GRAINS RALLY OFF LOWS

Overview

Solid day for the grains. Sure, while wheat rallied, corn and beans only closed up 1/4 to 1/2 a cent. But the charts look fairly strong, and I think we had an great close. We made higher lows following some key reversal patterns, and all the grains managed to close in the green despite corn and beans struggling early on. As they were both trading down double digits early on. We will have to see if we get some continuation strength to close out the week.

Wheat continues some strength from yesterday's massive rally. There were a few reasons for the sudden surge. First off, the obvious one was a war headline that bulls had been patiently waiting for. As Russia claims Ukraine tried to assassinate Putin with drone attacks. I'm not so sure that the funds want to be holding as big of a short position as they are over the weekend with the possibility for further escalation. But secondly, and perhaps more impactful we had terrible results from the Oklahoma crop tours. Where it showed the crop to be 50% of normal. These poor results have some questioning just how bad Kansas’s crop tour might be later this month.

Export sales this morning came in poor for corn. With their first weekly net cancellation during April for more than 20 years, as China cut 563k tons from its books. Wheat on the other hand came in somewhat strong, on the high end of the trade range.

***

Sunday's Weekly Grain Newsletter

Why We Will Thank Market For Lower Prices

Read Here

Today's Main Takeaways

Corn

July corn manages to close slightly in the green today at $5.89 but impressively rallied back from our overnight lows of $5.79 as we closed a dime off our lows.

Following wheat higher yesterday, corn also saw support from the entire Russia and Putin assassination and drone attack headlines. The news led to the funds liquidating a few of their new short positions they had recently added. The funds weren’t remotely close to being as short in corn as they were in wheat, thus the we didn’t see as big of a short covering rally as we did in corn.

As for the entire situation in the Black Sea, nobody really knows what is next. Bulls are hoping we get some more headlines to further support us here. As there is rising concerns that we might not see the agreement extended after all.

As mentioned, we this morning we got negative export sales which pressured corn. As we had the first weekly net cancellation in April in more than 20 years. I think the market has essentially priced in these cancellations already.

