BEANS RALLY & CORN HOLDS OFF NEW LOWS

Overview

Great ending to the week for bulls, as all of the grains rally. Led by a +23 1/2 cent break out in soybeans and as corn fought off to hold those harvest lows, bouncing exactly off those old lows before rallying back a dime.

Why were grains so strong to close out the week?

Overall, it was mainly South American forecasts. We have been saying this is the biggest factor going forward, and has the ability to push corn and beans much higher.

Before we dive into today's update, let’s take a look at what some others in the industry are saying:

Mark Gold from Top Third:

"The weather in brazil is certainly iffy for the corn market. They are gonna have trouble replanting second crop corn, first crop corn is gonna be drowned out in a lot of spots. I just can’t see getting bearish down here in the corn market."

Jeff French - Futures Trader:

"Lot of air up here on the bean chart. January beans could easily rally to $13.90 and do it quickly."

Farms.com Risk Management:

"Corn futures could have found bottom as South American crops are off to their worst start ever."

Here is how the prices shook out this week.

Big bull run in the beans, as even the November contract is back well over $13.

With today's gains, believe it or not, corn only lost 3 cents on the week despite what fell like a week full of down days.

Weekly Price Changes:

Today's Main Takeaways

Corn

Corn barely fights off a new low, as we bounced exactly off of $4.68 before reversing a dime off of those lows.

Still 30 cents off those $5.09 highs from October 20th, but today was a good sign. If we would have broken those lows, it would not have looked good on the charts.

