TARIFFS, CORN FUNDS, SOUTH AMERICA & MORE

MARKET UPDATE

You can scroll to read the usual update as well. As the written version is the exact same as the video.

Timestamps for video:

Tariff & Other News: 0:00min

Corn Funds: 2:45min

Brazil & Argy: 5:50min

Corn: 9:09min

Beans: 11:10min

Wheat: 12:59min

Want to talk or put together a market plan?

(605)295-3100

Futures Prices Close

Overview

Grains higher across the board following yesterdays blood bath across all markets including the outside markets.

What happened yesterday?

There was 2 main headlines.

The first was news that China developed a new AI platform called "DeepSeek". It is the exact same thing as Chat GPT but China built it for a fraction of the cost and far faster.

This led to tech stocks and nearly all the markets making a sizeable dip yesterday. For example, one of the biggest AI companies in the world NVDA (produces GPU chips) was down -17% and lost $600 billion worth of market cap. The largest one day market cap drop in history for a company.

The other headline was of course tariffs.

Grains were strong on optimism that tariffs could be taking a more gradual approach, but then this headline hit the markets and we sold off into close the day.

Tariffs

Initally, Columbia refused to allow US military planes carrying deported individuals to land in Columbia.

Colbumbia then ordered 25% tariffs on US imports, but shortly after they gave into Trump and it was announced that Columbia would agree to all of Trumps orders.

So no harm no foul, and no tariffs were added. But this initially spooked the market.

Then Saturday we have the official "tariff day" of February 1st.

As earlier Trump said he was going to give until February 1st to start implementing tariffs on Mexico, Canada, and China.

So that is the risk going into the weekend.

Nobody really knows how this is going to shape up. Trump himself probably doesn’t even know.

The initial proposed tariffs from Trump were:

🇨🇳 China 10%

🇲🇽 Mexico 25%

🇨🇦 Canada 25%

This is a big risk going into the weekend because Mexico has accounted for 40% of all US corn export commitments.

So this leaves open the "possibility" for cancellations IF tariffs come. As 308 million of their 620 million exports have not been shipped yet.

2 Proposed Tariff Plans

Basically there are 2 plans everyone is talking about right now.

The first is from Howard Lutnick, the Commence Secretary.

He thinks we should place tariffs now before negotiations.

The other is from Scott Bessent, the Treasury Secretary. He wants to get Trump to do a universal 2.5% tariff and increase them gradually every month. Rather than just slapping everyone with a 25% tariff right away.

He thinks this would give businesses time to adapt and countries time to negotiate.

However, Trump then responded and said 2.5% tariffs are too low and he wants much larger ones.

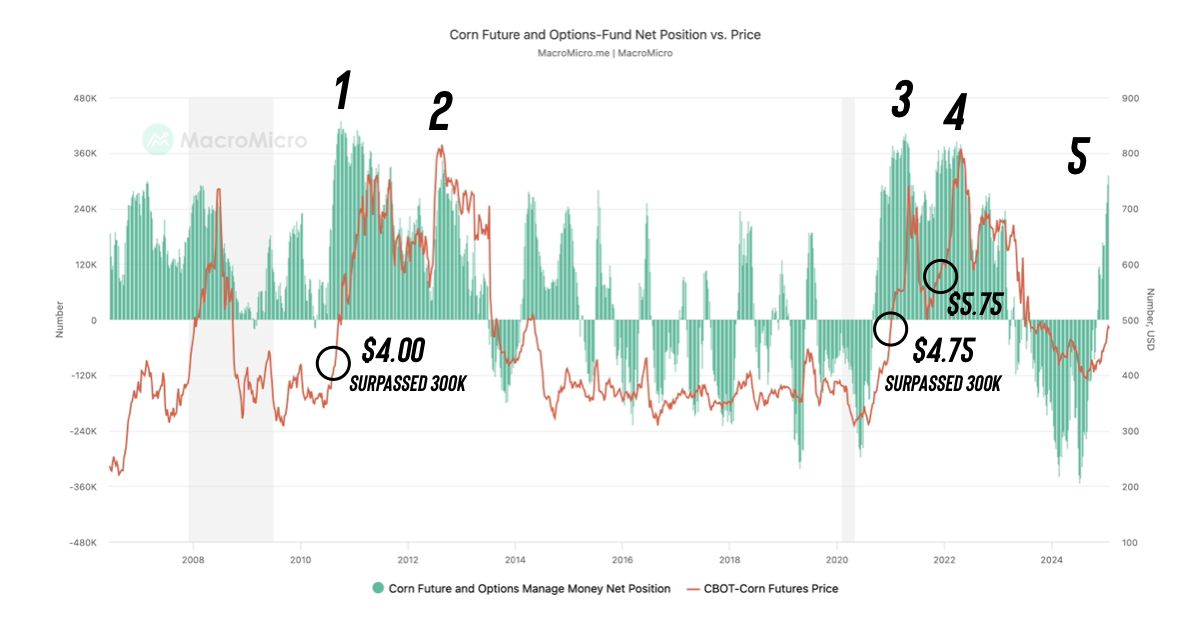

Funds Long Over 300k Corn

Here is some good data brought to my attention by Standard Grain.

There has only been 4 other instances where the funds went long over 300k contracts of corn.

Here is what happened during each of those.

August 2010:

The price of corn was around $4.00 when they first got long 300k.

They stayed long over 300k until June of 2011. Which is 10 months.

In that time frame, corn rallied as high as $7.50

July 2012:

This year is a little bit of an outlier due to the drought etc.

By the time they were long 300k corn was already about $8

They were only long 300k for about a month.

Dec 2020:

When the funds got long 300k, corn was at $4.75

They then stayed long over 300k until May 2021. Which was 5 months.

In that time frame, corn rallied as high as $7.40

Nov 2021:

When the funds got long 300k, corn was around $5.70

They were long over 300k until June 2022, 6 months or so.

Corn rallied to over $8.00

(Fun Fact: the funds have never been long 300k in a bear market cycle)

Now does this mean corn is going to $6 or $7? Absolutely not.

I am just showing you this because there is several people out there that think prices can’t go higher because the funds are nearly “max long”.

But this isn’t the case.

The real moves in the corn market happened AFTER the funds were already long 300k. Basically the funds had positioned themselves for the rally.

The funds don’t necessarily entirely move the market. More often than not they simply follow a trend they see.

I also wanted to show you that 3 of the 4 times the funds got long over 300k, they were long that amount for several months. (Exception is 2012).