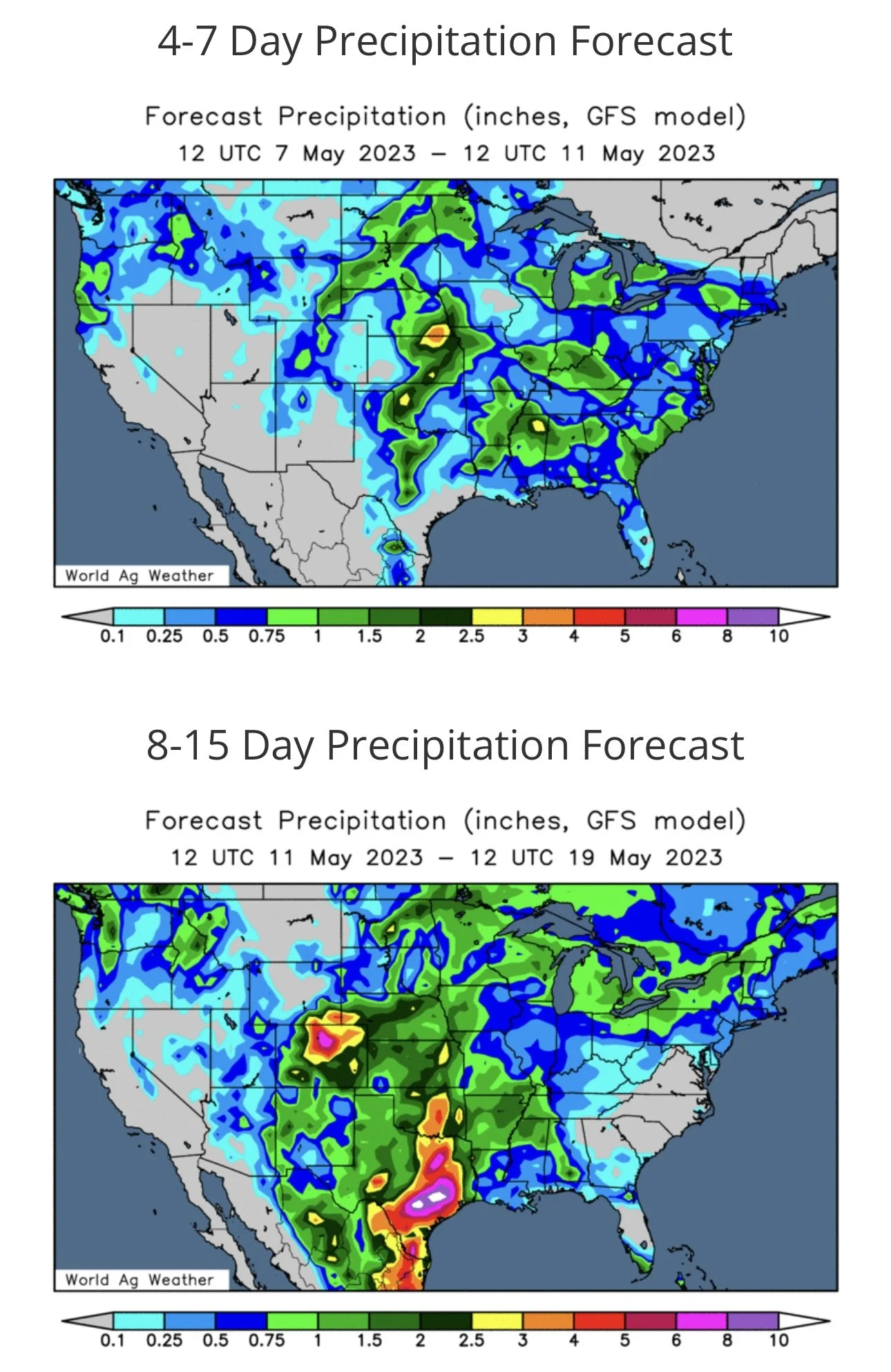

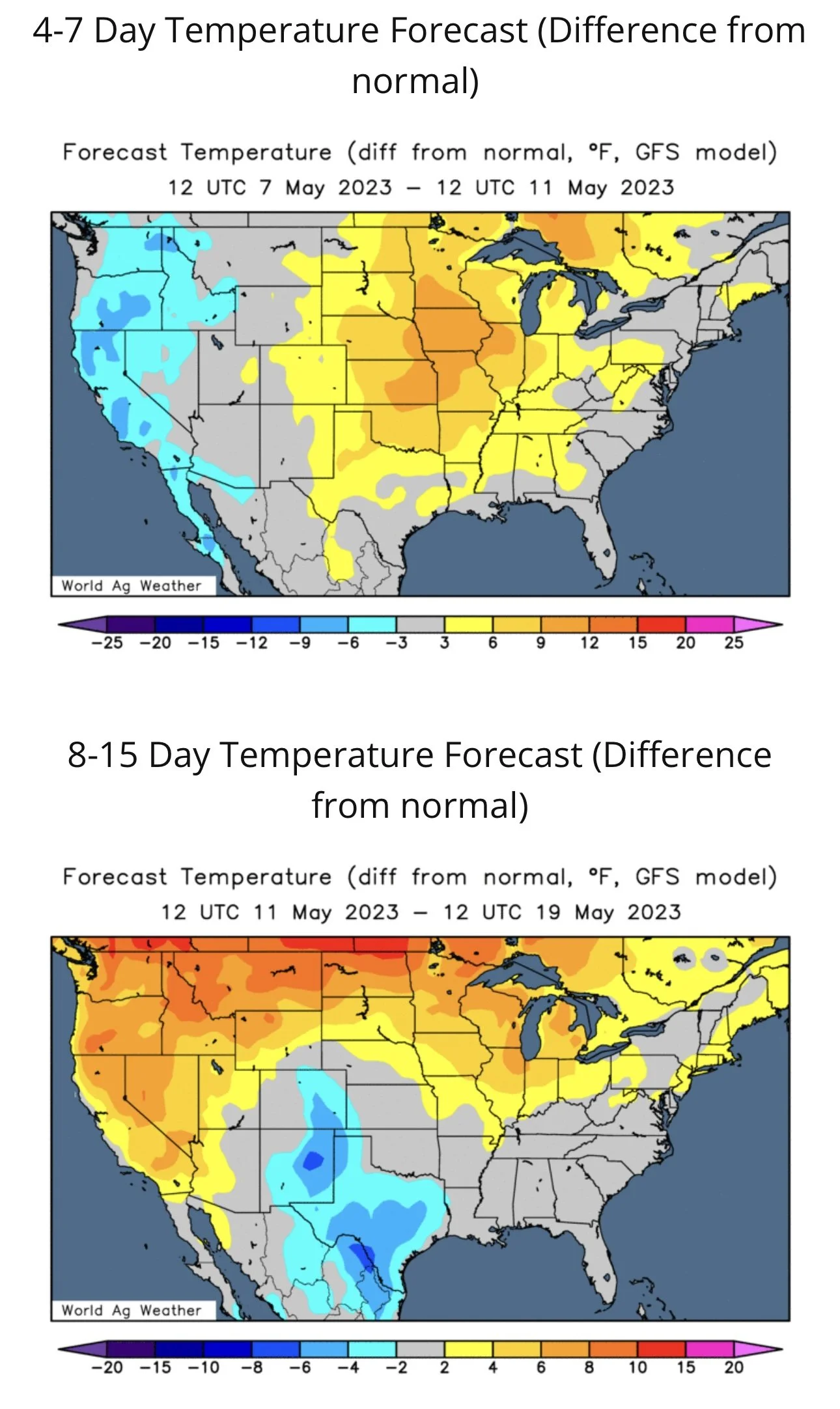

Taking a look at forecasts, we should be getting a pretty good window for planting, but there is some wetter conditions looking forward.

Going forward, the themes are going to be weather and war. If you scroll towards the end of today’s write up we dive deeper into the drought and lack of soil moisture situation and how this could have a bullish effect going forward.

Our stance remains the same. I’m not sure if the past two days was necessarily the end of the bleeding. We made a pretty nice reversal on the charts, but then again I could see us looking at additional pressure short term given the fast start to planting. But I still look we will look to make our lows towards the end of the month if we haven’t already, before getting that rally we have been talking about for some time.

