GRAINS STRONG AHEAD OF REPORT

*Note: There will be no market updates from June 13th to 21st as I am getting married Saturday and will be on my honeymoon next week. We will still have audio updates. All updates will resume as normal after.

Overview

Grains started off last night much lower, but managed to close very strong across the board ahead of tomorrow’s highly anticipated report.

Corn and wheat likely saw some short covering from the funds as they position themselves ahead of the report tomorrow.

The forecasts seem to be changing nearly every hour, which creates a ton of volatility. It looks like this weekend we could get some rain, but doesn’t appear to be any drought-busting rains.

Most of the corn belt is now facing moisture deficits.

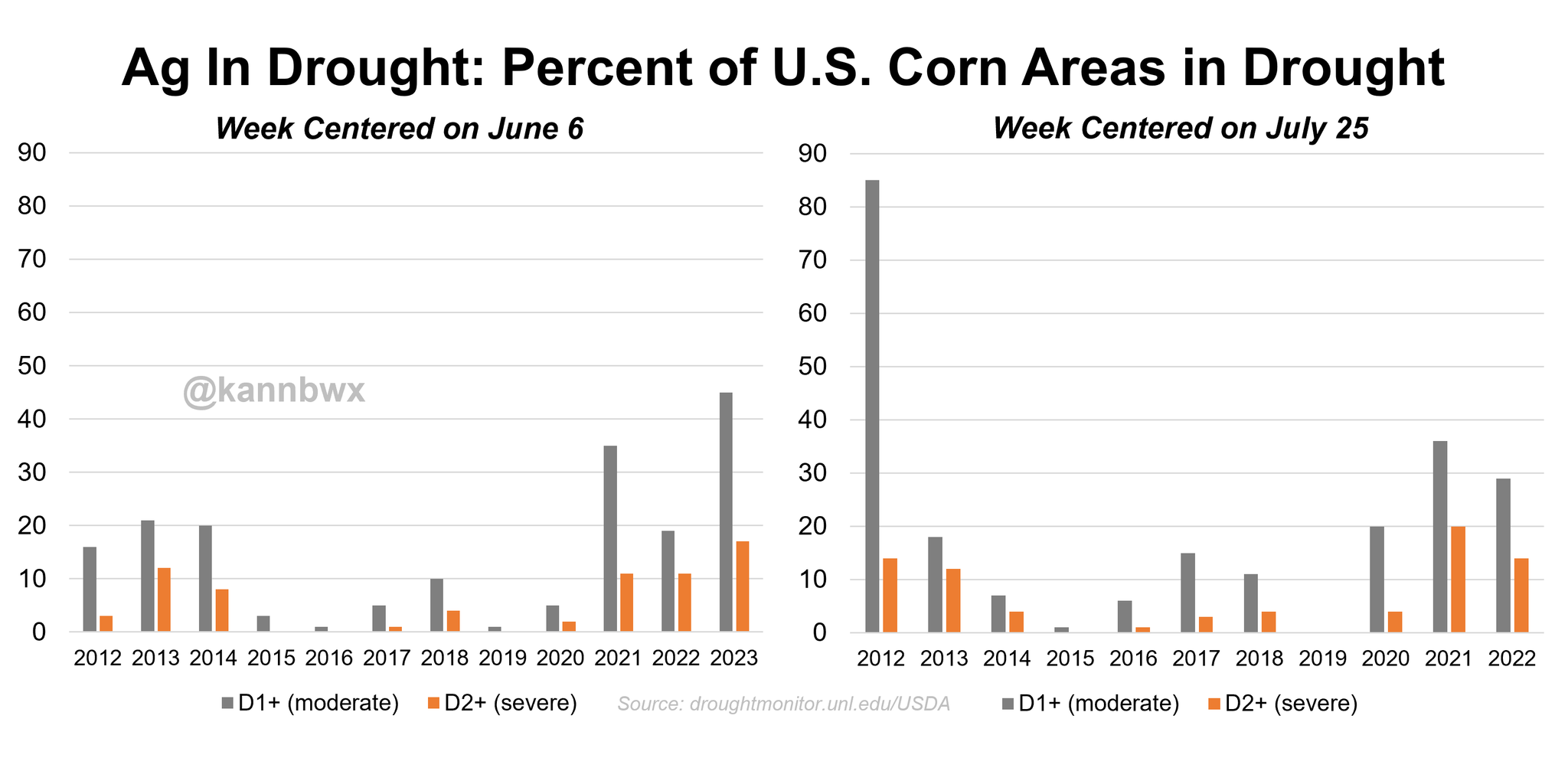

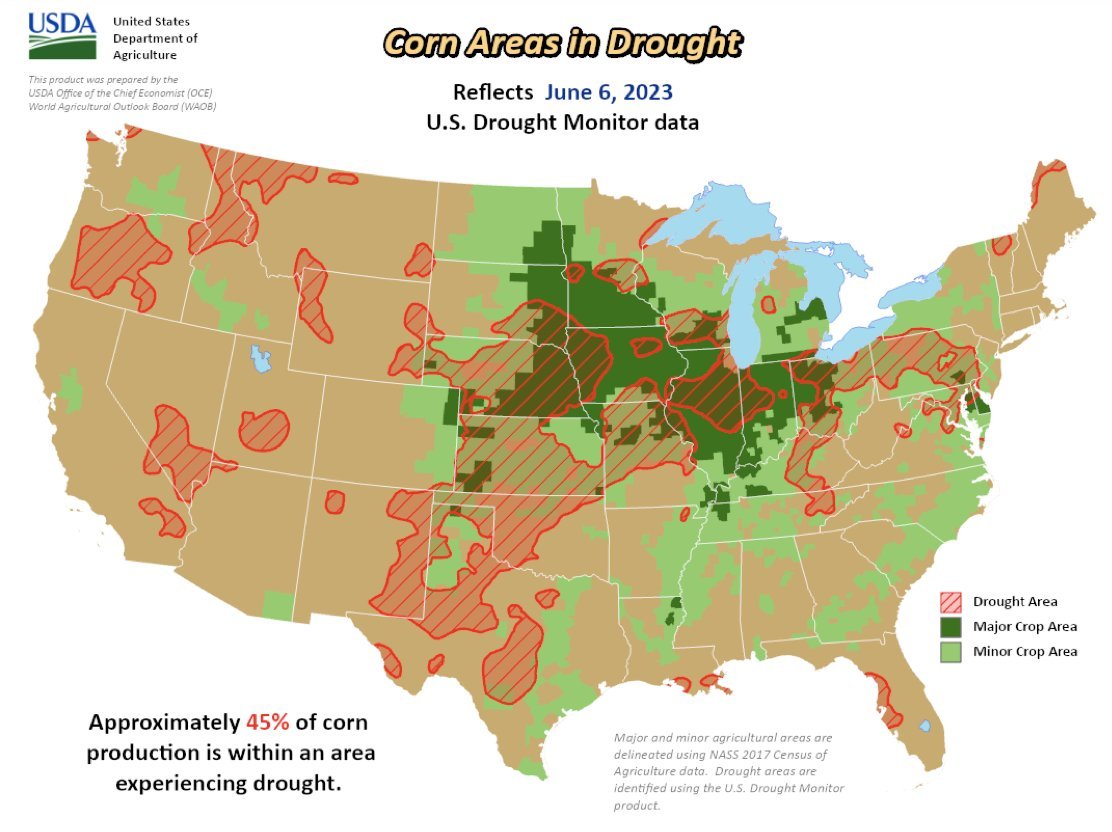

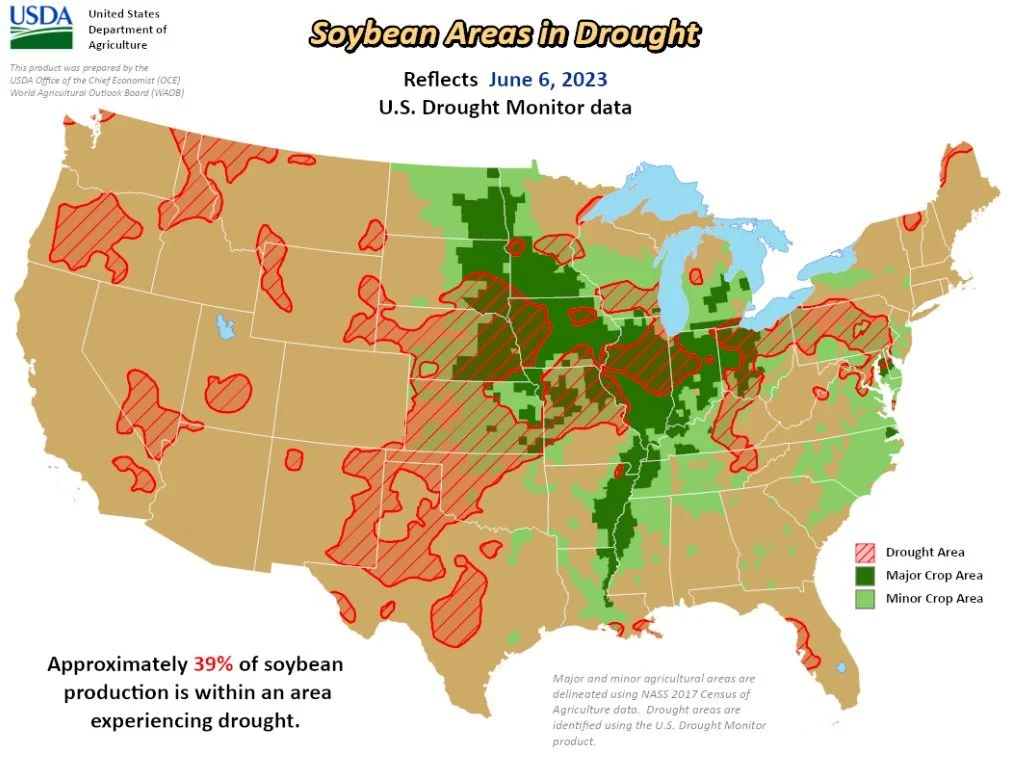

45% of corn area are experiencing drought while 39% of soybean areas are experiencing drought. Both of these are an 11% increase from last week. For the corn, this is the highest percentage we have seen for this week since they started keeping track of these records.

Below is a report preview, I think the pros will be looking to buy any breaks from the report if it comes in on the bearish side. I'm hoping for a bullish surprise, but wouldn’t be surprised to see them kick the can down the road.

***

In case you missed it, Sunday's Weekly Newsletter

AI Drought & Price Predictions - Read Here

USDA Preview

The USDA report tomorrow will be a big one. Do we see the USDA make the drop in yield our crop conditions suggest we should see, or does the USDA kick the can down the road until later this summer?

Historically, the USDA doesn’t make major changes in this report. Even though everyone thinks we should see yield lowered doesn’t mean the USDA has to lower it just yet.

