MORE DOOM & GLOOM AS CORN BREAKS BELOW $4.00

Overview

The sell off continues, as we saw corn closed below $4.00 for the first time since 2020 while soybeans post a new contract low.

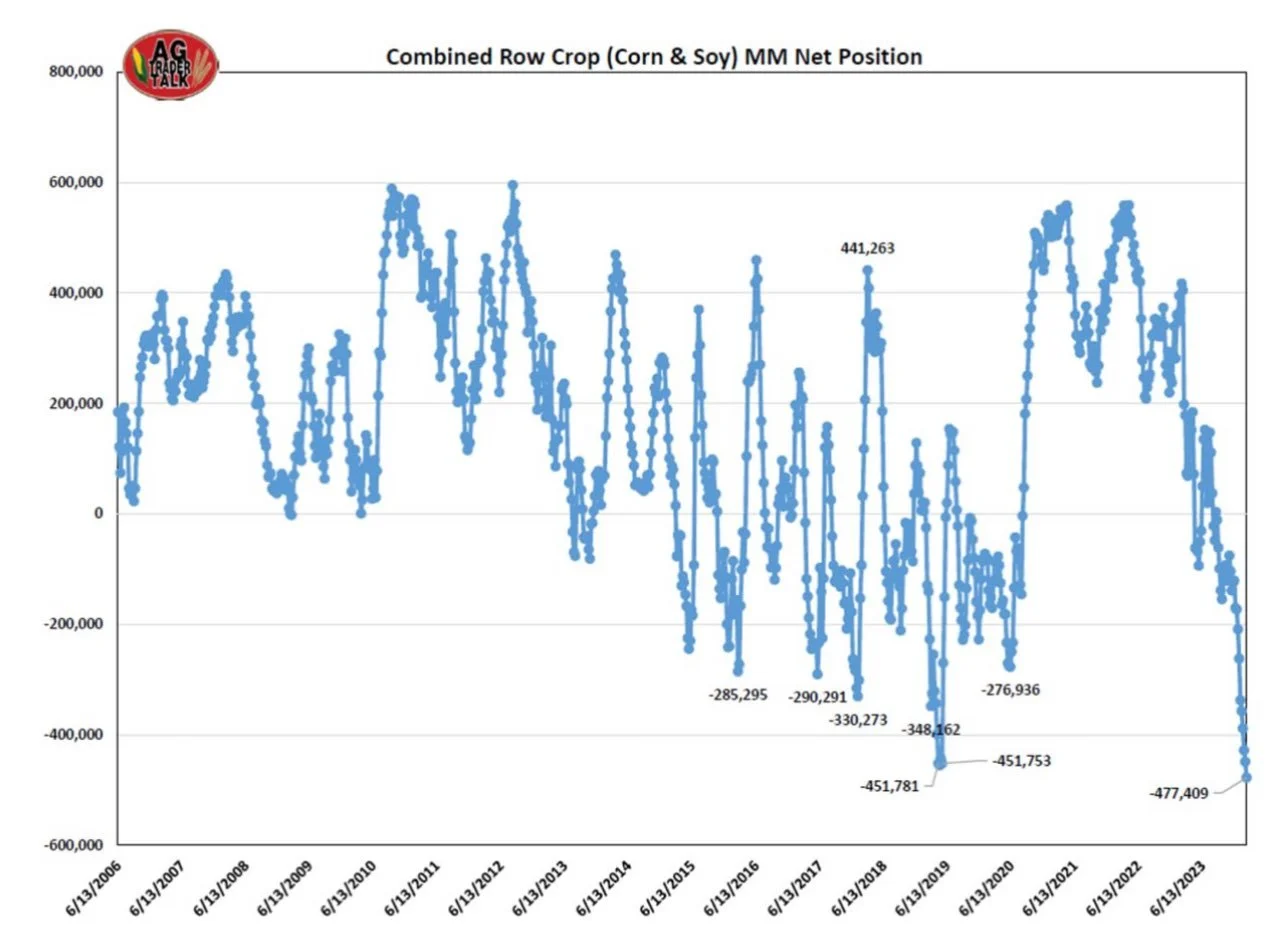

There isn’t any good news to help prices, which more so than often leads to more technical and fund selling. With the funds continuing to pile on to their record shorts.

Funds are now short around -340k corn, -130k soybeans, and -70k Chicago wheat.

Combined corn and soybeans shorts are the shortest ever. Surpassing 2019.

