ELECTION TOMORROW

MARKET UPDATE

You can still scroll to read the usual update as well. As the written version is the exact same as the video.

Want to talk? (605)295-3100

Futures Prices Close

Overview

Somewhat disappointing day for the grains.

We closed higher, but fell well off the early highs across the board.

At one point beans were up +14 to $10.08 but closed up just +3 1/2 at $9.97

Corn was up +5 1/2 cents to $4.20 but closed up just +2 at $4.16 1/2.

Wheat was up +8 at $5.78 but closed up +3/4 at $5.69

Why did we get that early pop?

Hard to say exactly why, one reason in beans I'll touch on later is the weakness in the Brazil Real as it approaches multi-year resistance.

But personally today I think it was due to the election.

Let's take a look at the election betting odds & polls.

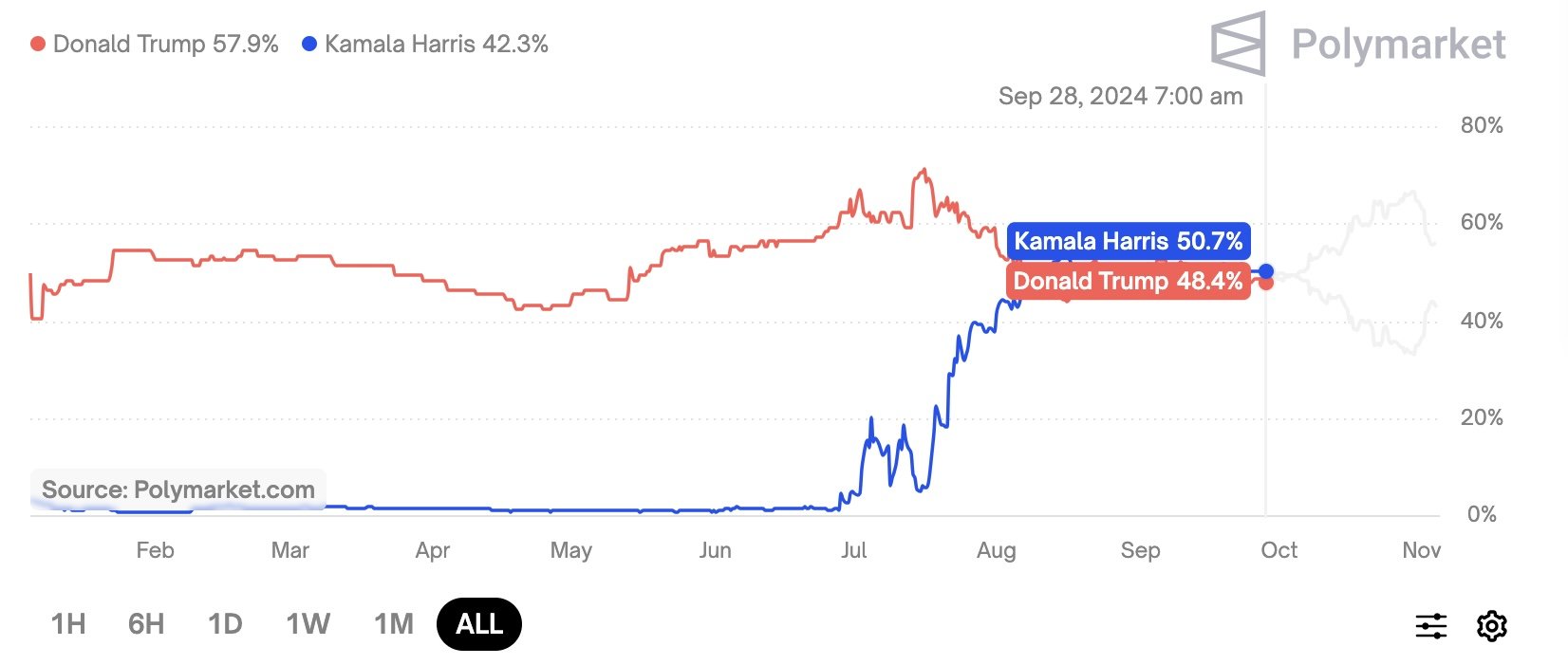

Here were the betting odds on September 27th when soybeans made their recent highs.

