GRAINS CRAWL BACK

Overview

Grains make a very impressive rally and bounce back from our lows. Initially it looked like were gonna get hammered again like we did yesterday with all grains trading down double digits, but we ultimately got a nice rally across the board aside from Minneapolis wheat.

As corn rallied 17 cents off its lows to end the day unchanged. Beans bounced nearly 30 cents off their lows. While Chicago ended 21 cents off it's low and KC 27 cents off it's low.

Minneapolis continued to see pressure due to the fast planting and overall good crop conditions for spring wheat. The US also bought some more wheat from Poland and Germant, which didn’t help the wheat market.

Initial pressure in the grains came from a few things. Demand has been pretty weak. Russia continues to hound the wheat market and sell cheap. Lastly, we have the China and covid situation which many people aren’t talking about. Basically, China is facing another covid break out which ultimately leads to them buying less and weakens their economics.

Overall, our markets were definitely oversold, especially considering the weather. We have seen nearly all of the rain across the corn belt continue to be removed from the forecasts. As the forecasts are getting hotter and more dry.

Mark Gold from Top Third said,

"This market reminds me of the 1983 market. Where despite a very hot and dry June, prices made their low on June 29th. The next day we had the crop report. It was hot and dry over the 4th of July weekend. Then the market exploded, and we rallied the beans $3 a bushel and the corn $1 a bushel."

In this morning's audio we said we thought grains had the chance to crawl back from those early lows. We also go over plenty of other factors as well as possible scenarios for our markets and more. If you missed it - Listen Here

The lows are getting very close to being made. Perhaps we make them tomorrow, or maybe it's not until next week. If we do get some follow through strength tomorrow, that would be a good indicator that the lows are in.

***

In case you missed it, Sunday's Weekly Newsletter

$3 or $12 Corn. Which Will Mother Nature Give Us? Read Here

Today's Main Takeaways

Corn

Corn manages to finish the day unchanged, after initially trading 17 cents lower at open.

Corn crop conditions came in at 69%, which was lower than the estimates of 71% and last year's 73%. We have been saying for the past few weeks that we think there is a solid chance that this is the highest number we see printed all year, that is if weather doesn't break and magically end the drought concerns.

For some years to compare, here are a few past years initial crop ratings. Keep in mind, not all of these come in at the same week every year.

Rated Good to Excellent %

2023 - 69%

2022 - 73%

2021 - 76%

2020 - 70%

2019 - 59%

2018 - 79%

2014 - 76%

2013 - 63%

2012 - 77%

We have compared this year to 2012 several times. But I again just wanted to take a look at the similarities between the two year's crop progress and conditions. If you notice, planting pace was fairly similar. Both were very fast planting years. In 2012 we saw an initial rating near 80% rated good to excellent, but that number was dropped to a little over 70%. Which means currently, our crops are in worse overall condition than that of 2012 at this same moment in time. After that, we saw small decreases until late June, then everything fell apart. Now I'm not saying this year is 2012. I am just pointing out the similarities, and if it does stay dry across the corn belt, we could ultimately be looking at a somewhat similar situation.

