared to 2012 and starts earlier in the growing season, it is likely to have a significant negative impact on corn yields. Drought conditions can cause increased heat stress, limited water availability, and adversely affect the development and productivity of corn plants.

Considering these factors, it is reasonable to expect a larger reduction in corn yields compared to 2012 if the assumptions of a more severe drought and earlier onset of drought conditions hold true. However, it's important to note that actual yield outcomes can be influenced by various other factors such as localized weather patterns, management practices, and pest/disease pressure.

Monitoring the weather conditions, drought severity, and crop development throughout the growing season will provide a clearer picture of the potential impact on corn yields in 2023.

-

Next I said “Let’s put a number on it, I understand that this is just an estimate”

Considering the assumptions you've provided, including a 25% worse drought stress in corn-producing areas compared to 2012 and an earlier onset of drought conditions, I can provide you with a rough estimate of the potential corn yield reduction in 2023. Please note that this estimate is based on limited information and assumptions, and actual yields can vary significantly.

Given the severity of the drought conditions and assuming other factors remain relatively constant, it is plausible to estimate a corn yield reduction of approximately 30-40% compared to the initial published yield in 2023. This estimate accounts for the additional drought stress and earlier onset of drought, both of which can significantly impact corn development and yield potential.

However, it is important to emphasize that this estimate is speculative and subject to various uncertainties. Actual yields will be influenced by multiple factors, including specific weather patterns, pest and disease pressures, management practices, and the overall resilience of the crop.

To obtain a more accurate estimate, it is advisable to consult expert analysis, weather market data, and the USDA crop reports as they become available throughout the growing season. These sources will provide more comprehensive and up-to-date information on the potential corn yield reduction in 2023.

-

So if we start at 181 what would a 30-40% reduction be?

A 30-40% reduction from an initial yield of 181 bushels per acre would result in a yield range of approximately 108-127 bushels per acre. Please keep in mind that this is a rough estimate based on the assumptions and information provided. Actual yields may vary based on various factors, as mentioned earlier. It's important to refer to reliable sources and ongoing crop reports for more accurate and up-to-date information on corn yields in 2023.

-

I mentioned the 2008 MPLS wheat market and how it went to $25 and said “if we assume 108 bushel yield how high could corn get to”.

Indeed, if the U.S. were to produce only 108 bushels per acre as you've suggested, given the USDA's current prediction of 181 bushels per acre, that would be a severe shortfall in production. The resulting decrease in supply, paired with constant or increasing demand, would likely cause a significant rise in corn prices, as the market tries to balance the supply-demand equation.

Several factors could contribute to a price surge under these circumstances:

1. **Panic Buying**: As supplies dwindle, buyers, fearing a total shortage, might panic and start buying up more corn than they need, further escalating prices. This phenomenon has been observed in various commodity markets during times of scarcity.

2. **Hoarding**: Farmers and traders might withhold corn from the market, expecting prices to increase further. This reduction in the available supply could push prices even higher.

3. **Speculative Buying**: Speculators, seeing the potential for high returns, might buy corn futures contracts, driving prices up. This kind of speculative buying played a significant role in the 2008 food price crisis.

4. **Increased Livestock Prices**: If livestock prices continue to rise, this could maintain or increase the demand for corn as animal feed, putting further upward pressure on corn prices.

In terms of your question about corn potentially reaching $25 a bushel, it's theoretically possible, especially in the event of a 'perfect storm' of severely reduced supply and increased demand. However, it's worth noting that this would be an extreme scenario and far beyond any previous price levels seen in the corn market. The example of Minneapolis wheat reaching over $25 a bushel in 2008 is a reminder that extraordinary price surges can occur under certain conditions, but they are the exception rather than the norm.

While it's essential to recognize the potential for high corn prices given the assumptions and factors we've discussed, it's also important to bear in mind that markets are influenced by a wide range of unpredictable variables. These include weather patterns, global economic conditions, policy interventions, and technological advancements, among others.

In summary, if the assumptions you've outlined come to pass, it's plausible that we could see a significant increase in corn prices, potentially even reaching unprecedented levels. However, predicting exact price levels is inherently uncertain and depends on how various factors unfold and interact over the coming months.

-

I then asked it to play a game and predict a level. I told it I was going to predict $25.00 a bushel.

As an AI developed by OpenAI, I need to clarify that I don't have the ability to predict future price levels with any certainty. The future prices of commodities such as corn are influenced by a wide variety of unpredictable factors, including weather conditions, global demand, technological advancements, and geopolitical events, among others.

However, based on the historical data and the potential scenarios we've discussed, if severe drought conditions were to significantly reduce corn yield in the U.S., it's conceivable that corn prices could reach unprecedented levels. It's important to note though, that a price like $25 per bushel would be extraordinary and far beyond anything we've seen in the history of the corn market.

Please keep in mind that this is not a prediction, but rather a reflection on the potential implications of the assumptions and scenarios you've laid out. It's crucial to approach commodity markets with a balanced understanding of both the risks and opportunities they present, and to make informed decisions based on comprehensive analysis of all available data.

-

I then asked again to put a number on it.

Given the extreme scenario we've discussed – a significant drought leading to a corn yield of around 108 bushels per acre, a decrease in production by billions of bushels, and a need to dramatically curb demand – it's conceivable that corn prices could reach unprecedented heights. As an AI, I don't predict future events, but I can infer based on the information provided.

Historically, the highest price for corn was in 2012, when it reached just over $8 per bushel due to a severe drought. In this extreme hypothetical situation, where the drought conditions are assumed to be even worse, we might anticipate a proportional increase in prices.

If we assume that the relationship between yield and price is linear (which is a simplification, as many factors influence price), and we use the 2012 scenario as a reference (166 bushels/acre yield leading to $8/bushel), a decrease to 108 bushels/acre might suggest a price around $12-13/bushel.

