CORN PRESSURED BUT CONDITIONS FALL

*Note: I am getting married this weekend and will be on my honeymoon next week, so there will be no market updates from June 13th to 21st. We will still have audio updates. All updates will resume as normal after.

Overview

Grains close mixed with corn seeing some pressure down 11 1/2 cents while the wheat market was very strong off the back of Russia and Chinese headlines.

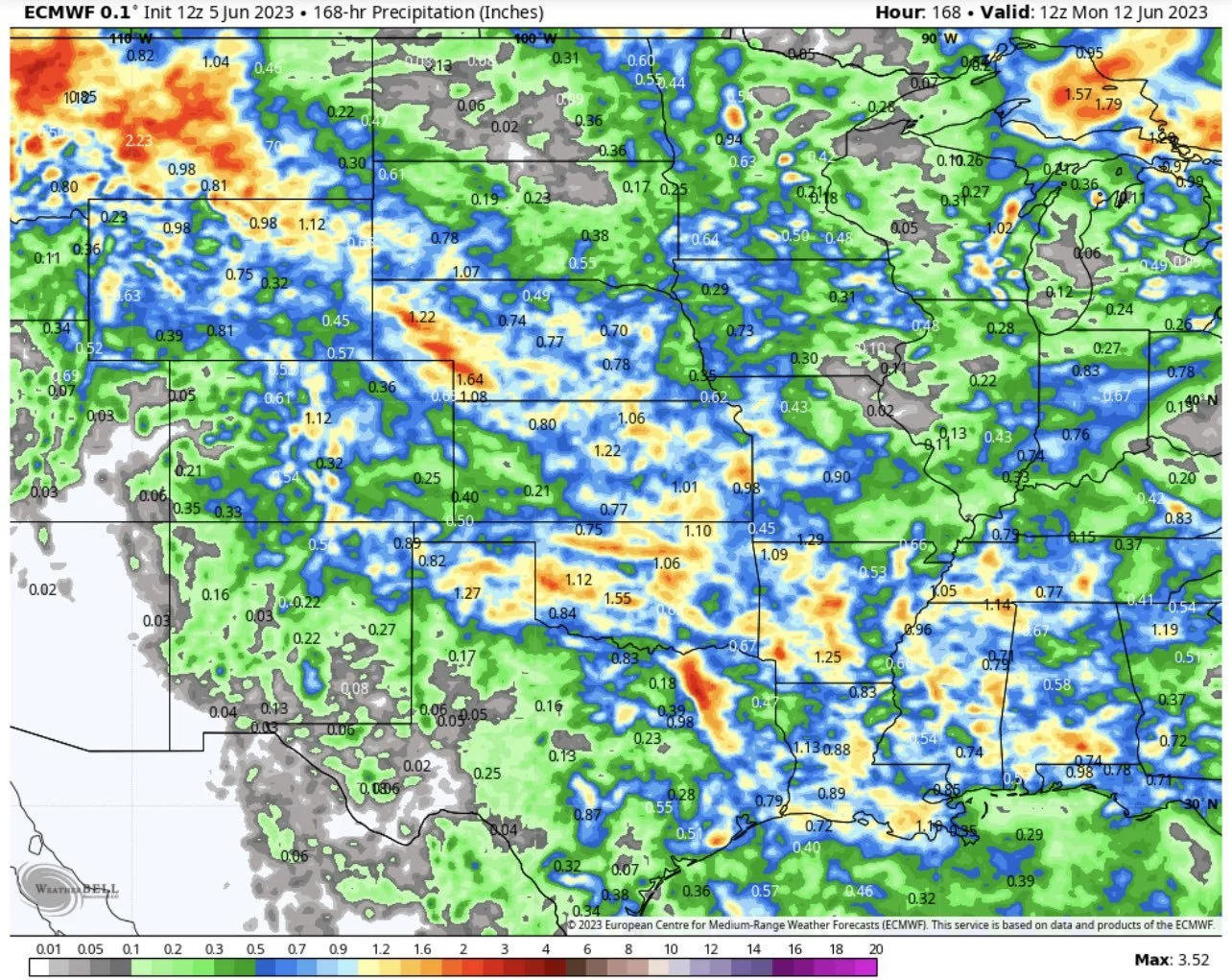

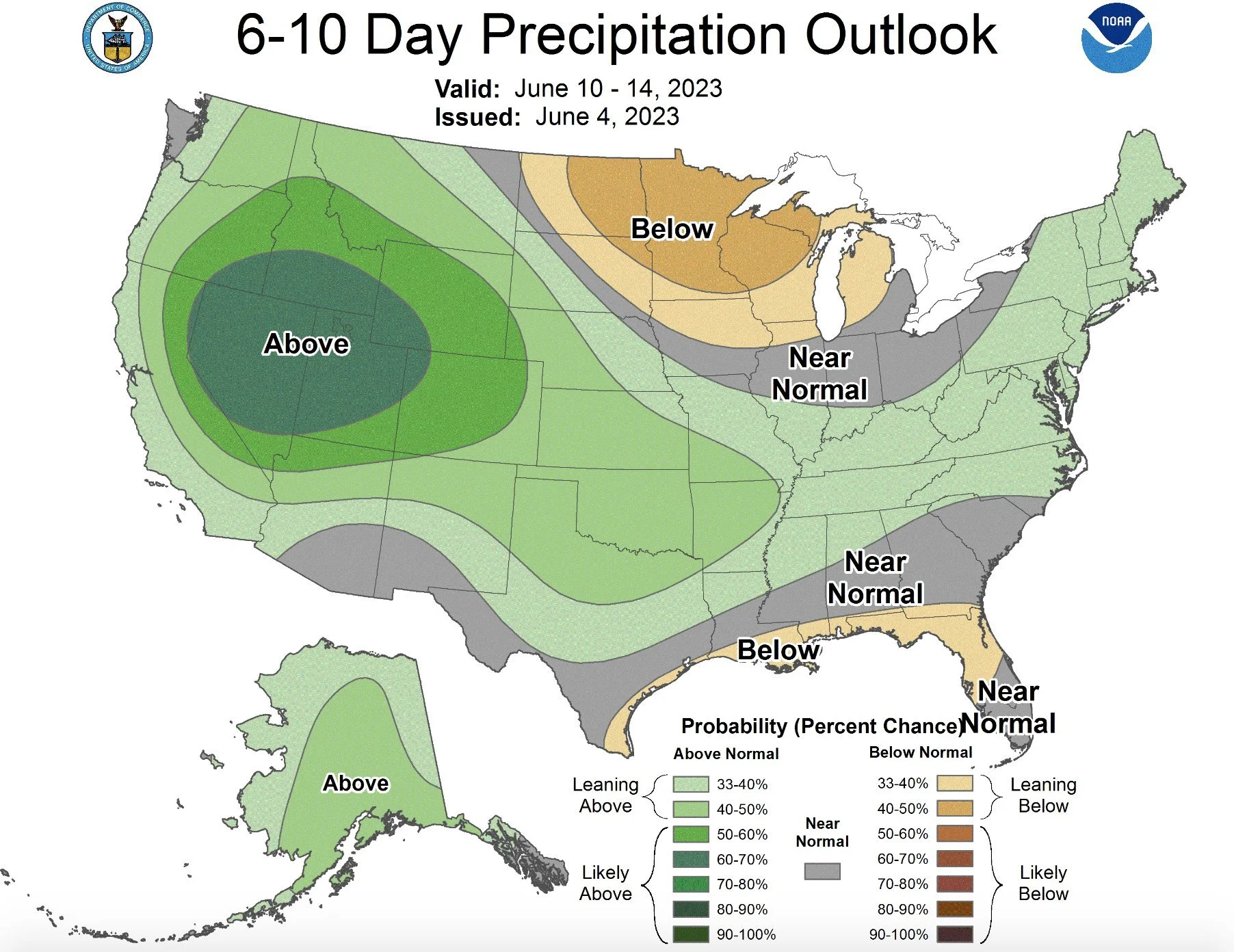

