PREPARING FOR USDA REPORT & TAKING A LOOK AT HISTORY

Overview

Grains end the day mixed as the trade prepares for the USDA Quarterly Stocks Report tomorrow. The choppy trade continues, as traders don’t want to push prices too far in either direction ahead of the report.

Today we had corn higher, as it continues to look to put in it's harvest lows, now +21 cents off it's lows from last week. Soybeans continue to chop in their recent range around $13, but did manage to close +13 cents off of it's lows today, so fairly good close there. The wheat market lower here today, as Chicago was just slightly lower and continues to hold it's lows from the last USDA report, but KC wheat did make yet another new move lower today and it was down -9 1/2 cents on the day.

Overall, not a ton that’s new. As expected. All that matters to close out the week here is the USDA report. After the report we will go back to trading yield results and demand.

One thing to note, we still have the looming potential government shut down over the weekend. Which would mean tomorrow’s report will be the last one for a while. As when the government shuts down, so do the reports and data collection. According to Goldman Sachs, there is a 90% chance that the government shuts down.

The trade is expecting slightly smaller stocks for beans and wheat compared to last year. As for corn, they are expecting a little over 50 million bushels increase from last year, but slight decrease from the last report.

This report, has a long history of providing surprises either which way.

Here is the estimates for tomorrow.