Corn July-23

Soybeans

July beans also close just higher by 1/4 of a cent, while the new crop saw some pressure. However, similar to corn we saw July beans get a nice bounce from our early lows. As they managed to close nearly 13 cents off our early lows.

Beans found the least support from the war headlines but the moves in corn and wheat were enough to help pull beans higher along with the rest of the markets.

The number one thing bears continue to point at is Brazil. As their record crop is just wrapping up harvest, while their prices continue to be offered at a lot cheaper discount than that of the US.

We of course have the massive losses in Argentina's crop, but bears are quick to point out that Brazil's record crop makes up for these losses. Witht he logistic issues Brazil faces with actually getting their crop out of the country, I think the problems in Argentina could ultimately lead to some more complications in the months ahead.

Taking a look at planting, we are off to a ready fast start. But looking forward we could definitely run into some delays with cooler wetter forecasts scheduled.

I think one of the biggest things that could help push beans higher is a greater demand story. Because right now we just don’t have that weather driven story for bulls to piggy back off of. Perhaps we do get one in the future, but right now we just don’t have one.

Looking long term, our fundamentals are still very bullish and we expect prices higher long term. Could it be a long battle to the top? It definitely could be. I think we have the possibility for a demand driven story to develop down the line.

Taking a look at the chart, we are still holding that uptrend support line from June. To confirm a breakout and retest previous highs, bulls would first like to break this short term downtrend and perhaps test our near term moving averages.

Soybeans July-23

Wheat

Wheat futures strong here again today's following yesterday's massive surge in all classes of wheat. Where we saw KC futures trading 40 to 50 plus cents higher.

Today’s price action wasn’t quite as strong but still provided bulls some relief. The main headlines surrounding wheat and the reason for the recent strength is of course the three W's; weather, war, and wealth.

Chicago closed up over a nickel and was 16 cents off its lows. While KC closed up 13 cents with an impressive 30 cent bounce off its lows. Minneapolis was also 24 cents off its lows, closing up 8 1/2 cents.

