CROP CONDITIONS CONTINUE TO FALL

*Note: This will be the last Market Update until the middle of next week. We will still have our Audio Commentary sent.

Overview

Overall it was a very strong day for the grains despite the sell off in the beans. We gapped open higher on the corn as the rains over the weekend were disappointing and continue to pop up and disappear. Next week or so is looking dry.

The funds are still short both corn and wheat, so we could see some support from fund buying especially with the long holiday weekend with Juneteenth.

The sell off in beans slightly weighed on all the grains. If it wasn't for the beans, we would’ve likely seen corn close even higher than it did.

After the close today we got the updated crop progress and conditions report. Scroll for the full numbers. The biggest takeaway was that both corn and soybeans came in down 3% rated good to excellent and 1% lower than the trade was expecting. Spring wheat also surprised, as it came in at 60% rated good to excellent. The trade was expecting 63%.

We have the Fed interest rate decision on Wednesday. But I doubt this makes much if any difference at all to the grains, as it’s all about weather.

Unless we get some major shift or timely rain, corn and beans should be well supported and bought back on any breaks.

***

In case you missed it, Sunday's Weekly Newsletter

Navigating USDA Report & Drought - Read Here

Crop Progress & Conditions

Corn 🌽

Rated Good to Excellent: 61%

Trade: 62%

Last Week: 64%

Last Year: 72%

Beans 🌱

Rated Good to Excellent: 59%

Trade: 60%

Last Week: 62%

Last Year: 70%

Spring Wheat 🌾

Rated Good to Excellent: 60%

Trade: 63%

Last Week: 64%

Last Year: 54%

Winter Wheat 🌾

Rated Good to Excellent: 38%

Trade: 37%

Last Week: 36%

Rated Poor to Very Poor: 31%

Last Week: 34%

Today's Main Takeaways

Corn

Corn futures trade at their highest levels since April on the back of today’s 13 cent rally.

Strength came from the moisture in the forecasts disappearing and total rainfall over the weekend coming in lower than expected. We mentioned several times in the past that those longer term forecasts are anything but reliable when it comes to rain.

The next 6 to 10 days are looking to be tender drier once again, which we look to add support.

After the close today, we got the updated crop progress & conditions. Corn came in at 61% rated good to excellent. This was a 3% drop from last week and a 1% bigger decrease than the trade was expecting.

We are now a full 10% lower than we were last year (62% vs 72%). The USDA expects us to believe yield is still 8 bushels higher than it was last year? In my opinion, there is a zero percent chance we get a +180 yield.

Many people are already using a number in the 176 to 179 range in their balance sheet models, and I've seen a lot of talk that yield is around the 172 range currently. So is a yield in the 165 range out of the realm of possibility? Not if it stays this dry.

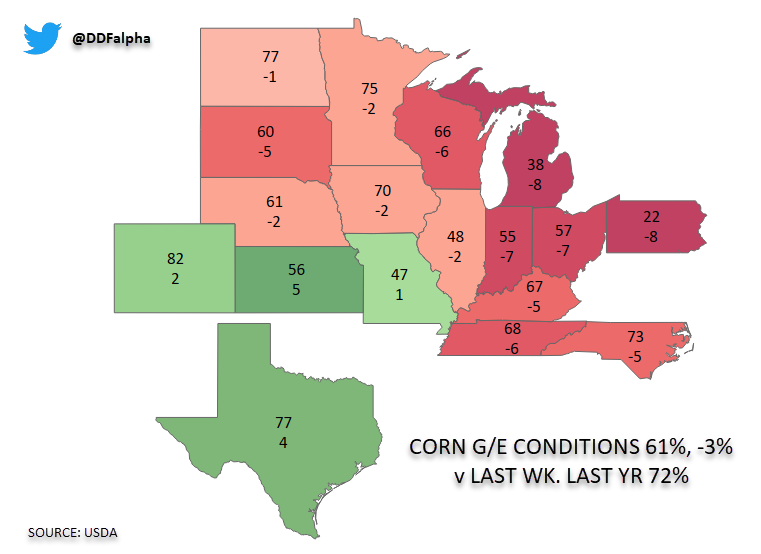

Below is a map showing the changes in conditions from just last week.

