USDA SNOOZE. RECORD FUND SELLING A CONCERN?

MARKET UPDATE

You can scroll to read the usual update as well. As the written version is the exact same as the video.

Timestamps for video:

USDA Numbers: 0:00min

Corn Export Story: 1:05min

Tariff News: 2:55min

Record Fund Selling Concern?: 3:55min

Corn: 6:00min

Soybeans: 8:00min

Wheat: 10:00min

Want to talk about your situation?

(605)295-3100

Futures Prices Close

Overview

Grains slightly lower following the snooze fest USDA report.

As we said yesterday, this report is not usually a market mover.

They are probably waiting to make changes until after we get the March planting intentions report at the end of the month.

This report was only for old crop, not new crop.

The USDA also stated that tariffs were not accounted for in these numbers.

They made ZERO changes to US corn or soybeans. Nothing.

Wheat on the other hand saw a small bearish surprise, as they increased imports by +10 million and lowered exports by -15 million. Resulting in carryout being bumped +25 million.

This report changes nothing moving forward as it was pretty much a non-event.

The world numbers were somewhat friendly, as global stocks shrank for both corn & soybeans.

While wheat stocks saw an increase.

The USDA also left the South America numbers unchanged.

However, they did drop Brazil's old crop corn by -3 MMT and raise Argy's old crop by +1 MMT. A little late for that..

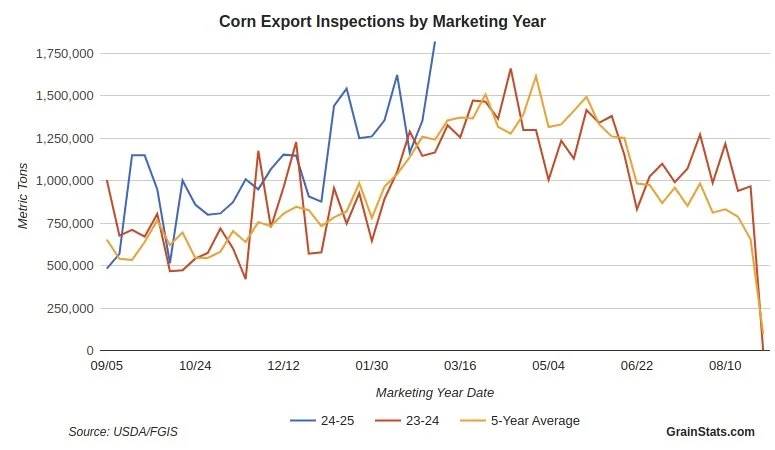

Corn Exports

Bulls were disappointed to see the USDA not raise exports but wasn’t surprising to see them kick the can down the road.

They will almost be forced to raise exports down the road.

Current exports are up +405 million bushels vs last year.

The USDA only estimates them to be up +158 million vs last year.

A 250 million bushel difference.

Last Year: 2,292

Current USDA: 2,450

Current Pace: 2,700

Exports inspections are on fire. Hitting a new marketing year high this week. Up +56% vs the same week last year.

Chart from GrainStats

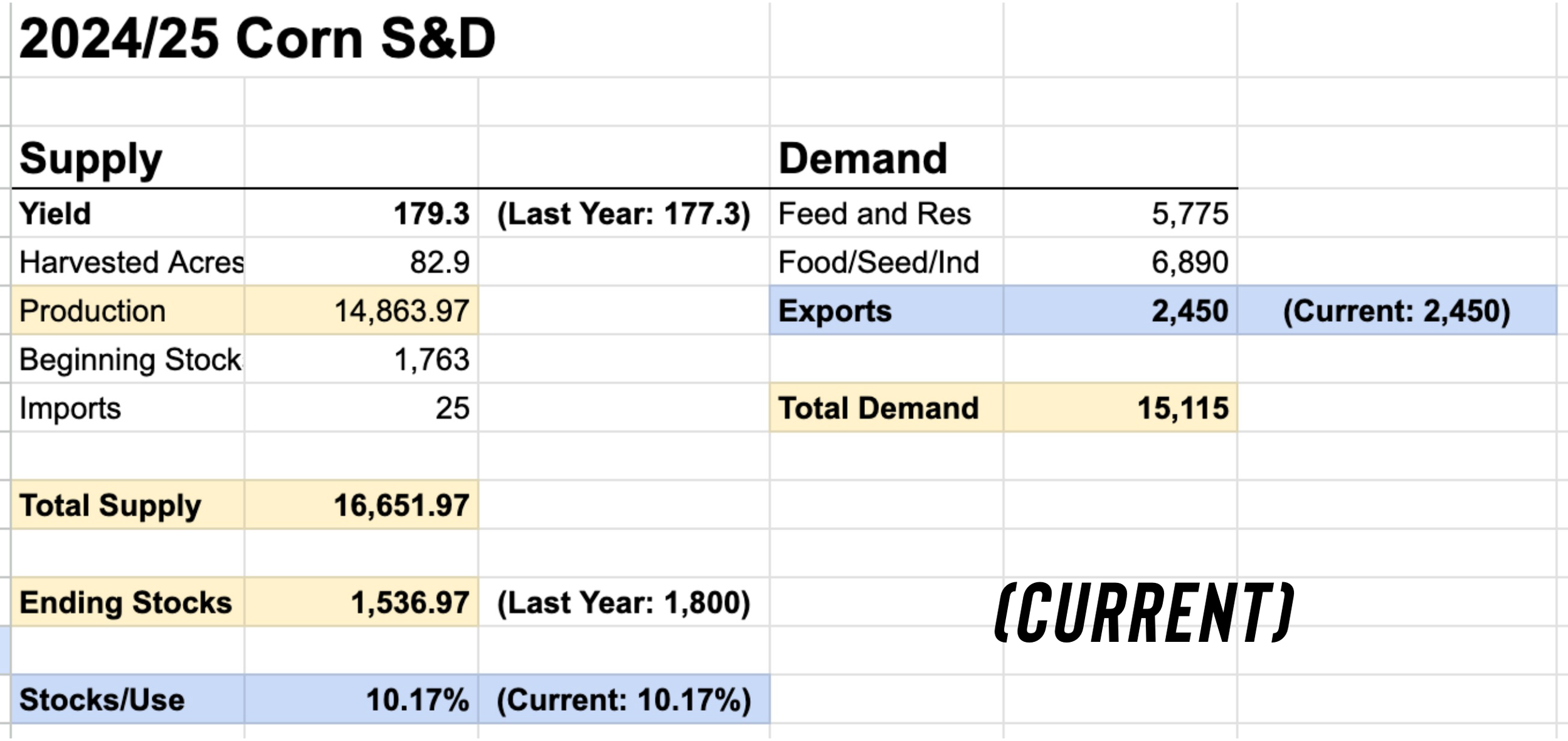

Here is what the current old crop balance sheet looks like with exports left unchanged from here at 2,450 million bushels.

