FAILED REVERSALS & ELECTION YEAR RALLIES?

Overview

Grains finally get some follow through strength to start the day. As today was essentially the first day of the year where we managed to take out the previous days highs.

This came after all the markets posting fresh lows yesterday before rallying to end the day.

However, the soybean sellers win once again today. As both corn and soybeans closed well off their highs and soybeans closed the day fractionally lower.

Overall some "signs" of reversals, but nothing quiet yet for bulls to write home about, as we failed to confirm any reversals with the funds selling the rally.

Wheat on the other hand strings together 3 green days in a row in hopes of a reversal with short covering and strong weekly export sales.

Fresh news in the markets is lacking.

The key for prices will be the funds. Do they want to continue selling? Or is enough enough?

If the funds do decide to cover, it would result in a nice rally given they are sitting on some very heavy shorts across the grains. Yet to be determined..

Weekly Price Changes

Mar-24 Corn: -1 1/2 cents

Dec-24 Corn: -5 3/4 cents

(March corn gaining on the December corn is a slightly positive sign)

Mar-24 Beans: -11 cents

Mar-24 Chicago: -2 3/4 cents

Mar-24 KC: -7 1/4 cents

Mar-24 MPLS: -4 3/4 cents

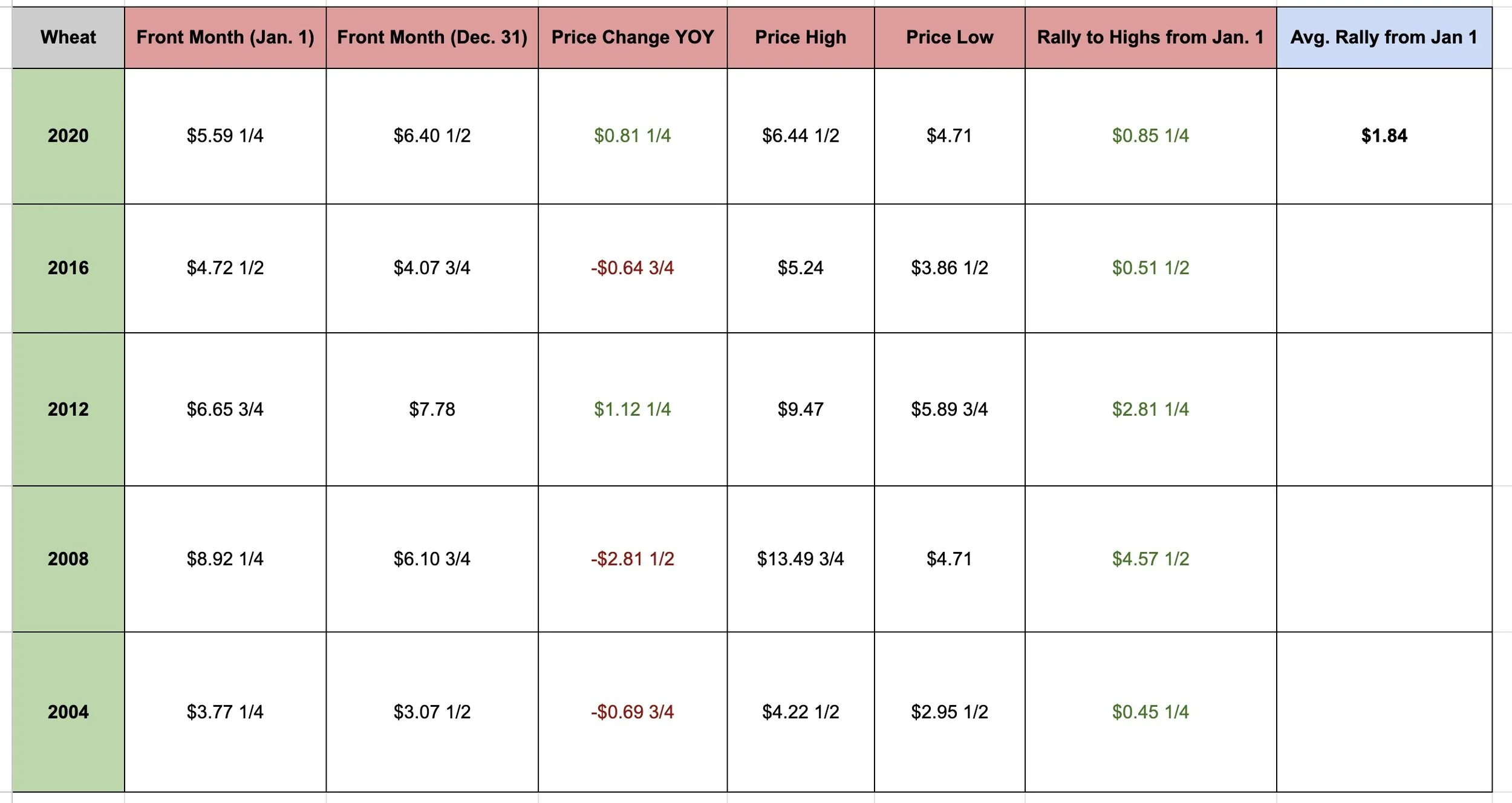

Election Year History for Grains

We mentioned yesterday that election years tend to be big ones for the grain market. But just how big are they typically?

Below are charts with our prices changes over the year as well as our average rally from January 1st to our highs for the year.

As you can see it's usually a coin toss as to whether we will be higher by the end of the year or not. But one thing we can’t ignore is that every election year for the past 2 decades we have rallied well off of where we opened up at on January 1st.

For this example we used the front months for each contract as some of the big moves for example happened after the contract went off the board for corn in 2020.

What was our average rallies?

Corn's average rally is +$1.52 3/4