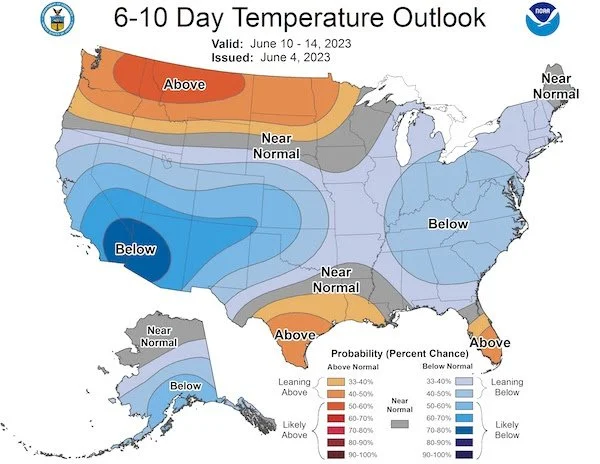

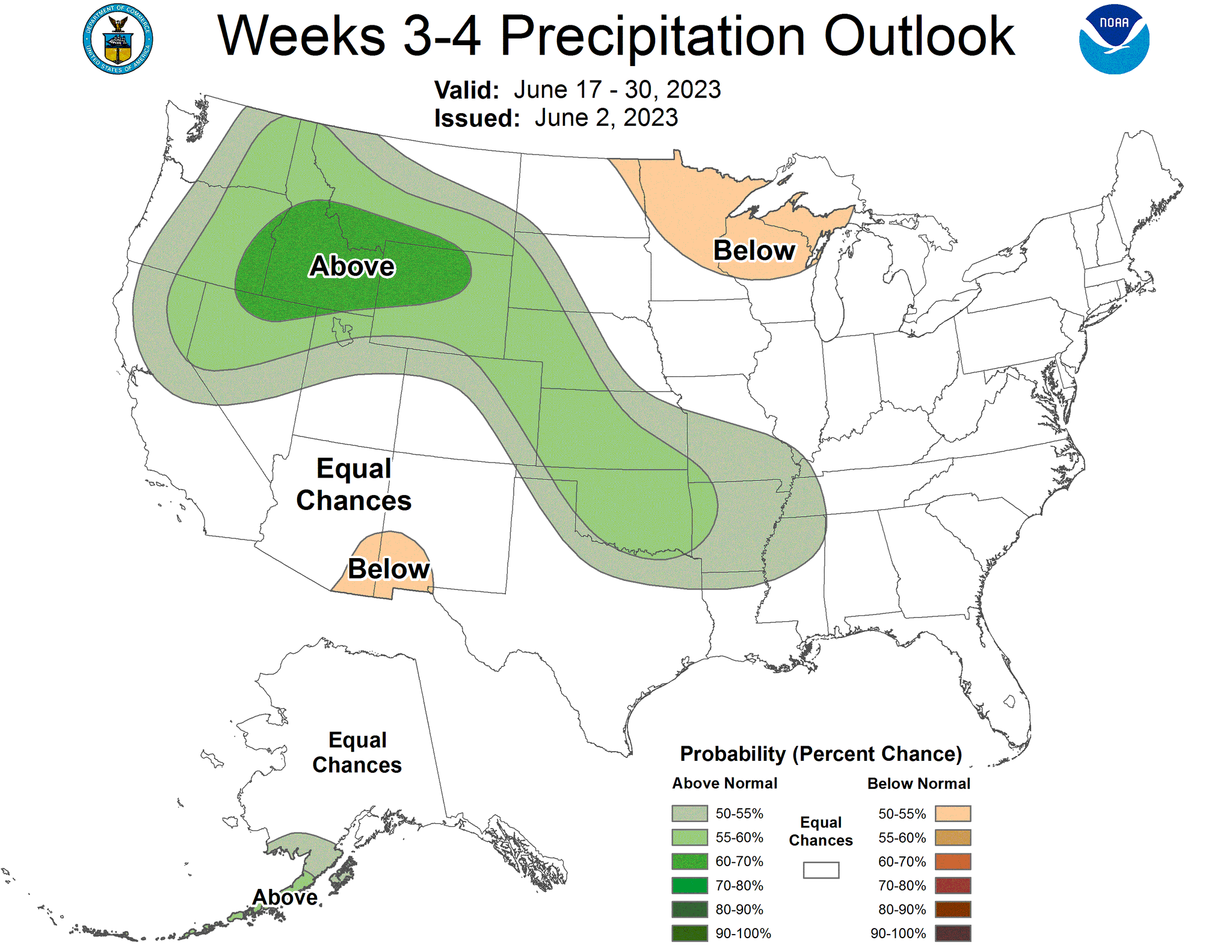

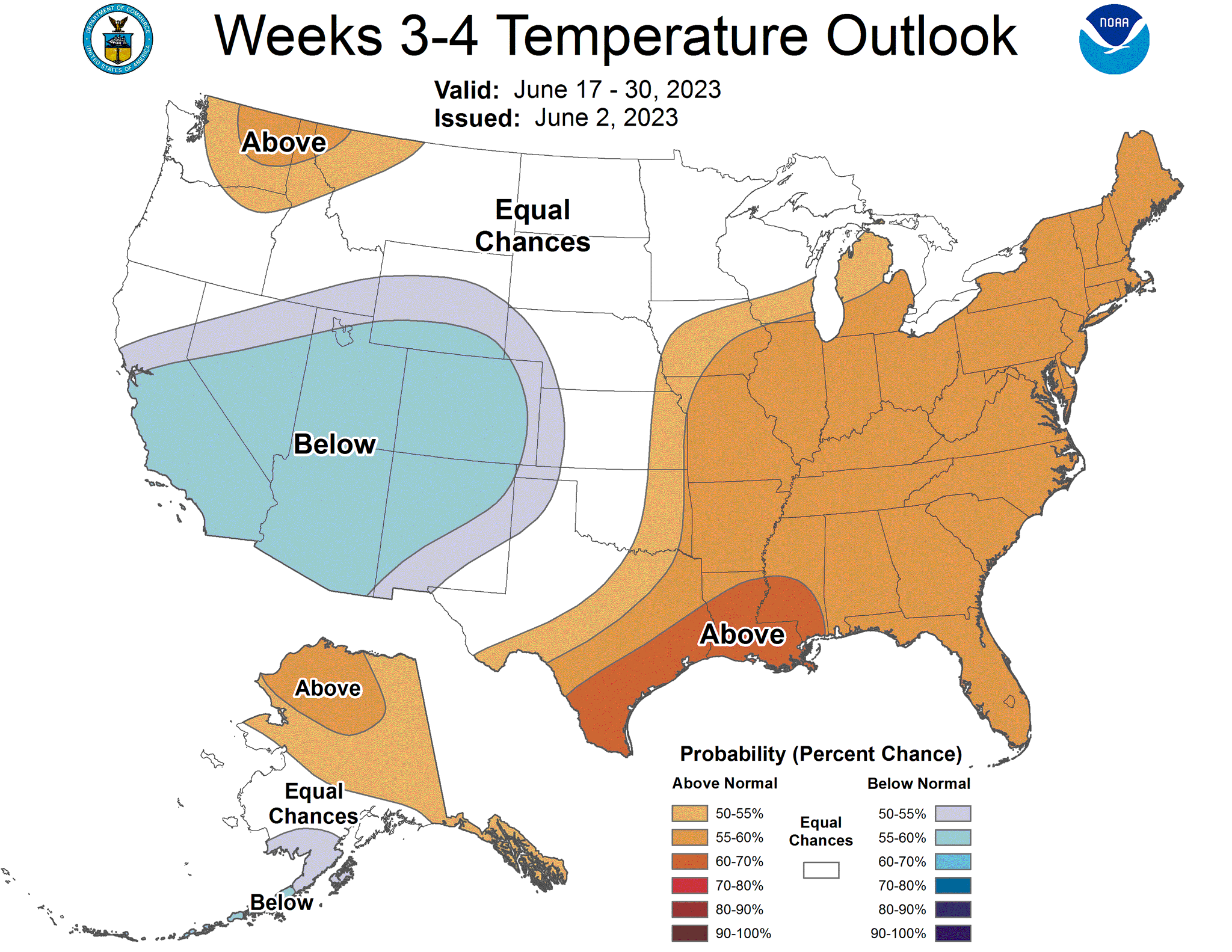

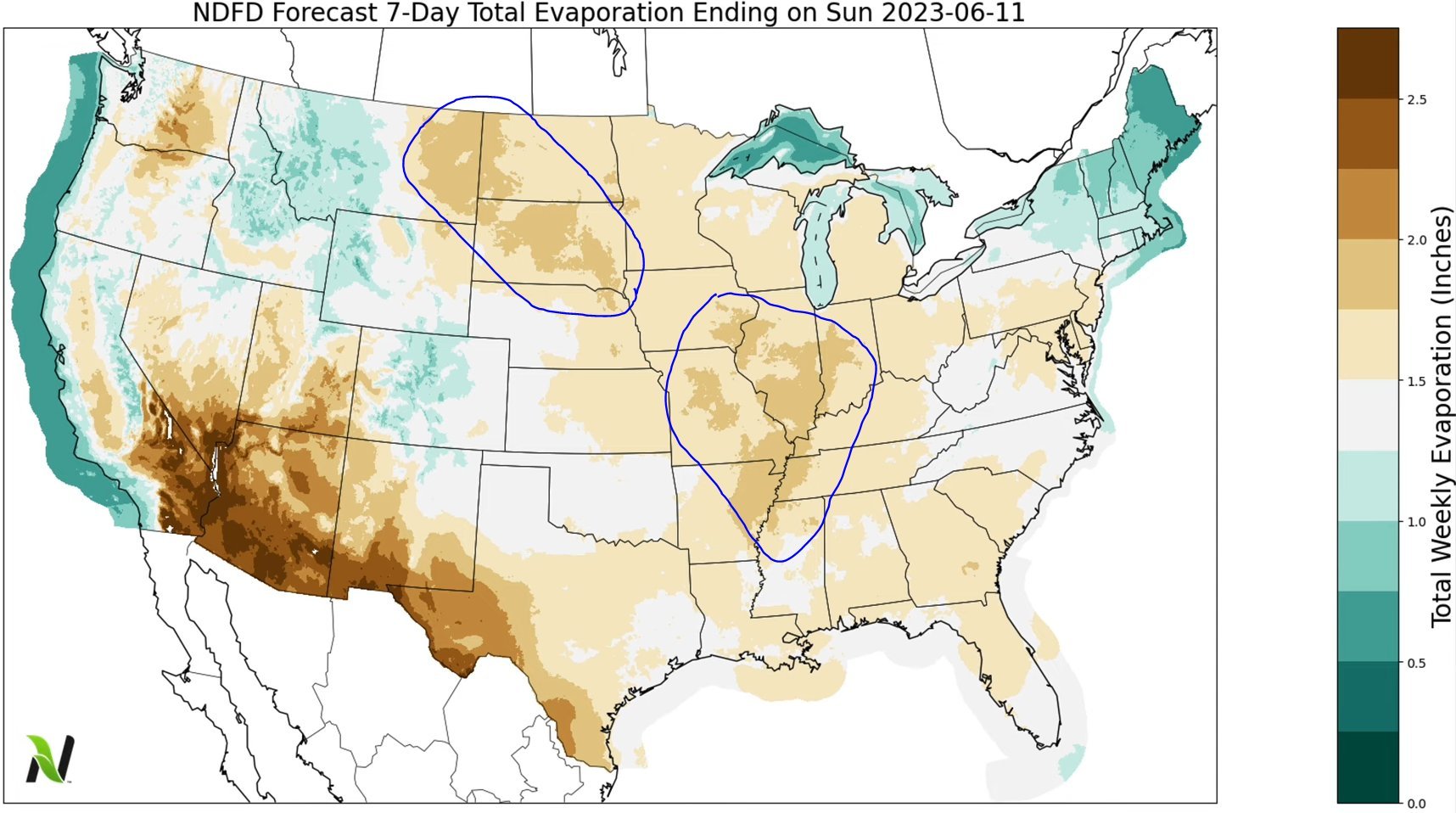

Corn was pressured due to forecasts showing some possible rain two weeks, but from what I could find it doesn’t look like it will even hit the areas we need it to in the I-states. The 2 week forecast has been anything but reliable. But the trade seems to be slightly worried about those long term forecasts. Keep in mind, more often than not, these long term rains haven't came to fruition, and it is still very dry.

We are going to see some spotty rain here and there, but until we see a major shift I don't see why we wouldn’t keep adding weather premium into these markets.

As for Russia, they essentially said they will not be renewing the agreement. But we have heard that story before in the past.

China is experiencing quality issues in their wheat with heavy rains .

Export inspections were lack luster for the most part aside from corn, but was still below last week's numbers.

We will get the supply & demand and crop production in Friday's report. There is virtually no chance our yield is where the USDA currently has it. But we will have to see if they decide to kick the can down the road and wait to make major changes until July, which I could definitely see happen. So don’t be extremely surprised if we see the USDA slow play this.

