ARE YOU READY FOR THE NEXT BIG MOVE?

WEEKLY GRAIN NEWSLETTER

Here are some not so fearless comments for www.dailymarketminute.com

If you look back over the past several weeks as well as this past week and had the opportunity to turn back time. Would you have done anything different in regards to selling, hedging, protecting, etc your crops?

The generic obvious answer is if given the opportunity to turn back time most would have done something that was a little more proactive in terms of grain marketing or hedging. But what if you also had the ability to turn time forward and via doing that it became known to you that we will see some of the grains at levels far exceeding the highs from a few weeks ago.

If you had the opportunity to turn back time and sell the levels we had a few weeks ago or sell the levels that your crystal ball told you would be soon happening, which one would you choose? Perhaps it depends on how much higher we may go in the future?

What if you found out that the volatility of our prices will increase and even though you know it will go higher you won’t be blessed with the ability to know we have made the highs. Now this is starting to sound like a real market; one where you don’t know if or when we will make highs nor if we have already. You don’t know how far prices could skyrocket nor drop. You don’t know how the War in the Black Sea will shake out, weather, nor what type of numbers the USDA will print in its USDA report that is out on Friday.

I could go on and on with a list of several factors that will help determine price direction and other black or pink swans that might even decide to come and join our grain market casino. About the best you can do is realize that the deck is stacked against the farmers via the Funds/Big Money/Big Ag/Algo/China/USDA etc all trying to make as much money as possible, with no regard to what it costs to raise a crop all of whom have motivation that doesn’t typically align with a farmers. None of which really care to see farmers become price makers instead of price takers. Most of the players in our market are there to make money for the line of business that they are in.

So where does that leave farmers such as yourself who want to become price makers, who want to buy fear, and sell greed. It leaves you with a big disadvantage in some aspects, but producers realize that perhaps knowing one is playing a stacked deck gives you all you need to be successful. It allows you to weigh factors such as your risk/reward profile, your cash flow needs, your operational needs, etc. While considering the probability and possibilities of outcomes for everything such as prices to what happens in the marco markets to how weather and the war shake out.

Most farmers are the most humble characters in the world which is a trait that needs to be carried into your grain marketing risk management plan so that you find ways and utilize tools to become comfortable.

Those that are going to be upset if they sell and the market rallies while those that don’t sell and the market decreases MUST find a way to be comfortable with the unknown outcomes given your perspective, on the likelihood and possibilities both considered and not believed to be possible.

One of the first steps I recommend is to make sure you have the tools and are aligned with professionals that can help get you comfortable in your unique situation in a manner that is understandable using methodology that provides information to help you to obtain your goals while being adaptable and customized to your mission. We want to be part of your solution via being a Grain Marketing Advisor Newsletter that gives you both the big picture while still working with producers in a manner that doesn’t just give generic advice.

Farmers utilize many others in the round table that helps create your successful operations, such as bankers, insurance agents, agronomists, etc. You need all that are at your roundtable that creates your operation as the tools cross over and become value added with used together.

When it comes to grain marketing and price risk management many operations are at various levels towards becoming a price maker instead of price taker.

After having at least one professional give you information as to market direction probability and potential one needs to be able to utilize the tools that will help grow and protect your operation. Or in other words one needs to have hedge accounts open to utilize futures and options. This is something that needs to be done for any that don’t have one available. It doesn’t need to be utilized until it fits, but it should be open.

Myself and Wade and the rest of Texas Hedge Risk Management would like to help you in this facet. Here is a link to open an account. You can also give me a call at 605-295-3100 to get started.

https://www.dormanaccounts.com/eApp/user/register?brokerid=332

Don’t wait on this, get your accounts open and ready if needed. Walk before you run, but get the account open. Stop chasing the markets up and down like a Yo Yo

