CORN CONTINUES LOWER & BRAZIL CONCERNS

Overview

Grains mixed as beans close higher for the second day in a row supported by some talk surrounding China business. While corn continues to trickle lower, fighting to hold off those harvest lows. The wheat market manages to bounce following it's recent losses as KC wheat's fresh new low yesterday.

Insurance prices have been set for fall.

Corn

Spring Price: $5.91

Fall Price: $4.88

% Change: -17%

Beans

Spring Price: $13.76

Fall Price: $12.84

% Change: -7%

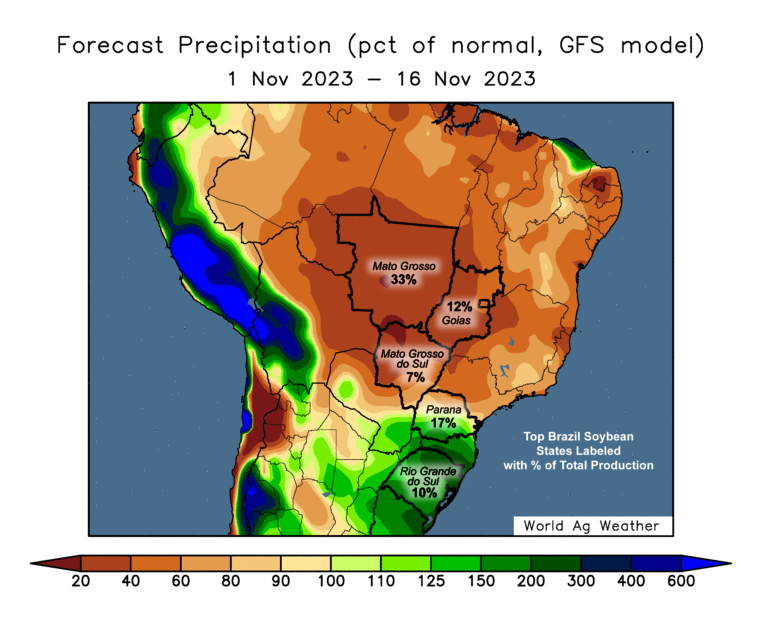

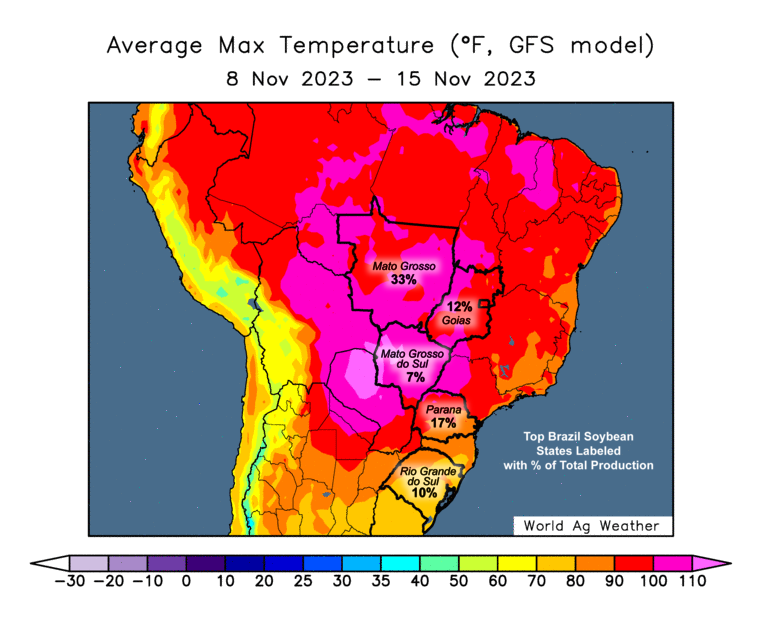

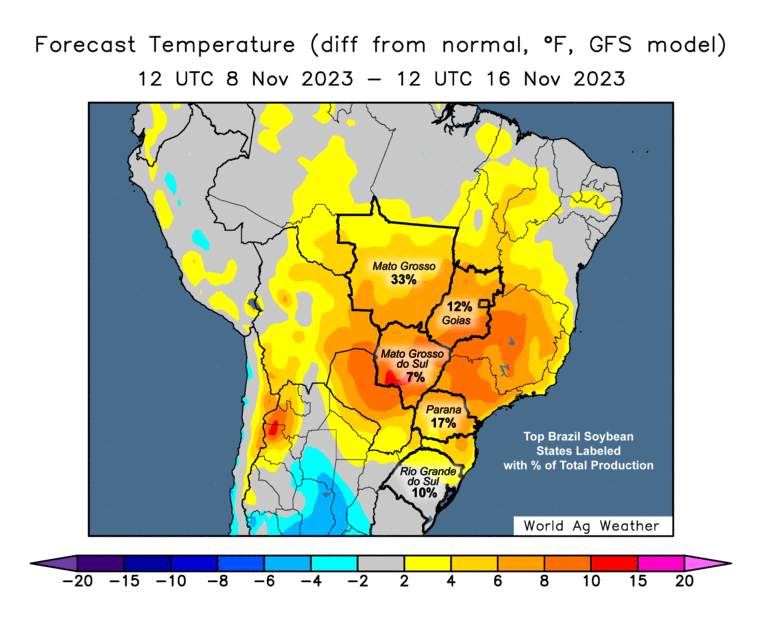

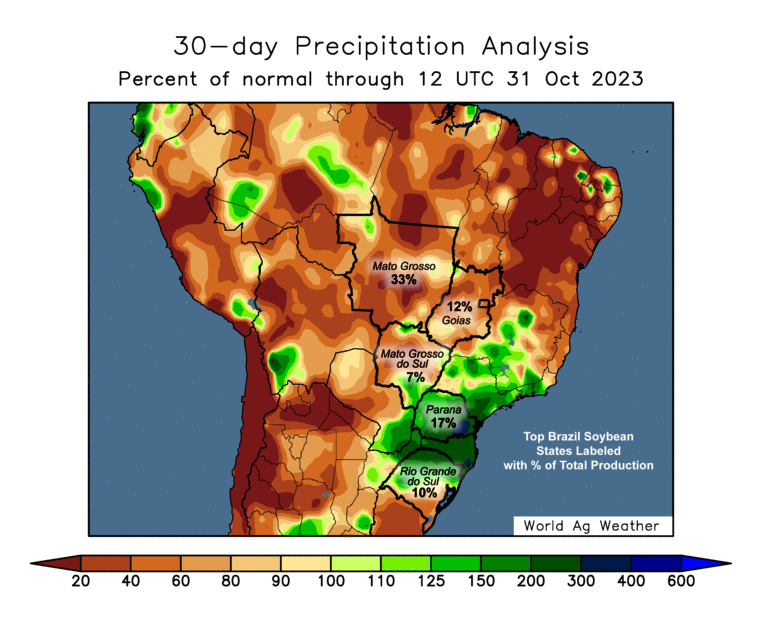

South America is going to be the most influential factor in these markets as we near the end of the year. Bears are arguing that the dry areas in Brazil received good rains, which they did. But take a look at these maps. It still looks pretty dry to me.

Another thing to keep in mind, there is zero weather premium built into these markets. Can’t imagine what would happen when the trade starts to take this into consideration if this were to continue.

So the dryness to the north in Brazil is not good for their production. But what about the south?

They have received far too much and have seen flooding, which is also not good for production and causes delays.

