BEANS PULLBACK & DROUGHT CONTINUES

Overview

What a wild week and a half it’s been since my last market update. Since then we have seen corn rally +70 cents and beans $1.30 even with today’s near 40 cent loss. In my last update June 12th, I mentioned we would be going a lot higher if it stayed dry come the end of June.

Following a $2 rally from our lows on May 31st, soybeans see some heavy pressure for essentially the first time on this rally. The pressure in the beans leaked over to corn futures as well.

There wasn’t a ton of reason for the major sell off in beans today. Bean oil got hit hard, but that’s the wrong reason to be selling beans. Likely a lot of profit taking given the massive rally the past two weeks.

We have some rains in the northern plains but not much if any across the I-states as it remains very dry. I think selling on a big break like today is a mistake especially with conditions and weather the way they are.

Pullbacks like the ones today are necessary in a bull market to keep the rally going. Parabolic uptrends are not healthy. So today’s correction was expected to happen sooner or later, but I think it sets us up better to continue this bull run.

Until we see some ground breaking shift in the weather pattern and get this extreme timely rain I don’t see why we wouldn’t continue to climb higher. Personally I wouldn’t want to be short over the weekend with the lack of moisture in the forecasts and knowing that we will very likely see crop conditions continue to deteriorate.

Today's Main Takeaways

Corn

Corn futures follow beans lower here today, as December closed down 8 cents, but managed to close 7 cents off it's lows.

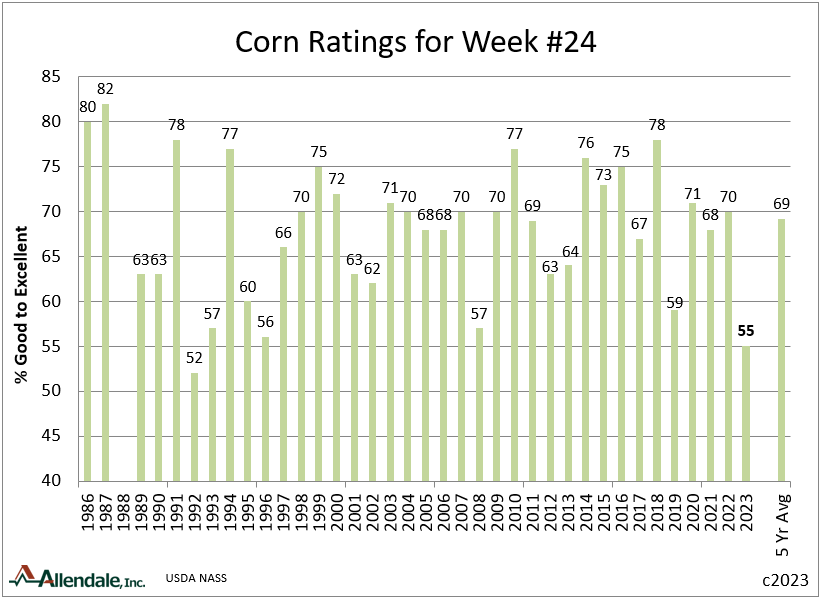

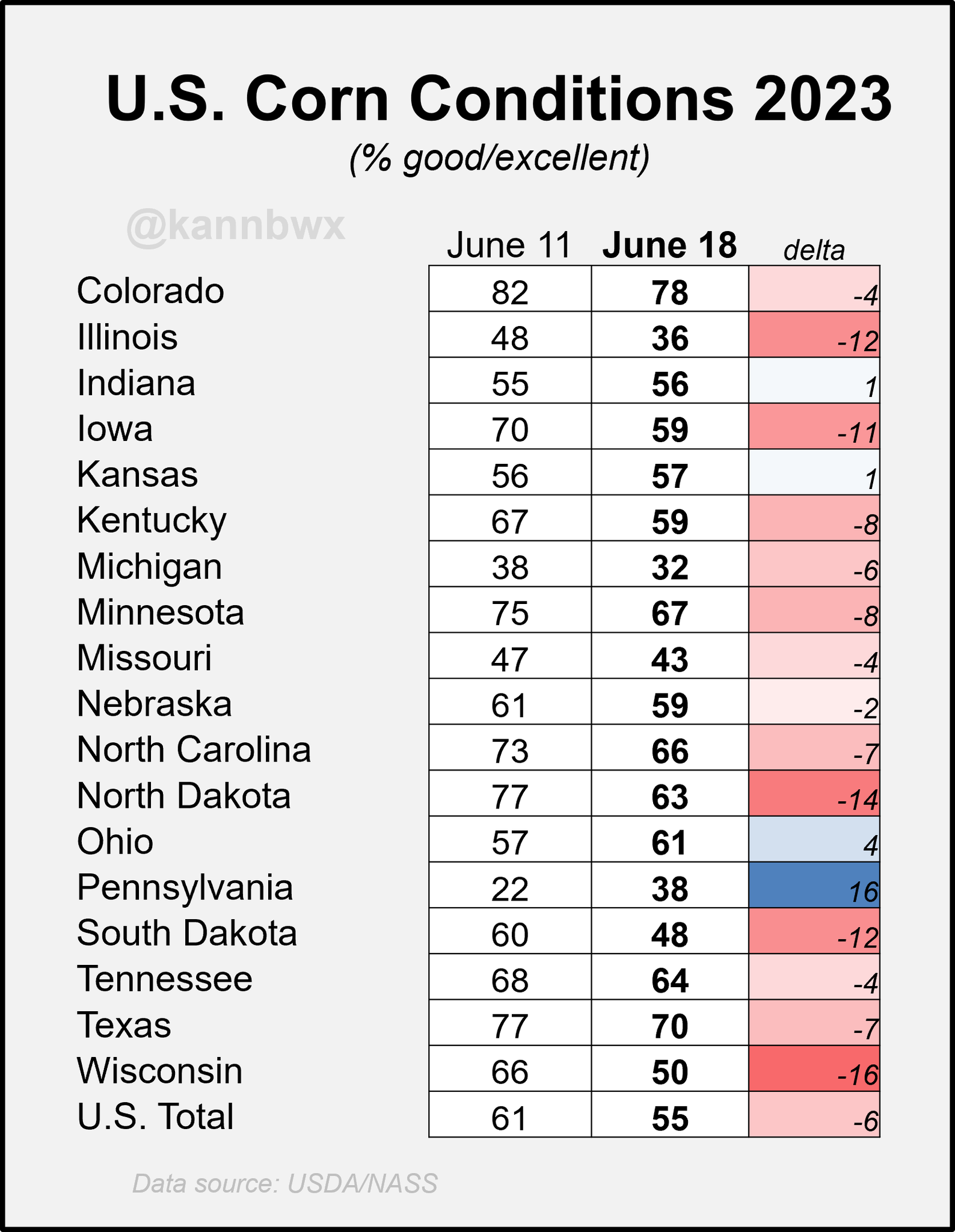

Crop conditions continue to fall. As the latest update showed corn ratings declining -6% down to 55% rated good to excellent. This was 3% worse the trade has been expecting. The lowest for this week since 1992. And the worst for any week of any year since 2012.

For comparison:

This year: 55% rated G/E

Last year: 70% rated G/E

2013: 64% rated G/E

2012: 63% rated G/E

Flat out the worst conditions in 30 years.