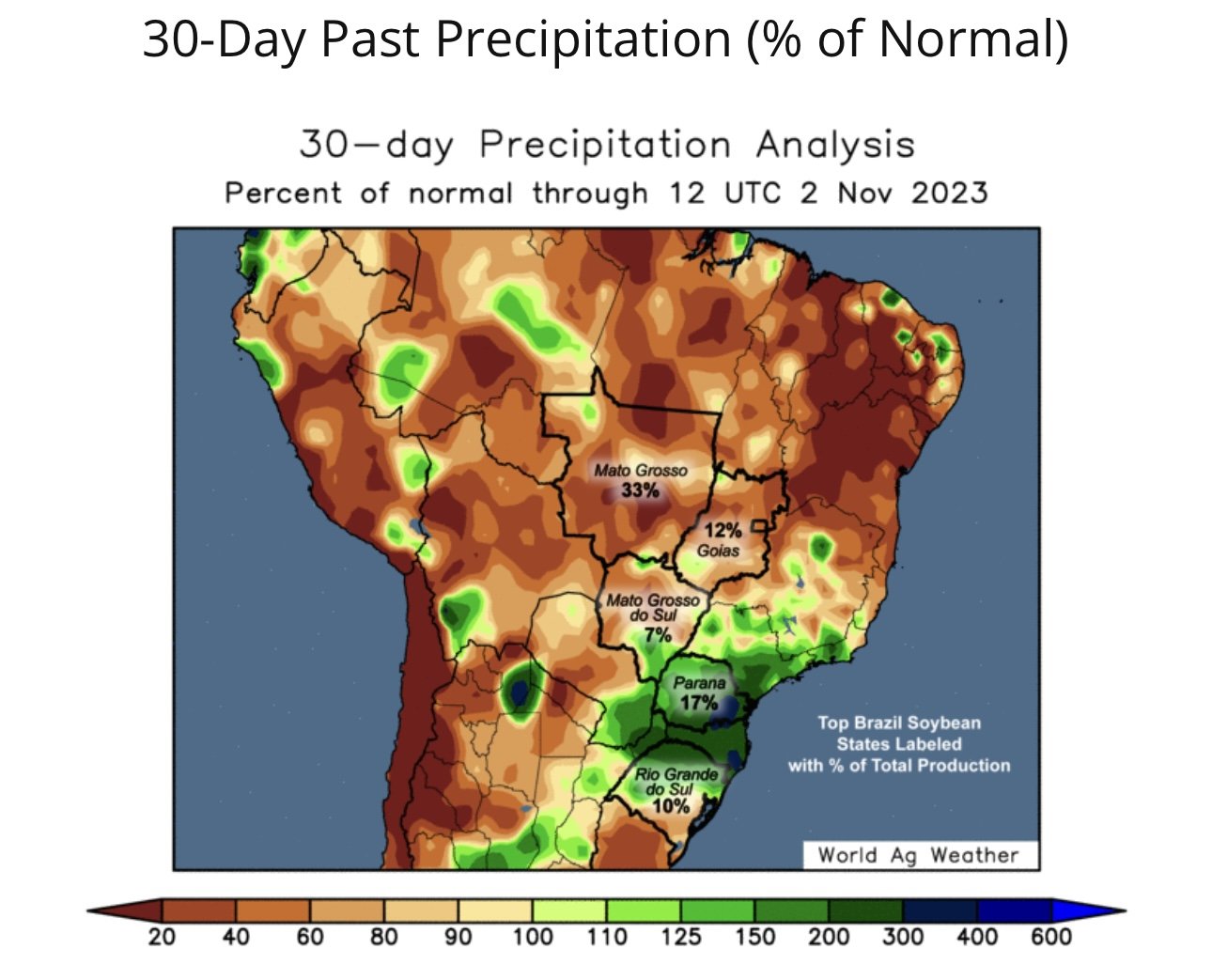

As mentioned, South America is going to be the ultimate factor. Brazil's rainy season is now officially a month late.

What's that mean? It means that growing season for their second crop corn will be a month shorter.

From Wright on the Market:

"Farmers and agronomists have become voval about giving up on growing two crops this season and switching to cotton. The remaining growing season is too short for a good crop of beans followed by corn, but plenty of time to grow cotton, which requires a longer growing season than corn or beans."

So this Brazil weather isn’t going to just damage the crops. It is going to cause less acres. Less acres means less supply. Less supply with unchanged demand typically leads to higher prices.

We have been saying all week that there was a good chance we tested those harvest lows or perhaps even broke them before reversing higher, because that is what the funds and algos do. Push us up into resistance, then back down to support. What's next now that we have done that?

Now that the funds got their sell stops in, they will probably become buyers. Buying back the contracts they sold the past two weeks.

Bottom line, we don’t like making sales here near two year lows. Prices will more than likely be much higher down the road. Forced to make sales? Consider a re-ownership strategy that aligns with your situation. Feel free to give us a call if you want to discuss what would be best for you. (605)295-3100.

Taking a look at the chart, we bounced perfectly off that $4.68 support. Right where we needed to. So now, we need to hold those lows. Hopefully we can see some buying push us back up towards $4.90. We have also now created a potential "double bottom" formation. Which indicates higher prices.

From Chris Robinson of the Robinson Report:

"Now is not the time to have expensive puts on the books. Keep a floor. Do not go without protection. But make that protection as inexpensive as possible. We are at 2 year lows. You do not want expensive puts on the book at 2 year lows."

Corn Dec-23

Soybeans

Soybeans week-long bull run continues. Up +45 cents the past 4 days.

Why the higher prices? South American forecasts.

Right now, the Brazil story seems to be mixed. StoneX Brazil increased their soybean estimate to 165 million metric tons, while Dr. Cordonnier dropped his to 160 million. The USDA sits at 163 but will update that number on Thursday.

Now no, that's not a small crop. But up until today, the trade has zero weather premium built into this market. Maybe they have finally taken into consideration the problems I've been pointing out the past few weeks.

I don’t know about you, but this doesn’t look like very ideal growing conditions to me.