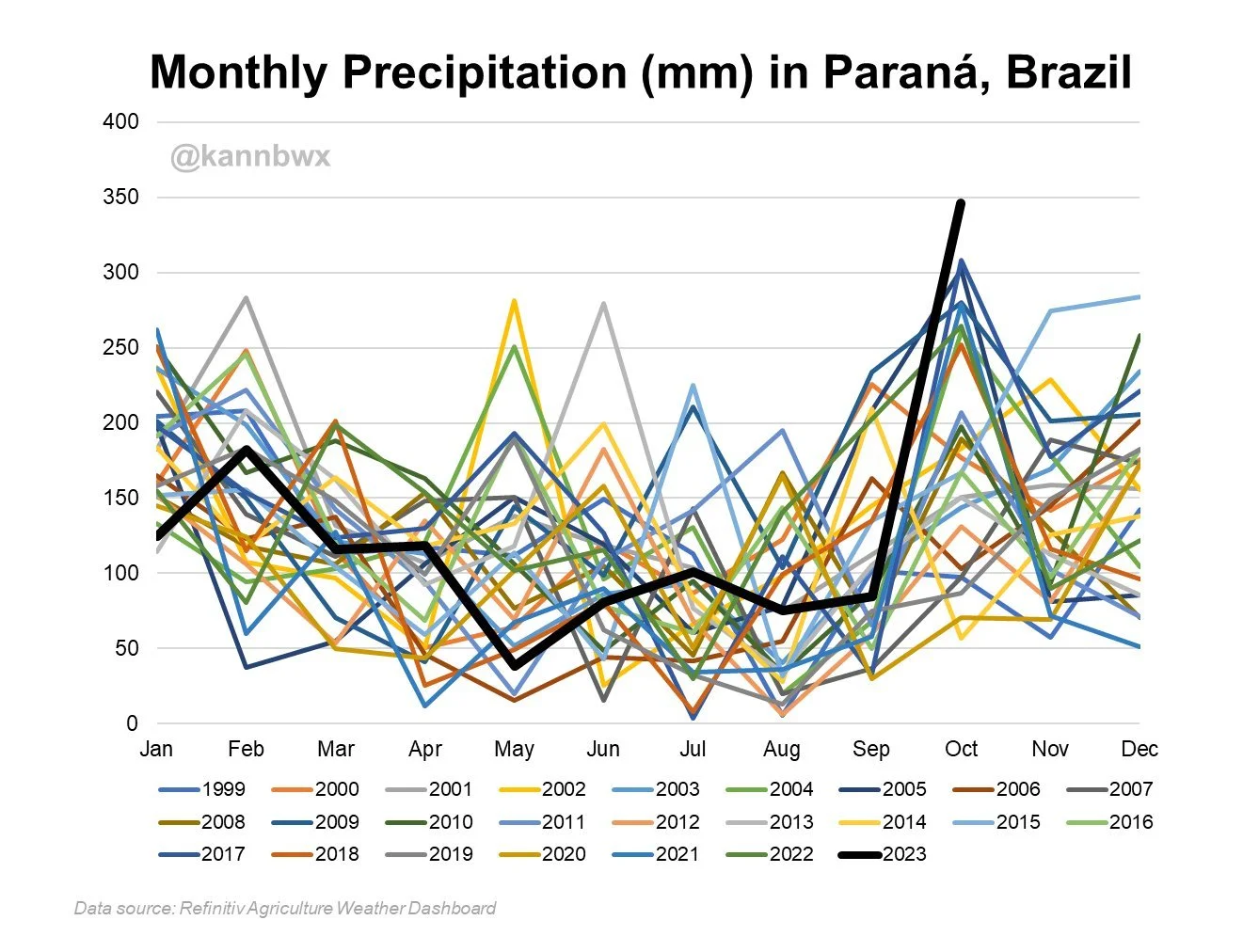

Here is a chart from Karen Braun that showcases the rain in Parana Brazil (southern state). This October they have seen more rain than any other month dating back to 1999.

Make sure to scroll to the very end of today’s update where we include AI’s perspective on the grain markets.

Today's Main Takeaways

Corn

Corn continues to chop around and trend slightly lower. We have traded in a 35 cent range since July.

There isn’t a ton of fresh news or headlines to chew on from bulls nor bears. Which often leads to risk off approaches.

What are bears saying? For starters, they are arguing that South America has seen some needed rain. Which they have. But you can’t tell me the outlook is all that favorable. We are already seeing some lower adjustments made to the Brazil crop. Dr. Cordonnier lowered his Brazil corn number by 2 million metric tons due to his belief that there will be less acres due to the late soybean planting. He had a neutral to lower bias moving forward.

Bears also argue that it's going to be hard to manage a rally with this massive US carryout. Which is a valid argument that I somewhat agree with. A major rally here will not be easy. As I have mentioned several times in the past, the path for higher corn will be a marathon and a dog fight. Because yes, 2 billion bushels is a lot of corn.

However, this is what bulls are looking at. They think we could still see the US crops lower as well as our ending stocks tighten up down the road. Possible, but I wouldn’t bet the house on it.

Bulls are also looking at the potential weather worries in South America. Now this is what I think could be that catalyst bulls are searching for. I’m not a weather man, but there is already talk that the USDA is too high on their Brazil estimates solely based off of fewer acres. A weather worry for their second crop would be a major deal for corn.