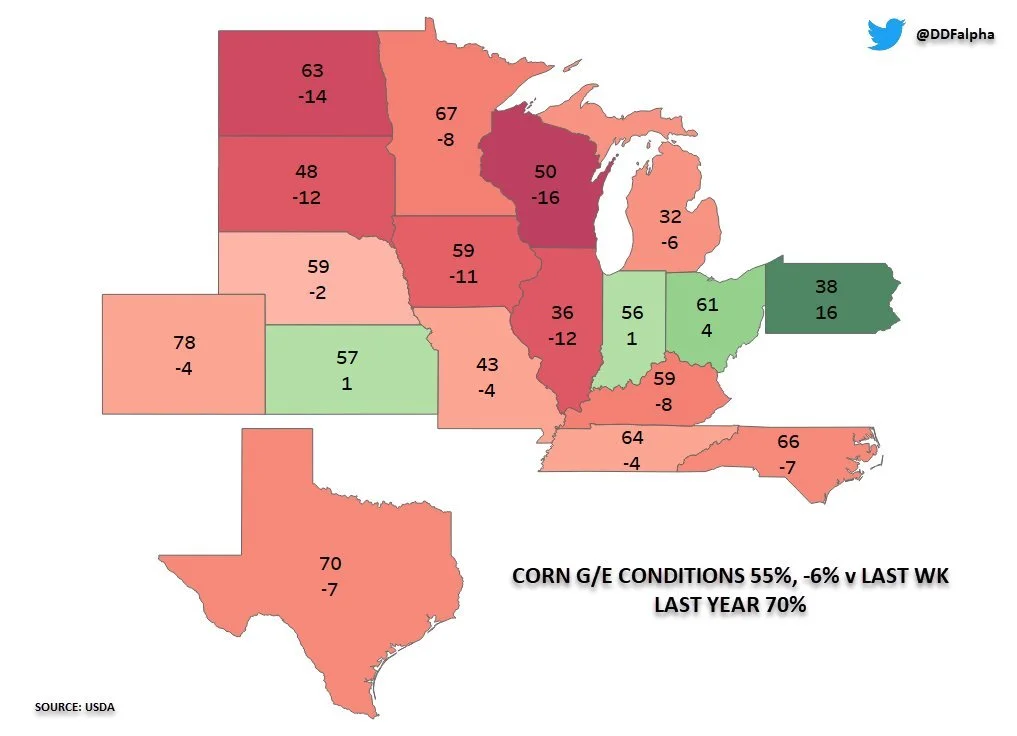

Some notable changes from last week:

Illinois: -12% (38% rated G/E)

Iowa: -11% (59% rated G/E)

Michigan: -6% (32% rated G/E)

Wisconsin: -16% (50% rated G/E)

North Dakota: -14% (63% rated G/E)

South Dakota: -12% (48% rated G/E)

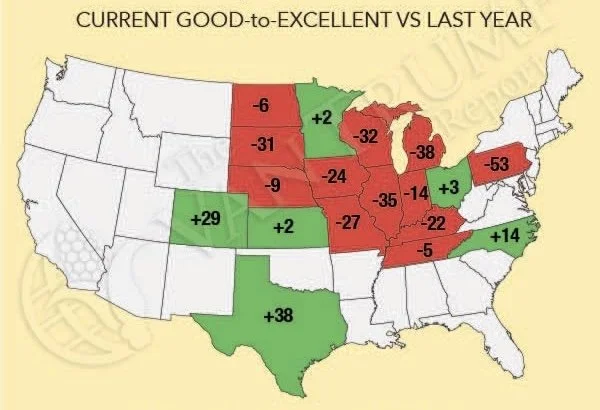

Below is a map showcasing the changes from last year.

Crop conditions are 15% worse than they were at this time last year, yet the USDA thinks yield is somehow 8 bushels per acre higher? Not a chance.

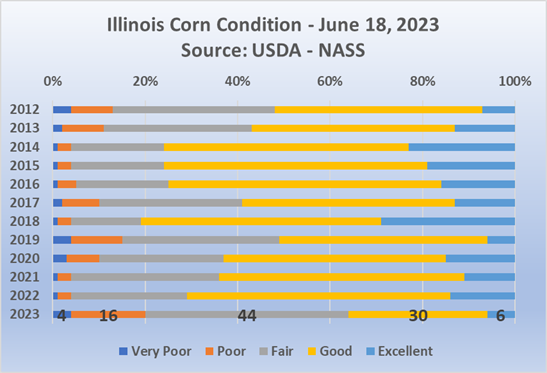

Here is a quick comparison of Illinois crop conditions for every year since 2012. They are currently worse than every year including 2012.

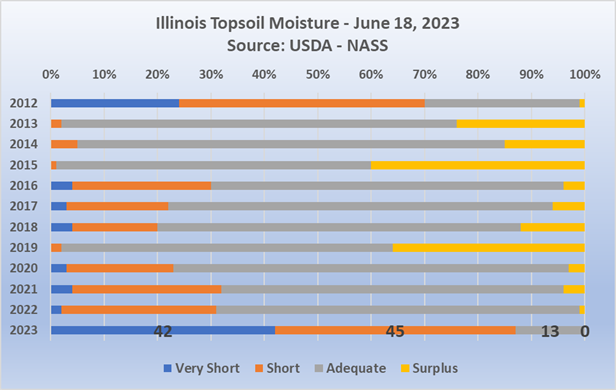

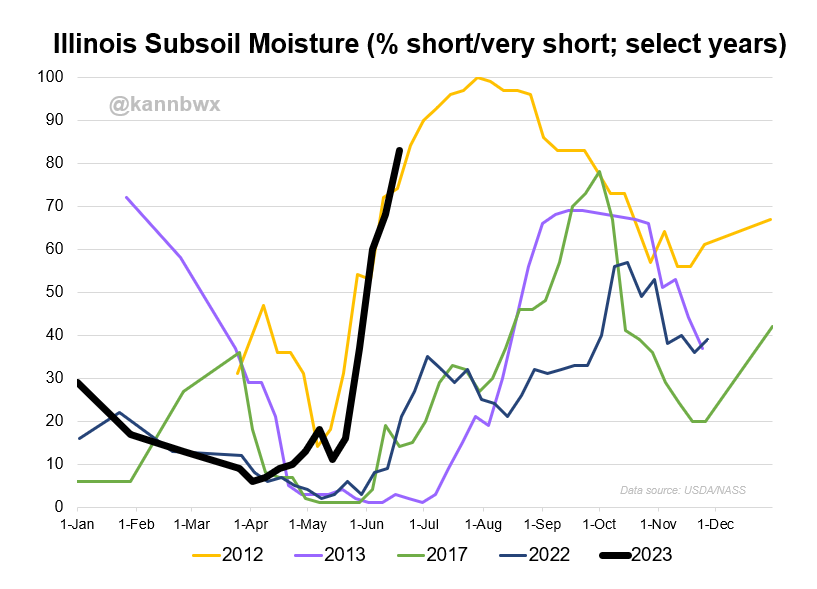

Here is the topsoil and subsoil moisture situations in Illinois compared to those same years. Again, take notice that they are the shortest they have ever been this week since they starting tracking it. Currently sitting 87% short to very short, with only 13% sitting at normal levels.

