4 STRAIGHT DAYS OF LOSSES IN GRAINS

Overview

Awful performance yet again for the grains. Initially all the grains started off higher overnight to give back all of the gains and end the day lower.

This now marks 4 straight red days in a row, every single day of this week.

For the week (July Contracts):

Corn: -18 1/4

Beans: -43

Chicago Wheat: -18 3/4

KC Wheat: -12 1/4

For the month of May (July Contracts):

Corn: -1/2

Beans: +42 1/4

Chicago Wheat: +75 1/2

KC Wheat: +74

Why do grains continue to go lower?

The simple answer is a lack of a bullish catalyst. When we lack a reason to go higher, often times the path of least resistance is lower.

On the charts, we failed to break out Tuesday. This led to technical selling.

Corn planting is going to be done in a week or two. The wheat market has paused because the Russia and Urkraine issues are priced in for now. So we no longer have wheat supporting corn and beans.

The funds had been big buyers recently, but have now again switched to sellers. Which does give them more power to cover in the future, but right now they see less upside risk than they did previously when the market wasn’t sure how planting would turn out. Right now there is no risk in these markets for another few weeks.

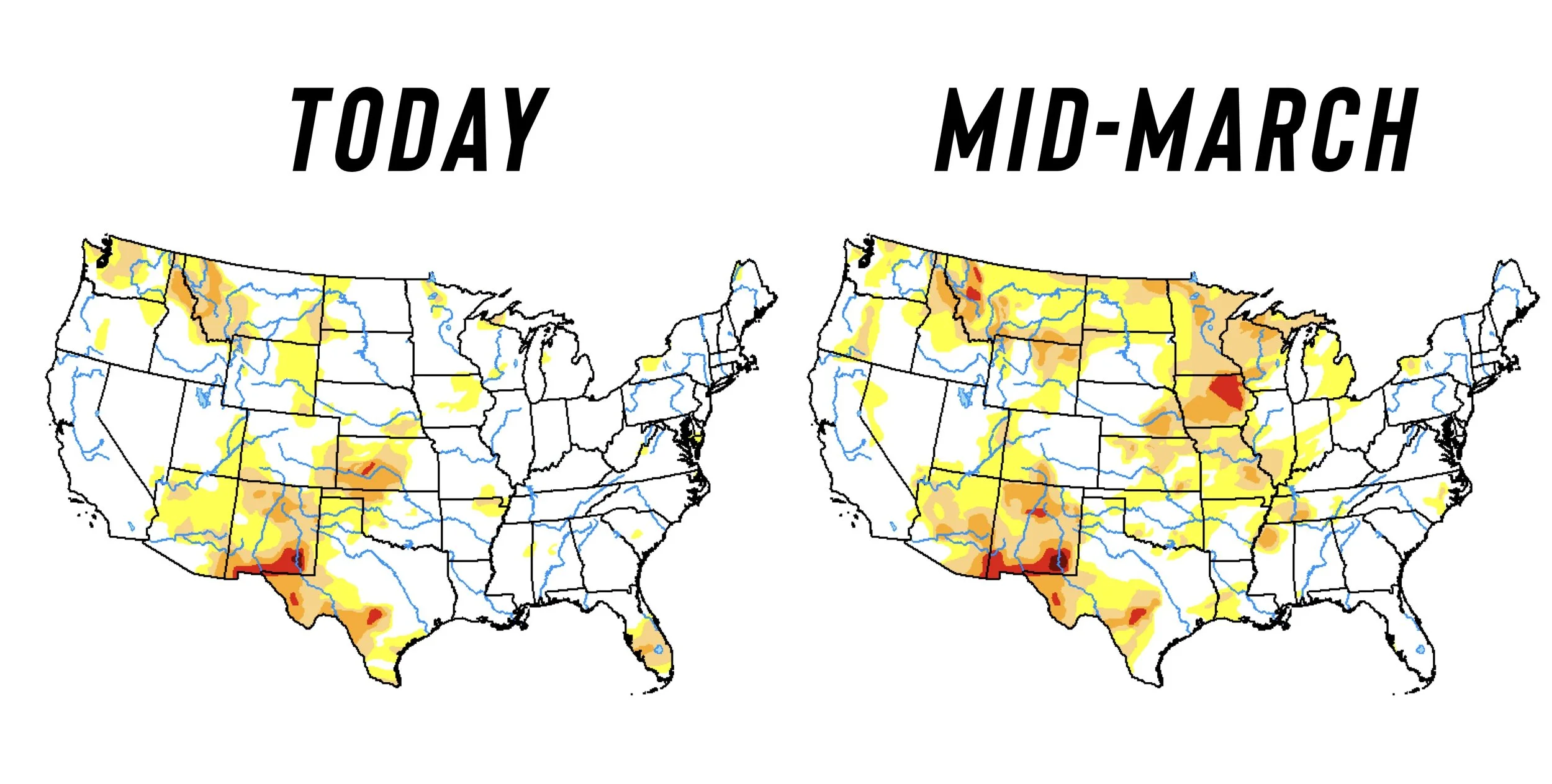

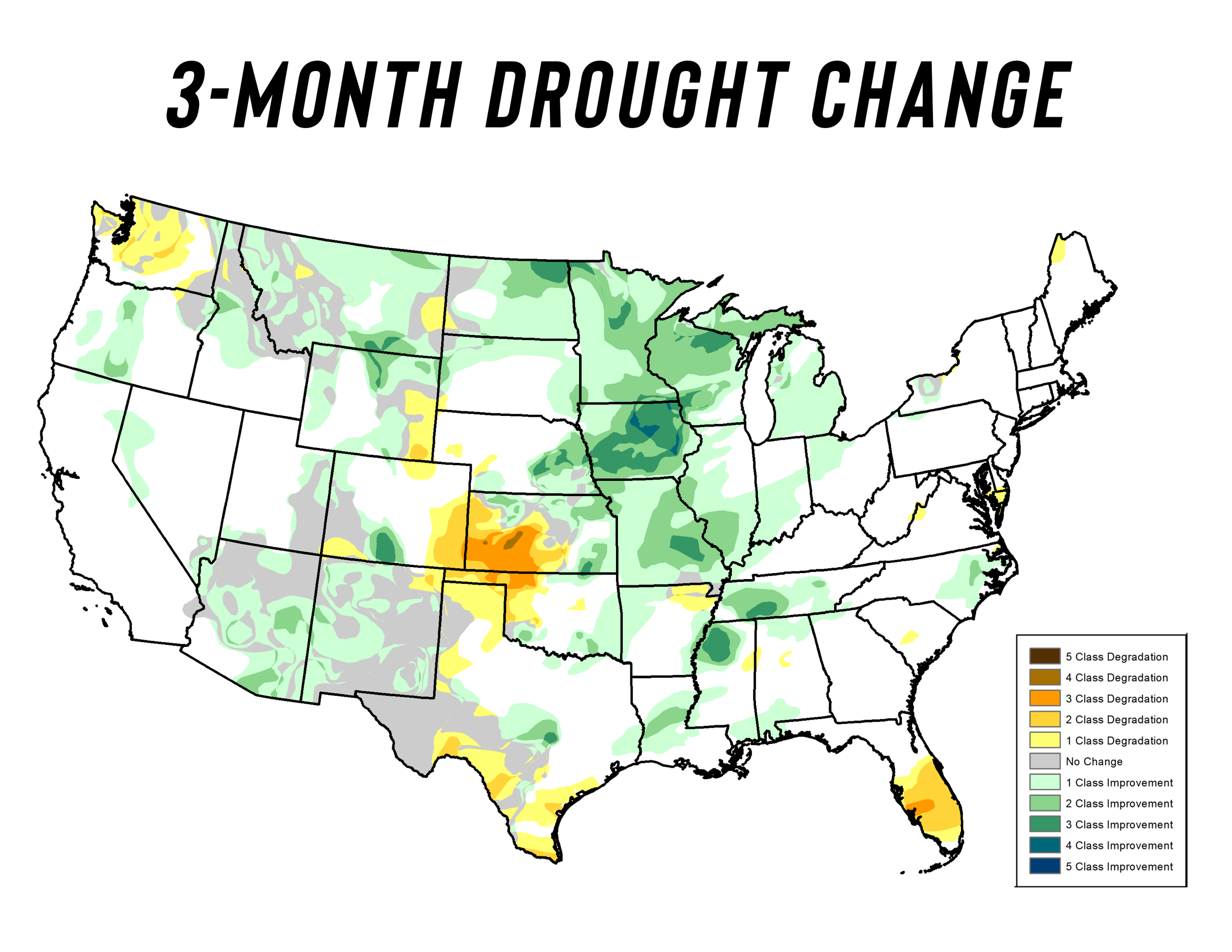

There are no more planting delays. The current US weather outlook looks favorable. This market has completely removed 100% of that weather premium we had in corn and beans. (But gives us the opportunity to add more later).

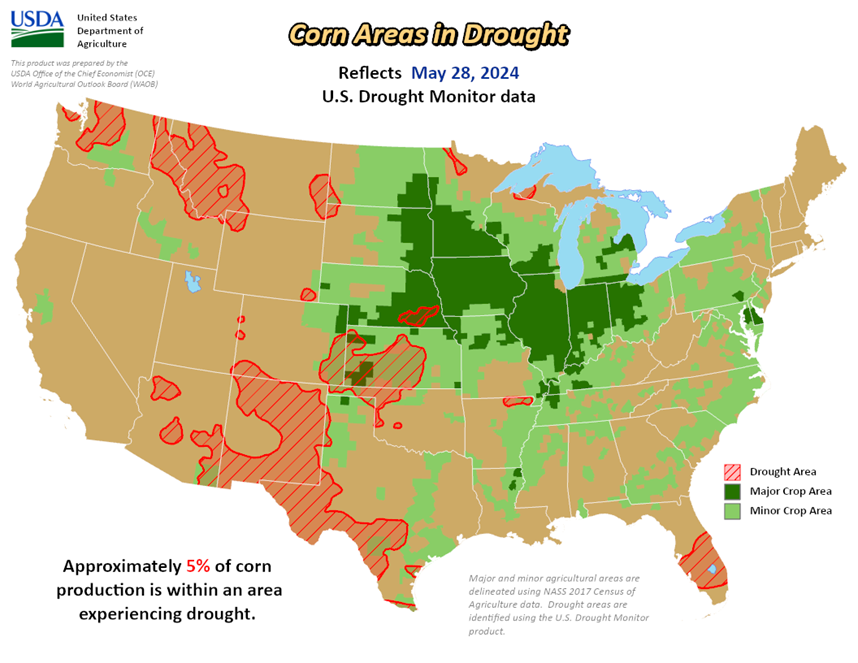

The corn belt drought is now gone.

Areas experiencing drought:

