BEANS COLLAPSE

Overview

Grains pressured across the board, as soybeans led the grains lower, getting hammered by nearly 40 cents. This came after yesterday's strong price action where wheat led us higher following their bullish report Friday.

The main pressure in beans came from the fast planting in the crop progress report yesterday, as well as some poor economic data coming out of China this morning. The lack of fresh bullish news also didn’t help bulls today.

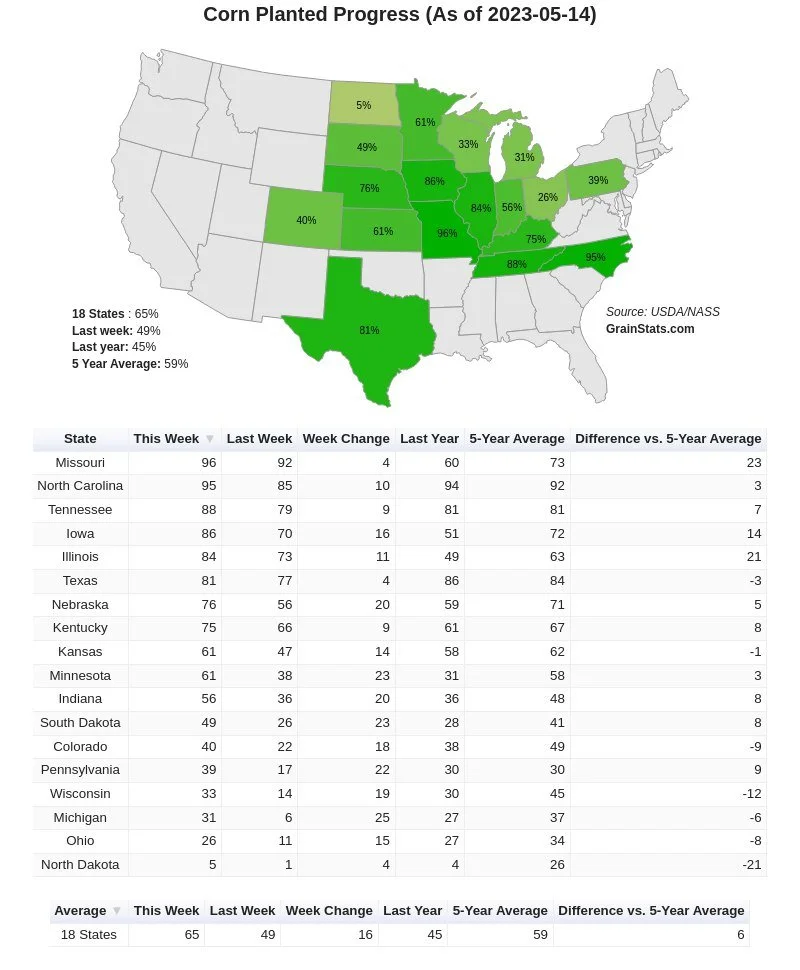

Planting showed corn at 65% planted vs the 59% average. If we take a look, it's the "I states" that are ahead of pace. Which is an indicator that it is very dry across the corn belt.