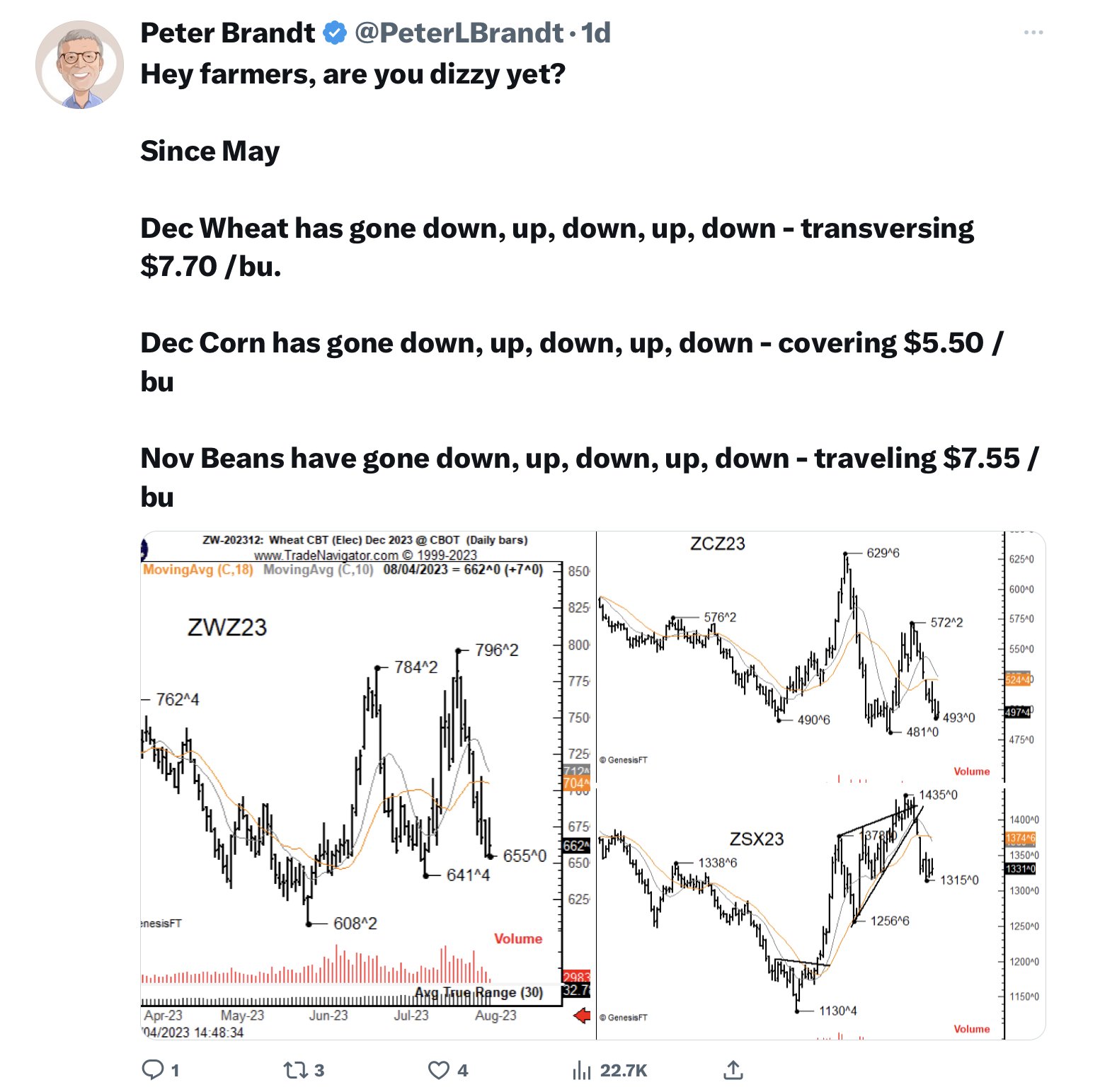

Below shows exactly what has been happening in our markets. This is very accurate and if you have been on the wrong side very costly.

It is why it is important to be proactive not reactive. Don’t chase markets, buy low and sell high, not the other way around.

If you are utilizing someone that isn’t being proactive consider switching to hedge accounts with our team with Texas Hedge Risk Management and we will help get you on the path towards leading instead of chasing.

https://www.dormanaccounts.com/eApp/user/register?brokerid=332

The above Yo Yo volatility is also how some will get more for their grain this year then the markets trade. Buy low, sell high. Buy when it is cheap, don’t chase.

You want to become a price maker instead of being a price taker. Having a hedge account available at the appropriate time is a must.

The next step to become a price maker instead of price taker is to learn to separate cash price into two basis and futures price. Followed by that is negotiation on basis combined with learning basis trends, factors that impact it, along with seasonal trends.

A couple other things that I will help change farmers to price makers instead of price takers include revaluation of tools presently used that actually make it so buyers like BIG AG and others don’t have to push prices to get supply.

Number one is delayed price or price later storage. If you really want to become someone that controls the prices you get, don't utilize DP nor let your neighbors. It creates a basis weakness and then domino effect once various suppliers have got needs covered.

Next is you should not use HTA or Futures Fixed contracts with your buyers for the same reason, they don’t have to compete because one can’t sell it another direction.

Why am I spending so much time talking about being set up to be successful, having your mastermind alliance to help you?

A few reasons: Number one is we are not in the business of predicting the minute by minute price movement of the markets. We are in the business of helping farmers manage risk in a manner that helps create profits for their operation while being comfortable not knowing exactly which cards will get drawn out the deck nor in which order. But via utilizing tools such as hedging with futures and options along with the knowledge and direction from the others in your mastermind alliance one should be able to become comfortable.

The next reason is I think we are about to enter some very volatile markets again.