Personally, we don’t think there is really any chance we come anywhere near the 181.4 bpa the USDA currently has forecasted. To achieve this unrealistically high yield, we would need some incredibly timely rain. Heck, even if we want to see a number similar to last year's yield, we will almost certainly need some very timely rain. (More on this later in today's update)

So what are the different possible outcomes for tomorrow?

In the first scenario, we see the USDA indeed lower their yield estimate. Perhaps they price in something closer to the 175 bpa range, or maybe the USDA learned their lesson and will actually put something realistic. This would ultimately provide some support and help us rally. But again, this is an optimistic outcome.

The second outcome we could possibly see is the USDA opt to leave yield unchanged. Are we anywhere close to 181? No. But the USDA likes to slow play these things especially this early into the summer. If the USDA does decide to go this route, it could be a somewhat bearish report. But ultimately, even if they do do this, it will come down to rain. Even if they leave it unchanged, and rains in the forecast disappear over the weekend or simply don’t come to fruition, we could be in for some fun.

Outside of yield, the trade is expecting South America production to be mixed. With Argentina coming in lower once again, while seeing a small increase in Brazil numbers.

Now for the demand side of things, they are looking for some bearish numbers. With increases in carry out. As the trade is expecting US ending stocks to come in higher across the board. For new crop, they probably won’t change the demand unless they change the yield. If they drop the yield, they will probably drop the demand.

Wheat production is also expected to come in higher across the US.

Even if we do wind up seeing the yield coming in on the bearish side, which is very well possibly could, along with the bearish demand numbers. I think the breaks will be bought back in a quick fashion barring any meaningful rains over the weekend.