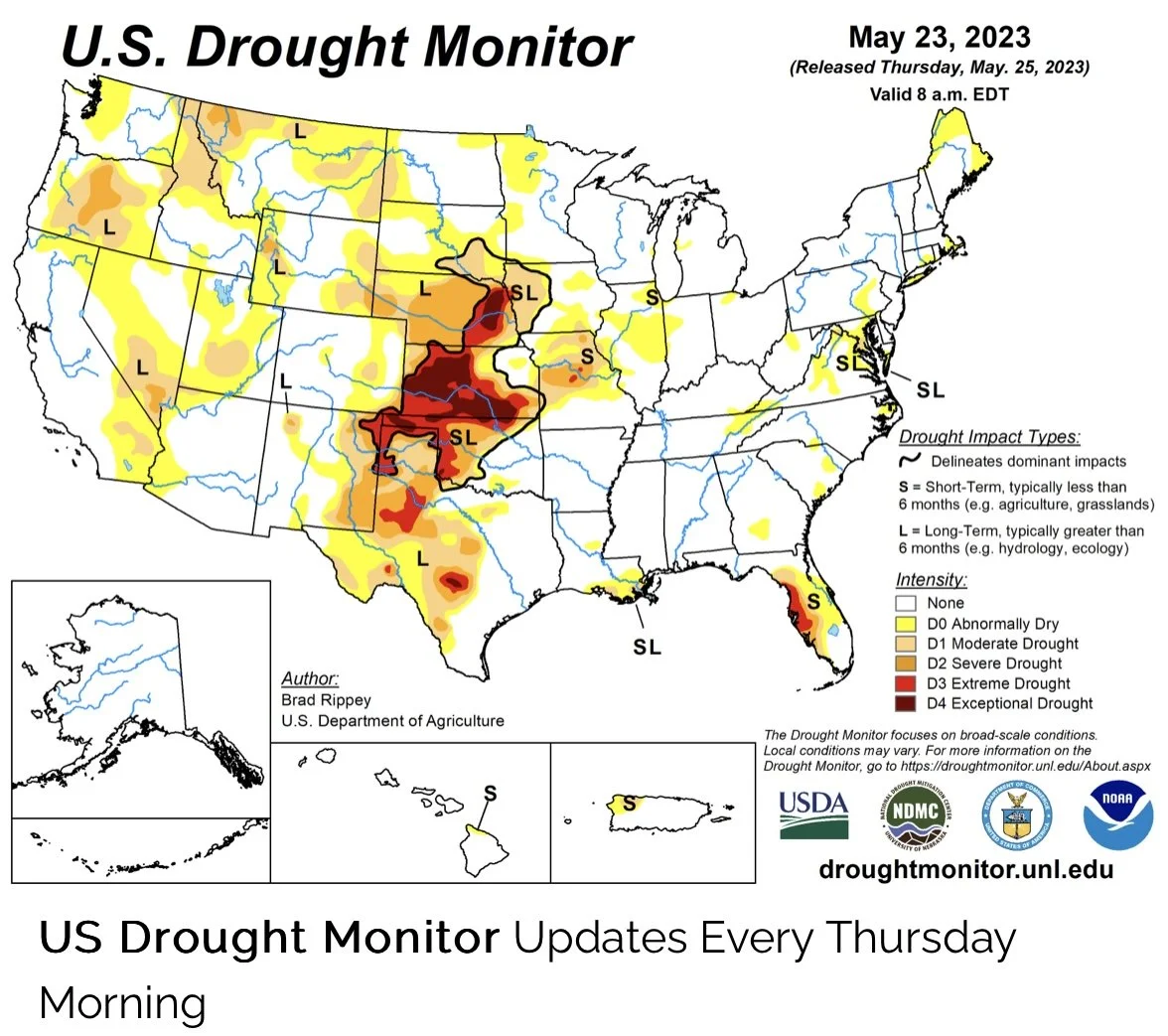

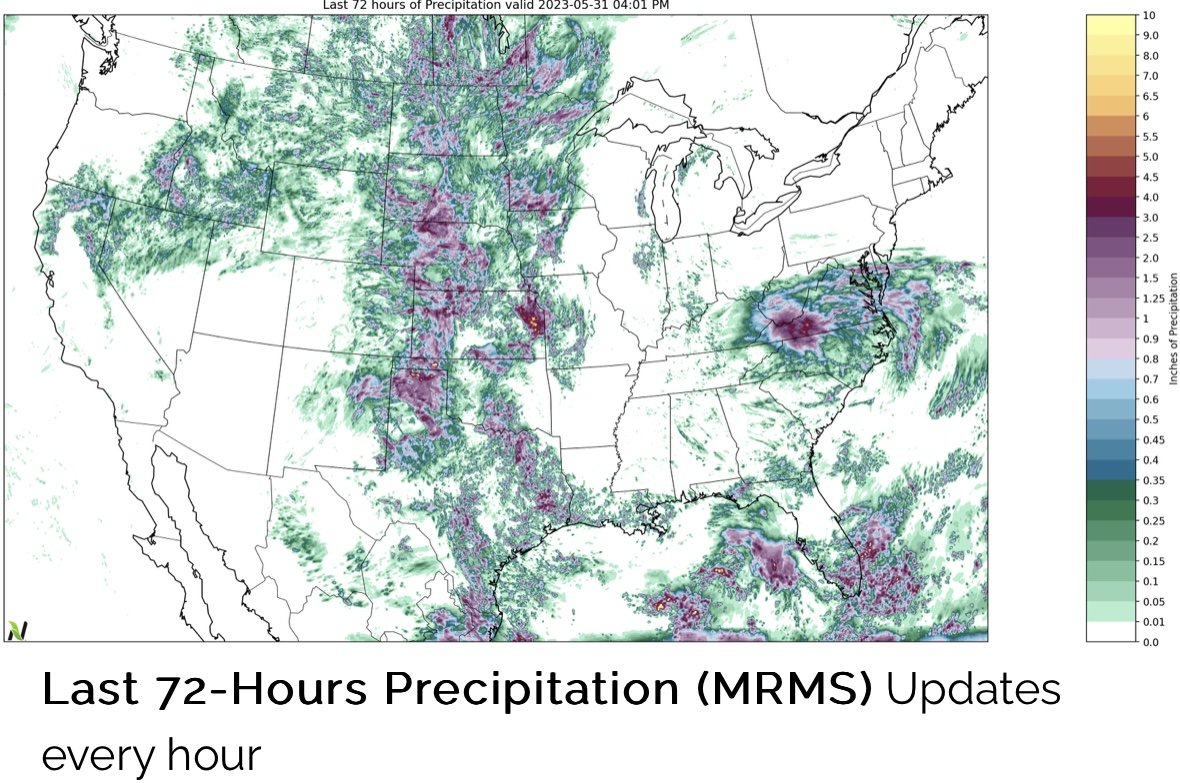

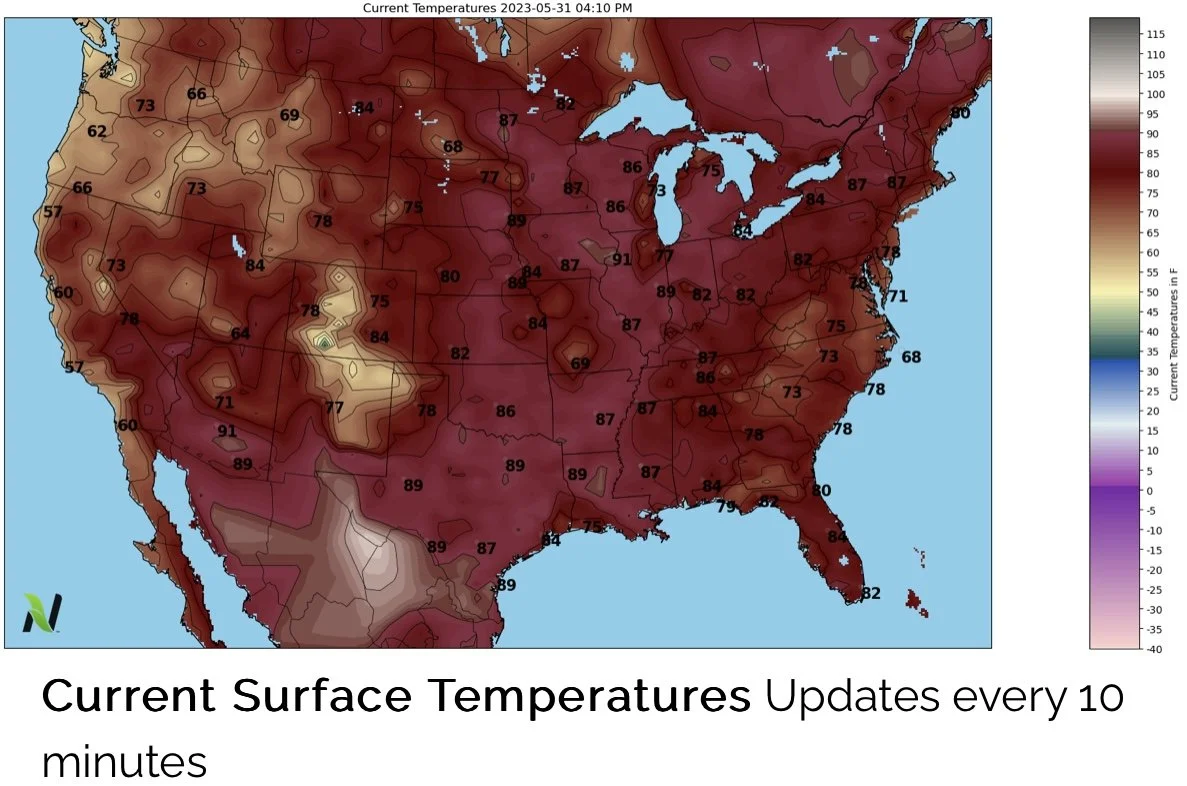