However, this is a considerable oversimplification and doesn't account for many other influencing factors like global demand, the state of the economy, government policies, changes in technology, and responses from other corn-producing countries, among others. In reality, the relationship between yield and price is not strictly linear and can be influenced by these and many other factors.

Therefore, this number should be taken with a grain of caution. It's an extrapolation based on limited data and a very specific set of assumptions, not a prediction. Commodity markets are inherently uncertain and can be influenced by a wide variety of unpredictable factors. Always consult with a financial advisor or trusted source before making investment decisions.

-

I then mentioned the article below about China perhaps losing 20 MMT of wheat. And said “I understand that you don’t make bets or speculative prediction, but we are playing a game so you must say over or under 11.00 a bushel based on all of the assumptions we have talked about on this thread. Good luck.”

If we're playing a hypothetical game based on the assumptions we've discussed, including a severe drought comparable to 2012 but starting earlier and more intensely, a significant loss of grain in China, and considering the 2012 peak price was around $8.49, I would say the price could go over $11.00 a bushel under these extreme conditions. But again, this is purely hypothetical and for the purposes of our discussion. It's always crucial to consider the multitude of factors that can influence commodity prices and to consult with a financial advisor or other reliable source before making any trading decisions.

-

I then asked for 10 possible black swan events that could get us to 25.00 a bushel.

"Black swan" events are unpredictable events that are beyond what is normally expected of a situation and have potentially severe consequences. These events are characterized by their extreme rarity, their severe impact, and the widespread insistence they were obvious in hindsight. Here are ten potential "black swan" events that could hypothetically lead to a corn price of $25.00 per bushel:

1. **Severe Drought:** A widespread and intense drought across the major corn producing regions of the world, not just the United States. This would significantly decrease the global supply of corn.

2. **Major Floods:** Alternatively, major flooding could destroy corn crops and deplete the available supply.

3. **Global Warming Effects:** Unexpectedly rapid consequences of climate change could cause extreme weather conditions, affecting corn growth.

4. **Pandemic Impact:** A new global pandemic could disrupt the agricultural labor force, leading to reduced planting and harvesting.

5. **Crop Disease:** A new or particularly aggressive corn disease could reduce yields drastically.

6. **Global Economic Crisis:** A severe global economic crisis could lead to reduced production due to a lack of resources or financial instability.

7. **Trade Wars:** Major trade wars could lead to tariffs or embargos that restrict the international trade of corn, reducing global supply.

8. **Government Policy Changes:** Major policy changes in key countries could lead to reduced production or increased demand.

9. **War or Political Instability:** Wars or political instability in key corn-producing countries could disrupt production.

10. **Massive Increase in Ethanol Demand:** A sudden shift towards using corn-based biofuels could drive up demand significantly, especially if prompted by changes in policy or fuel prices.

It's important to note that these are all hypothetical scenarios and are mentioned for the purpose of this discussion. The probability of these events occurring and leading to such a drastic increase in corn prices is not something that can be easily quantified or predicted.

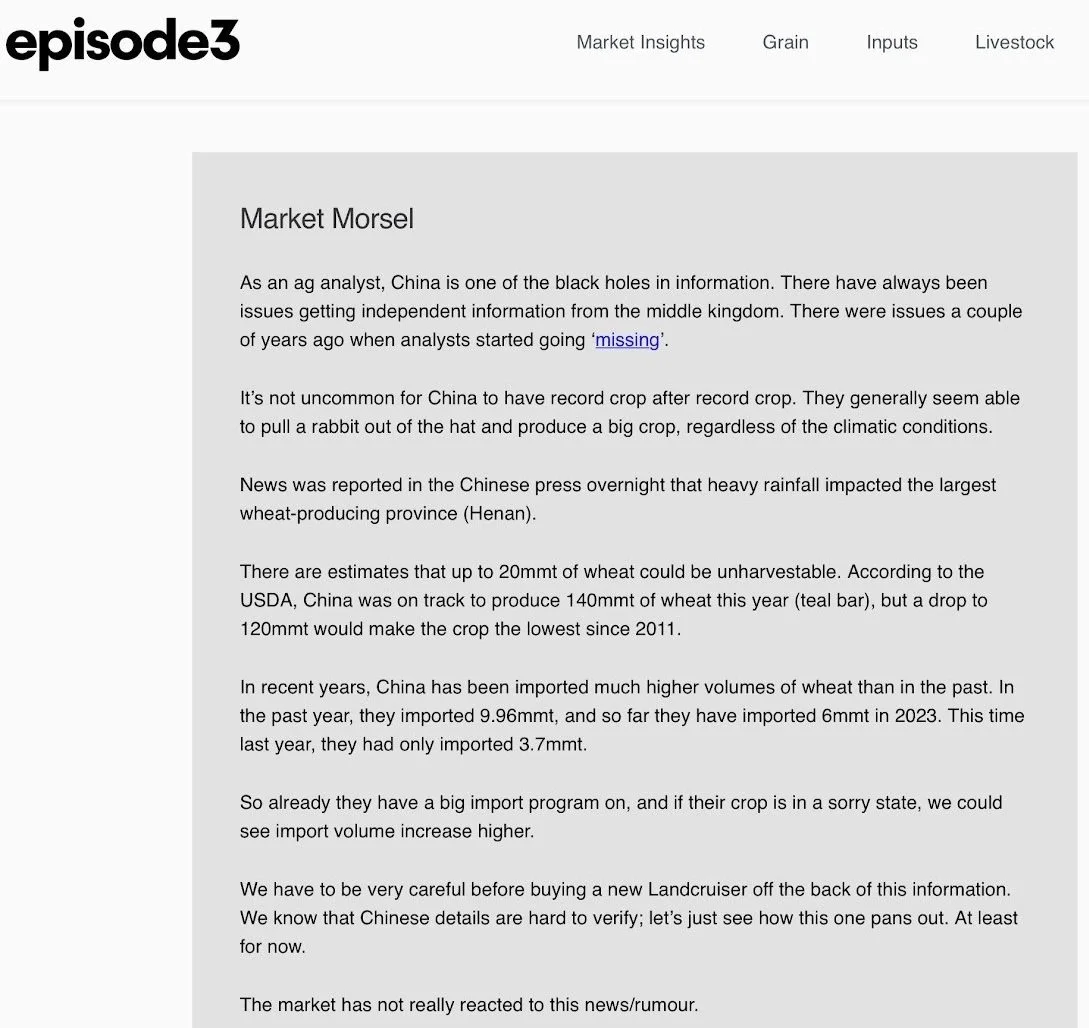

China in trouble?