Trump: 48.4%

Harris: 50.7%

Shortly after, Trump took a sizeable lead and soybeans gave back that entire rally.

Here is the betting odds on October 30th.

Trump: 67%

Harris: 33%

This was the day Trump had his largest leads on the betting market.

It is also coincidentally the day soybeans made their recent lows last week.

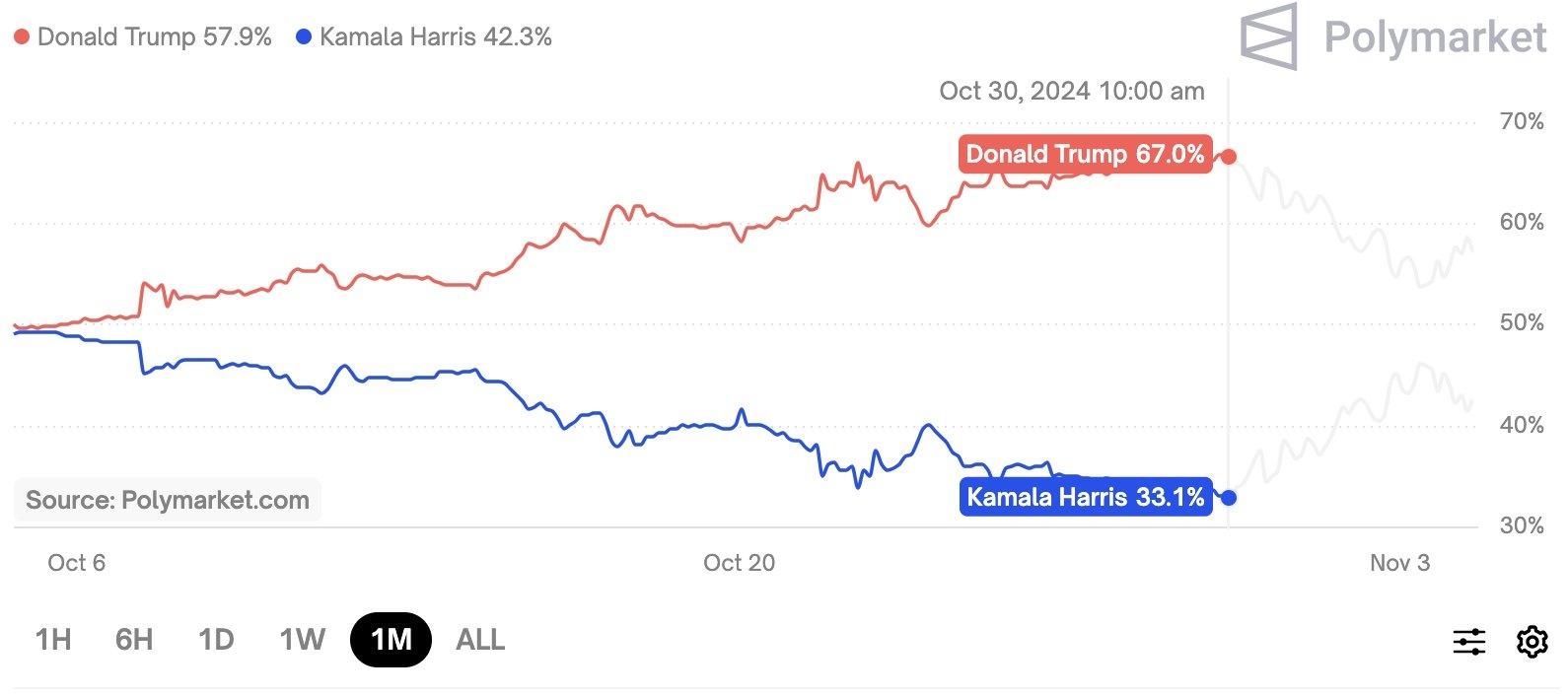

Now here is the betting polls from yesterday.