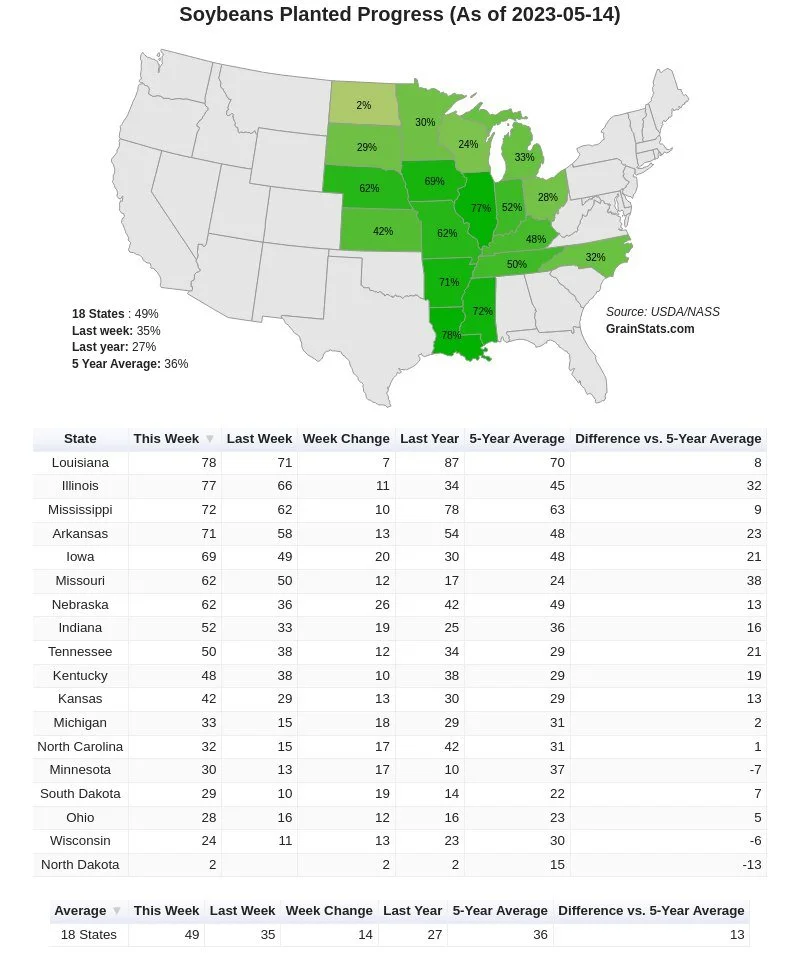

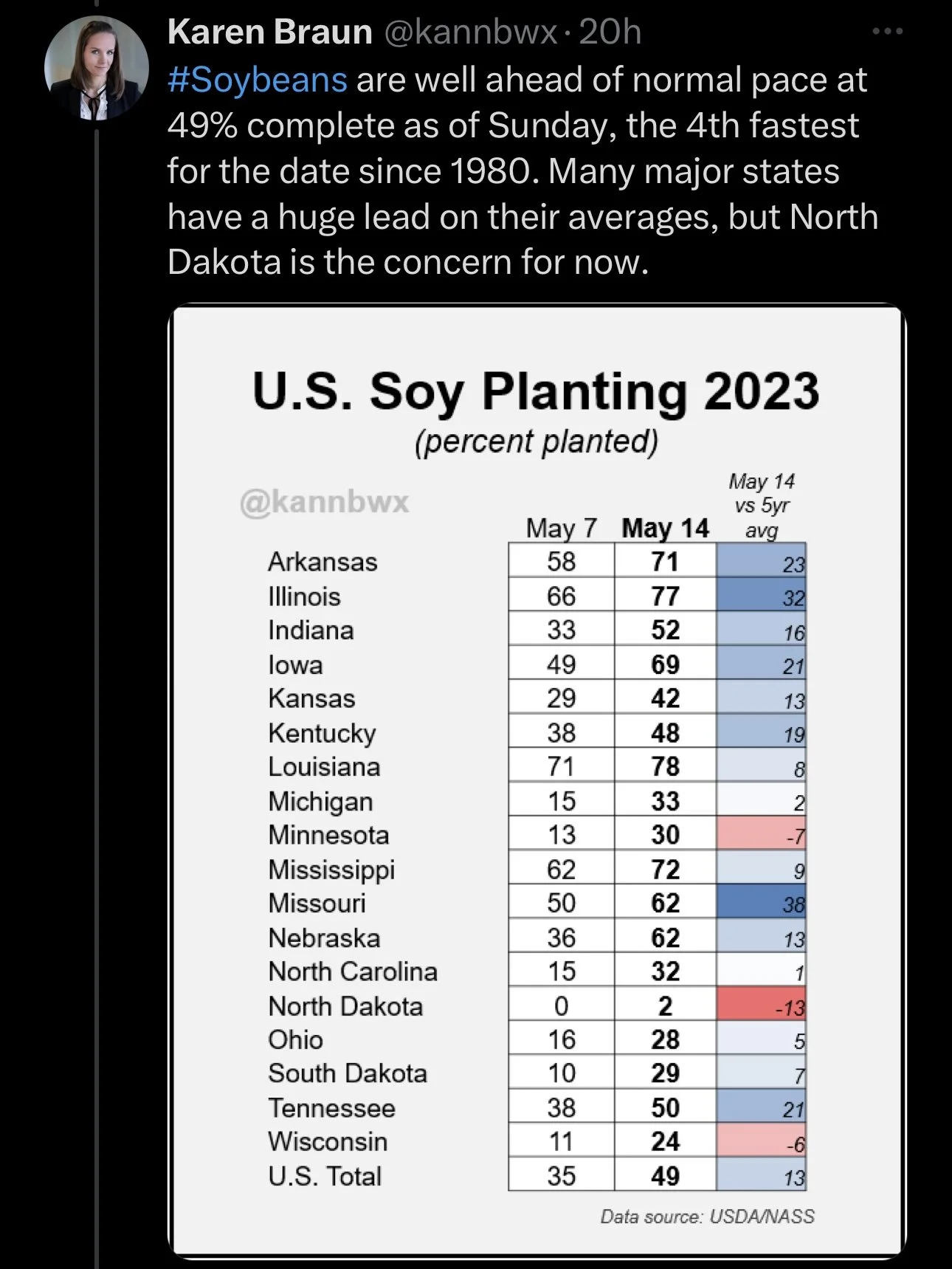

Beans are well ahead of pace, coming in at 49% vs the average of 36%. This is their 4th fastest pace since 1980.

Wheat conditions did slightly improve, but were nothing to write home about. As good to excellent ratings