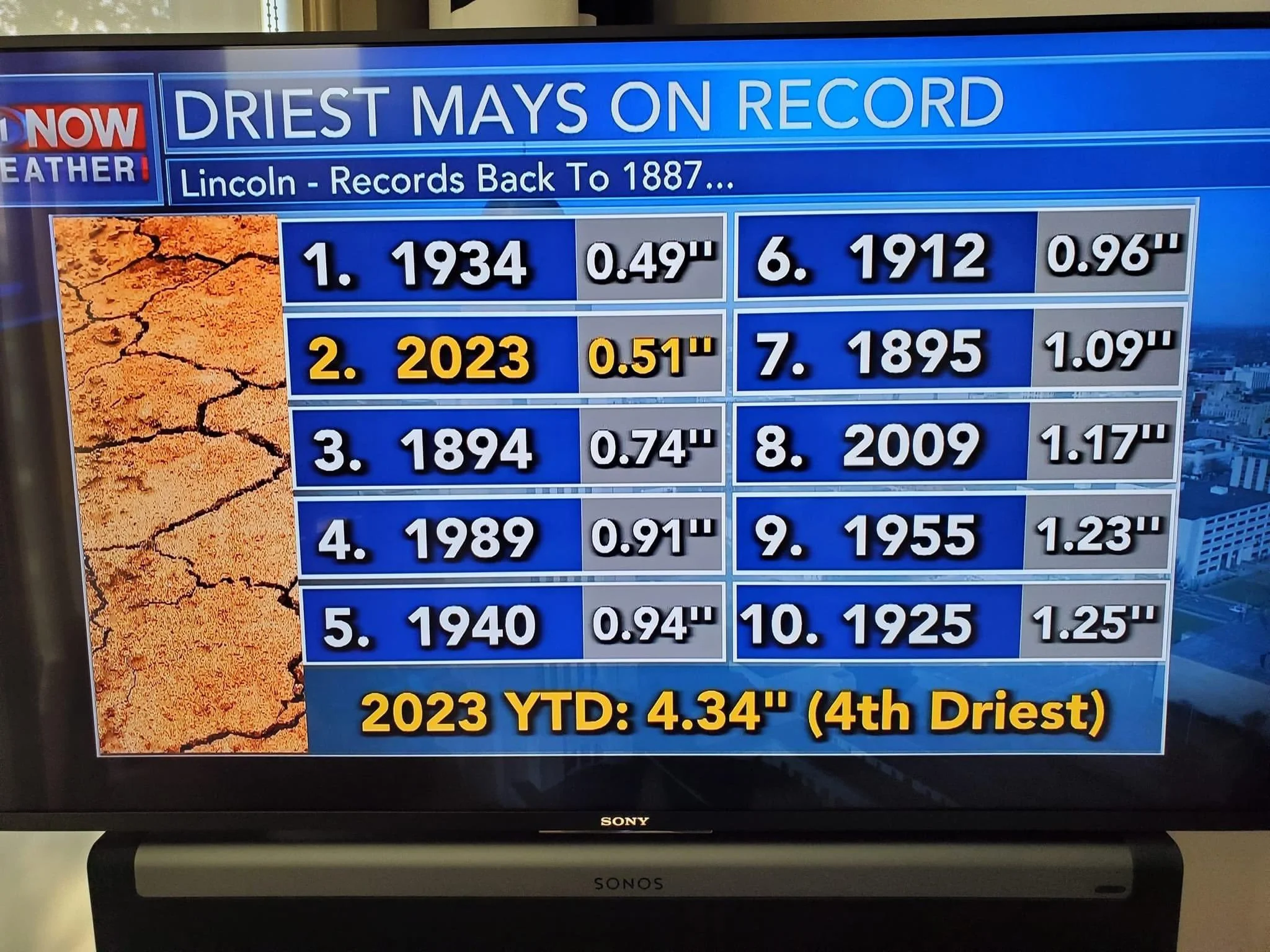

This April and May is one of the driest on record. The difference between this year and 2012 is that we are already much drier than we were at this same time. The biggest question is, do we continue to stay this dry throughout June?