Bean's is a whopping +$3.89 1/2

Lastly wheat's is +$1.84

Here was the dates of those highs:

Corn:

2020: Dec 31st

2016: June 8th

2012: August 10th

2008: June 30th

2004: April 5th

Beans:

2020: Dec 31st

2016: June 10th

2012: September 4th

2008: July 3rd

2004: March 24th

Wheat:

2020: Oct 20th

2016: June 8th

2012: July 23rd

2008: Feb 27th

2004: March 22nd

Here were the dates of the lows we made before the rally:

Corn:

2020: April 29th

2016: April 1st

2012: June 1st

2008: March 8th

2004: Jan 12th

Beans:

2020: April 21st

2016: Jan 6th

2012: Jan 12th

2008: April 1st

2004: Feb 2nd

Wheat:

2020: June 20th

2016: April 16th

2012: Jan 18th

2008: Jan 10th

2004: March 12th

Now does this mean this year will follow this same trend? No, but I just wanted to point out that historically, yes election years tend to see rallies across the board.

Timing of when they happen is another question, some years the rally happened in the summer, some happened in the fall and winter.

We don’t know for sure how big the rally will be, or if we will get a major one at all. I think we will, but there are a lot of factors at play such as how this upcoming growing season for corn will be.

But what we do know is this is an election year, so something big will likely happen in the world as usual.

One thing to keep in mind if Trump is elected is the potential implications or possible trade war with China.

This next data is from futures trader Darrin Fessler. He pointed out some interesting facts.

First for corn. Since 1963, January 1st to first notice date of the December contract, there habse only been 4 years that December corn failed to close higher than the highest January closing price.

Those years were 1985, 1986, 1989, and 2001.

January closing high price for December 2024 contract? $4.98 3/4

It's about the same story for soybeans. This has only happened 7 times since 1963. Those years were 1975, 1981, 1985, 1986, 1999, 2006, and 2019.

Harvest Trader on Twitter:

"By no means a bull, trust me. But eventually we will run out of sellers for now... shorts will feed on themselves..."