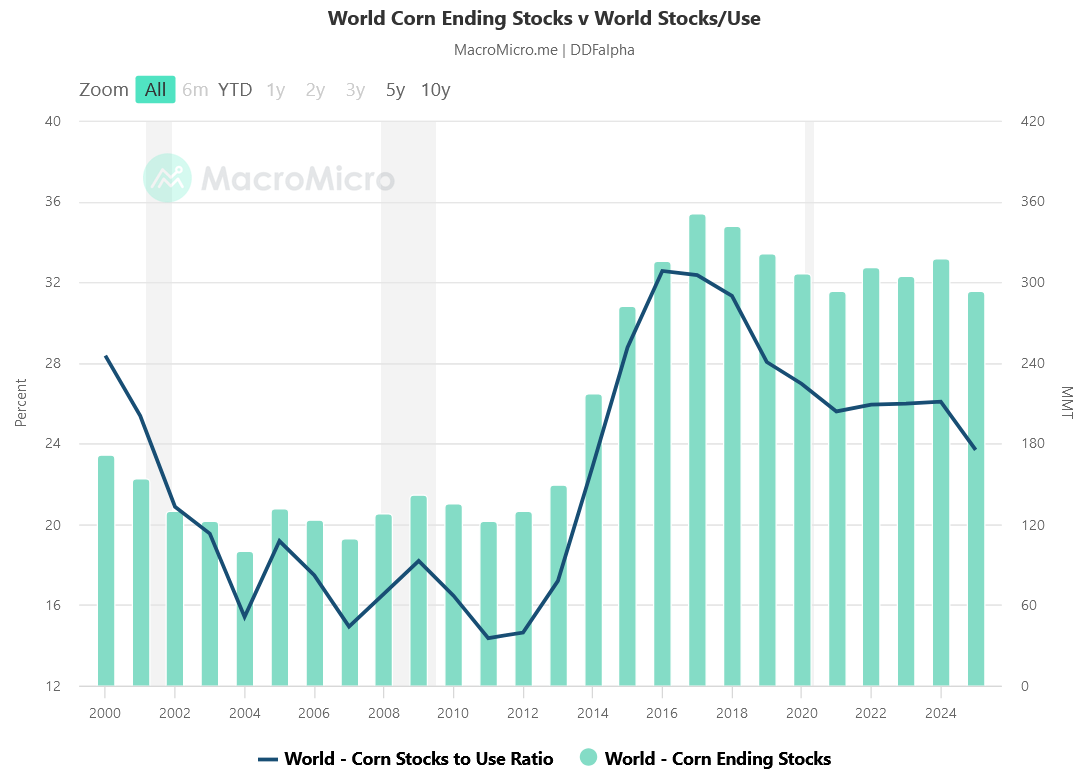

World Corn Situation

Here is a chart from Darrin Fessler showing the corn world ending sticks & stocks to use ratio. He quoted this chart by saying:

A chart worth watching.

11 year lows

Safrinha needs to perform

US acreage needs to be big?

Tariffs/demand uncertainties

Weather, weather, weather

Our global situation for corn is very friendly, with the lowest stocks to use ratio in over a decade.

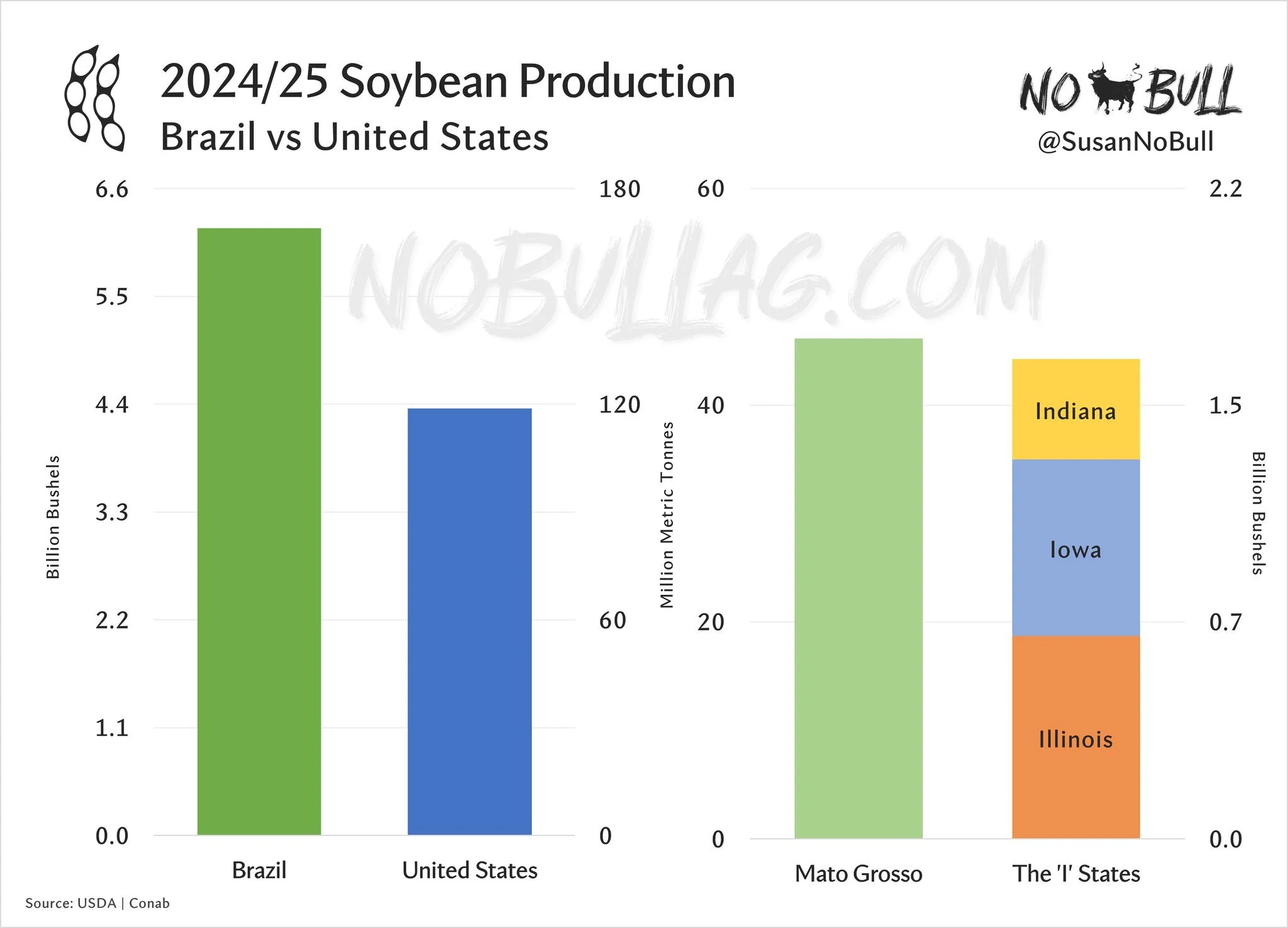

The Brazil Bean Issue

Here is a great chart from Susan of NoBull Ag that shows just how big of a producer Brazil is.

