GRAINS LOWER WITH LACK OF NEWS

Overview

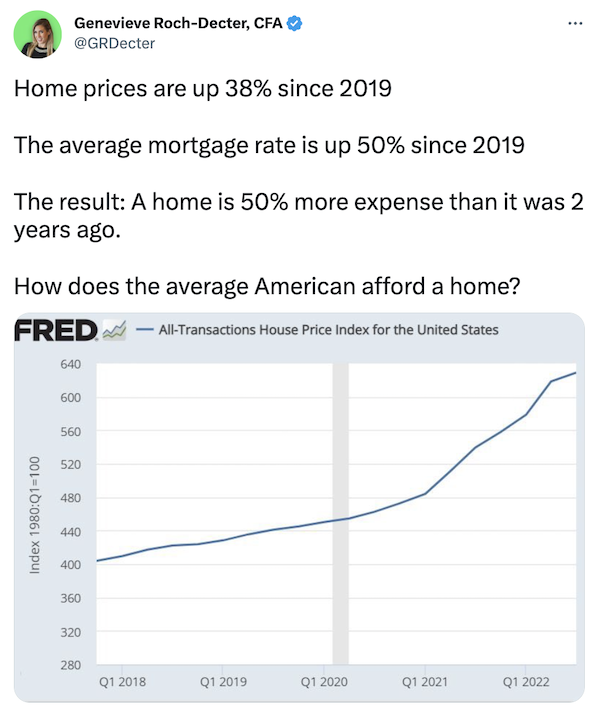

Markets lacking fresh news to chew on today. Looks like just a risk off day with grains lower across the board and a little continuation weakness from yesterday. Grains, energies, and metals all trading lower.

South America forecasts looking a little more cooperative this week which has beans under pressure. But Argentina weather looks pretty dry the rest of the month. Markets also continue to debate global demand, as demand for U.S. supply is a lacking area.

Things to look out for going forward; South America forecasts, Russia & Ukraine headlines, and China.

Listen to yesterday’s audio on why we think we will see higher prices come spring and summer. Listen Here

Today's Main Takeaways

Corn

Corn continues to chop around, trading lower again here today in a fairly tight range. Only trading as high as half a cent higher than the opening price.