Corn: 5%

Beans: 3%

Winter wheat: 25%

Spring wheat: 3%

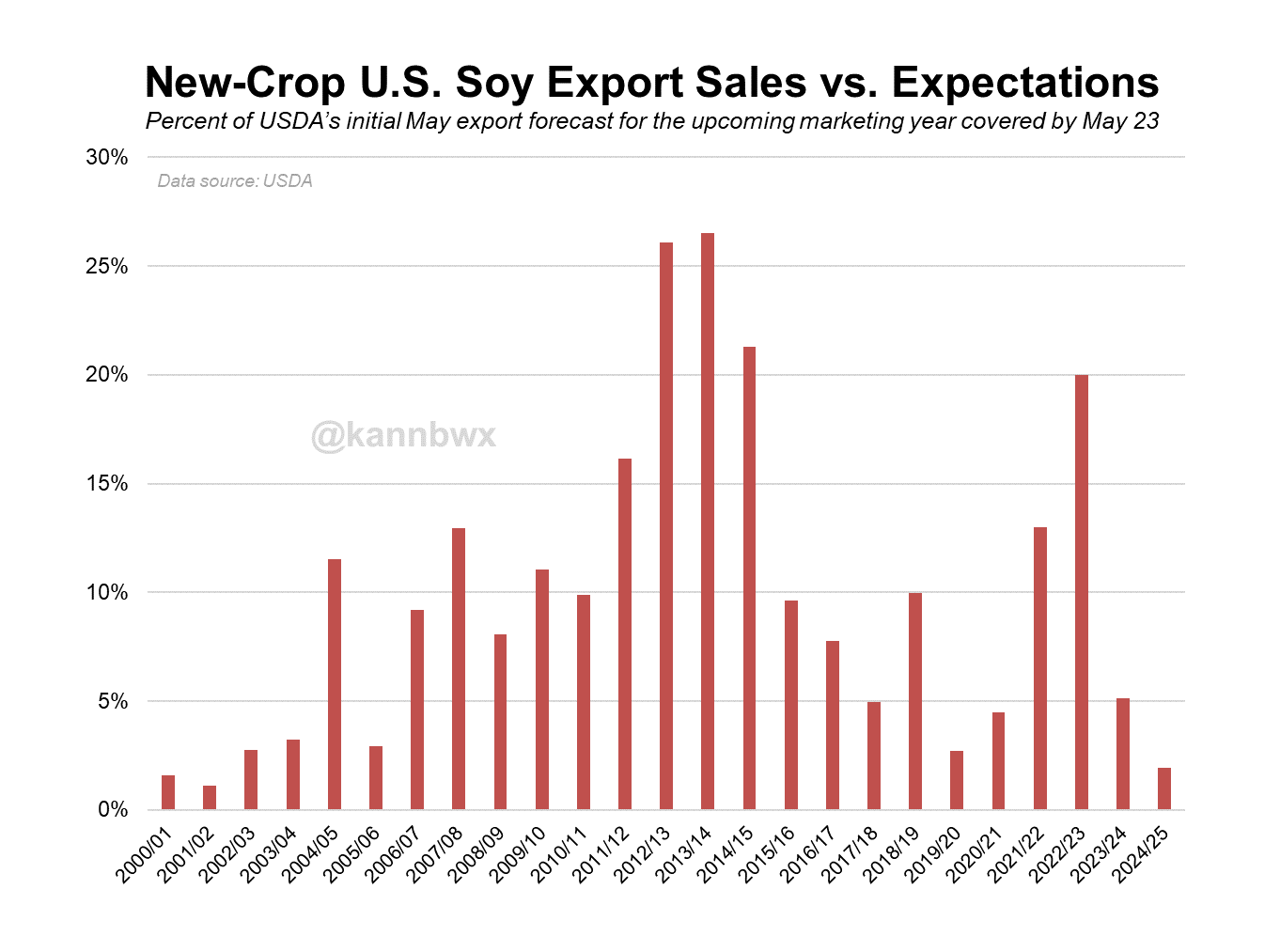

This morning's weekly export sales didn’t provide any support either. As new crop sales for soybeans are the worst in 23 years relative to expectations.

Chart Credit: Karen Braun

We will get our first crop ratings of the year on Monday, most expect some pretty strong initial ratings.

After that, next big piece of data the market is going to get to chew on is the WASDE report in 2 weeks and the USDA acres report a month from now. So this does put bulls in a tough place, with lack of reason to go roaring higher short term until we get into that "real growing season".

However, although we lack a reason to go screaming higher here. We also don’t have a reason to just continue to fall and fall. This downside move was overdone. I don’t see how they would want to break the entire market before the release of the upcoming USDA and acre reports. Plenty of uncertainty still left in these markets...

Today's Main Takeaways

Corn

Corn lower for 4 straight days. It took us 3 months to build up this rally and 3 days to give back half of it.

The funds are now selling again as we lack that catalyst to maintain a rally.

The market has moved on from delayed planting. The focus is now the growing season.

From now on out, rain will be seen as bearish.

Corn planting is going to be done in a week or two, and the wheat rally has paused.

You can’t predict yield in May, but I think it is safe to say we likely won’t hit 181. If we somehow get timely rains and perfect conditions, yes something as high as 179 is possible.

The bigger issue delayed planting and wet spring brought was NOT actually delayed planting itself. It was mudding the crop in. A lot of these crops were planted in poor conditons.

Your "spring sins" as some call it will not show up until later in the year. Those compaction issues and problems you get when planting in wet soil.