She compares the #1 growing state of Mato Grosso to the I-States in the US.

Mato Grosso produces more than all of them combined.

Another reason why this monster crop in Brazil is weighing on the upside in beans.

I am not saying beans are going to $9 I am just stating that this could definitely limit some upside.

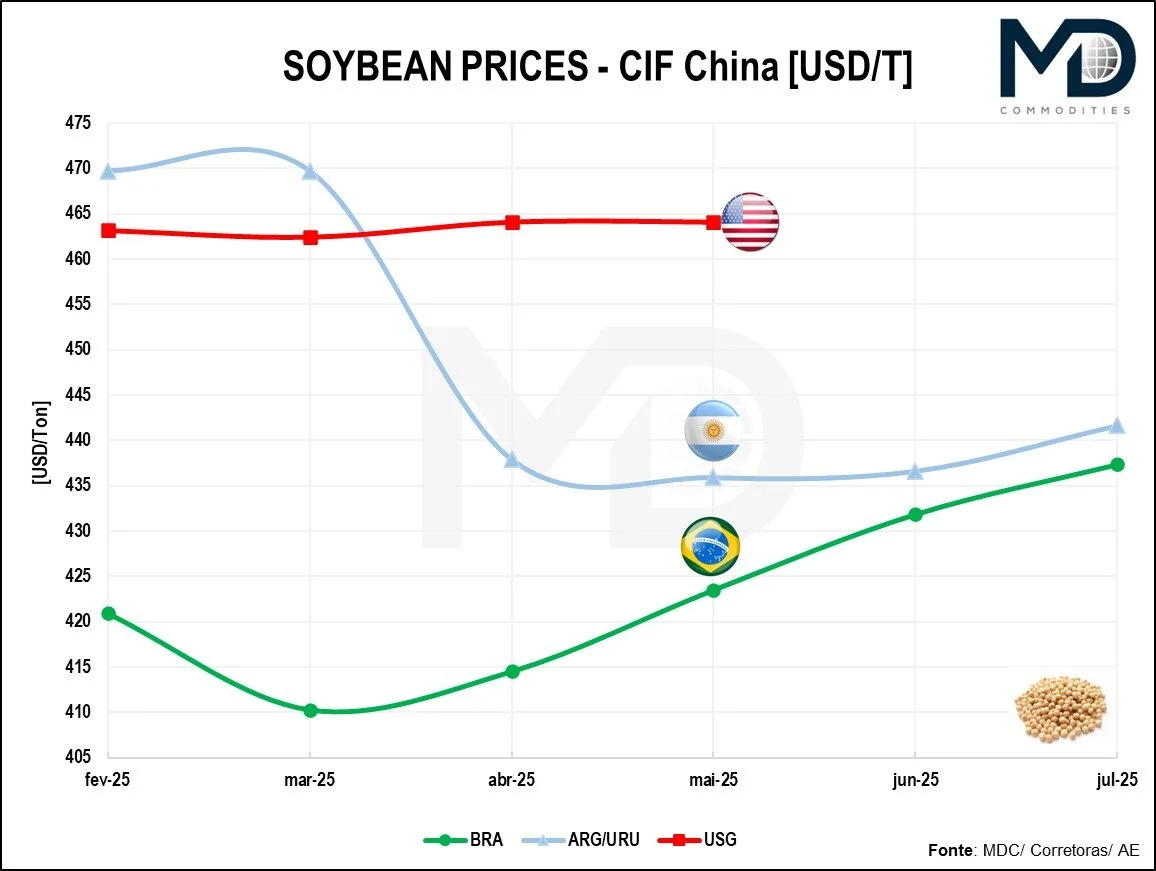

Now here is the soybean price comparisons to China.

The US is far more expensive than both Brazil and Argy.

And this is without any tariffs on China.

This could possibly bring the chance for future US exports to disappoint.

SA Slow Harvest & Planting

Brazil will have a monster crop, but harvest is the slowest in years.

Sitting at just 3.2% complete vs last years 8.6%.

This is also leading to the planting of the 2nd corn crop in Brazil being the slowest on record. At just 1.4% complete vs 10.3% last year.

This was part of the reason for the strength in corn today.

Sources are now saying that 30-40% of that corn crop is going to be pushed into a less than ideal growing window. Which opens the door for production loss.

This is more of a friendly headline for corn than soybeans in my opinion.