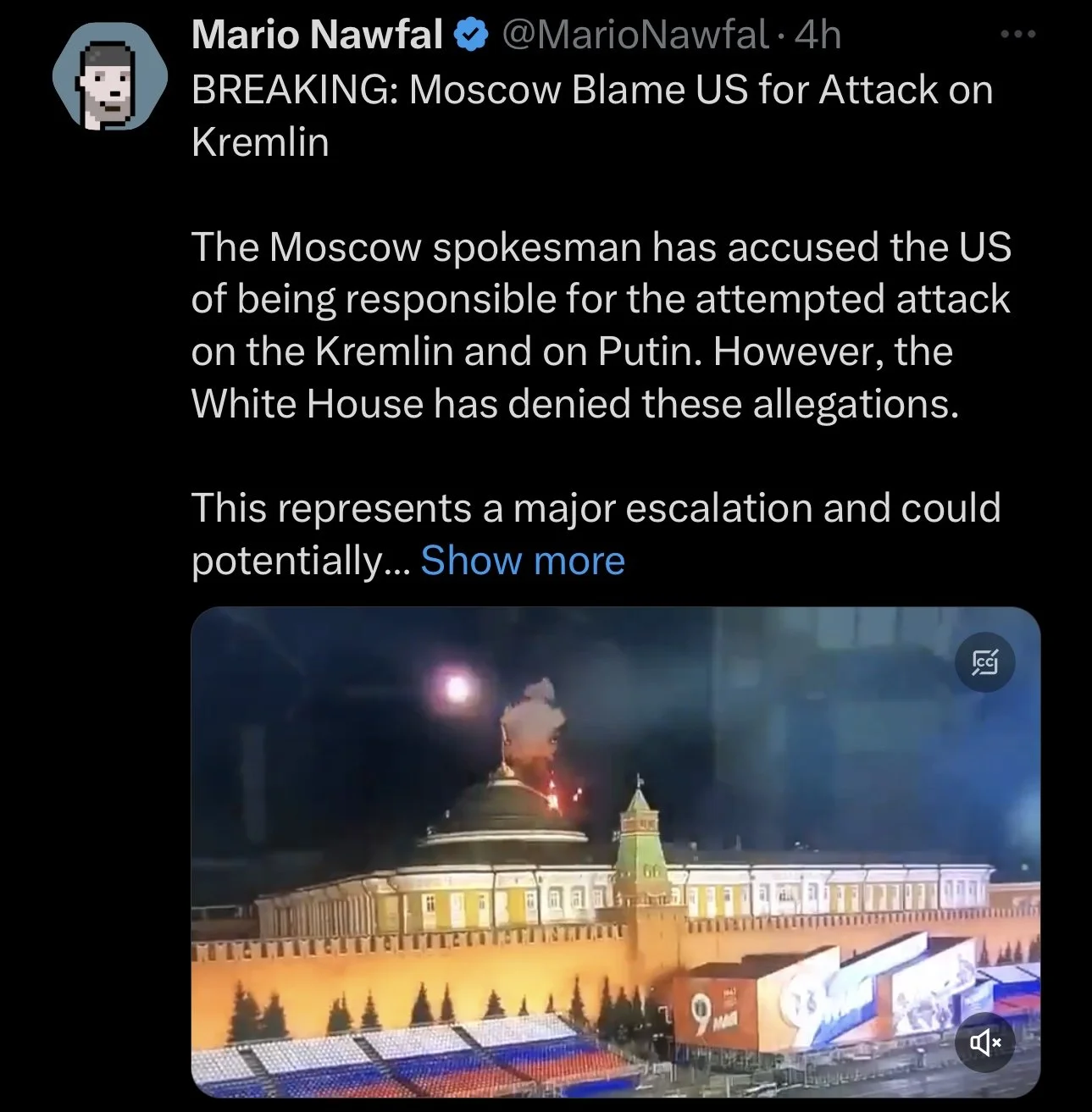

As mentioned, news broke out that Ukraine attempted to assassinate Putin, or so Russia claims. We had video footage on the internet of the drone attacks on Kremlin. Did Ukraine actually try to do that or is Russia just causing chaos? Nobody really knows. But any war escalation such as this is bullish to the wheat market.

The first day of talk to extend the Black Sea agreement made no progress yesterday, with no indications of an agreement. The deal is set to expire May 18th.

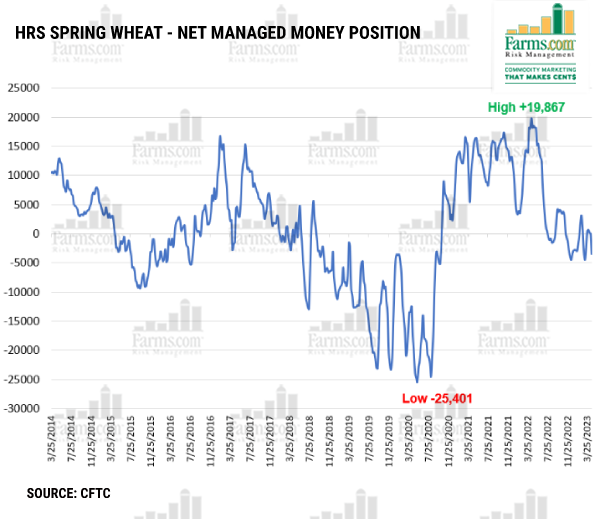

Funds were heavily short heading into the rally yesterday. Bulls such as myself were waiting for that one bullish catalyst to catch the funds off guard, and we finally not one, but two catalysts.

But as for the funds, based on open interest yesterday, it doesn’t look like the funds have actually covered that many shorts on yesterday's rally. With funds being short well over 100k contracts, it just tells you how large the rally will be if or when they decide to actually cover this massive short position. Perhaps yesterday opened some eyes.

Now for the crop tours in Oklahoma. These tours showed the crop to be 50% of normal and are predicting the smallest crop since 1955.

Kansas is set to grow the smallest crop in 24 years, and it’s even more impressive when we realize that they planted the most wheat acres since 2016.

I think when these crop tours get rolling later this month the trade will begin to realize just how poor of a wheat crop we have. Was this 2-day rally the bottom? It’s tough to say. But long term I think we still have a ton of upside. We made a key reversal on the chart, and one has to imagine what type of rally we could see if the funds did decide to jump ship on their massive short position.