Rain later in the year is more important during a wet spring than if we were to have had a dry spring. A wet spring requires timely rain throughout growing season. Without it, our root structure won’t be there.

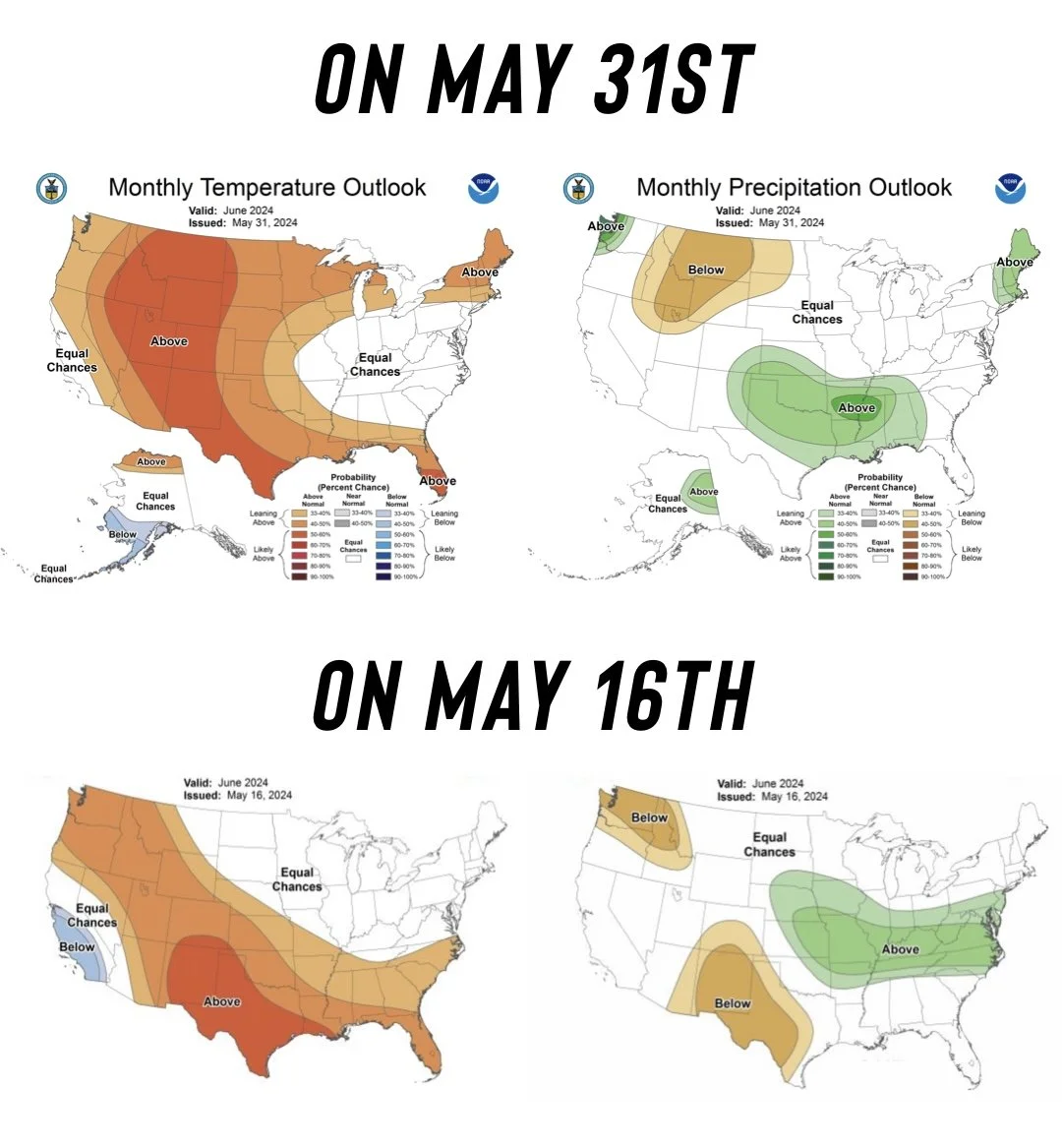

Today they updated the June forecasts. They shifted hotter and drier for the corn belt.