remained at 29%, while poor to very poor went from 44% to 41%. However, our top grower of Kansas did slip again, as they still sit at just 10% rated good to excellent.

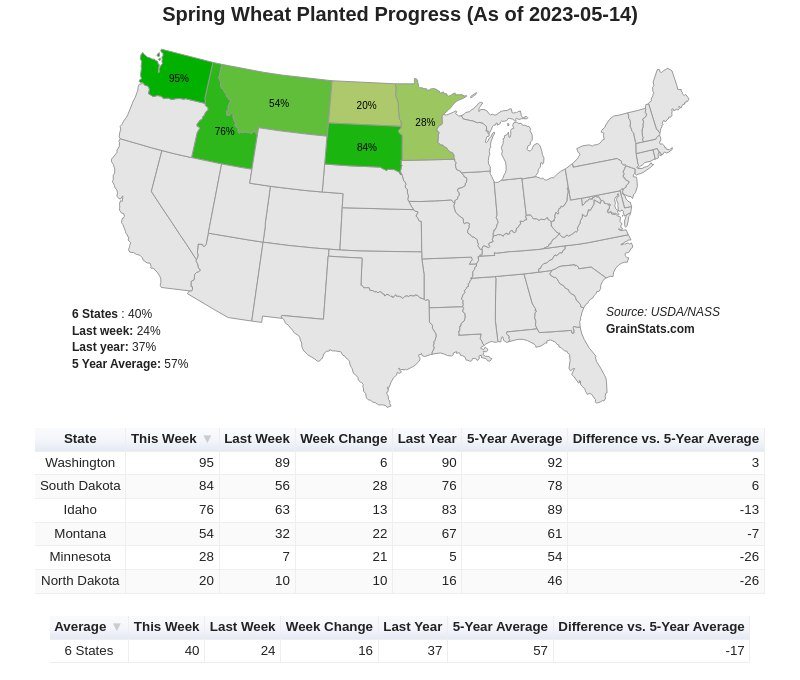

Spring wheat planting is still well behind schedule. Coming in at 40% planted vs our average of 57%.