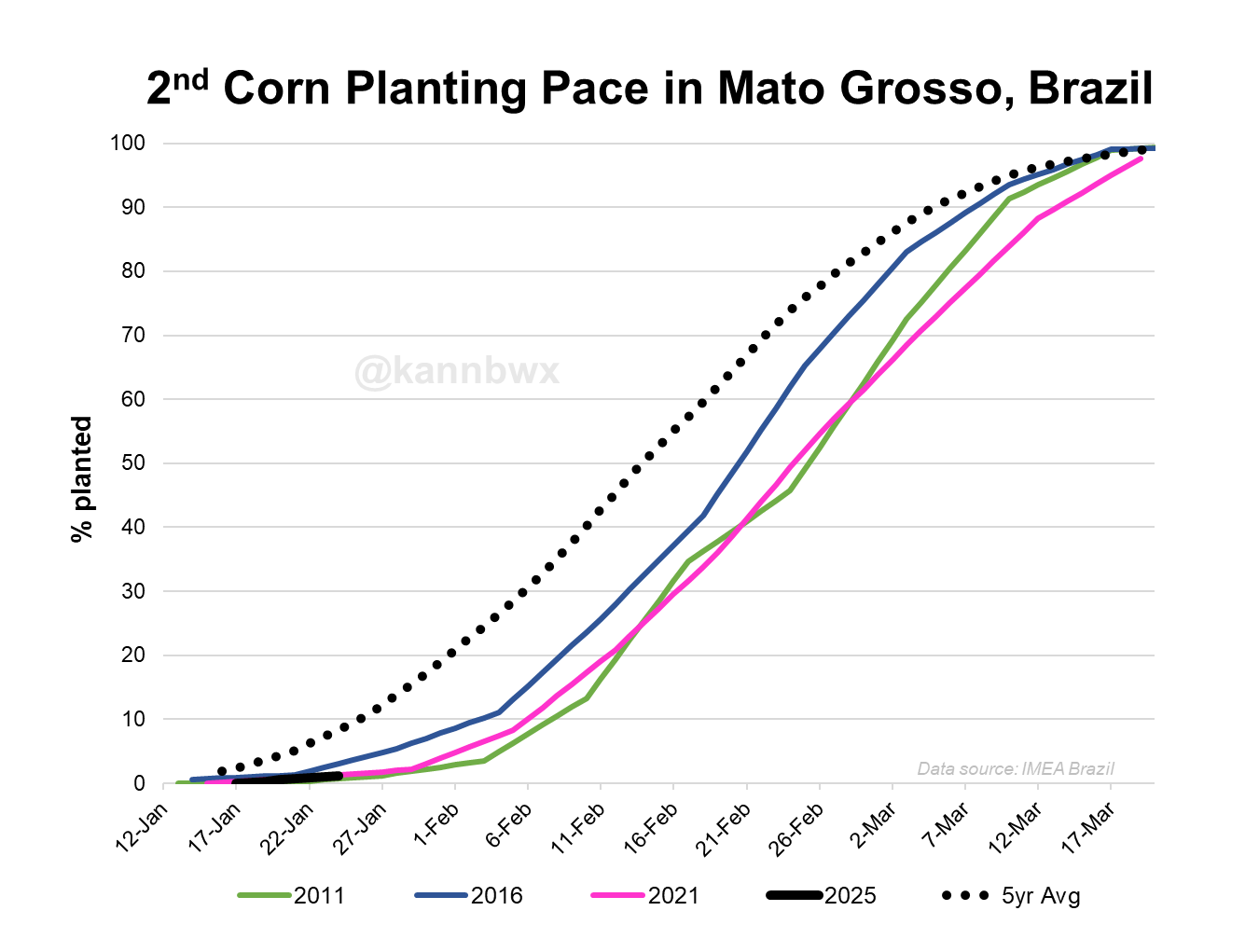

The 3 years that had the poorest yielding corn years?

They all had slow planting pace. 2011, 2016, and 2021.

Here is a chart from Karen Braun showcasing the planting pace in Mato Grosso (the number #1 growing state).

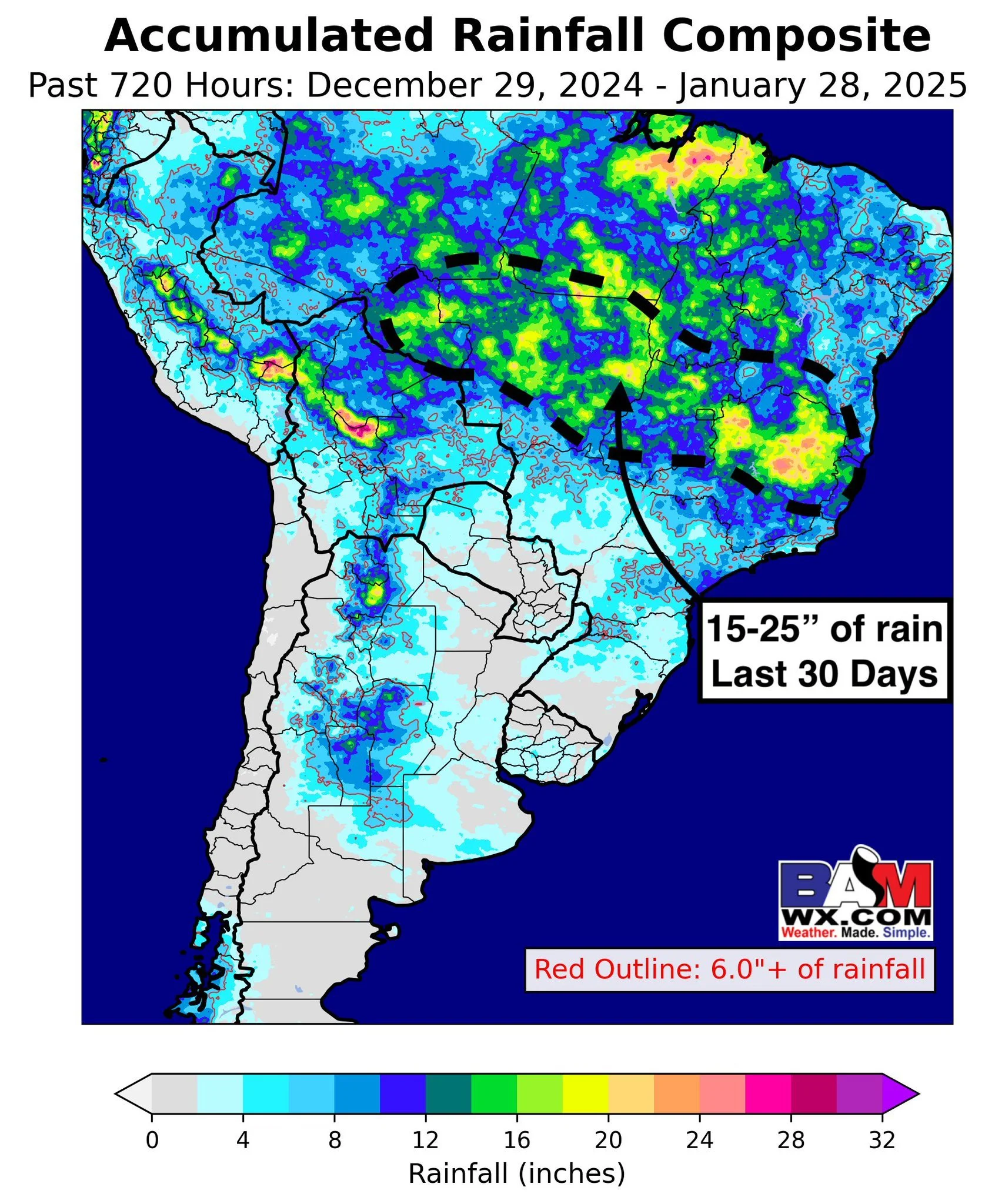

Brazil has been too wet, Argy has been too dry.

Analysts are also dropping their Argy estimates.

Right now analysts have the Argy bean crop at 49 vs the USDA's 52 MMT.

With Argy corn at 47 MMT. Well below the USDA's 52 est.

Here is past 30 days of rain.