Some notable changes include:

Michigan: -8%

Ohio: -7%

Indiana: -7%

Wisconsin: -6%

South Dakota: -5%

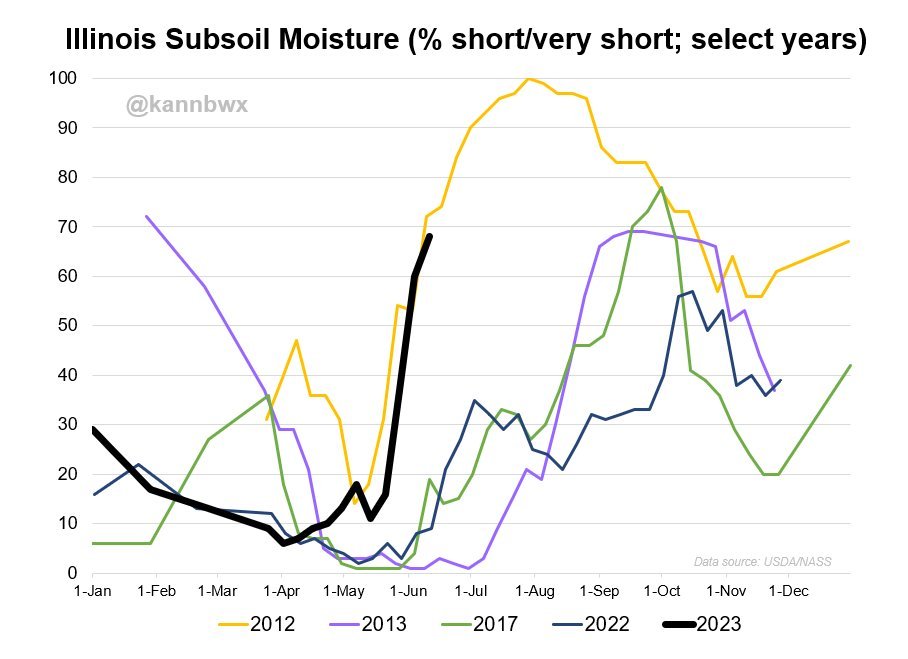

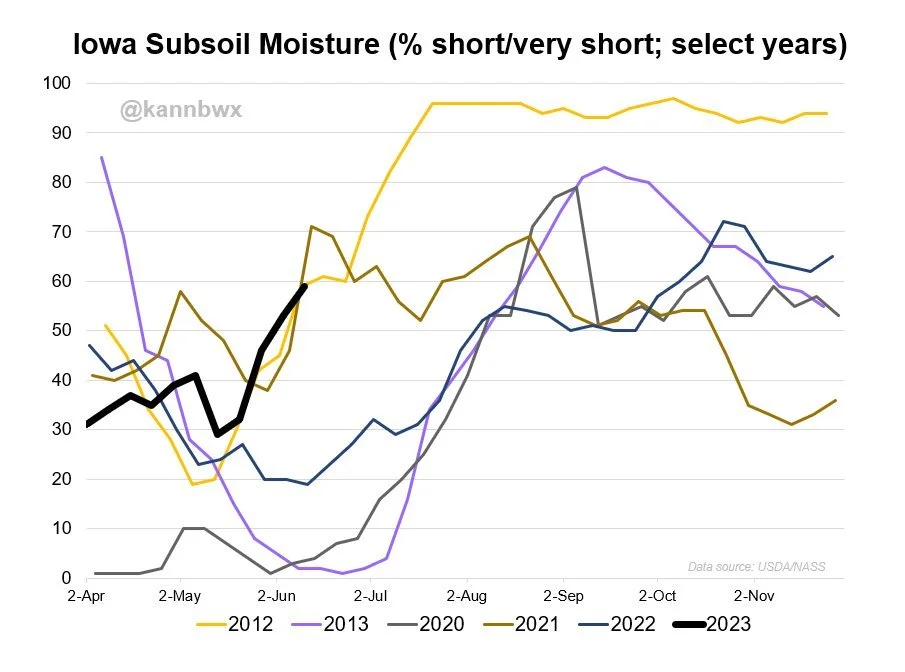

Here is a few subsoil moisture situations for the I-states. Illinois alone is short nearly 70% of their subsoil moisture.

