WEATHER SCARES & CHINA DEMAND

Overview

Grains rally post USDA report. The report yesterday did nothing. No major changes outside of the Russia crop dropping from 88 to 83 MMT. It was a little disappointing to see no significant cuts to the SA crops.

The focus is now weather and that acres report on June 28th.

This report will be HUGE. One of the biggest of the entire year.

The range for corn acres is 87 to 93 million. That is nearly a 1 billion bushel swing.

Along with acres, we will get the stock numbers. So we will find out how much old crop the US farmer is holding. The less they are holding, the less farmer selling pressure we will see on a rally.

Outside of that report, weather is going to be the other main factor.

Right now, the hot forecasts are starting to catch attention.

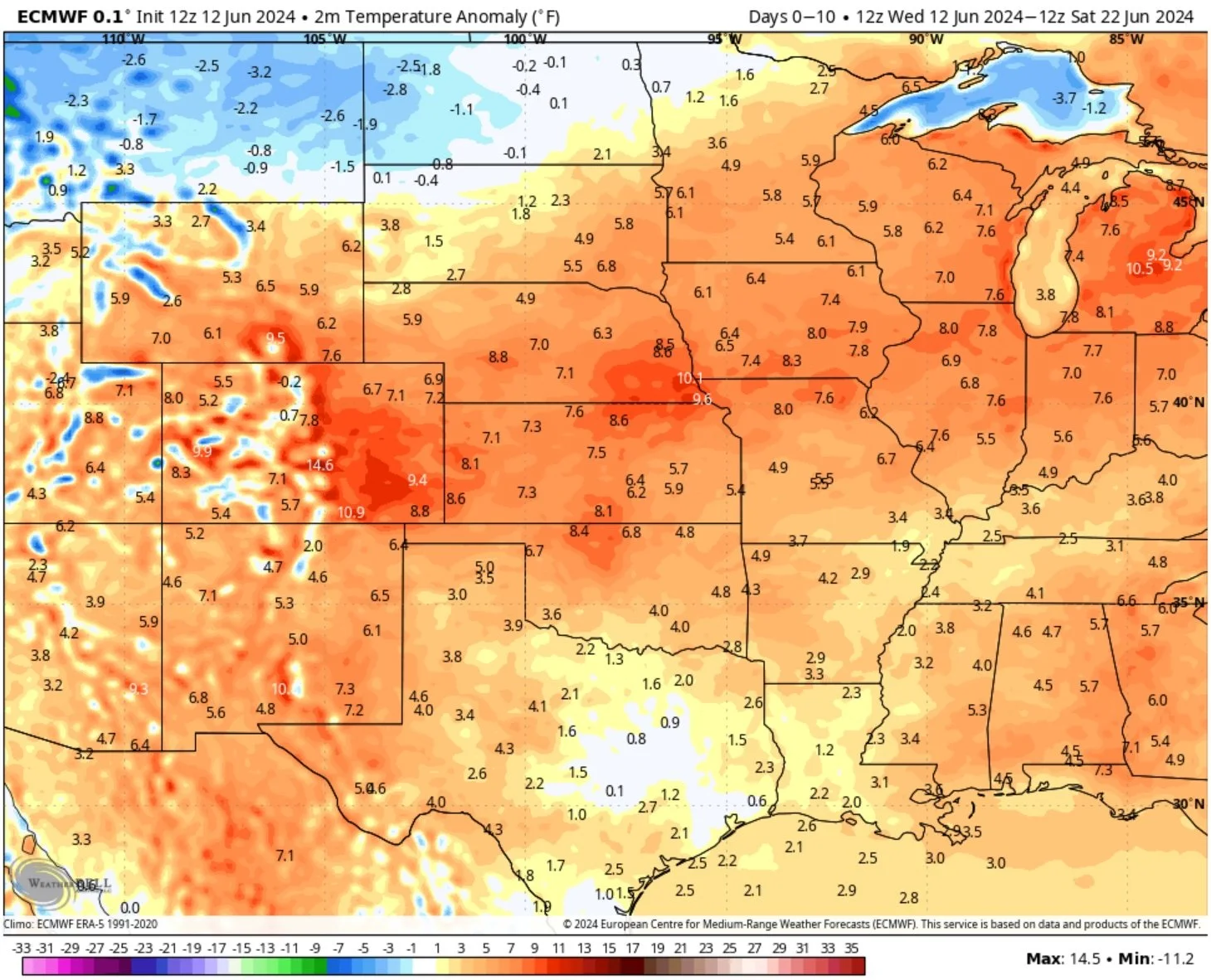

For the next week or so much of the corn belt is going to be up to +8 degrees hotter than normal. It is only June..