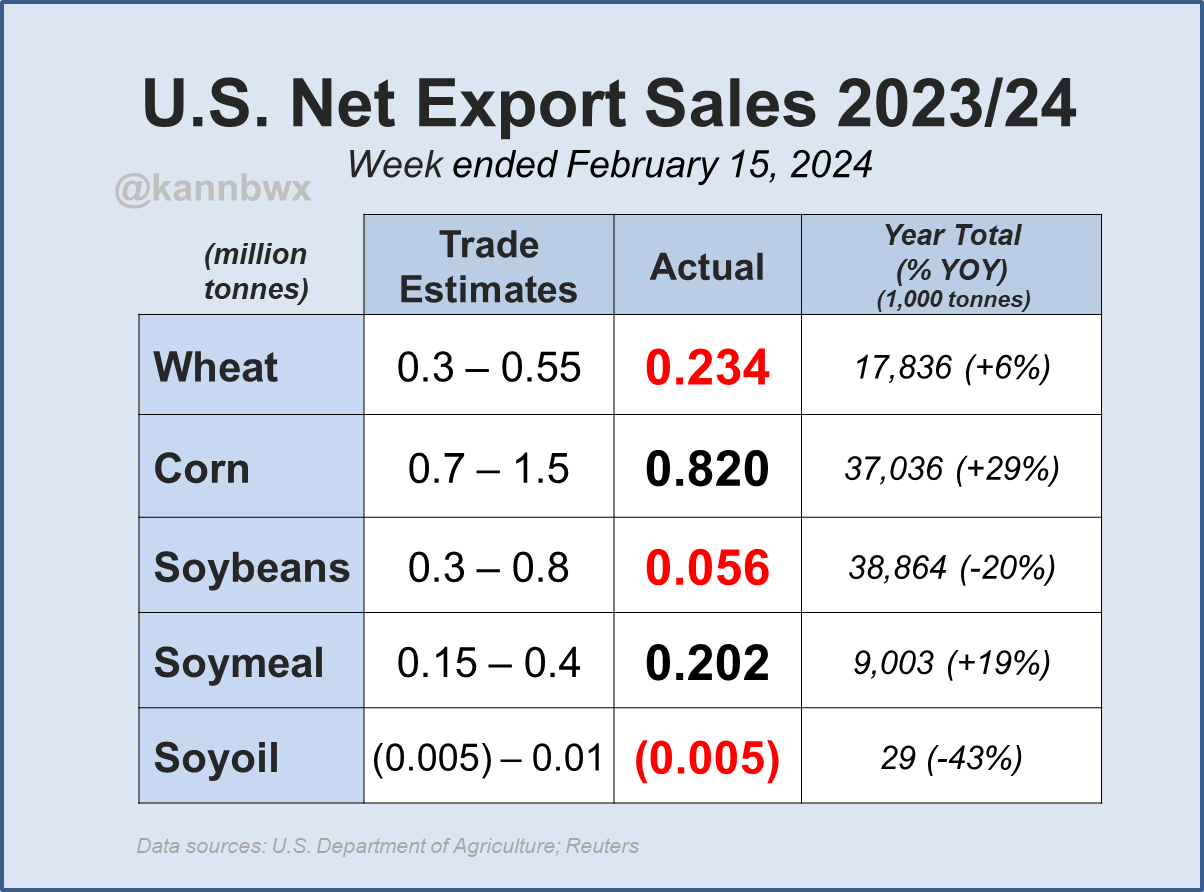

We had terrible soybean exports. Some of the worst in recent memory. They came in at 56k while the estimates were 300k to 800k. Exports were light all around. Chart is from Karen Braun.

We have mostly favorable weather in South America for the next two weeks. With their crops stabilizing and Argentina being far better off than last year.

We have the sanctions in Russia, but this isn’t having much of an effect as the market doesn’t seem to concerned.

Biden approved the sale of ethanol year round, but just like everything else that news disappointed as it will not start until 2025. Most were hoping it would start this year.

Then today we also had March options expiration, which added even more selling pressure.

From Heartland Farm Partners:

"First notice day for March futures is next week. This could signal the end of forced liquidation we have seen recently and could be the beginning of fund short-covering next week."

Do we have anything at all to provide a glimmer of hope?

Well, there is only 2 things that are remotely friendly in our markets..

The first is the funds. Holding record shorts. They will "eventually" have to cover.