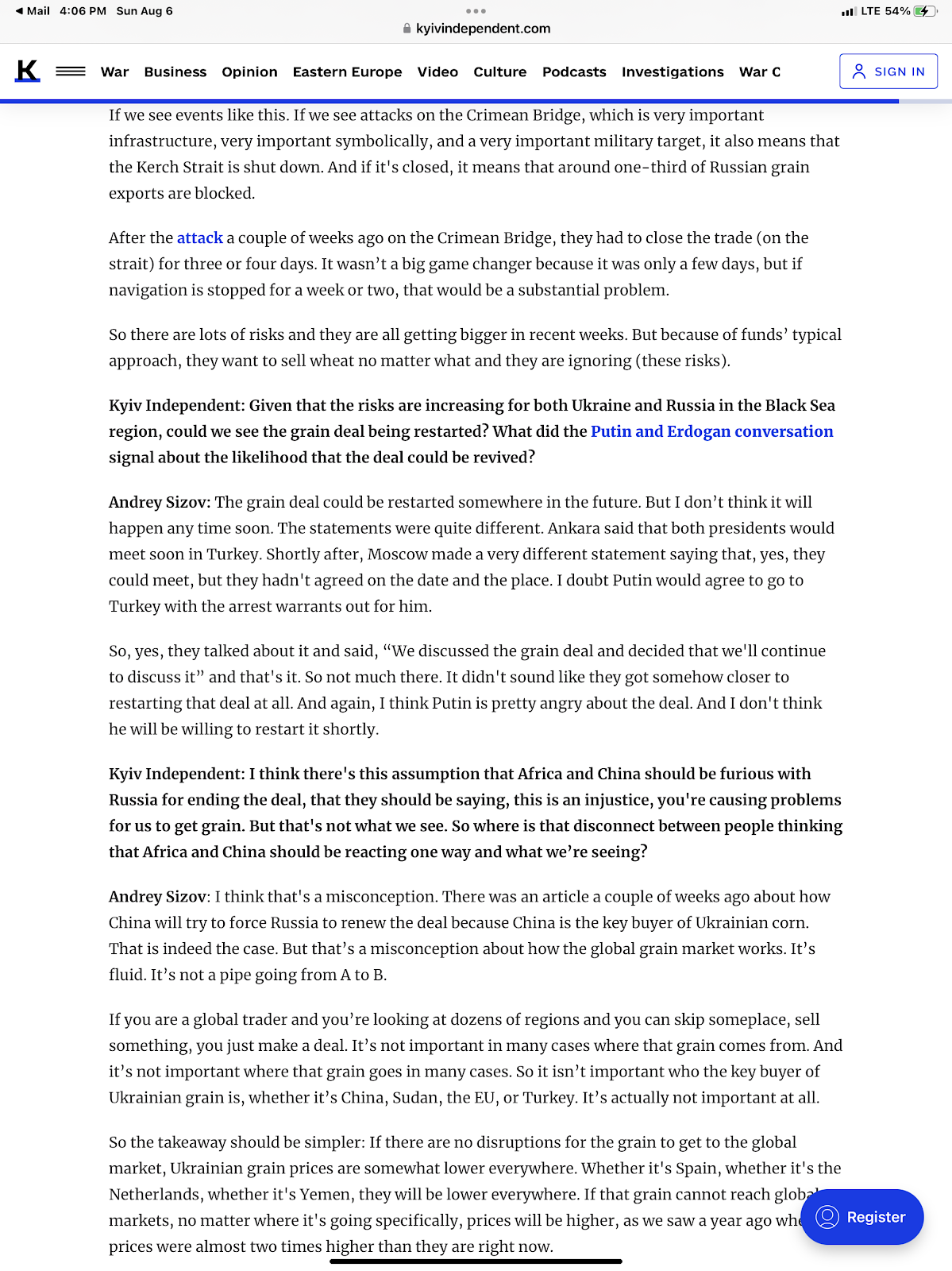

It sounds like over the weekend Russia and Ukraine decided to re-insert a couple of big wild cards into the deck. Cards that have the potential to allow us to see 2022 type levels depending on if they hit the table and in what order.

Check out below.

The bottom line is we could see this wheat market get on fire and do something similar to a few weeks ago where it closed up. But we also have cried wolf so many times over the past 16 months that no matter how relevant the news, wheat is wheat, which allows it to trade any way it wants.

I am calling our markets higher and I believe that we have a decent opportunity to close the gaps we left on the charts last Sunday which means I believe we don’t recommend puke selling nor fear selling. If you are not comfortable and don’t believe that we will bounce, one can always buy September puts. But our recommendation is to ring the cash register on puts and short futures for corn, beans, wheat. Re-own sales with courage calls or futures depending on your situation. Once again if you need help call me 605-295-3100 or you can call Wade at 605-870-0091

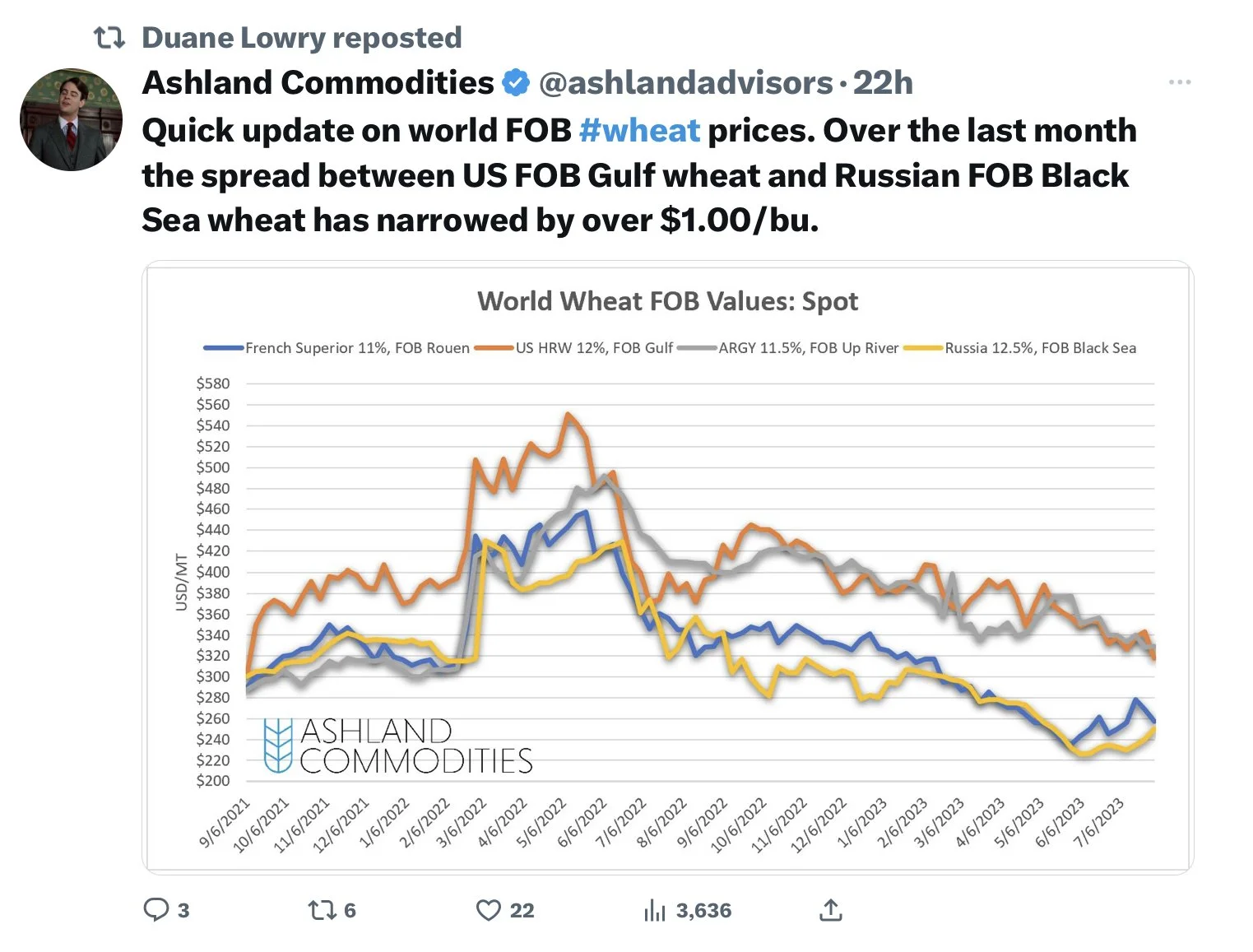

See below from Twitter for various info.