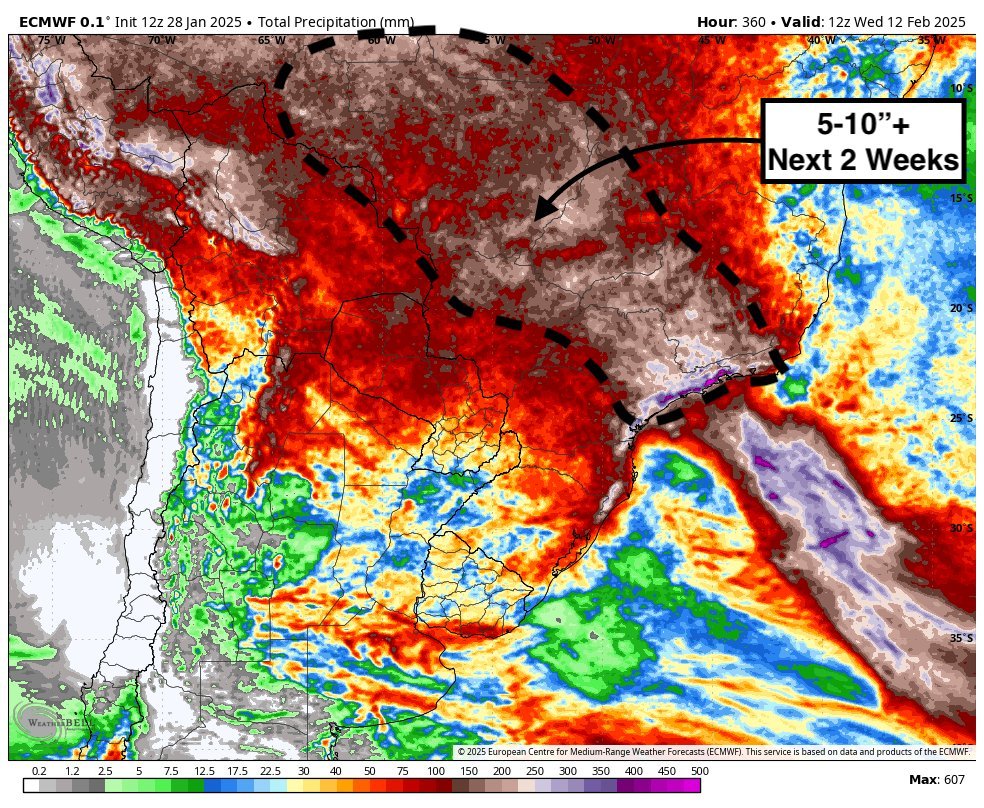

Here is next 2 weeks of rain.

Argentina should get a little bit, but it looks like Brazil could continue to face delays with the rain.

Argy Export Tax Cut News

We mentioned this a few days ago, but Argy is cutting export taxes until June 30th.

This led many thinking that we would see more competition for the US.

However, reports suggests that Argy farmers are 72% sold on last years bean crop and 80% sold on their corn. And farmers are hesitant to sell here with the weather issue concerns.

So this might not create that much competition.

Today's Main Takeaways

Corn

Long term I still see plenty of upside in the corn market.

We have a carryout that has dropped to 1.5 billion vs +2 billion not long ago.

The funds are long 300k contracts for the first time in years.

We have a friendly global balance sheet.

The biggest issue corn faces is the potential for a ton of acres this year.

Then of course tariffs are an unknown, but the funds obviously aren’t concerned about tariffs. They are putting their money where their mouth is.

Short term, I could still easily see corn getting a correction but we do not have to.

If we do, I am looking for a bounce in the $4.65 to $4.70 area.

My line in the sand to remain bullish is $4.50 (blue line)

I still think there is a chance corn sees well over $5.00 with $5.37 being my bigger picture target.

As that is the next fib level (38.2% retracement) to the 2022 $8.24 highs.

Again front month corn posting its first higher high since those $8.00 highs back in 2022 isn’t something to scoff at.

I think this could very well potentially be a trend shift looking long term.

Again, we have a golden cross.

(50-day MA crossed the 200-day MA)

A textbook long term indicator suggesting a shift in trend.

We hit my first new crop target at $4.64 last week

Next upside target is $4.72

Soybeans

Seasonally this is the time of year where soybeans could struggle.

As we do have a huge crop coming online from Brazil.

We do not have to go lower, but that was a big reason for last weeks sell signal.

No one knows how tariffs will shake out.

Maybe we get 25% tariffs and Trump sends beans to $9.

Or maybe he makes China live up to their trade agreement and they wind up purchasing a ton of US grain. Somewhat like the end of 2020 and into 2021 (although I do not seeing it being nearly to that extent as China had issues of their own as well).

The global situation is still bearish, but the funds are now long soybeans for the first time since 2023. Do they know something?

Brazil has a big enough crop to where our upside might be limited. But at the same time, the US balance sheet has turned around so I think that eliminates our chances of $9 beans.

The South American crop are also getting smaller, not larger.

Looking at the charts, we have bounced right in this golden zone from the $10.19 to $10.76 rally.

Bulls would like a bounce here to keep the bias remaining higher short term.

Looking at continuous beans, bulls biggest obstacle is going to be to bust this downward trend from 2022.

My next targets for new crop beans are still the 50-61.8% retracements levels of the May highs.

$10.82 and $11.11

As we are currently hovering right around the 38.2% at $10.53

Unless we bust above this level, I could see us just simply be range bound between the 23.6% ($10.18) and 38.2% ($10.53) fib levels.

Wheat

The wheat market got some love today.