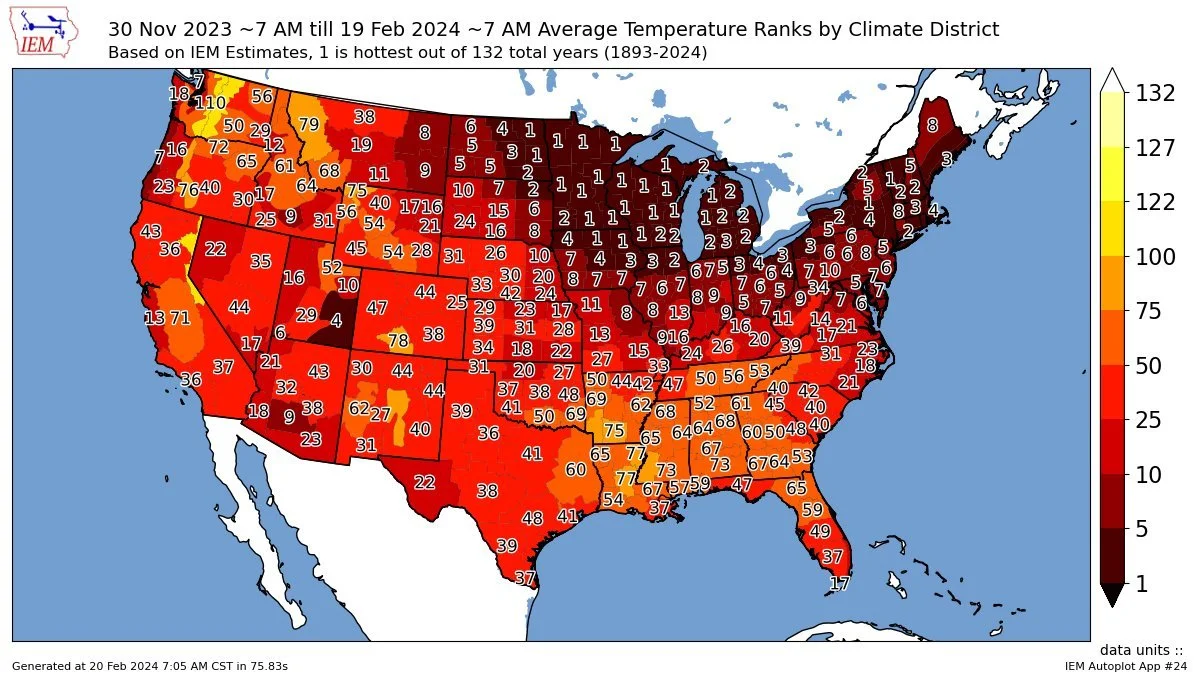

The second is US weather. We have had an abmorally warm winter with little snowfall.

Does this matter right now? No. Will this send prices higher right now? No.

It is far too early to be making any bold predictions, but looking long term, it has the "potential" to be a very positive factor.

So what does this look short term?

We will probably early planting due to the lack of frozen ground and rain will absorb better.

My opinion there is to get started early on your planting, as a few week head start could help add to your bushels if we do get a drought.

So what does this "potential" drought look like?

Here is a breakdown of the warmest winter on record.