Here is what fellow advisor 247 Ag had to say regarding beans:

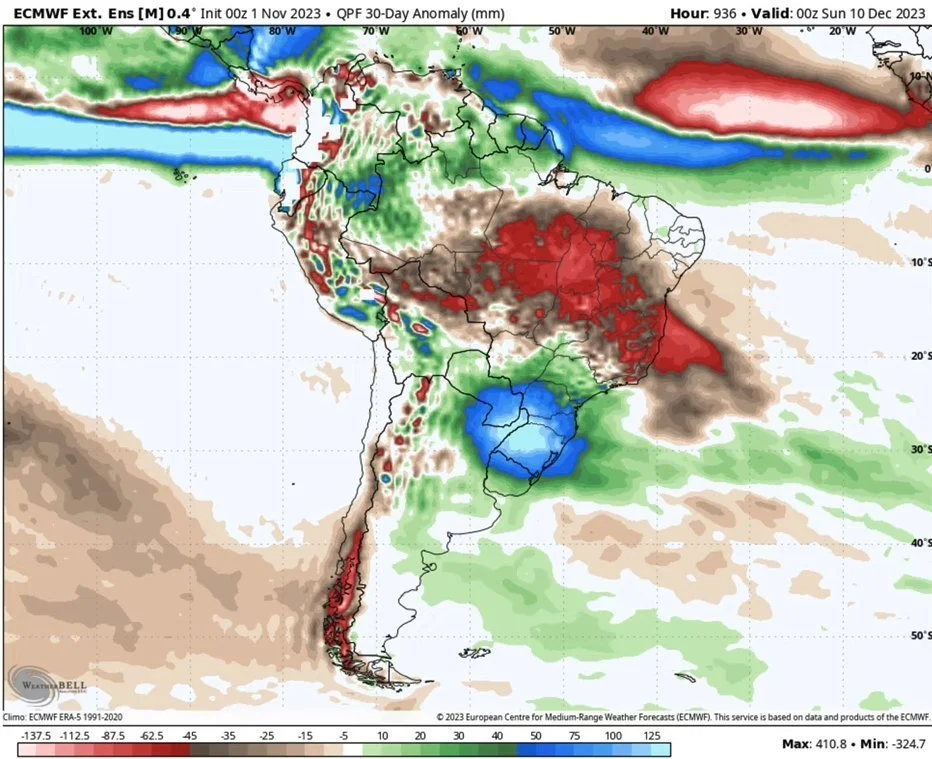

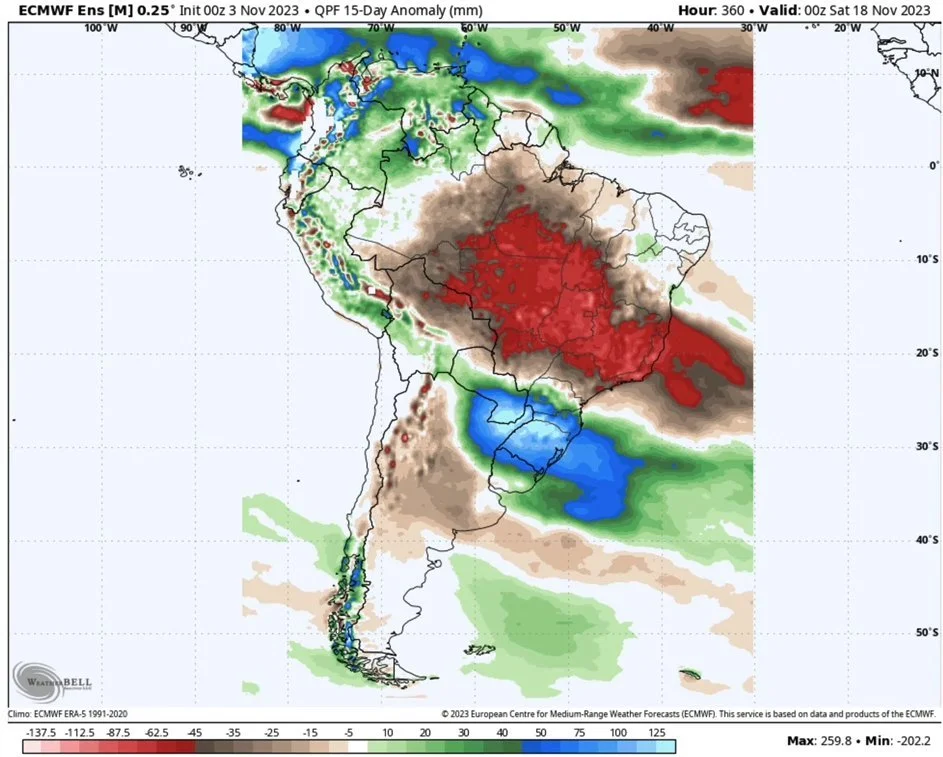

"Comparing Brazil's November to their December forecast. Dejavu? This has been our forecast since September and the reason we have been recommending re-owning ALL past cash grain sales in soybeans. The trend is your friend."