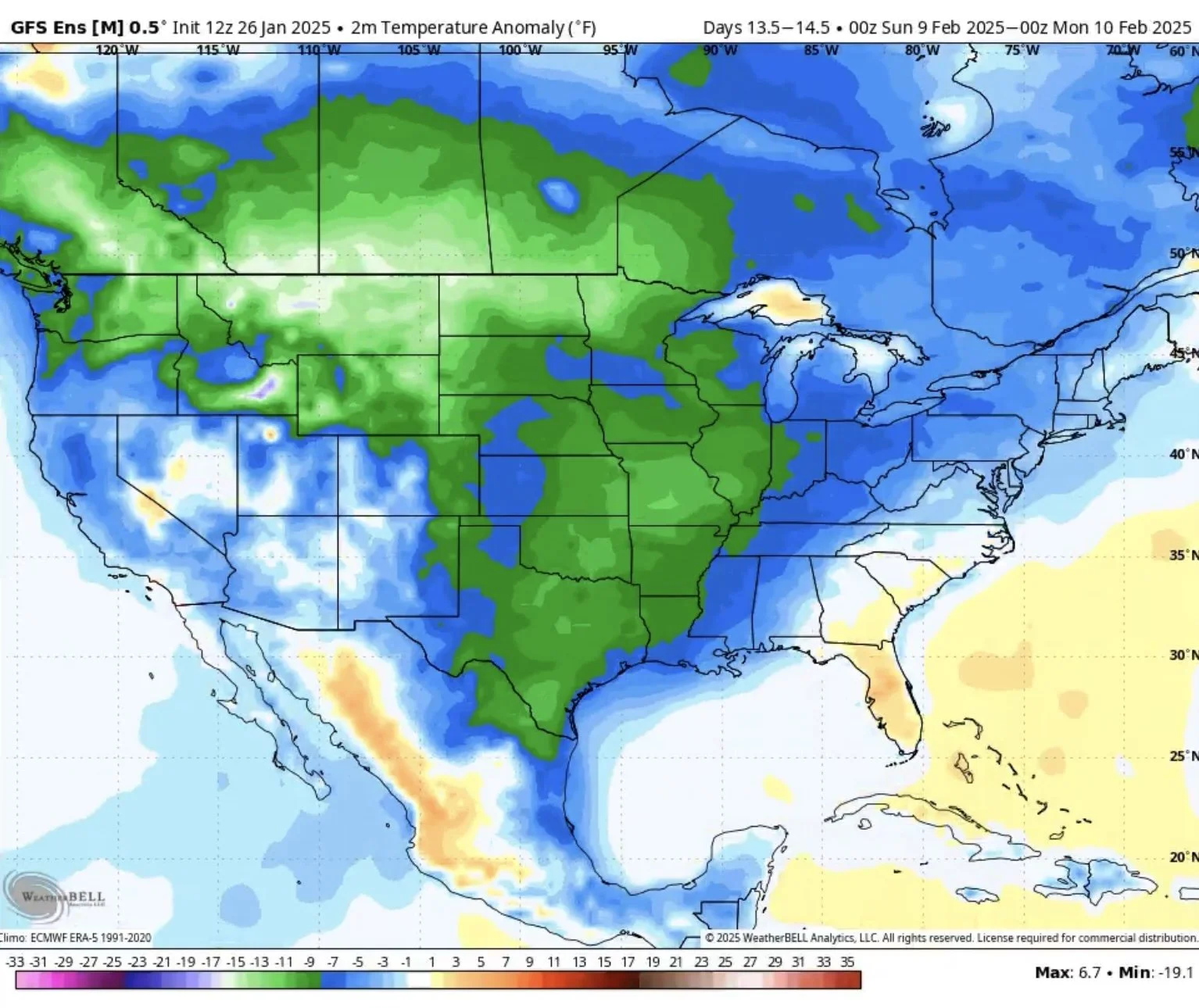

We have 2 weather headlines. Russia and the US.

First Russia.

37% of Russia's winter wheat is rated poor. 31% is rated good. That 31% is the lowest good condition in 23 years. So Russia's winter wheat is arguably the worst all time.

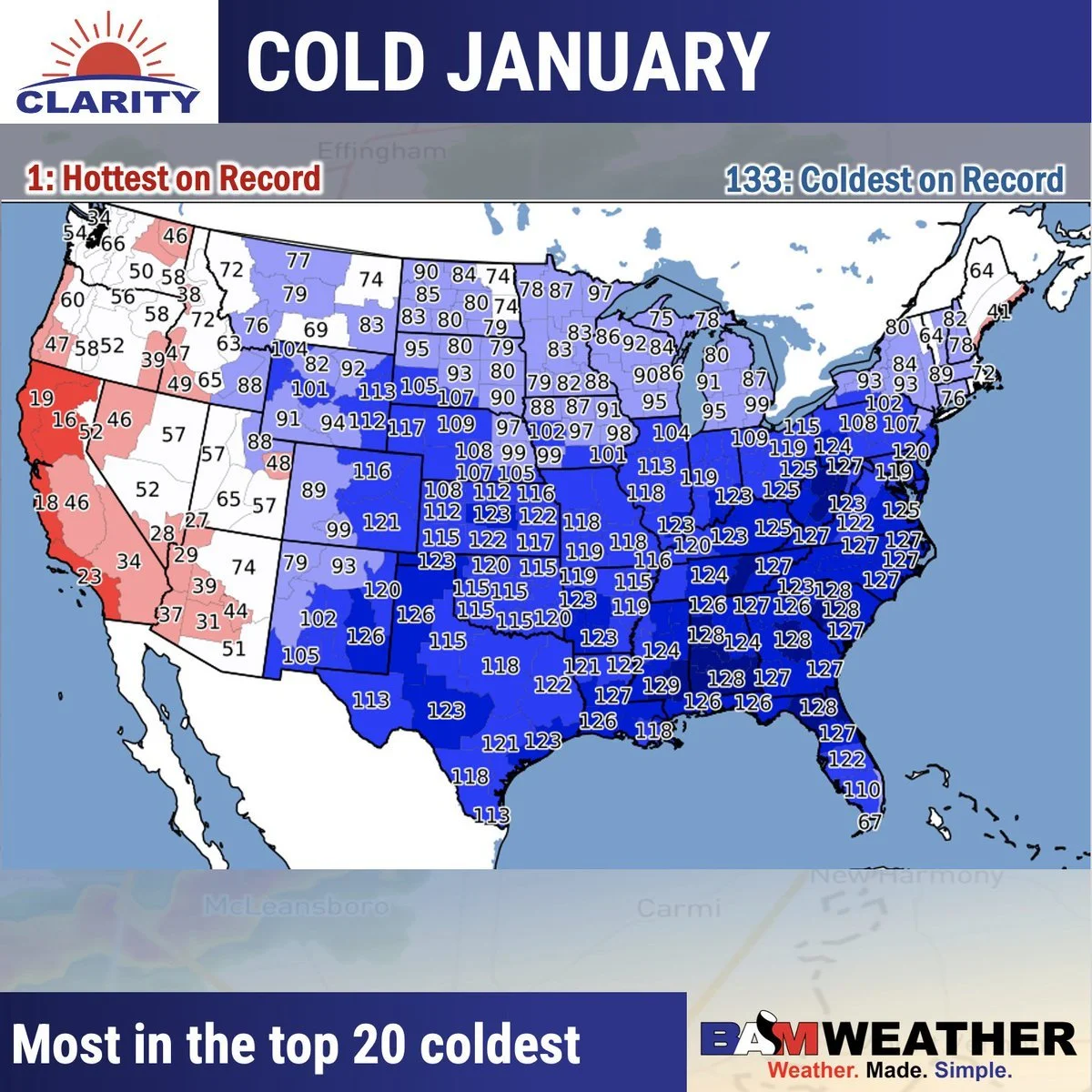

Then we have cold weather in the US that likely caused some damage to our winter wheat crops. Reports say that 65% of winter wheat regions were impacted by the cold snap.

Reports also say that up to 15% of winter wheat in the US is now in critical condition.

This January was one of the coldest on record.

Now the US is warming up to start February which opens the door to future possible winter kill, as it'll remove that snow cover.

Then it is suppose to get cold again come mid-February.

Start of Feb

Mid-Feb

Bottom line, I will continue to beat a dead horse and believe wheat has plenty of upside from here. Even if it doesn't happen in a timely manner, the upside is there.

Still think the chart looks decently friendly and should ultimately lead to a breakout.

