BRAZIL RAINS?

*Note: Due to the holidays we will not have a Weekly Wrap tomorrow, we will have an audio instead. Updates will resume as usual next week.

Overview

Mixed choppy trade continues as corn and beans turn lower with some rains a week out for Brazil while wheat trades higher due to war headlines in the Black Sea.

The wheat news was that a Panama flagged ship was struck by a Russian mine.

They added rains to the forecasts for Brazil next week. This time actually both the Euro as well as the GFS agree that rain is coming.

The dollar is trading at it's lowest levels since July.

Outside of those, there really isn’t a ton of fresh news. Expect more choppy two sided trade was we close out the new year.

With the lack of news, we also have thin trade with less traders taking place in the action. This will lead to moves in the market like today being over exaggerated.

Let's take a look at the Brazil situation.

Although rain is forecasted for Brazil, we have seen this story time and time again. As they will call for rains 1-2 weeks out only for them to disappear. More on this later..

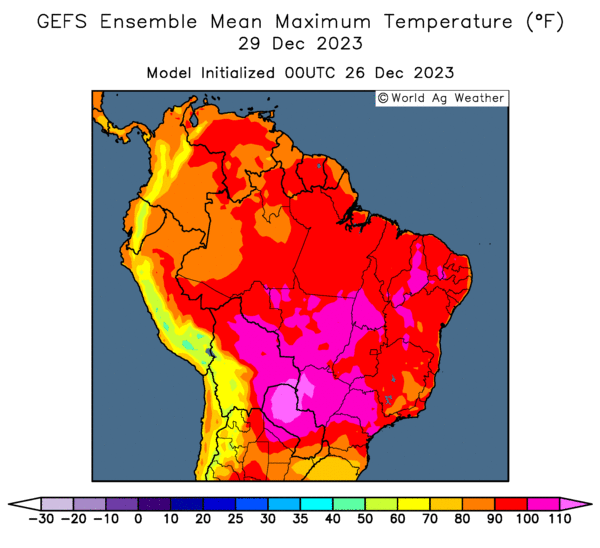

The crops are still deteriorating and they are starting to harvest some areas in Mato Grosso. Which is the earliest ever. Most are looking for the lowest yields in 40 years.

This rain, if it hits could certainly stop some of the damage, but we can’t ignore the fact that significant damage has been done.

Dr. Cordonnier dropped his Brazil bean estimate to 153 million metric tons. Far lower than the USDA's current 161. It is safe to say more cuts to production estimates are coming, but by how much and what is currently priced into the market is the main question.

From Brazil Producer Diego Meurer:

"18 soybean producing towns in Brazil have declared a state of emergency due to severe drought and high temps. The rains that fell over the holiday hit the capital the most which is not a grain producer."

Over the past 2 months most weather forecasters have far over promised the rain for Brazil a week out and been wrong. However, there has been one company who has been consistently accurate and that is BAM weather.

BAM weather had this to say:

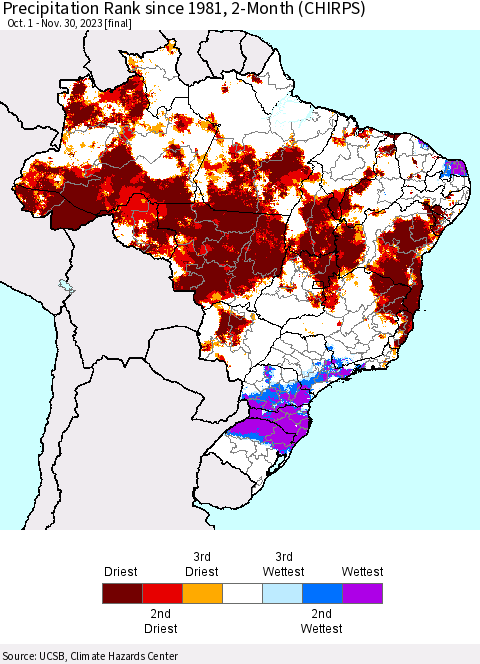

Drought concerns are on going in central Brazil, which is one of the highest producing areas in the entire world. This image shows the least amount of over the past two months compared to the last 40 years.

"What is more concerning is if we look back at history, it tells us this concern will linger for potentially many months ahead."

Keep in mind, the current time frame for Brazil currently compares to that of August in the United States. What would our crop have looked like if it was the driest on record for June and July and we didn’t get any rain in August either? Something to consider when debating how these crops have been impacted.