Here are the numbers and estimates for tomorrow:

Today's Main Takeaways

Corn

Corn manages to capture a small rally ahead of the report tomorrow, closing up 6 cents. Posting our highest close since April.

A few things bears are looking at is the potential cooler temps in the forecasts, and of course any potential rain that pops up. As for tomorrow, there is a strong argument that we could see demand reduced in the USDA report tomorrow.

The trade is looking for old crop export estimates to be lowered by 20 to 50 million bushels, while they aren’t looking for any significant changes on the new crop balance sheet.

Even if we do see temps cool off a bit, there just isn’t enough rain. In simpler terms, we don’t have enough moisture in the right areas. Forecasts continue to change. One day a model calls for rain, the next a different model says it will remains just as dry for the next two weeks. The GFS model is notably drier for the next 11 to 15 days. Even if it remains cooler, we will still need some very timely rain to make much of a difference in the current drought situation.

Until we get a game changer, people will continue to buy the breaks and dry forecasts, and sell rallies on the wet forecasts. But ultimately, if it doesn’t rain, the drought story will take over.

Currently, there is no chance we see +180 yield unless something crazy happens. The USDA really thinks our yield is 8 bushels higher than last year, yet crop conditions are nearly 10% worse than they were at this same time last year.. Doesn’t make a ton of sense.

But of course, the USDA will do whatever it wants. Bulls would love to see them make a cut to yield, but they don’t have to. One could argue we should see a cut in the 173 range, but that is highly doubtful. Even a trim to the 177 area would be a step in the right direction. The question is just when will the USDA decide to make that cut.