Temp Anomaly

Maximum Temps

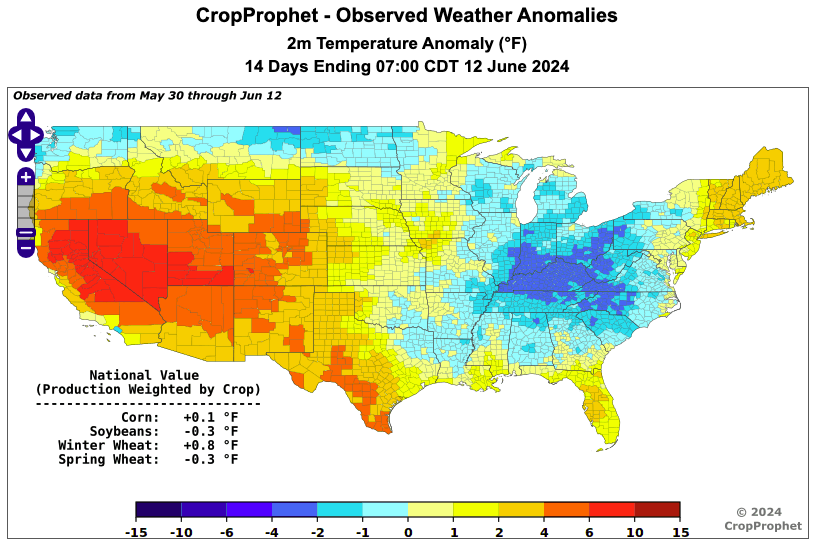

Here is the past 14 days temp anomaly vs the next 14 day from Crop Prophet. A big change coming.

The other big thing we have seen is some demand headlines.

Export sales for corn were strong, on pace to beat the USDA estimates.

We got our first soybean flash sales to China since January.

The last 4 of 5 days we have seen daily sales for beans. This comes off the back of the Brazil tax change, which has helped price US soybeans more competitively to the world market.

What makes these sales even more interesting is the fact that we typically do not see sales of old crop beans during this time. Usually they are nonexistent. This is the time of year where Brazil is usually drowning in beans stealing most of the business.

Direct effect of the tax change, or is Brazil's crop not as massive as advertise? Who knows. If Brazil does have a monster crop, it wouldn’t make sense for China to continue to come buying.

Let's dive into the rest of todays update where we go over everything you need to know..

Today's Main Takeaways

Corn

Today's corn section is longer than normal as we go into a lot of stuff.

Corn is +20 cents off of it's lows from last week.

The USDA report was friendly corn but not a market mover.

No changes in yield as expected. Those come in July and August.

One headline we have is China. The #1 world importer and #2 grower of corn.

China said that the recent heat is having a immense negative impact on their planting. 40% of China's corn has been dry and most areas have only seen 20-30% of normal precip since May 1st. China has actually launched emergency responses to manage the drought in several areas.

Not a huge headline yet, but something to watch. If it continues could be a bigger problem.

The market is finally starting to react to the hot weather we have been talking about coming for months.

There have only been 3 years since 1980 where we did not get a weather scare. 3 in 53 years.

Why do I think we will still get a weather scare?

We had an overly wet spring. Now we are going to get an overly hot and potentially dry summer. The market should start adding in more premium.

Wet springs are horrible for final yields. They require year long rain. Despite amazing soil moisture, excessive heat will hurt this crop. Why?

Because most of this crop did not get to build a good root structure. In a dry spring, you build up this root structure that can soak up moisture later in the year when you need it. We did not get that this year, so we won't be able to tap into moisture as well if the rain turns off.

The true effects of a wet spring also come later in the year. Right now the USDA has crop conditions some of the best on record. Starting so high gives the market an opportunity to find something to rally on. The ability for crop conditions to drop.

Crop conditions are a pure eye test. They are not as accurate in a wet year as a dry year. In a drought you look at the crop and say "Ya that's bad". You can’t do that with a wet crop because the problems with nitrogen loss and poor root structure appear later.

An example of this is 2010. The USDA raised yield in August only to cut it in Oct because the wet problems didn’t appear until later.

Here is a chart from Wright on the Market. It show cases the highs for Dec corn.

Green years we made our highs in April, May, or before June 21st (which is when seasonals turn lower). Red years we made our highs after June 21st.

