CHINESE APPETITE CONTINUES TO SUPPORT CORN

Overview

Grains closed mixed with corn and beans higher and wheat slightly lower.

I think there is definitely some pent-up buying that wants to try and come back into the market with all of the banking crisis we've seen.

Exports sales this morning were fairly strong across the board, which helps justify a rally here to close out the week.

Chinese continues to be a buyer of corn, with their 3rd purchase of the week this morning.

Today's Main Takeaways

Corn

Corn continues its run higher, as it looks like China is back in the market for more U.S. corn. We saw another flash sale from China this morning, as they bought another 641,000 metric tons of corn.

Here is a recap of sales this week:

March 14th - 612,000 metric tons

March 15th - 667,000 metric tons

March 16th - 641,000 metric tons

Bringing us to a total of 1.92 million metric tons booked the past 3 days.

Looks like they might be worried about the low supplies coming from Argentina and Ukraine, so they are turning to us at lower prices to grab some cheap corn.

The recent increase in appetite from China has bulls hopeful, as this was one of the 2 things that I mentioned yesterday that bulls would need to see to have higher prices.

China announced yesterday that their economy expanded more than 2.4% in January and February from a year ago, and up from the 1.3% in December. This is beneficial to the grains.

The second factor I mentioned was South America. Buenos Aires Grain Exchange lowered their corn production for Argentina down to 36 million metric tons vs their previous 37.5. The USDA's number currently is 40, which is significantly lower than their 47 they had in February. But that 40 is still more than likely far too high. I don't think we've seen the last of the crop reductions in Argentina. A sub-30 million metric ton crop is still a real possibility. Rosario grain exchange has their estimate at 35 million, and this will likely continue lower. The crop losses in Argentina will continue to tighten global supplies.

Crop condition ratings for Argentina's corn crop also came in at 59% rated poor to very poor, which was 3% higher than last week, and far worse than the 22% we saw last year or even just a month ago when that number was at 34%. Only 5% of the crop is currently rated good to excellent.

Another thing bulls are looking at, is the possibility of our current acre forecasts here in the U.S. being too high.

The charts are starting to look better and better. From a technical standpoint, bulls would like to see a close above our resistance in the $6.37 and $6.40 range to justify a rally up to our 200-day moving average which sits a few cents over $6.60.

With the recent business from China and a continuation of problems in Argentina, I think we see strength in corn continue.

Corn May-23

Soybeans

Beans finish the day a few cents higher, but rebounded over +14 cents off their lows of $14.78, closing at $14.91 1/2.

The NOPA crush numbers yesterday were mostly a disappointment, with numbers coming in slightly below expectations.

