POST USDA SELL OFF

Overview

Blood bath following yesterdays USDA report that showed massive record yields.

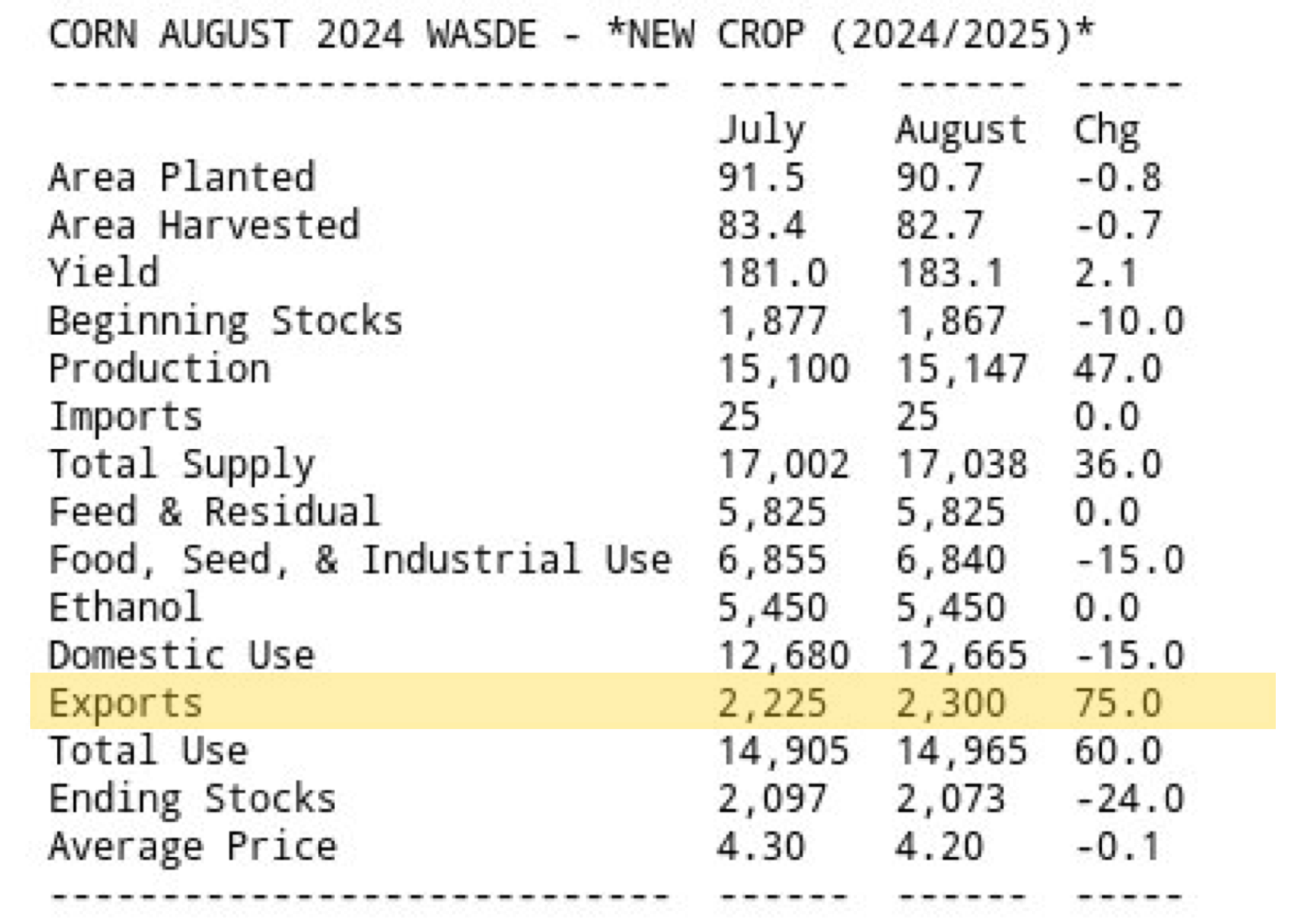

Despite corn yield going from 181 to a record 183, the report wasn’t actually "bearish" corn. The report could have easily been very bearish, but it wasn’t.

It was neutral to maybe even slightly friendly for corn given that fact that despite the 183 yield we actually saw our carryout decrease. This was due to acres falling -800k along with a slight bump in demand on the exports. As they raised export demand by 75 million bu.

So even with a +2 bushel to yield, carryout came down.