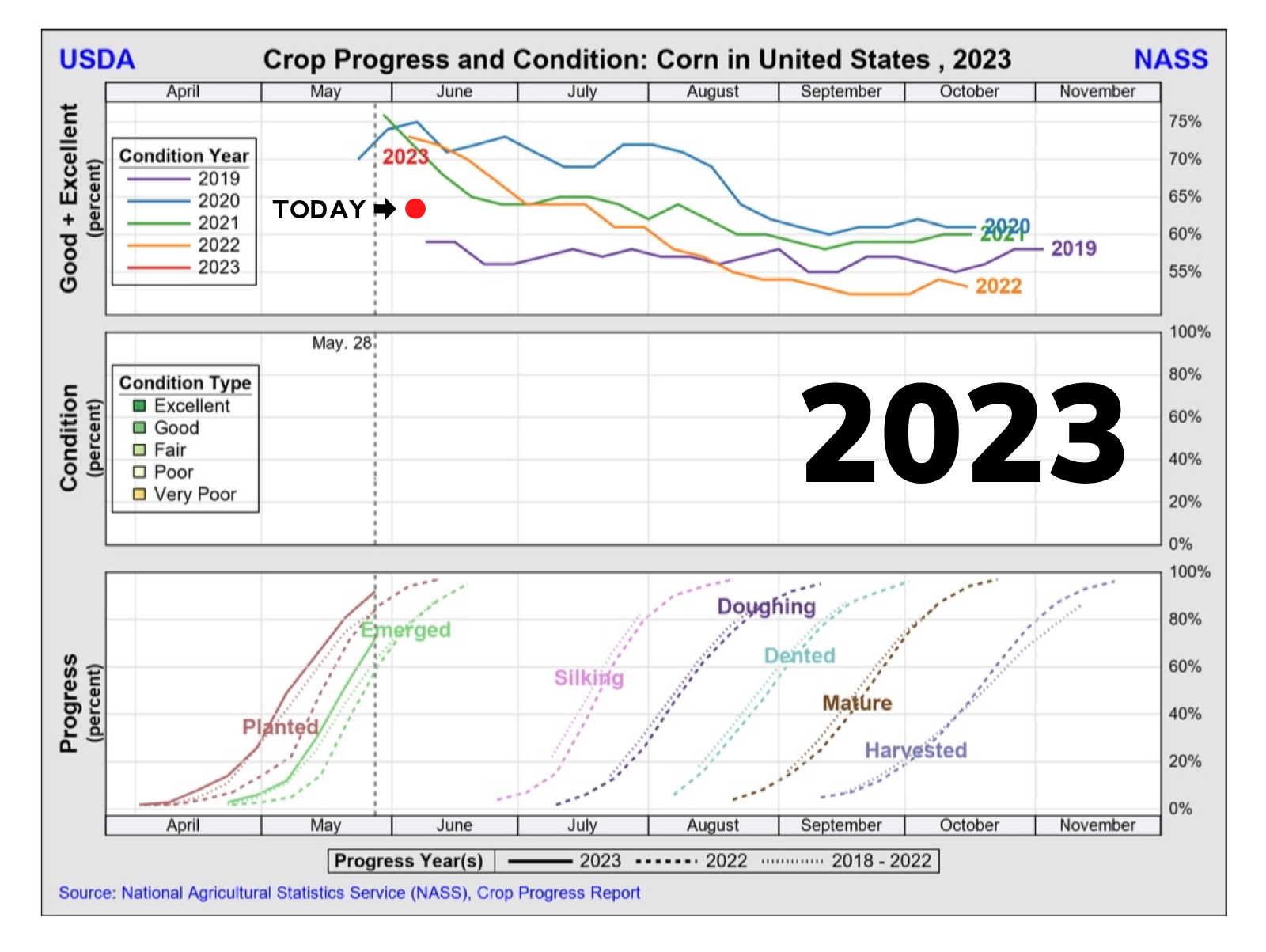

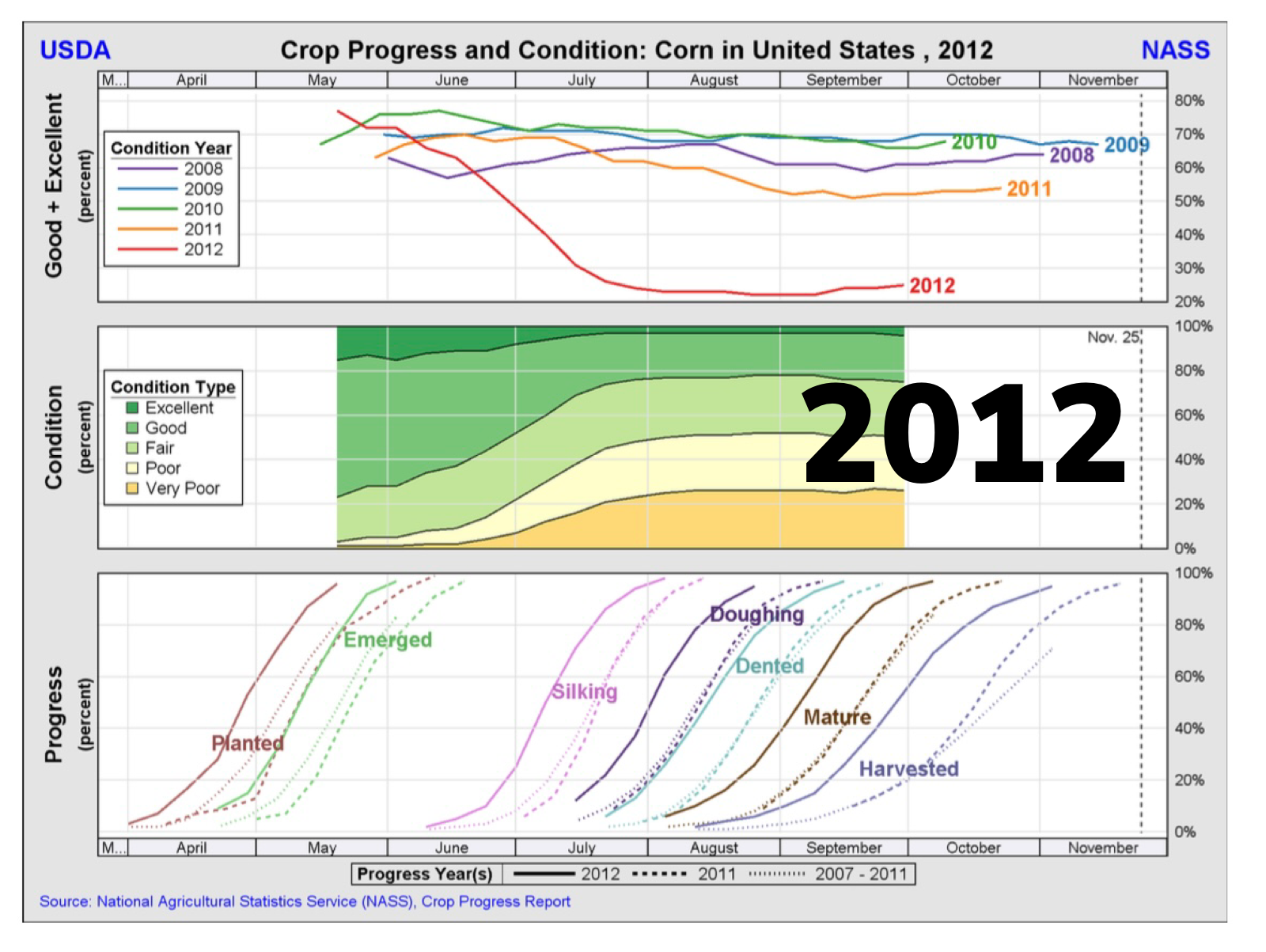

Crop conditions came in after close today. If you scroll we go over the numbers. But especially beans and corn came in below expectations. The biggest takeaway was that our corn crop is rated 9% worse than it was last year, but somehow the USDA is predicting a much bigger yield.. doesn’t make a ton of sense.

Especially with the crop conditions being bullish after close, I think pros and the funds will be looking to buy breaks in both corn and beans.

***

In case you missed it, Sunday's Weekly Newsletter

AI Drought & Price Predictions - Read Here

Crop Conditions & Planting

Corn 🌽

Corn came in at 96% planted, which is above the traditional pace of 91%. But again, keep in mind fast planting just means it is drier than normal.

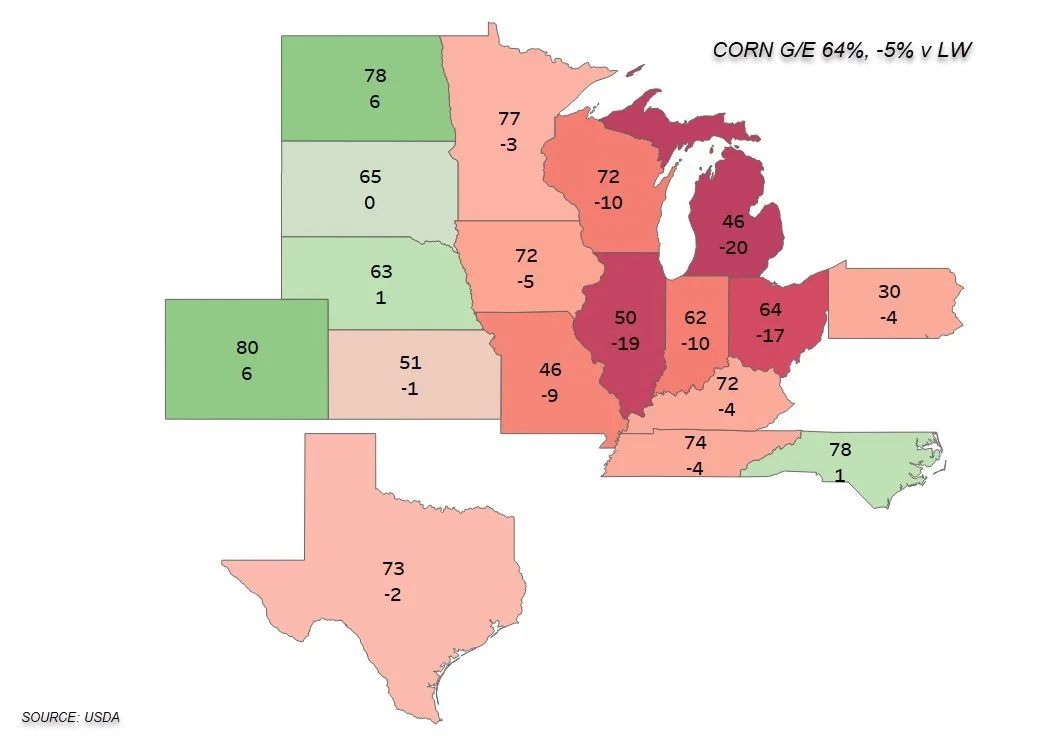

The biggest takeaway from the report was corn crop conditions. They came in at 64% rated good to excellent. Which is a 5% decline from just last week, and below the trade estimates of 67%. This now means we are now 9% lower than we were last year at this same time.. But the USDA is still predicting yield 8 bushels higher than last year...

Typically the USDA likes to slow play yield decreases in this upcoming report Friday. But with these numbers, I think it is safe to say +180 yield is off the table here.

We saw some pretty massive decreases to conditions across the corn belt.

Some notable changes:

Illinois -20% from last week

Indiana -10% from last week

Ohio -17% from last week

Iowa -5% from last week

Soybeans 🌱

Soybeans came in at 91% planted which is well ahead of the usual pace of 76%.

Similar to corn, conditions came in in lower than expected for soybeans. Coming in at 62% for their first condition report of the year. This was lower than the estimates of 65% the trade was expecting.

Spring Wheat 🌾

Came in at 93% planted, which is exactly on par with our 5 year average.

Conditions also saw a decline, coming in at 64% rated good to excellent. Below trade estimates of 66%.