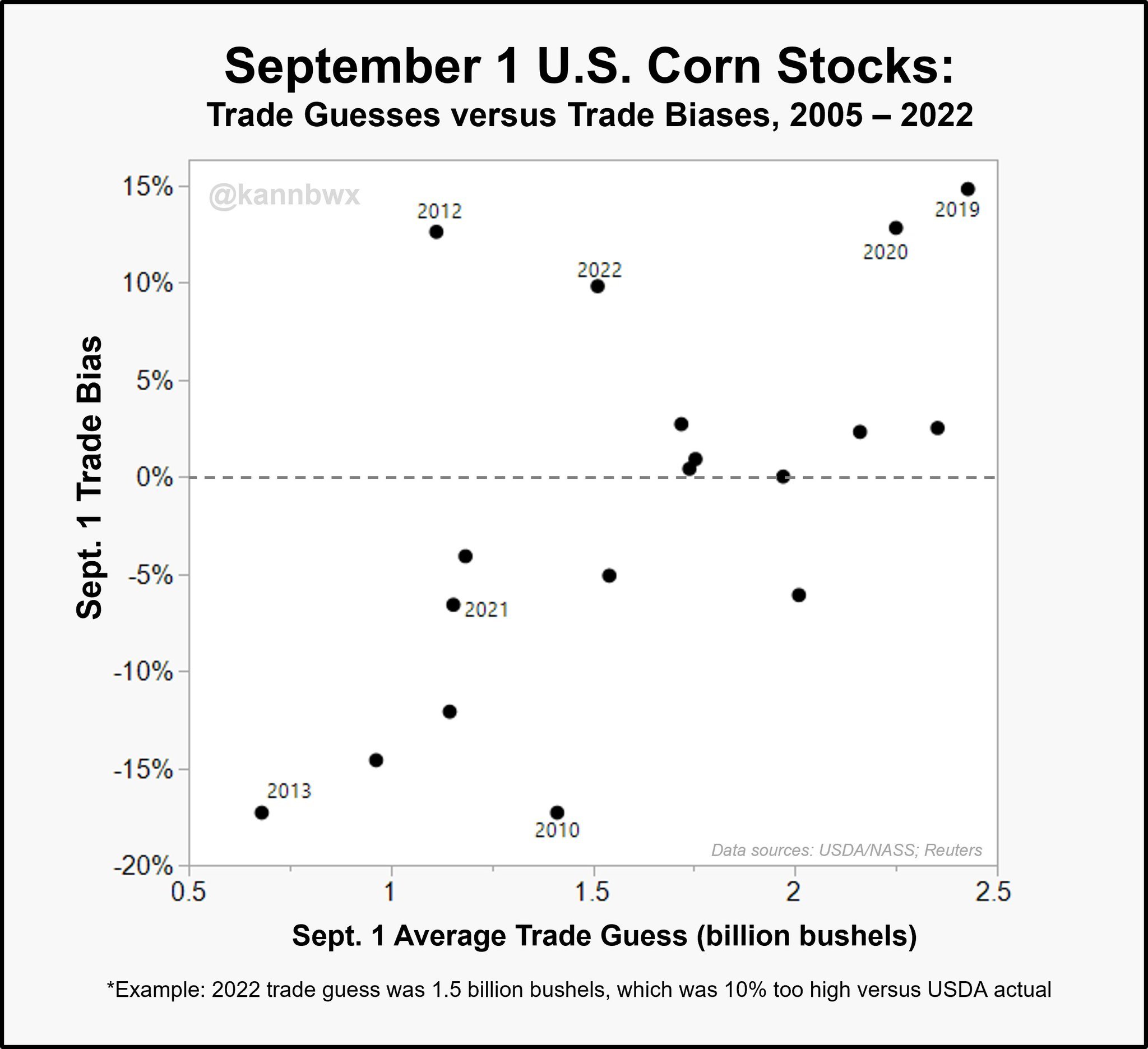

Chart Credit: Karen Braun

History of September Report for Corn

Below is a great graph from Karen Braun. It showcases how this report has played out in the past.

The left axis shows the % that the trade estimate was off by.

The bottom axis shows the average trade guess number in billions of bushels.

As you can see from the chart, historically when the trade is expecting larger numbers in this report, they tend to surprise under (bullish surprise). When the trade is expecting a smaller number, the report tend to have a surprise over (bearish surprise).

The trade's guess for tomorrow is somewhat in the middle of the road. Sitting at 1.429 billion bushels, which is similar to last year's 1.5 billion. Last year we had a bullish surprise, as the trade was 10% too high with their numbers.

Now should we be expecting a bullish surprise? Not necessarily. This year's estimates are right in that middle ground. So we could be in for a surprise either which way. We could have a report like last year, or like 2010. It is anyone's guess.

One thing to note is that sometimes stocks will come in higher due to a fast harvest.