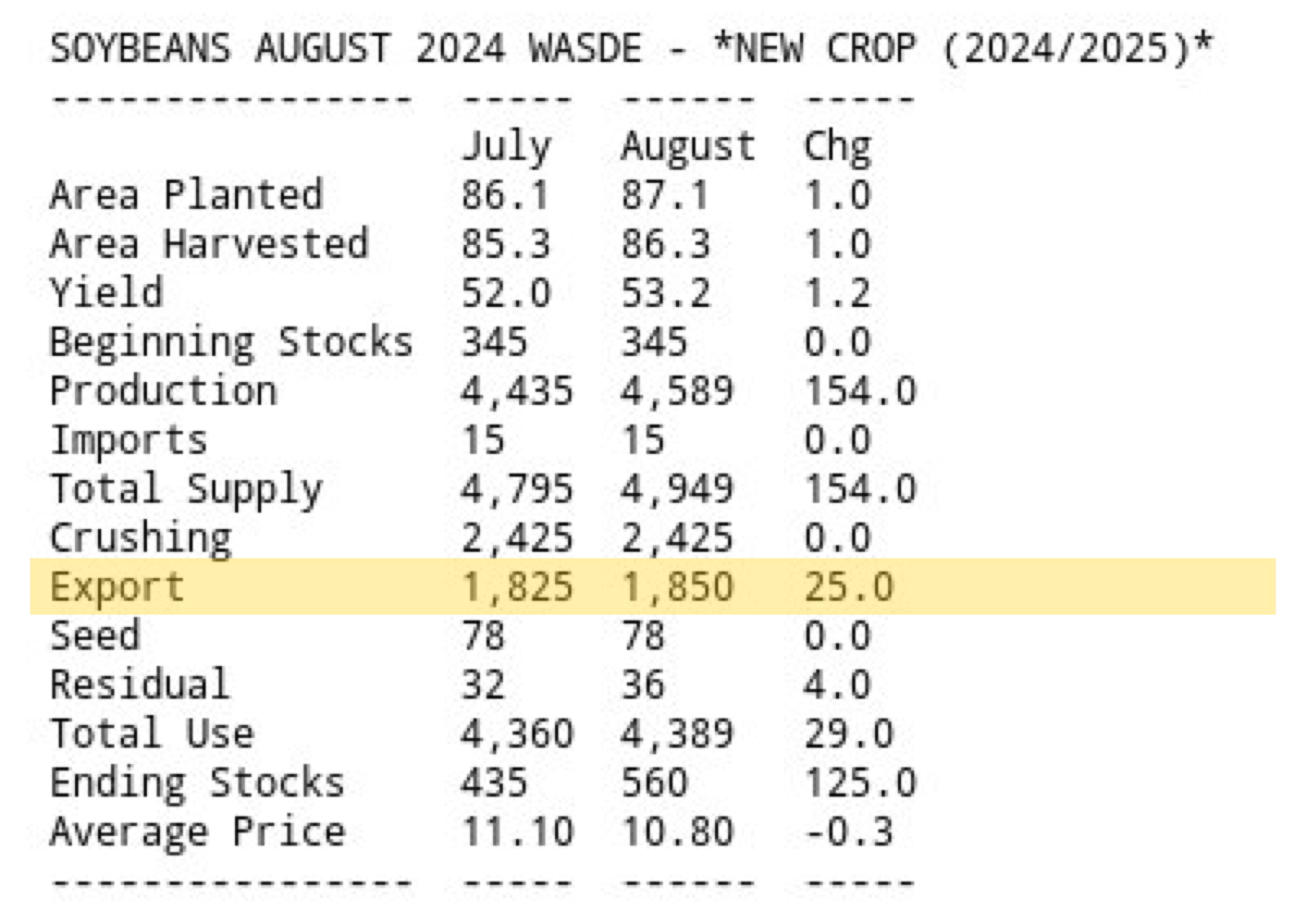

Soybeans on the other hand had about as bearish of report as you'll ever see. Yield was expected to increase, and it did. Going from 52 to 53.2. But the real whammy was the acres. Both harvested and planted acres jumped a whopping +1 million acres when the trade was expecting harvested acres to decline by -145k.