This year is lining up exactly on par with 2012.

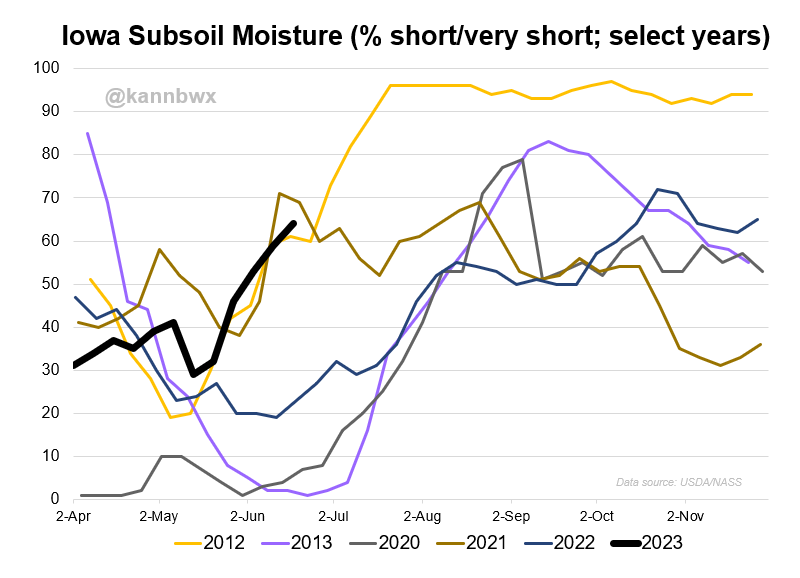

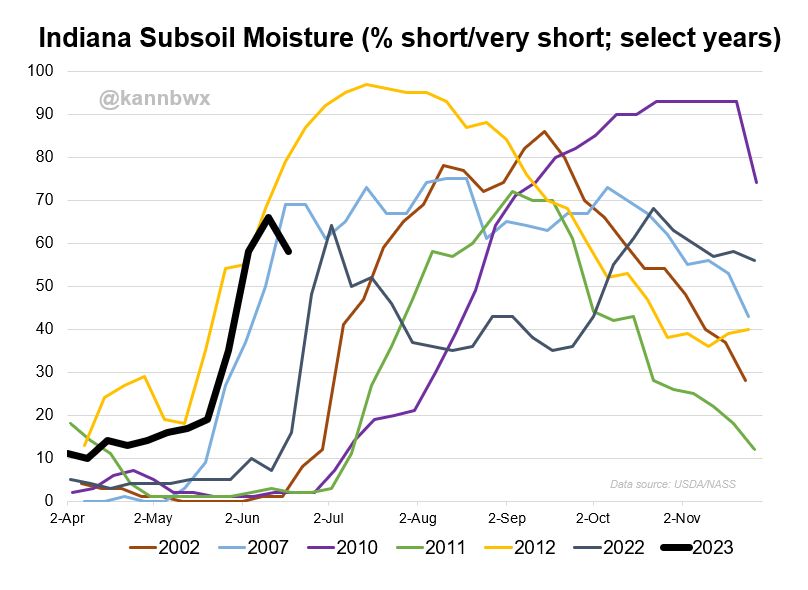

Here is the other I-states of Iowa and Indiana.

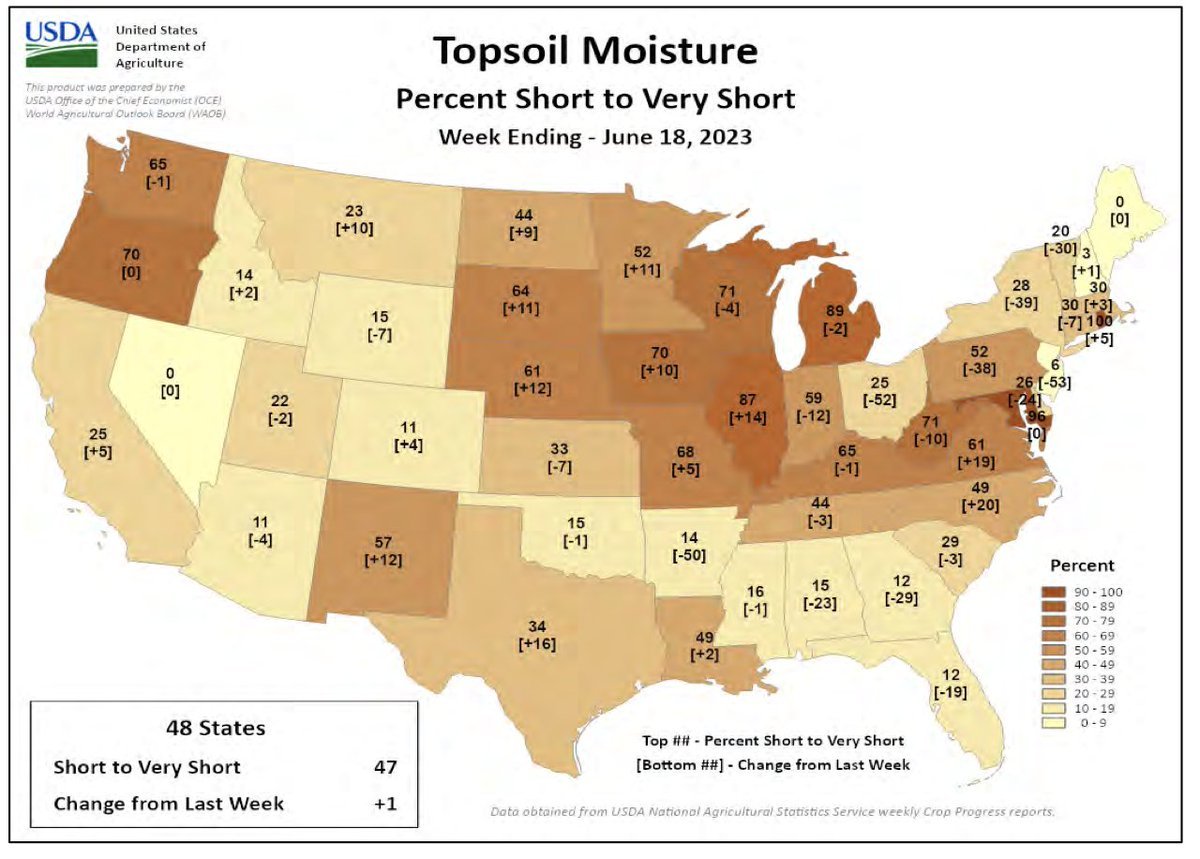

Illinois isn't the only one. Nearly all of the corn belt and I-states are very short topsoil moisture.