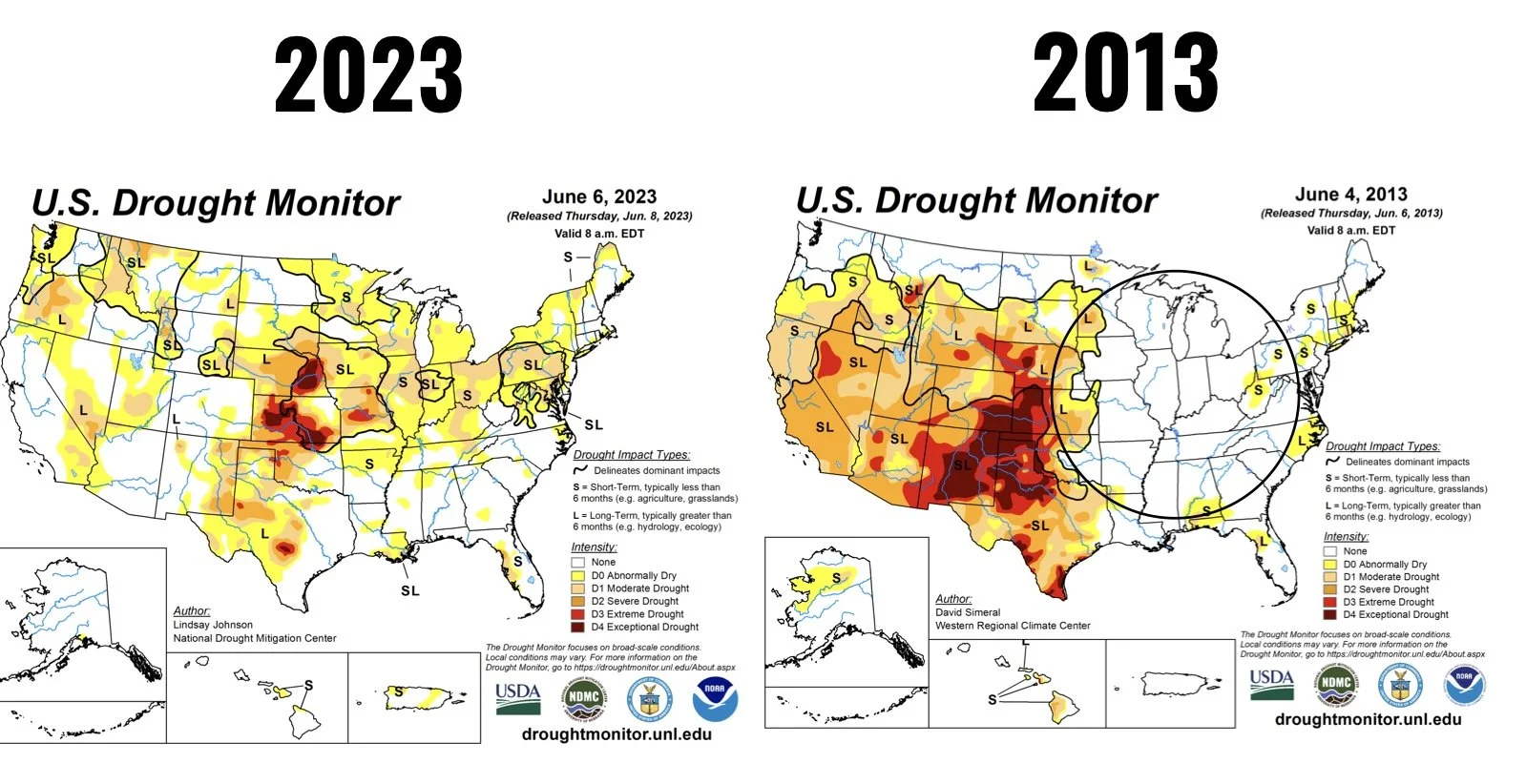

Also take notice of 2013. We weren’t short any amount of moisture in June and July. It wasn't until early fall where subsoil started getting short, when the crop was already made. Adding more to our argument that this year is nothing like that of 2013.