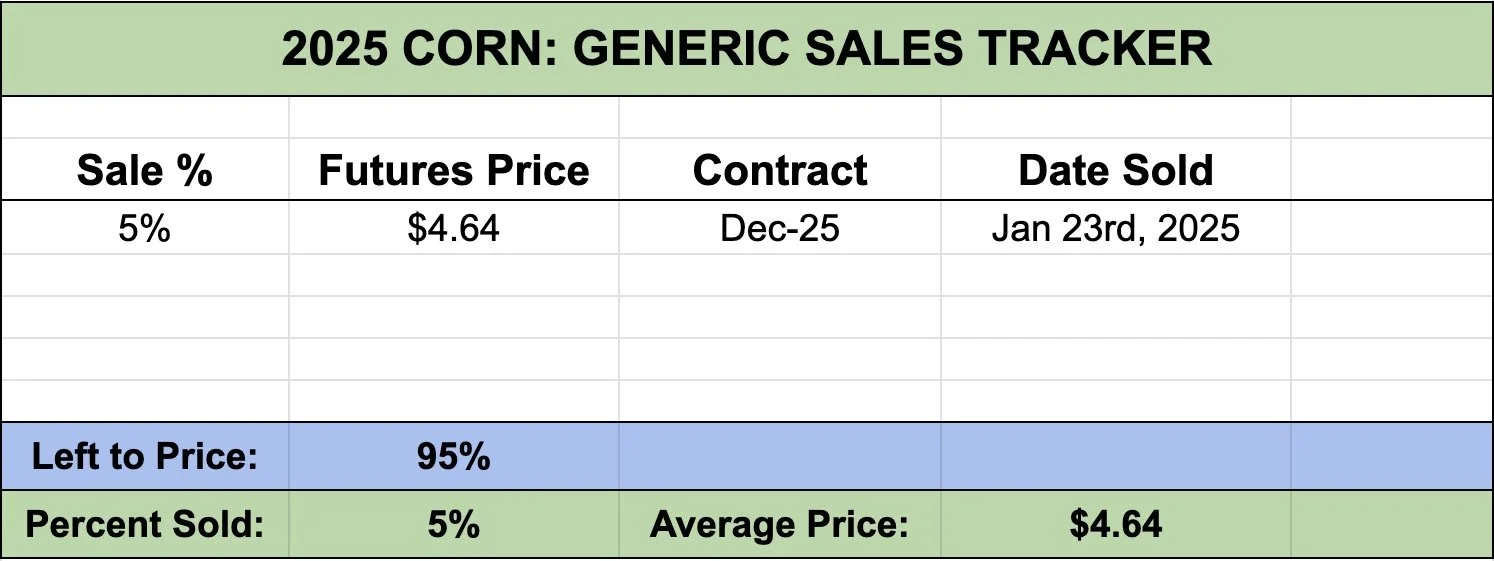

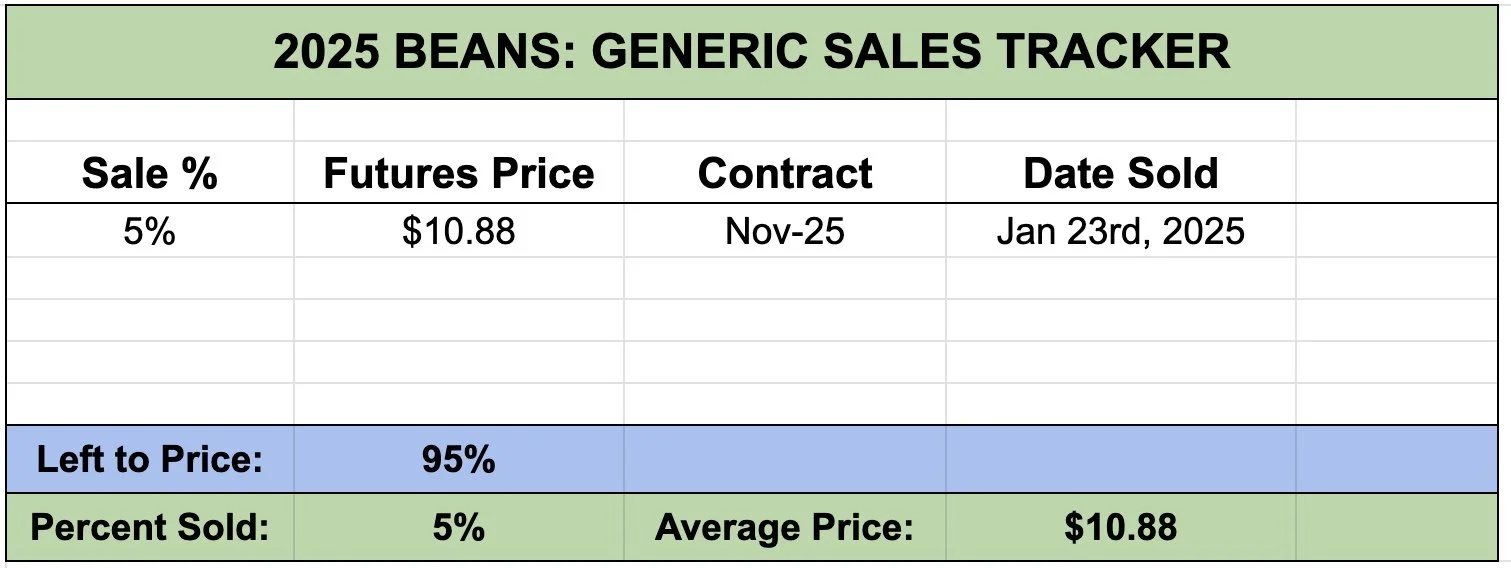

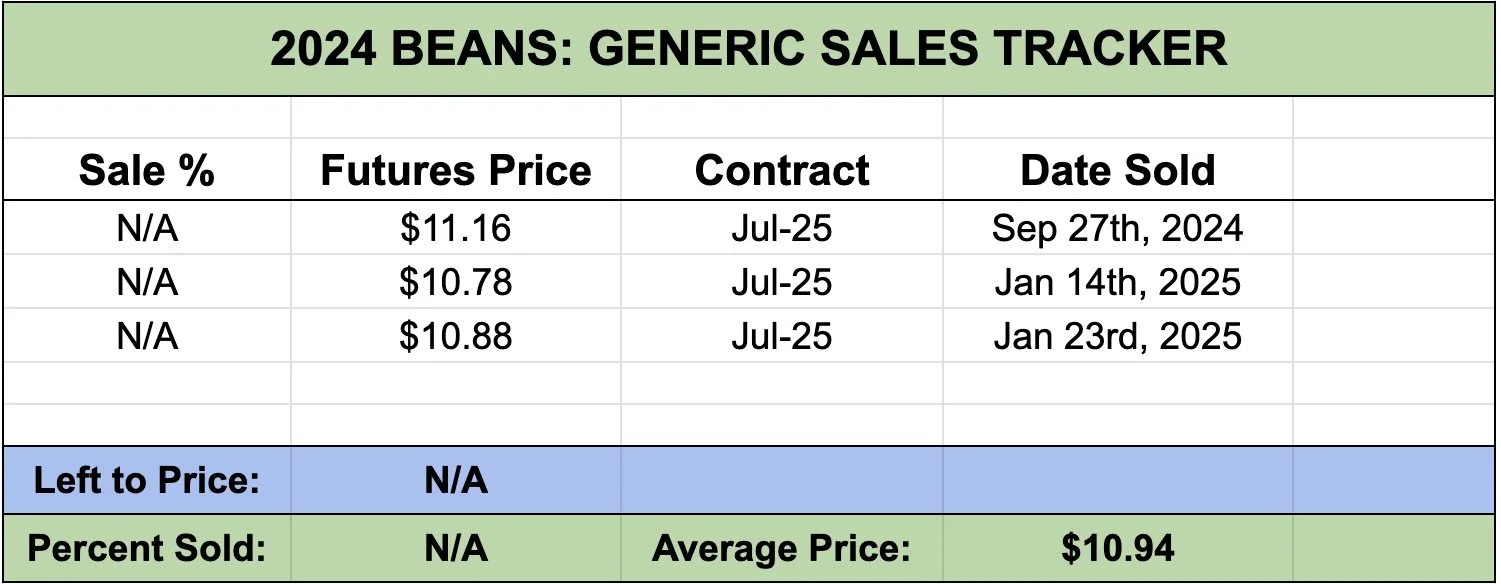

Generic Cash Sales Tracker

Due to requests here is our generic cash sales trackers.

This does not include any hedge recommendations etc. Simply cash.

This is futures prices.

For old crop there is no percentages as we only recently started tracking our generic sell signals. Future new crop sales will have percentages as we continue to make sales.

This will be included at the bottom of every update.

Past Sell or Protection Signals

We recently incorporated these. Here are our past signals.

Jan 23rd: 🌽 🌱

Corn & beans old crop sell signal.

CLICK HERE TO VIEW

Jan 15th: 🌽 🌱

Corn & beans hedge alert/sell signal.

Jan 2nd: 🐮

Cattle hedge alert at new all-time highs & target.

Dec 11th: 🌽

Corn sell signal at $4.51 200-day MA

CLICK HERE TO VIEW

Oct 2nd: 🌾

Wheat sell signal at $6.12 target

Sep 30th: 🌽

Corn protection signal at $4.23-26

Sep 27th: 🌱

Soybean sell & protection signal at $10.65

Sep 13th: 🌾

Wheat sell signal at $5.98

May 22nd: 🌾

Wheat sell signal when wheat traded +$7.00

Want to Talk?

Our phones are open 24/7 for you guys if you ever need anything or want to discuss your operation.

Hedge Account

Interested in a hedge account? Use the link below to set up an account or shoot Jeremey a call at (605)295-3100.

Check Out Past Updates

1/27/25

HEALTHY CORRECTION WE TALKED ABOUT & TARIFF NEWS

1/24/25

GRAINS DUE FOR SHORT TERM CORRECTION?

1/23/25

OUR ENTIRE NEW CROP SALES THOUGHTS & OLD CROP SELL SIGNAL

1/22/25

GRAINS TAKE A BREATHER. IS CORN IN A BULL OR BEAR MARKET?

1/21/25

HUGE DAY IN GRAINS. WHAT TO DO WITH OLD CROP VS NEW CROP

Read More

1/20/25

VIDEO CHART UPDATE

1/17/25

TRUMP, CHINA, ARGY & USING THE SPREADS INVERSE

