WILL FUNDS BE FORCED TO COVER?

Overview

Great day across the grains, as wheat extends it's 5-day rally to nearly +70 cents while corn found strength following yesterdays poor performance.

Soybeans initially got hammered hard, down double digits but rallied back to close down just -1 to -3 cents.

Export sales for corn this morning where impressive and part of the reason corn was higher. Wheat export sales were decent. Soybean export sales were terrible and the main reason we sold off early in the day.

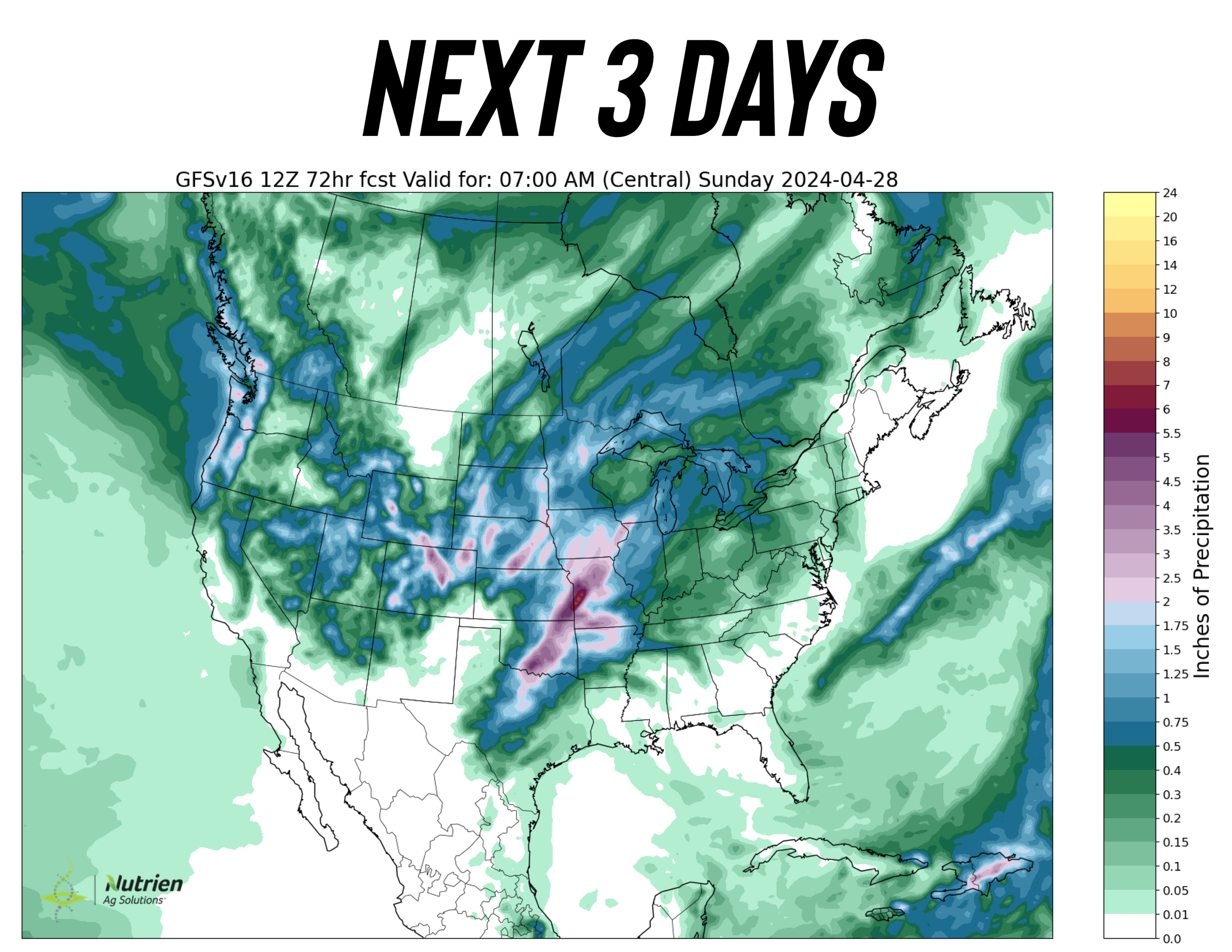

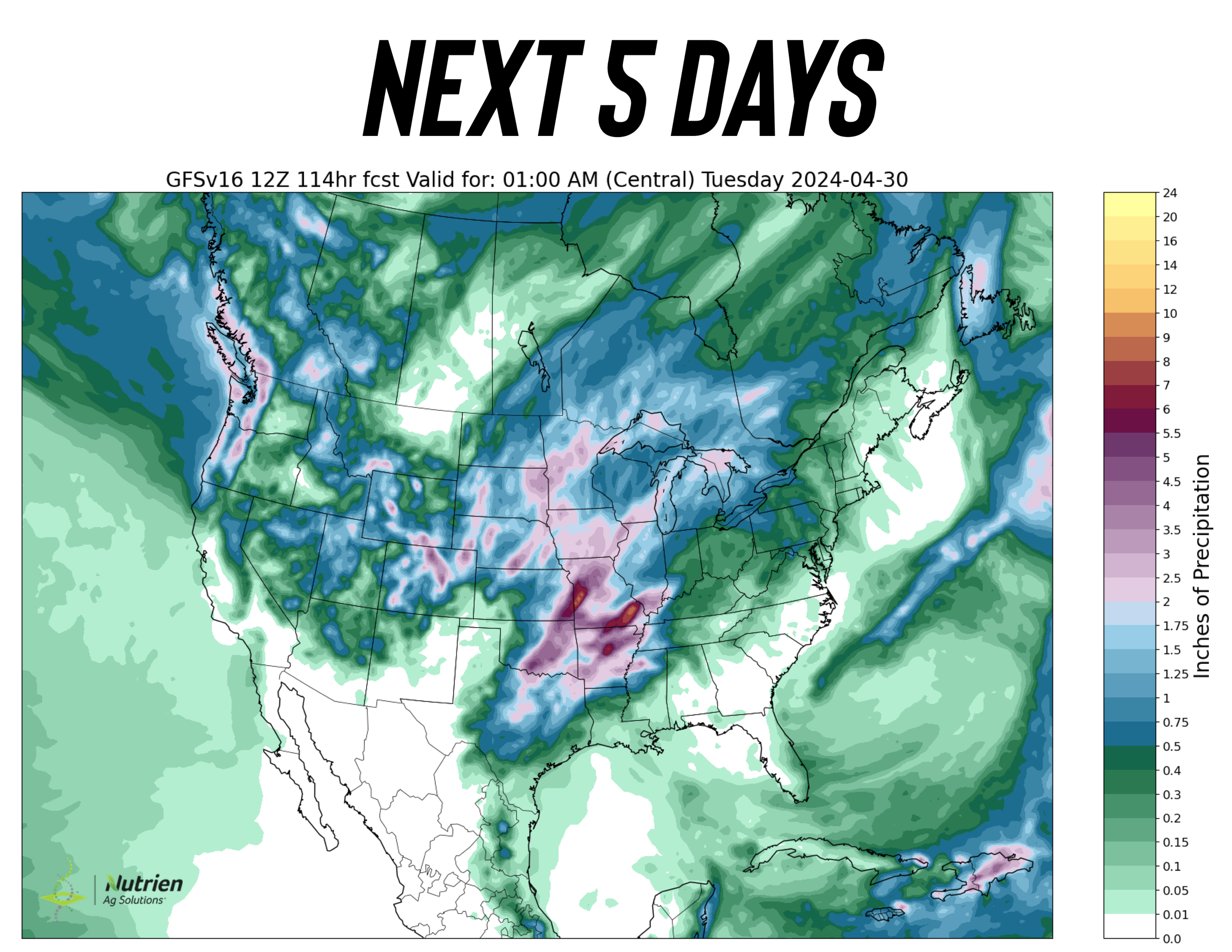

Planting has been going great so far for most, however it does look like we could see a step back the next 5-6 days. Rain in April isn’t unusual, but we are suppose to get decent rain until around May 4th. So about another week.

The rain is supposed to be the greatest in Iowa, Minnesota, Wisconsin, Missouri, eastern South Dakota, and Nebraska. Areas such as Indiana and Ohio are expected to be drier in comparison.

We are also going to be getting rain in the winter wheat country, the same one that has severely lacked moisture. However, some of these storms could bring high winds and possible tornados.

This is going to cause some delays to planting for the next week. Which means crop progress will likely fall behind normal pace next week, but should quickly rebound in early May.

Here are the forecasts:

Delayed Planting?

Let's say planting get's severely delayed. Remember 2019?