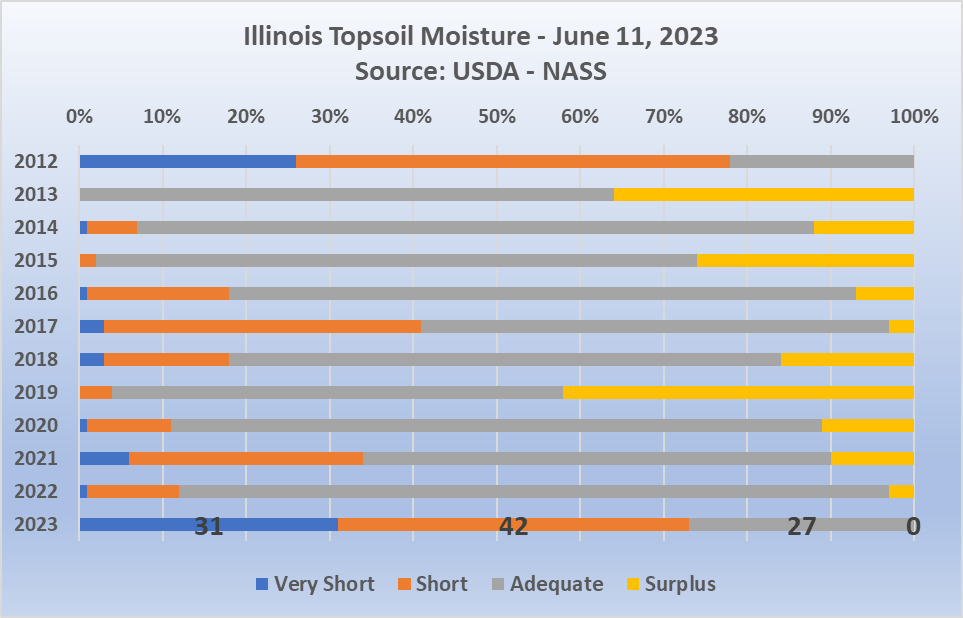

Here is a topsoil moisture chart for Illinois. Again, this year has the least moisture since 2012. In 2013 we weren’t short at all.

Bottom line is, if those drought stricken areas don’t receive some meaningful rain soon, they could be in for some trouble. We have an entire growing season left and we are just getting into summer. Wait until we see that July heat. If it stays this dry until late June, we could be going much higher. But again, this is all in the hands of Mother Nature.

I noticed a few other advisors were making some sell signals to make a few new crop sales with the weather rally. Now yes, there is absolutely nothing wrong with this. Just because we think we have potential to go higher doesn’t mean you shouldn’t take some risk off the table. Do whatever you’re comfortable with and makes sense for your operation. If you want to discuss getting calls or other risk management strategies you can always give Jeremey a call at 605-295-3100.

Bears do point at last week's USDA report as a weak point for corn. As they argue that we will still see some trimming done to the balance demand side of the sheet. So there is some uncertainty surrounding demand. But weather will ultimately trump nearly everything.

In this morning's audio, we went over multiple reasons why this year isn’t even comparable to 2013. The biggest key reason..? There wasn’t a drought in the corn belt in 2013. If you missed this morning's audio you can listen to it here.