Just over a 10% stocks to use.

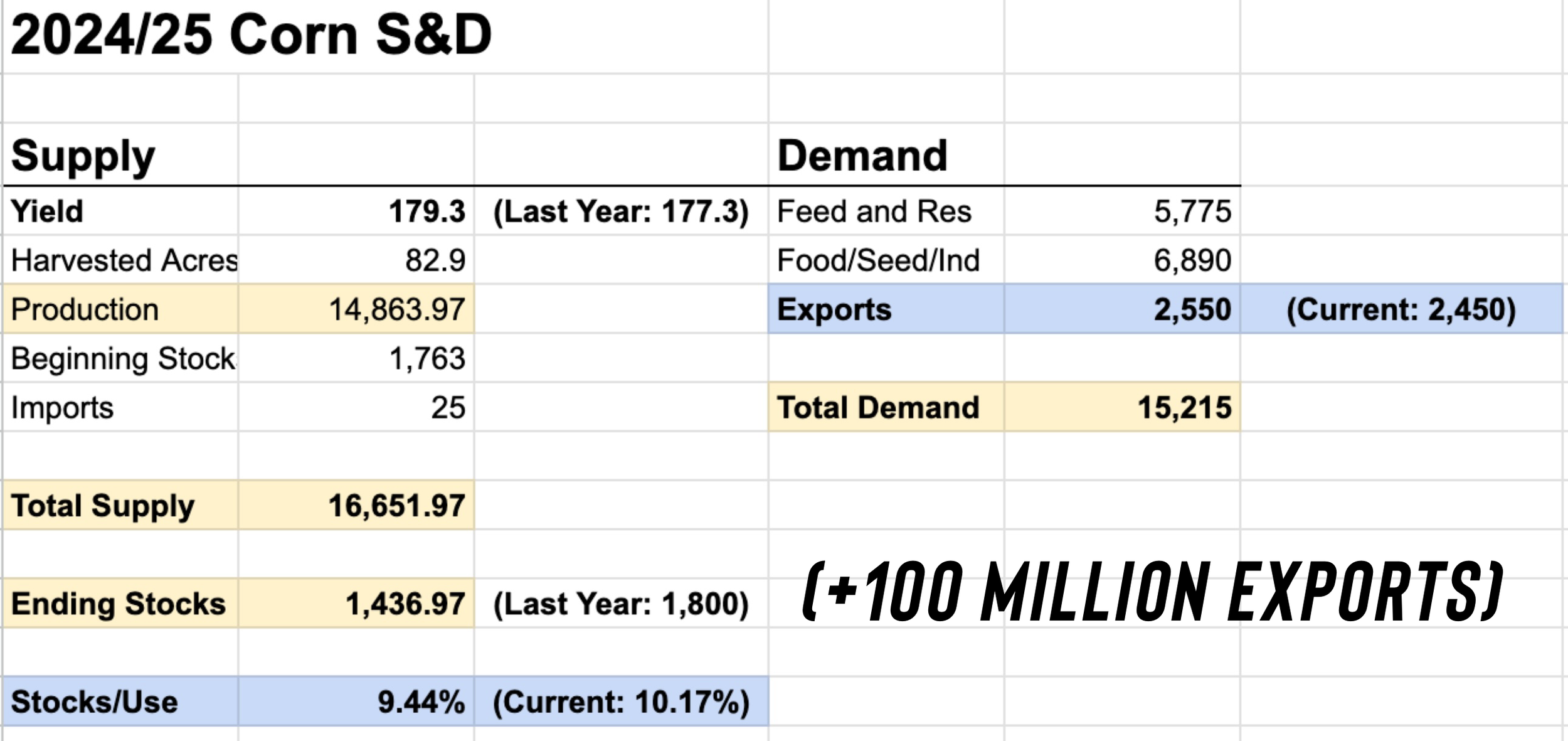

Here is what it would look like if we raised exports by +100 million bushels.

It would drop our stocks to use ratio below 10%.

Which would be bull market territory.