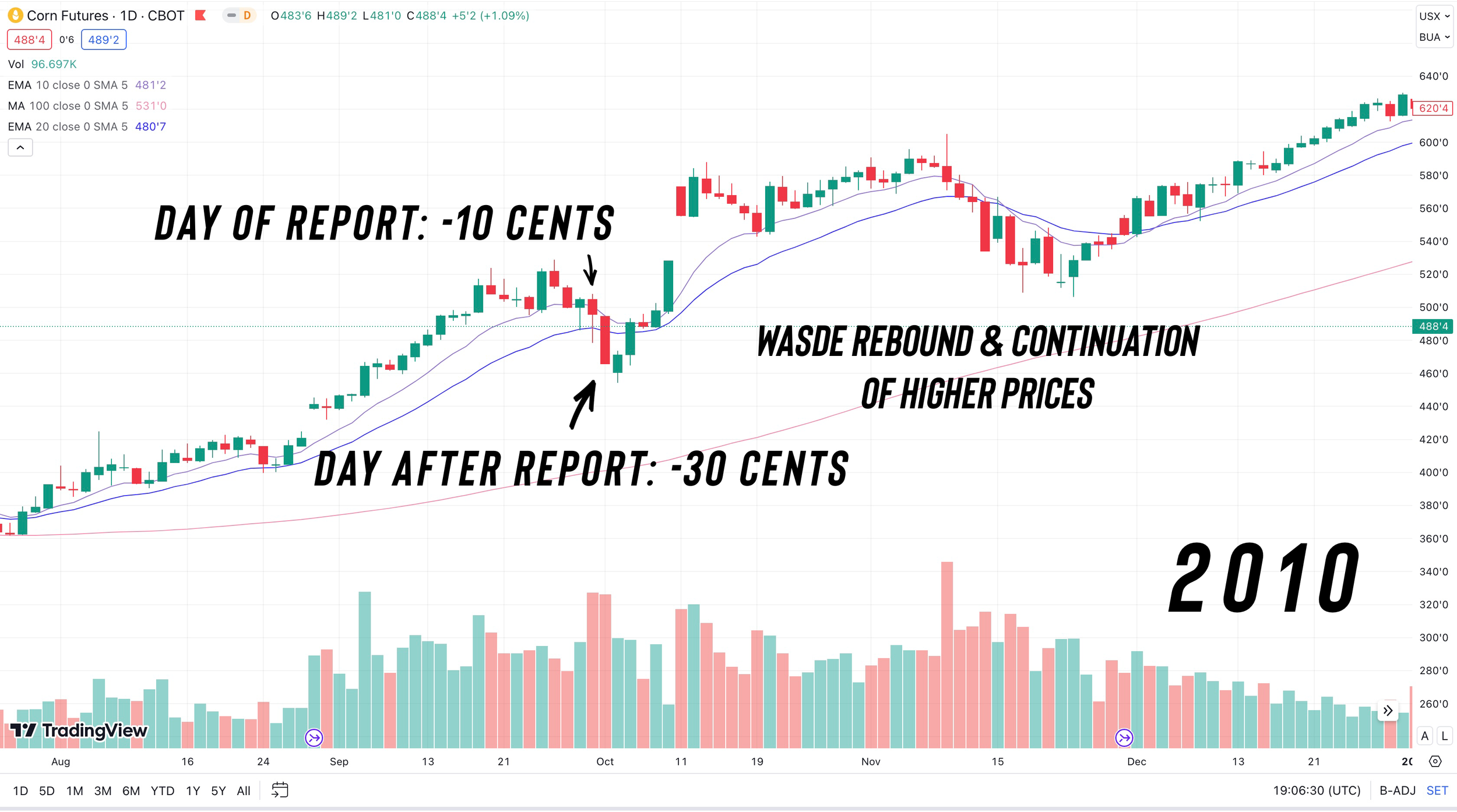

What happens if we do get a report similar to 2010 where the USDA comes in with a bearish whopping 15 to 20% above estimates?

Let's take a look back. In 2010, on the day of the report on Thursday, September 30th we lost -10 cents. The following day Friday, October 1st we lost an additional -30 cents. Meaning we lost a massive -40 cents from the report.

So if we get a bearish report, expect to see some pressure. It doesn't mean that pressure will last. We will still be putting in harvest lows no matter how the report shakes out.

If you take a look at the chart from 2010, after the report we lost that -40 cents, but we then climbed right back up when the WASDE report came out. Not only did we regain all we had lost, but we continued higher until spring of the next year.

Bottom line, look for this report to shake out either way. These reports are always coin flips.

If we come in above estimates, we will take it on the chin. If we come in below, we will go higher and confirm this harvest bottom. Either way, the harvest lows will be in soon if they are not already. If we get a bearish report, and by this time next week we are still holding those lows from last week, it would be a very good indication that the bottom is indeed in.

Today's Main Takeaways

Corn

Corn continues it's small rally, seeing it's highest close since August 28th and over 20 cents off it's lows from last week. This move higher was even more impressive given the weakness in both the soy complex and wheat.

Outside of the report, bears continue to look at is of course Brazil, who is looking at a top 3 record crop that is recently harvested. Demand is also one of the biggest things that has kept a lid on futures.

Bottom line, we should be in for higher prices later this year and into next. Our harvest lows are in or very near.

***

Here is a great little write up from Wright on the Market to go along with some historical charts. This strengthens our argument that the lows will be made very soon if they are not already in.

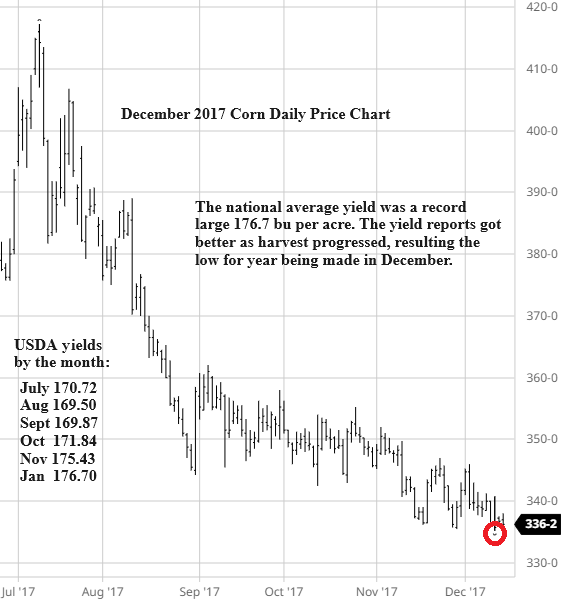

"The following charts are daily price charts of December corn from summer through harvest with the USDA projected corn yields July through January (USDA does not make yield adjustments in December). The purpose of these charts and monthly yields is to show you the price action before and after the low trade day. The only years a new low made after the first week of October is when the yields through harvested are better than the market and USDA expected. That has not happened since 2017.

If you think 2023 is a year where actual yields will be better than current expectations, then wait to buy corn or corn calls to offset cash sales.