No I do NOT expect this to happen, but if it did the market would not even care about this for another 3 weeks if history is any indication.

In 2019 we had extremely delayed planting, the worst we have seen and the market did not find a bottom until May 13th before rallying.

Even with these slight delays I imagine planting will pick right back up after this week and go along at a normal to above normal pace.

IF it does not and IF we do NOT have 50% of this corn crop planted by May 10th (forecasts show wet until May 4th) the market will start to care.

Again, I don’t see this happening but it is possible.

Options Exp & First Notice Day

Options experation is tomorrow. First notice day is next Tuesday.

Typically the big money tries to pin the market where the most open interest is, making the most amount of people lose money.

First notice day and basis contracts needing to be priced or rolled, leads to farmer selling.

The last few options expirations and first notice days were all blood baths leading up to it.

No we do not have quiet as many basis contracts out there, hence we have seen less pressure than we did in February.

But after each time we have gotten these events out of the way, the market has found support and bounced. Once these are not standing in the way, it will be friendly for our markets.

I would not be surprised to see the funds try to position May corn right $4.40 and wheat right at $6.00 tomorrow.

Why?

When we go into options expiration and the funds are short, they want as many options to expire as worthless as possible.

Because for every short position (seller) there is a long position (buyer). Currently the funds are the sellers.

If those options expire worthless (meaning we close below the strike of the call option, or above on a put option), they will make the most amount of money possible on the options they sold (collect the full premium). (When you sell an option you collect the premium the buyer paid to buy the contract).

On May corn, there is a ton of open interest at both the $4.40 calls and puts. We are right above $4.40 today. So don’t be surprised to see the market try to pin us right at $4.40 to try and make everyone holding their $4.40 options lose their money.

The same thing goes for May wheat, it is the $6.00 calls that have the most open contracts.

I do not see this as an issue for soybeans as the only contract with a lot of open interest is the $12 calls and we are already under that.

The Funds

The funds are still heavily short:

Corn: -250k

Beans: -115k

Wheat: -35k

For the past 2 months, our markets have chopped sideways to slightly higher.

This means that the funds have been holding a position that is not making them money.

They are frustrated.

What do you do with a position when it isn’t making money?

You get rid of it.

We are also heading into a time frame associated with weather risk and a time where we typically price in weather premium and trade higher.

Let's dive into the rest of today's update....

Today's Main Takeaways

Corn

Corn posts a solid day taking back most of yesterday's losses.

Today we were led by great export sales as well as some strength in wheat.

As mentioned, the rains are going to delay planting a little bit but we won’t know for a few more weeks if this is going to dramatically slow things down.

I still think we will have a relatively fast planting. But there is always that possibility if the rain continues. May 10th is the date to watch, if the crop is less than 50% planted the funds will get nervous fast.

Every year we run into weather conversations and if yield is going to be there or not.