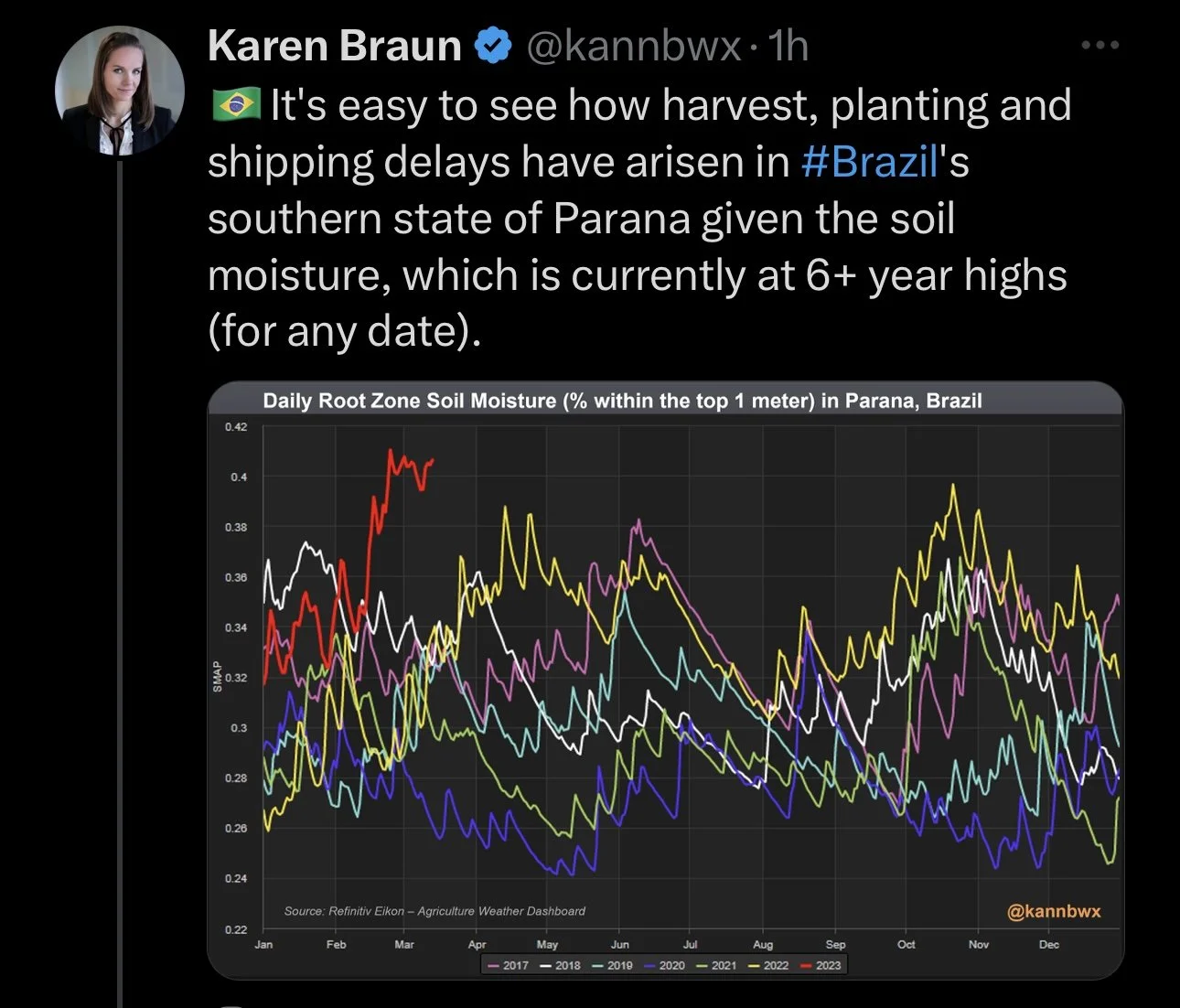

Brazil harvest might look to add some pressure as its moving along well, now sitting over 50% complete. However, bulls are starting to look at other areas of Brazil such as Rio Grande do Sul which could run into some production issues. There are many people saying that the USDA could be 5 million metric tons overly optimistic on their Brazil estimate. (USDA currently has 153).

Buenos Aires Grain Exchange lowered their bean production for Argentina down to 25 million metric tons vs their previous 29. The USDA is currently at 33. So there is definitely a chance that the USDA is 8 million or more too high.

I think there is definitely more Argentina concerns and bullish catalysts from this as we take a longer term approach. The biggest concern in the future is still Brazil's large crop, but then again this crop is appearing to get smaller, not larger.

Taking a look at the charts, we broke below our long term uptrend, and have created a short term downtrend which isn't a great sign. We again found support at the $14.79 level, as bulls are trying to stay above our 100-day moving average which sits around $14.82. Short-term I wouldn’t be totally caught off guard if the funds decide to possibly liquidate a few of their longs here, but we still have to respect the obvious problems in Argentina which aren't going away and only worsening.

Soybeans May-23

Wheat

Wheat futures close the day slightly lower as Chicago and Minneapolis see minor losses, while KC ends the day unchanged.

No real updates quiet yet surrounding the Black Sea agreement & extension. Germany has joined talks with Russia today about renewing it for 60-days. Turkey is still pushing for the deal to be extended by 120-days. I think the decision ultimately comes down to what Russia wants to do, which appears like the 60-day renewal. I doubt this causes much pressure if any in wheat when it gets renewed, as you'd have to imagine this is essentially already priced in.

A few main things bulls are looking at is the poor winter wheat crop here in the U.S., yes we've seen some improvement in areas experiencing drought, but there is still a ton of concerns here.

We also have the war. Keep in mind the funds are still incredibly short. One major headline could flip this thing and push us higher on a short covering rally. The main problem is that we just don't have that one bullish catalyst to cause the funds to exit with no major demand story right now. However, when we do, we could see wheat go higher in a hurry. But, this might not happen necessarily relatively soon. My bullish outlook is looking more towards spring.