Options Trader Brian Wilson:

"The catalyst that starts a rally in the grains may not be a number crunching reason of weather. It may just be, enough is enough."

Farm Futures asked:

"Anything on the horizon that could inspire a price rally for corn?"

Highly respected Naomi Blohm replied with:

"Weather for safrinha corn has to be perfect. Demand for Brazil corn equals 131.5 million metric tons. Currently the USDA has Brazil corn pegged at 127 million vs 137 last year. Approximately 32 million is growing right now, with 95 million pegged for the 2nd crop, which hasn’t been planted yet."

From Kevin Duling:

"I have to think South America will bring some fireworks as we get further into the Safrinha crop. It's just being planted now, so we're a ways off yet, but more rain now means more delays. More delays mean more corn trying to pollinate in the hot, dry season as opposed to their ideal season."

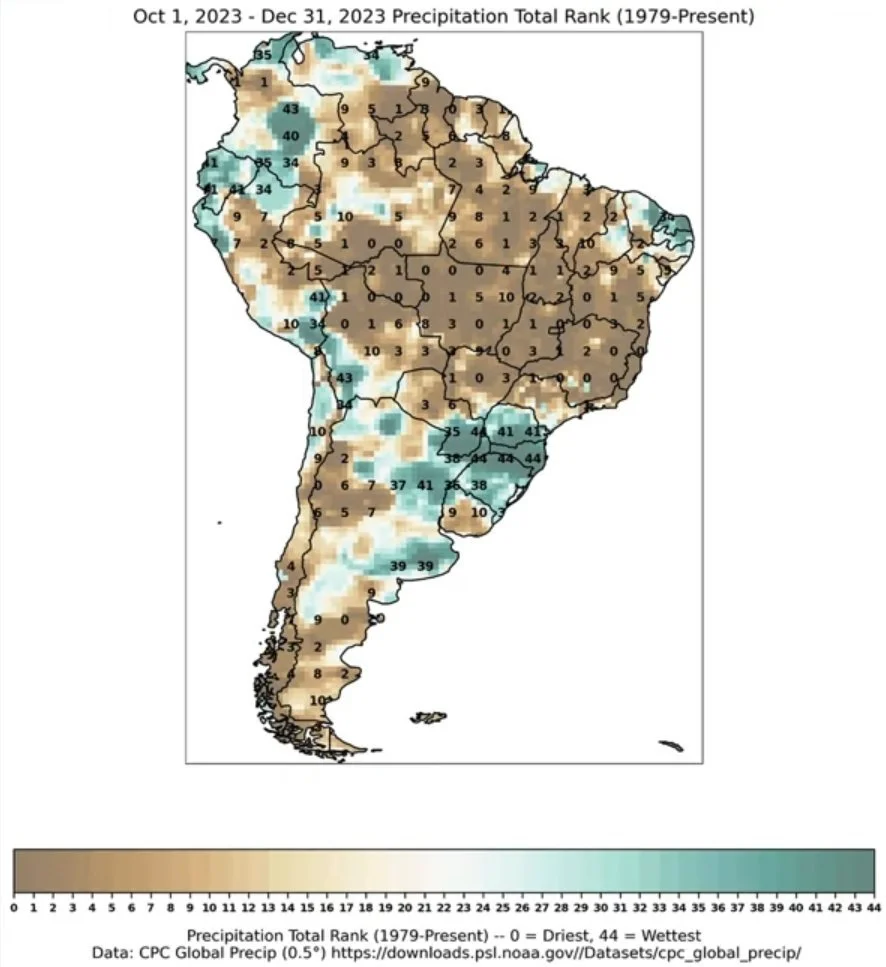

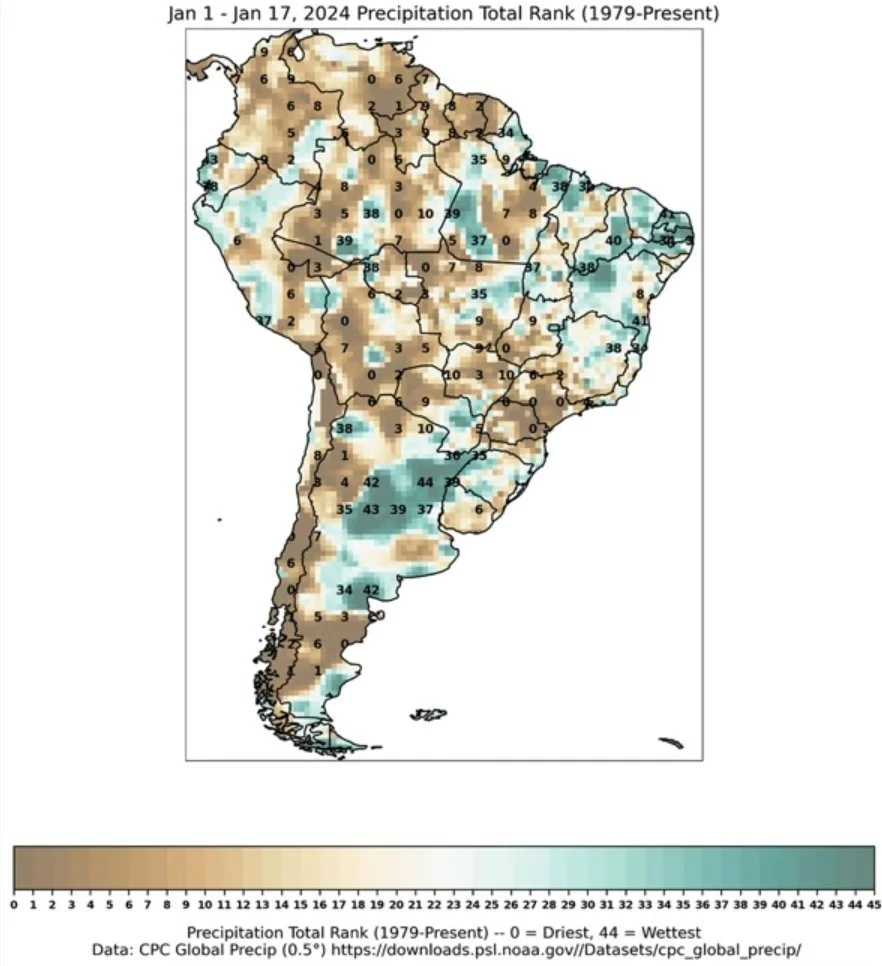

Following a historic 3-month long drought in Brazil where nearly every area ranked dead last in precipitation on record.. January saw some rains.

But how much? Some areas got great rain, others continue to struggle.

Rains now will not make much of a difference to the soybean yields. However, too much rain could create more problems as harvest gets underway and lead to delays for the second corn crop.

So yes, rain now would actually be beneficial to prices.

October to December Precip Rank

January Precipitation Rank (So Far)

Now let's dive into today's update..

Today's Main Takeaways

Corn

Corn had an okay day, slightly disappointing to see us close off our highs. But we were strong the entire day. After making new lows yesterday, we rallied and then we followed that rally up with a little bit of strength.

It is still early, but there are some clear signs of a possible reversal taking place.

Right now, there isn’t really a major factor to help us bounce of out here right now. The reasoning for the strength more than anything is that the sellers seem to be running out of steam.

The funds are short somewhere around -240k contracts of corn. That is a huge amount. What happens when they are forced to cover? They will be forced to buy a massive amount of corn.

So that is actually one of the best things corn has going for it right now, the fact that the funds are holding massive shorts. Timing of when they will decide to cover is the bigger question.

From Dormant Genius on Twitter:

Corn is 3 for 3 the last 10 yeas when the funds are short 150k or more contracts to start the year. Is this the 4th?