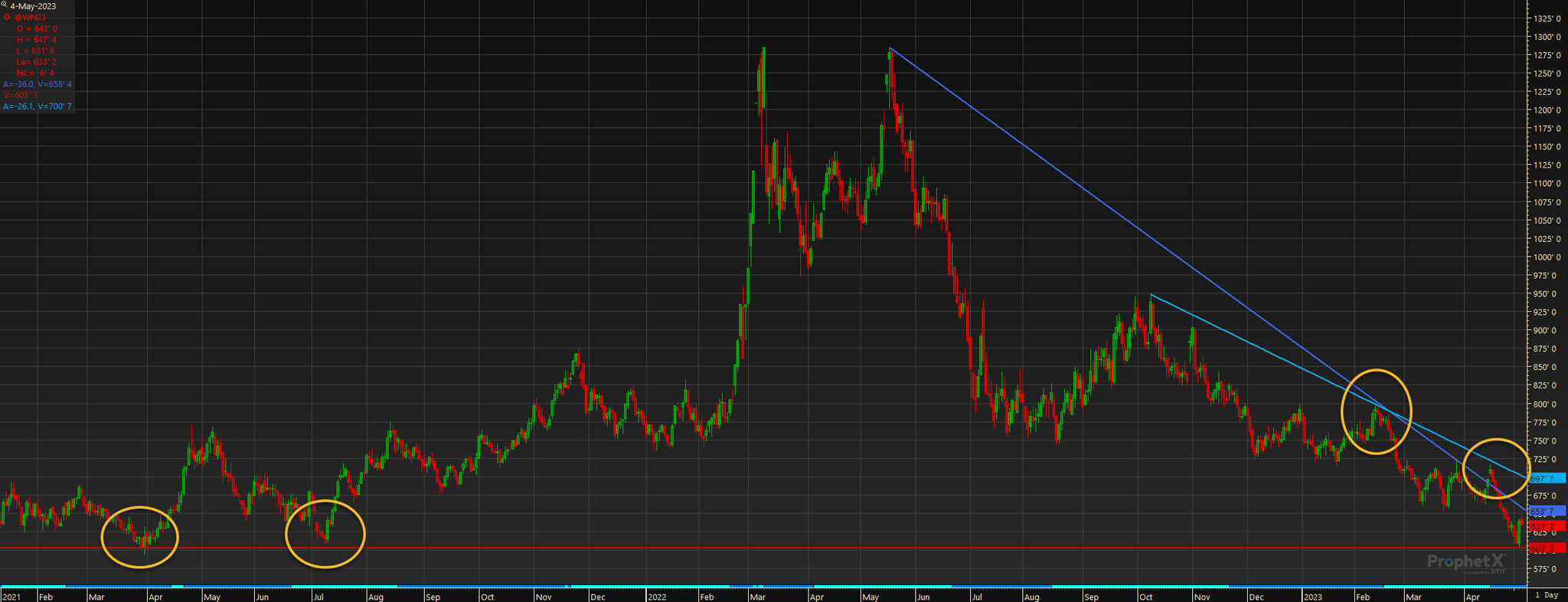

If you scroll towards the end of today’s write up, I included a chart that showcases how we made a key yearly reversal on the charts and are flirting with a break out.