They now say that La Nina has a 69% chance of developing by July to September and a 100% chance by the end of the year. La Nina brings hotter and drier weather to the corn belt. Some are even saying this has the potential to be the hottest summer on record. We did just have the hottest 4 months to start a year in 175 years.

Yes heat is good for this crop. Extreme heat is not. If we get 10 days in a row of +110 degrees during corn's reproductive phase, it would cause a supply scare and rally.

We are going to get hot and dry at some point. But right now the market does not care about anything other than the fact sub soil moisture is the best we've had in years. But we will likely get a weather market again this summer, it happens nearly every year. Since it’ll likely be a supply driven rally, it is going to happen fast and then crash fast if/when it happens.

As mentioned, we don’t have any major events for another few weeks. Some think we could see the USDA lower yield in June. Personally I think there is only a 10% chance or so that happens. It has only happened in severe delayed planting years such as 2019. We aren't close to that, in fact we are ahead of pace now.

If you look at the corn chart, we did break some support. I am hoping it's a false break out and bear trap. We have been mentioning the possibility for a bear trap all week. Where the market pushes us just past where we think it will go.

My bias is that we will get that typical seasonal rally and supply scare.

But that does not have to happen. Hedging is extremely important, and I have been saying I like adding protection the past week or two.

You cannot control or outguess the market. Only Mother Nature can. Marketing is nearly impossible. You will always second guess yourself. All you can do is control your plan and get comfortable.

No there is not a major reason for me to think we just continue to fall here, but there is always downside risk. I don’t want to get super aggressive with sales, but there is nothing wrong with small sale increments here and there.

Tuesday I said I liked adding protection. For those that are undersold or can’t stand this volatility, you could still look at grabbing puts. For others, we might want to be a little more patient until we get into the heart of the seasonal time period to do so.

Give us a call if you have questions. Not everyone should do the same thing, but everyone should have a plan. I can’t stress this enough. (605)295-3100.

One thing to keep in mind is that there is a lot of corn still in hands. When that wave of corn hits the market, things could get uglier on the cash side. The other big risk we have is if we raise an above average crop, we already have a big carry out. We could go a lot lower come fall. I hope that doesn’t happen, but that’s the risk. Hope isn’t a marketing plan. Keep in mind there is just as good of a chance the opposite happens and yield and carryout shrink.

July Corn

Soybeans

Soybeans have been the biggest loser on this downfall. Dropping over -40 cents in 4 days.

Soybeans were actually very strong early today, which gives me some reason to think that this market has a little bit of life under it.

The same story as corn. The weather premium is completely gone.

Looking long term, this could be beneficial. It means if we do get that summer scare, we have a lot to price in. Short term it means things could be tough unless we get a catalyst before the key growing season where we typically get that scare.

As mentioned, demand for soybeans is poor. China just doesn't want US soybeans. This is one of the biggest negatives.

With new crop exports being the worst in 23 years compared to expectations. If China starts coming in to buy our soybeans, it would be a big supportive factor. Especially given the fact that soybeans in China just hit new highs last week of over $15 a bushel.

Soybeans have a tighter balance sheet in the US than corn does. If we see any cuts to yield this year, things could get awfully tight. But of course, you can’t predict this crop size in May.

We completely failed a breakout on the charts. We have now given back a huge part of this $1.00 rally. However, we are still over $12.00 and +65 cents off the lows for the year.

Yes, beans have a lot of potential. But on Tuesday I mentioned I liked protecting the downside with puts for a lot of you guys. For some of you, it still makes sense to lock in a floor despite the recent sell off. When you get puts here you hope they go to zero, but have more peace of mind if we continue to fall further.

Personally I think we find support here. I don’t think we will scream higher, but we do not have a reason to just completely fall apart either. We need to hold right here, if not we could easily see another 10 to 15 cents of more downside.

July Beans

Wheat

Wheat is only -22 cents off of it's highest close of the year. As despite trading as high as $7.20, our highest close was right at $7.00.

The EU imposed tariffs on grain from Russia. This could give some advantage to the US.

There is some rain expected for those dry areas in Russia, so this has added some pressure.