Illinois: 87% short

Iowa: 70% short

Minnestoa: 71% short

Wisconsin: 89% short

Indiana: 59% short

Missouri: 68% short

Both Dakotas: +60% short

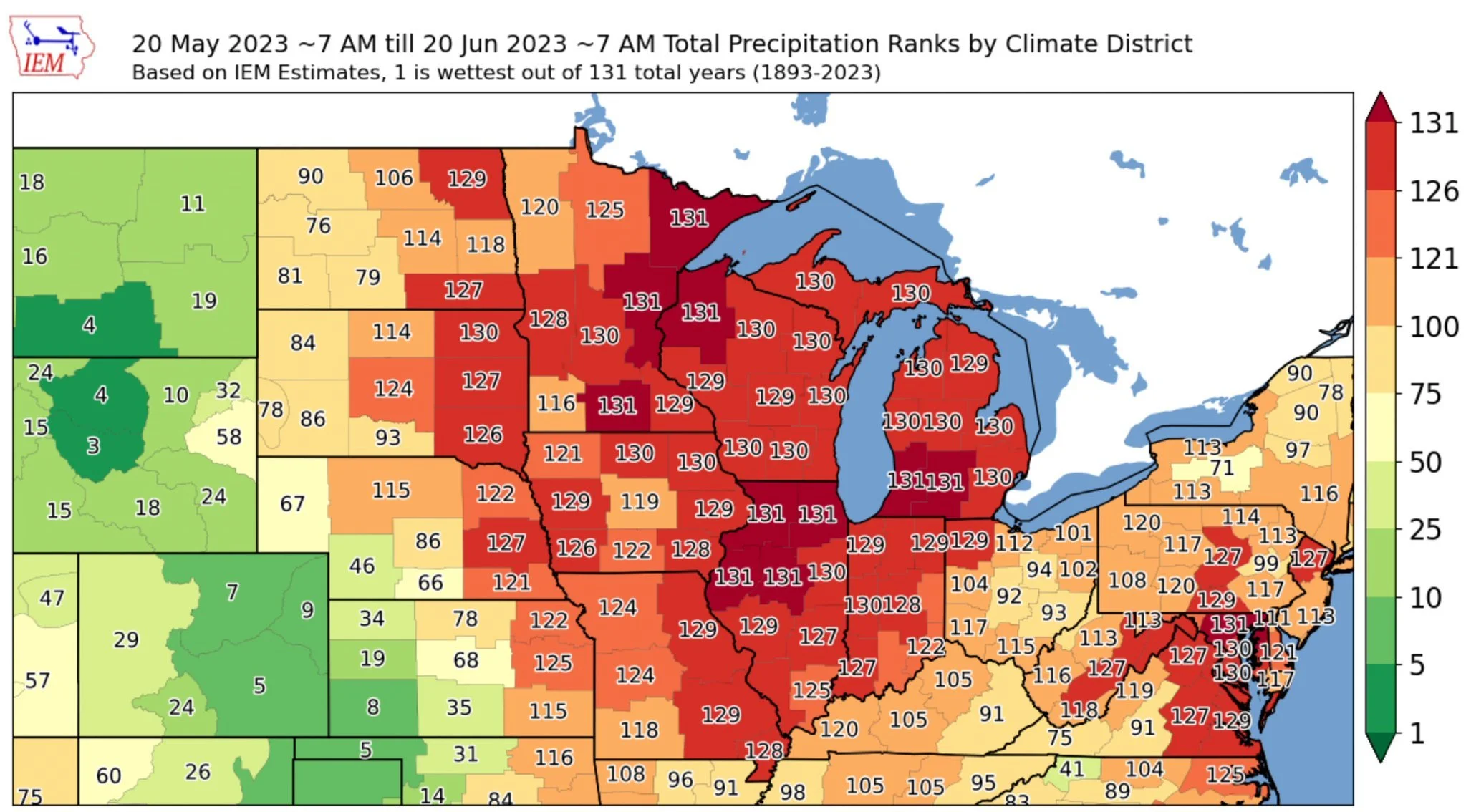

Here is a map of the midwest that ranks precipitation over the past 131 years. A large portion of the I-states are experiencing nearly if not the driest year in 131 years.