The high was in made in April, May, or before June 21st in 12 of those years,

The high was made after June 21st in 10 of those years, and in July 3 years.

Right now our high is in January, which has only happened twice in 2001 and 2013.

We have plenty of weather premium to add. Basis is firming. US exports and demand are increasing. We had an overly wet spring. Now the forecasts are calling for severe heat.

Corn demand has been increasing for the past 7 months. As corn to use has increased 365 million bushels.

The funds are also still short 200k contracts. This is better than if the funds were long. Because it gives them the ability to hit the buy button if a scare comes.

As example, on May 1st last year, the funds were short 150k contracts. By late June they were net long and we rallied $1.00 higher.

The USDA says last year was the best crop on record, yet we still rallied $1.00 higher on a weather scare.

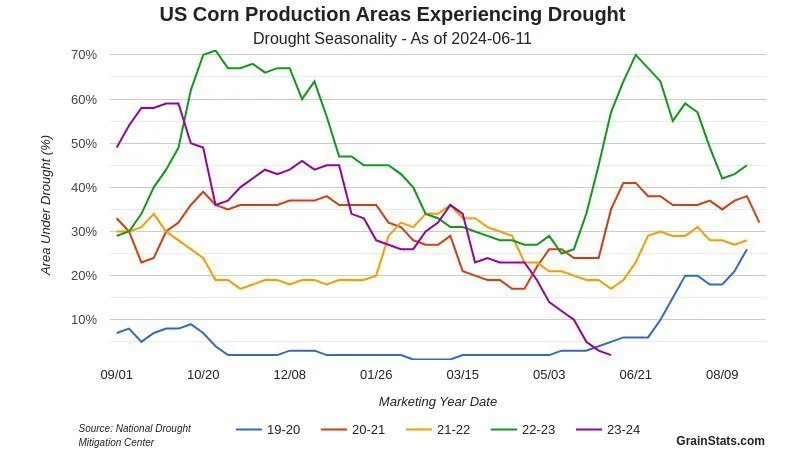

Lastly, here is some data from GrainStats.

This market was overly bearish, the drought is completely gone and can only get worst from here now.

Only 2% of corn is in a drought.

Starting at 2% drought and jumping to even 20% by July could change the entire sentiment for corn.

Going from 75% drought to 2% drought is going to have a lot less of an impact than going from 2% to 20%.

The end of month report is the biggest of the year, and the most unpredictable.

It is a COMPLETE WILD CARD. Nobody knows. The range is 87 to 93 million.

If we come in at 89, the crop conditions start coming in lower, and the forecasts are hot. This market will rally. However, that is a BIG IF.

Some think acres will come in higher due to farmer sentiment being so low when the initial survey was done, as it was done right at the price lows. If acres come in high, it could send prices a lot lower.