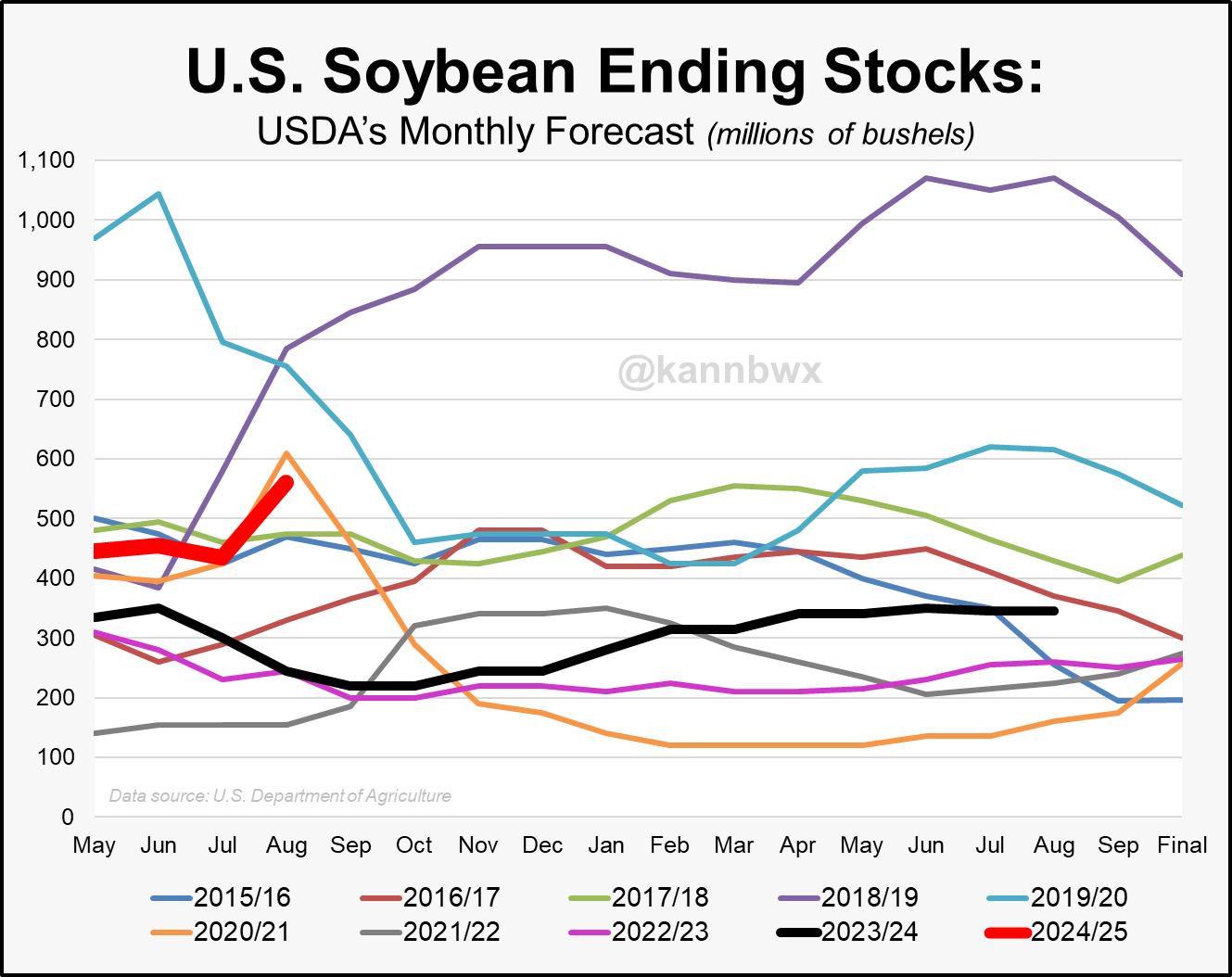

So while corn carryout decreased, soybean carryout saw a massive +125 million bushel increase from 435 to 560 million. A +22% increase from last month.

Here are the numbers:

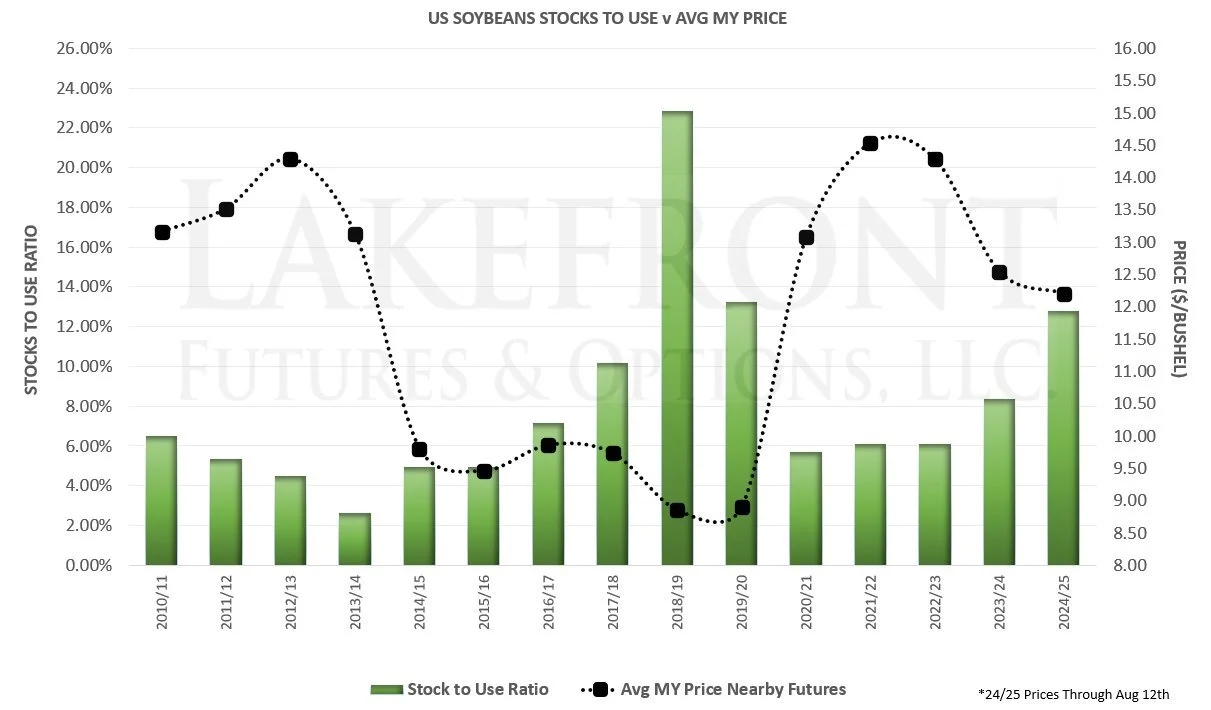

This brought soybean stocks to use ratio all the way to 12.8%. A huge number.

The last time we saw a +12% ratio soybeans traded below $9. Granted this was during the trade war in 2019/20.

Here is a good chart from Lake Front futures that shows how stocks to use ratio can correlate to prices.

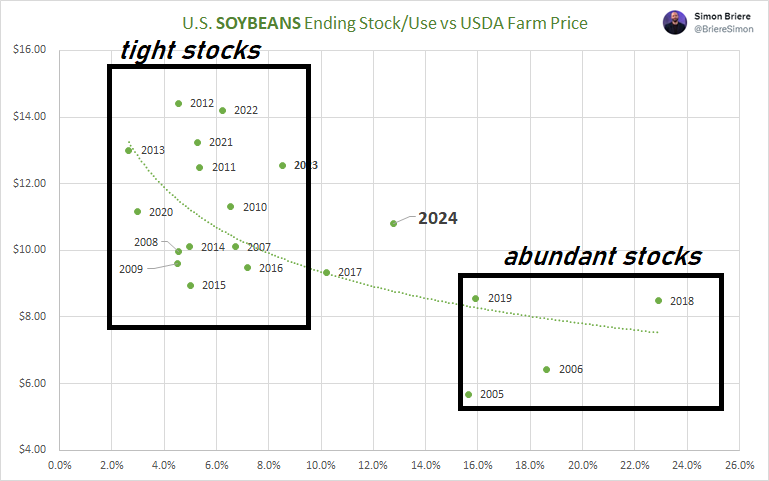

Here is another graph from Simon Briere.