***

In case you missed it, check out Sunday's Weekly Grain Newsletter where we went over the USDA report and the garbage assumptions. Read Here

Crop Progress & Conditions

Corn 🌽

Planted: 65%

Trade: 68%

Last Week: 49%

Last Year: 45%

Average: 59%

Beans 🌱

Planted: 49%

Trade: 51%

Last Week: 35%

Last Year: 27%

Average: 36%

Spring Wheat 🌾

Planted: 40%

Trade: 39%

Last Week: 24%

Last Year: 37%

Average: 57%

Chart Credit: GrainStats

Winter Wheat 🌾

Good to Excellent: 29%

Last Week: 29%

Last Year: 27%

Poor to Very Poor: 41%

Last Week: 44%

Last Year: 41%

Today's Main Takeaways

Corn

July corn ends the day down 11 3/4 cents, giving back all of our gains from yesterday.

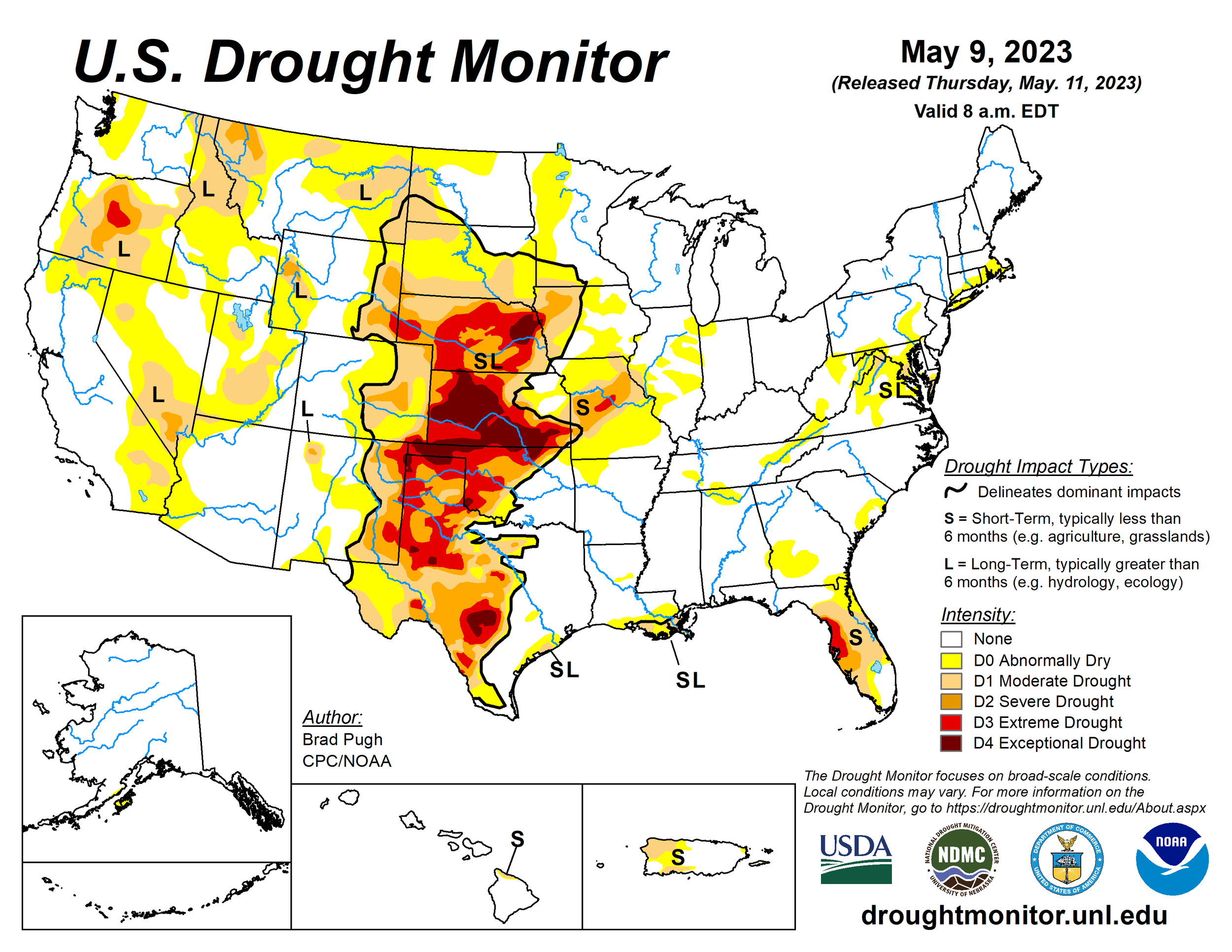

Planting for corn continues to move along fast, as we came in at 65% planted. Which is a jump from last week's 49% and is 6% higher than our 5-year average pace of 59%. On the surface, sure one could look at the fast planting to be a slightly bearish factor. But we have to remember, fast planting means it’s dry. Drought is still a very real concern the corn belt is facing. Just take a look at the states that are running ahead of pace. It’s the "I states" of Iowa and Illinois.

With all of the hard red winter wheat production issues we've seen and less being used in feed rations, this leads bulls to make the argument that more corn is going to be used.

Bears on the other hand still look at Brazil as a negative factor. As their crop appears to be getting bigger, but then again if you read Sunday's right up, we pointed out that a large portion of their second corn crop was planted too late, and a lot of areas that have gotten rain is in very sandy soil. If you take a look at their current forecast, it’s pretty dry.

Which leads to another argument that the USDA may have jumped the gun on raising their Brazil estimates. China might eventually get burned from canceling those sales if the corn belt remains dry and Brazil remains dry.