BAM went on to say:

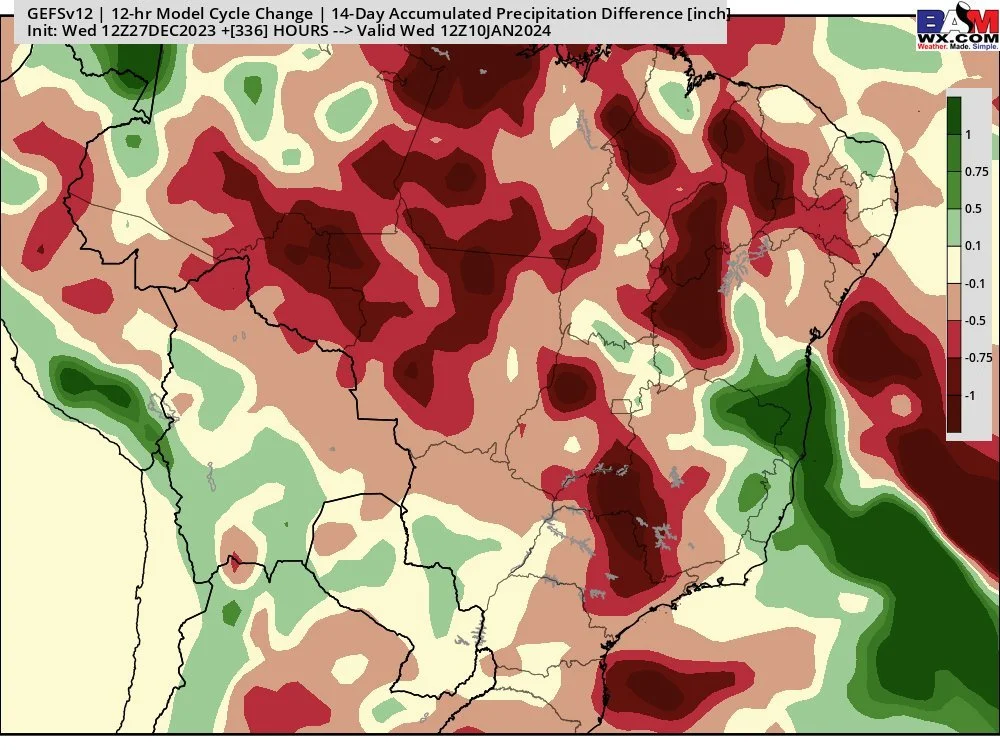

"Latest GFS Ensemble 12z, 12 hour precip change over the next 2 weeks, significantly drier across major central #Brazil #soybean areas.

Why such a change?

It's readjusting its MJO forecast more correctly, which we talked about in our latest SA ag weather update at @bamwxcom!

As the MJO heads into the drier phases of 3-4-5-6 into January, expect the data to be too wet and to roll forward drier (just like it did for December)."

Essentially they are saying to expect the forecasts to show moisture but to disappoint.

SLE Farms from Brazil had this to say:

"The drop will be significant and pointing out percentages at this moment is a guessometer and total disrespect for other peoples intelligence."

"The drop will be historic in this region, which represents one of the largest production centers in Brail and has a yield standard that is among the best in the world. Algorithms and satellite images do not calculate plant height, much less production load."