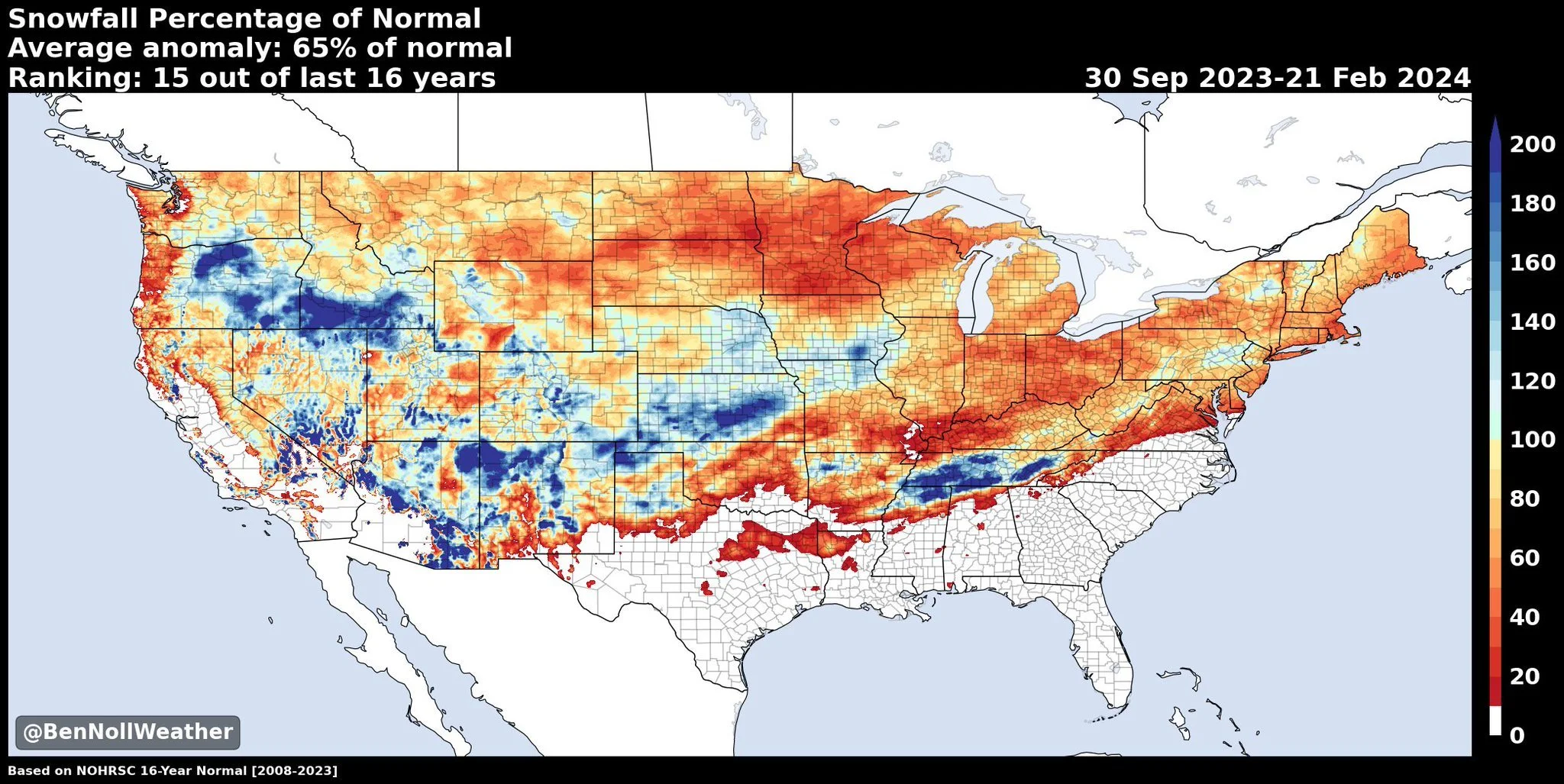

But that is not the biggest concern. The biggest concern is the lack of snow.

We are having the least snowiest winter since 2011-12.

This is even more concerning given that we already went into winter fairly dry.

The extended forecasts are also calling for "drought-like" expectations.

How you can never fully trust the weather man. But what if these forecasts hold true?

Take a look at the CFS monthly forecast from BAM Weather.

It completely nailed spot on the entire winter.

This could be the catalyst we need to finally give these markets some pain relief.

It will not happen very soon if this is the catalyst, but could very well cause our markets to rally come spring.

We "almost always" get a weather scare rally even if the scare doesn’t come to fruition at all. The scare is usually enough to provide at the very least a pricing opportunity in spring or summer.

The only question is, how low can we go before this happens?

Today's Main Takeaways

Corn

Corn continues to fall, finally closing a 3 in front of it at $3.99 3/4. Down -18 cents on the week.

As mentioned, there is just nothing for bulls to chew on.

What are some ways we could we see $4.80 to $5 corn?

One possibility would be if the Brazil second crop corn is smaller than realized.

There is a wide range of guesses for this crop.

From Pro Farmer:

"There are similarities to 2016. The soybean low came in 2016 on March 2nd, though dry conditions for safrinha corn fueled the rally. Cuts to Brazil's safrinha corn crop could lead to higher exports of US corn and be a catalyst for a rally this year."

Also from Pro Farmer:

"2024 saw a strong El Nino start, much like in 2016, which ultimately led to a dry growing season for safrinha corn, sparking a rally through much of spring. The most bullish catalyst over the coming month will likely come from from a South America production scare. Which will likely lead to an increase in exports, giving demand side of the balance sheet a much needed boost."