Tight stocks typically correlate to higher prices, abundant stocks to lower prices.

Right now we are roughly in the middle.

So it looks like we are going to have a monster crop of soybeans here in the US.

The even bigger problem?

Demand.

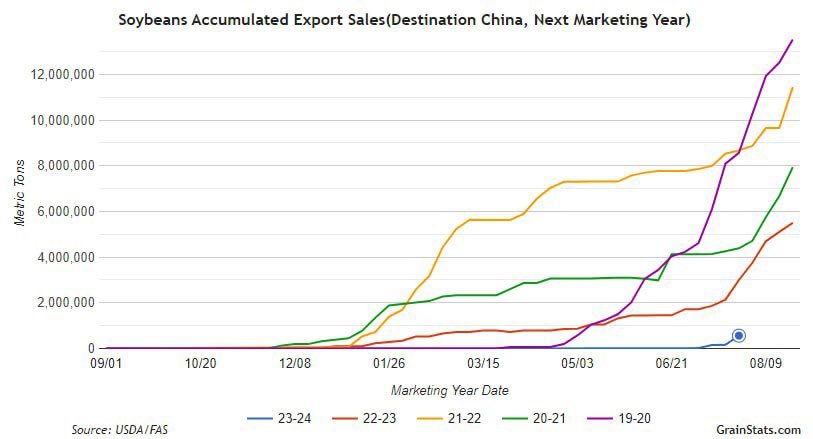

Today we saw yet another round of small exports sales. 132k MT of beans to China. Yesterday we saw 300k MT of beans to unknown.

Now these are good news, but not enough to move the needle at all.

Look at this chart from GrainStats. You can see just how far behind we are in export sales to China.

Eventually low prices will cure low prices.

$15 beans cured $15 beans. The will happen to $8 or $9 beans.

We will need demand to start eating into this now large carryout.

Was this weak market perfect timing for China to step in soon..? Or will they continue to be on the sidelines?

There is no telling as to how low we will have to go to create enough demand to rationalize higher prices.

But what we do know is that at some point, we will find demand. The question is how long and how low do we go before doing so? That is the risk.