Winter Wheat 🌾

Winter wheat was a slight mixed bag. We saw good to excellent conditions improve slightly, while also seeing the poor to very poor rating dropped simultaneously.

As 36% came in good to excellent vs 34% last week. While the poor to very poor rating came in at 34% vs 35% last week.

Today's Main Takeaways

Corn

Corn futures run into some selling following our recent rally from Friday. Losing 11 1/2 cents on the day. As July corn is now back right under $6 sitting at $5.97 1/2.

The reason for the weakness today was simply the long term forecasts. As some models have thrown some rain into the forecasts for 2 weeks out. Personally, I think the selling today was a mistake. It is still very dry. Sure, the forecasts might show some rain. But remember just how often these long term rains have disappeared. As the recent 2 week forecasts have been anything but reliable.

In our opinion, as well as many others, the weather is still a very bullish factor. It is still dry, and forecasts look dry for the next two weeks. Instead of the trade looking at forecasts showing "potential" rains, they should be looking at what has already happened. We just had a record dry 60 to 90 days. The corn belt just had the driest 60 days since 2014 and driest 90 days since 2012.

Funds trimmed about roughly half of their short position on our recent rally. As they bought around 47k contracts last week, but they still remain short. I think we will likely continue to see them liquidate that short position and push us higher.

Friday we will be getting the USDA report, where we will get an update on where the USDA sees corn yield. Is their current 181.4 bushel per acre accurate? Not at all. But does this mean they have to change it? No, not necessarily. The USDA has a tendency of playing games and slow playing things like this. So ultimately yes I could see the USDA look to make minimal changes or perhaps none of at all their until the July report even though I think they are far off. So keep that in mind and don’t be super disappointed if we don’t get the major reduction we should. Come July this could leave the door open to see a major change, especially if it stays dry.

As for demand, bears like to make the argument that we see the USDA make a reduction to demand with the recent lack in export sales. So the biggest battle bears and bulls will be looking at is potential decreases in demand vs potential reductions to yield.

I think everyone will be buying the breaks in both corn and beans. Especially with the crop conditions that were released after close today.

I think we will be well supported tomorrow and could see us firm up going into the report later this week. But bottom line is bulls are trying to combat the demand issues, and if the USDA does opt to leave this overly optimistic yield unchanged we could run into some pressure short term. But weather will ultimately trump everything going forward after the report. Our bias is still higher from here, with he potential to go much higher if it stays dry.

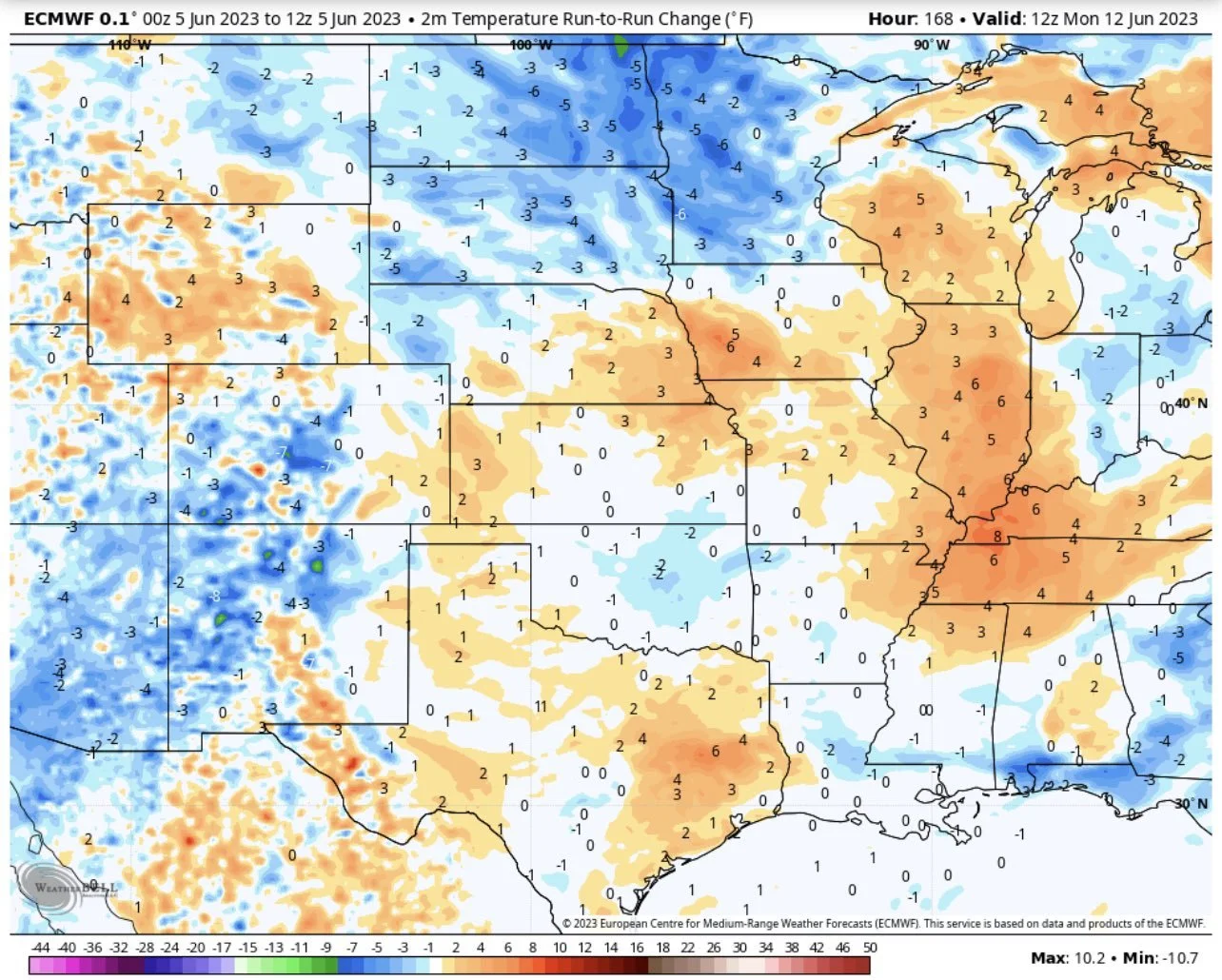

The Euro model below went drier over the next 7 days. Taking out the heavy rain chances and increasing temps for good portion of corn belt. Shocker.