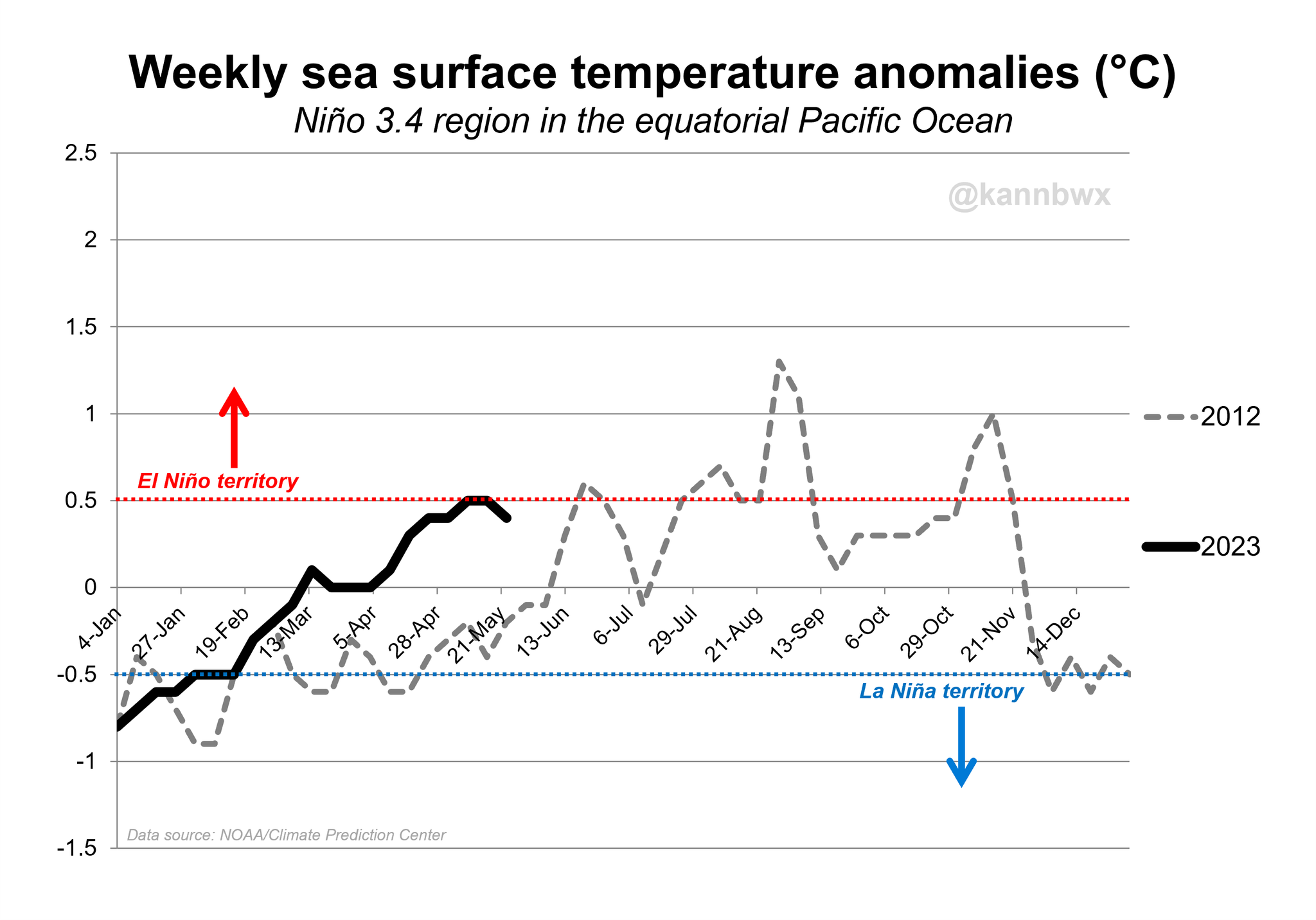

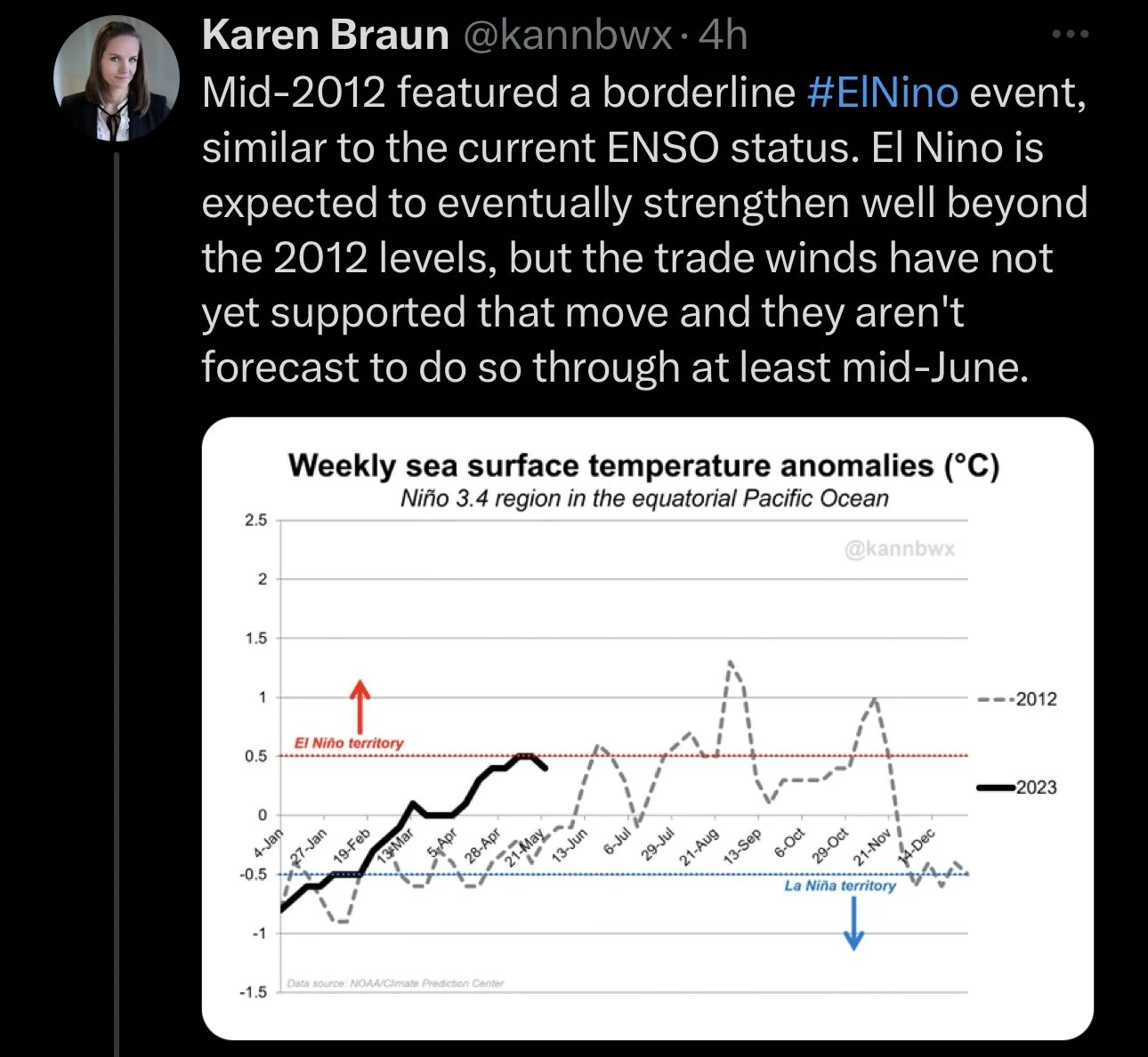

Here is a graph Karen Braun put together. It show cases the effects of El Nino and our sea surface temperatures. The current research suggests that El Nino is expected to strengthen well beyond that of 2012 levels. It also suggest that the trade winds won’t support that move until mid-June.