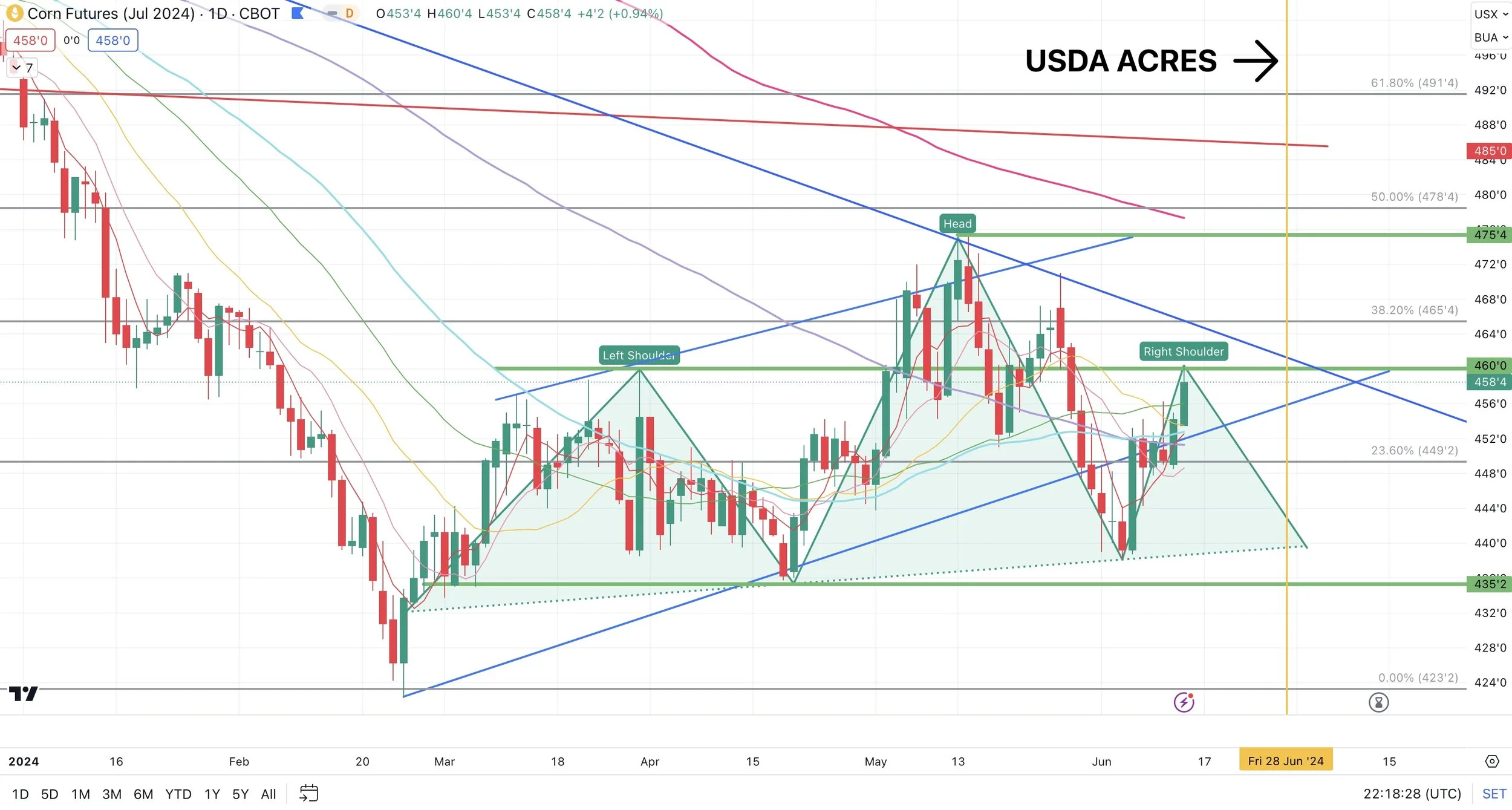

Taking a look at the chart, my targets to take some risk off for July corn are still $4.65 to $4.75.

Anything much higher than $4.70-$4.75 will be tough without a weather scare or miss on the acres report. But certainly possible.

This would probably put Dec corn around $4.90, which will likely be met with a lot of farmer selling. That is a decent spot to take some additional risk off. Although I do think we will see $5.00 Dec at some point this year.