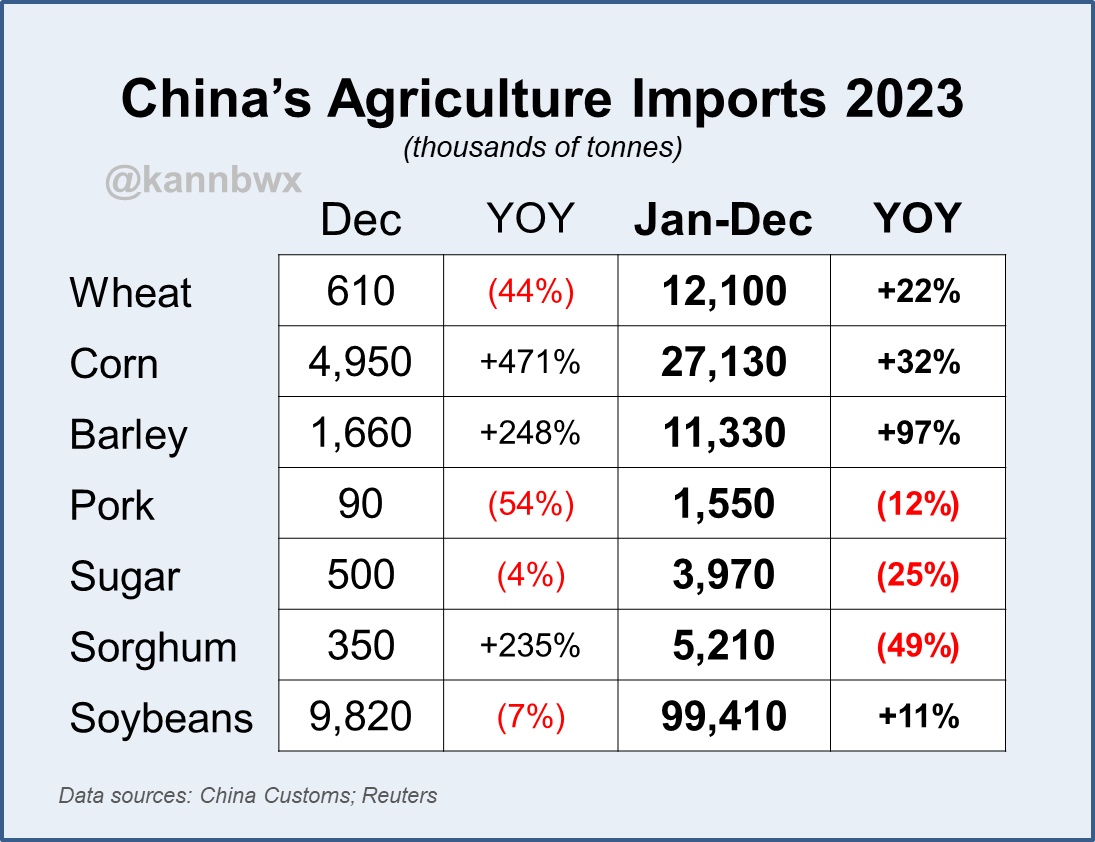

One friendly thing corn saw came from 2023 China corn imports.

They imported 27.13 million metric tons, a +32% increase from 2022.

We saw record December imports of 4.95 million, the previous record was 3.59 million and this number was +400% higher than December of 2022.

Why is China importing record amounts of corn if they just harvested their biggest crop ever last year?

Some think they are bluffing about their crop, but who knows. These are the numbers the market knows so that is what they will trade.

Chart Credit: Karen Braun

I still believe the second Brazil crop could wind up being a major bullish wild card down the line as we get further into it, but that doesn’t mean it "has" to happen. But this factor alone would be more than enough to cause the funds to want to cover their shorts.

For corn to move higher we absolutely need the funds to take the gas off of selling. Typically we need a catalyst for this happen. Some catalysts that could do this are a weather scare or some big buying from China.