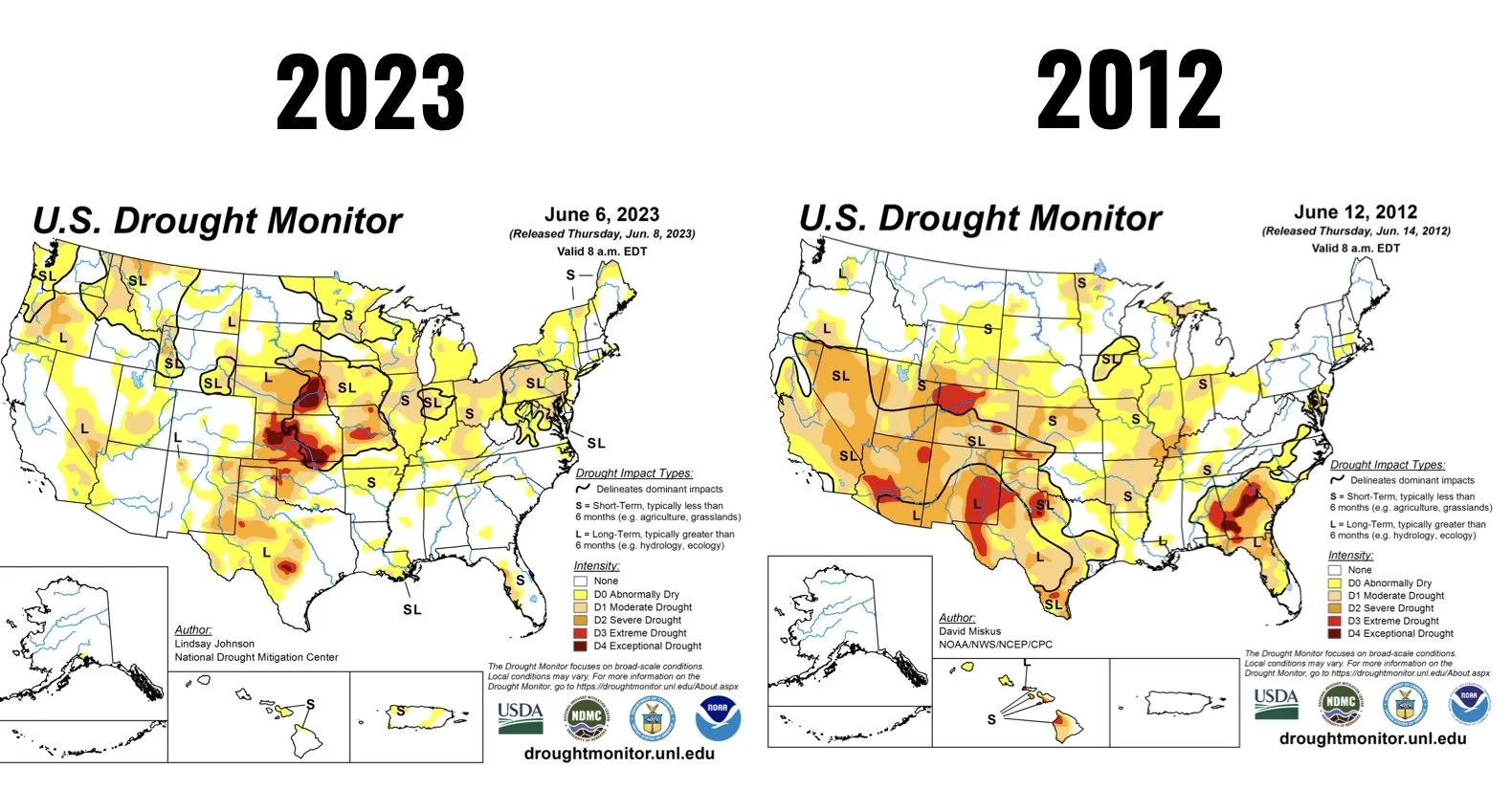

As you can see from the drought monitor comparison above, it’s not even close. In fact, this year is actually worse in the corn belt than it was in 2012 at this exact same time. But of course, weather through out the rest of the month will determine if this improves or if we see a similar story to that of 2012.

I'm not saying this year will be like 2012, although it could be create similar results, the main argument here is that this isn’t a repeat of 2013.

Here is another quick comparison to 2012 just to put things into perspective.