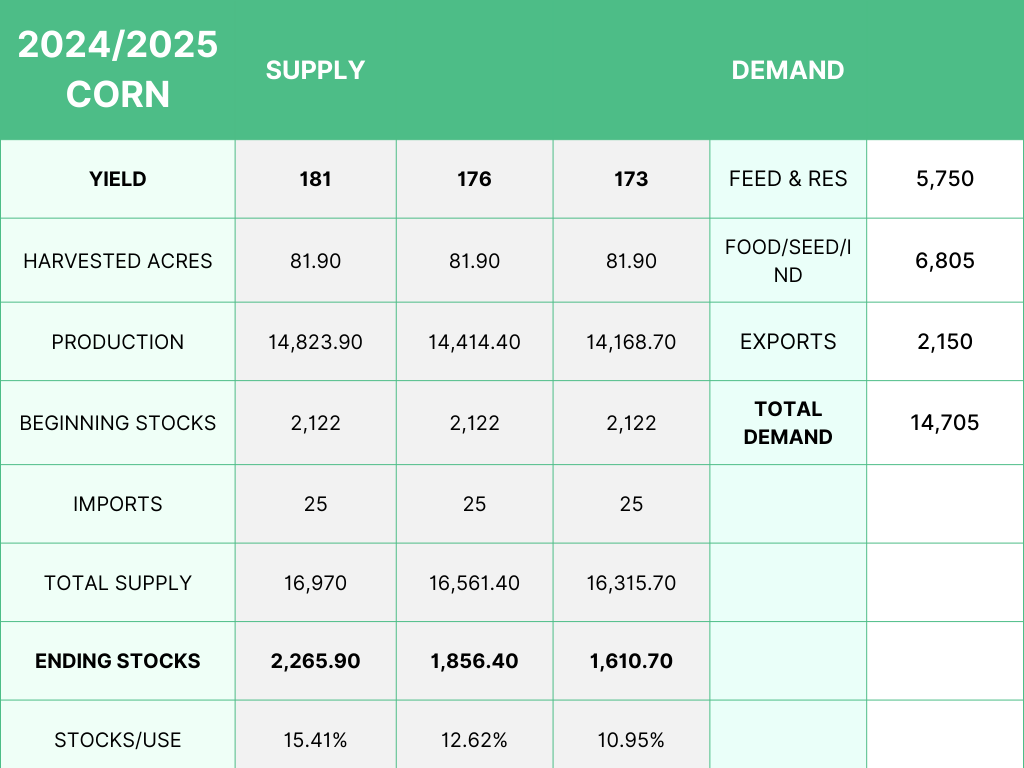

I wanted to against show you this chart about roughly how our carryout situation would change if yield drops from the current record 181 the USDA has.

If yield goes to 173 to 176, it changes the entire corn situation.

It doesn’t even need to be real, the market just has to imagine and perceive this as a possibility.

That is why we get a weather driven rally nearly every year. Typically making highs in the June time frame.

The current outlook for this summer is brutally hot and dry. However it doesn’t get brutally hot and dry until July. So there is a chance this corn market tops out a little later than where we usually do.

That is my stance as for now.

Some areas are seeing very strong basis, if you are in that area there is nothing wrong with getting some of that cash then re-owning if you want to participate in the upside. There are many ways to re-own.

Options will get more expensive the farther we get into the weather market because they will price in greater volatility.

With the funds as short as they are I think they will eventually want to cover that position. When the futures rally, basis may not see as nice of a rally.

But for most of you we want to be making sales in that June timeframe, waiting for a trigger to tell us we are near the highs.

Keep in mind, we have rather big carry in the corn market. Which means you might not wanting to be selling nearby, rather hedging the rallies and waiting for basis to get better.

Give us a call if you have questions or want specific advise. (605)295-3100

On Dec corn, a break above $4.81 would take out the highs from the day of the USDA report, it would take out the 100-day MA, and the downtrend from June. Once we break that, the next major resistance is the gap left at $5.03

Dec Corn

July Corn

May Corn

Soybeans

Soybeans post a great day despite closing lower. Bouncing double digits off the lows.

As mentioned, we were lower on the horrible export sales, but rumors of China buying some cargos of Brazil beans helped add support.

Remember the recent sell off that was partially due to Brazil farmer selling due to the US Dollar vs Brazilian Real price? Well that is partly out of the way now, as a week ago 5.3 Reals equaled $1 in the US. Now is is 5.15. So we should see less Brazil farmer selling now.

Not much else new for soybeans.