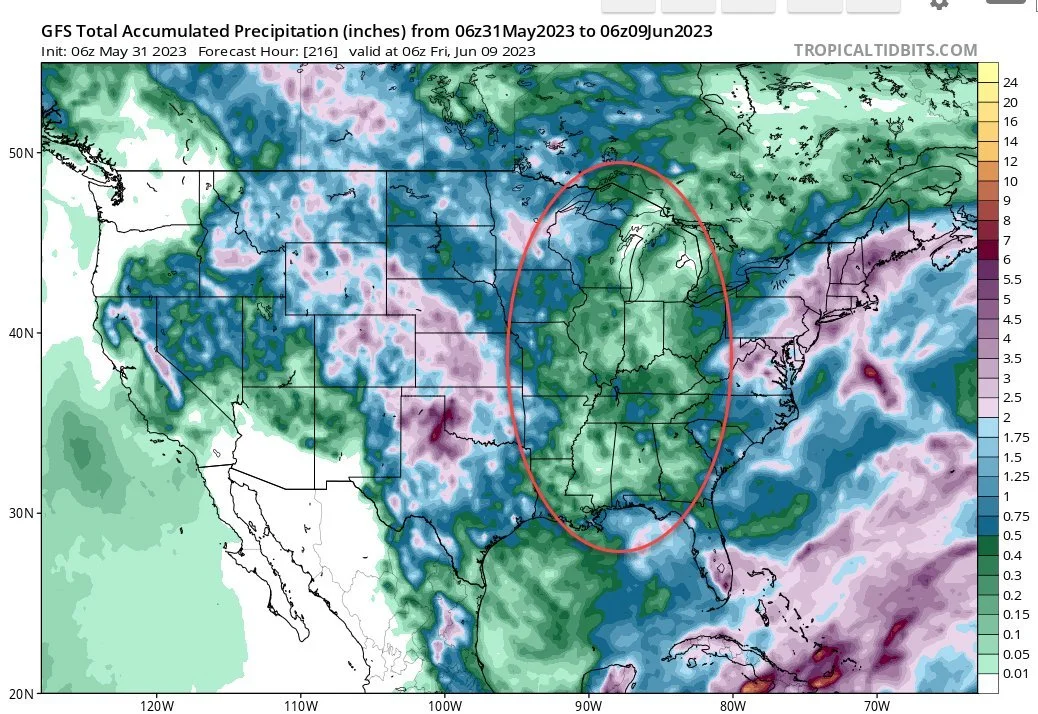

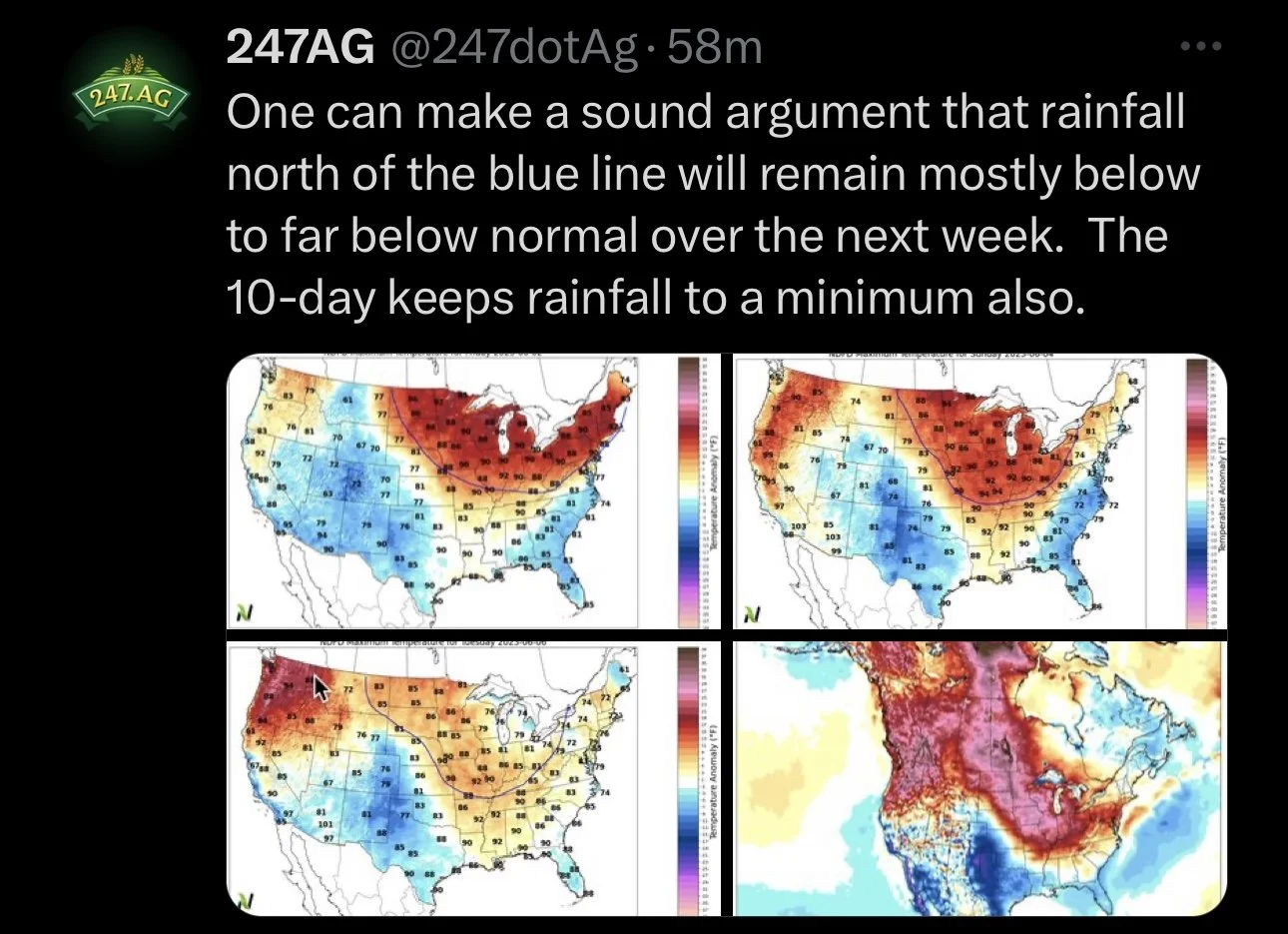

Taking a look at forecasts. It doesn’t look like we will be seeing any moisture relief in the next 10 days for the corn belt. This comes on the heels of the driest April and May in over 30 years.