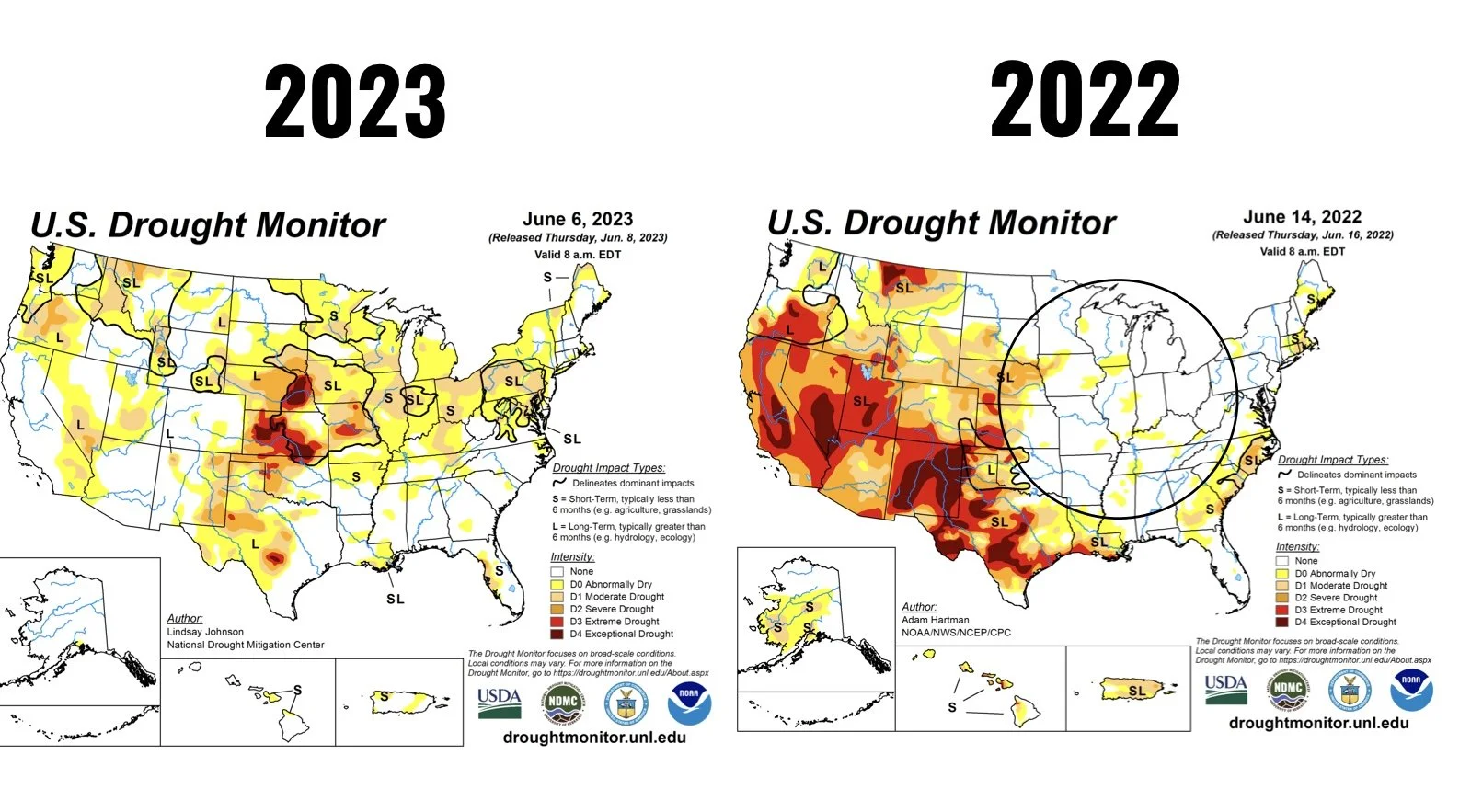

Here is a quick comparison to last year.

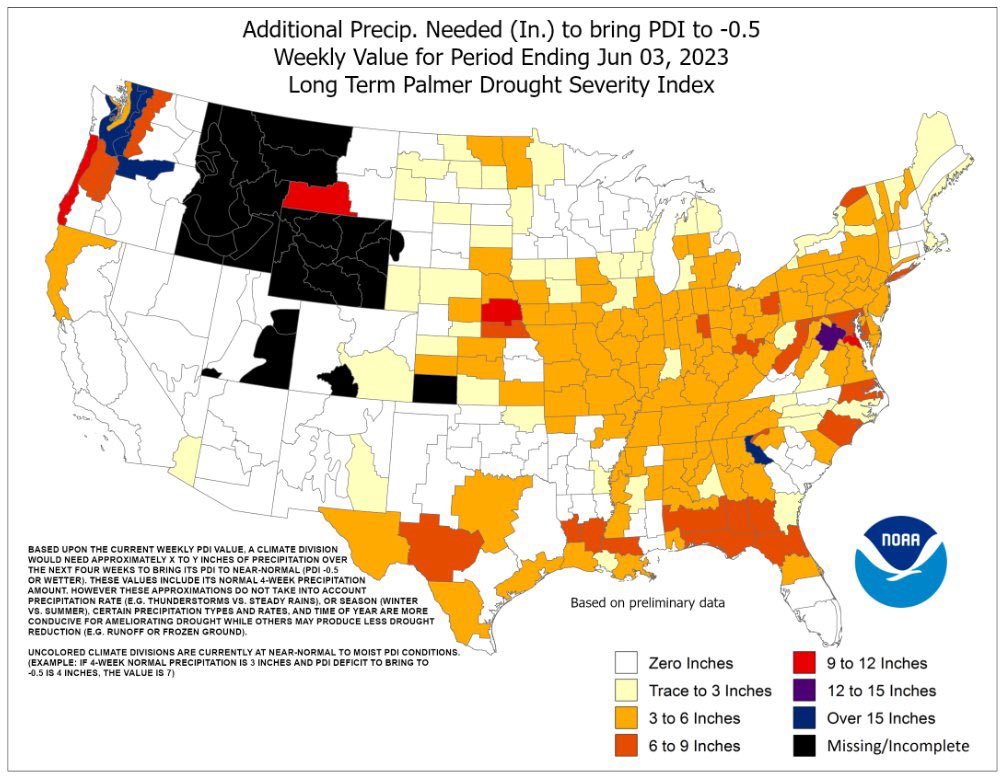

Here is a map showing the amount of precipitation needed. If you take a look, the majority of the corn belt needs 3 to 6 inches of rain.