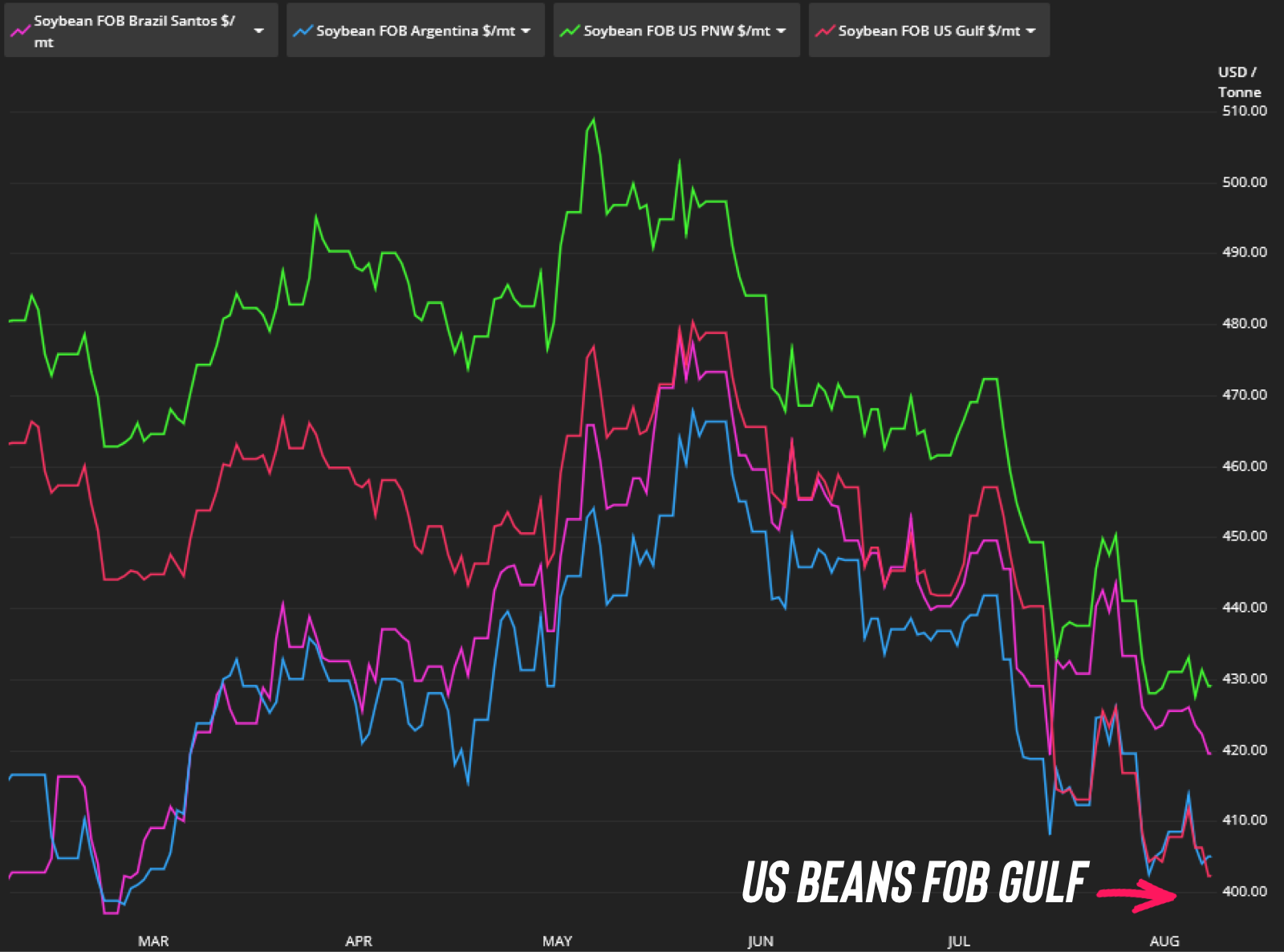

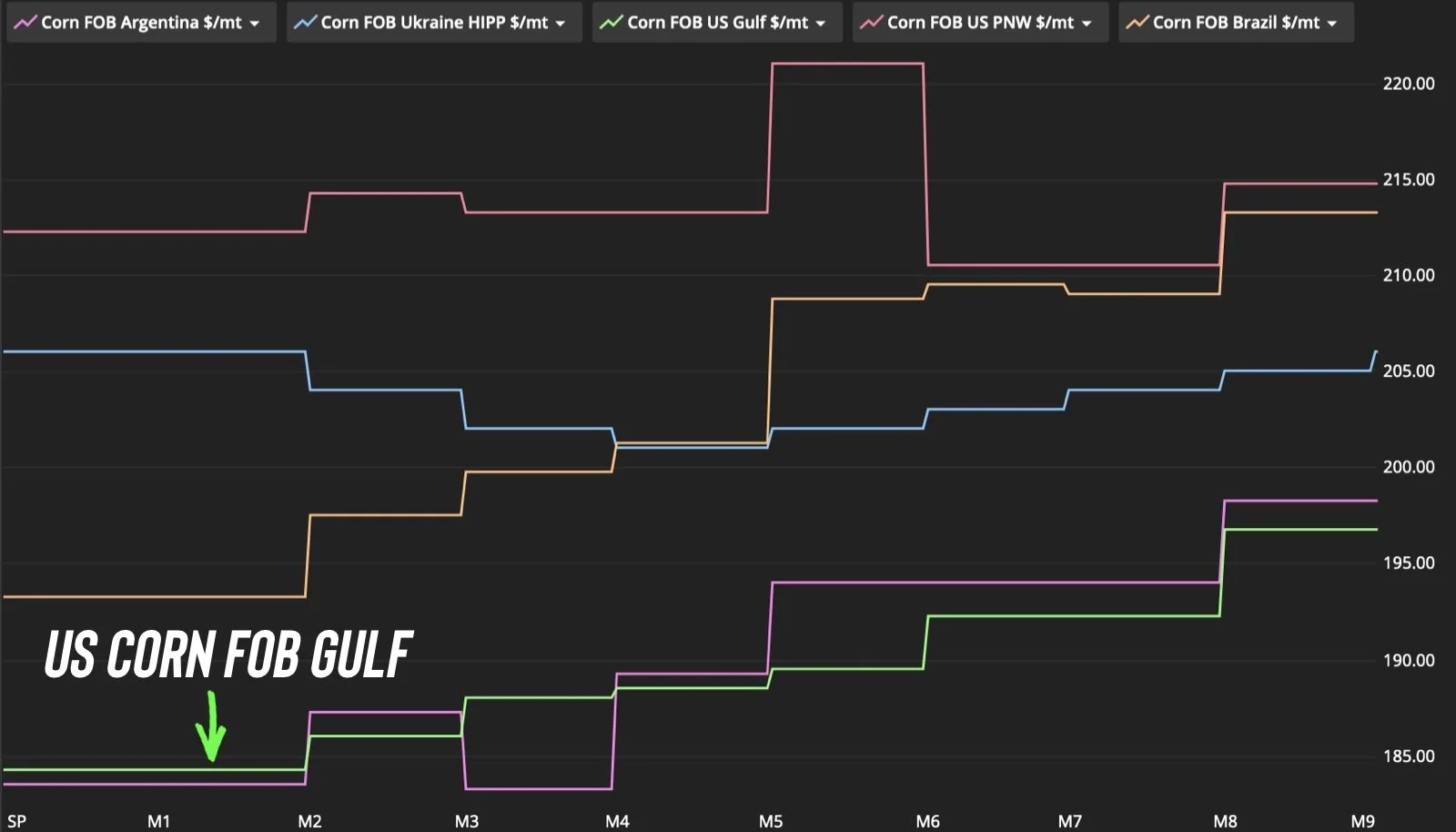

I included these images last week. But here they are again. US Gulf soybeans & corn are the cheapest in the entire world.

So we have the cheapest grain in the world off the Gulf. China is severely underbought soybeans.

One could expect us to start finding demand here at these levels. But yes, we can still go a lot lower before doing so.

The point is, we need demand. Especially for soybeans. If we cannot find demand, we can still go a lot lower from here. Demand aka China is about the only thing that can save this soybean market.

Once China comes in heavy (I'm talking about 1 million MT at a time) that would be an indication that the bean market is done going down. However, until that happens, this monster crop in the US could very well continue to push us lower until after harvest when the trade starts to pay attention to South America etc. Then it might take some South America issues to save the market, but right now expectations are for a monster 169 bu crop out of Brazil.