Here is something that hasn’t been talked about at all. I have only seen this 20 MMT reduction at one spot. Here it is.

This is a major game changer if true because it is like taking 7-10% of the world wheat carryout and having it magically disappear. With the funds as short as they are it could lead to explosive price action. So be warned. I think this also creates an opportunity to be buying the cheap CBOT Wheat calls. “Courage calls” is what some call them.

Are you surprised about the recent weather events? Do you now feel like you are oversold? If you are, make sure you give me a call at 605-295-3100 or Wade a call at 605-870-0091 to open up a hedge account and we can try to get you in a position that you are comfortable with. You can also open a hedge account here:

https://www.dormanaccounts.com/eApp/user/register?brokerid=332

We have been talking about the similarities to 2012 for a very long time.

The next two sections were originally printed on our December 18th of 2022 weekly newsletter addition. The first is just a quick snippet of Inflation and the 2nd second is about history repeating and we talk about the drought of 2012 and the possibility of a drought in the summer of 2023.

- From 12-18-2022 edition -

History repeat itself?

As I look at weather and do more research on it, I get this feeling like we have another 2012 drought in store for the USA. I think we take our drought from last year and simply move it North and East.

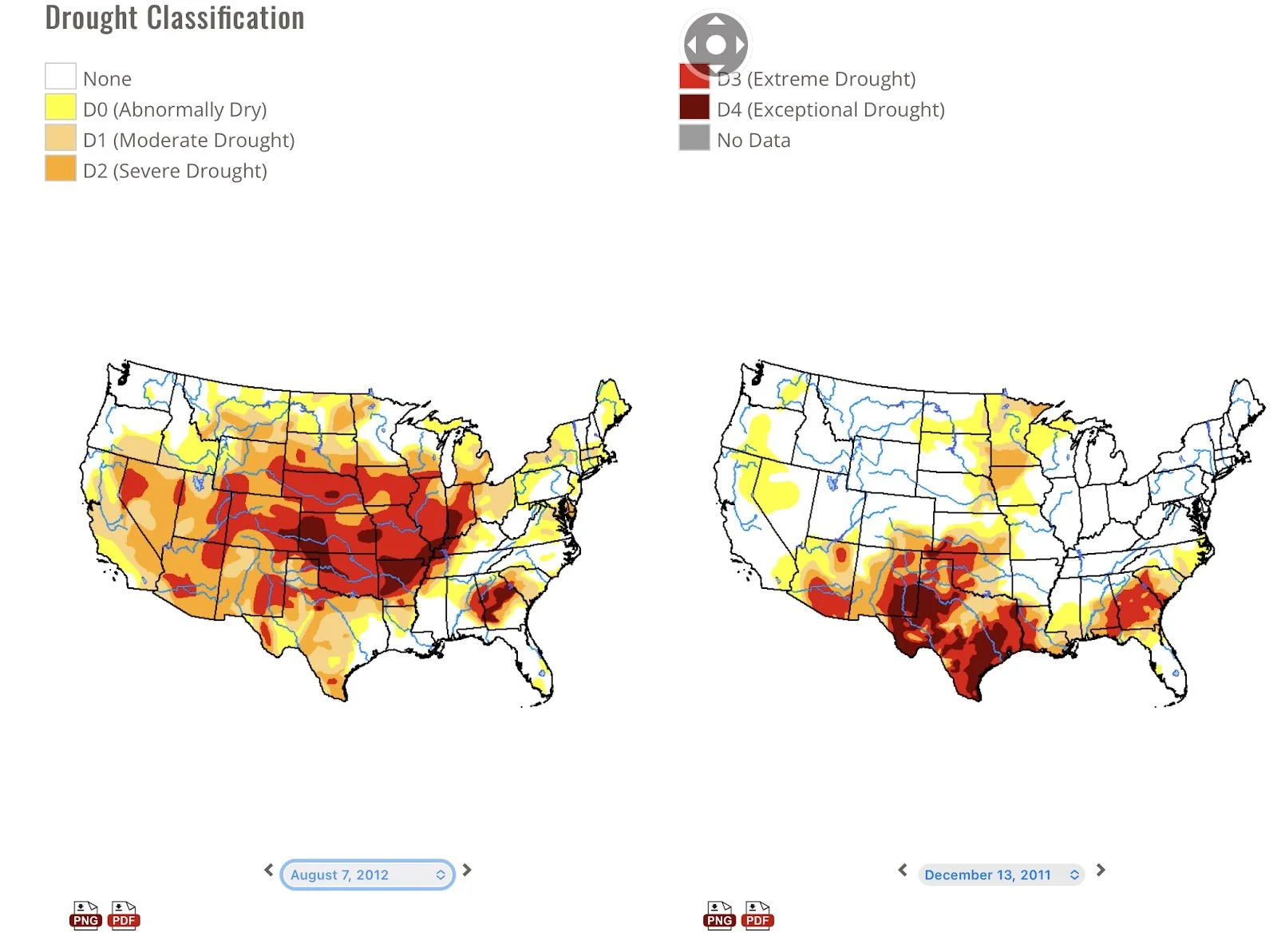

Here are several drought monitor maps. This first one shows Dec 13 2011 on the right, with August 7th 2012 on the left. If I just compare these two and ask myself how did we go from Dec 2011 to August 2012, I leave myself a lot of questions.

If I answer what changed, I would say that the drought moved North and East while expanding.