The other would be if we get a drought or even just a scare of drought this summer. US production is going to start to be the hot topic very soon.

I mentioned that we are having the warmest winter on record along with the least amount of snow since 2011-12 which well help early planting and will help rain absorb well. But the lack of snow could turn out to be a serious problem as we went into winter already pretty dry to begin with.

What is our risk?

The risk is the same as we have been mentioning for months. If we get another big crop here at home, we already have this massive carry out. If this happens we could very well see corn closer to $3 later this year.

Nobody on earth knows where prices will go. Because nobody can predict the outcome of the possibilities. We can list every possible factor and their impacts, but at the end of the day it is all about positioning yourself to be comfortable.

The corn market lacks a reason to go higher. Until we get one, the path of least resistance could be a slow grind lower.

I still believe we will be getting that seasonally weather scare type of rally even if we don’t actually get a drought. I am still remaining patient. How big of a rally that weather scare brings is still an unknown.

If you have grain to move in the next 1 or 2 months, the charts continue to point to new lows. So if you are in that situation and need to move it and you have a good basis or the basis is locked in already, you should simply price the bushels and buy a call if you want to keep re-ownership.

If you can hold on and think basis will get better, you could buy a put to add a floor under the price of futures. We like using either the April or May put because we do not want to be spending a ton of money protecting these levels and hope that is the time frame where we will get that seasonal bounce.

For those of you that are scared you won’t pull the trigger on a rally because you think it will just keep going higher or if you have made sales. Courage calls may be a fit for you. To give you the courage to pull the trigger. Give us a call if you have questions because grain marketing isn’t one size fits all (605)295-3100.

Taking a look at the chart, we are at our most oversold levels since 2014. Corn has been trading in oversold territory according to the RSI (relative strength index) for two weeks now. When the RSI drops below 30 it is considered oversold. The RSI has now fallen 20. (The RSI is on the bottom of the chart).

It is impossible to give upside targets and recommendations until we find a bottom. Once a bottom is confirmed we will be giving upside targets.

Hopefully we can finally rebound when the farmer selling dries up and hopefully we do eventually get that catalyst that scares the funds. Such as South America production, US weather, or business from China.

It is hard to be bullish, but it is just as hard to bearish at these levels. We have the funds holding a record short position going into the safrinha corn and US growing seasons.

Corn March-23

Soybeans

Soybeans also continue to fall. Taking out those summer lows from last year. Down -29 cents on the week.

Same as corn, nothing for bulls to chew on.

South America is more competitive regarding the export price of soybeans. Their harvest is well ahead of schedule and US exporters could be get more competition.

We also have heard some chatter about China possibly switching to more soybean acres from corn with a new government program, but nothing has been confirmed.

The biggest thing today was the awful export numbers for soybeans. As mentioned, they came in at 56k vs the estimates of 300k to 800k. Worst number in a very long time.

South America is going to be what to watch closely short term and how their crops look coming out of the fields. Bulls are also hoping the next USDA report shows some sizable cuts finally.

US acres and production is going to slowly start to be talked about a lot more.

From VanTrump Report:

"The USDA's first guess is 87.5 million new crop soybean acres to be planted in 2024 vs 83.6 million planted in 2023. I think that number might be a little high especially if prices continue to trend lower."

If you are active on social media, you might’ve seen everyone talking about how soybeans hate trading in $11 range. Meaning we are in the $10's or lower, or $12's or higher, but never $11's. This is true.

I could see us bouncing back over $12 if we get some news out of Brazil. But if we do not, the next major support levels are $11 and $10.80 if we take a look at where we historically found resistance in prior years.

You know things are rough when even the biggest bears think this market is overdone.

An analyst who has been bearish soybeans for months had this to say:

"The bearish boat is quiet full. It has been a smooth ride for bears for months, but something tells me the ride could get rocky soon.."

From Soybean Trader 88:

"The good news is that every time the commercials have gotten this long, the market has turned around. The bad news is that is it not instantaneous and can take some time."

I would like to think that we start seeing some US weather concerns or a greater demand story to spark things back in the favor of the bulls, but as always no one wants to catch a falling knife.

We could get a 2016 type of repeat where Brazil's crop is smaller or get drought concerns here in the US, but nobody knows.

All you can do is get comfortable with where you are at in your situation. If you have to move something in the next 1 or 2 months, and have a good basis or basis is already locked in, you should be pricing bushels and buying calls if you want to re-own.