On the other hand, wheat continues to be pressured by the larger crops out of countries such as Russia and Australia, as well as a stronger U.S. dollar and recession worries.

Looking at the charts, we sit well below all moving averages. I would like to see us close over $7.13 to open the door to higher prices. Nonetheless, I think we put in our lows last Friday. The main themes going forward will remain, weather, war, and the funds.

Chicago March-23

KC March-23

MPLS March-23

Crude Oil

Following its massive sell off this week, crude finds some strength today. As crude closed roughly $2.50 off its lows of $65.71. I wouldn’t be too surprised to see us make one more leg lower and perhaps test $62 or even lower.

Here is what a commodity technical analysis Vince Irlbeck had to say about the crude oil market:

"Biden wants to crush Russia and wants to crush inflation. The easiest is to drive oil lower. Many of the banks have put money into the oil market as a hedge so they are bleeding from the low interest bonds and bleeding margin money from the dropping crude market. Biden has to walk a tightrope between stopping inflation and not bankrupting the Banks, while hurting the Russian war machine. He now has to also stop the run on deposits leaving banks and entering the bond market. I believe the 55-57 area is where he starts filling the SPR back. Remember, he sold off the SPR at 120 so his advisors did a good job in the energy market."

April-23 Crude Oil WTI

3 Bullish Factors

From Wright on the Market

Crude oil traded 80¢ to $1.22 higher most of Tuesday evening to about the start of the business day in Europe. Crude oil prices lost $6 before recovering almost $2 on the settlement. It traded lower than any time since early December of 2021 and is 50% of its price just 53 weeks ago.

The reason for the weakness in crude oil was the irrational fear of a world-wide bank failure as the troubled Credit Suisse Bank was once again in the spotlight when Saudi Arabia’s main bank said they cannot not buy any more shares of Credit Suisse because of regulatory constraints (they already own 10% of Credit Suisse). However, Swiss banking regulators pledged cash infusion for Credit Suisse after the flagship Swiss bank shares declined 30% on Wednesday.

Even though the Biden Administration said months ago it would begin buying crude oil to restock the nation’s Strategic Petroleum Reserve (SPR) when crude traded below $70, there was not a peep about the SPR even though crude traded to the mid-$65 range.

Yesterday’s Producer Price Index (PPI measures inflation at wholesale level) was down one-tenth of a percent in February. The market expected an increase of three-tenths of a percent. For the past 12 months, the inflation rate was 4.6%, the lowest 12-month inflation rate in two years and way below the 5.4% expected by the market.

Lost in yesterday's chaos was the USDA announcement of the sale of 667,000 mts of old crop corn to China. The two-day total corn sales to China total is 1.279 million mts. That is 50.3 million bushels.

Chinese economic news yesterday showed their economy expanded in January and February 2.4% more than a year ago and up from the 1.3% expansion in December.

All three of the above are very good news for commodity prices. As soon as the market figures out the world’s economy is not going to collapse, commodities have to trade the bullish news of the past three weeks and the bullish news ahead.

Highlights & News

U.S. retail sales for February were down 0.4% from January, vs an expected decline of 0.3%. However, January retail sales were revised higher to 3.2% which is the biggest gain in nearly 2 years.

IEA said yesterday that they expect the crude oil market to go from a surplus in the first half of 2023, to a deficit in in the later part of the year.

Rains and hailstroms could damage some of India's key winter crops such as wheat, rapeseed, and chick peas. This is happening just before harvest following crops that were already under some stress from heat.

India's February palm oil imports drop to 8-month lows.

Allendale pegs U.S. corn slightly lower than USDA, but beans slightly higher than the USDA.

As they pegged U.S. corn at 90.414 million acres vs the USDA's 91. This is still higher than the 88.579 we saw in 2022.

They had their beans at 87.8 million vs the USDA's 87.5.

The Swiss National Bank reported an annual loss of $141 billion. Largest in the central banks 115-year history.

Livestock

Live Cattle up +0.300 to 156.875

Feeder Cattle up +1.475 to 200.275

Feeder Cattle

Live Cattle

Social Media

South America Weather

Argentina 4-7 Precipitation

Argentina 8-15 Precipitation

Argentina 15-Day Percent of Normal Precipitation Forecast

Brazil 8-15 Precipitation

U.S. Weather

Source: National Weather Service