Keep in mind, this Russian wheat is made or lost in June. Still has the chance to be a lot better than the recent estimates or a lot worse. Time will tell. The recent estimates suggest this crop could be 80 MMT. The initial estimates were 93 MMT. That's a big change.

Here is a chart of their growing season.

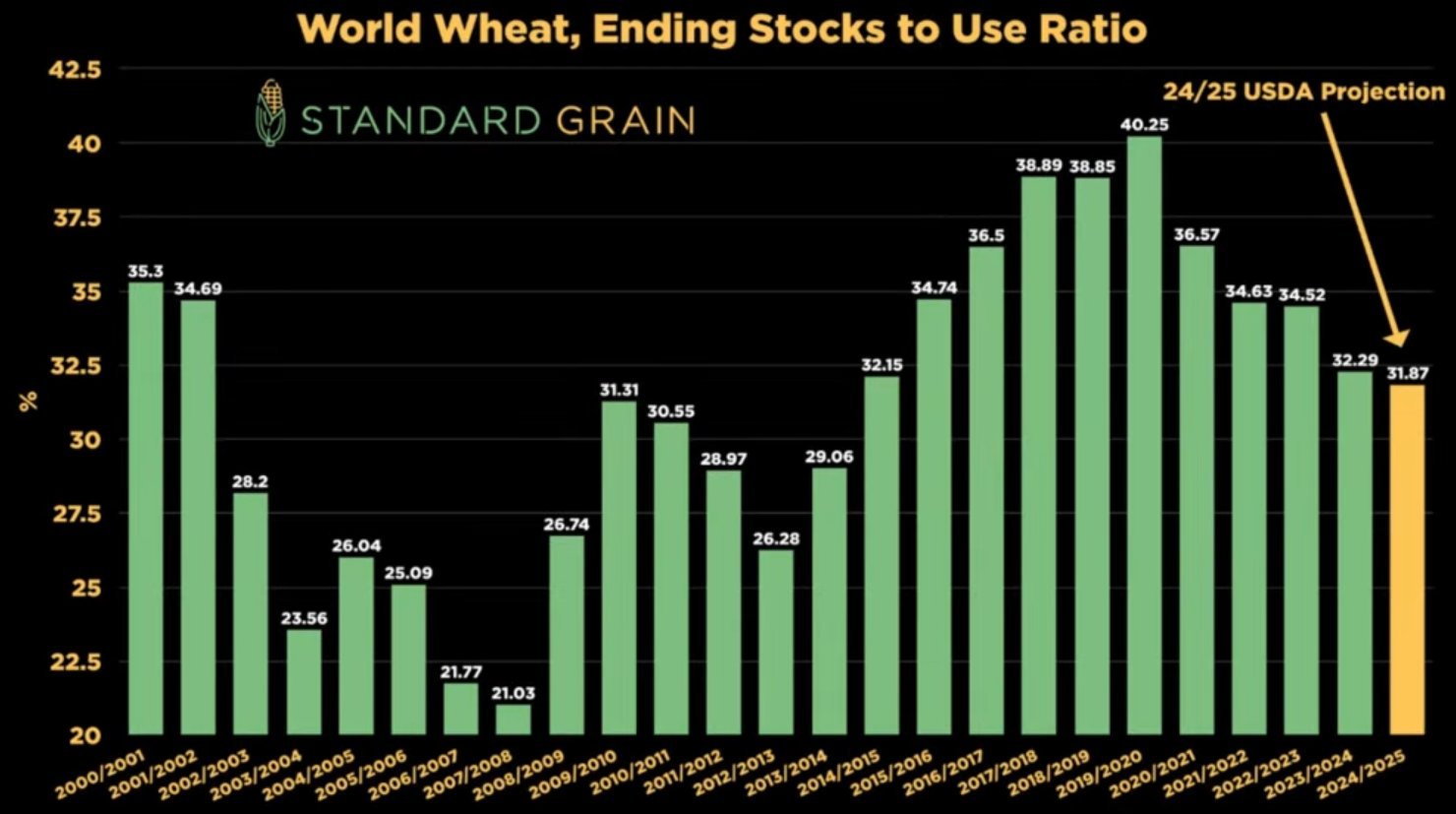

Wheat is stuck at a crossroad here. We have world supplies from countries not named Russia at 15 year lows. We have the Russia frost damage and drought across the Black Sea.