I noticed some other advisors had placed sell signals for both corn and beans. By all means do what is comfortable for you and profitable to your operation. Just remember that markets will be very volatile moving forward, and there are also different ways to help your operation be more successful. If you have any questions regarding what is best for your operation or want to open a hedge account, simply give Jeremey a call at 605-295-3100 or click here.

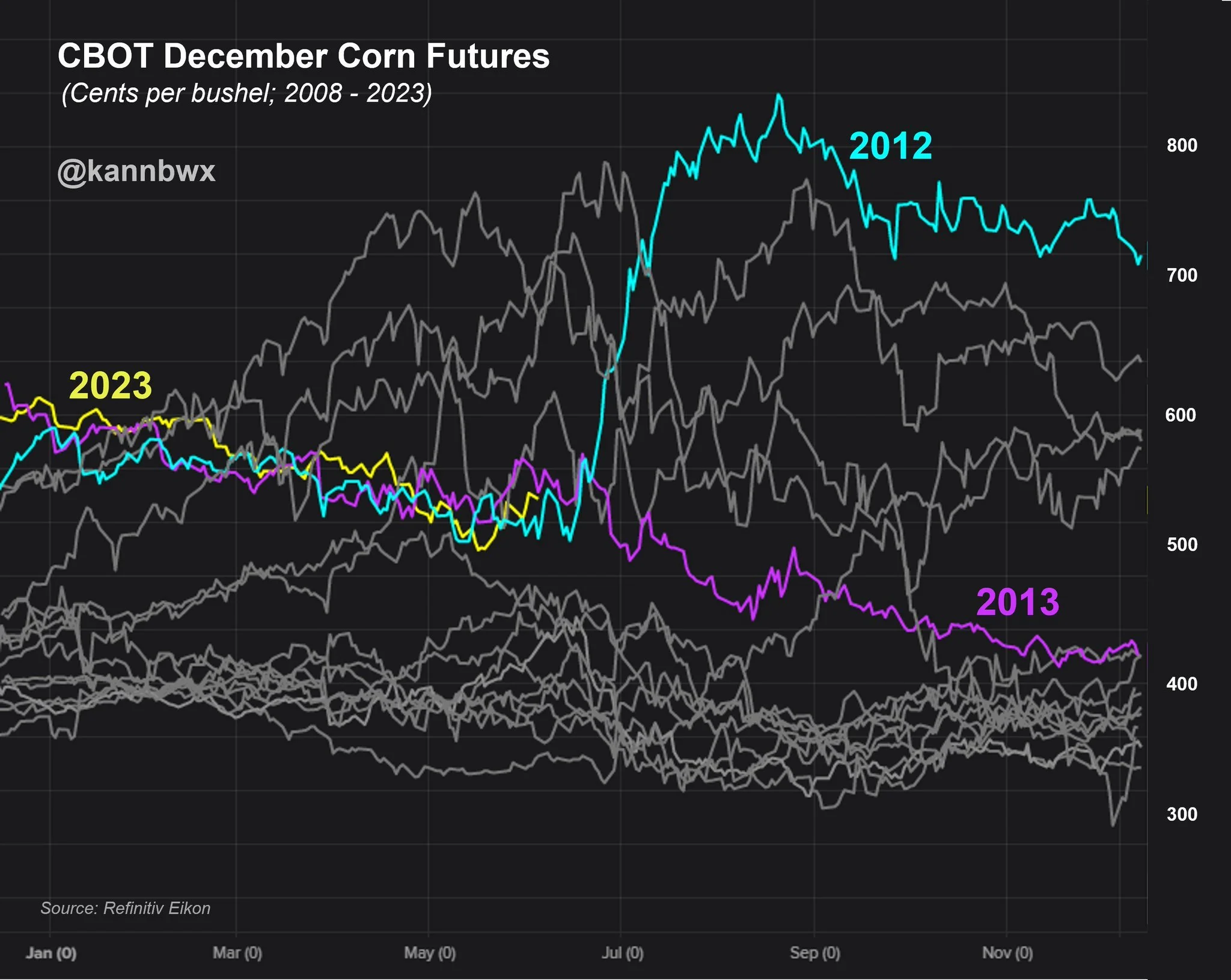

As for the drought situation, it hasn't gotten any better. I know we constantly compare this year to that of 2012. But why not compare this year to the year we made all-time highs. Some say we are beating a dead bush, but it just puts into perspective what is possible if this continues.