There are some questions surrounding the increase on the demand side of the corn balance sheet. As some question if exports will really be higher than this past year. But I think we are at low enough prices where this should translate to demand, but we haven’t quiet seen the demand yet. Business is starting to pick up in corn & wheat, but nothing dramatic yet.

The USDA also increased their export projections for beans. Many are already skeptical of the current demand sheet on beans given we have a tiny new crop book of sales to China right now.

The USDA is also assuming that these lower prices will lead to more demand.

Below are charts from GrainStats where you can see the increases they made to export demand:

Today's Main Takeaways

Corn

Corn lower despite a neutral to somewhat friendly report. Corn was simply drug lower by soybeans today.

On the charts, we did not take out yesterday's lows which was a good sign.

On the bright side, we got a report that showed a huge 183 yield, yet our carryout decreased.

I am NOT saying there couldn’t be more downside from here.

But, what else is left to sell this market on?

Yes, there is a lot of supply that will be entering the market. Which may make a rally until post harvest hard.

But we already know we have massive crops and record yields.

We are at prices where demand should start to only increase from here.

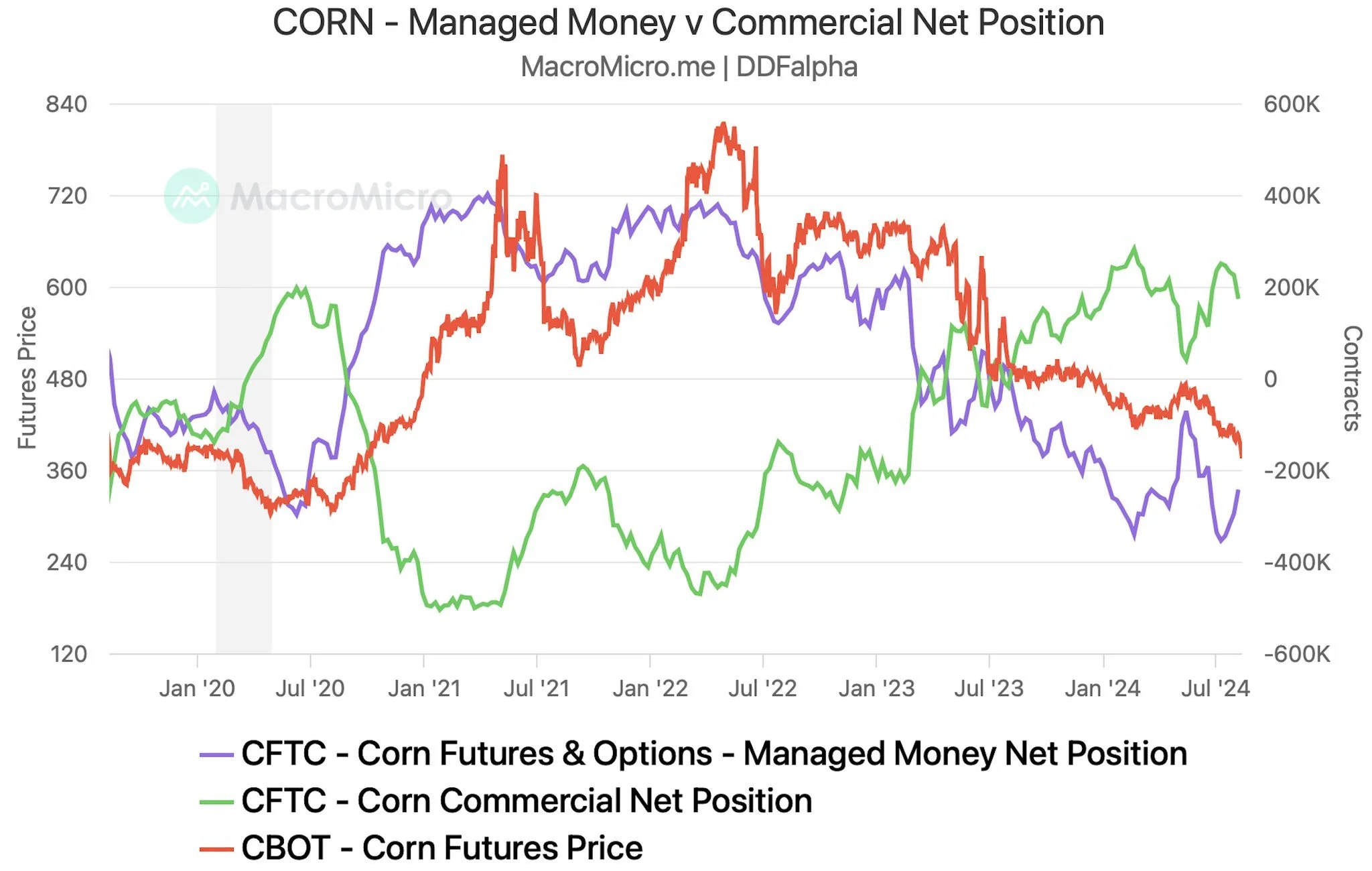

The funds actually covered +50k of their record shorts, but it was met with -30k selling from the commercials. So the fund buying was met with farmer selling, which is why futures didn’t go higher despite fund buying.

Chart from Darrin Fessler

But overall I am not sure how much bigger this crop could actually get on the balance sheets, or if demand is going to weaken to the point where it will justify the funds keeping this big of short position at these low prices.