Last week it was reported that China bought US SRW, Sorghum, and beans. With rumors that perhaps some corn business is in the works. We are getting more competitive in the world marketplace.

Here is a diagram to help determine possible tools to use in your grain price risk management. We will be expanding this in the near future.

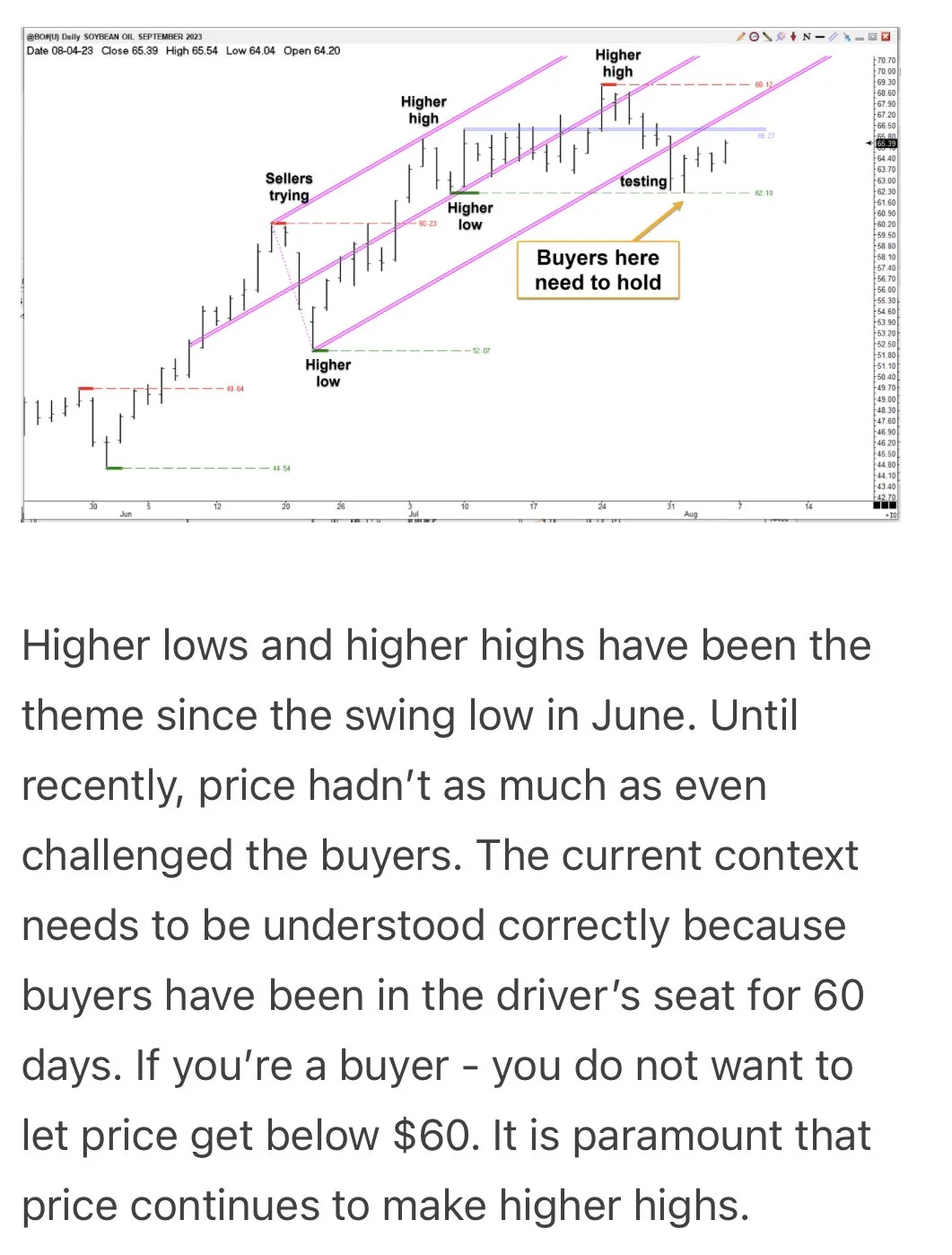

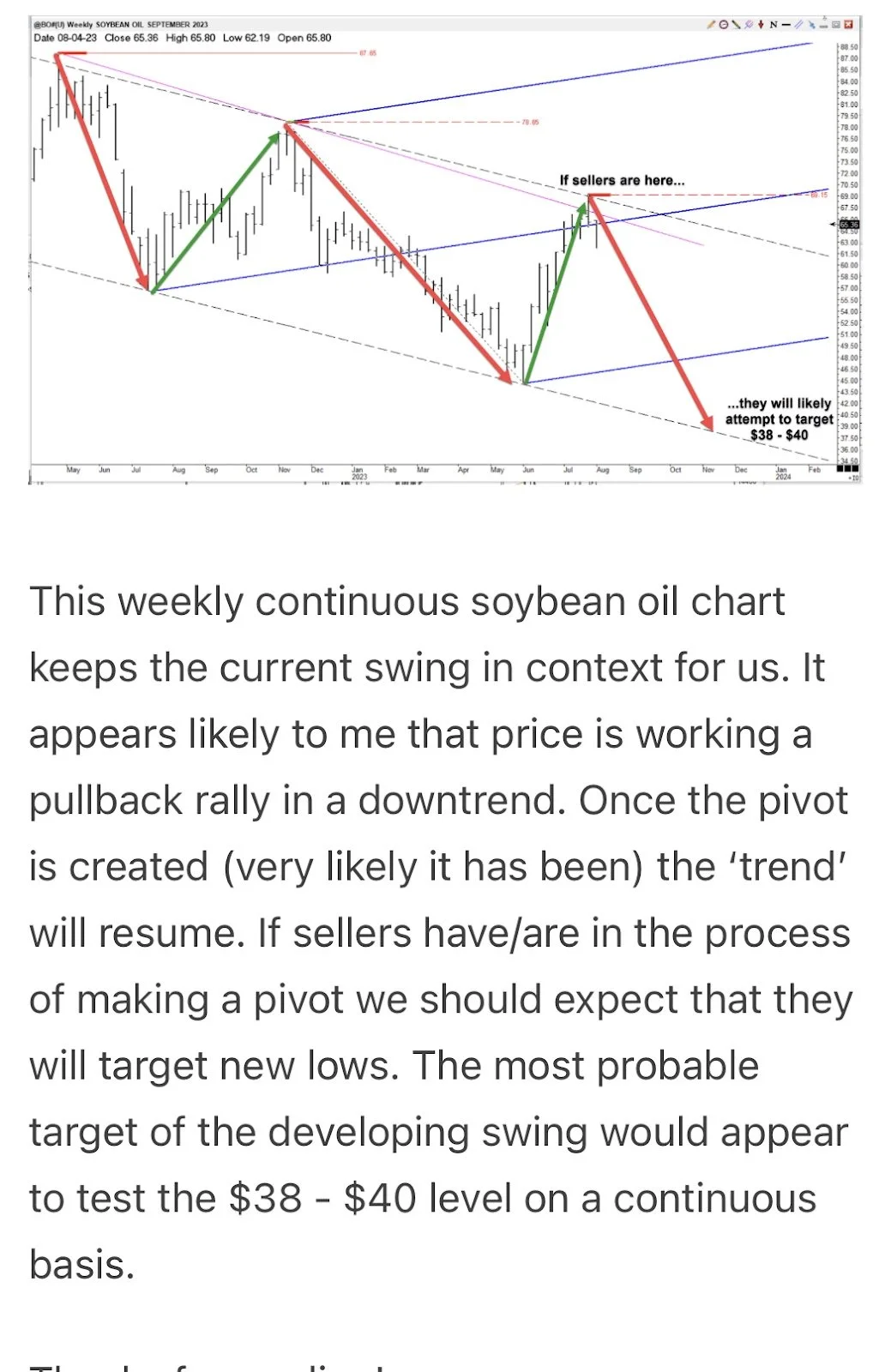

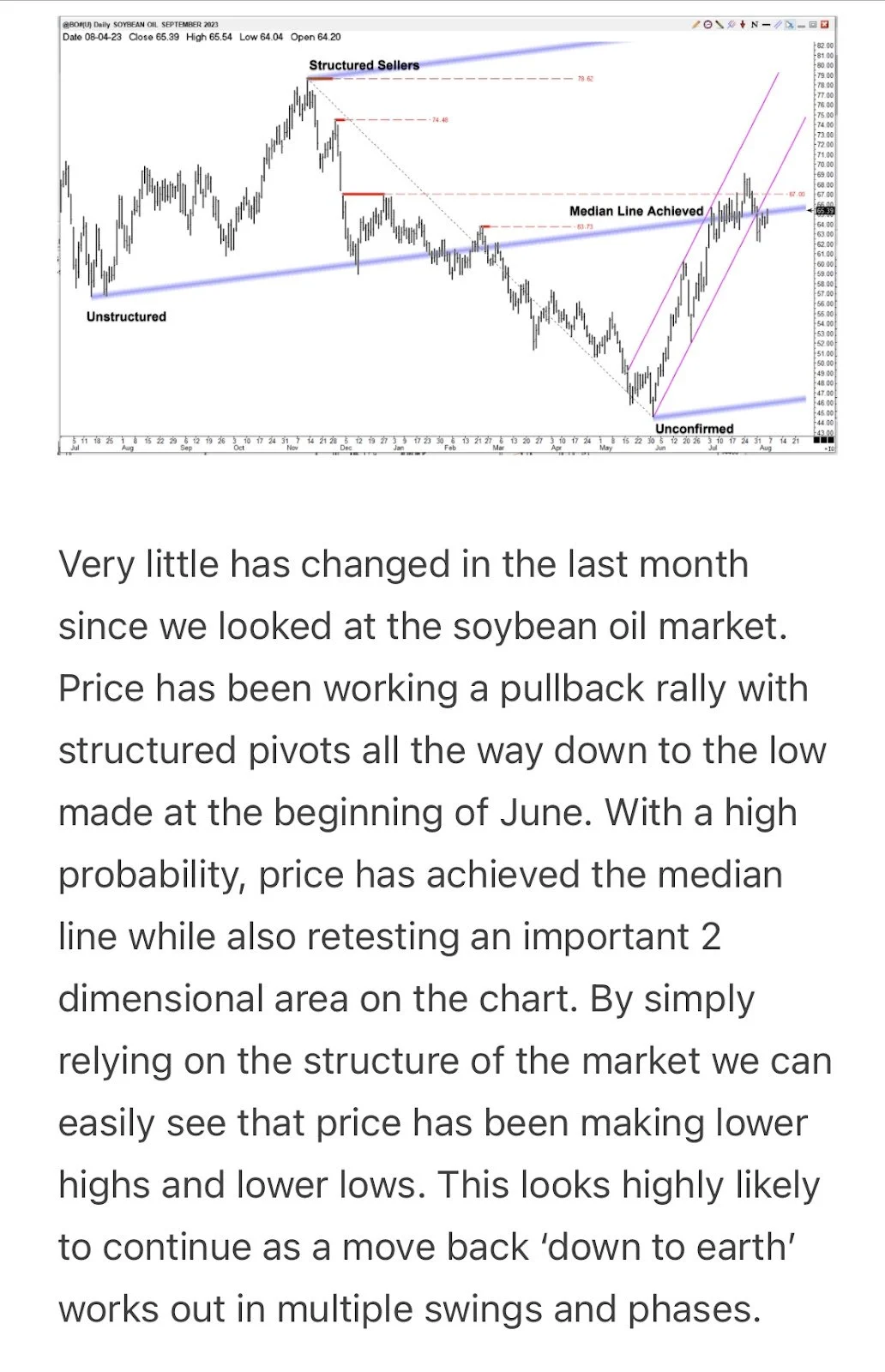

Take a look at the below write up and opinion on the Soybean Oil market. This would be one of those possible times one would want to remember to keep what is cheap and sell what is high in regards to sunflowers