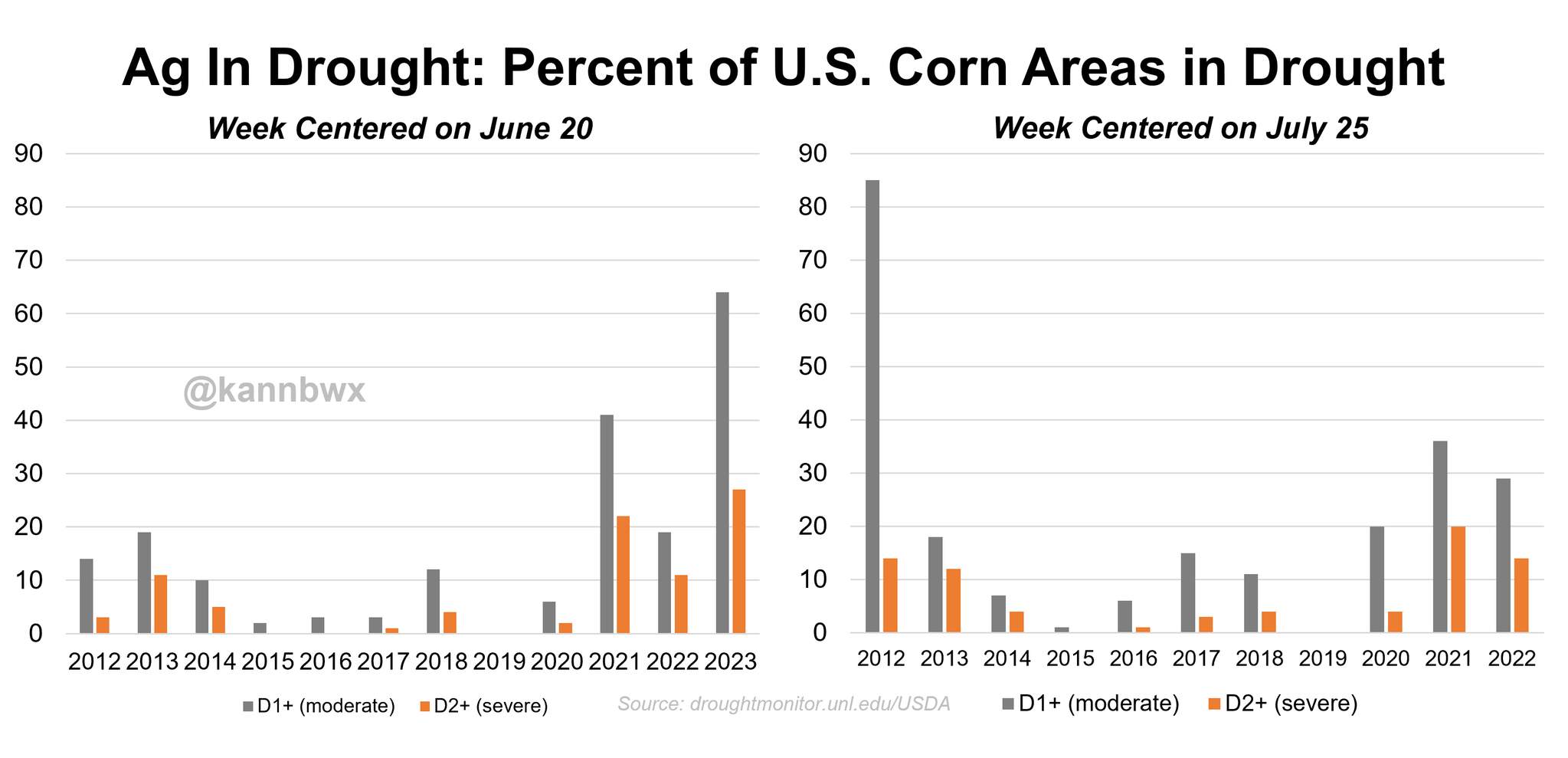

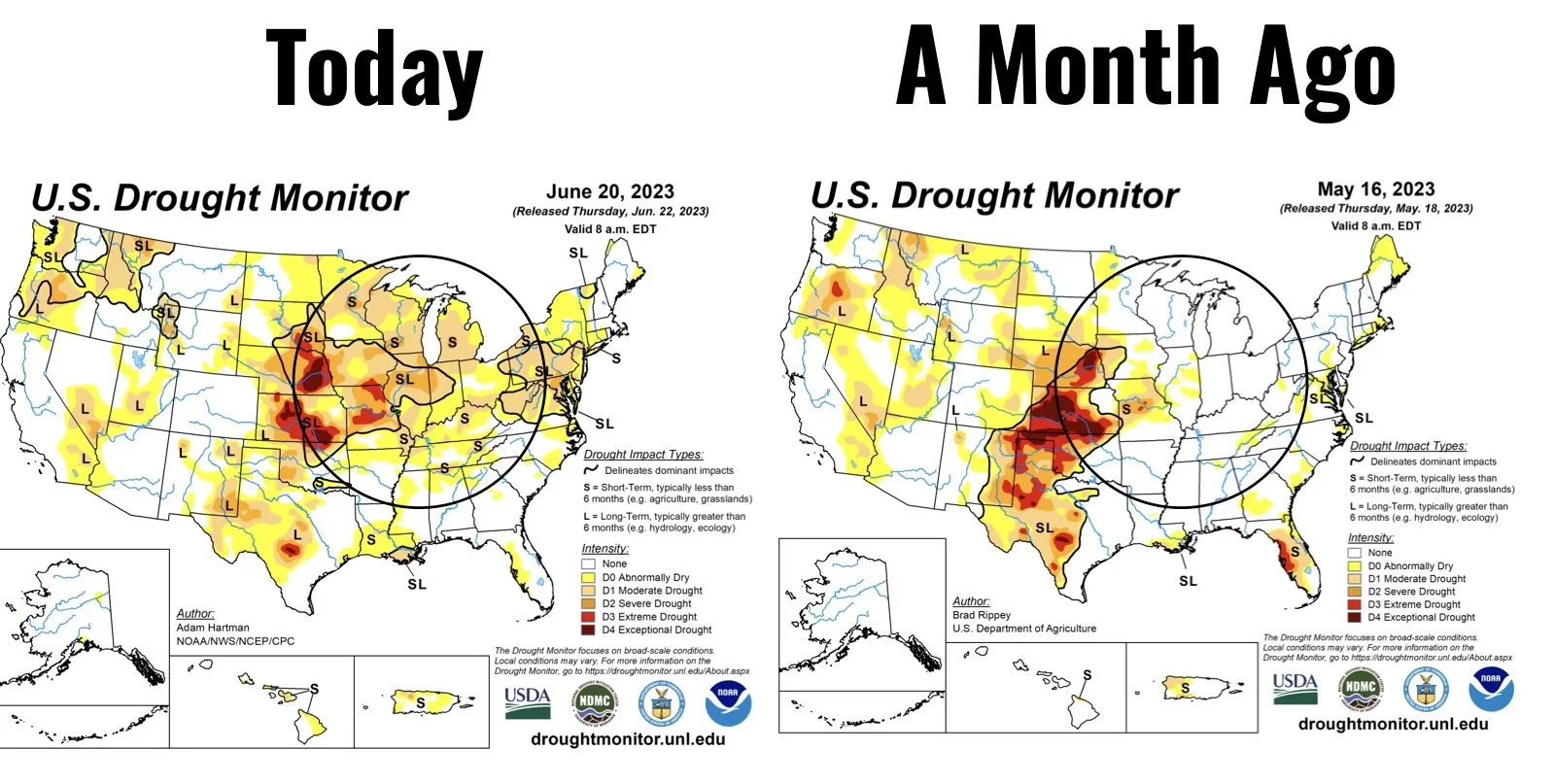

Now let’s take a look at the drought situation.

67% of corn is experiencing drought. A big 7% increase from just last week.

Here is a chart comparing the history of corn areas covered in drought. The one on the left is the week's for June 20th, the one on the right is for the week's of July 25th.

For this week, this is the most drought coverage we have seen on record.

Now let’s compare drought monitors.

First, let’s compare the change from just 4 weeks ago.

The drought is obviously expanding and moving east over the corn belt.

Here is a closer look at the midwest. As you can see, a major change.

Now let's compare last year, since the USDA apparently thinks yield is somehow someway supposedly higher than last year.

Now two more comparisons. The two years everyone has been comparing 2023 to for months now.

First is 2013. We said months ago this wasn’t a repeat of 2013, because it's not even close. We didn’t have a drought across the corn belt in 2013. It’s pretty crazy looking back the amount of people who told us this year was going to be a repeat of 2013 just by looking at this comparison.

Now for 2012. The year we have been comparing since last September.

If you take a look at the midwest, we are actually much drier across pretty much the entire corn belt.

