DO YOU HAVE ENOUGH PATIENCE & STAYING POWER TO WAIT FOR NEW ALL-TIME HIGHS

WEEKLY GRAIN NEWSLETTER

Here are some not so fearless comments for www.dailymarketminute.com

Many times over the past several months I have mentioned not to sell grain cheap, or not to give grain away. Every time we have weeks like we did this past week my phone gets blown up from guys wondering if they should now throw in the towel. Or when are these all time high prices coming?

First off, fundamentally we are much tighter in our old crop than we were several months ago. Here is a quick snippet from Wright on the Market that does a great job of summarizing things.

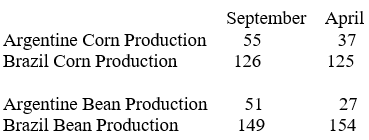

“Here are some facts on the Argentina & Brazil corn, bean production, USDA numbers, mts:

USDA has the two countries producing 788 million bushels less corn than expected in September; that is 55.7% of the projected US carryout

USDA has the two countries producing 698 million bushels less beans than expected in September; that is 332% of the projected US carryout

The Buenos Aires Grain Exchange (BAGE) reduced their estimate of Argentina’s soybean production by a half million mt to 22.5 mil mts (USDA 27), the smallest crop in at least 24 years.

If the economy is so terrible, why are fed cattle and beef prices higher than ever before by a wide margin?”

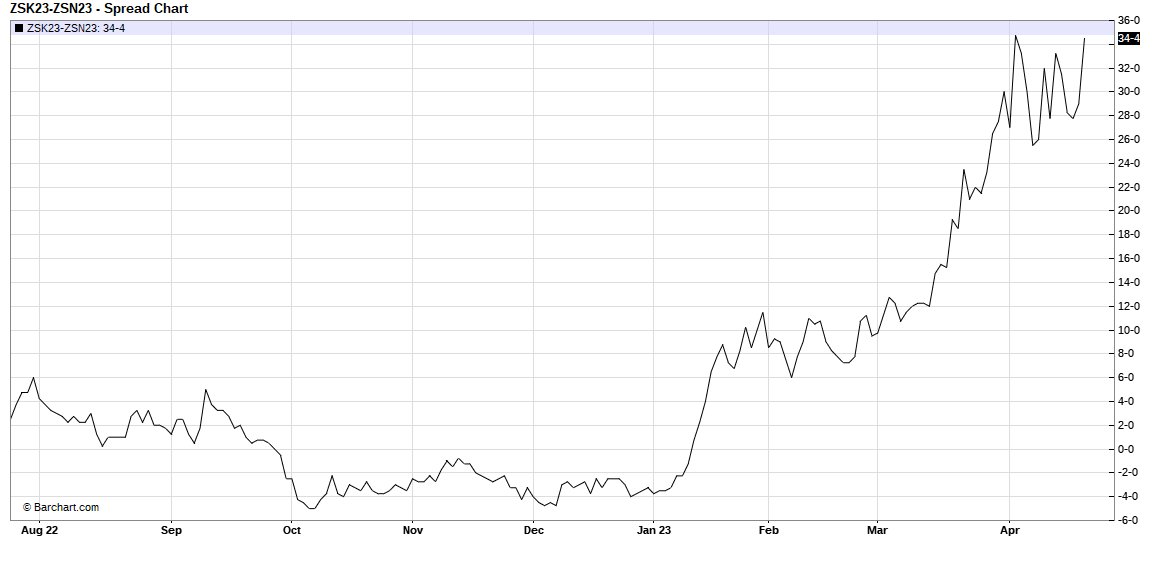

The above from Roger is just simple production, but if you look at spreads they are on fire. As they should be when you look at the information on production and carryout above.

Both of these spread charts show how the May futures contract has started to go parabolic against the July contract. The first one is soybeans and the second one is corn.