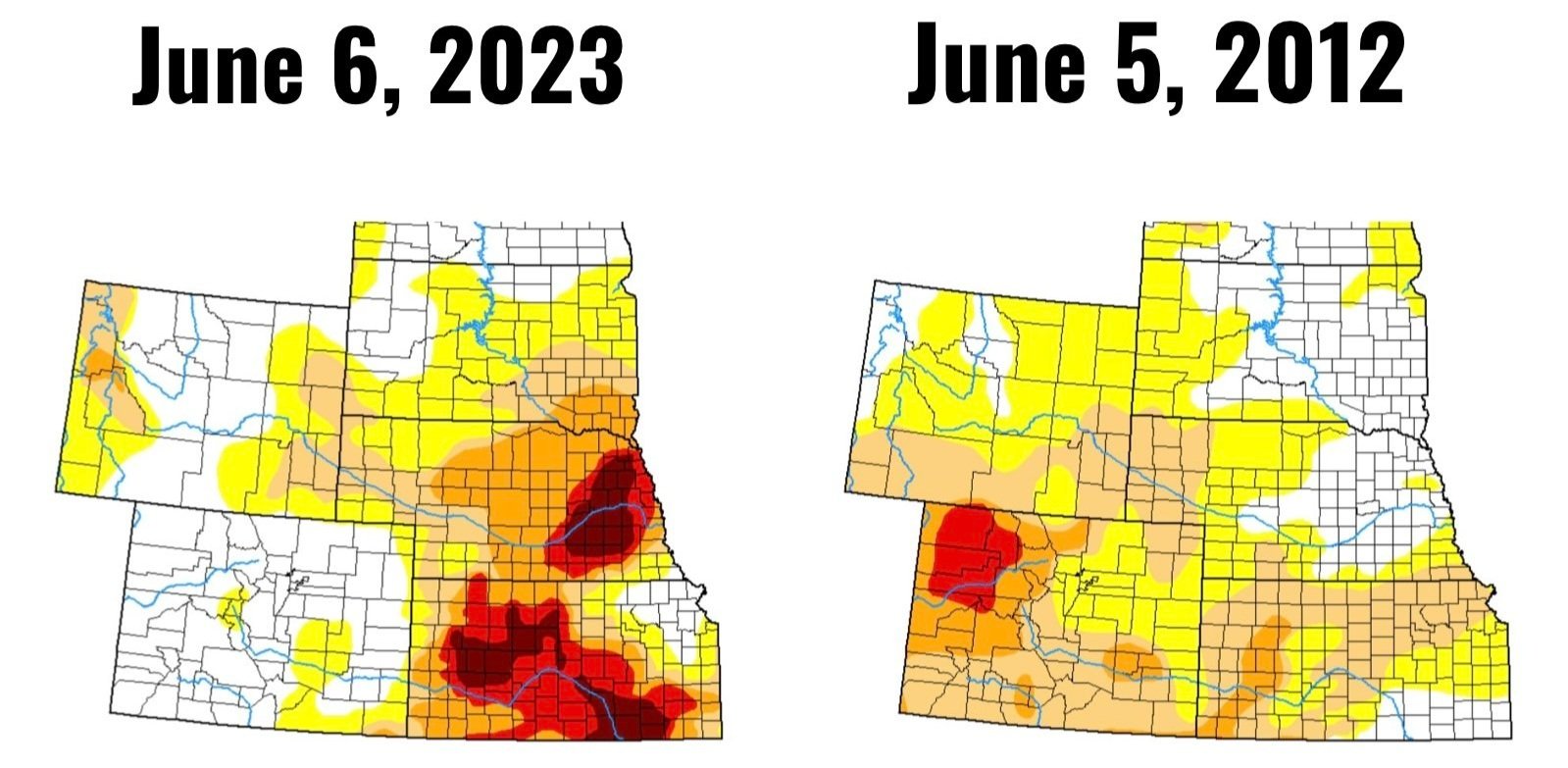

The next two charts shows corn areas experiencing drought. It came in at 45%. A whopping 11% higher than last week alone. This 45% is the most for this week since they began tracking these records back in 2012.