Note the market action just before and just after the low is made (red circle) each of the last six years and compare that action with the 2023 market action. Specifically, how many days does December corn usually trade near the fall low?"

Basically what he is saying is that we have made our lows later than the first week of October only one time in the past 6 years. That year was solely due to the fact that that yields were better than both the market and USDA were expecting, which hasn’t happened since that year. I’m doubting yields are better than expected this year.

Yesterday we finally closed above our 20 day moving average and have broken out of our downtrend. Overall, the corn chart is starting to turn pretty friendly. Hoping tomorrow’s report doesn’t ruin it.

Again, if the lows are not already in, look for them to probably be made next week.

Corn Dec-23

Soybeans

Beans slightly down here today, hovering around that $13 mark. Most of the pressure today was simply due to fund liquidation.

For tomorrow’s report the trade is looking at for beans to see some slight reductions. It appears that most aren’t expecting any major changes to the exports or domestic crush. But it will be interesting to see if they decide to make any changes to last year's production estimate.

From Kevin Van Trump:

"As a spec, I am going into tomorrow's report holding a small bullish position. If the USDA delivers a bearish surprise I may look to take another very small bite adding to my current position. As a producer, I'm in no hurry to make more cash sales with an entire SAM weather season ahead, a fairly tight US balance sheet, and thoughts that the current USDA new-crop production estimate is going to work its way lower, not higher in the coming reports."

Kevin's stance pretty much sums everything up.

Even if we do get a bearish report tomorrow, the long term outlook for beans is still bullish. We have a tight US balance sheet. We have yields and production which will likely be working their way lower. Historically, beans have also rallied following this September report. There isn’t much reason for them not to continue that trend.

South American weather will be one of the biggest key factors to watch moving forward. If yields aren’t there here in the US like some suggest, then we couple that with a hiccup in South American production. It could be a wild ride for the bean market in the future.

Our key support remains at $12.82 which is the 50% retracment from our rally of $11.30 to $14.35. Bulls do not want a break below that level, otherwise it could lead to some further downside.

Soybeans Nov-23

Wheat

Wheat futures lower again here today, as Kansas City wheat remains the dog. Making yet another low. Chicago wheat however has held that low we mentioned following the last USDA report.

The recent rally in the dollar certainly hasn’t helped wheat and our exports.

After tomorrow’s report, the trade is going to get a lot of new data to digest. The estimates for tomorrow have wheat stocks sitting at 1.172 billion bushels vs last year's 1.178 billion. So a very very slight decrease is expected.

However, I have heard some talk that some think this number could ultimately be closer to 1.150 billion or perhaps lower. That would be a nice surprise for bulls. But as always, we can’t bank on the USDA providing a bullish surprise.

If we get a negative report, Chicago wheat likely makes a new lows, which could trigger some additional selling. If we get a positive report, there is a good chance those recent lows hold and the wheat market carves out it's seasonal lows.

Short term, there still isn't a major reason for wheat to rally aside from a war or weather wild card. But long term, the potential is still there. Especially when you take into consideration all of our global weather headaches we are seeing across the globe in Australia, Argentina, Canada, the EU, etc.

Still patiently waiting for all of these bullish factors to matter. As mentioned the past few weeks, seasonally this is the time when we put in our harvest lows.

On Chicago, we need to hold that $5.70 low. If we can’t, we could be looking at another leg lower. As for KC wheat, I'm not trying to catch a falling knife. If we were to continue lower, the $6.61 level might be the next major support if we don’t find some soon.

Chicago Dec-23

KC Dec-23

MPLS Dec-23

Hedging Account

No matter the situation you are in, our partners at Banghart Properties Grain Marketing can help you come up with a plan of attack to help you manage your risk. If you want help managing your risk you can give them a call anytime at (605) 295-3100 or set up a hedge account below.

Check Out Past Updates

9/27/23 - Audio

PROTECTING YOUR INSURANCE GUARANTEE

9/26/23 - Market Update

GOVERNMENT CONCERNS & PREPARING FOR USDA REPORT

9/25/23 - Audio

HAVING A PLAN OF ATTACK

Read More

9/22/23 - Market Update

WEEKLY WRAP

9/21/23 - Audio

HARVEST BASIS THOUGHTS

9/20/23 - Market Update

BUYING OPPORTUNITIES

9/19/23 - Audio

CAN WE FIND DEMAND?

9/18/23 - Market Update

HARVEST PRESSURE

9/15/23 - Audio