Here is a takeaway from Commstock Investments:

"Farmers still hold some un-priced bushels but the trade expectation that they will hold for the market low to give up is likely exaggerated. They do not have to sell the last bushel before the funds cover shorts. They do need to sell remaining inventory to empty bins for the next harvest but at this point a rally may well buy those bushels better than market gravity. Funds do need to buy back short positions so if technical momentum reverses, they will become the best buyers. Farmer psychology is broken and they are willing to sell a rebound. Bearish market sentiment had become so negative you could cut it with a knife. Seasonal lows are often made in August so timing is here. One can also count 5 wave declines in corn and Monday we have a daily upside key reversal. Follow through is needed. A weekly one would be better. Monday's report may have mitigated the wildly bearish imagination circling the trade that the yield would blow out the top with demand falling through the floor. The first thing that a market has to do in order to bottom is stop going down. Mondays low will be key to that. ($3.93)"

Could we see another -40 cents of downside? It is possible. It's not very likely in my opinion, but $3.50 Dec corn is not out of the cards. As we found support there many times in other bear market years.

That probably only happens IF this crop gets even bigger and demand disappears. I don’t see either of these happening, as corn growing season is over and we should start finding demand. But both are possible.

Looking at the chart, we have resistance at $4.03 and $4.09.

Once we clear $4.09 the chart will look friendly. To confirm a bottom, I still need a break above $4.23-26.

Until that happens, the risk is still lower. We now have support at $3.93 (USDA lows) and $3.80 is our major support. If we can continue to hold $3.93, the chart will look okay but if it breaks $3.80 is probably next.

Longer term, demand should lead us higher. But it might be difficult to see a major rally until after harvest.

Looking towards next year, if fertilizer remains this expensive we could see acres down to the high 80's. Couple that with demand and you could see higher prices. But again, that's the long term perspective.

Short term, if your risk is lower, protect it. Call or text us if you want to go through things 1 on 1. (605)295-3100.

Dec Corn

Soybeans

Soybeans take it on the chin, taking out yesterdays lows and touching that $9.60 trade war resistance price target I had been putting out for a while.

I already went over the report side of things.

So what would it take to save this bean market?

There are a few things.

First would be an early freeze to offset some supply. Possible but very unlikely.

The biggest thing would be China.

At what point do they start to buy?

From Chris Robinson:

"Do the Chinese see this price box? They do not seem to be in a hurry to put their buying shoes on. If you were a buyer, would you want to call the low or just keep going hand to mouth?"

When China starts buying HEAVY, the bottom is likely in.

BUT until they start to do so, the risk as it has been for months is lower.

We are officially in the bear market territory.

If we take out $9.60 we are actually back to trade war levels.

During other bear market years, we didn’t find support sometimes until low $9's or even sub $9.

Right now our stocks to use ratio and US ending stocks would indicate that a scenario like that is possible IF China doesn’t start to come in and buy.

Ending stocks right now are the 3rd largest behind only the trade war years.

Chart from Karen Braun

I would assume China starts to come in and buy, given the big discount and them being as under bought as they are.

But what if they don't?

That is why I have been preaching to protect the downside in these market updates for a long time. Because I hate to say it, but there is still more downside risk from here.

If China doesn’t want to buy, then all we are left with to save this market is a possible South American issue later in the year.

Nobody can predict what China will do. The risk is lower until they start to buy.

Bottom line, if your risk is lower.. protect it.

One thing bulls do have going for them is the fact the funds are record short still and will take profits eventually. Looking to next year, cheap beans aren’t going to hold acres. Low prices will create demand. But none of that has to happen in a timely manner.

From GrainStats:

"I feel the USDA jumped the gun a bit early (talking about export projections). So from a trader point of view, we all want to see some more exports on the books before traders get bullish again. That happens when we have new and increasing demand for exports, OR we have problems in competing countries of Brazil or Argentina."

So basically to say we are done going down we need exports or problems in SA.

Call or text us if you want to come up with a game plan. (605)295-3100. It's free so don’t hesitate.

Nov Beans

Wheat

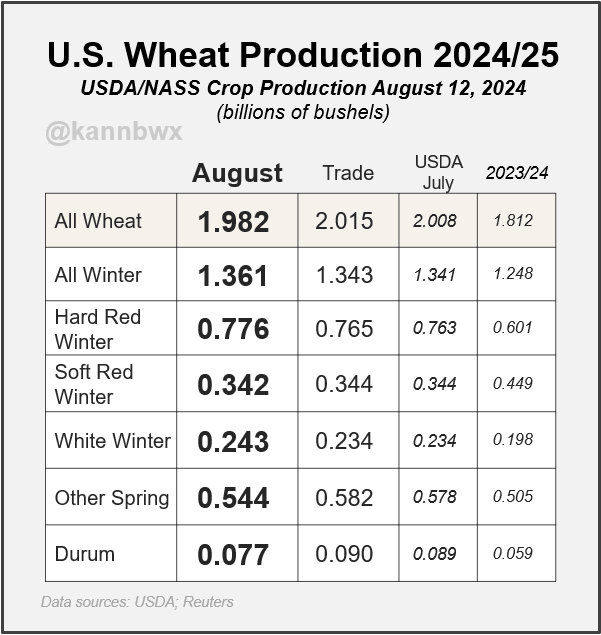

Wheat follows the rest of the markets lower.

The USDA report didn’t have anything major for wheat. Wasn’t incredibly bullish nor bearish as everything was close enough to the estimates to not make a big difference.

US carryout fell due to smaller crops.

From Scott Irwin:

"USDA shocked the market with it's 53.1 bpa yield estimate in July for spring wheat and then dropped it by 1/2 a bushel to 52.6 yesterday, confirming the high yield from last month."