I noticed a few other advisors still had buy signals in place for corn. If you have made sales, I think this is a decent spot to look to re own. Need to make sales or will be making sales? I think it makes the most sense to lock in a floor vs selling at these levels.

Bottom line, we broke some recent support on the charts. We now sit just 7 cents away from those September harvest lows. There is a chance we look to test those or even break those lows. I also wouldn’t be surprised to see the algos and funds to push us to new lows then we get a reversal, similar to what they did when they pushed us past $5 and reversed us back down.

November is often a difficult month for corn futures. We can’t out predict the markets, but we can manage our risk as best as possible.

The biggest thing right now would be, with us in the bottom of this 3 month range, the best way to manage risk would be to not make sales here. If you are forced to sell, we want to have some sort of re-ownership strategy in place. If you want to protect the downside, we don’t want to spend a ton of money protecting prices at these levels. Levels where we aren’t going to lose $1 within the next month.

Bulls need to hold $4.73 1/2 or we could very easily look to test the $4.68 lows.

Corn Dec-23

Soybeans

Soybeans put together 2 green days in a row, but they have been stuck in the same 20 cent range since October 17th, from $13.05 to $13.27 (Jan-24 Beans).

I still see a ton of "potential" in soybeans. Yes there is still a pathway for +$14 to $15 beans. Now this will all depend on two things. First, where US yield and production comes in. Yields come up short, that'd be very supportive. But the even bigger potential factor is South America. If they run into issues and don’t produce, we go higher. If both of these scenarios happen, we go a lot higher. These scenarios are "what ifs" but very very possible.

We are already seeing more chatter about South America. The south is drowning, and the north is burning up. Keep in mind, there is ZERO weather premium built into these markets. If the weather concerns in Brazil continue, there is huge potential for higher soybean prices.

Soybeans might have the most upside, but they also have the most downside risk. Manage your risk accordingly.

Think we will have a South America driven rally later in the year? Look at calls to stay in the game after you’ve made sales.

Looking at the chart, the $13.05 level is important. Bulls need to hold or we likely go back to the previous lows. Now those lows of $12.70 are critical to hold. There is a wide pocket of air down below if it breaks. But I do think our lows are likely still in for the year and I see higher prices.

Here was our thoughts on what to do on basis contracts to become a price maker. You can check it out HERE

Soybeans Nov-23

Wheat

The wheat market continues to tread around it's recent lows. All the classes of wheat higher today, but KC wheat made yet another fresh new low yesterday.

The main headline bears are talking about is the one that's kept a lid on wheat prices since forever, cheap Russian wheat. As the war is basically a non factor in the markets right now and we are seeing improved export routes out of Ukraine.

The surge in the dollar as it reached near contract highs has also been a negative factor for the wheat market and isn’t helping our exports.

China announced they are expecting a smaller wheat crop this year and that they will need to up their wheat imports from last year. This is beneficial long term to wheat.

Along with this, the drought concerns we have seen in Canada, Australia, and Argentina could very easily push more of that China business to the US.

Bulls also are quick to point out that this year is the 5th year in a row where the world has lower global supply. To add on to this, there is rumors that China is sniffing around for US wheat and perhaps their appetite is looking to grow. This rumor becomes even more compelling when we discuss the rumor that some are saying China will import a record amount of wheat this year due to their production issues and flooding we saw.

Bottom line, the funds don’t want to get long wheat. I mean why would they right now? There just isn’t a major reason for them not to be short.

Long term, the wheat market has plenty of upside. When will we see that upside? Nobody really knows. Just a matter of time before the funds find a reason to slip their shorts, I'm just not holding my breathe waiting for that to happen. Remaining patient for now realizing the upside is there.

Taking a look at the chart, Chicago wheat has still held it's lows from September 29th which is a good sign. Still sitting 22 cents off that bottom. That is the level bulls need to hold. A break below triggers more selling. Bulls still need to crawl over $6 (which we tested on October 20th) if we want to get excited.