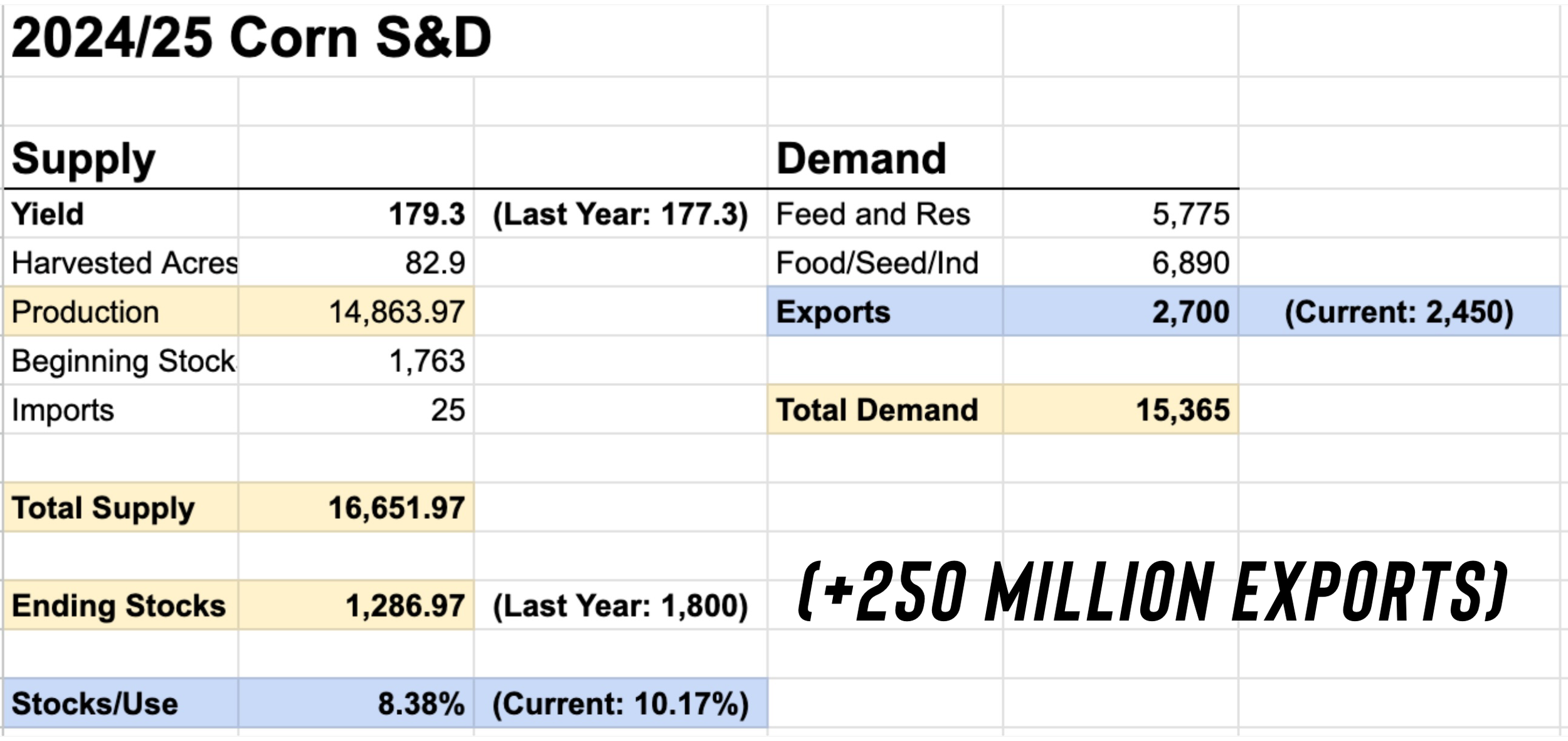

Here is what it would look like if exports were raised by +250 million bushels.

Which is how much we are currently ahead of the USDA's projection.

(Very doubtful they raise them this much)

Stocks to use drops to near 8% and a full-blown bull market.

The USDA will almost have to raise exports, but by how much is the question.

Other News

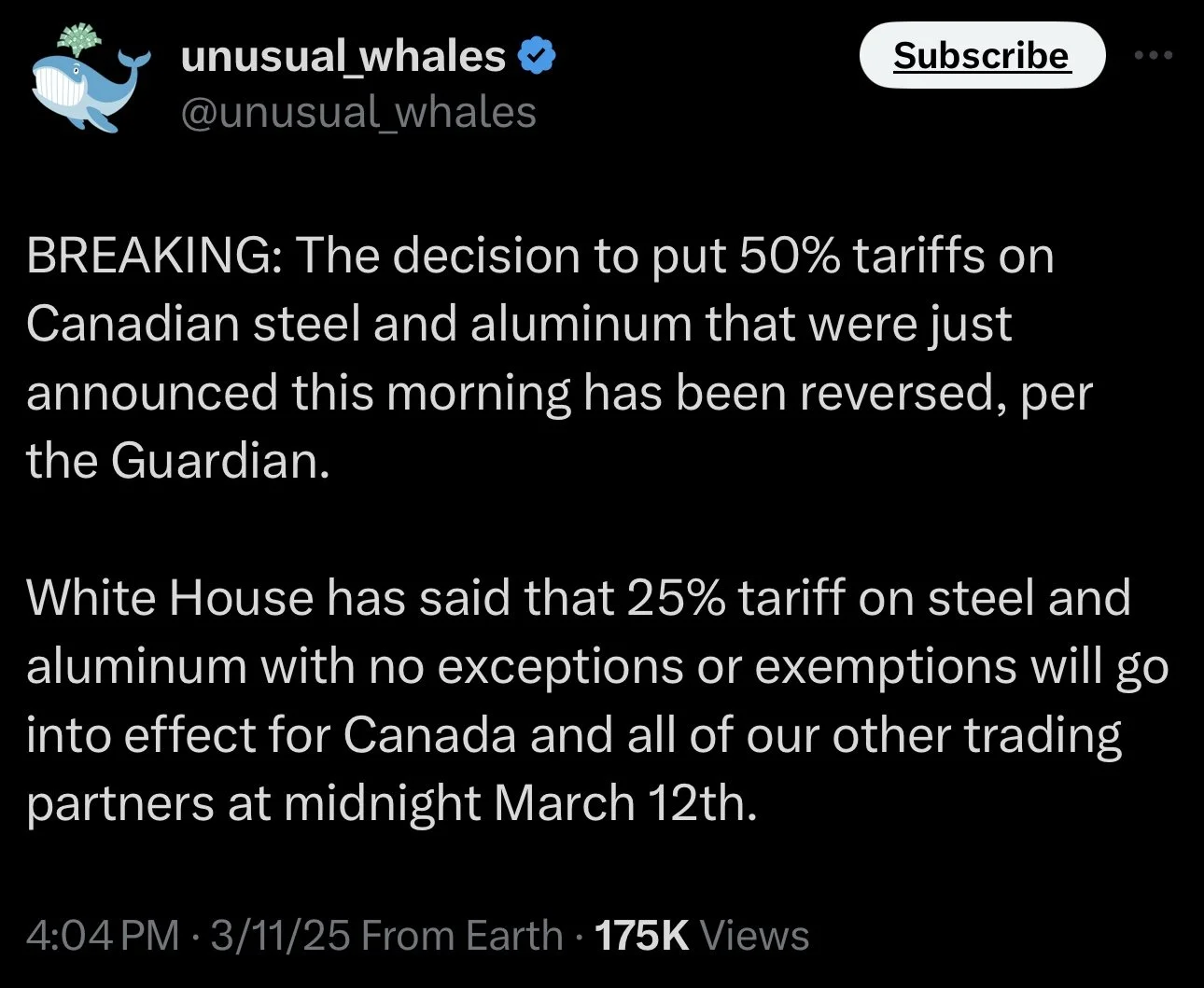

Canada Tariffs

Ontario put a new 25% tariff on electricity going into New York, Michigan, and Minnesota.

It did not last long, as after the markets closed it was announced they were suspending it.

The stock market had a good reaction to this.

The stock market hasn’t found relief like the grain market has because the Canada trade war doesn’t directly impact grains like a war with Mexico (corn) or China (soybeans) would.

At 9:00am CT Trump announced he was upping the Canada steel & aluminum tariffs by +25% to now 50%.

By 4:00pm CT it was announced he was reversing that decision.

9:00am

4:00pm

Ukraine Ceasefire

Ukraine agreed to a US proposed 30-day ceasefire deal with Russia.

Until this news came out, the corn & beans were trading higher.

Not sure how this would be bearish news.

As the war hasn’t been a bullish factor in years.