Trump: 54%

Harris: 46%

Trump gave back some of that lead.. coincidentally soybeans traded higher as a result.

Lastly here is the current betting market as of right now.

Trump: 58%

Harris: 42%

So Trump starts to lose ground on Harris yesterday and soybeans trade higher.

Today Trump crawls back some of that lead and soybeans give back their gains.

Really feels like beans are somewhat following the election odds.

Here is more evidence of this possibility.

Pennsylvania is projected to be the "make or break" state in this election.

Trump was favored by as much as 64% favorite last week.

This weekend, Harris actually took the lead at 51%, but Trump has since re-gained some of that lead.

We also had a popular poller Ann Selzer come out with her polls and state that she has Harris winning Iowa.

Obviously you can’t trust polls or betting odds.

But the point is that the market and funds were buying a little beans in case Trump isn’t a surefire win.

As everyone still believes that a Trump win could be negative for soybeans long term if we see a trade war etc.

Ann Selzer Iowa Poll

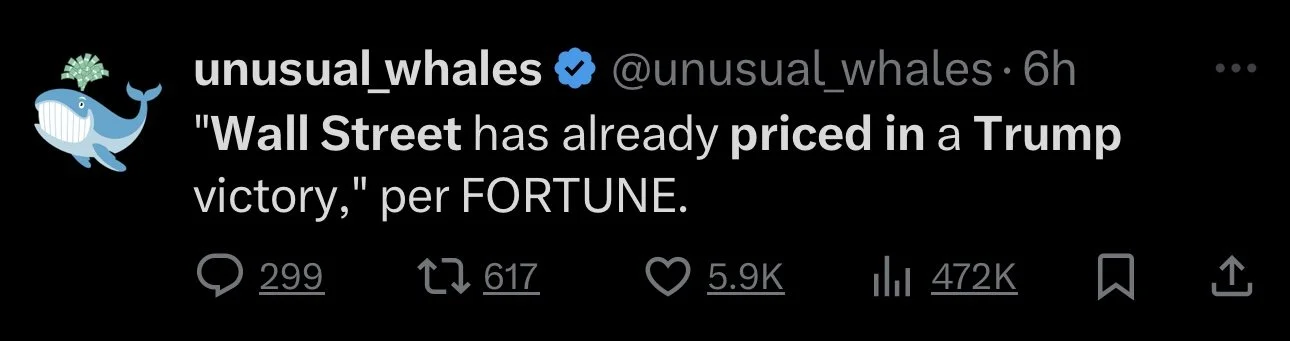

If Trump does win.. is it priced in?

According to Fortune,

"Wall Street has already priced in a Trump Victory."

So if the stock market has already priced in a Trump win, I don’t see why the futures market hasn’t either.

It is called a "futures" market after all. Most known factors are priced in. If betting odds favor Trump, then the market has probably priced in a decent amount.

Could we get a knee jerk reaction and see one big red day for soybeans? Absolutely possible. But for the most part I think it is priced in.

Long term however, a trade war will of course likely be negative if it were to happen. But then again, nobody knows what the fine details will be and if there will be something such as China being forced to meet a certain number of purchases.

Today's Main Takeaways

Corn

Decent day for corn, but disappointing we closed so well off the highs.

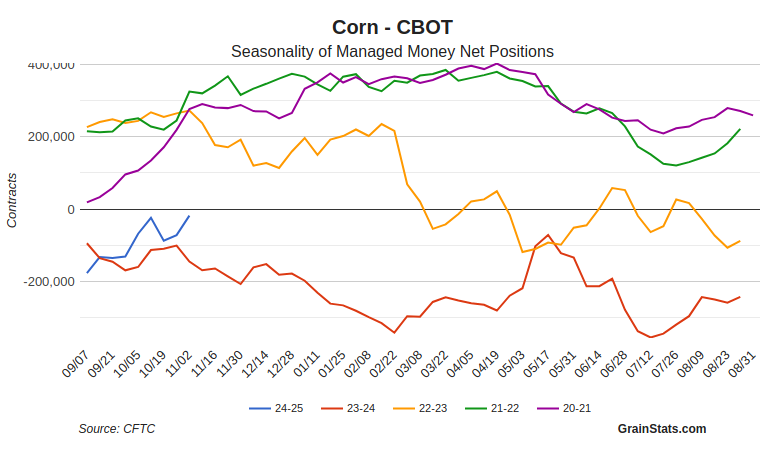

Funds Update:

The funds at one point this year were short over a record -350k contracts of corn.