Chicago July-23

KC July-23

MPLS July-23

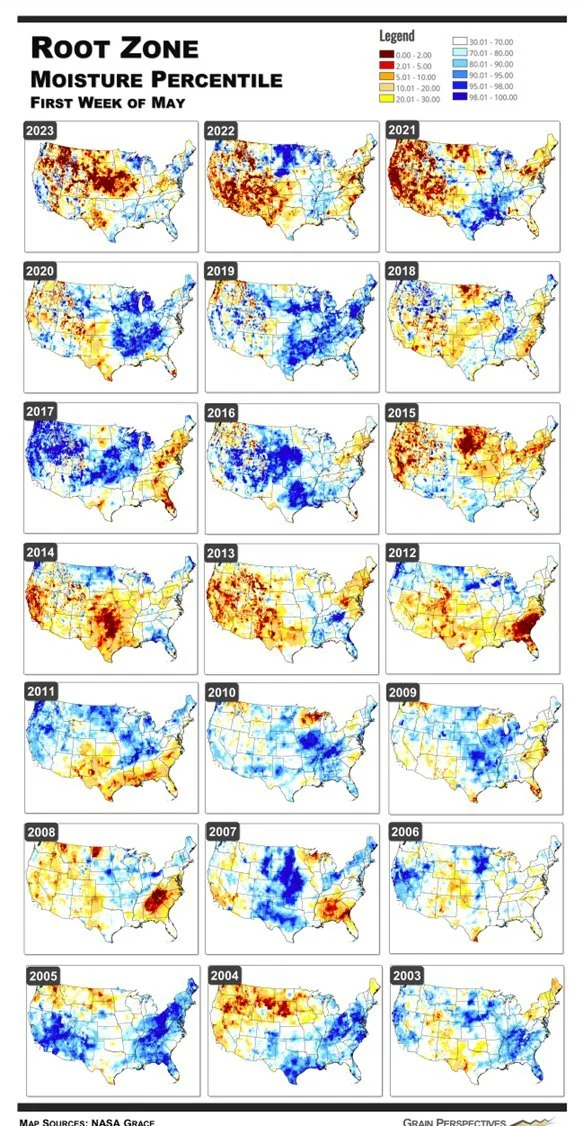

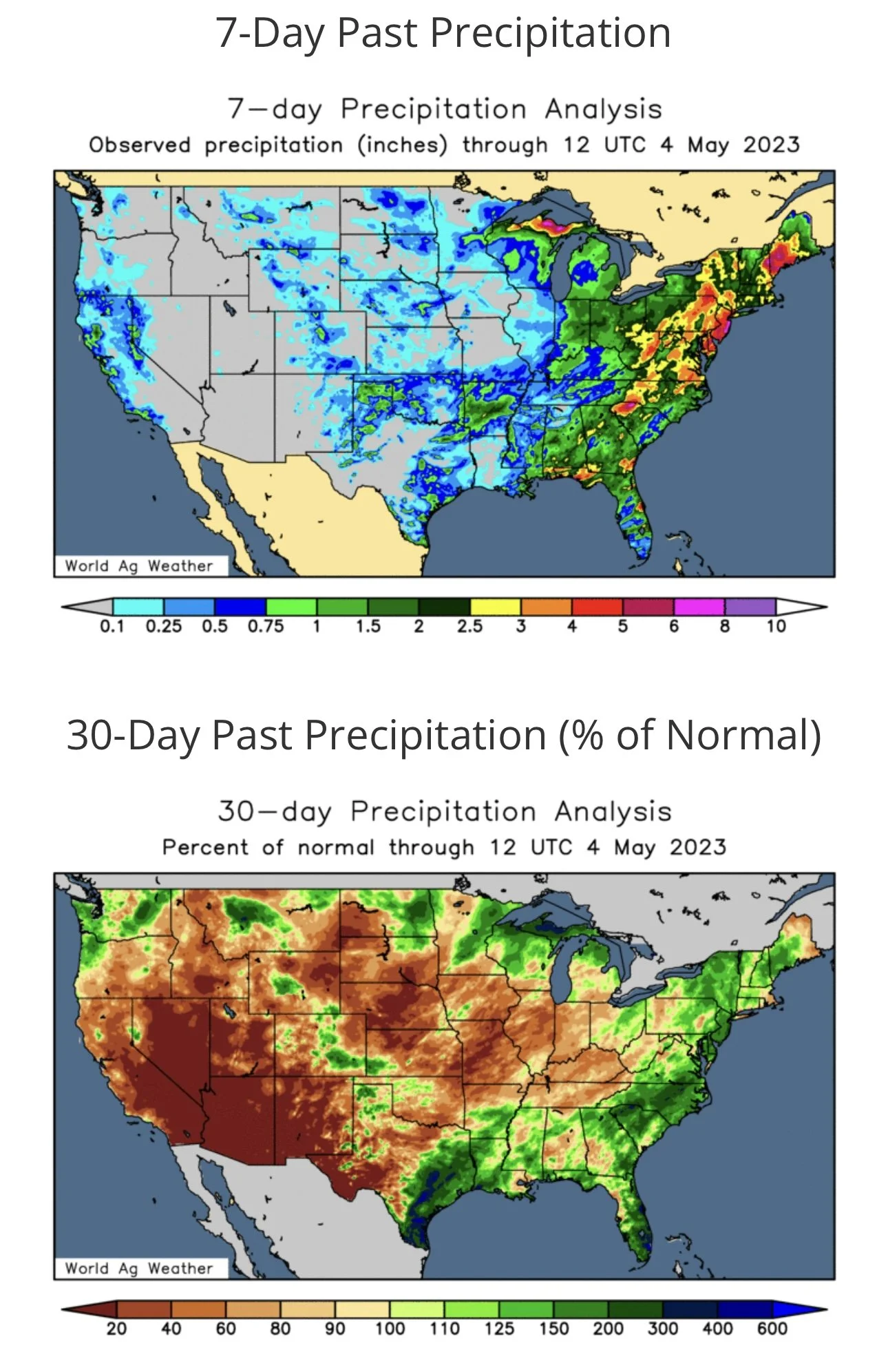

Lack of Soil Moisture Situation

I think the market could be undervaluing the dry conditions here.

In 2012 we had an extreme fast start to planting. Some are saying this year will be the fastest planting since 2012.