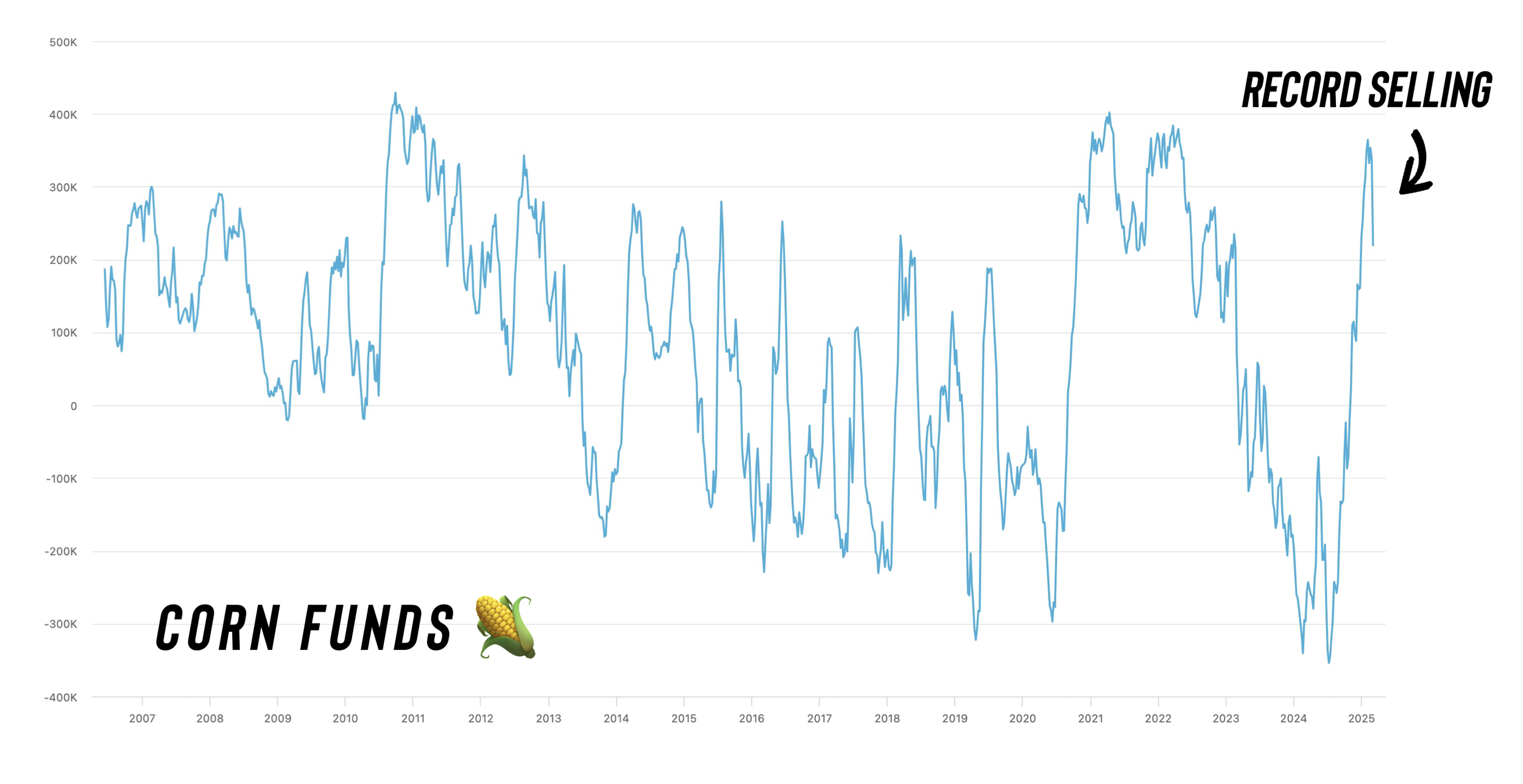

Record Corn Fund Selling.. Concern?

Through March 4th, the funds cut their long corn position by -118k contracts.

Bringing their new long position to just +220k.

This was the 2nd largest weekly selling on record.

Is this a concern?

I would lean towards no.

Yes, this was record selling. BUT only 10% of the selling was due to new short positions being added.

Here is the funds positon broke down:

Long: +312k (-104k vs week prior)

Short: -92k (-13k vs week prior)

Net: +220k (-118k vs week prior)

This means that the funds are not getting short corn.

They simply took a risk off approach and reduced their long exposure due to the tariff uncertainties.

This risk off story wasn’t just the grains, it's all markets.

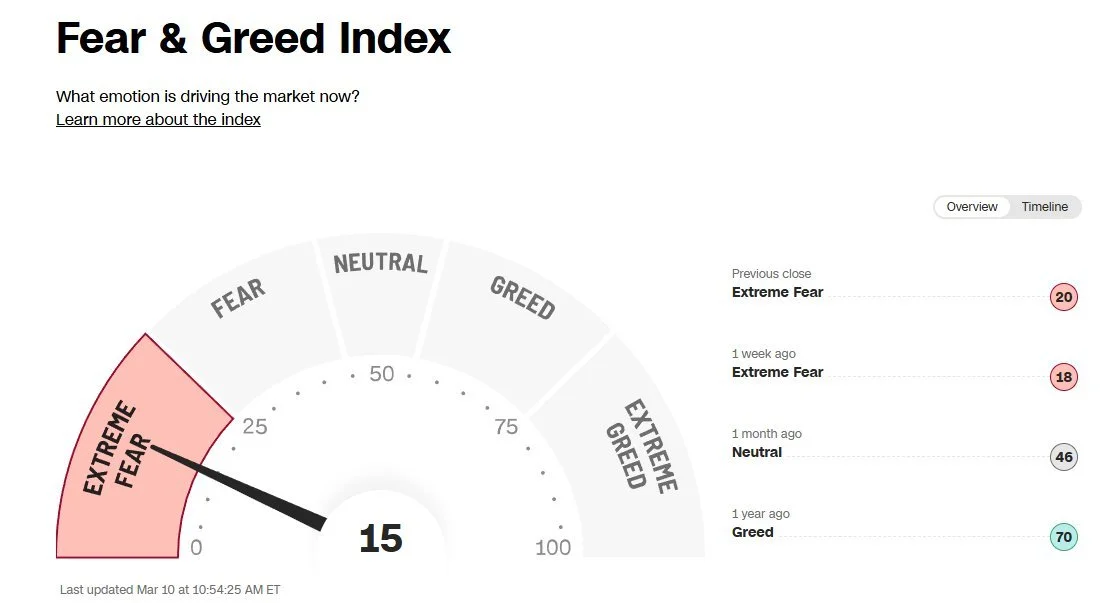

The stock market posted it's worst single day performance since 2022 yesterday.