I started buying grain in 2000 for CHS Midwest Cooperatives. I was taught about how important USDA reports could be to market price action. But more importantly was the general rule that the markets behaved by.

To buy grain end users or commercials such as CHS, ADM, Cargill, Bunge, etc

Firm basis

Take away carry in the market and invert the market

Buy futures or run up future prices.

As most of you know the firm basis has been happening for months but really has got more legs the past few weeks in most areas.

The charts above show how much the market has inverted.

Last step should be happening as we get into delivery, but like futures markets there is no guarantee when it will happen, as futures markets and markets in general have their own timeline.

It will however happen, as we have already put a check mark on number 1 and number 2. So it is simply a matter of time before future price appreciation needs to take place to get products (grain) to become for sale.

Now the more farmers become price makers instead of price takers the higher the bounce can and should be. The bottom line is many farmers have bin doors shut and likely will be shut until we hit 7.00 plus futures or see a crop being made, which we won’t know until sometime in July-August.

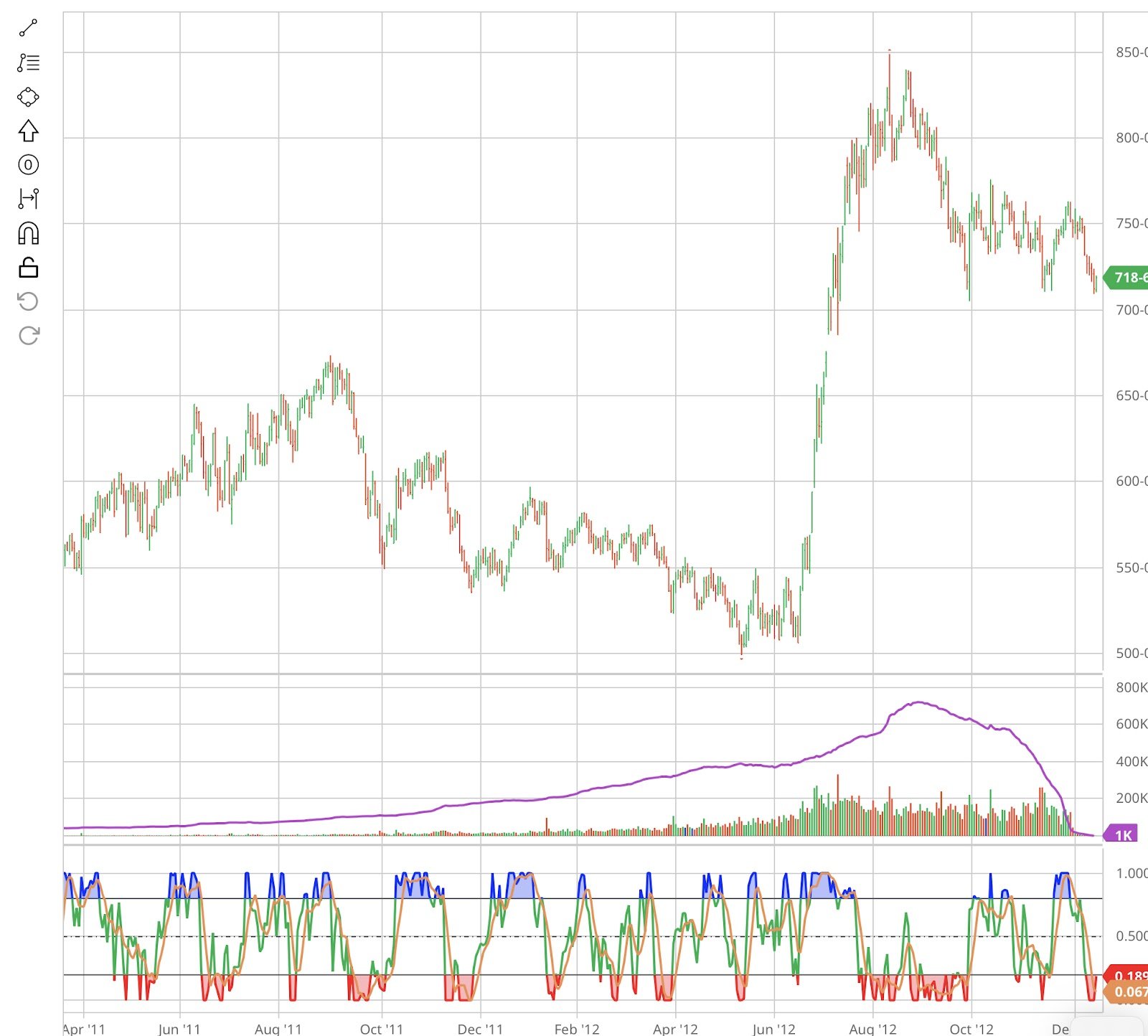

If you remember in 2012 we had a market that to me looks very similar to what has happened so far with Dec 2023 corn.

Take a look at these two charts. The first is this Dec corn contract, the bottom is from 2012. You will notice in 2012 we just grinded lower and lower, until making a low in June before topping out in August.

As I have mentioned previously I regularly watch Market to Market, here is part of the transcript from the Market Plus.

Shawn Hackett:

“Well, we are bullish grain markets later in the year. As we mentioned in the show, because of the significant increase in feed demand as African swine fever requires and causes a change in the herd regrowth phase. So that's a demand side story later on in the year, but it's really not a factor during the growing season. The growing season may be driven by the Safrinha corn crop and by us growing weather. We think the Safrinha corn crop is going to be fine, but we think much of that is getting priced in very, very quickly. But we don't think that the US weather is going to be as, you know, as perfect as the market is anticipating. In fact, we think it could be down right. The last time we had a transition from La Nina to El Nino with a negative PDO was 2012 and we're seeing a lot of similarities to the sea surface temperatures to suggest that might be something to be on the lookout for.”