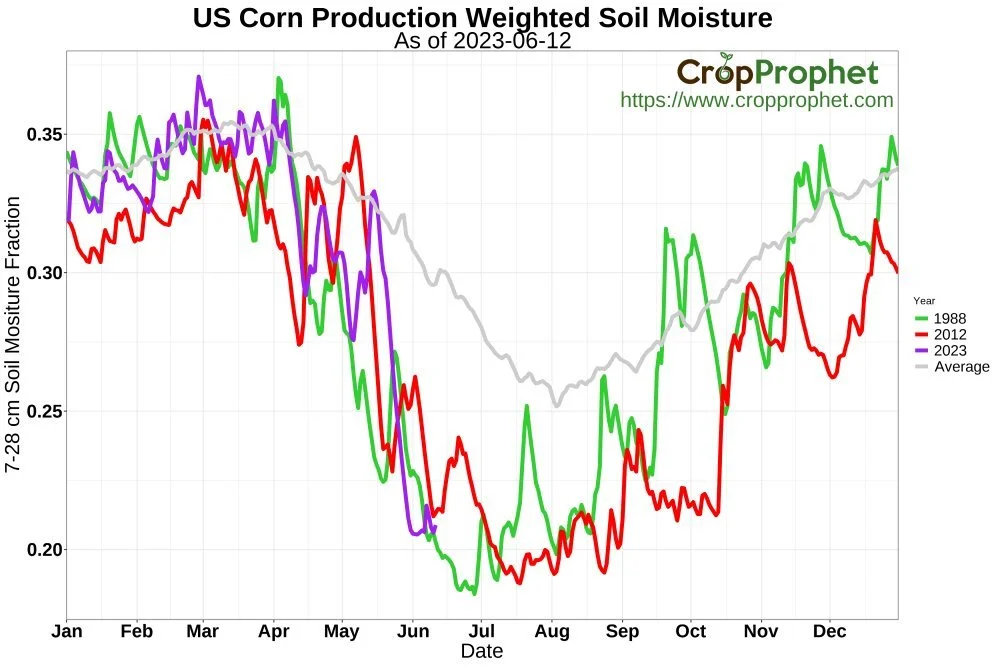

Below is a chart from CropProphet.com showcasing US corn production weighted soil moisture. As you can see this year (2023 is purple) is far below average, and following a similar path to both 1988 and 2012.

Soybeans

Soybeans take it on the chin today despite the weather concerns which provided support to corn. As bulls fail to add on to last week's +30 cent rally.

There wasn't a ton of reason for the sell of in beans today. Possibly people we looking to buy corn and sell beans. We also saw some unwinding of spreads, as new crop beans actually closed up 4 cents. Nonetheless I think today's downside move was slightly overdone given the current crop conditions. It is still early for beans, but I think they will be well supported with the drought concerns.

Weather continues to be the theme across the world of grains. As time is ticking and the weather becomes more and more important as we near July.

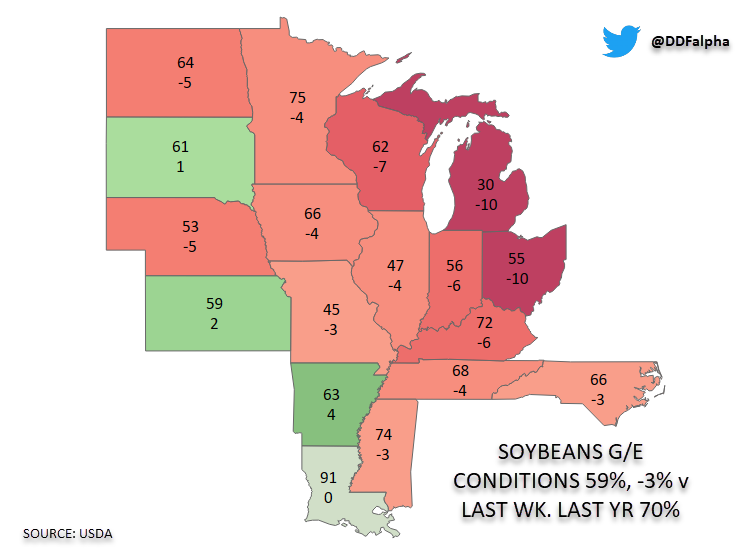

Soybeans crop conditions came in at 59% rated good to excellent. A reduction of 3% from last week and similar to corn, slightly below what the trade had in mind.

Here is a state by state breakdown with this week's good to excellent conditions compared to last weeks.

Some Notable Changes

Michigan: -10%

Ohio: -10%

Illinois: -4%

Iowa: -4%

Indiana: -6%

Wisconsin: -7%

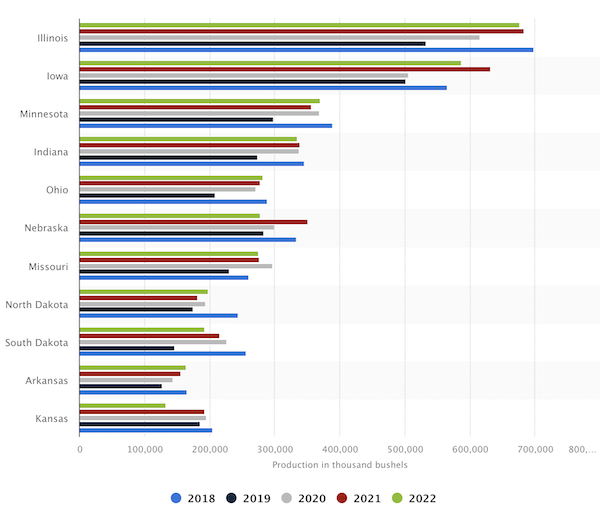

As mentioned earlier, Illinois is the shortest subsoil moisture it's been in a decade at this time of the year. Keep in mind, Illinois was the largest producing state last year (chart below).