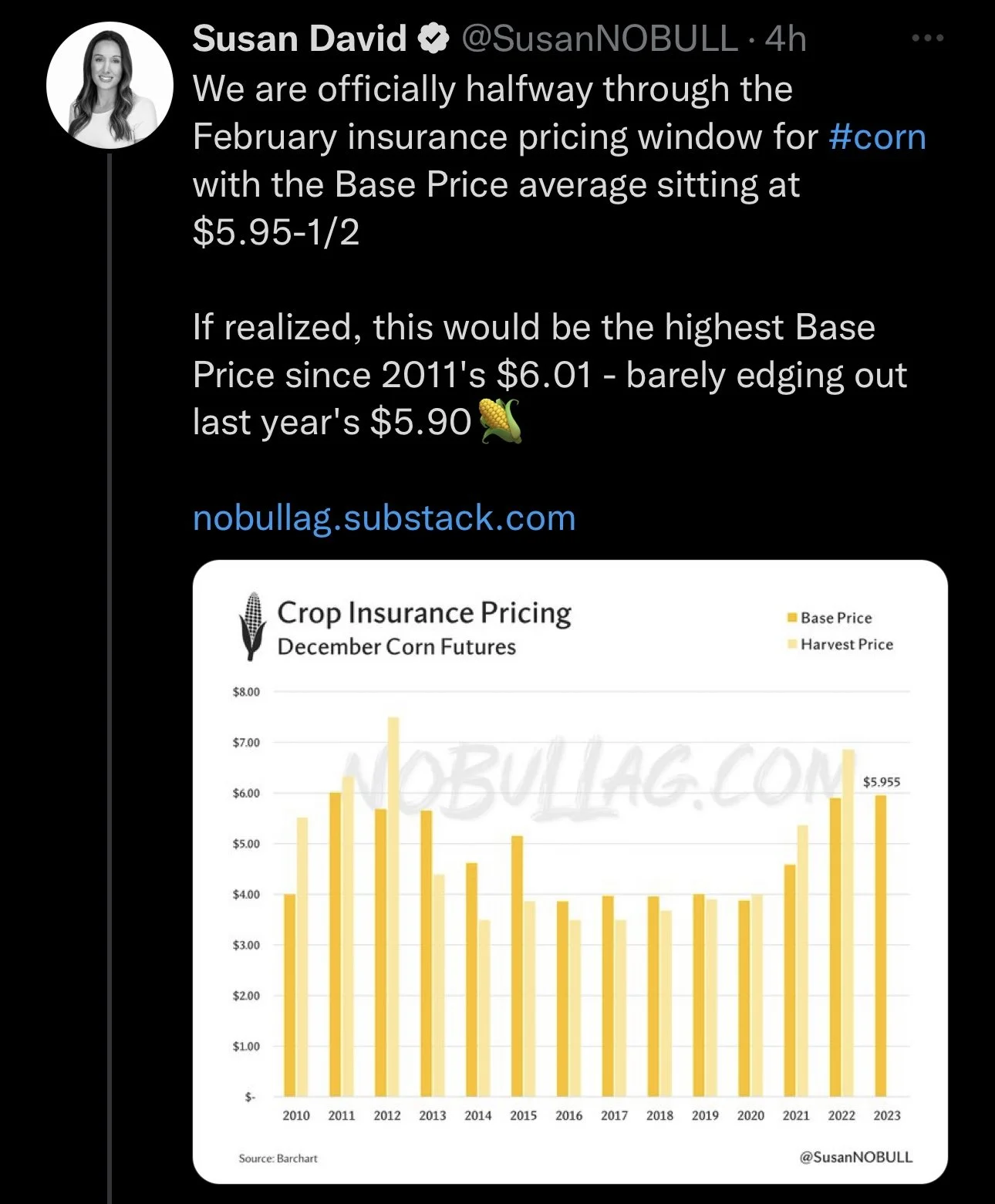

The biggest debate surrounding corn and the rest of the grains is the demand story. As demand surrounding exports, ethanol, and feed are all in question. Acres will also start becoming a larger topic of discussion going forward.

One thing we saw supporting the corn market is that Mexico is going to allow GMO corn for feed use.

Looking short term, corn would like to see better export sales, as that could possible help bump futures higher. Taking a look at the bigger long term picture, bulls can’t ignore just how poor Argentina's crop will be, which should continue to add support going forward. We also still have Brazil planting running behind pace which could cause problems down the road.

Bulls also continue to debate that we see the USDA walk back their Argentina and Brazil production forecasts and see reductions. The argument is looking like most think we need to see an additional -2 to -4 million metric ton cut to both estimates with Argentina expected to get the biggest reduction going forward. If South American weather continues to throw curve balls and sees problems those cuts could be even larger.

Headlines from Ukraine and Russia should also continue to add additional support to both the corn and wheat market. Most are expecting the grain deal to get renewed, but there is that slim chance it doesn’t.

Taking a glance at the charts, corn bumps off its resistance for the third time. Creating a possible triple top, as the $6.85 remains a very difficult resistance. Perhaps we continue to chop around like we have until the trade gets a better grasp on South America production numbers and U.S. planted acres. Short term I wouldn’t be surprised to see more red, but looking into the future. I think we could easily climb into the $7 to $7.50 range come May.

Corn March-23

Soybeans

Soybeans join the rest of the markets lower here today. We did have an okay close though, as we closed nearly a dime off our lows.

Beans under some pressure here today with northern Brazil drying out a bit. Opening up the potential for them to get a lost of harvest done. Additionally southern Brazil, which is the area that’s in need of rain is expected to get some. So overall Brazilian weather adding pressure to beans on this risk off day across the grains.

Nonetheless, bulls keep looking at Argentina. As Argentina weather and supply concerns are what has drove this meal market as Argentina is the worlds leading exporter. Similar to corn, most suggest the USDA still has some work to do in cutting its South America production estimates, with Argentina expected to see large cuts going forward with Brazil perhaps seeing some small ones.

Some think we might see the USDA raise its U.S. export estimates if Argnetina keeps importing beans from Brazil and we see China as a bigger buyer in the market come spring.

Ultimately, bulls would like to see an increase in Chinese demand to go along with some more production and weather concerns over in South America.

Short term, my concern is meal. Following its recent rally to decade highs, I just can’t help but wonder if we see funds take advantage of this. But they of course could continue to be buyers and keep pushing this thing higher.

Soybeans March-23

Soymeal

Soymeal March-23

Wheat

Wheat getting hit the hardest amongst the grains today, losing anywhere form 8 to 17 cents. Weakness here isn't a total surprise following our recent rally.

One negative thing that hit headlines was rumors that India is forecasting a record crop over 112 million metric tons or so. Where as the USDA currently has their estimate set at 103 million. So we will have to see if these sources are right and we see an increase in India production, and if so how high does the USDA raise their number.