Paul Yeager:

“I don't know the weather of 1952, but I do know the weather of 1983. Earlier in the broadcast, we talked about the snow in the Sierra Nevada, second biggest. Do you know what third biggest was? The snowfall of 1983. I don't know anything in between, but that may tend to that's part of that negative PDO.”

Shawn Hackett:

“We talked about a three in our writings months ago about how this record snowfall led to one of the top five worst grain crops in the summer of 1983. That this is this teleconnection, this pattern of a negative PDO led to that very, very poor growing season in the central Eastern grain belt. Of course, we have blown that record off the water this time around, but it's a very similar mechanism that negative PDO And remember, we have not had the central eastern grain will get into trouble since 2012. It's been a long time that we haven't had drought coming to the area. We are due in the set up is there this year for it. The way we see it.”

Not only is Mr Hackett talking about this but so are some other weather guru’s that are talking about similar Mother Nature risks. There is talk of the 89 drought cycle, talk about the volcano eruptions that will do major destruction to our crops. Plus just the past few years we have had Canada and Argentina have ½ crops or so. On top of all of this we have world wide issues such as the war in the Black Sea.

The world is not set up or prepared for ½ of a US corn crop. I don’t think we will see ½ of a crop, but I could see something that is 10-30 bushels below trend line yield.

Folks with our demand and tight situation we are not set up for that either.

Bottom Line

Bottom line is we have plenty of upside left in our markets. The path and journey to get to new all time highs might not be as fast as I or you would like. It won’t be a comfortable straight shot path. But overall things haven’t changed, we actually have more reasons to move much higher. Fundamentally we are much tighter than we previously were.

I don't like doing any grain marketing today, but I want to be set up and have hedge accounts open. So that I can utilize the tools out there to be set up to take advantage of higher prices. If we get cheaper like we did in 2012, it might mean buying some calls. Or it might be buying puts to try to make money on the way back down.