If you can hold in and think basis will improve, look at grabbing puts to add a floor. But do not overspend. I like adding protection more on soybeans than I do corn, because there is greater downside. But again keep your protection cheap.

Every operation is different so please feel free to give us a call if you want to go over what the best move for you would be. (605)295-3100.

Soybeans March-23

Wheat

The wheat market has held in better than corn and beans, as we haven't made a new low like we did in the those. However, it is disappointing to see us trade $6 yesterday and we are now over -25 cents off those highs. Chicago wheat was actually +6 1/2 cents higher on the week.

The weakness in the corn market isn’t helping wheat.

Today we had lousy export sales, which were down -33% from last week and down -28% from our 4-week average.

The biggest story in wheat is the sanctions being issued by the US and European Union on Russia.

However, the market doesn’t seem to care about this story. Intially it provided support, but kind of like the war headlines, the interest faded. Nobody knows id this will limit Russia's wheat exports or not. So for right now, I don’t see this as a major factor.

US weather is a wild card for wheat. Weather has been very warm which has eliminated a large portion of snow cover. Now forecasts are calling for a cold snap next week, which in turn brings potential winter kill with the lack of snow cover. But I do not think winter kill is all that likely but something to watch.

The lower prices in corn and soybeans could result in higher wheat plantings here in the US. However the reduction in spring plantings in Canada could be supportive the next few months.

Just like the US, drought potential looms. With the less snow and higher temps.

For right now, the market seems complacent trading sideways to lower. Russia has their cheap stock pile of wheat.

Wheat as I have said for a long time is still a sleeper, and I am remaining patient heading into the spring uncertainties here in the US.

As we mentioned yesterday, I look for Chicago to lead us short term when we decide to go higher.

Mar-24 Chicago

Mar-24 KC

Cattle

The cattle market looks like it wants to push to new highs, as we reached 4-month highs.

From a technical standpoint the market looks great. The cash market fundamentals are also solid.

We are not here to outguess the markets. We are here to practice good risk management.

Last week I recommended to hedge on paper and take advantage of this rally with a long put to keep your upside open and give you a floor.

I still like this strategy as there is a chance we go to test those highs, but realize this could also potentially be the top.

Depending on your risk to reward appetite, it might make sense to establish a floor with some puts as I personally like taking risk off the table on this rally.

Give us a call if you have questions or want help discussing a game plan. (605)295-3100.

I like having corn for feed and soybean meal needs covered in the cash market through February.

Live Cattle

Feeder Cattle

Want to Talk?

Our phones are open 24/7 for you guys if you ever need anything or want to discuss your operation.

Hedge Account

Interested in a hedge account? Use the link below to set up an account or shoot Jeremey a call at (605)295-3100 or Wade at (605)870-0091

Check Out Past Updates

2/22/24

HAVING A PLAN & DEFINING RISK

2/21/24

LOWER LOWS & DROUGHT TALK

2/20/24

HOPE ISN’T A MARKETING PLAN BUT HISTORY REPEATS ITSELF

2/16/24

HAVE ENOUGH OF YOUR NEIGHBORS THROWN IN THE TOWEL SO WE CAN BOTTOM?

2/15/24

BASIS CONTRACTS & USDA OUTLOOK

Read More

2/14/24

SELL OFF AHEAD OF USDA OUTLOOK: STRATEGIES TO CONSIDER

2/13/24

LA NINA, FUNDS, & USDA OUTLOOK FORUM

2/12/24

WHAT TYPE OF GARBAGE USDA OUTLOOK REPORT IS ALREADY PRICED IN?

2/9/24

RECORD SHORT FUNDS, SOUTH AMERICA, & MANAGING RISK

2/8/24

CONAB VERY FRIENDLY. USDA NOT. FULL BREAKDOWN

2/7/24

NEW LOWS IN CORN & USDA PREVIEW

2/6/24

WHAT IS EXPECTED FROM USDA & WAYS TO GET COMFORTABLE

2/5/24

STILL NO CLEAR DIRECTIONS IN THE MARKETS

2/2/24

NEW BEAN LOWS.. HOW LOW CAN CORN GO?

2/1/24

NO CONFIRMATION OF HIGHER OR LOWER PRICES IN GRAINS

1/31/24

HOW SHOULD YOU BE SETTING YOUR TARGETS?

1/30/24

OUTSIDE UP DAY IN ALL THE GRAINS

1/29/24