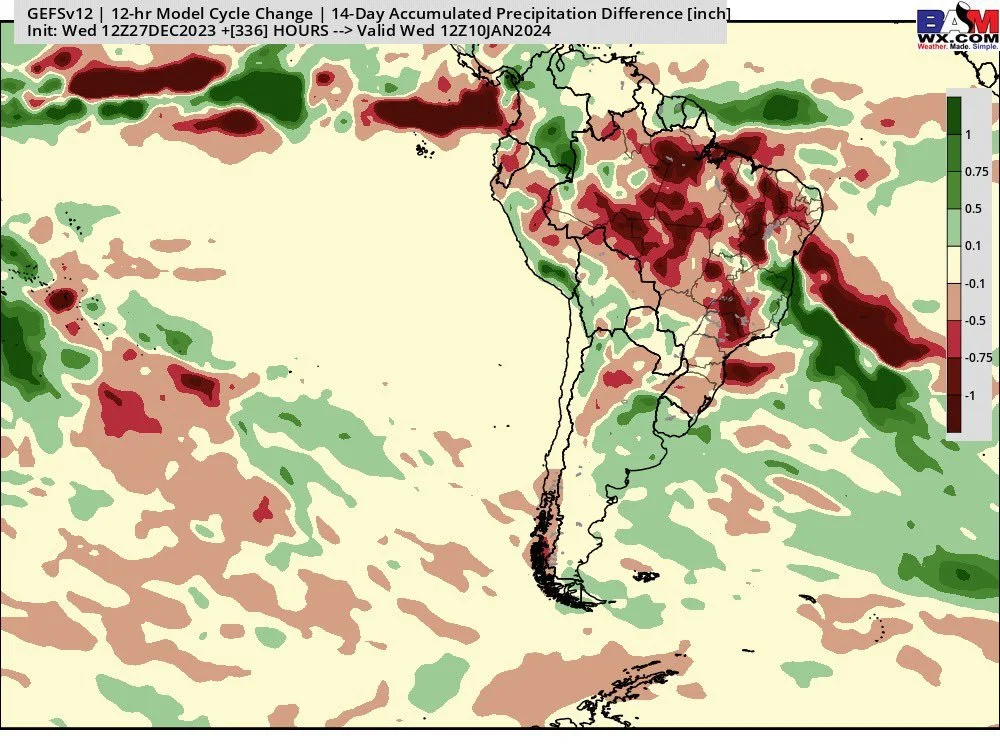

Here is what the Euro and the GFS are predicting. They are both in agreement that Brazil will see wide heavy rainfall next week. This was the main reason for soybeans falling -20 cents off their highs today.

Will they actually fall is the question..

From Darren Frye:

"If January is anything like December, it might exceed 30 million metric tons (losses to Brazil's bean crop) Below is the 2 week change from the previous model run. Very consistent with the past 90 days. Promise me rain in week 2, and then lose the moisture as week 2 rolls into week 1."

From 247 Ag:

"Still cooking in Brazil, not good. Weekend rains were a flop. Oh but rains are coming next week!" (Sarcasm)

Today's Main Takeaways

Corn

The corn futures market was slightly lower as we continue to chop around in this recent range.

We opened up higher but eventually gave back the early gains along with soybeans and crude oil.

No real fresh news. The losses today were due to the rain in the Brazil forecasts along with thin holiday markets that allow the algo's to push markets where they want.

The funds remain heavily short. Some think they will rebalance after the first of the year, however they might wait until they see how much the American farmer sells after the first of the year. So perhaps we don’t see any major movement from the funds until a week or so into the new year.

Remember there is an old saying, "the market won’t go up until 2/3's of the American Farmers have sold out of corn."

The Brazil situation still has the chance to be a big wild card early in 2024.

Unlike soybeans, the problem with the Brazil corn can’t necessarily be "fixed". The delayed soybean planting will already lead to less corn acres. There are plenty of estimates throwing out acres to be down -20% to -25%.

CONAB already has their acres pegged down -4.5% for the second crop corn a few months ago. We also have many companies reporting that their sales of fertilizer and seed for the second corn crop are down as much as -20% due to less corn getting planted.

However, we still have large carry out here in the US. That opens up potential risk. The risk is that we wind up growing a big crop next year with a yield above trend line. If that happens there is a chance we could be swimming in corn. We think that demand will pick up as we move forward, but us thinking that doesn’t guarantee that is how it will shake out. So therein lies some risk with so so demand along with above trend line yields.

If you need to move it in 30-60 days, be proactive. That means you need to do something in your grain marketing plan. Don’t just wait if you will be forced to sell. Be proactive which means different things for different situations. Some of you might be worried about the bottom falling out, you are suppose to buy puts. Some might be worried about it rallying right after you sell. Your move could be buy corn call options that align with your grain price risk management style. Some of you it might mean making a sale basis on a technical signal, like a moving average, or RSI. If you need help reach out to Jeremey at 605-295-3100 and he will help you come up with a grain plan that works for your operation.

By the way, corn options are very cheap. Which means the trade doesn't think the market will move much and allows you an easy opportunity to put a cheap floor in to protect from the downside.

The big thing bulls need to demand. We need China to come in and start buying like they have recently in beans and wheat.

Brazil corn is over $6 vs our sub $5. One would think this would eventually lead to more US exports, but I guess we will have to see.

Short term I think we will likely see choppy up and down trade. Long term, I see higher prices looking to spring and summer.

Taking a look at the chart, that downward trendline we've been trapped under since July is the line bulls need to break. Sadly big money and the algos pay attention to these silly lines.