Typically our market doesn’t go up and just holds a price level. We go up and then reverse, we give opportunities to make (or lose) money going both directions. That’s where seasonals, fundamentals, and technical analysis help to be triggers to make the right decision based on your operational situation.

Our Biggest Risk

Here in lies our biggest risk, that economic recession keeps the funds from being involved in the grains.

This is a small write up from Farms.com Risk Management:

Hedging

If you don’t have a hedge account open and would like to open one to help you, both myself and Wade have recently joined Texas Hedge Risk Management.

Below is a recent announcement that went out to some of those that I have worked with for years:

“Texas Hedge Risk Management along with Banghart Properties is excited to announce that Jeremy Frost and Wade Hardes are joining our team as associated persons for Texas Hedge Risk Management to better assist you with your grain price risk management solutions as we will now be able to tie in futures and options to cash grain trading that will still be offered via Banghart Properties.

Texas Hedge Risk Management is a new Independent Introducing Broker clearing through Dorman Trading, established in 2022. While the IB is new to the business, each broker has over 10 years of experience in not only the brokerage business, but production agriculture as well. While other IBs are on path to get acquired by larger corporate entities, Texas Hedge Risk Management takes pride in their ability to remain a small, regionally held office, that can maintain control over their operation while continuing to offer a competitive and comprehensive suite of risk management services and strategies.

The reason Jeremy and Wade are such a great fit for the team is because of their strong ties to production agriculture and their commitment to their customers.

Founding partner Lauren Urbanczyk, lives in Hereford, Tx. She brings over 10 years of experience in risk management strategies and solutions for farmers, ranchers, and commercial operations. Her husband farms corn, wheat, and sorghum silage for their own farms as well as a custom farms for several local dairies. He owns and operates a large custom hay and silage chopping business. Together they also run their own 2000 head grow yard, primarily feeding holstein angus cross cattle. Lauren brings her hedge experience to their cattle operation, managing the hedging and marketing of their cattle.

Founding pattern Jake Kuker, lives in Onawa, IA, where he trades and farms himself. He brings over 20 years of experience in farming and marketing grain to the brokerage business. Besides ag markets, Jake tends to focus on equity futures. His business is trading and farming, which equips him to provide sound risk management strategies for his customers.

Managing member Ross Birkenfeld has worked with Lauren for the past 4 years. He brings his own proprietary trading models to the team, which are used for hedging execution and strategies. Options strategies are Ross’s strength, along with capital and cash flow management. When Ross isn’t trading, he is running his dairy, calf ranch, and grain farming operation.

Along with futures and options trading, Texas Hedge Risk Management also offers OTC services through hEDGEpoint Global. Margin financing and managed hedging services are now available to be offered in 2023.

We look forward to working with you and growing a lasting relationship for years to come.

To open a hedge account or to start the process of transferring your present hedge account simply click this link. https://www.dormanaccounts.com/eApp/user/register?brokerid=332

For those of you that don't know much about Dorman Trading you will be pleased to learn that they are owned by Miami International Holdings, Inc. (MIH) who also owns Minneapolis Grain Exchange.

This will further help producers in the Northern Plains gain a competitive advantage via having this partnership.

I look forward to helping you in your grain risk management and marketing needs in the near future. Thank you for your business over the years and thank you for your time