Bears are also looking to add onto that with a record crop expected out of both Australia and Russia. But some suggest Russia's numbers might be slightly over optimistic.

Even with these expected large crops, bulls continue to point at war headlines. A few weeks ago when the announcement was made that Russia was planning an attack, sources said it would happen February 15th, which is today. So we will have to keep an eye on what Russia does and if we get any news the next couple of days. As this is definitely something that could push us a lot higher.

We also have rumors that Russia doesn't want to extend the grain corridor agreement. Most including myself think that we do eventually see them renew the deal, but even just the thought of this happening might scare more shorts in the market.

Weather here in the U.S. is turning slightly favorable looking at forecasts. But we cant ignore the fact that two thirds of the U.S. growing regions are experiencing drought and we have some of the worst crop conditions we’ve seen in a long time. The real question is what happens if the severe drought in the central plains intensifies this spring? And we can’t forget just how short the funds are.

Even with the lower prices here today, I fully expect wheat to keep gaining strength with all the potential bullish headlines in the deck. Now this might not happen tomorrow or even next week, but I think the first couple weeks of March and heading into spring we could plenty of see strength.

Taking a look at the charts, on today's lower prices we went down and tested our February uptrend. Hopefully we can a bounce at the trendline and keep seeing upward momentum.

Chicago March-23

KC March-23

MPLS March-23

NOPA Crush Report

January soybean crush lower than expected

179.007 M/bu vs 181.66 M/bu expected

-1.8% vs last year

January soybean oil stocks lower than expected

1.829 B/lbs vs expected 1.906 B/lbs

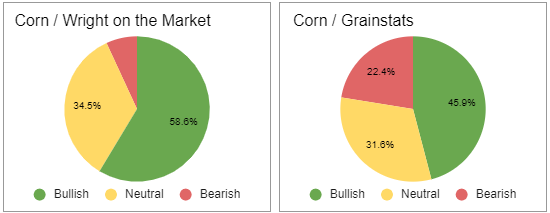

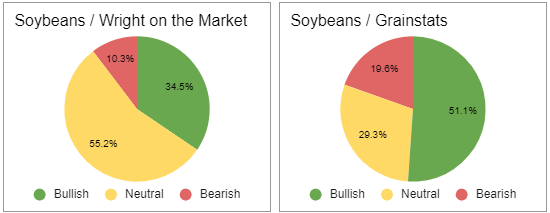

Bullish vs Bearish

The following charts are voted on by GrainStats & Wright on the Markets audiences

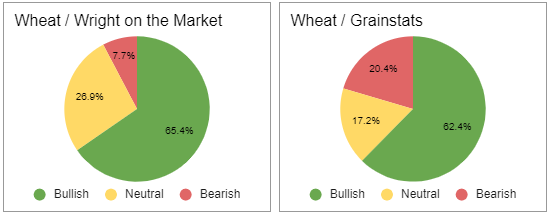

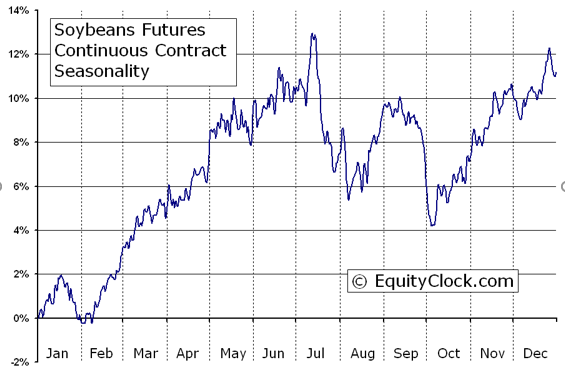

Seasonal Charts

As you can see from the charts below, corn and beans typically make their highs come spring and summer. Will this year follow the trend?

Highlights & News

Farmers in Ukraine are facing fertilizer shortages. A lack of this could sharply reduce their harvest.

Agroconsult cut their Brazil soybean estimate. Lowering their number by 400,000 metric tons to 153 million.

Ohio train explosion was right next to the Ohio river, which is the third largest river by discharge volume and flows directly into the Mississippi. This could impact thousands of farms according to Market Rebellion.

President Biden announced another 26 million barrels will be released from Strategic Petroleum Reserve as Russia cuts production.

Livestock

Live Cattle down -0.075 to 164.600

Feeder Cattle up +0.675 to 187.325

Feeder Cattle

Live Cattle

South America Weather

Argentina 4-7 Precipitation

Argentina 8-15 Precipitation

Argentina 15-Day Percent of Normal Precipitation Forecast

Brazil 8-15 Precipitation

Social Media

U.S. Weather

Source: National Weather Service