As the stock market has now erased it's entire "Trump Pump" from the election.

The stock market fear & greed index dropped to it's most fearful since 2022.

The point is that money was flowing out of everything taking a risk off approach.

We agreed to delay Mexico tariffs until April and I'd imagine we come to a complete deal with them. Trump and Mexico's President respect each other. Mexico's economy simply cannot handle a trade war.

The funds went from record short to near record long in a very short amount of time.

The reason the funds got long has not changed. As we have seen no fundamental changes.

All this selling was simply the funds getting spooked from tariff talk. The bull story and reason they got long is still there.

So I think they will be back and wait to see how the US growing season shapes up.

Because the global situation cannot afford losses here. The funds know this.

Today's Main Takeaways

Corn

Fundamentals:

The story for corn is still there.

Global stocks are still the tightest in years.

They are so tight that the US has to have +94 million acres to prevent this demand rationing event where prices are forced to go screaming higher.

Exports are some of the best ever with zero help from China. Mexico has very little choice where to come for their corn needs. They can’t afford a trade war.

So this sell off in corn wasn’t really justified.

Moving forward, I still think corn is undervalued here.

Technicals:

Corn is now +30 cents off the lows and from our buy signal.

Next upside objective is still $4.80 (50% retracement of the sell off).

That was also the old must hold support, so it is now resistance. Which means we could struggle there.

So if you feel like you missed the boat on our Feb 18th sell signal or have to move something relatively soon, that is where I'd look to de-risk.

For Dec corn, next objective is $4.60 to $4.65 (50-61.8% of the sell off).

Weekly Chart:

Still a nice potential set up on the weekly chart.

Looking big picture towards spring/summer, the $4.96 level is still that crucial resistance.

We rejected off of it 5 straight weeks in a row on the recent highs.

It was also key support & resistance several times before. Like the exact lows in 2021.

A break above there and there is no resistance. So $5.37 remains my big picture target.

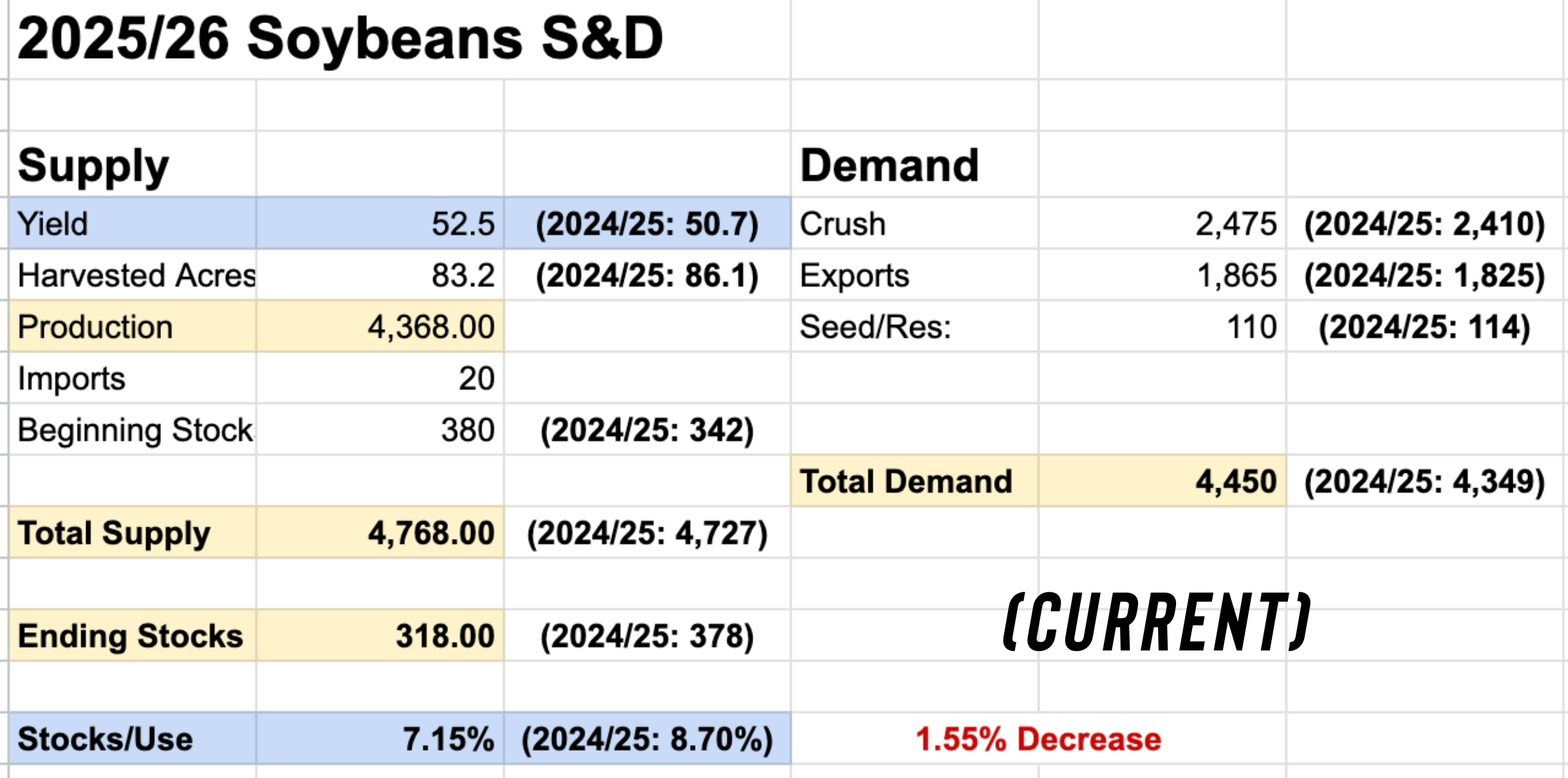

Soybeans

Fundamentals:

Soybeans are in a tough spot here.

It is hard to get overly bullish due to the record Brazil crop and immensely bearish global situation.

But the situation here in the US could get awfully tight due to less acres.