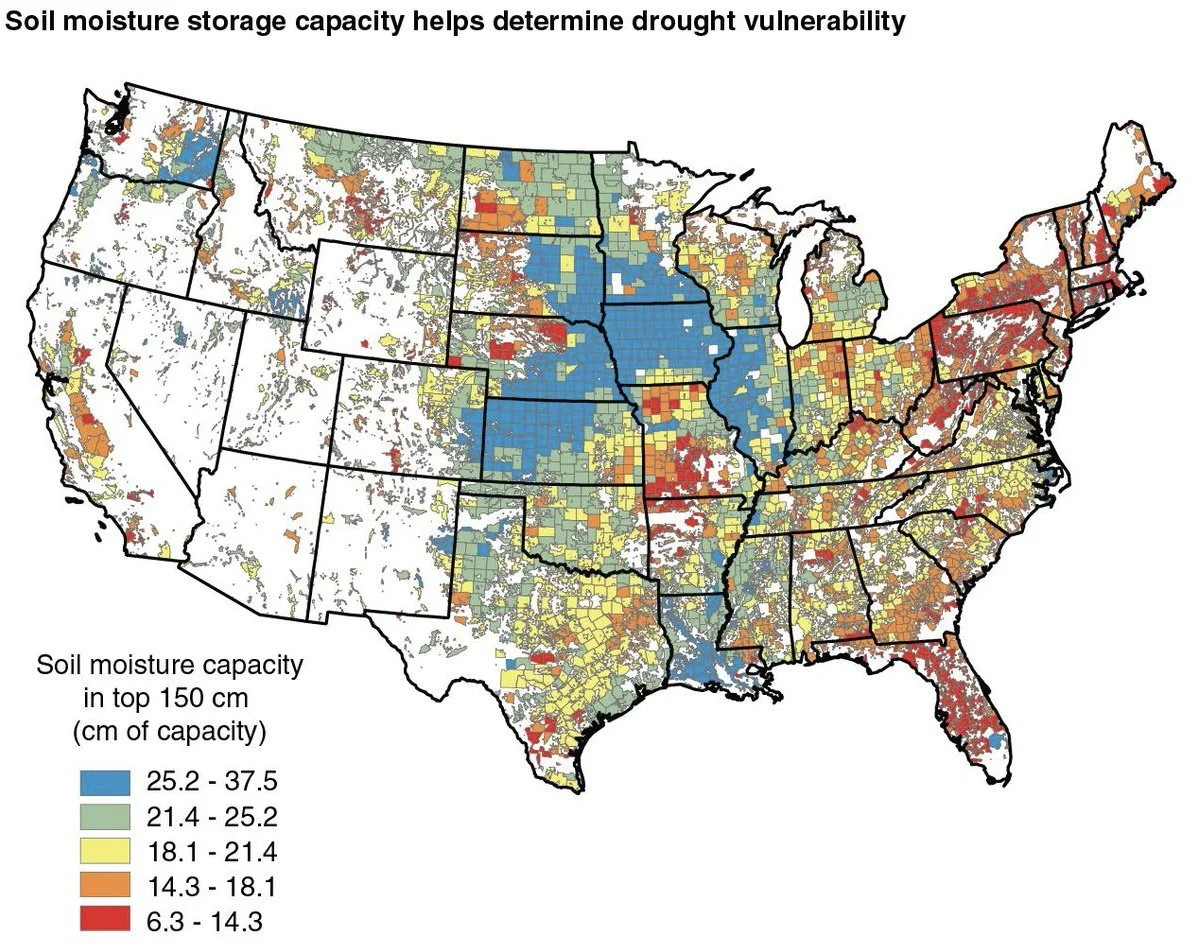

Here is a map that shows soil moisture capacity. A lot of the areas such as Iowa and Illinois that are able to hold a higher capacity for moisute (thus making it less vulnerable to drought) are the ones who are experiencing the worst drought already. Again, further pushing the argument for how dry it really is.

This week's corn condition index score fell to 348. The lowest since 1988. In 1988 the national yield was 84.6, down from 119 and a move 29% below trend line yield.

If we were to see that same drop this year, that would bring us to 129 bushels an acre yield.

In 2012 we saw yield drop from 164.5 to 123, a 25% reduction.

A 25% drop from this year's 181 would be 136 bushels per acre.

Now a 30% cut isn’t the most realistic scenario. But could we see yield sub 160 or even push 150? It’s a real possibility. A 10% drop from trend line would bring us to the 163 range. A 20% drop would be 145 bpa.

The 1-3 week weather outlook into the 1st week of July shows no drought busting rains. Wait until the real heat starts to come the next few weeks as we inch closer to July. If it stays dry the upside in our markets is ridiculously high.

Farms.com Risk Management said,

"The funds have just started their panic buying as they finally throw int eh towel but this is just the start of the vertical move higher so look for $7 corn futures by next Friday. Depending what Mother Nature does and the USDA says we could see $9 corn futures by mid-August."

I completely agree with their statement. July corn is only 40 cents away from $7. Which isn't that big of a rally compared to the moves we've seen the past two weeks.

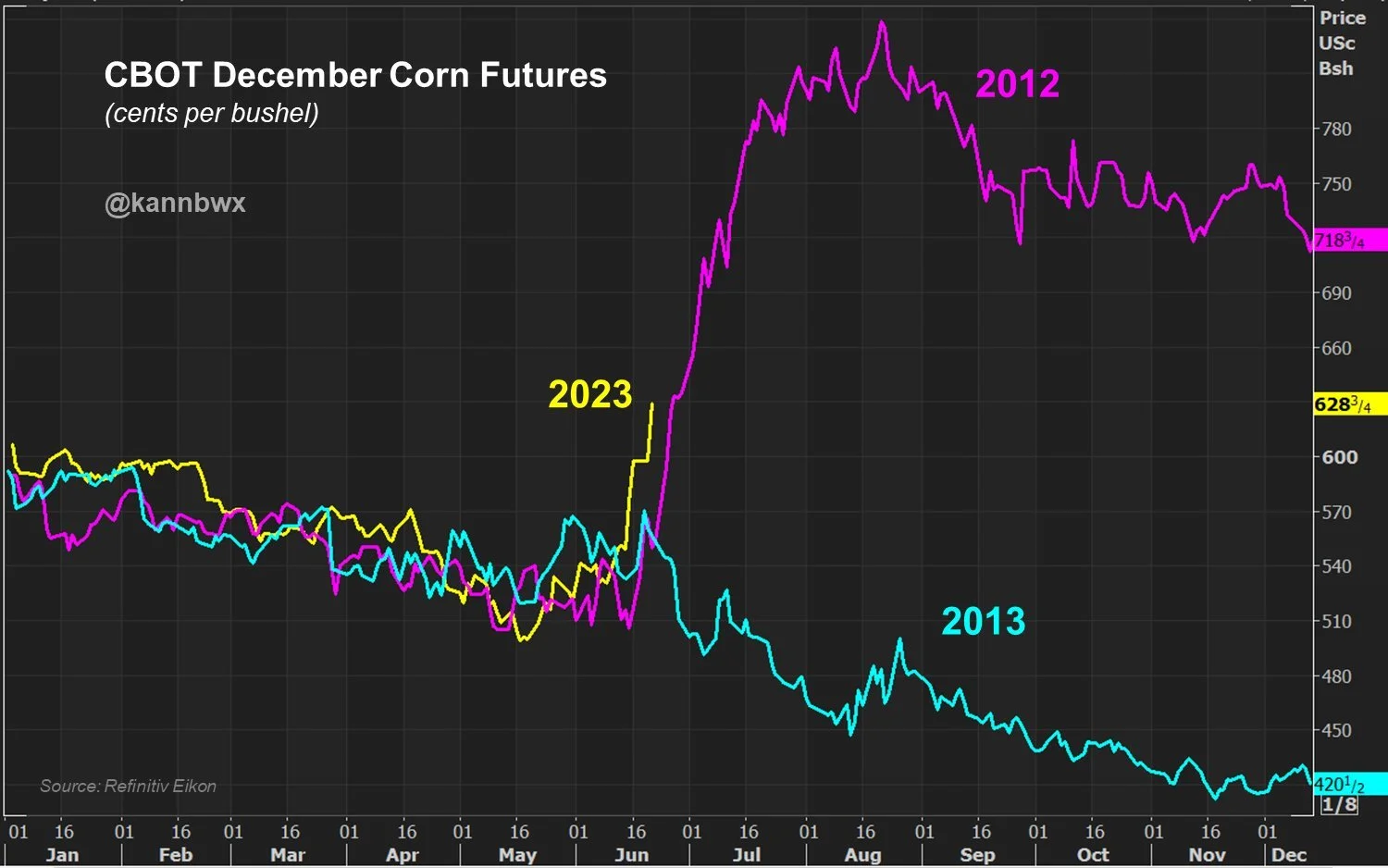

I know this year isn't 2012, but if the story winds up being anything similar the sky is the limit.

Remember when I showed this same exact chart over a month ago?

The 2012 comparisons continue and the potential upside is unreal.

Overall, demand is the only concern and argument bears have. It's weather bulls vs demand bears. I think weather will ultimately trump any other factor.