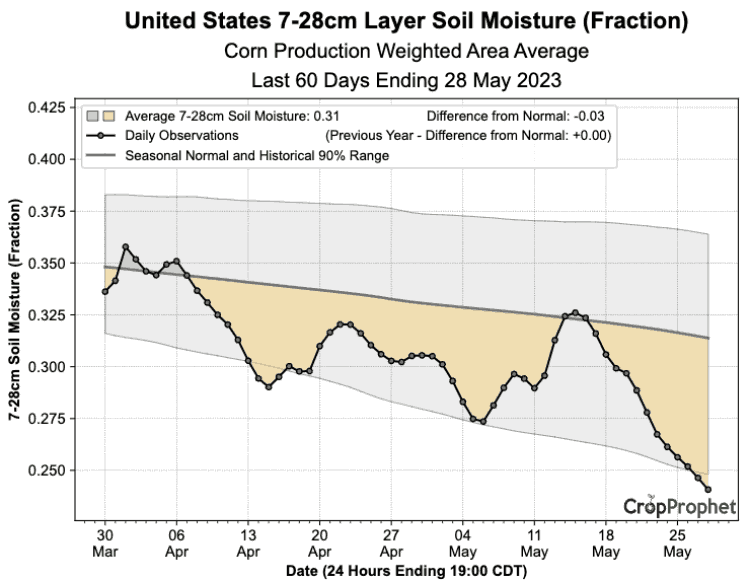

Just take a look at how rapid our soil moisture dropped over the course of May. If we don’t get some good rain, one could imagine we continue to see this drop at a fast decline.

Weather is really a wild card however. As one day they throw rains in the forecasts, the next day they take them out. Some weather gurus think we ultimately do get rain, some predict we won't. More often than not, it does seem like rains in the forecast start to disappear when we take a look at longer term forecasts. So personally I think weather is still bullish, and if it does indeed stay dry, this would push corn much higher. But we will have to wait and see just how dry it stays until mid-June.

With the initial crop conditions coming in worst than recent years, bears again question how well that 181.5 yield is going to hold up. If it stays dry with limited rain, 175 will become the new number of debate. I think the trade could already be anticipating a number closer to that range.

In the end it will all come down to weather. Does the corn belt receive or rain, or does it stay dry? That is too be determined, but it might already be drier than the trade realizes.

If we take a look at the continuous chart, the similarities between this year and 2012 tempt me to further debate the question.. Will history repeat?

Today’s price action wasn’t all that bad. Sure we closed unchanged. But that huge bounce from our lows was a good sign of strength. The funds are still incredibly short. A bigger weather scare could cause a rather large short covering. Are the lows in? It is tough to tell, but if i had to guess I'd predict a low within the next week or so if we haven’t already made them.

Corn July-23

Soybeans

Soybeans continue to bounce around near their recent lows. Initially beans were down 27 cents at open but managed to rally nearly 30 cents off their lows from last night and end the day 3 cents higher.

Bean planting also continues to keep it's hot start. Coming in at 83% planted vs last week's 66%. This is also well ahead of last year's 64% and the 5-year average of 65%.

China headlines have been pressuring beans, with uncertainty from the worlds largest soybean buyer. As there were rumors that China declined a meeting between the two nations defense chiefs at the annual security forum in Singapore. Additionally, as mentioned, China is now dealing with another covid break out which further creates demand uncertainty.

Brazil is still one of the biggest concerns for the bean market, as they still have that monster crop. But the biggest question there is how well can their logistics and labor handle exporting that record amount of beans. Which creates a potential wild card for down the road.

It appears that the trade and USDA are assuming ideal planting, a perfect growing season in the US, along with no logistical issues out of Brazil. Sure, these could all happen. But there is a ton of weather premium left to be built into the markets here, and an entire growing season ahead.

Is it really bearish that Brazilian soybeans are going to the US? Perhaps it means that the US simply doesn’t have enough supply.

Funds have continued to recently pressured beans, as of last Friday they were still holding a tiny net long position. They are now projected to be short.

As for the effect of weather and forecasts, it is a similar story to corn. Forecasts are somewhat of a mixed bag, but ultimately I see them as bullish. Remember, the weather for the next month will more directly effect corn rather than that of beans. That is because typically, our July weather makes or breaks the corn crop. While August weather makes or breaks the bean crop.

So short term, I wouldn’t be surprised to see beans trail behind corn if corn gets this massive bull run. but nonetheless, should still be well supported. The bean market is definitely oversold here, so we will have to see what the funds decide to do. Looking long term, our fundamentals are very bullish, and I think there is a deeper demand story brewing in the bean market. Just how long it takes for that story to develop is the real question.

Taking a look at the chart, on today’s rebound. We are now right back at support, as that potential double bottom is still in play.