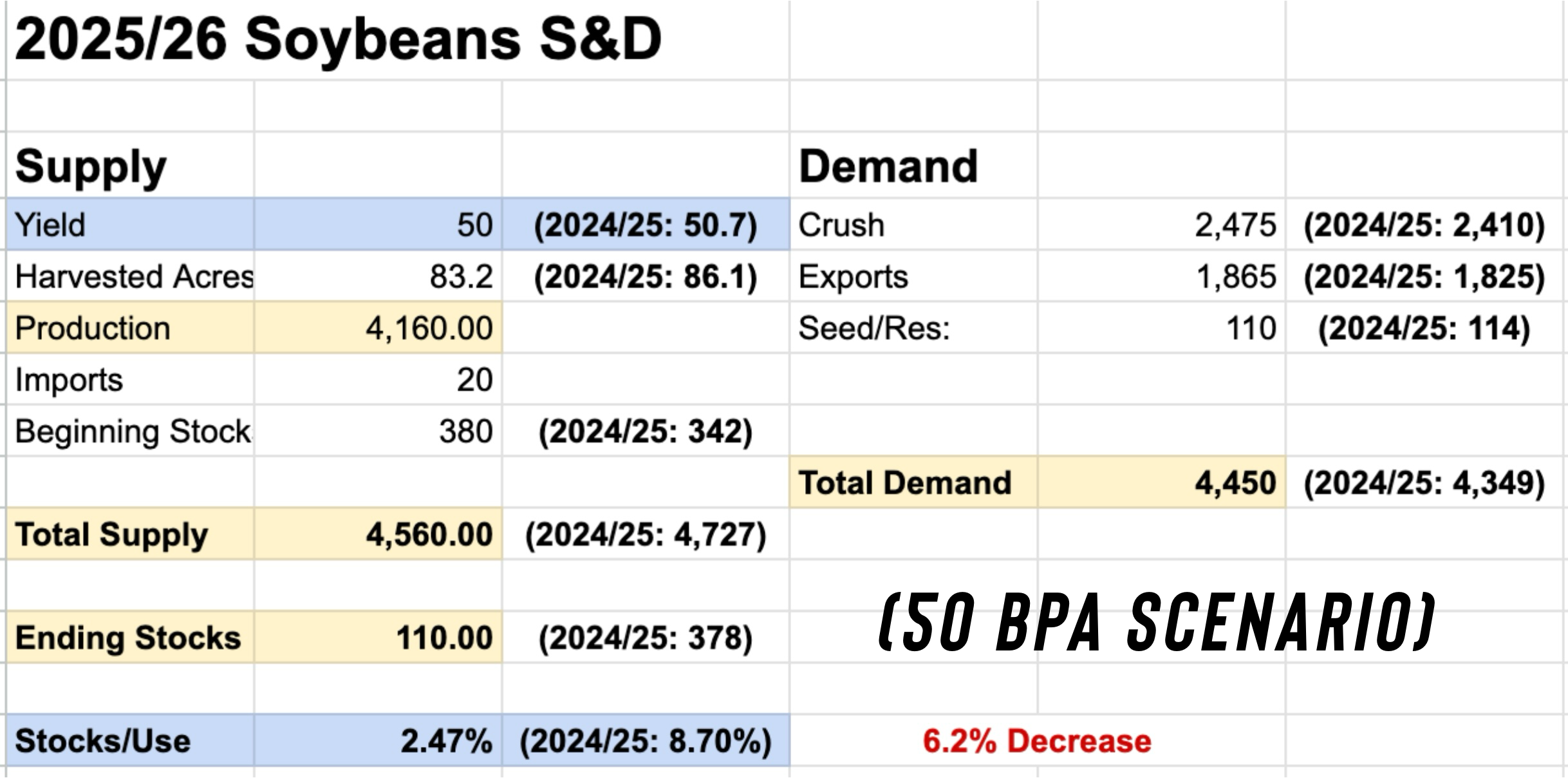

Just look at the new crop balance sheet.

We are already looking at a -1.5% decrease to our stocks to use with a 52.5 bpa yield.

If yield were to fall to 50 bpa for example, the US could run out of soybeans. As it would bring the stocks to use down to 2.5%

(This is of course without changes to demand. Demand will have to rationed, but to do that prices would have to rise).

So the potential for a US soybean story is there.

I still can’t justify telling anyone to go out and sell a bunch of their soybeans so far below the cost of production even if there is a risk for lower prices and a trade war.

Technicals:

We once again rejected that 100-day MA. If we can break above that, it should result in a test of the 200-day MA.

(I circled each instance the 100 & 200-day MAs were support and resistance)

No concerns as long as we can hold those recent lows.

Still have a potential inverse head & shoulders pattern.

Short term target for those that want one is $10.42 to $10.53 (50-61.8% of the sell off).

Same set up in Nov beans.

Need to hold the lows. Potential inverse head & shoulders.

Wheat

Fundamentals:

Wheat still isn’t bearish fundamentally.

We had a little bearish surprise in the USDA today but it doesn’t change anything moving forward.

The global situation is the tightest in a decade.

The world's leading exporter's exports are forecasted to be down -30% in 2 years.

Wheat isn’t going to win over any extra acres.

Can’t get bearish at these levels and no interest selling wheat down here.

Technicals:

Not much to update on the charts.

We are up +30 cents from our buy signal last week.

Bounced right where we needed.

Now simply range bound bound between here and the recent highs.

Next point of interest is once again going to be those recent highs.

I think the potential for near $7 wheat is there long term.

Not much to update for May wheat.

Bounced where we needed.

Now trapped in this channel.