For those of you that have been subscribers for some time now, you might remember this next chart I posted the first week of May on corn's brutal sell off where I called for a bottom and similar price action to that of 2012.

Here is how the chart is shaping up as of today. A near identical scenario is playing out.

How high can we go? It all comes down to Mother Nature. But if it does indeed stay dry, watch out the next few weeks. If it is still dry come July 4th weekend, we could be in for a wild ride and the potential upside is ridiculous.

Soybeans

Soybenas hit hard today with the fall out in bean oil, as the EPA heavily pressured bean oil. November beans closed down 37 1/2 cents, but managed to climb back 17 cents off their early lows.

As mentioned earlier, today's sell off was due to the weakness in bean oil as well as some profit taking given our $2.40 rally the past few weeks.

The pressure from bean oil came from the EPA lowering the biodiesel blending mandate for 2024 and 2025. Which were a step back from the volumes they had originally proposed.

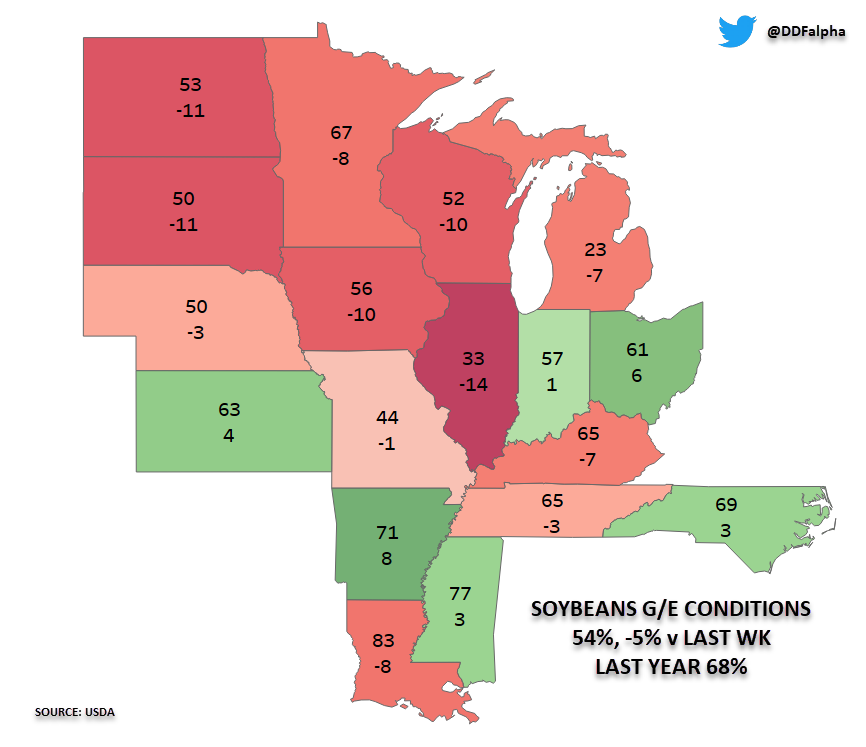

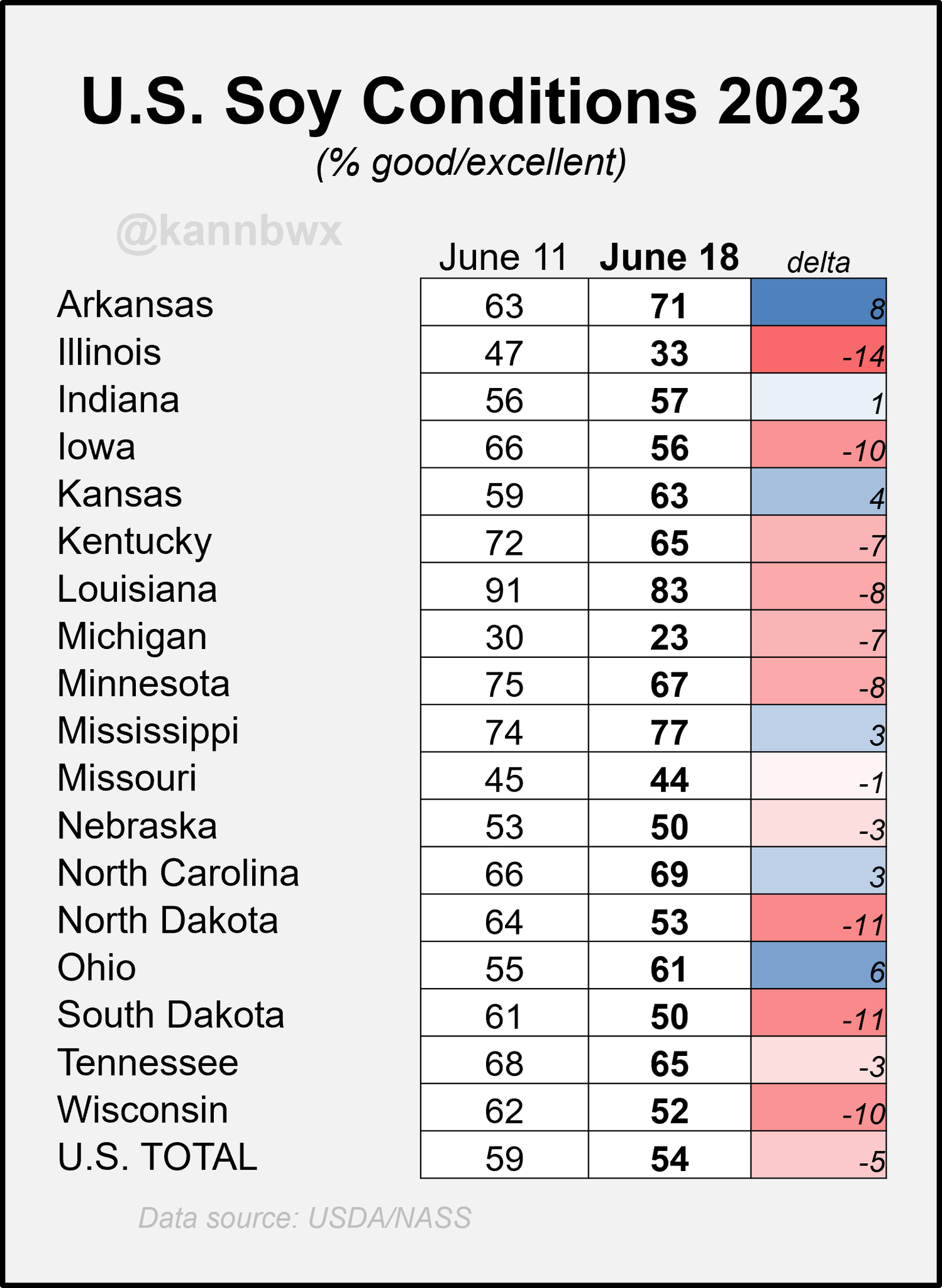

Bulls continue to point at the deteriorating crops. As they came in at 54% rated good to excellent, a 5% drop from last week. Last year we were at 68% at this same time.

Some notable changes from last week:

Illinois: -14% (33% rated G/E)

Iowa: -10% (56% rated G/E)

South Dakota: -11% (50% rated G/E)

Wisconsin: -10% (52% rated G/E)

Michigan: -7% (23% rated G/E)

Here is a crop condition chart from the Van Trump report. Comparing this week vs the same week in 2012 vs where we ended the year in 2012. Notice that we are already quiet a bit worse than we were in 2012.