Now they are short just -17.7k contracts.

The smallest short position since August 2023.

You can look at this two ways:

There is no longer the potential for a massive short covering event.

But it also means that the funds are no longer betting that corn is heading lower.

Chart from GrainStats

Long term, I still believe corn has plenty of upside. (I am talking +3-6 months looking towards next year)

The USDA could very well be too short on their exports & ethanol numbers.

Exports are the 3rd best in a decade.

Ethanol production is well ahead of last year despite the USDA projecting lower than last year.

We are finally seeing these low prices create demand.

Looking at the USDA, I doubt we see any major changes. If we get any changes perhaps they adjust exports slightly higher.

Short term, really still stuck in this range.

I am watching these two blue lines to confirm the next move.

Looking at the 4 hour chart, we bounced right where we needed to at the 61.8% retracement level.

Soybeans

Outside from the changing election odds, one reason for the recent mini bounce in soybeans might be the weakness in the Brazil real today.

As you can see, they are highly correlate sometimes.

If the Brazil real goes up, beans often go down. And vice versa.

This is one "potentially" friendly factor I see.

As the Brazil real is sitting at multi-year resistance levels.

Of course it could keep going higher and bust through, but if it was gonna cool off this would be the spot to do so.

Short term, if we look at the chart we also have some potentially friendly signs.

Yes the past 2 sessions we closed well off the highs, which is not a good sign.

However, we have a daily MACD bullish cross. The last time saw one was that late August rally.

We also have some bullish divergence on the RSI.

This is also a friendly sign and sometimes signals "possible" reversals.

(It happens when the RSI forms an uptrend, while prices form a downtrend)

I am not saying this HAS to happen. But they are potentially friendly signs short term.

For example: we had bullish divergence at the end of August, yet we still went lower.

If we were to get a rally, and you wanted to look at a spot to take some risk off the table. I would be looking at the $10.30 to $10.44 range. (green box)

As $10.44 is our 61.8% retracement to those September highs, $10.30 is the 50% retracement, and we have a volume gap to $10.35.

Short term, we also don’t have that first notice day selling pressure.

With harvest complete, it looks like we won't see farmers pulling beans out of storage at levels $1.50 below breakeven.

But if we do get a short term pricing opportunity, be ready to take advantage.

As the long term outlook for soybeans is still very unclear and bearish if nothing changes.

A major rally is going to be tough unless we see a story out of Brazil.

But right now, Brazil doesn’t look like a problem. Their planting is entirely caught up and they are forecasted to have great rains for now.

"Well what if the USDA drops yield this week?"

It would be friendly, but wouldn’t create this monster rally. Even if the USDA drops yield, it won’t make a huge dent in the balance sheet.