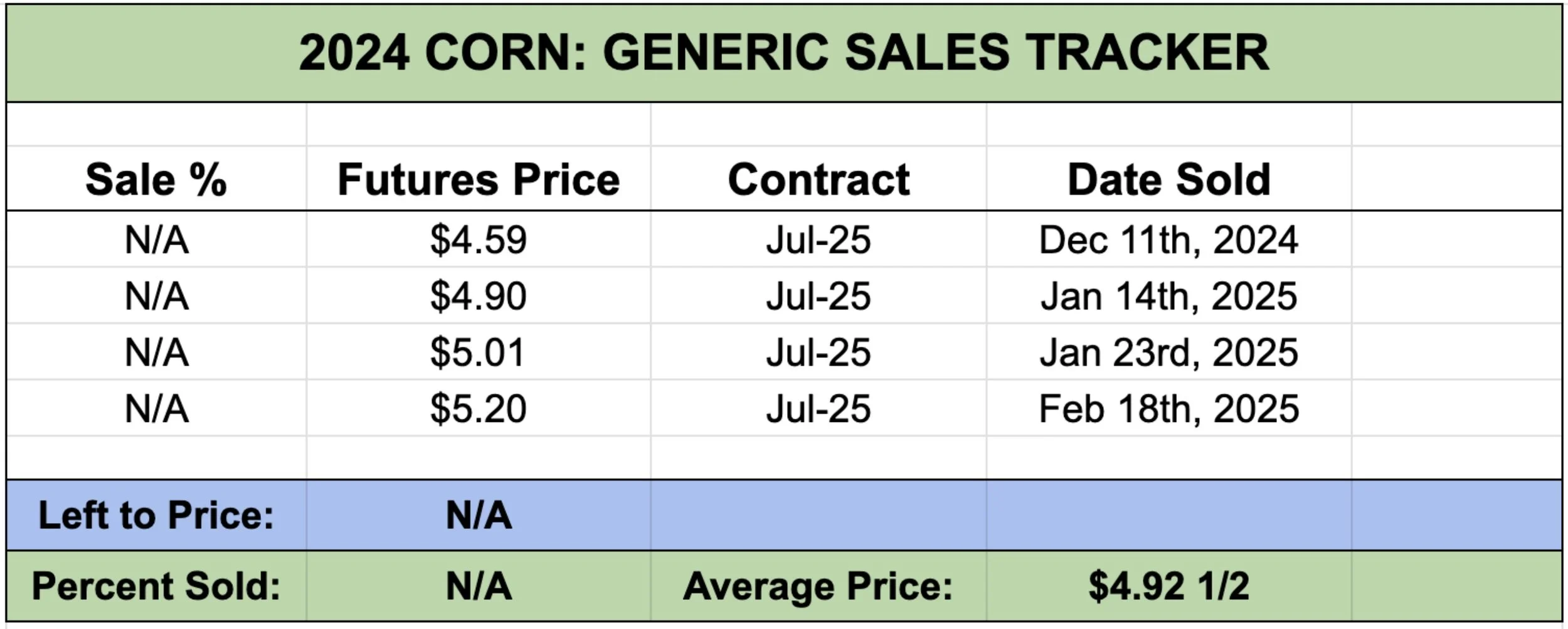

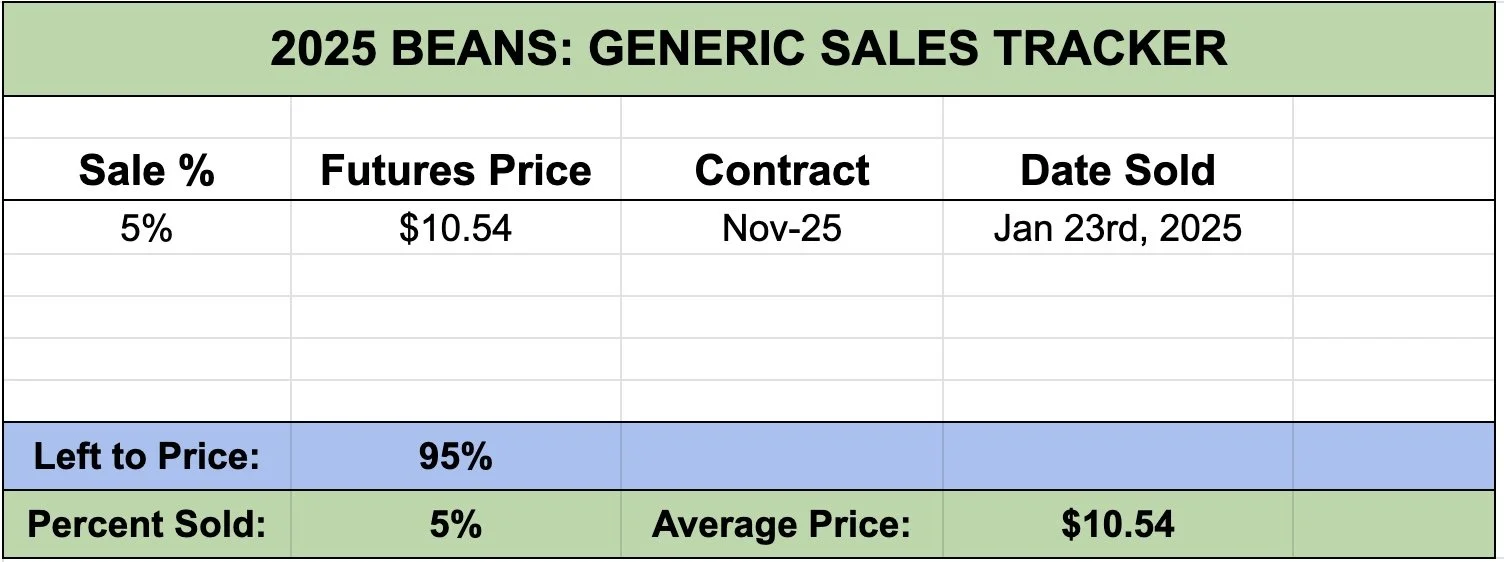

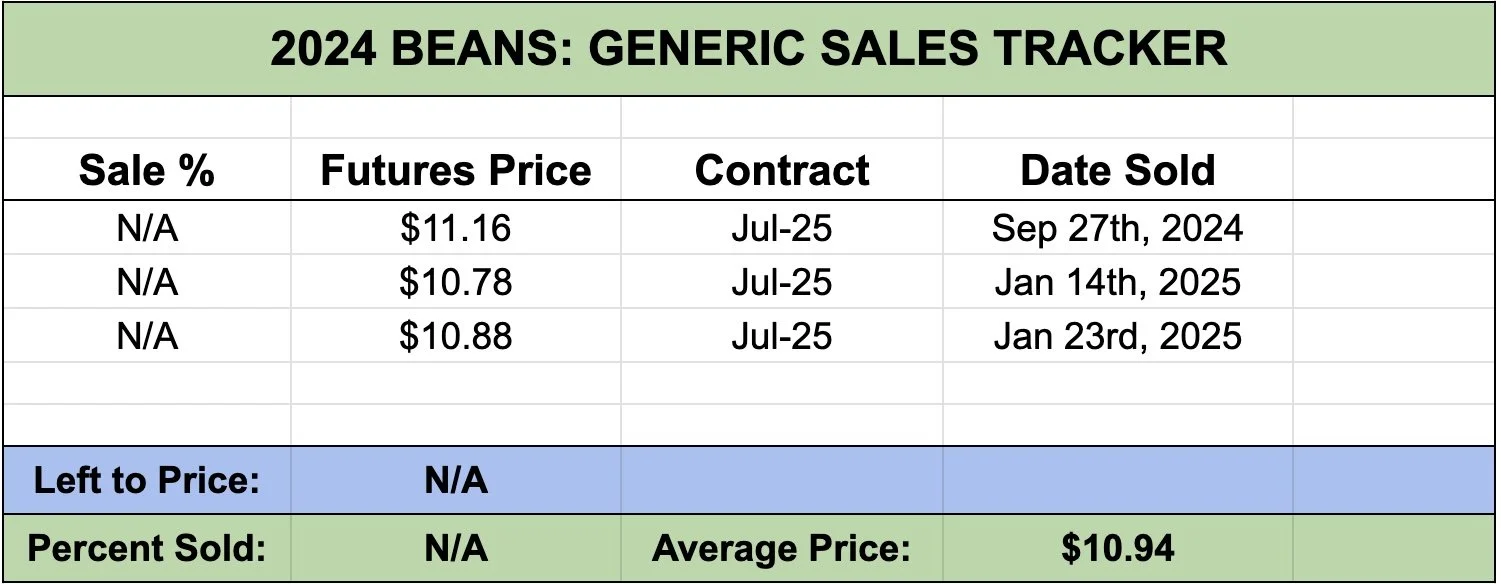

Generic Cash Sales Tracker

Due to requests here is our generic cash sales trackers.