versus soybean oil. I.E. consider buying soybean oil puts versus selling cash sunflowers. Keeping what is cheap and selling what is expensive on a relative basis helps make one into a grain price maker.

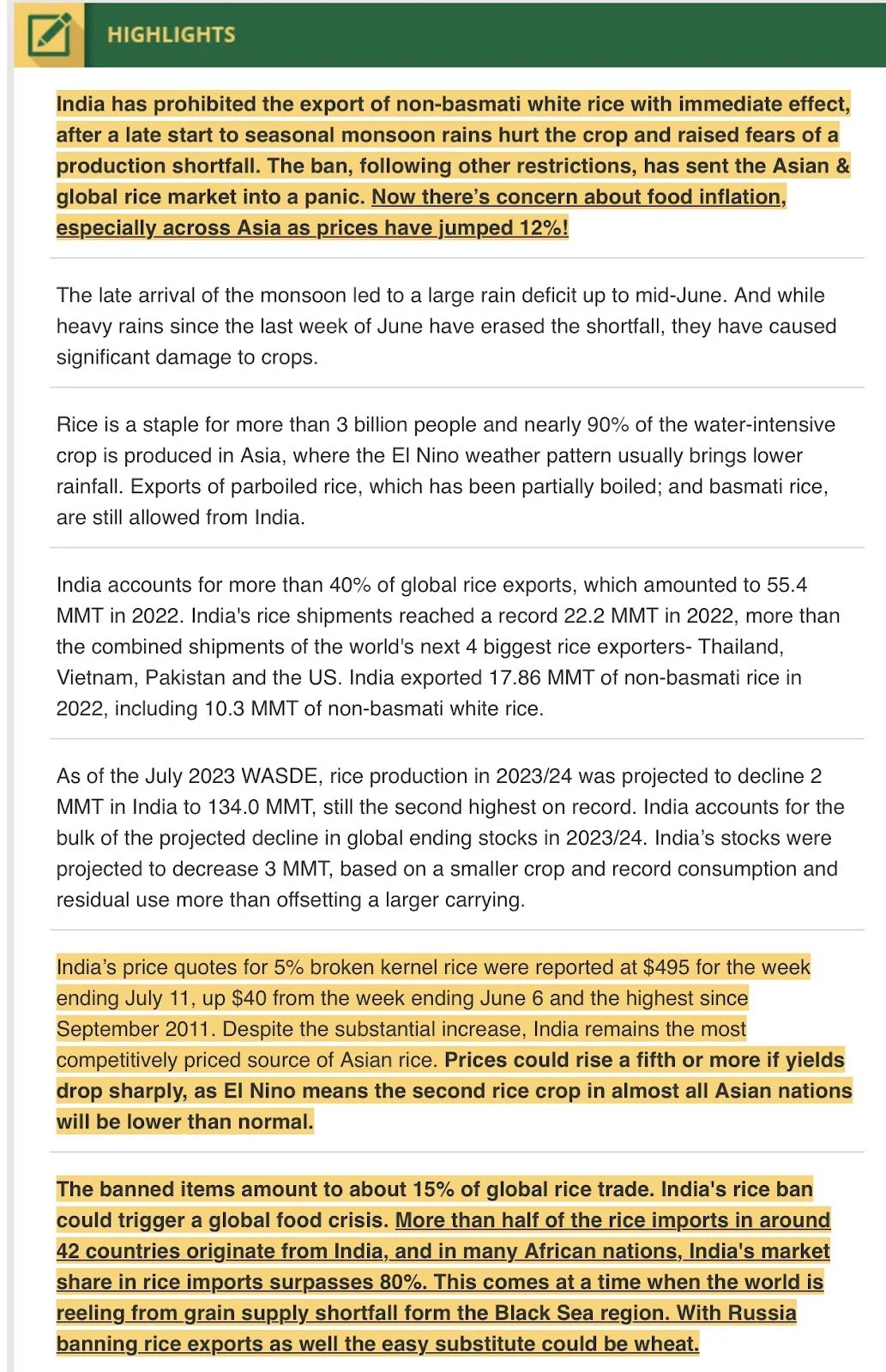

Below is from farms.com risk management . The situation in Inida is very world wheat prices.