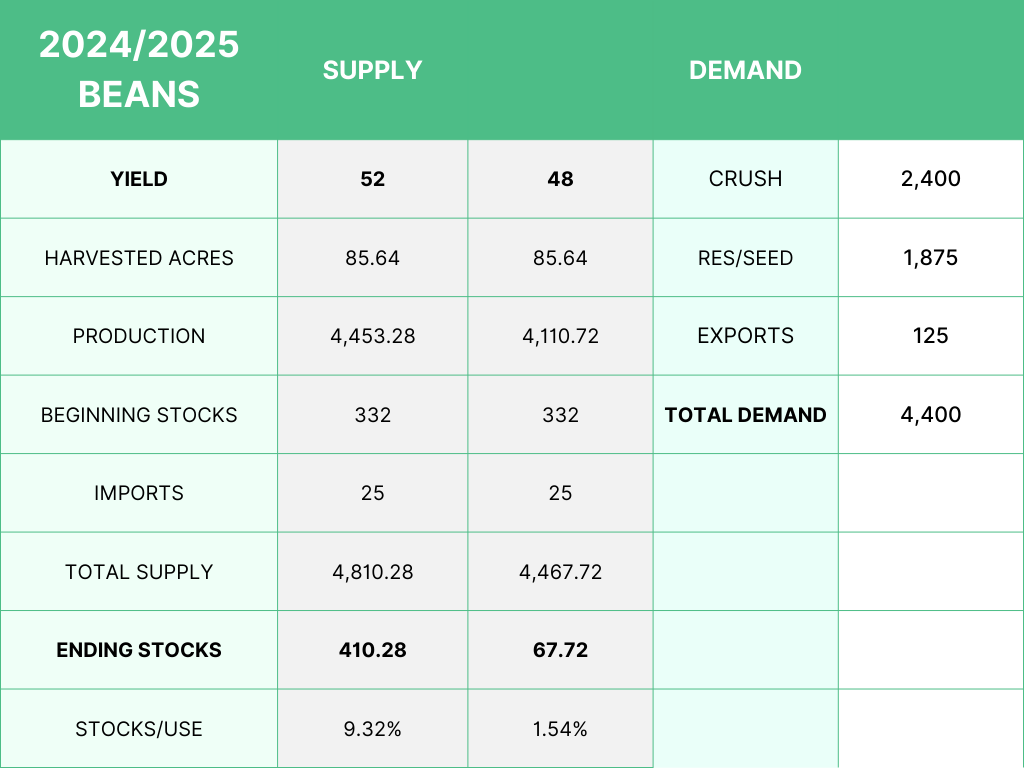

Again, look at how tight our situation here in the US could get if yield drops. We already have a decently tight situation. If the market thinks yield is 48 even for a moment, it could rally us because with a 48 yield we nearly run out of soybeans.

Still remaining patient looking towards the summer for soybeans.

Looking at July beans. Beans are sitting right at resistance.

We need to take out that downtrend and the 50-day MA.

If we can do that, our next resistance is around $$12.30 to $12.40 which is the 100-day MA, and the highs from the day of the USDA report.

If we can take out those highs, the next stop could be that gap fill around $13.00

July Beans

May Beans

Wheat

Wheat continues to shine, up +70 cents in 5 days.

Why are we rallying?

There are a few things:

We have brutal dryness in the southern plains and winter wheat country, however they are expected to get rain.

We have had an increase in war tensions, as Russia said they are going to attack Ukraine again because the US aided $61 billion to Ukraine for their military and economic suppoort.

Then we have India stocks being the lowest in 16 years. They are a top 3 producer in the world behind China and the EU. They are on the verge of switching from a net exporter to a net importer for the first time in a long time which would be very friendly for export business.