1/16/25

OLD CROP LEADS US LOWER. MARKETING THOUGHTS

1/15/25

SIGNAL & HEDGE ALERT QUESTIONS EXPLAINED. IS $6 CORN EVEN POSSIBLE?

1/14/25

MORE DETAILS ON TODAYS HEDGE ALERT & SELL SIGNAL

1/14/25

CORN & SOYBEANS HEDGE ALERT/SELL SIGNAL

1/13/25

USDA GAME CHANGER OR NOT?

1/10/25

BULLISH USDA FOR CORN & BEANS

1/9/25

USDA OUT TOMORROW

1/8/25

2 DAYS UNTIL USDA. BE PREPARED

1/7/25

THE HISTORY OF THE JAN USDA & MORE

1/6/25

MAJOR USDA REPORT FRIDAY

1/3/25

UGLY DAY ACROSS THE GRAINS

1/2/25

LONG TERM CORN UPTREND? JANUARY DROP OFF IN BEANS? LONG TERM WHEAT FACTORS

1/2/25

CATTLE HEDGE ALERT

12/31/24

MASSIVE DAY FOR GRAINS. FLOORS? 2025 SALES? GAME PLAN? CHART BREAKDOWNS

12/30/24

GRAINS FADE EARLY HIGHS

12/27/24

STILL LONG TERM UPSIDE POTENTIAL, BUT TAKE ADVANTAGE OF 6 MONTH CORN HIGH

12/26/24

CORN ABOVE 200-DAY MA. ARGY DRY. BEANS +44 CENTS OFF LOWS

12/23/24

CORN & BEANS TALE OF 2 STORIES. BEANS REJECT OLD SUPPORT

12/20/24

PERFECT BOUNCE IN CORN. SIMPLE BEAN BACKTEST BEFORE LOWER?

12/19/24

THE SOYBEAN PROBLEM. NEW WHEAT LOWS. CORN UPTREND

12/18/24

BEANS BREAK SUPPORT & OPEN FLOOD GATES

12/17/24

SINK OR SWIM TIME FOR SOYBEANS

12/16/24

SOYBEANS & WHEAT FIGHTING LOWS. WILL CORN DEMAND CONTINUE

12/13/24

POST USDA COOL OFF

12/12/24

CORN CORRECTION. WHY WE ALERTED SELL SIGNAL YESTERDAY

12/11/24

USDA PRICED IN? FAIR VALUE OF CORN? BEAN BREAKOUT?

12/11/24

CORN SELL SIGNAL

12/10/24

USDA BREAKDOWN

12/9/24

USDA TOMORROW

12/6/24

CORN TRYING TO BREAKOUT. MAKING MARKETING DECISIONS

12/5/24

OPTIMISTIC BOUNCE IN GRAINS

12/4/24

WHEAT UNDERVALUED? MOST RISK IN BEANS. HAVE A GAME PLAN

12/3/24

BEANS HOLDING DESPITE LACK OF BULLISH STORY

12/2/24

TRUMP & BRAZIL HURDLES

11/27/24

CORN SPREADS, CRUCIAL SPOT FOR BEANS, SEASONALITY SAYS BUY

11/26/24