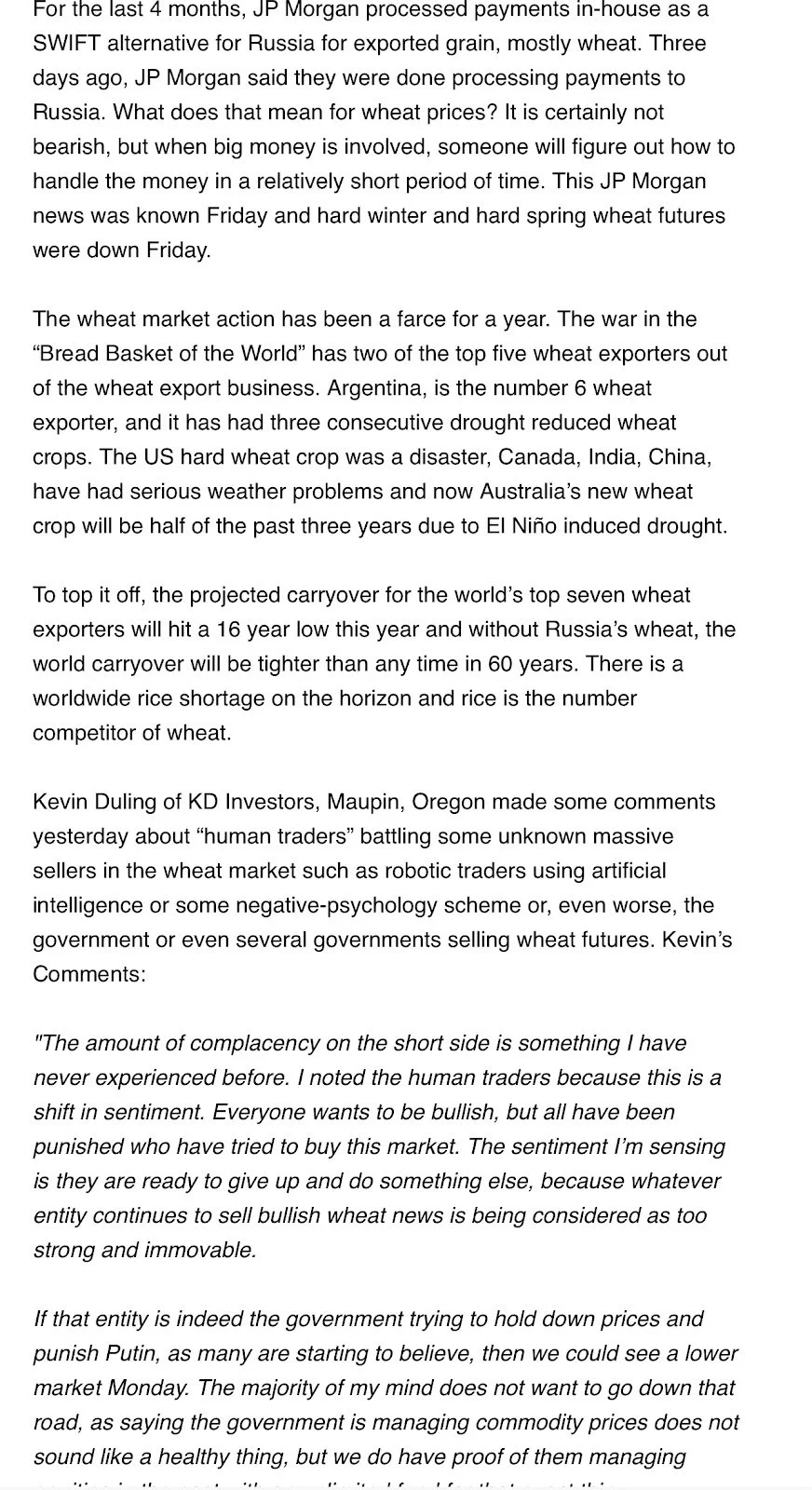

Below is good write up from Wright on the Market on the wheat market.

See Us At Dakota Fest

Make sure you stop in and see us at Dakota Fest in Mitchell, South Dakota, if you are attending. We will be booth number #2505. We will be there the 15th, 16th, & 17th.