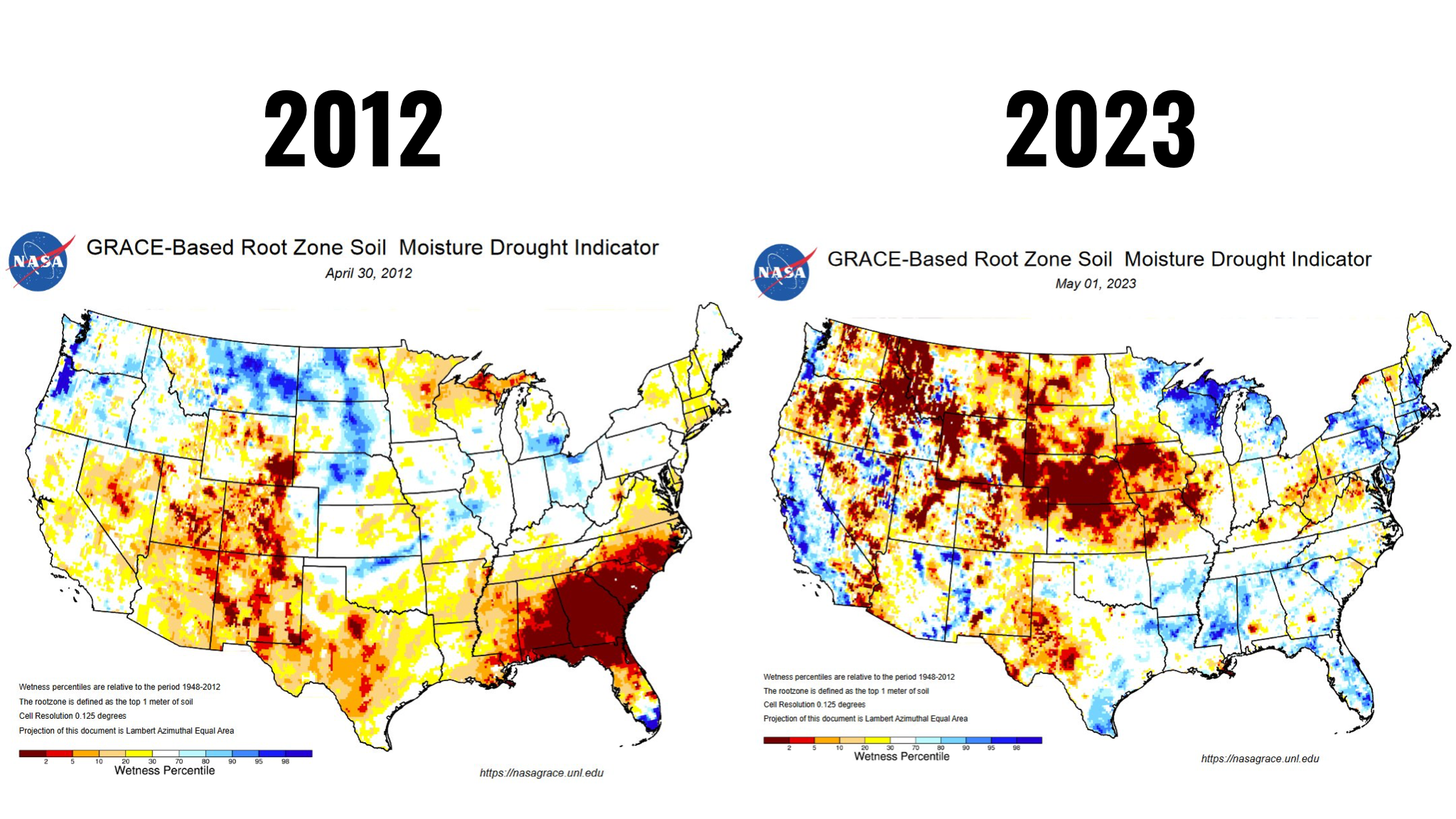

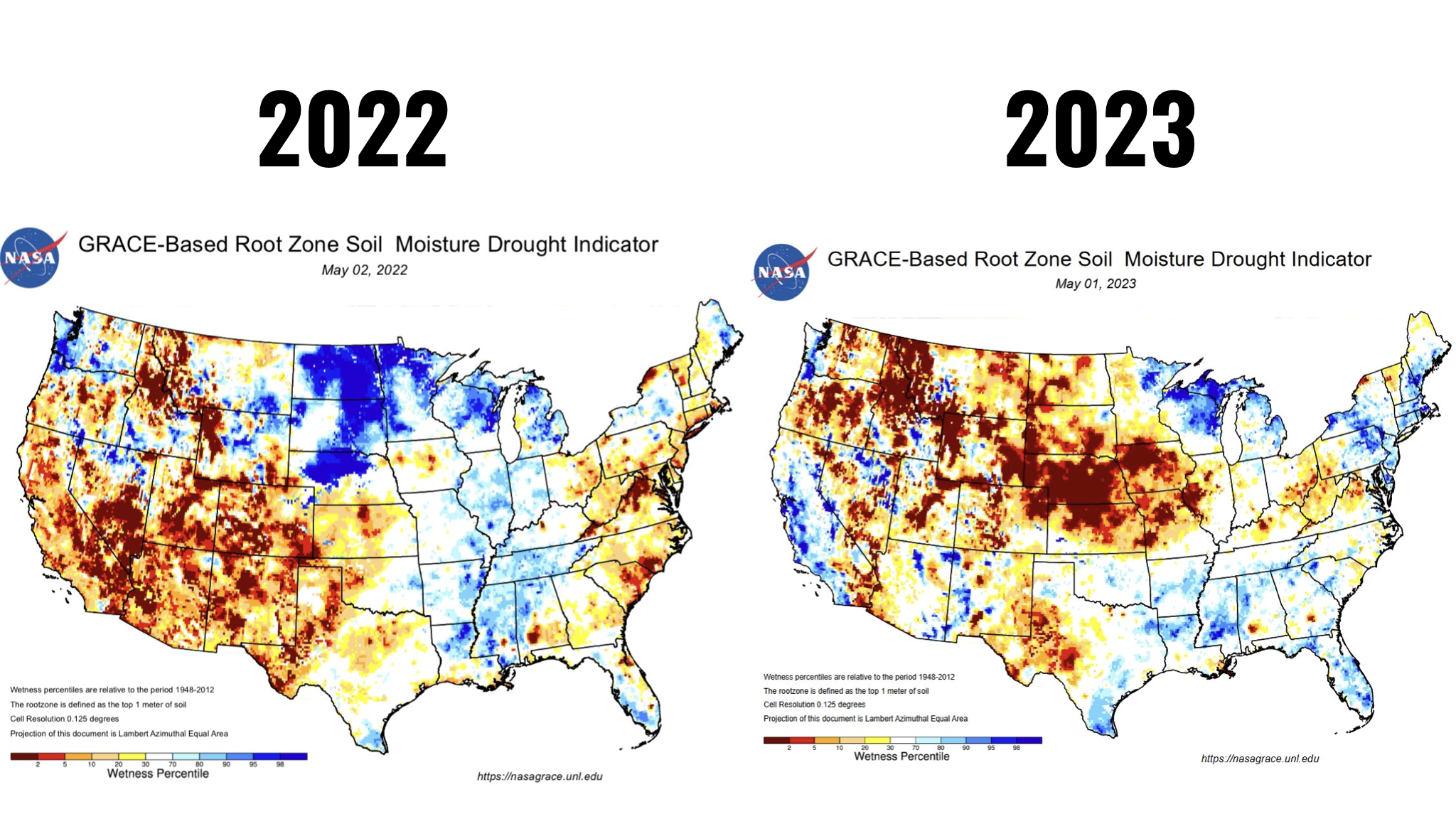

Just taking a look at our soil moisture situation this year compared to last year and to 2012, this year is looking a lot worse.