After beans put in that reversal October 12th, we had also been saying we liked the idea of re-owning. Since then, beans are 40 cents higher. Is right now still a good spot to re-own?

From a pure risk management perspective, it always makes sense to consider rewarding the rally. Even after this 40 cent rally, we believe beans have a lot of upside as does 247 Ag. But there is nothing wrong with rewarding the rally.

If you were forced to sell for some reason, in that scenario we would consider re-owning because you acted as a price taker and took the price you didn’t want. If you got the price you wanted, then there is nothing wrong with just moving on here. We don’t necessarily want to chase a rally. Once a guy is done making a sale and is comfortable with the outcome, he doesn’t always have to be chasing more.

Now yes, these forecasts can change. As they always do. But if this trend stays the way it has been with the north getting far less rain than they need, while the south is drowning. We are in for a wild ride.

If this trend continues, it will cause lower yields, replants, and less production.

Bottom line, short term we could see this rally take a breather. Long term, the upside is there. I still believe we will see $14 later into this year and into next, and if the South America cards fall right, I wouldn’t rule out $15 beans either.

With the most upside, comes the most downside. Although they have all the upside in the world, for some of you it might make sense to reward this rally.

We have now taken back more than 50% of the harvest sell off from $14.20 to $12.70, sitting at $13.52.

The next targets are our retracement levels of $13.63 then $13.88.

Soybeans Nov-23

Wheat

The wheat market manages to string together 3 strong green days in a row for the first time since July.

So what's the wheat story?

There really isn’t one. Mainly the same old story.

This is a time period of the year where we usually won't be getting any major factors in the wheat market.

Cheap wheat continues to flow out of Russia as well as parts of Europe while the US struggles to hold onto any market share and be competitive.

However, there is a rumor that China is looking around for US wheat. Nothing has been confirmed, but this would be beneficial for the wheat market.

Global weather is still seen as a positive, as we all know the problems we have seen in Australia, Argentina, Canada, the list goes on.

Bottom line, bulls need the funds to take their foot off the gas when it comes holding that short position they’ve held for a year. When will it happen? That's anyone’s guess.

But I do think the wheat market has finally found some footing here. As mentioned, the first 3 days in a row where we see green on the board might mean something.

Think we are carving out a bottom and will slowly begin to move higher. Wheat also has a ton of upside, but when that upside is going to come remains to be seen.

Being patient for now. There are plenty of wild cards that could spook the funds into pushing wheat higher.

I still have my eyes set on $6 in Chicago. A break above could cause the funds to re-evaluate their position. At the same time, we need to hold those lows so we don’t give them a reason to keep adding onto their shorts.

Chicago Dec-23

KC Dec-23

Check Out Past Updates

11/2/23

EVENING THE PLAYING FIELD

Read More

11/1/23

CORN CONTINUES LOWER & BRAZIL CONCERNS

10/30/23

HOW TO BEAT BIG AG AT THEIR OWN GAME

10/27/23

WEEKLY WRAP

10/26/23

SEPARATING THE FUTURES & BASIS COMPONENT TO BECOME A PRICE MAKER

10/25/23

LONG TERM UPSIDE & BEING PATIENT

10/24/23

TECHNICAL SELLING, SA WEATHER, & MANAGING RISK

10/23/23

IS THIS CORRECTION A HEAD FAKE?

Read More

10/20/23

BIG WEEKEND CORRECTION

10/19/23

CORN BREAKS $5. IS WHEAT NEXT? - SOYBEAN RECCOMENDATION

10/18/23

BEANS BREAK $13. IS CORN NEXT?

10/17/23

DID BEANS CONFIRM REVERSAL?