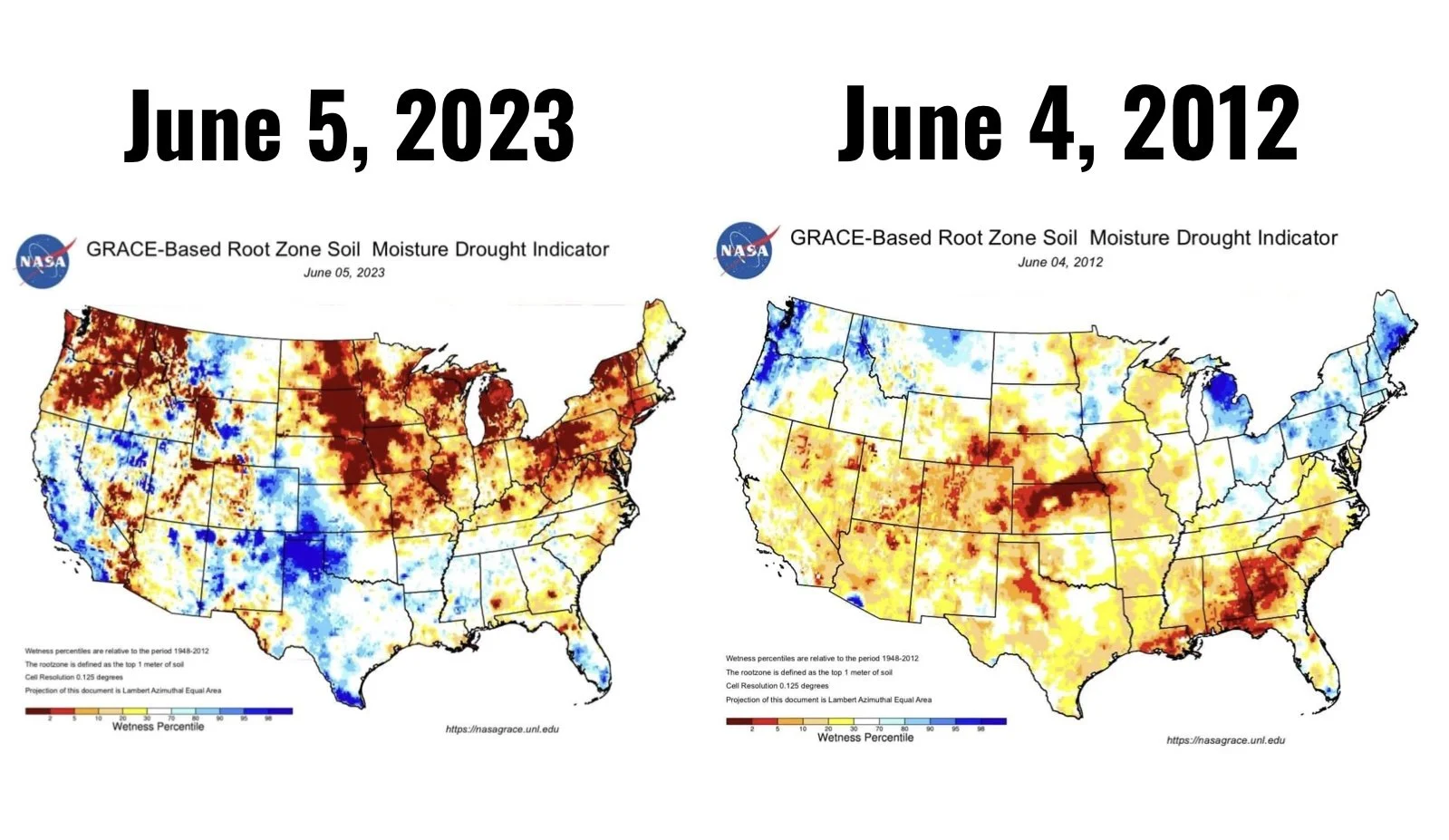

Now let’s take a look at the soil moisture situation. Again, just some food for thought to put into perspective just how dry the past few months have been.