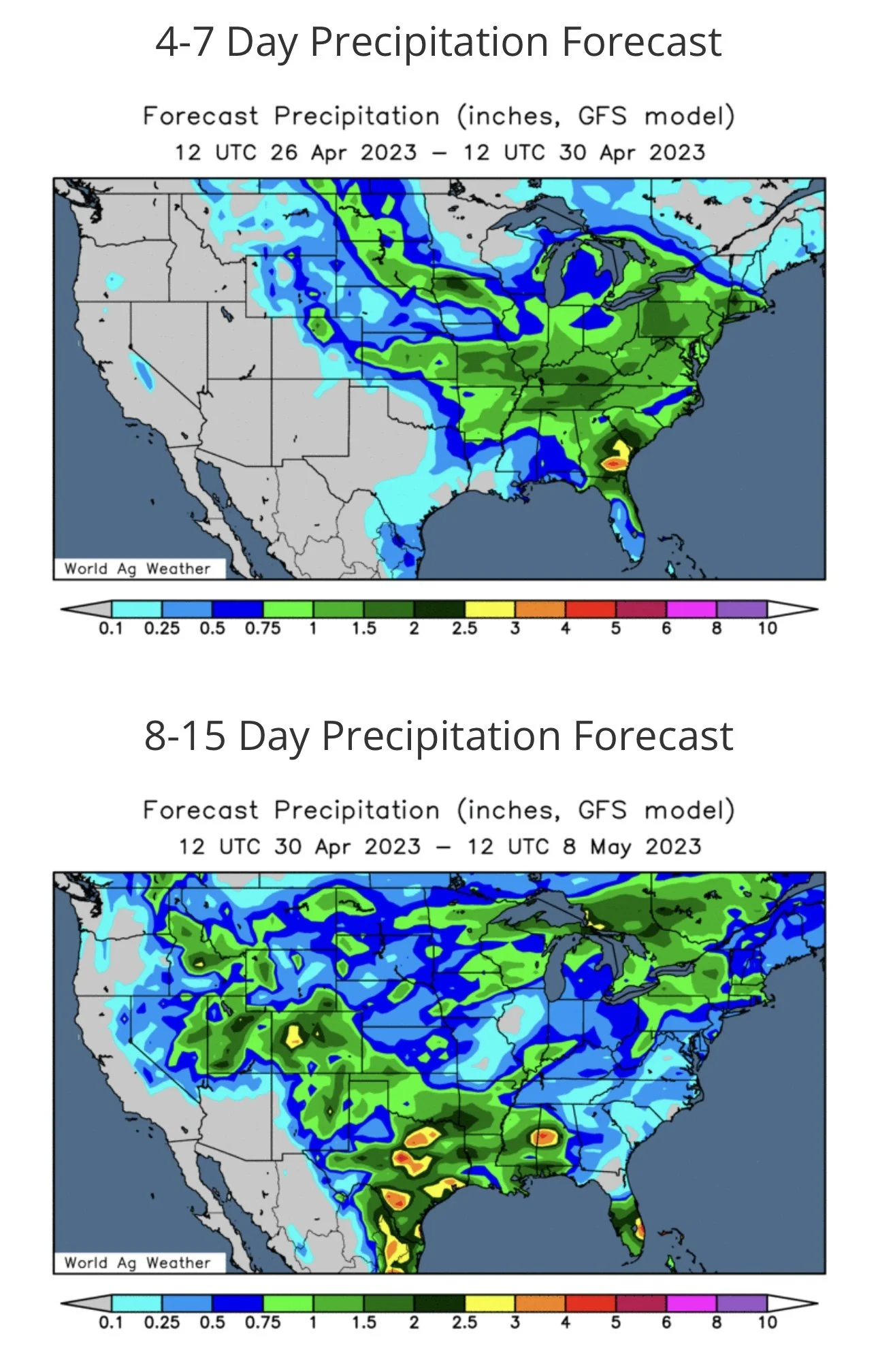

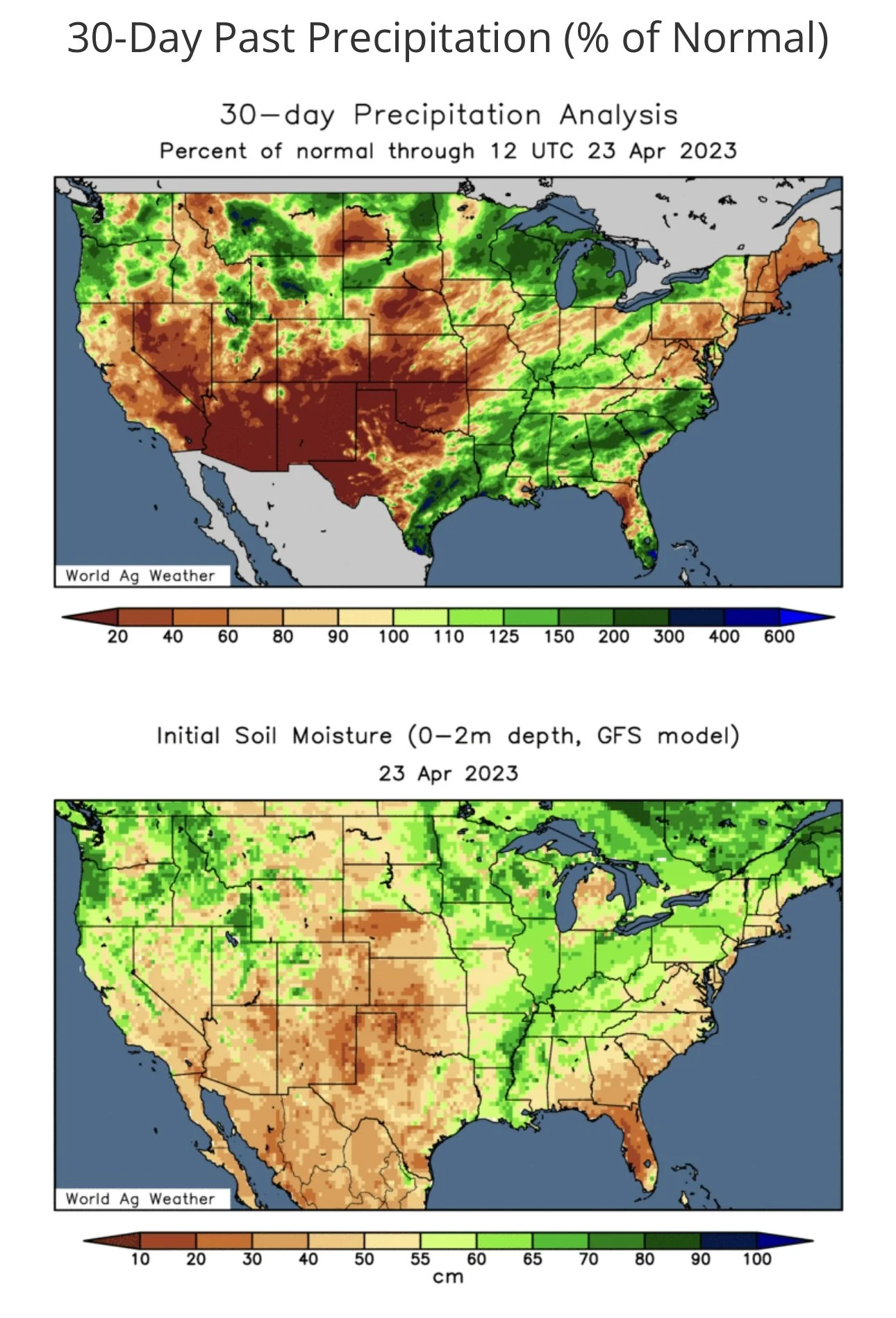

U.S. Weather

The Charts

Corn 🌽

Beans 🌱

Chicago Wheat 🌾

Check Out Last Week's Stuff

4/21/23 - Market Update

3-Day Sell Off Continues

4/21/23 - Audio Commentary

Ugly Day On The Surface, Spreads Tell A Different Story

4/20/23 - Audio Commentary

Patience & Seasonal Opportunities in the Markets

4/19/23 - Market Update

Grains Pressured Across Board

4/18/23 - Audio Commentary

Mother Nature & Seasonal Trends

4/17/23 - Audio & Market Update

Money Flowing Into Grains?

4/16/23 - Weekly Grain Newsletter