Perhaps they ease up a bit on the selling here as the market may simply fun out of sellers and say enough is enough. But there is still a chance they continue to pound us lower until we get that catalyst.

I firmly believe prices will be higher come spring and summer. However, one thing that has the ability to feed bulls and push us towards $4 or even lower would be a bumper crop here in the US because we already have a massive carryout that is already bearish to begin with.

Nervous about the downside or have unpriced bushels? Seriously consider grabbing puts. It locks in a minimum price for you and puts in a floor while keeping the upside open to make sales. Make sure you keep your puts cheap, we don’t want to overspend on protection at these levels.

If you have made sales, I like the idea of courage calls with this mini bounce. For some of you, that route may make more sense than protecting multi year lows.

If you have questions or want specific advice, please give us a call. Every operation should be taking a different approach. Some of the options I mentioned may not be for you. (605)295-3100.

Taking a look at the chart, there are signs of a reversal. I would like to say we have found a bottom, but we don’t want to try catching a falling knife.

We closed above the 5-day moving average which was great. Bulls would like a close back above $4.50, but to really say this is the bottom we likely need to break out of this brutal downtrend which I have labeled with the blue line.

Our downside risk? $4.00

From National Farmers:

"March corn had a chart key reversal. Made contract lows and closed higher than the previous days close. This often signals a major low or a major immediate low."

Corn March-23

Soybeans

Yesterday soybeans posted some good action, and early today it looked like we would get some great follow-through strength. However, the sellers came in once again and we closed well off our highs.

We did manage to take out the previous days high for the first time basically all year, which was a good sign. But the sell off in the middle of the day killed the complete reversal. Some signs of a reversal, but just like corn it wasn’t quiet enough to for sure say we reversed.

The funds are now holding their shortest position in beans since February of 2020.

We had a sale of soybeans to China today, the first one in about a month. So good news.

South America weather is looking more favorable. It looks like Brazil is suppose to get some rain to end the month, which is favorable. But Argentina is now the one who may be going through a drought with some scorching temps.

However, rains at this point are not going to effect the soybean yields heading into harvest. If anything, too much rain could be a bad thing for their crop and harvest.

Longer term I still see much higher prices simply due to a demand driven market. We have a tight situation here in the US. We have the sustainable aviation fuel situation. Brazil is not having a bumper crop (although it might not be the failure bulls hoped for).

One "potential" negative I do see is China. There were just reports of their population decline. Less people could equate to less demand from them.

Even though long term I could see prices higher, does not mean we can’t go lower from here. If this reversal does not hold, there is still chance we drop below $12 with the chance to even test those summer lows of $11.45.

Whether these are our lows and we reverse higher, or if we go back below $12 will depend on what the funds want to do. None of us know what that decision will be.

Was this -$1 drop to start the year enough damage for now? Guess we will have to see.

I think we will see a slight short covering rally here very soon. How high prices go after that or if we give back that rally will depend on a few factors such as China and what the Brazil crop looks like once we get into the fields.

As for risk management, it's the same story as corn. If you have unpriced bushels it very well might make sense for you to lock in a floor with some cheap puts, as there is still some risk to the downside here.

Give us a call if you have questions (605)295-3100.

Taking a look at our chart, have signs of a reversal. But still need confirmation. If we do get a short covering rally, I think we could see $12.50 very easily. If the funds do decide to continue hammering us lower, bulls will need to defend that $12 level. If they can not, there is a big pocket of air to the downside and our next big levels of support are $11.75 and then the summer lows of $11.45.

Bottom line, don’t be surprised to see some more pressure short term if the funds decide they don’t want to cover yet. Long term and later into this year I do believe we will see higher prices, but of course it doesn’t have to shake out that way. So get yourself comfortable with every scenario.