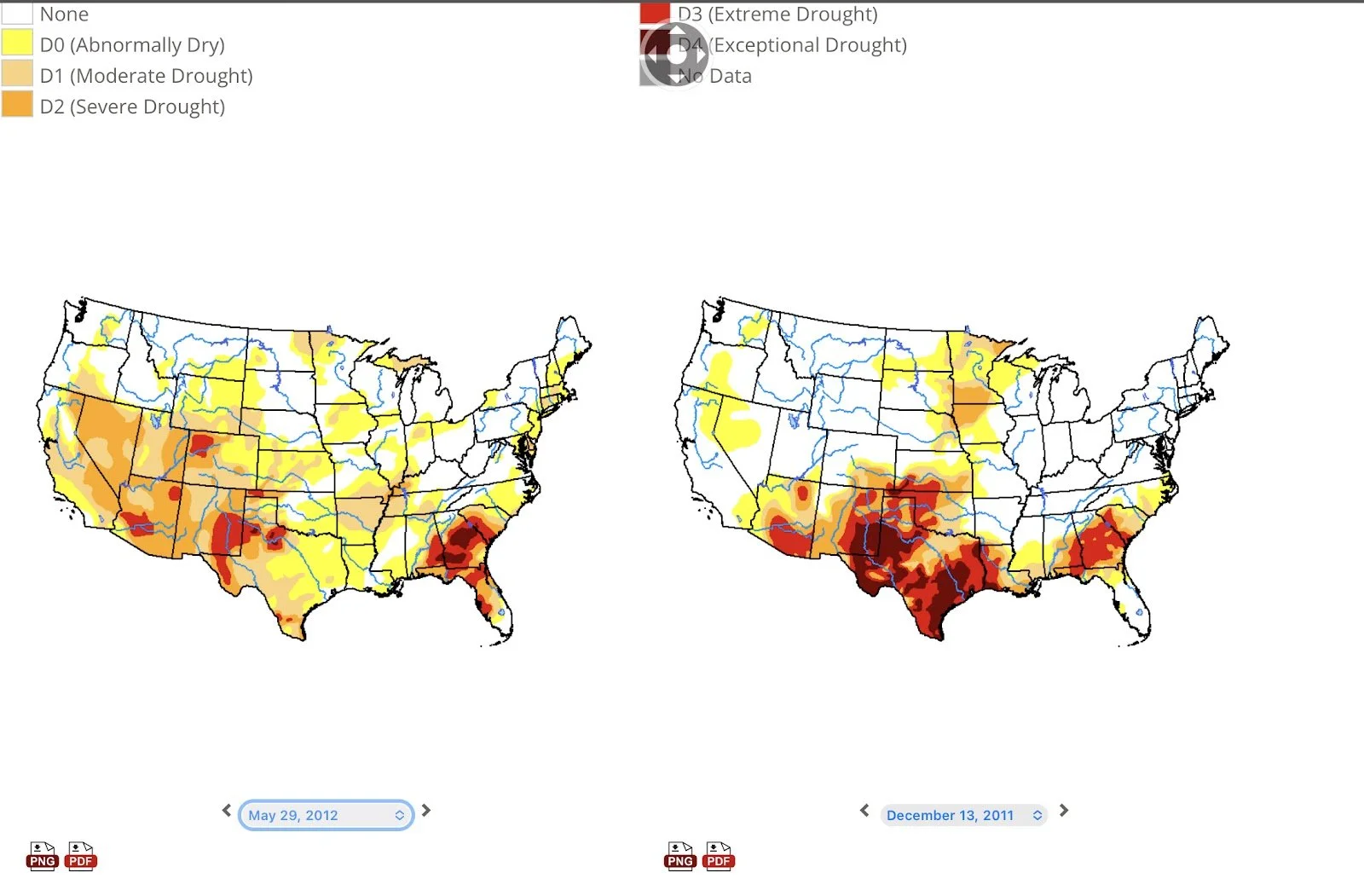

This next one is Dec 13th 2011 on the right and May 29th on the left.

This is April 2012 versus Dec 2011. As you can see the drought had on the surface improved, but if you remember planting started off at a very fast pace.