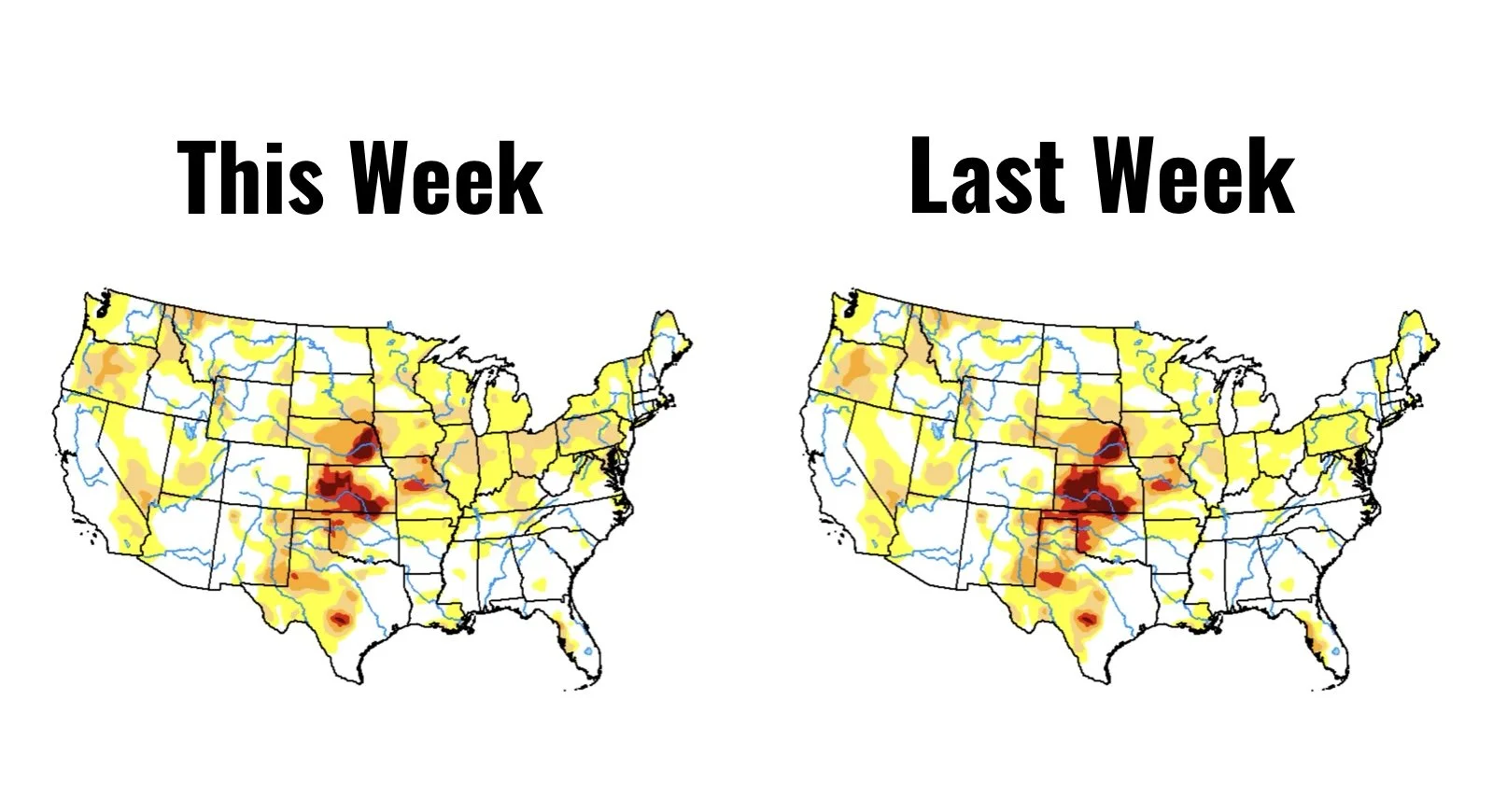

Here is the drought monitor comparison for this week vs last week. The drought continues to expand east into the corn belt.

Now here is the current drought monitor vs this same week in 2012. Yes, 2012 was overall drier. But if you take a look, the corn belt and midwest are far more dry. The midwest is actually 31% more dry..

Bottom line, I'm hoping the USDA surprises us and decides to step up to the plate early. But we don’t want to be overly optimistic of that scenario happening. If they do decide to make some early cuts, we could get a huge rally, throw in some more dry forecasts and increased drought and the sky is the limit. If they leave yield unchanged, it could be a different story. We could of course still get a big rally simply due to drought, but that is all in the hands of Mother Nature. If it stays dry thorough out June, regardless of what the USDA does tomorrow, we will be going much higher.

In 2012 and 2013, June 22nd was the date that we found out if we were going to rally or flop. This year has so far nearly replicated both of those years thus far.

Soybeans

Soybeans end the day slightly higher in a day full of volatility. Closing 11 cents off its lows and 8 cents off its highs. July beans are now roughly 90 cents off those lows posted just 9 days ago.

Beans are finding some support from belief that we will see some strong Chinese demand. As China imported 24% more soybeans, they think this will carry over to our crop eventually.

The biggest potential problem for soybeans is of course Brazil's monster crop. But ultimately, additional weather scares down the road could still lead us to seeing a rally. Remember, a corn crop is made in June, while the bean crop is made later in the year. So weather premium short term here won’t directly affect beans as much as it will corn. This leads to bears arguing that it is a tad early to have any extreme concerns with the crop here in the US.

Bulls are looking at both Chinese demand and weather premium to ultimately create that catalyst we have been talking about potentially happening later this year.

Looking at tomorrow’s report, the trade is looking for the USDA to leave domestic crush unchanged, reduce export estimates, with some small changes to South America production. More than likely we won’t see the USDA make any major changes to their new crop production numbers, as it is still a little early.

Similar to corn, a large portion of soybean growing areas are experiencing drought. As 39% is now in drought, an 11% increase from last week.

If the USDA provides bearish numbers, I think that will be a good opportunity for bulls and expect the breaks to be bought.

I still think we have a deeper demand story lining up for later in the year. To go along with an entire growing season full of uncertainty. But short term we could certainly see some pressure if the report doesn’t go in the bulls favor. Expect heavy volatility ahead.

Wheat

Wheat futures rally across the board. With Chicago up nearly a dime, KC up 17 and Minneapolis up 22.

Wheat has received support from Australia headlines. As they are experiencing some record temps and drought conditions due to El Niño. Which has estimates saying their crop next year will be cut by a third.