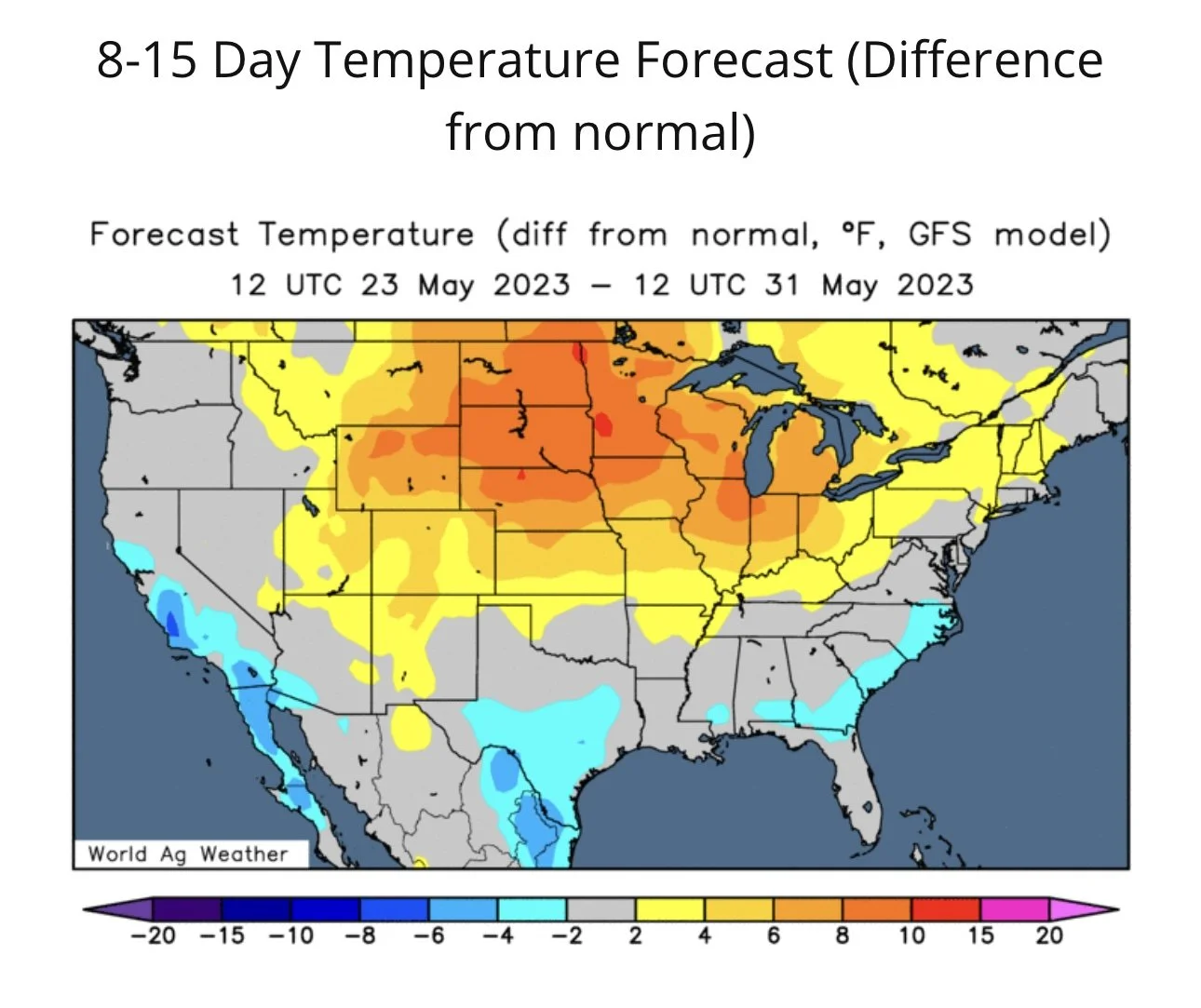

The more and more we continue to look at and compare this year to that of 2012, the more we continue to realize the similarities. In 2012 we were essentially done planting towards the back end of May. The trade didn’t realize the drought issues we were facing until late June. This year could very easily be a similar story line, as the funds are undervaluing weather premium and drought in our markets. We still don't have much if any weather premium built in.

The funds are holding a massive short position of over 100k contracts of corn going into an entire growing season. Will they really want to hold that big of short with all of the potential wild cards and weather concerns that we could very easily encounter over the course of the next month or so?

Below is a few weather maps. The first is past precipitation, and the other two are forecast precipitation. Just take notice of the "I states" and the corn belt.

****

Technical Analysis Audio

Here is an analysis from Vince, where he talks about dates where we might see reversals & highs. As well as our reversal pattern still being in place.

Corn July-23

Soybeans

Soybeans collape today. As July beans close down nearly 37 cents, trading at our lowest levels since August.

One of the biggest reasons for the downfall in beans today was poor economic date we received from China this morning. The poor data had such a negative effect as China is the biggest buyer for US beans.

The data showed that their unemployment rate is above 20% in Bejiing for the time since they started tracking the data 5-years ago. To add on to the pressure, bean planting remains at a fast pace. Coming in at 49% planted vs our typical average of 36% planted.

We also continue to see South America, mainly Brazil pressure the bean market. As Brazil still is looking at a massive crop, which is being offered at a huge discount to that of the US. We saw some yields come in a little better than expected, which ultimately led to Dr. Cordonnnier bumping his Brazil estimate by an additional 1 million metric tons to 155 million.

Bears continue to look at Brazil as one of the biggest things putting a lid on beans. Not only do they have a monster crop, but it is still being offered at an 80 cent discount. However, we can’t count out the problems we have seen in Argentina. We haven't really seen Argentina involved in the markets at all. With the problems they've faced, we could look to see more demand in meal.

From Mark Gold at Top Third,

”Over the weekend we saw the basis in Brazil go from 15 under to 30 over. When the basis moves 45 cents like that essentially over the weekend it's an indication that farmer selling has dried up.”