Yes, beans are an August crop. But the continued dry and hot weather will stunt growth and ultimately harm yield potential.

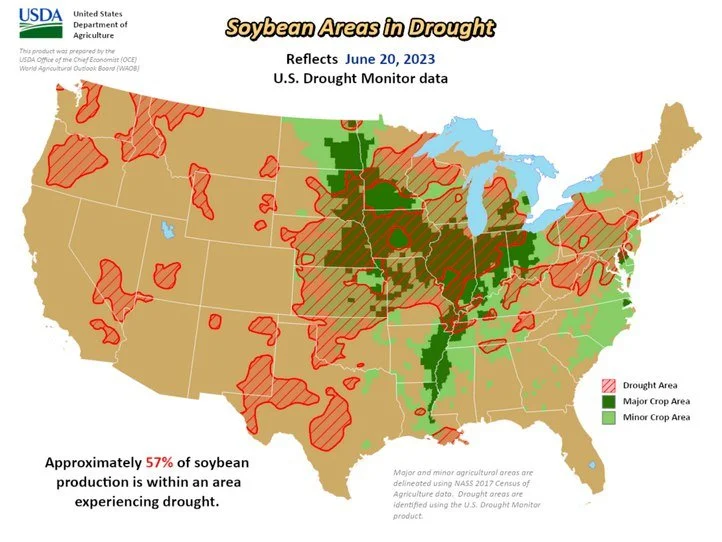

The drought continues to expand. As 57% of soybean production areas are now experiencing drought. A 6% increase from just last week.

There is some precipitation in the forecasts for over the weekend which might have added pressure today, but these rains are anything but drought busting rains. Who knows if we will get any of this rain?

The USDA has bean yield at 52 bushels an acre. Many people have already lowered theirs to the 49 bpa range. Bears argue it's too early to start lowering bean yield in June.

Bottom line is I expect corn to lead our markets due to corn being more directly affected by the weather in late June and early July. But if it stays dry, and crops continue to deteriorate beans will follow corn higher.

Unlike nearby corn, we do have a demand story brewing for beans which I have been talking about the potential for the past few months now.

Unless we see forecasts completely shift we should be well supported. I think today's sell off was a mistake but it was needed, as a bull market needs to take a breather.

I think today's near 40 cent losses are a great opportunity and I expect this break to be bought right back.

Wheat

Wheat futures close slightly higher while corn and beans take it on the chin. As wheat futures have finally began to pick up some momentum after a year long downtrend following the initial war headlines. (scroll to see the breakout in Chicago).

Here is a little write up from the Van Trump report that essentially summarizes everything going on in the wheat market for both bulls and bears.

He said,

"Bulls are talking about SovEcon lowering their production estimates for Russian wheat, as some of their spring wheat areas are experiencing weather complications, but they are still a bit higher than the current USDA estimate. The trade is talking about planting delays in Argentina, a mixed bag of wild weather across parts of Canada, the flooding in parts of China, perhaps lower acreage in Australia, uncertainty in India, and the ongoing worries surrounding the war in the Black Sea region. In other words, bulls have a few production headlines to chew on. Bears are pointing toward cheap wheat still pouring out of Russia, headwinds for US exporters, and ongoing macro uncertainties for the funds."

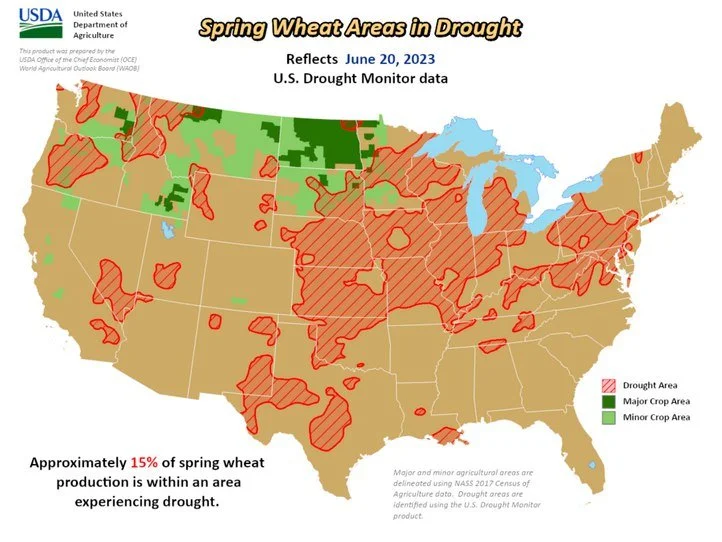

The newest drought monitors showed a big increase in spring wheat areas experiencing drought. As they went from 4% to 15% experiencing drought. Nothing too worrisome quiet yet but something to take note of.

Winter wheat areas experiencing drought on the other hand came in unchanged from last week. Sitting at 50%.

Going forward wheat might be the sleeper in the market and surprise some guys.

This is due to the fact that there is different global issues going on across the world when it comes to wheat. We have a Chinese crop that's getting smaller with he flooding issues. Russia's wheat crop getting smaller. Australia's crop possibly getting smaller. India's wheat harvest is 10% lower. Weather uncertainty in Canada. Now we have some spring wheat complications. To put a cherry on top, war is still a very real factor at play.

So all in all, there a ton of uncertainties and factors that all have the possibility to spark wheat higher. I'm not as bullish wheat as I am corn, but the wheat market might surprise a few people if these global factors continue.

The Charts

Corn 🌽

We smashed past that long term resistance from last fall. Next target for December corn is the $6.38 range, past that we might look to the $6.60 level.

Corn Dec-23

Soybeans 🌱

Similar to corn, we smashed that long term resistance. Now sitting right at support. If we can hold here I think we go to restest the old highs from last year.

Soybeans Nov-23

Wheat 🌾

After months of getting pushed around and failing to gain momentum, Chicago finally picks up some steam and breaks that year long downtrend. Now nearly $1.40 off it's recent lows. Next major resistance might be around the $8 range.

Chicago Sep-23

KC Sep-23

MPLS Sep-23

Hedging Account

No matter the situation you are in, our partners at Banghart Properties Grain Marketing can help you come up with a plan of attack to help you manage your risk. If you want help managing your risk you can give them a call anytime at (605) 295-3100 or set up a hedge account below.

Check Out Past Updates

6/22/23 - Audio

DON’T FEAR THIS VOLATILITY

6/20/23 - Audio

VOLATILE MARKETS

6/19/23 - Audio

CORN SUPPLY RALLY

6/16/23 - Audio

ARE THE GRAINS ABOUT TO GO PARABOLIC

6/15/23 - Audio

2023 IS WORSE THAN 2012

6/15/23 - Audio

CAN CORN BREAK MAGIC LINES?

6/13/23 - Audio

2012 REPEAT OR WORSE

6/12/23 - Market Update

CROP CONDITIONS CONTINUE TO FALL

6/12/23 - Audio

WHY THIS YEAR ISN’T 2013

6/11/23 - Weekly Grain Newsletter

NAVIGATING THE USDA REPORT & DROUGHT