US wheat production fell due to smaller output for spring & durum which offset the increase in winter wheat.

World carryout was slightly lower but nothing major.

Russia wheat crops & exports were unchanged. China unchanged. Ukraine crops up +2 MMT with exports up +1 MMT. Australia wheat crop & exports both up +1 MMT.

France is reported as having their worst crop in 40 years.

16 suppliers have offers to Egypts wheat tender to buy nearly 4 million MT of wheat. So this shows some possible global demand, but nothing direct. It is a positive sign that globally wheat is at levels that are creating demand.

Overall, I still think we are in the process of carving out our lows. Yes we could still go lower from here, but there are plenty of global factors that could lead to a rally in the coming months.

If you didn’t make any wheat sales when it was closer to $7, I still like keeping puts on for protection if you're undersold. I do think you'll get a chance to price +$6.00 wheat at the very least.

Need to see us above $5.67 to call a bottom. After that, upside targets are $6.00 and $6.25.

Sep Chicago

Sep KC

Want to Talk?

Our phones are open 24/7 for you guys if you ever need anything or want to discuss your operation.

Hedge Account

Interested in a hedge account? Use the link below to set up an account or shoot Jeremey a call at (605)295-3100.

Check Out Past Updates

8/12/24

USDA REPORT: BEARISH BEANS. SMALLER CORN CARRYOUT & RECORD YIELDS

8/9/24

USDA REPORT MONDAY

8/7/24

HUGE USDA REPORT MONDAY

8/6/24

WHEAT UNDERVALUED? CORN YIELD? WHAT TO DO WITH GRAIN OFF COMBINE

8/5/24

GRAINS STRONG WHILE WORLD PANICS

8/2/24

GRAINS RALLY, YIELD ESTIMATES, CHINA STARTS TO BUY

8/1/24

MARKET EXPECTS A PERFECT CROP?

7/31/24

CORN BREAKS $4.00, FAVORABLE WEATHER & CHARTS

7/30/24

GRAINS FAIL REVERSAL BACK NEAR LOWS

7/29/24

GRAINS SHOW SIGNS OF REVERSALS

7/26/24

BLOOD BATH IN GRAINS: EPA REVERSAL & WEATHER

7/25/24

CHINA, DROUGHT, FUNDS & RISK

7/24/24

BEANS LOWER DESPITE DROUGHT TALK

7/23/24

BACK TO BACK GREEN DAYS FOR CORN & BEANS: MARKETING DECISIONS

7/22/24

BEST DAY FOR GRAINS IN A LONG TIME

7/19/24

DULL MARKETS: STRATEGIES TO USE IN GRAIN MARKETING

7/18/24

DEMAND, CHINA, POLITICAL PRESSURE, & TECHNICALS

7/17/24

DIFFERENT GRAIN MARKETING SCENARIOS YOU MIGHT BE IN

7/16/24

RELIEF BOUNCE FOR GRAINS

7/15/24

GRAINS HAMMERED. TRADE WAR FEAR

7/12/24

USDA REPORT: LOW PRICES CREATING DEMAND

7/11/24

USDA TOMORROW

7/10/24

GRAINS CONTINUE TO GET HAMMERED

7/9/24

RAINS, RECORD FUND SELLING & 2014 COMPS

7/8/24

PUKE SELLING, RAIN MAKES GRAIN & FUNDS RECORD SHORT

7/3/24

THIN HOLIDAY TRADE FOR GRAINS

7/2/24

BEARISH WEATHER, RECORD SHORTS, & CHINA

7/1/24

SUPPLY WILL BE THERE, BUT CAN DEMAND LEAD US HIGHER?

6/28/24

GARBAGE USDA REPORT

6/27/24

BIGGEST USDA REPORT OF YEAR TOMORROW

6/26/24

USDA PREVIEW & COUNTER SEASONAL RALLIES?

6/25/24

POSSIBLE RISKS & OUTCOMES THIS USDA REPORT COULD HAVE

6/24/24

VERY STRONG PRICE ACTION: RAINS & USDA KEY

6/21/24

DON’T PUKE SELL. ARE YOU COMFORTABLE RIDING THIS STORM?

6/20/24

RAIN OR NO RAIN FOR EAST CORN BELT?

6/18/24

WEATHER MARKET ENTERING FULL SWING

6/17/24

SELL-OFF CONTINUES DESPITE FRIENDLY FORECASTS

6/15/24

EXACT GRAIN MARKETING SITUATION BREAKDOWNS & WHAT YOU SHOULD BE DOING

6/12/24

USDA SNOOZE: WHAT’S NEXT?

6/11/24

USDA TOMORROW

6/10/24

IS USDA OVERSTATING CROP CONDITIONS? DOES IT MATTER?

6/7/24

WEATHER & USDA NEXT WEEK

6/6/24

ARE GRAIN SPREADS TELLING US SOMETHING?

6/5/24

GRAINS NEARING BOTTOM? 7 DAYS OF RED

Read More

6/4/24

HIGH CORN RATINGS, SCORCHING SUMMER, & RUSSIA CONCERNS

Read More

6/3/24

5TH DAY OF THE SELL OFF. ARE YOU COMFORTABLE?

5/31/24

4 STRAIGHT DAYS OF LOSSES IN GRAINS

5/30/24

I DON’T THINK SEASONAL RALLY IS OVER. WHAT IS THE PLAN IF I’M WRONG?

5/29/24

PLANTING DELAY STORY VANISHES. BUT IS REAL STORY OVER?

5/28/24