Soybeans March-23

Wheat

The wheat market was the hero today. The only grain that didn’t give back all of it's gains. Believe it or not, this was the 3rd day in a row we have traded higher and bulls are hoping this is the start of a reversal.

The reason for the higher prices is technical short covering as well as some better than expected weekly export sales. As they came in the strongest we have seen in 5 weeks.

Bulls are pointing at some better demand from China along with the EU crop getting smaller, not bigger.

From the data I showed above in corn, China imported nearly +30% more wheat in 2023 than the year before.

Bulls are also talking about the brutally cold temps recently here in the US. The weather is suppose to get pretty warm towards the end of January, which will melt a lot of snow cover and open that door to potential winterkill in February.

Bears are looking at the recent rally in the dollar. They are of course also still talking about Russia's bumper crop along with the poor US exports.

Bottom line, I still think wheat is a sleeper and has all of the upside in the world. When that upside will happen is anyone's guess. Could we go lower? Sure. But there is a solid chance prices will be higher than where we are currently later in the year.

If you have questions on marketing or anything else, please don’t hesitate to give us a call, text, or even reply back to this email. We would be more than happy to held and it's completely free. (605)295-3100

Yesterday the wheat market posted a fresh new low, but we have since rallied +20 cents. Good signs of a possible reversal. I am hesitant to say that this was a sure fire bottom, but the past two days action was friendly.

I'd like to see us take out $6.20 on Chicago to have a better confidence in saying the bleeding is over. Our heavy support remains at those November lows of $5.56

Chicago March-23

KC March-23

Livestock

Livestock showed some small losses.

Live cattle is under pressure from a lack of trade in plains direct cash markets ahead of the USDA on feed report this afternoon.

The main pressure is simply some profit taking following the rally that led to mutli week highs recently. The profit taking was largely due to pre report positioning ahead of the USDA report.

From a technical standpoint, the cattle market looks great. Could definitely have some more room to run from here.

Live Cattle April-24

Feeder Cattle Mar-24

Want to Talk?

Our phones are open 24/7 for you guys if you ever need anything or want to discuss your operation.

Hedge Account

Interested in a hedge account? Use the link below to set up an account or shoot Jeremey a call at (605)295-3100 or Wade at (605)870-0091

Check Out Past Updates

1/18/24

UTILIZING TRENDS & TECHNICALS IN YOUR GRAIN MARKETING PLANS

Read More

1/17/24

FUNDS & CHINA

1/16/24

BEANS TRY TO BOUNCE FOLLOWING BEARISH USDA

1/12/24

FULL USDA REPORT BREAKDOWN

1/11/24

USDA REPORT TOMORROW. ARE YOU PREPARED?

1/10/24

PREPARING FOR THE USDA

1/9/24

TURNAROUND TUESDAY & USDA PREVIEW

1/8/24

HOW TO GET COMFORTABLE AHEAD OF USDA REPORT

1/5/24

FIRST WEEK OF NEW YEAR FLOPS

1/4/24

REALIZING POTENTIAL UPSIDE BUT BEING AWARE OF RISKS

1/3/24

RAINS & BRAZIL ESTIMATES

1/2/24

UGLY DAY: BRAZIL, RISKS, & MARKETING STRATEGIES

Read More

12/29/23

SHORT TERM RISK & LONG TERM UPSIDE

12/28/23

BRAZIL RAINS?

12/27/23

EFFECTS OF US DOLLAR COLLAPSE ON GRAINS & STRATEGIES TO CONSIDER

12/26/23

GETTING COMFORTABLE WITH ALL POSSIBILITIES

12/22/23

BEAN BASIS RECOMMENDATION TO TAKE BACK CONTROL FROM BIG AG

12/21/23

COMMODITIES ARE DIRT CHEAP VS STOCKS

12/20/23

ARE YOU COMFORTABLE WITH $3 CORN OR $6 CORN?

12/19/23

CORN FIGHTING NEW LOWS & BRAZIL RAINS

12/18/23