Bears do argue that the cut the USDA made last week to US exports wasn’t quiet enough and we could ultimately see more down the road. There is also talk that the Chinese crush margins are weakening.

Looking long term, I still think we could see a bigger demand story develop for beans. Near term, weather won’t have as significant of impact on beans as it will corn, due to the bean crop being made later in the year. But nonetheless, it it stays dry, I don’t see why beans wouldn’t continue to follow corn higher. Long term our fundamentals are still very bullish.

With the conditions coming in worse again this week, I think we should be well supported and I think today’s sell off will be bought back.

Wheat

Wheat futures trade both sides of the board and end the day mixed. With Chicago and Minneapolis slightly higher and KC slightly lower.

Friday's USDA left essentially nothing to chew on for anyone. As they left the old crop side of the balance sheet unchanged. The new crop balance sheet became worse, as the USDA opted to make increases to its winter wheat production estimate, with a +6 million bushel increase.

War headlines continue to be an important factor in play. As you likely know, Russia blew up that dam. Reports are saying that that dam provided irrigation to somewhere around 1.5 million acres of Ukraine crops. From what I understand, Ukraine lost 6% of their winter wheat crop due to the flooding from the dam breach. We also had another dam destroyed yesterday.

Putin announced late last week that Russia will be giving nuclear weapons to Belarus. This country shares a 700 mile border to the south with Ukraine. This country has also been used as a staging area for Russian military since the war began. The US responded yesterday by saying they were going to transfer fighter jets to Ukraine and possibly supply nuclear weapons.

We also have the flooding in China still providing support.

This is the month that the Russian wheat crop is made or lost, as their harvest begins at the end of June and wraps up in August. So Russia forecasts will be one to watch out for int the days ahead. Keep in mind, 70% of their wheat is winter wheat, and the remaining 30% is spring wheat.

July is going to be interesting for wheat. On July 12th we have the USDA report where we could see some changes. This occurs just a few days before the current Black Sea deal is set to expire. Will the deal get renewed? Who knows.

Crop conditions came in slightly mixed after close today. As spring wheat numbers were very bullish, while winter wheat numbers were on the bearish side.

Spring wheat came in at 60% rated good to excellent. This was a 4% decrease from last week. The trade was estimating 63%. So I expect Minneapolis wheat to be well supported tomorrow.

Winter wheat came in at 31% rated poor to very poor down from 34% last week. While the good to excellent rating also slightly increased by 1% to 38%.

If you scroll to the chart section, we finally got that break in the July Chicago chart.

The Charts

Corn 🌽

We flirted with that target of our 100-day moving average I talked about last week. This is an important area of resistance. If we can get a solid break through I expect us to break out of this downtrend we've had since October.

Corn July-23

Soybeans 🌱

Soybeans July-23

Wheat 🌾

For July Chicago we finally got that break out of that over year long downtrend. We are now sitting right above that second resistance trendline. A break and potentially we go and test that downtrend from October.

Chicago July-23

KC July-23

MPLS July-23

Weather Outlook

Hedging Account

No matter the situation you are in, our partners at Banghart Properties Grain Marketing can help you come up with a plan of attack to help you manage your risk. If you want help managing your risk you can give them a call anytime at (605) 295-3100 or set up a hedge account below.

Check Out Past Updates

6/12/23 - Audio

WHY THIS YEAR ISN’T 2013

6/11/23 - Audio

NAVIGATING THE USDA REPORT & DROUGHT

6/9/23 - Audio

USDA REPORT BUST

6/8/23 - Market Update

GRAINS STRONG AHEAD OF REPORT

6/8/23 - Audio

WHAT TO EXPECT FROM THE USDA REPORT

6/7/23 - Audio

ARE WE IN A TYPICAL SEASONAL RALLY?

6/6/23 - Market Update

CORN LEADS VOLATILE WEATHER MARKET

6/6/23 - Audio

WEATHER & WAR

6/5/23 - Market Update