Chicago Dec-23

KC Dec-23

AI’s Perspective on the Grains

We asked AI to give us an outlook and understanding as to what’s going on in the grains as we close out the month of October

Here is what it had to say:

The closing week of the month experienced a turbulent future trade landscape, particularly noticeable within the soy complex as the November contract transitioned into delivery. An unexpected tally of 438 deliveries against the November contract emerged overnight. The market gains were capped due to a dearth of fresh news, overhead technical resistance, and an improving weather outlook in South America. Mixed reactions were observed in the outside markets with equities and the dollar on an upward trajectory, contrasting with a sharp decline in crude oil prices.

A narrative gaining momentum is China’s intensified wheat import activity, driven by the necessity for high-quality produce following adverse weather conditions impacting their domestic wheat quality. Despite a record production, the quest for quality imports for blending purposes has escalated. It's estimated that around 20% of China’s new crop wheat is subpar in quality, necessitating approximately 12 million metric tons of imports for blending.

The resurgence of African Swine Fever (ASF) in China casts a looming shadow over the industry. Though currently confined to northern regions, the fear of its spread southward has triggered early herd liquidation in central and southern China, exacerbating the already oversupplied pork market in China and driving values lower.

Now, diving into specific grains:

Corn 🌽

Short-term analysis shows December corn futures navigating a well-defined sideways pattern between $4.67 3/4 and $5.24. The recent rally nudged the December corn contract above the $5.00 mark, momentarily halting at the 100-day moving average. The long-term prospect, fueled by a favorable demand curve, could see higher prices, contingent on factors like improved export demand, favorable trade agreements, and adverse weather conditions in competing nations. The key resistance is the 50-day moving average of $4.85 1/2.

Soybeans 🌱

The November soybean contract touched the $13.00 mark but faced resistance at the 100-day moving average at $13.20, retracting gains. Long-term, the potential upside is clear, given a favorable demand scenario and potential supply constraints. Ongoing harvest pressure and South American weather might impede a break above the resistance at $13.00. The critical support at $12.80 needs to hold to fend off bearish sentiments.

Wheat 🌾

Chicago December wheat has been ensnared in a downtrend, with a brief breach above the $6.00 mark before correcting. Export demand and global production updates will dictate the choppy trade within the $5.40 and $6.00 range.

Price Outlook:

Short-term (1-2 months):

Prevailing technical and fundamental factors may lead to a continued sideways to a downward trend.

Long-term (4-12 months):

A bullish outlook, especially heading into next spring. Anticipated higher prices are predicated on favorable demand, with potential market reactions to monthly USDA reports and global supply dynamics playing crucial roles.

Key Points to Watch:

- Weather patterns in major grain-producing regions.

- Export demand and global supply dynamics.

- Policy changes or trade agreements affecting grain markets.

- Market reactions to monthly USDA reports.

Grain marketing isn't a one-size-fits-all domain. For personalized assistance tailored to your unique circumstances, feel free to reach out to Jeremy at 605-295-3100

Check Out Past Updates

10/30/23

HOW TO BEAT BIG AG AT THEIR OWN GAME

10/27/23

WEEKLY WRAP

10/26/23

SEPARATING THE FUTURES & BASIS COMPONENT TO BECOME A PRICE MAKER

10/25/23

LONG TERM UPSIDE & BEING PATIENT

10/24/23

TECHNICAL SELLING, SA WEATHER, & MANAGING RISK

10/23/23

IS THIS CORRECTION A HEAD FAKE?

Read More

10/20/23

BIG WEEKEND CORRECTION

10/19/23

CORN BREAKS $5. IS WHEAT NEXT? - SOYBEAN RECCOMENDATION

10/18/23

BEANS BREAK $13. IS CORN NEXT?

10/17/23

DID BEANS CONFIRM REVERSAL?

10/16/23

CHOPPY BORING TRADE

10/13/23

POST USDA REPORT CORRECTION

10/12/23

BULLISH REACTION TO USDA REPORT

10/11/23

CAN THE USDA GIVE US A BULLISH SURPRISE?

10/10/23

BEANS BREAK THEN BOUNCE - USDA PREVIEW

10/9/23

WILL YOU BE FORCED TO SELL ANYTHING AT HARVEST?

10/6/23

CORN & WHEAT HOLD LAST WEEK’S LOWS

10/5/23

UPSIDE BREAKOUT IN CORN

10/4/23

ARE YOU A PRICE MAKER OR PRICE TAKER THIS HARVEST?