This does not include any hedge recommendations etc. Simply cash.

This is futures prices.

For old crop there is no percentages as we only recently started tracking our generic sell signals. Future new crop sales will have percentages as we continue to make sales.

This will be included at the bottom of every update.

Past Sell or Protection Signals

We recently incorporated these. Here are our past signals.

Feb 18th: 🌽 🌾

Old crop KC wheat & old crop corn signal.

Jan 23rd: 🌽 🌱

Corn & beans old crop sell signal.

CLICK HERE TO VIEW

Jan 15th: 🌽 🌱

Corn & beans hedge alert/sell signal.

Jan 2nd: 🐮

Cattle hedge alert at new all-time highs & target.

Dec 11th: 🌽

Corn sell signal at $4.51 200-day MA

CLICK HERE TO VIEW

Oct 2nd: 🌾

Wheat sell signal at $6.12 target

Sep 30th: 🌽

Corn protection signal at $4.23-26

Sep 27th: 🌱

Soybean sell & protection signal at $10.65

Sep 13th: 🌾

Wheat sell signal at $5.98

May 22nd: 🌾

Wheat sell signal when wheat traded +$7.00

Want to Talk?

Our phones are open 24/7 for you guys if you ever need anything or want to discuss your operation.

Hedge Account

Interested in a hedge account? Use the link below to set up an account or shoot Jeremey a call at (605)295-3100.

Check Out Past Updates

3/10/25

USDA TOMORROW. GETTING COMFORTABLE IN MARKETING

3/7/25

HOW TIGHT IS THE WORLD & US SITUATION?

3/6/25

TARIFFS PUSHED BACK. FUTURE OPPORTUNITIES?

3/5/25

IS GRAINS BIGGEST RISK WEAK CRUDE & DEFLATION?

3/4/25

TRADE WAR BEGINS. 8TH DAY OF PAIN FOR GRAINS

3/3/25

TARIFFS ON TOMORROW. BUY SIGNAL

3/3/25

BUY SIGNAL

2/28/25

WHEN WILL THE BLEEDING STOP?

2/27/25

CORN AT CRITICAL SPOT. USDA ACRE REPORT. WAY TOO EARLY DROUGHT TALK

2/26/25

HISTORY SUGGESTS CORN TOP ISN’T IN? ACRE OUTLOOK TOMORROW

2/25/25

POSITIVE CLOSE. WHAT TO KNOW ABOUT USDA OUTLOOK

2/24/25

USDA OUTLOOK, FIRST NOTICE DAY & BRAZIL

2/21/25

WHAT TO EXPECT MOVING FORWARD IN GRAINS

2/20/25

FIRST NOTICE DAY CONCERNS. MASSIVE CORN ACRES OR NOT?

2/19/25

HOW TIGHT IS THE CORN SITUATION?

2/18/25

MORE DETAILS ON TODAYS SELL SIGNAL

2/18/25

OLD CROP KC WHEAT & CORN SELL SIGNAL

2/14/25

WHEAT BREAKING OUT ON WEATHER RISK. TECHNICALS & FUNDAMENTALS

2/12/25

GLOBAL GRAIN SITUATION, ACRE TALK, CHARTS & MORE

2/11/25

USDA: NOT A BEARISH REPORT. DISAPPOINTING PRICE ACTION

2/10/25

USDA TOMORROW. LONG TERM PATH FOR SUB 10% CORN STOCKS TO USE?

2/7/25

WHY WOULD THE FUNDS EXIT THEIR LONGS?

2/6/25

WHEAT FINALLY CATCHING A BID

2/5/25

COMPLETE THOUGHTS ON MARKETS: BACK & FORTH DISCUSSION

2/4/25

STRONG JANUARY LEAD TO STRONG YEAR? TARIFFS, CHARTS & MORE

2/3/25

TARIFFS PUSHED BACK

1/31/25

TARIFF NEWS ALL OVER THE PLACE. ARE YOU PREPARED FOR POSSIBILITIES?

1/30/25

WHEAT BULL ARGUMENT. TRUMP ADDS TARIFFS

1/29/25

CORN APPROACHES $5.00

1/28/25

TARIFFS, CORN FUNDS, SOUTH AMERICA & MORE

1/27/25

HEALTHY CORRECTION WE TALKED ABOUT & TARIFF NEWS

1/24/25

GRAINS DUE FOR SHORT TERM CORRECTION?

1/23/25

OUR ENTIRE NEW CROP SALES THOUGHTS & OLD CROP SELL SIGNAL

1/22/25

GRAINS TAKE A BREATHER. IS CORN IN A BULL OR BEAR MARKET?

1/21/25

HUGE DAY IN GRAINS. WHAT TO DO WITH OLD CROP VS NEW CROP

Read More

1/20/25

VIDEO CHART UPDATE

1/17/25

TRUMP, CHINA, ARGY & USING THE SPREADS INVERSE

1/16/25

OLD CROP LEADS US LOWER. MARKETING THOUGHTS

1/15/25

SIGNAL & HEDGE ALERT QUESTIONS EXPLAINED. IS $6 CORN EVEN POSSIBLE?

1/14/25

MORE DETAILS ON TODAYS HEDGE ALERT & SELL SIGNAL

1/14/25

CORN & SOYBEANS HEDGE ALERT/SELL SIGNAL

1/13/25

USDA GAME CHANGER OR NOT?

1/10/25

BULLISH USDA FOR CORN & BEANS

1/9/25

USDA OUT TOMORROW

1/8/25

2 DAYS UNTIL USDA. BE PREPARED

1/7/25

THE HISTORY OF THE JAN USDA & MORE

1/6/25

MAJOR USDA REPORT FRIDAY

Read More

1/3/25

UGLY DAY ACROSS THE GRAINS

1/2/25