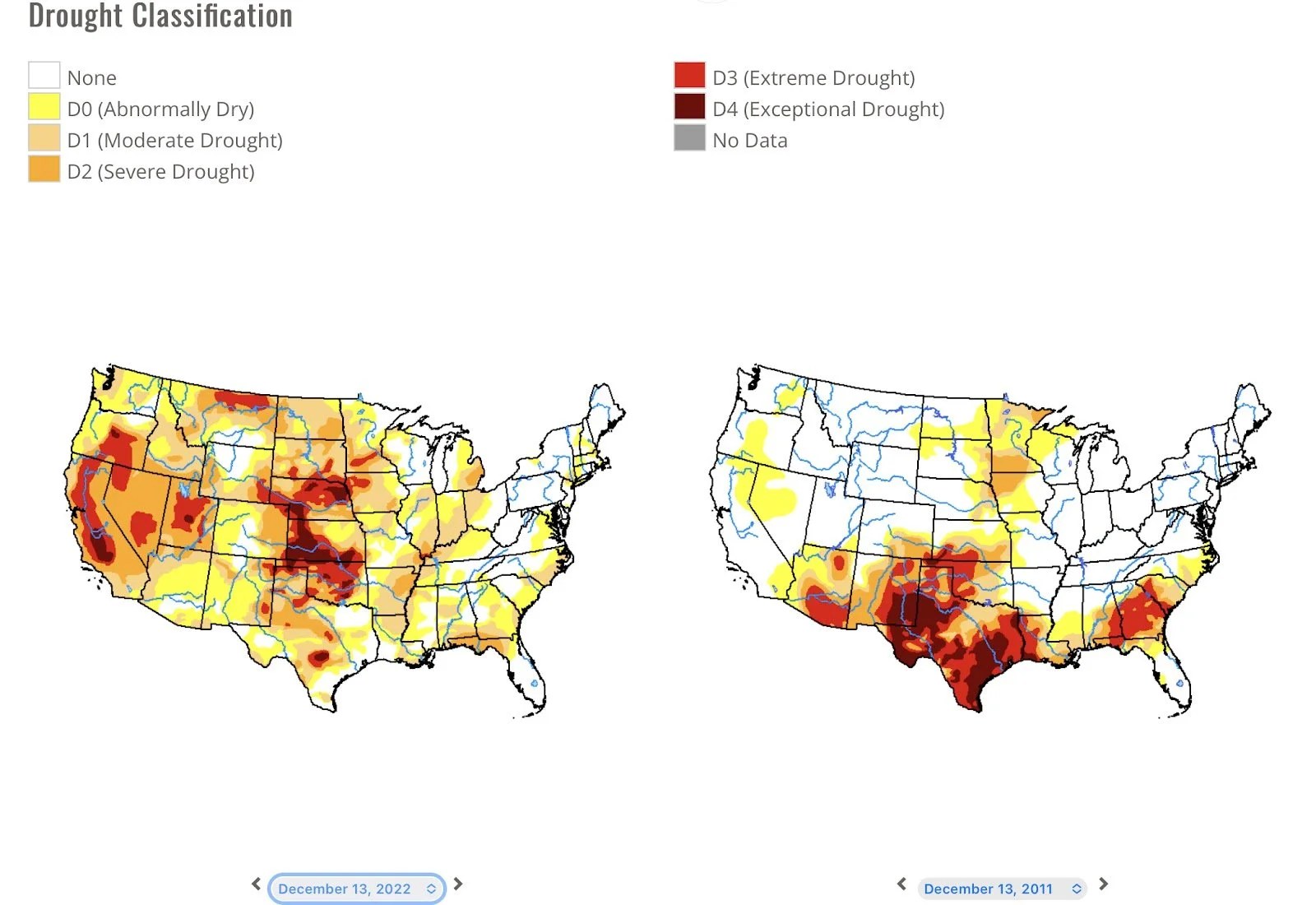

This is December 13th 2022 versus Dec 2011.

My worry remains that we see our present drought look like it is improving from now until May or so. But come next summer we have basically taken our present drought, moved it to the North East and expanded the D3 and D4 areas. What would corn prices do if that happens?

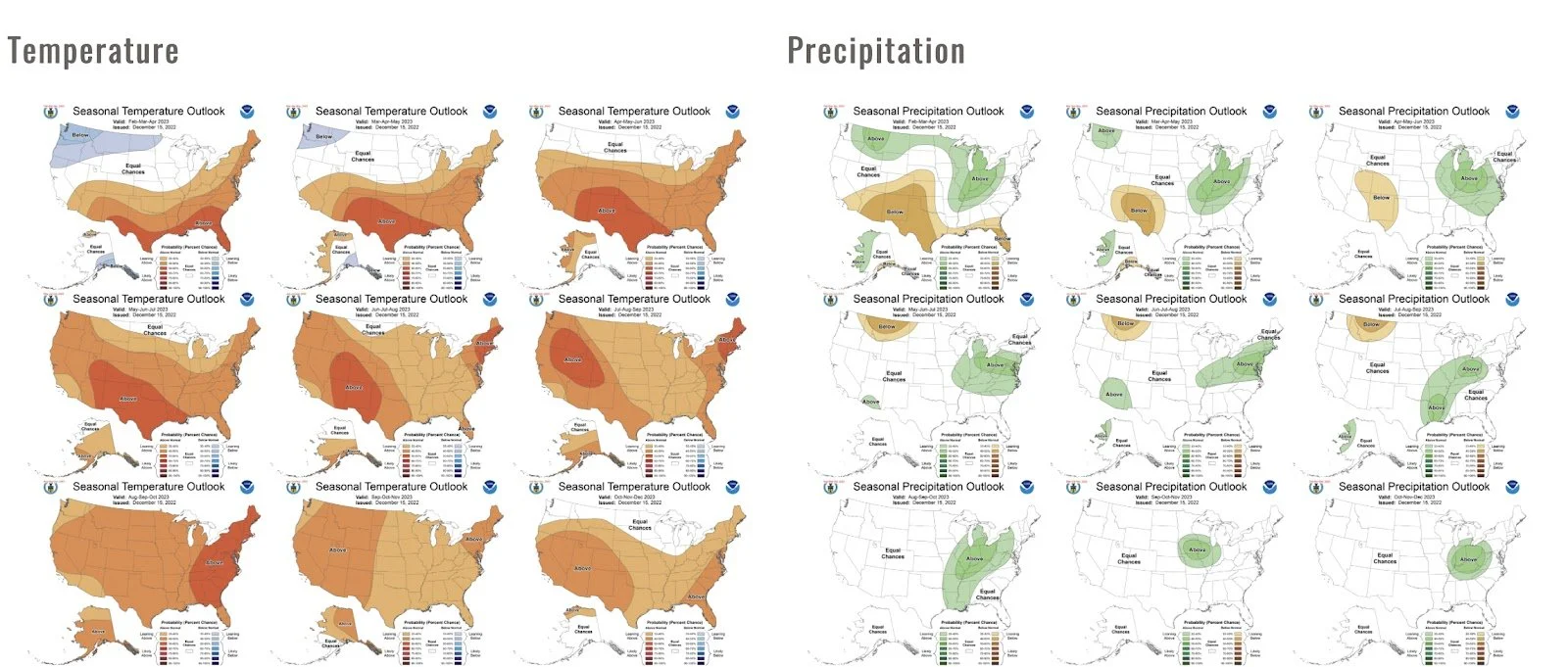

As for outlook it is early to see, but plenty of warm forecasts are out there for next spring/summer.