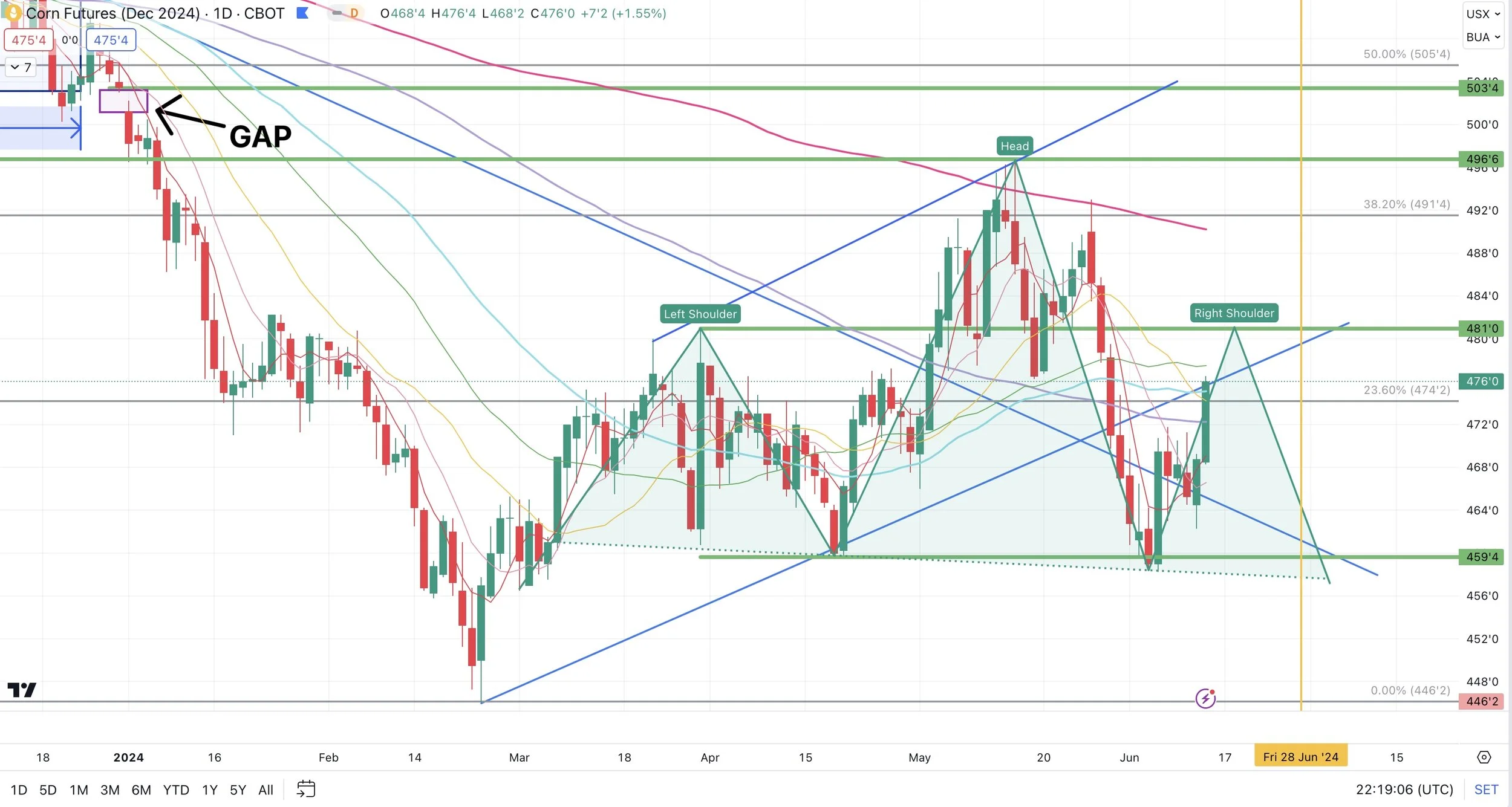

We do have potential head and shoulder patterns in both July & Dec corn (negative patterns). If these negative patterns hold, we will likely alert a small sell signal.

If we can take out $4.60 on July and $4.75 on Dec, the charts open right back up to those previous highs. We will know very soon if we are going higher as today July closed at $4.58 and Dec closed at $4.76.

Although I see us going higher, as a producer you have to ask yourself what would hurt more.. sub $4 corn or $5+ corn?

If you are uncertain of your situation, instead of getting generic advice please give us a call or text. It comes with your subscription. We will go through everything you have going on and give you the best advice possible. (605)295-3100.

If you are undersold vs what you normally are, consider using a short term July or August puts to put a floor in. We believe that the recent technical strength should lead to a further rally, especially if weather forecasts continue to bring the heat.

If you feel you are oversold, then get your courage calls bought sooner rather than later as you do not want to chase this market.

For the rest of you, let's be patient and see what the charts and weather do over the next couple of trading sessions. Be ready to make sales or place hedges.

July Corn

Dec Corn

Soybeans

Not as much to say on soybeans.

We continue to chop around. As we have bounced from $11.75 to $12.00 for 8 days in a row now.

The USDA report was nothing noteworthy for beans.

The biggest thing as I mentioned has been the increased export demand.

Demand is the #1 thing this bean market has been lacking.

Some say this China buying it is just due to the Brazil tax change and won’t last so it is nothing, but if this continues it would be a big supportive factor for soybeans. Right now, the market is not convinced that these purchases will continue.

If Brazil does indeed have a huge crop, you wouldn’t think they would continue to buy. If they continue to buy, maybe that Brazil crop is actually smaller than everyone thinks.

Right now the USDA thinks the US is going to be swimming in beans with a 350 million carryout. But right now buyers say there are hardly any beans out there to buy.

Just like I think corn will get a weather scare due to the heat, I think soybeans will follow in corns path and see some buying.

Even though we have a 350 million carryout, if yield even drops a few bushels it can change everything and we could easily run out of beans in the US.

Soybeans aren’t made until August. Right now the outlook for later this summer is still hot and dry.

We have an entire growing season full of uncertainty, and for now a lot of the bearishness is in the rearview mirror.

On the charts, we continue to hold the $11.75 level. They tried pushing us lower but couldn’t. Which is a sign of strength.