Bears continue to point at Russia. As they have continued to dump cheap wheat. Which has kept a lid on global prices. This has been one of the biggest things preventing wheat from capitalizing on these small rallies.

On the other side of things, weather continues to be a talking point for bulls. As many areas are still facing drought, while others face overly wet conditions which have caused some quality concerns. There are weather headlines and concerns across the globe. China is facing some serious floods, Australia is facing record heat, Canada and the US both have problems of their own. So there is a ton of potential weather premium for the wheat market.

The war headlines continue to cause volatility. As a few days ago we got a very short lived rally. Now receiving news that a ammonia pipeline used to transport fertilizer from Russia to Ukraine has been damaged. This is further creating the discussion as to whether or not the Black Sea deal gets renewed. But then again, it doesn't expire until the middle of July.

Taking a look at the report tomorrow, the trade is looking for the USDA to lower its US old crop exports, and raise its new crop production. So overall, expectations are we see a fairly bearish report for wheat tomorrow. But perhaps we do see the USDA leave exports unchanged, or maybe we don’t see the USDA raise new crop production by much if any. Guess we will have to see.

Going forward following the report, weather and war will continue to be the theme. Bulls would still like the funds to start liquidating that short, but that just hasn't been the case, as wheat has struggled to gain any sort of momentum. There is still definitely the possibility to see a weather or war wild card however.

Math of Rolling Basis Contracts

From Wright on the Market,

***

There are two steps to roll a basis contract.

To roll a basis contract, the merchandiser must liquidate the long (buy) futures position. That is done by selling the previously purchased futures contract, March in this example, to offset the March buy. When a basis contract is rolled, no money changes hands if the price has not declined 30%.

The second step is the merchandiser buys a deferred futures contract, logically, the next nearby contract, but it could be any month.

Get this: The merchandiser sells a futures contract and buys a different futures contract of the same commodity. He buys and he sells. To roll a March basis contract to May, the merchandiser sells the March and buys the May. If the March sell is above the May buy, the farmer makes money on the roll, equal to the price difference. If the March sell is at a price lower than the May buy, the farmer loses that amount.

When markets are inverted, meaning the deferred contracts are trading at a lower price than the nearby contracts, the selling price will be higher than the buying price.

On February 27th, 2023, March corn settled at $6.43 and May corn settled at $6.43½. So, a half cent loss on the roll plus a one cent roll fee.

On April 27th, May Corn settled at $6.27 and July corn settled at $5.81. A roll on the close resulted in the May being sold at $6.27 and the July was bought at $5.81. That is a 46¢ gain less the 1¢ rollng fee. Whatever the May basis was, the July basis is 45¢ firmer. If the May basis was 10 over the May, after rolled to the July at the close of business on April 27th, the basis became 55 over the July.

If one thinks the corn prices will move higher after June 29th, then the July basis contract needs to be rolled to September. As of the close yesterday, July corn was $6.43 and September was $5.25. If a July basis contract was rolled on yesterday’s close, the July would have been sold at $6.43 and the September would have been bought at $5.25, a gain of 79¢. If a July basis contract was 56 over the July, the basis in the September would be $1.35 over the September minus 1¢ fee.

If your merchandiser will not let you roll from July to September, your only choices are to cash-out as close to the high as possible between now and June 29th and be done with the 2022 crop or buy September corn in your own futures account.

The Charts

Corn 🌽

July corn now in a short term uptrend as we hold that inverse head and shoulders. Next target is the $6.20 range and our 100 day moving average.

Corn July-23

Soybeans 🌱

I think the intial move to the downside was over done. Next upside target is 20 cents higher in the $13.84 range.

Soybeans July-23

Wheat 🌾

July Chicago continues to flirt with that downtrend. Will this finally be the attempt we get a break through? We would need to break that upper trendline to confirm a reversal.

Chicago July-23

KC July-23

MPLS July-23

Weather Outlook

Hedging Account

No matter the situation you are in, our partners at Banghart Properties Grain Marketing can help you come up with a plan of attack to help you manage your risk. If you want help managing your risk you can give them a call anytime at (605) 295-3100 or set up a hedge account below.

Check Out Past Updates

6/8/23 - Audio

WHAT TO EXPECT FROM THE USDA REPORT

6/7/23 - Audio

ARE WE IN A TYPICAL SEASONAL RALLY?

6/6/23 - Market Update

CORN LEADS VOLATILE WEATHER MARKET

6/6/23 - Audio

WEATHER & WAR

6/5/23 - Market Update

CORN PRESSURED BUT CONDITIONS FALL

6/5/23 - Audio

WEATHER VOLATILITY CONTINUES

6/4/23 - Weekly Grain Newsletter

AI DROUGHT & PRICE PREDICTIONS

6/2/23 - Market Update

WHEN WILL FIREWORKS START?

6/2/23 - Audio