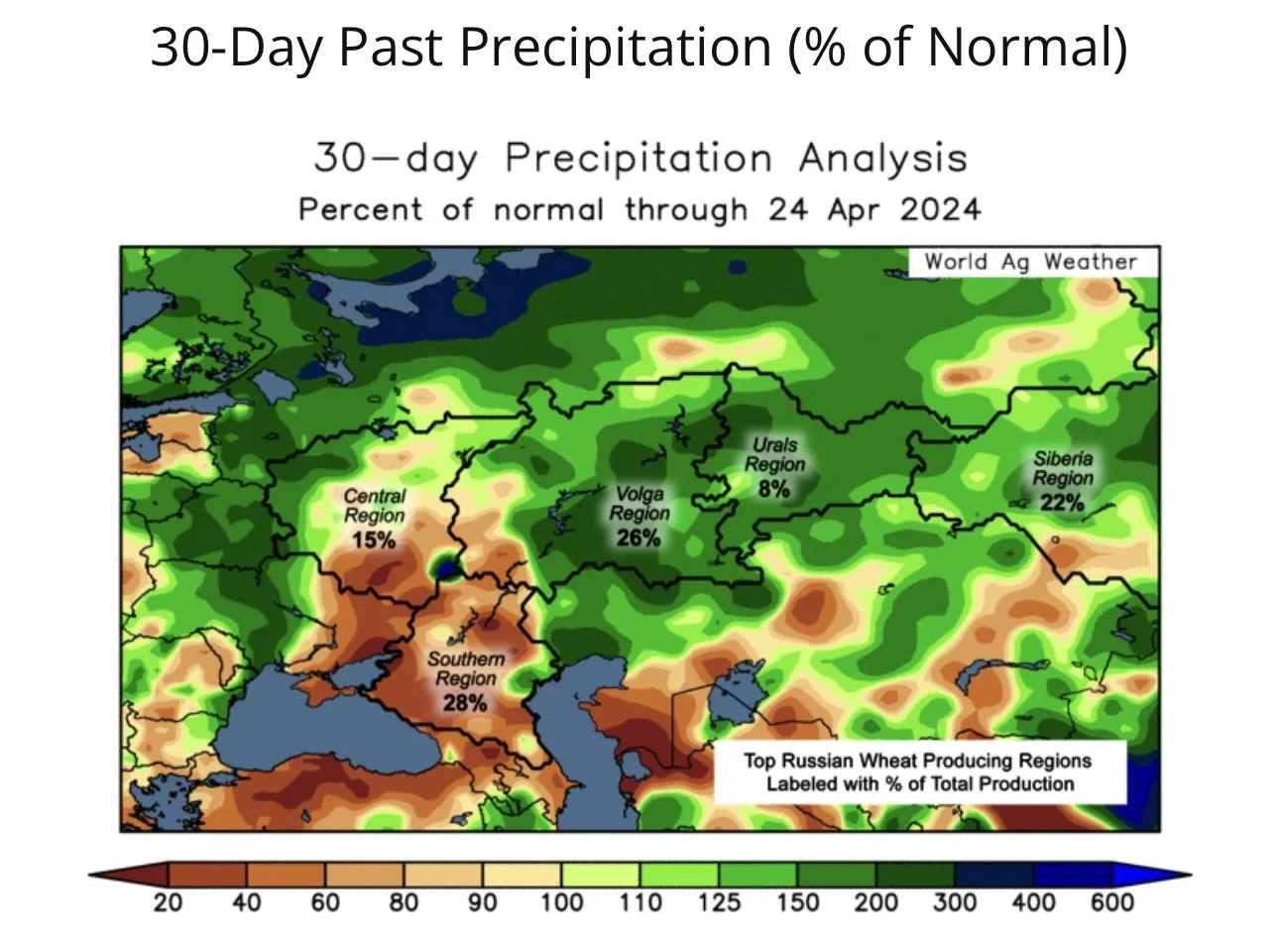

Lastly one of the most important factors is southern Russia weather, where a good chunk of the winter wheat crop is grown. They are very dry and the forecasts suggest continued dryness.

It feels like things are finally starting to turn around in the wheat market.