Corn March-23

Soybeans

Soybeans in thin holiday trade got a little pressure by potential rains in Brazil, as they close -15 cents off their early highs, giving back all of yesterday’s gains. As both weather models have 2-5 inches coming in to Brazil next week.

Despite all the rain we have had in the forecasts this week, soybeans are still higher on the week.

Brazil is the largest bean exporter in the world. We the US do not have all these extra beans to sell. So if Brazil continues to have problems and their production falls like some think it could, we will have to curve demand and one of the only ways to do that is to create higher prices.

You, I, and no one else knows if Brazil will get rain or not.

Personally, I think the damage has been done for the most part. I suppose there is a chance they are able to raise an "okay" crop. But I don’t think there is a good possibility they raise a record crop like everyone thought they would’ve had and like the USDA is currently forecasting.

Is the USDA and market kicking the can down the road? Remember last year when they kept kicking the can down the road on the Argentina crop? We had one of the worst crops ever.

Dr. Cordonnier has his estimate at 153. I have heard estimates as low as 145 or even 140. A 10% reduction to the USDA's current 161 would be 145. I don’t think a 145 crop would be all that unrealistic at all.

Longer term we still have a ton of "potential" upside. The upside for $14 and $15 beans is still there. Again, I am not saying it "will" happen. I am saying it is a very real possibility if the cards are dealt right.

If the rains next week fall, we will take it on the chin short term. What happens after that will come down to how damaged their crop is and if these rains are too late.

If you are nervous about the downside, there is nothing wrong with taking some risk off the table or considering locking in a floor. I would prefer to be making sales in spring and summer, but if you want to or need to move stuff here, you need to remain proactive. Proactive and getting comfortable is different for every operation. For some of you having a floor in place via buying some puts is the right move. For others it could be making sales or putting in a stop order. Give Jeremey a call at 605-295-3100, if you want to talk about your situation and he will help you come up with a grain marketing plan and strategy that will help you be comfortable.

We have talked about getting comfortable several times in the past. Here are some excerpts of our audio comments where we discuss in detail the concept of getting comfortable.

Check it out here.

Soybeans March-23

Wheat

Wheat took it on the chin yesterday, but took back nearly all of yesterday’s losses on today's slight rally.

The strength in wheat came from two things.

The first was the war headlines as mentioned. The second is short covering from the funds.

The recent snow added some pressure yesterday, as it gave the crops snow cover.

Outside of that, there isn’t much else going on in the wheat market.

We are looking at a potentially improved crop here in the US, but we still have problems globally.

Bottom line, we still view the wheat market as a sleeper here.

Bulls would like to another catalyst such as Chinese appetite, war, or weather concerns to spark more short covering.

Most do seem to think we will see the funds start to rebalance their positions after the first of the year. With the funds still pretty short wheat, that would mean most think we see the funds step in as buyers here soon.

One other headline is that Russia's wheat harvest is expected to drop nearly -10% from last year's record harvest. But this crop would still be the second largest ever.

I think a breakout to the upside is coming, but that doesn’t mean it will happen soon. The wheat market tends to have a time table of it's own.

Looking at the chart, we have resistance at the $6.50 level. A break above could really open up the charts, get the bulls excited, and cause more short covering.

Chicago March-23

KC March-23

Want to Talk?

Our phones are open 24/7 for you guys if you ever need anything or want to discuss your operation.

Hedge Account

Interested in a hedge account? Use the link below to set up an account or shoot Jeremey a call at (605)295-3100 or Wade at (605)870-0091

Check Out Past Updates

12/27/23

EFFECTS OF US DOLLAR COLLAPSE ON GRAINS & STRATEGIES TO CONSIDER

Read More

12/26/23

GETTING COMFORTABLE WITH ALL POSSIBILITIES

12/22/23

BEAN BASIS RECOMMENDATION TO TAKE BACK CONTROL FROM BIG AG

12/21/23

COMMODITIES ARE DIRT CHEAP VS STOCKS

12/20/23

ARE YOU COMFORTABLE WITH $3 CORN OR $6 CORN?

12/19/23

CORN FIGHTING NEW LOWS & BRAZIL RAINS

12/18/23

THIN HOLIDAY TRADE & BECOMING COMFORTABLE

12/15/23

NEXT WEEK WILL BE KEY

12/14/23

WHY WE DON’T SELL FEAR

12/13/23