The bean spreads also have continued to firm. Another positive sign.

We need to take out $12.04 to confirm higher prices.

July Beans

Wheat

Wheat finding some footing following the recent sell off.

The USDA report was overall neutral. One surprise was the USDA dropping the Russia crop from 88 to 83 MMT. Which is the largest May to June drop in 20 years. However, they of course offset that with demand so it didn’t have as big of an effect. But they are acknowledging that crop is shrinking.

Keep in mind, that Russia crop is actually made in June. Not May. So they still have the potential to see that crop deteriorate or of course it could potentially get better.

Could wheat see another rally?

Of course it is possible. I do not think we have seen the last of the Russia headline type rallies, but I could be completely wrong.

Long term, I see plenty of upside and reasons to go higher. Short term, without a Russia headline we do not have a reason to rally like we did. Russia will have to run into more problems. Right now the outlook is still hot and dry.

For those of you that can’t hold wheat +1 year, hopefully you took advantage of our sell signal on May 22nd. The signal was -7 cents from our highest close.

If you did not follow the signal, then remain patient or add some puts for protection. We might not get quiet that rally, but there is a decent chance you get a better pricing opportunity than where we are today.

If you are okay with $6.20 wheat, then by all means take more risk off it you are nervous we are going to continue to fall. We are still nearly $1.00 off the lows. However, our bias is higher prices long term.

July Chicago

July KC

Want to Talk?

Our phones are open 24/7 for you guys if you ever need anything or want to discuss your operation.

Hedge Account

Interested in a hedge account? Use the link below to set up an account or shoot Jeremey a call at (605)295-3100 or Wade at (605)870-0091

Check Out Past Updates

6/12/24

USDA SNOOZE: WHAT’S NEXT?

6/11/24

USDA TOMORROW

6/10/24

IS USDA OVERSTATING CROP CONDITIONS? DOES IT MATTER?

6/7/24

WEATHER & USDA NEXT WEEK

6/6/24

ARE GRAIN SPREADS TELLING US SOMETHING?

6/5/24

GRAINS NEARING BOTTOM? 7 DAYS OF RED

Read More

6/4/24

HIGH CORN RATINGS, SCORCHING SUMMER, & RUSSIA CONCERNS

Read More

6/3/24

5TH DAY OF THE SELL OFF. ARE YOU COMFORTABLE?

5/31/24

4 STRAIGHT DAYS OF LOSSES IN GRAINS

5/30/24

I DON’T THINK SEASONAL RALLY IS OVER. WHAT IS THE PLAN IF I’M WRONG?

5/29/24

PLANTING DELAY STORY VANISHES. BUT IS REAL STORY OVER?

5/28/24

GETTING COMFORTABLE WITH GRAIN MARKET VOLATILITY

5/24/24

WET SPRINGS DON’T CREATE RECORD YIELDS, DO THEY?

5/23/24

MANAGE RISK DESPITE STUPID PRICE POTENTIAL IN GRAINS

5/22/24

BEANS NEAR NEW HIGHS. WHAT TO DO WITH WHEAT?

5/21/24

BIG MONEY KEEPS DRIVING WHEAT HIGHER

Read More

5/20/24

ALGOS & BIG MONEY CONTINUE TO MOVE GRAIN PRICES

5/17/24

WEATHER MARKET VOLATILITY CONTINUES TO HEAT UP

5/16/24

SITUATIONAL GRAIN MARKETING

5/15/24

HEDGING VS GUESSING

5/14/24

CORRECTIONS ARE HEALTHY

5/13/24

FUNDS DON’T WANT TO BE SHORT GRAINS

5/10/24

PRICE ACTION TELLS DIFFERENT STORY FROM USDA REPORT

Read More

5/9/24

MARKET PRICING IN NEGATIVE REPORT. WHAT TO EXPECT FROM USDA

5/8/24

USDA IN 2 DAYS

5/7/24

WHO SHOULD WAIT FOR TRIGGERS NOT TARGETS

Read More

5/6/24

GRAINS HIGHEST IN 4 MONTHS

Read More

5/3/24

SEASONAL RALLY JUST BEGINNING OR BULL TRAP?

5/2/24

ARE THE TIDES STARTING TO TURN?

5/1/24

BE PATIENT & READY FOR THESE OPPORTUNITIES

4/30/24

FIRST NOTICE DAY SELL OFF

4/29/24

WHEAT TAKES A BREATHER

Read More

4/26/24

SHOULD YOU REWARD WHEAT RALLY?

4/25/24