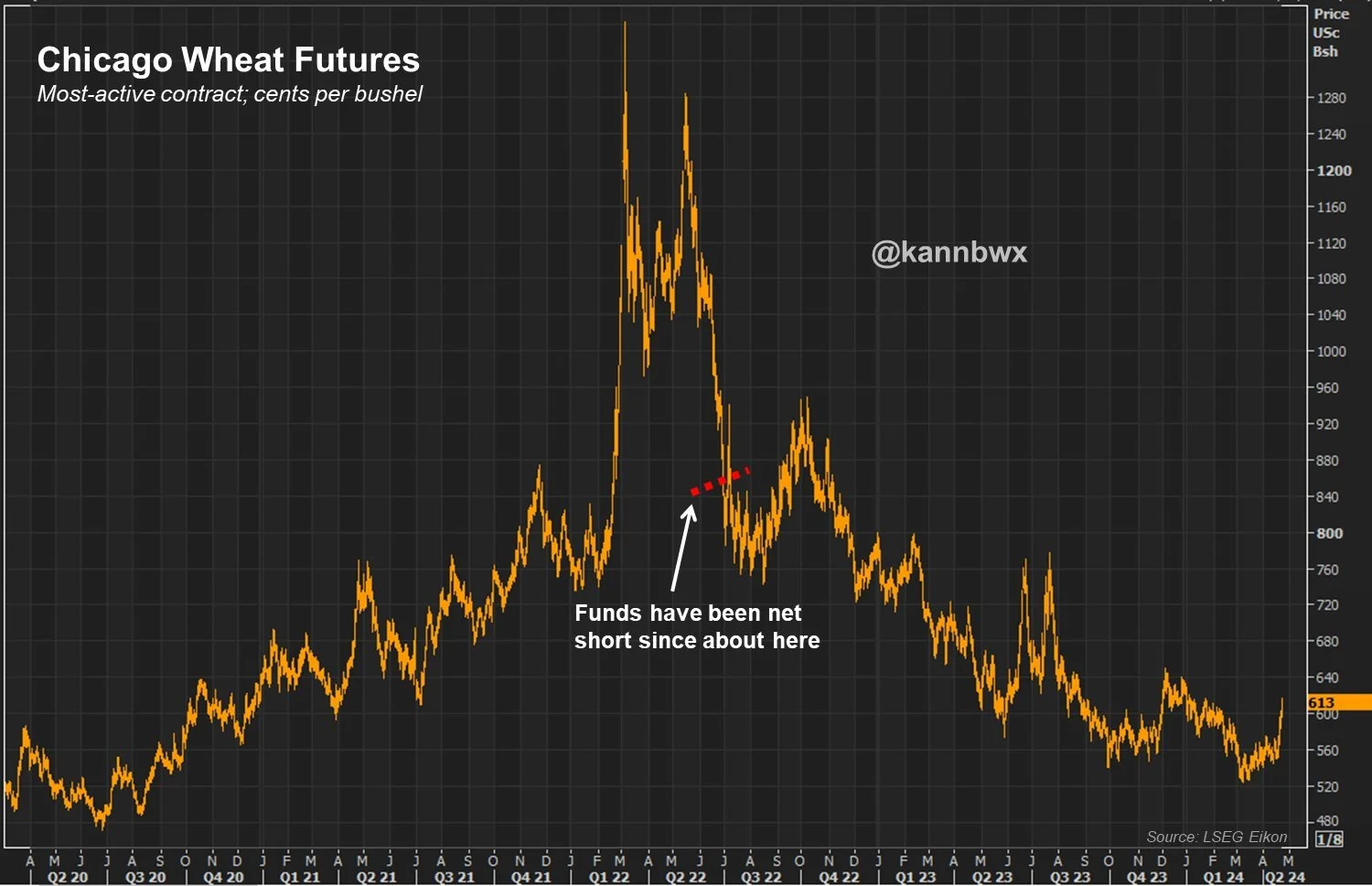

The funds have been short wheat since March of 2022.

What happens when they get long?

One wouldn’t expect them to continue holding on to a position that is losing them money.

We are a little overbought, so don’t be surprised to see a slight correction.

However, unless the Russia wheat forecasts turn wet, one would expect the breaks to be bought.

If you are in a situation where you can hold wheat for a year or longer, then I don’t think you have to do anything here. If you are someone who knows you are going to have to move something soon then there is absolutely nothing wrong with rewarding this rally.

Give us a call if you have questions on your situation. (605)295-3100

The charts could be another reason the funds want to continue to cover wheat.

If we break above the 200-day MA I think the funds will be forced to cover even more.

For July Chicago wheat that is $6.28, just +8 cents away.

July Chicago

May Chicago

July KC

May KC

Cattle

Cattle market continues to show some strength following the recent sell off.

From the charts it looks like we want to go test that upper trend resistance.

Give us a call if you want to go through any strategies. (605)295-3100.

June Live Cattle

August Feeder Cattle

Want to Talk?

Our phones are open 24/7 for you guys if you ever need anything or want to discuss your operation.

Hedge Account

Interested in a hedge account? Use the link below to set up an account or shoot Jeremey a call at (605)295-3100 or Wade at (605)870-0091

Check Out Past Updates

4/24/24

WHEAT CONTINUES BULL RUN & CORN FAILS BREAK OUT

4/23/24

FUNDS CONTINUE TO COVER & RALLY GRAINS

4/22/24

GRAINS CONTINUE 2-DAY RALLY

Read More

4/19/24

ONE DAY WONDER? EXTREME VOLATILITY & RALLY

4/18/24

GRAINS WAITING FOR WEATHER MARKET

4/17/24

NOT IN THE WEATHER MARKET QUITE YET

Read More

4/16/24

CHOPPY TRADE IN GRAINS CONTINUES

4/15/24

PLANTING PROGRESS & BRUTAL CHOP

4/12/24

MARKET DOESN’T BELIEVE THE USDA

Read More

4/11/24

GARBAGE USDA REPORT THAT DIDN’T MEAN MUCH

4/10/24

USDA & CONAB TOMORROW

4/9/24

USDA IN 2 DAYS. THINGS TO WATCH & HOW TO BE PREPARED

Read More

4/8/24

USDA REPORT THIS WEEK. WHAT YOU SHOULD BE DOING

4/5/24

STRATEGIES ELEVATORS COULD BE OFFERING THAT YOU SHOULDN’T BE USING

4/4/24

WEATHER, BIG MONEY, CHOPPY TRADE

4/3/24

EXPECT BIG PRICE SWINGS & VOLATILITY