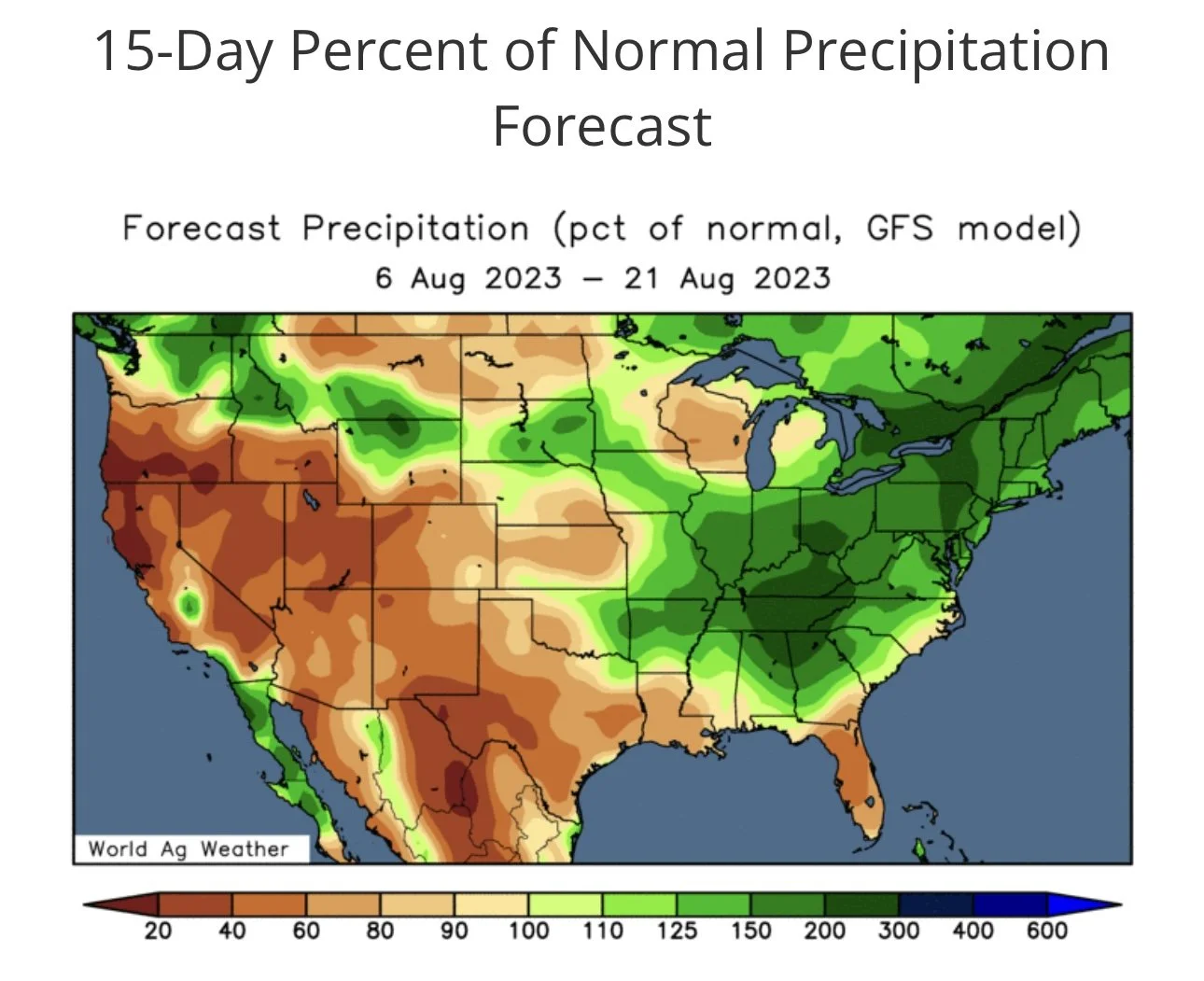

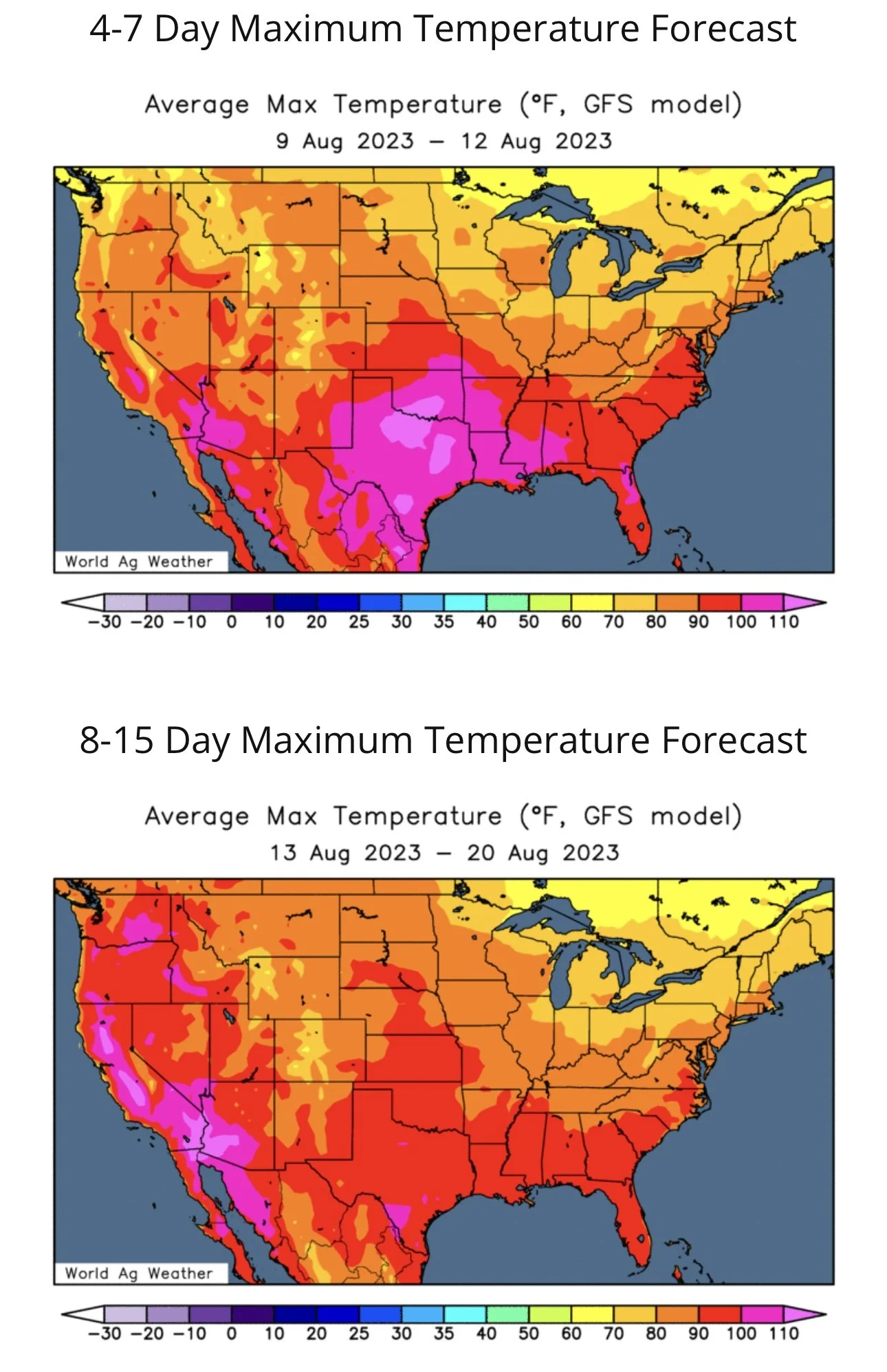

Weather

Check Out Past Updates

8/4/23 - Audio

CAN OUR MARKETS BOUNCE ONE MORE TIME?

Read More

8/3/23 - Market Update

YIELD, DROUGHT UPDATE, TIME FOR CALLS?

8/3/23 - Audio

BUYING RECOMMENDATIONS

8/2/23 - Audio

WEATHER & WAR VOLATILITY CONTINUES

8/1/23 - Audio

WHEN WILL THE BLEEDING STOP?

7/31/23 - Market Update

WEATHER HAMMERS THE GRAINS

7/30/23 - Weekly Grain Newsletter

HOW MUCH DAMAGE WAS DONE FROM RECENT HEAT?

7/28/23 - Audio