Going into today, the funds were long around 40k contracts. We will have to see where they are sitting at the end of the week but they probably sold 25k to 30k contacts on today’s sell off.

Taking a look at the chart, we made new lows on today’s brutal sell off. Breaking our March lows and trading at our lowest levels since August. We do have a gap to fill at $13.53 from last July which is 11 cents lower than where we closed today. So I wouldn’t be surprised to see us try to fill that gap before getting a reversal higher.

Right now there isn’t a ton for bulls to chew on with the China news and the fast planting. Nearby, I could definitely see us face additional pressure and struggle to rally. But long term I think we might have a deeper bull story developing, but it might not happen until early summer.

Soybeans July-23

Wheat

Wheat futures mixed here today. Chicago kind of took it on the chin as it followed corn and beans lower, closing 13 cents lower. As both Chicago and KC futures give back some of their gains on today’s losses following the 2-day rally we just saw. But Minneapolis managed to close green, as did the back month KC contracts.

Planting progress and crop conditions didn’t provide a ton of change, but are still factors bulls think could continue to add support. Spring wheat planting is extremely far behind (-17%). Coming in at 40% planted vs our average of 57%.

The winter wheat ratings did see a slight improvement. The good to excellent rating was left unchanged at 29%. Poor to very poor improved from 44% down to 41%, but the biggest take away there is that Kansas's poor to very poor rating slipped yet again. This alone could look to support KC wheat on any breaks.

Drought and dryness are starting to grab more attention. As dryness in Canada continues. The eastern midwest looks dry, which might make some start paying more attention. We also have El Niño which could cause that area to become even more dry.

No real updates surrounding the Black Sea agreement. The deal expires this Thursday so that will be something to keep an eye on. Overnight, Reuters reported that Russia made some drone attacks on Kyiv. So there is definitely still some possibility for escalations.

Going forward, we have the KC crop tours getting underway, as today is the second day. I personally can’t imagine a world where these remotely even come close to being better than expected. So I expect these to open some eyes and keep the wheat market well supported.

Keep in mind, the funds are still short over 100k contracts of Chicago wheat. Could we continue to see some pressure in Chicago? Of course it’s a possibility. I think KC will continue to lead the wheat market higher. We have an awful winter wheat crop. We a have drought that many may not realize the extent of yet. I don’t think anyone would want to be short wheat here.