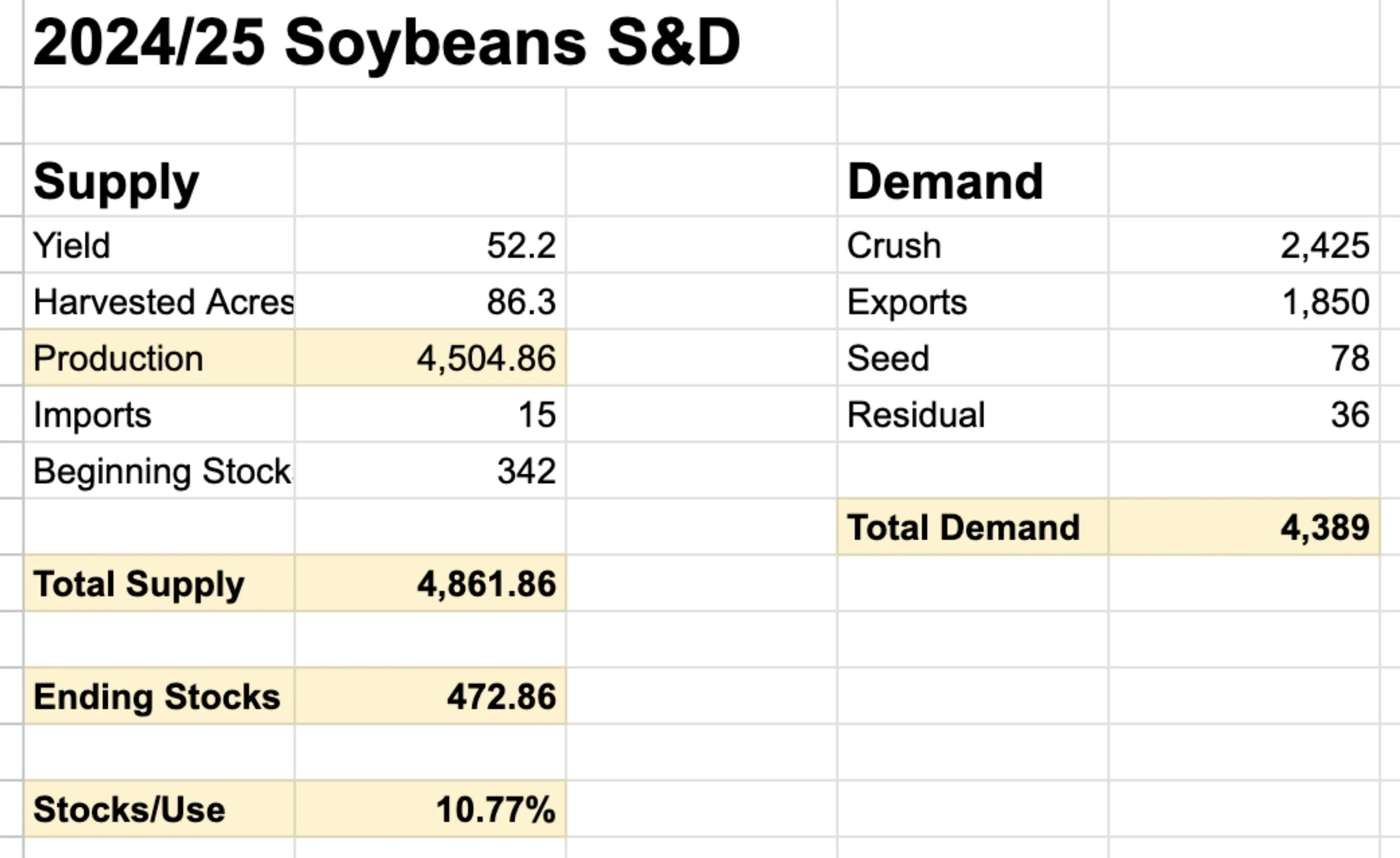

Here is the current balance sheet vs if yield falls -1 bpa.

Overall on soybeans, I am short term optimistic. Long term extremely cautious.

Wheat

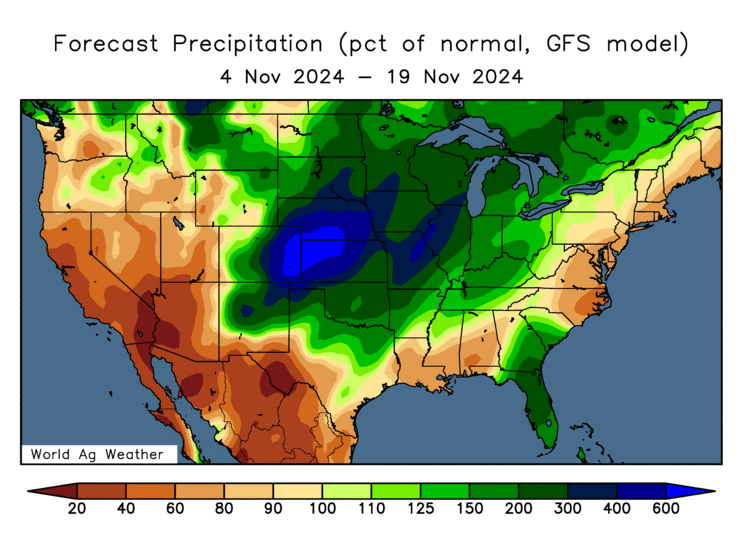

Wheat might see a little bit of pressure due to the rains scheduled for the plains.