Corn July-23

Soybeans

Soybeans ended slightly lower today, following a choppy day of trading both sides. Closing over 11 cents off the highs but 7 cents off the lows.

The dryness concerns haven’t provided quite as much support for the bean market as it has corn. This is due to the forecasts calling for potential rain later in the month of June. Which would be fine for the beans. As we make or break our corn crop in June, while make or break our beans late summer.

Rumors are that China is a big buyer of Brazilian soybeans, which also leads some to question if China's crush demand will start to increase. China as a whole has a lot of question marks. We have the COVID situation. How bad is it this time and how will it affect their economy and demand? It is really just a different situation to gauge.

Going forward, I think there is a demand story in the making for beans. But my concern is how much pressure we see from now until that story develops. Nonetheless, this market will continue to be full of volatility.

The first crop conditions of the year were fairly bullish. Coming in 2% lower than what the trade had estimated.

Soybeans July-23

Wheat

Wheat futures find some support with a few different factors at play.

Firstly we again had Russia rumors. As Russia is saying that they will not be extending the deal when it expires. We have heard this story before from Russia previously, so Im not sure how much of their statements hold merrit.

The other big headline we have seen that not a ton of people are talking about is the problems China is facing with their wheat crop. As the wet weather in China is putting a ton of their wheat crop at risk. With estimates showing that 20 million tons of their crop could run into majority quality issues with the recent heavy rains.

Another smaller headline we saw was that the Saudi's bought 624k metric tons of wheat. However, it doesn’t appear that the US got any of the business. This purchase was also done at very cheap prices, which again provides fuel to the bears argument surrounding global competition which is still a negative factor in the wheat market.

Reports are saying that Ukraine might lose 20% of their winter grain yield if the poor weather persists.

As mentioned, crop conditions were a mixed bag for the most part. Spring wheat planting is right on pace, while winter wheat conditions see increases to both the good and poor ratings.

War and weather are still the factors at play in the wheat market. I think there is a good chance we continue to see some weather based headlines look to add support globally and here in the US. With the floods in China, dryness in Australia, and now our crop here that was very poor might be getting too much rain here soon potentially causing more damage.

Bulls would like the funds to play along and decrease that short position if we want to go higher. Looking at the chart, Chicago is again testing that magic downward trendline that has kept a lid on prices for a year. Will the 6th time be the charm we finally get a break out?

Chicago July-23

KC July-23

MPLS July-23

Corn Condition Comparison

Below is a comparison from this year's ratings with 2012. Just some food for thought.

New Crop Marketing Plan

From Wright on the Market,

This is exactly what you need to say to your prospective buyers of your new crop corn, wheat and beans:

As you know, the high futures price is usually before the size of the crop is known and I want to have a shot at catching a price near the top on 100% of my expected production.

I am looking for a merchandiser who will allow me to engage in a HTA contract for 100% of my expected production before I know for certain what my production will actually be.

You can make that possible for me if you will let me contract on a HTA 100% of my expected production. If I come-up short on bushels, I want to be able to roll the delivery of those bushels to the next crop year. I will take the risk on the spread from one crop year to the next. I fully realize the market may be inverted. That is at my risk, not yours.

Another reason farmers do not sell enough of their production at a profitable price is because farmers want to have more grain to sell if the price continues higher. Eventually, no matter how high the price goes, the price will peak, then fall like a rock and all us farmers still have a lot of unpriced bushels.

I am seeking a merchandiser who will buy put options for me and attach them to my HTA, just like you do calls now. If the market firms after I price the HTA and I buy put options, I can make the money on the way down I did not make on the way up. I will never exercise a put; I will either have you sell the puts or I will let them expire worthless.

If I buy corn puts at strike prices 30 cents apart and bean puts at strike prices 40 cents apart, my market plan will probably capture the top of the market without any stress on me or you.

Will you buy corn puts at 25 cents and bean puts at 40 cents for me and attach to the HTA delivery contract?

What is the fee for HTA, the fee to roll to the next crop year and the fee to purchase puts?

If a merchandiser provides these two marketing tools, the two excuses farmers use to not sell 100% of their crop near the top are gone. Use these tools and it will change your life for the better. This plan has been used successfully since 1990.

Weather Maps

Hedging Account

No matter the situation you are in, our partners at Banghart Properties Grain Marketing can help you come up with a plan of attack to help you manage your risk. If you want help managing your risk you can give them a call anytime at (605) 295-3100 or set up a hedge account below.

Check Out Past Updates

6/5/23 - Audio

WEATHER VOLATILITY CONTINUES

6/4/23 - Weekly Grain Newsletter

AI DROUGHT & PRICE PREDICTIONS

6/2/23 - Market Update

WHEN WILL FIREWORKS START?

6/2/23 - Audio

COULD WE SEE 160 OR EVEN 140 YIELD?

6/1/23 - Market Update