If we don’t get a ton of meaningful rain there is a ton of weather premium left to be built into these markets.

To add on to this, below is a write up from Wright on the Market where they discuss Pacific Decadal Oscillation, PDO for short.

Here is an explanation of what PDO is;

PDO is caused by sea surface temperature variability in the northeast and tropical northern Pacific Ocean. Extreme phases of the PDO have been warm (positive) and cool (negative) variation from normal.

The multi-year La Niña has ended just as the sunspot solar 22 year cycle also ended. This can happen every 44 years but rarely does. This coincidence usually never occurs in a person’s lifetime.

This recent end of the multi-year La Niña and this solar cycle PDO produced lighter-than-usual precipitation in the lower Midwest. Yep, we knew it was dry in Nebraska, Kansas, Oklahoma and Texas. Another trait of this transition is Northern California receives heavy rain (snow) in December and January. We can checkmark that box. If this PDO continues, which is expected, it will most likely override the normal cool and wet traits for the Corn Belt of an El Niño episode. Instead, the Corn Belt will be warmer and drier than normal in July and August.

The current negative PDO, in the absence of any other dominating weather pattern, will move the US jet stream north this spring allowing a ridge of high pressure to develop in the Central United States in the late spring and it will dominate the summer.

Since soil conditions are already drier than normal, a rapid transition to drier and warmer weather will likely begin to stress crops in late June or early July.

The transition to El Niño has already brought and will probably continue to bring rainfall into the Western Corn Belt and Great Plains until early June, probably delaying the start of warm and dry conditions until later in June. Crops in the Plains and Western Corn Belt should get a good start.

Soils do not have deep moisture and it might take a while for repetitive rain events here in May to get the ground wet enough for the moisture availability to protect crops in the early days of summer. The months for crop stress this year will likely be July and August, and it will be mostly in the Western Corn Belt, while the Eastern Midwest does a little better.

The Northern Plains and Canadian Prairies likely will see greater rainfall in the east in May shifting west in June and July.

So, here we go into the growing season with an escalating war in the “Bread Basket of the World” and probable drought in the “Corn Capital of the World.”

Just to set the table, take a look at the scary early May Corn Belt 2023 drought map compared to the last 20 years:

So we again ask the question, could we see a similar drought situation similar to that of 2012?

If history would to repeat itself and we get the drought they are talking about. Planting should get off to a fast start (as it has), similar to 2012.

Taking a look at corn futures, we would then make our lows in late May or perhaps early June before the market fully absorbs the drought premium and pushes higher like it did in 2012.

The Bottom Line

From Farms.com Risk Management,

Technically, a key bullish reversal in MN spring wheat futures and Chicago wheat which is bullish as the momentum turns back to the bull. Longer-term bullish fundamentals in MN/HRW markets will matter more. A delayed U.S. Northern Plains planting season could see more spring wheat acres go PP (Prevent Plant) and we could lose 1-3 million acres and drop total acres below 10 million for the first time in a long time and keep the North American spring wheat balance sheet tight! Futures in the next 4-6 weeks will be better than they are today and at harvest time.

Our on-the-ground intelligence In ND says that all that snow only had 3 inches of moisture and if you dig below 15 inches it is bone dry! Timely rains will be needed in June and July if the U.S. Northern Plains can avoid a lot of PP (prevent plant) acres.

The 2023 U.S. spring wheat planted pace at 12% will continue to fall behind next week and it’s the 3rd slowest pace for this date since 1997 and 2011. The Dakotas have not started planting yet, which is not very surprising, but they will remain the laggards and could lead to the funds hitting the panic button in early June as the last 20% of acres struggle to get planted like in 2019. (Please see charts below)

The U.S. Fed meeting was a disappointment suggested that interest rates could pause but did not hint at any pivots to lower interest rates in the future. Afterhours news that PacWest stocks dropped 40% as is weighing a sale will not help the open as that negative macro fund sentiment has not changed yet!

The huge gains across the wheat complex today was a huge boon for Russia, as the rally will raise global wheat prices to an area more comfortable for Russia and their wheat farmers.

We called the market bottom in the grain markets on April 27 as both wheat and corn futures got to cheap and fundamentally undervalued as the selling is finally exhausted. Look for a further short covering rally in the next 4-6 weeks with higher closing highs. Any weather scares will send futures much higher!

Wheat Chart

The following chart is from Mister Commodity on Twitter. He points out that we made a key reversal on lows from 2021 and are flirting with a break out.

Check Out Past Updates

5/3/23 - Audio Commentary

Wheat Prices Catch Fire

5/2/23 - Market Update

Grains Fade of Highs

5/1/23 - Market Update

Wheat Continues to Fall

4/30/23 - Weekly Grain Newsletter

Why We Will Be Thanking Market for Lower Prices

4/28/23 - Market Update

Grains Green First Time in 10-Days

4/27/23 - Audio Commentary