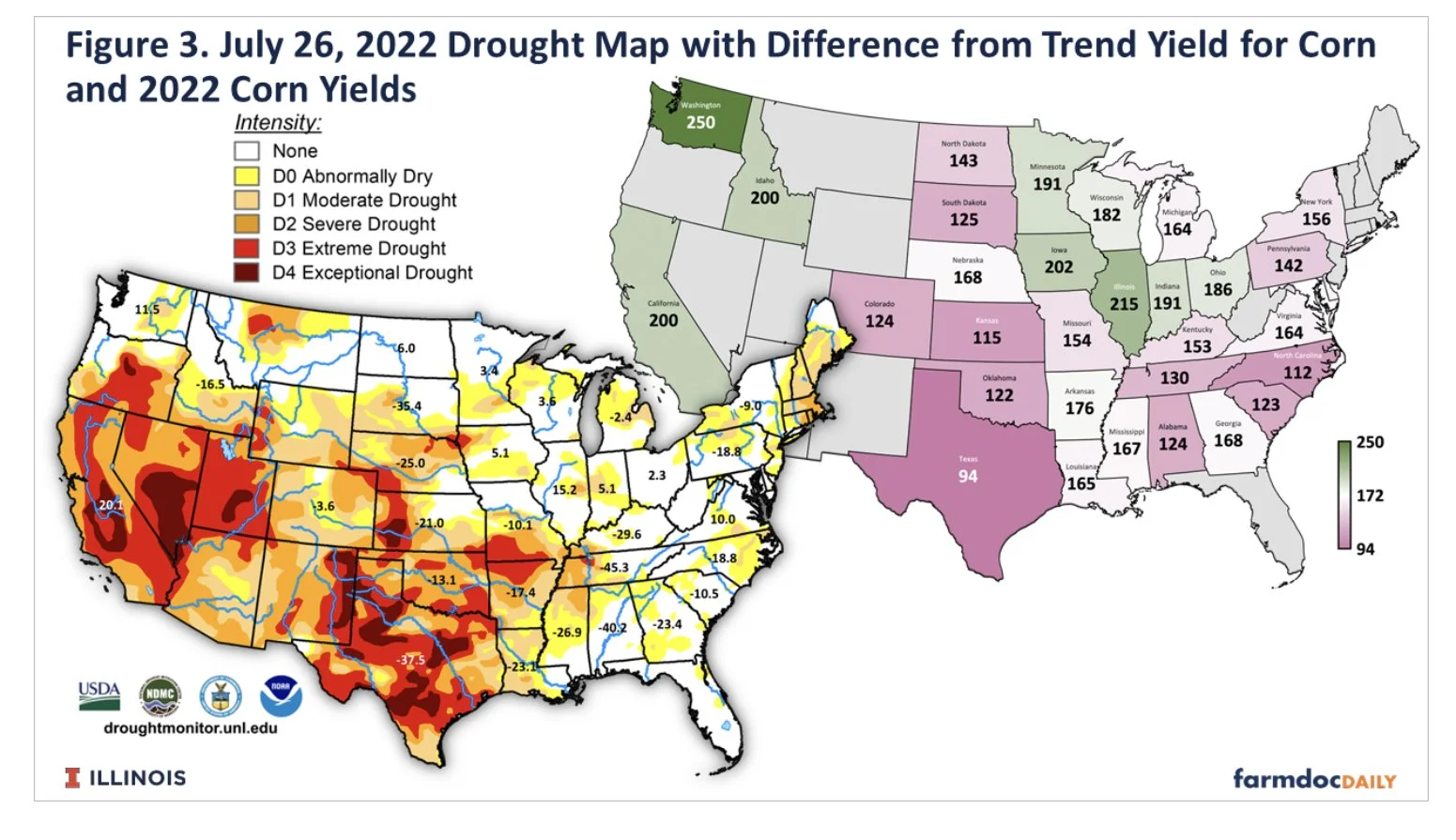

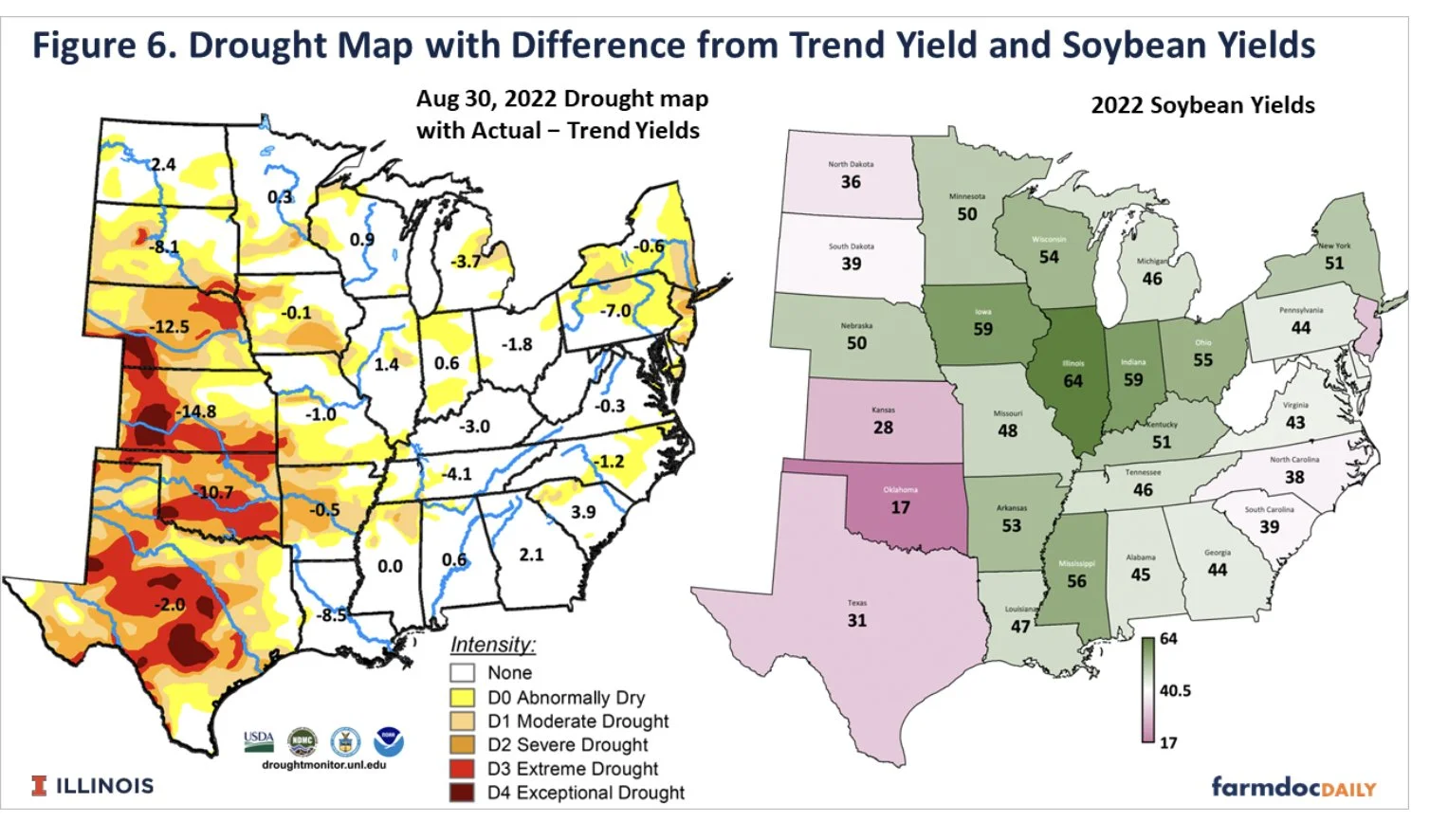

This is from U of Illinois and it shows yields versus trends. We can not afford to see those areas in green turn a different color. Our ‘I’ States this year had great crops. If our drought moves over them as I suspect it will we will have a train wreck.