2-Week % of Normal Precip

Overall, I still think wheat has plenty of reasons why it has potential looking longer term.

For example, Andrey Sizov the Black Sea guru continues to drop his Russian export estimates. As he believes Russia is going to limit exports.

He's dropped his export estimates from 49 to 45.9 MMT (USDA is at 48).

Russia is the world's leading exporter. So this would be friendly.

For major exporting countries, our stocks to use ratio is the lowest since 2008 and the carryout is the lowest since 2012.

No major updates on wheat, but I did want to include some thoughts from a grain advisor out of Oregon.

From Kevin Duling:

"There is stiff support right under this market and when you are dealing with strong demand, that is not a time to play games with the short side of futures, which is exactly what the funds are doing. We are going to move from a super tight balance sheet this marketing year to a year that is beyond tight with a product that will be considered scare by January 2026. I am amazed the funds continue to sell heavily into it"

"The Russian Ag Ministry is concerned about the pace of exports and who they selling to, so we are going to see further export curbs in the very near future. I cannot imagine the market sagging lower through year end with Russian exports remaining at record speed despite a small crop. That makes no sense from any angle."

Short term, I'm remaining patient personally.

Looking at the chart, we are still stuck in the downward channel & "potential" bull flag. If we bust above that blue line, it would look very friendly.

We continue to find support at this $5.65 level. So looks good as of today, but we need to continue to hold it. A break below offers very little support until those lows.

Essentially the same set up in KC.

We need to hold $5.61 and break out if this channel (blue lines).

Past Sell or Protection Signals

We recently incorporated these. Here are our past signals.

Oct 2nd: 🌾

Wheat sell signal at $6.12 target

Sep 30th: 🌽

Corn protection signal at $4.23-26

Sep 27th: 🌱

Soybean sell & protection signal at $10.65

Sep 13th: 🌾

Wheat sell signal at $5.98

May 22nd: 🌾

Wheat sell signal when wheat traded +$7.00

Want to Talk?

Our phones are open 24/7 for you guys if you ever need anything or want to discuss your operation.

Hedge Account

Interested in a hedge account? Use the link below to set up an account or shoot Jeremey a call at (605)295-3100.

Check Out Past Updates

11/1/24

GRAINS WAITING ON NEWS

10/31/24

ELECTION & USDA NEXT WEEK

10/30/24

SEASONALS, CORN DEMAND, BRAZIL REAL & MORE

10/29/24

WHAT’S NEXT AFTER HARVEST?

10/25/24

POOR PRICE ACTION & SPREADS WEAKEN

10/24/24

BIG BUYERS WANT CORN?

10/23/24

6TH STRAIGHT DAY OF CORN SALES

10/22/24

STRONG DEMAND & TECHNICAL BUYING FOR GRAINS

10/21/24

SPREADS, BASIS CONTRACTS, STRONG CORN, BIG SALES

10/18/24

BEANS & WHEAT HAMMERED

10/17/24

OPTIMISTIC PRICE ACTION IN GRAINS

10/16/24

BEANS CONTINUE DOWNFALL. CORN & WHEAT FIND SUPPORT

10/15/24

MORE PAIN FOR GRAINS

10/14/24

GRAINS SMACKED. BEANS BREAK $10.00

10/10/24

USDA TOMORROW

10/9/24

MARKETING STYLES, USDA RISK, & FEED NEEDS

10/8/24

BEANS FALL APART

10/7/24

FLOORS, RISKS, & POTENTIAL UPSIDE

10/4/24

HEDGE PRESSURE

10/3/24

GRAINS TAKE A STEP BACK

10/2/24

CORN & WHEAT CONTINUE RUN

10/1/24

CORN & WHEAT POST MULTI-MONTH HIGHS

9/30/24