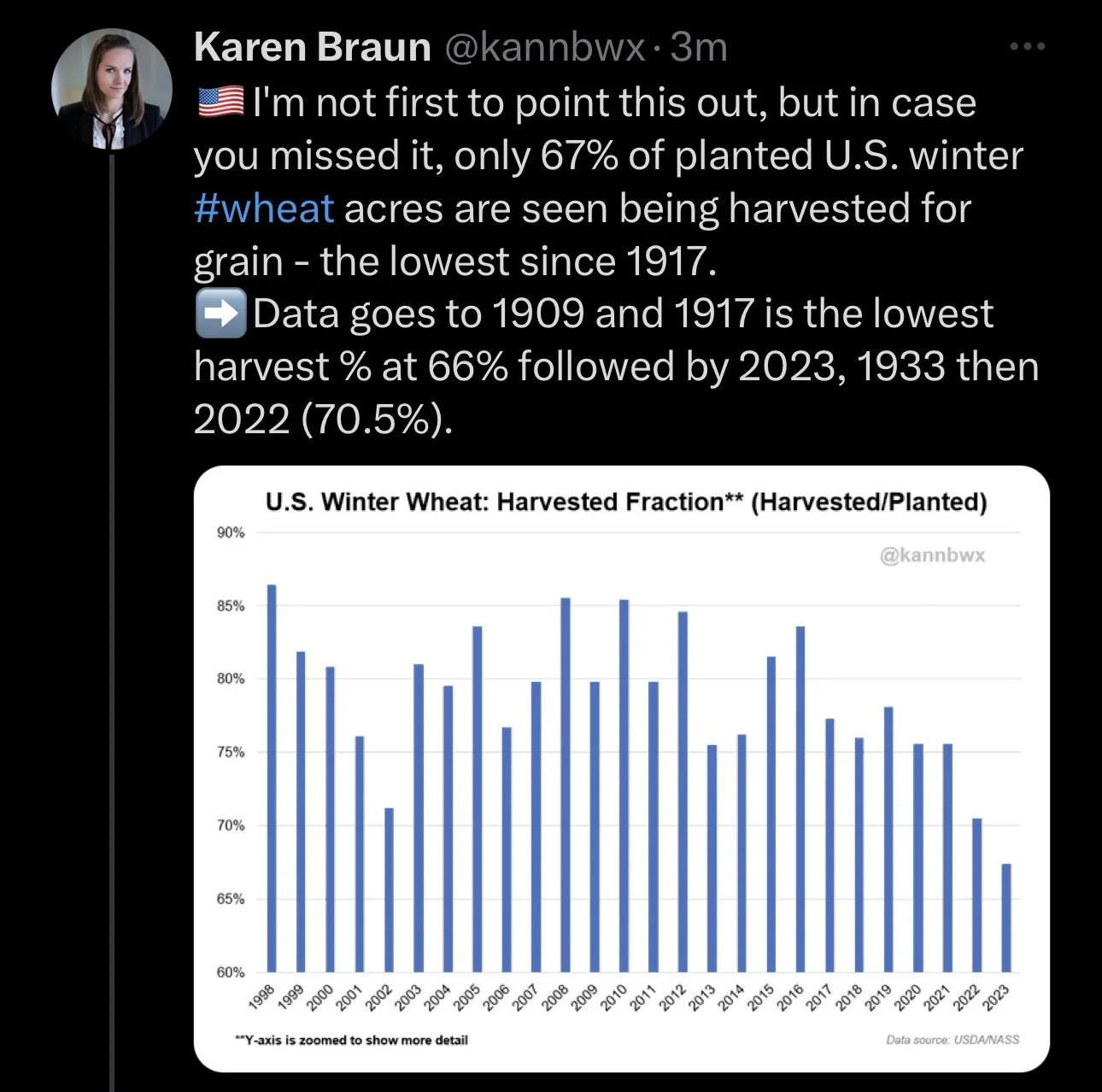

I saw some interesting data on Twitter today. It showed that US winter wheat acres are having the highest abandonment rate since 1917.

Taking a look at our charts. First we have Chicago, where on yesterday's rally we actually tested a break out from the downtrend from last May. On today’s losses we went back and found support at that line. Bulls would like to continue to see a break out to go and test that other downtrend from October.

KC on the other hand blew past our downtrend, and found resistance right at that $9 target I had last week. A break past that and we could see the upside open up.

Chicago July-23

KC July-23

MPLS July-23

Other Highlights & News

According to Reuters, the corn belt drought is worse than a year ago.

From Wright on the Market, "Turkey’s presidential election will be going to a runoff on May 28th. Ukraine Grain Corridor deal is probably dead."

From CHS hedging, "Farmers are not engaged with corn at these price levels as they are more focused on getting their crops planted."

The crop tours for Kansas wheat crop is getting underway, as today is their second day.

North Dakota planting remains far behind for all crops.

All of China's economic data targets were missed.

Hedging Account

No matter the situation you are in, our partners at Banghart Properties Grain Marketing can help you come up with a plan of attack to help you manage your risk. If you want help managing your risk you can give them a call anytime at (605) 295-3100 or set up a hedge account below.

Check Out Past Updates

5/15/23 - Audio

If You're Short Wheat.. Be Ready to Sleep On Street

5/14/23 - Weekly Grain Newsletter

USDA Garbage Assumptions

5/12/23 - Report Recap Audio

USDA Confirms Horrible Wheat Crop, Plays Games With Corn & Beans

5/11/23 - Pre-Report Market Update

Grains Pressured Ahead of Report

5/10/23 - Audio