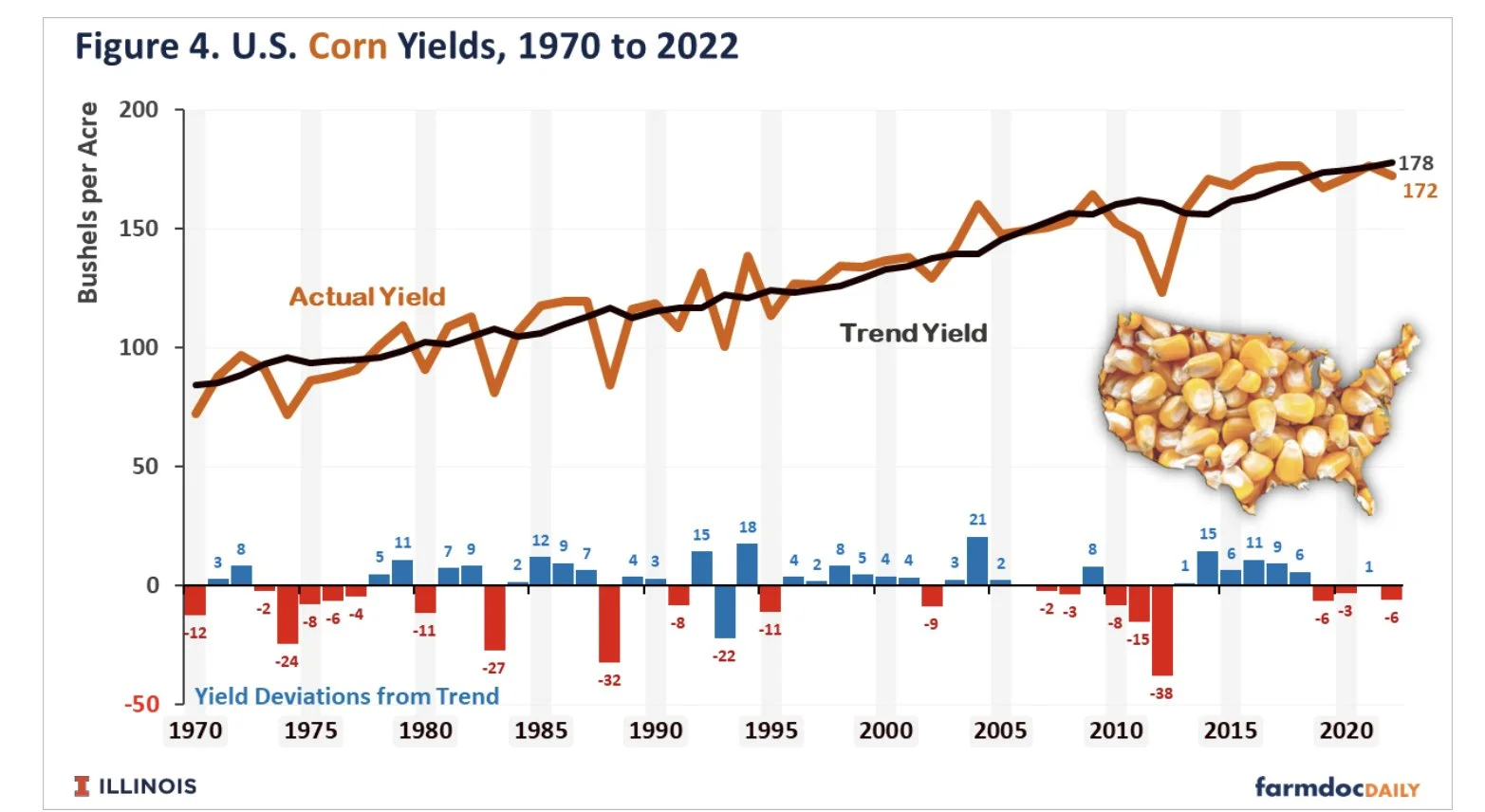

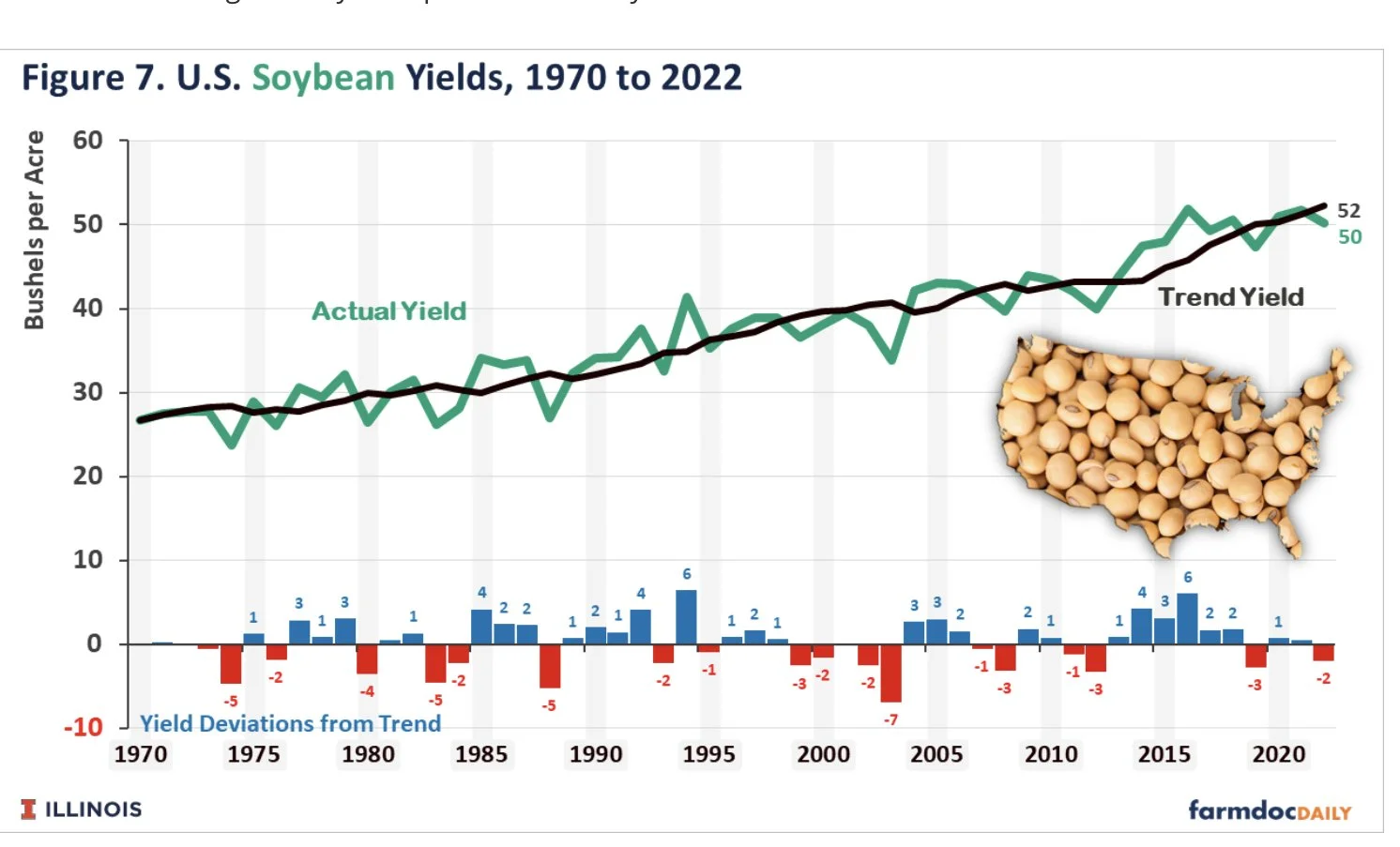

Are we due for a bad corn crop? If history repeats itself, I could see 2023 being similar to 2011-2012. From 2007-2012 we had all but one year where yields came in under trend. Before that we had 9 out of 10 years when yields came in above trend. Presently we are on a streak of 3 out of 4 years below trend. Before that we had 6 years in a row of above trend line yields.

We have yet to have trends significantly below trend. Despite several places around the world have extreme swings in production for various crops. Look at Argentina wheat production, nearly ½ of what it was the previous year.

Here is the same for soybeans.

I could find more bullish points and write all day long about how I think grains will make new all time highs in 2023. But at the end of the day I am smart enough to know that I might be wrong. But I have also been in this industry for over 20 plus years and I see plenty of signs out there that tell me I am going to be correct.

At the end of a day as a farmer you need to balance your situation along with your risk/reward. If I can help just a few guys simply improve their grain marketing via utilizing tools such as options to put floors in versus selling grain and watching it go nuclear parabolic I will have done my job.

If guys read and listen to me and I have conveyed that they need to be comfortable not knowing where prices are going, but here are the reasons I think we could and should go higher and they find comfort in that and get comfortable in their grain marketing plan. Then I have done my job.

If guys read and listen to my stuff on the days and times when I am bullish and they get complacent in marketing while they are uncomfortable in their unique risk reward situation then I have failed to properly communicate the correct move for their operation.

The correct move is always going to be finding that sweet spot where a producer is comfortable knowing the factors that could drive prices higher or lower, and being comfortably contempt exactly how they are situated.

Please note that we will have regular updates during the week next week depending on the market price action, but we will not have a weekend newsletter. Have a Merry Christmas

-

From December 18th, 2022

Check Out Past Updates

6/2/23 - Market Update

When Will Fireworks Start?

6/2/23 - Audio

Could We See 160 or Even 140 Yield?

6/1/23 - Market Update

Drought & AI Predictions

6/1/23 - Audio

Weather Markets In Full Swing

5/31/23 - Market Update

Grains Crawl Back

5/31/23 - Audio

Are Markets Overdone to Downside?

5/30/23 - Audio

Is There Opportunity In Today’s Sell Off?

5/28/23 - Weekly Grain Newsletter