However, a lot of this has been priced in. It will take additional news to keep this market rallying. Traders have to have confidence to continue to buy at higher prices.

Long term I think we have "potential". Doesn’t have to happen next week or even this year. But the wheat situation is changing. Global ending stocks for wheat are the tightest they have been in a decade and continues to get tighter year after year despite global production increasing.

India is now importing wheat. When and if the USDA realizes the situations in Russia and India, it could cause a huge swing on the balance sheets and make things even tighter.

Chart Credit: Standard Grain

Trying to outguess the market is impossible. You make sales and then worry we will keep rallying. You don’t make sales and worry this market will give back half of this major rally.

It is all about being comfortable. Find that balance.

As we have been saying since May 22nd, we alerted a sell signal. If you know you will have to move wheat off the combine, need cash flow, don’t have storage, or can’t hold wheat +1 year for whatever reason. Start scaling into sales or puts. We are still near the highs.

For those that have more time on your hands, you don’t need to be as aggressive but it makes sense for many to at least consider partially rewarding a $1.60 rally. Long term wheat still has plenty of upside.

How mad would you be if you did nothing, then next week this wheat market decided to give back half of the rally?

How mad would you be if you made a bunch of sales and we rallied another $1.00?

These are questions only you can answer. Because every operation is different.

If you do not want to make a sale, consider grabbing a put. If you made a sale but think we have upside and want to participate in that upside, grab a call.

Give us a call to walk through your specific situation 1 on 1. (605)295-3100.

July Chicago

July KC

Want to Talk?

Our phones are open 24/7 for you guys if you ever need anything or want to discuss your operation.

Hedge Account

Interested in a hedge account? Use the link below to set up an account or shoot Jeremey a call at (605)295-3100 or Wade at (605)870-0091

Check Out Past Updates

5/30/24

I DON’T THINK SEASONAL RALLY IS OVER. WHAT IS THE PLAN IF I’M WRONG?

5/29/24

PLANTING DELAY STORY VANISHES. BUT IS REAL STORY OVER?

5/28/24

GETTING COMFORTABLE WITH GRAIN MARKET VOLATILITY

5/24/24

WET SPRINGS DON’T CREATE RECORD YIELDS, DO THEY?

5/23/24

MANAGE RISK DESPITE STUPID PRICE POTENTIAL IN GRAINS

5/22/24

BEANS NEAR NEW HIGHS. WHAT TO DO WITH WHEAT?

5/21/24

BIG MONEY KEEPS DRIVING WHEAT HIGHER

Read More

5/20/24

ALGOS & BIG MONEY CONTINUE TO MOVE GRAIN PRICES

5/17/24

WEATHER MARKET VOLATILITY CONTINUES TO HEAT UP

5/16/24

SITUATIONAL GRAIN MARKETING

5/15/24

HEDGING VS GUESSING

5/14/24

CORRECTIONS ARE HEALTHY

5/13/24

FUNDS DON’T WANT TO BE SHORT GRAINS

5/10/24

PRICE ACTION TELLS DIFFERENT STORY FROM USDA REPORT

Read More

5/9/24

MARKET PRICING IN NEGATIVE REPORT. WHAT TO EXPECT FROM USDA

5/8/24

USDA IN 2 DAYS

5/7/24

WHO SHOULD WAIT FOR TRIGGERS NOT TARGETS

Read More

5/6/24

GRAINS HIGHEST IN 4 MONTHS

Read More

5/3/24

SEASONAL RALLY JUST BEGINNING OR BULL TRAP?

5/2/24

ARE THE TIDES STARTING TO TURN?

5/1/24

BE PATIENT & READY FOR THESE OPPORTUNITIES

4/30/24

FIRST NOTICE DAY SELL OFF

4/29/24

WHEAT TAKES A BREATHER

Read More

4/26/24

SHOULD YOU REWARD WHEAT RALLY?

4/25/24