Soybeans July-23

Wheat

Wheat futures continue to get slapped around. Chicago continues to make new lows. Today we did see Chicago and KC both make an impressive run up from our lows. Minnesota on the other hand couldn't over come the pressure, and closed down 13 cents near it's lows.

The main thing pressuring wheat is Russia. As their wheat continues to get cheap, further creating more global competition. As global buyers struggle with demand and higher interest rates.

We also saw crop conditions improve in yesterday’s report. As winter wheat came in at 34% rated good to excellent, which was higher than the trade's estimate of 32% and last week's 31%. The poor to very poor rating also saw a pretty good dropped, as it decreased from 40% rated poor to just 35%.

The biggest improvement was seen in Oklahoma. As their good to excellent rating jumped from 10% to 30%. On the other hand we saw Nebraska drop 7% down to 25%, while Kansas remained unchanged at just a mere 10% rated in good condition.

Spring wheat planting continues to roll along at a fast pace. Coming in at 85% complete, which was higher than the trades estimate of 82% and a big jump from last week's 64% and last year's 70%. But is right on par with the 5-year average.

So essentially, the improved crop and Russia have been the main driving force on these lower prices.

Bulls however do continue to make the argument that we could see Russia opt to not extend the Black Sea agreement. As rumors are stating they are more likely to not extend it than they are to agree to another extension. But who knows what Russia is thinking.

A headline I haven’t seen hardly anyone talk about is the flooding in China. As a large part of their wheat crop in key growing regions were hit by torrential rains and floods at the start of harvest. Keep in mind, China was expecting a bumper crop. But sources are saying that China is doing everything they can to save the wheat crop.

Bulls also continue to point at the dryness in parts of Russia, Canada, and Australia.

Going forward, I do think we will eventually see a bullish catalyst to push wheat out of this slump. But is a very difficult task to pick a bottom.

Chicago July-23

KC July-23

MPLS July-23

From Wright on the Market,

"Good afternoon Roger,

You haven't said much about USA weather lately. Here in southeast Iowa it feels more like June 30th than May 30th. No humidity at all this past Memorial Day weekend which is so odd for us. It's super dry here and hasn't rained in two weeks and nothing at all on the extended forecast. Yards are even starting to go dormant and turn brown already. Never seen it so dry this time of the year. The early crops look good but a lot of population issues in corn and beans locally are to dryness and one 2.5 inch pounding rain crusting everything over and not raining since. It's not looking good around here at all right now. It will be interesting to see how this turns out. Beans planted last week to get guys finished up around here was probably a waste because they won't come up until we get some rain."

Thank you, Brandon!

The Bottom Line

From Farms.com Risk Management,

After a decent start to the year, U.S. grain export demand fizzled out once demand started shifting to the 2022/23 Brazilian record soybean crop and then to the corn crop as they usually get booked during the spring/summer. Although Argentina’s crops were decimated by drought and heat, Brazil’s record soybean crop was offsetting some of that shortfall. Chinese buying, which has become crucial in supporting U.S. grain demand in recent years, did register some big sales numbers in the early part of the year. But in the second quarter, there were more cancellations from China of U.S. grain business as their economy was sputtering. China this year is suspected of trying to “challenge the world order” as we know it by diversifying their purchases to other countries, like buying corn from South Africa.

The negative developments in terms of Ag demand from China are not the farmer’s friend. Lower domestic prices of corn & soybeans in China this year is having ripple effects as it dampens demand & eventually weighs on US corn & soybean futures.

But in reality, China is such a wildcard that the near-term doom & gloom emanating from the country due to their economic concerns, new COVID XBB variant outbreak, & their intention to diversify away from the US Ag, & be self-sufficient could flip on its head. It could take time though as global economic malaise affects all. The truth is that China is so big, with a huge 1.2+ billion population that includes a large proportion of strong purchasing power components, that they cannot do away with Ag imports and the US & Canada are among the most surefooted Ag exporters. China needs these commodities from North America. Their push to cultivate more soybean acres has its limits, given that China is a country that has got its acreage maxed out. Where is it going to get the extra acreage?

China’s wheat substitution for corn & soy meal had made the top of headlines. But China's central Henan province has experienced heavy rainfall, leading to the flooding of wheat fields shortly before the harvest. This situation has resulted in increased wheat prices and raised concerns regarding the quality of this year's crop in China.

An upside change in price direction will not be dredged by demand short term but rather by a supply hiccup due to weather.

Maps Showcasing Drought

Hedging Account

No matter the situation you are in, our partners at Banghart Properties Grain Marketing can help you come up with a plan of attack to help you manage your risk. If you want help managing your risk you can give them a call anytime at (605) 295-3100 or set up a hedge account below.

Check Out Past Updates

5/31/23 - Audio

Are Markets Overdone to Downside?

5/30/23 - Audio

Is There Opportunity In Today’s Sell Off?

5/28/23 - Weekly Grain Newsletter

$12 or $3 Corn? Which Will Mother Nature Give Us?

5/26/23 - Audio

Volatile Markets Ahead of Memorial Day

5/25/23 - Market Update

4th Day of Gains in Corn

5/24/23 - Audio

Are You Prepared If We Tank or Rally?

5/23/23 - Market Update