IS THE PANIC SELLING OVER?

AUDIO COMMENTARY

Being comfortable in your marketing

Risk management

Don't let the ag giants steal your grain

Demand and prices

Flushing out the weak longs

What to do if you panic sold

Is there enough wheat in the world

Listen to today’s audio below

Overview

Grains end of the month of February on a pretty sour note across the board. Grains seeing some strength here today, with prices higher across the boards. While beans lead the way with Argentina forecast looking hot and dry.

A lot of this recent weakness is likely being driven by fund selling. We all knew the funds were incredibly long both corn and beans. We broke many levels of support on the charts, so that led to some more selling as they look to liquidate their long positions.

This morning we saw China's February manufacturing PMI come in at 52.6 vs 50.5 which was expected. That 52.6 is the highest in 11 years. So its looking like China's economy is coming back, which could lead to greater demand.

Yesterday's Audio

Now Is Not The Time to Panic Sell - Listen Here

Today's Main Takeaways

Corn

Despite the continuation of lower production estimates in Brazil and Argentina, corn continued to see weakness yesterday, showing a little bit of life here today and bulls try to stop the bleeding, with prices trading at their lowest levels since August.

Corn is being pressured by worries surrounding overall demand and a bearish outlook for the U.S. new crop balance sheet, the expectations for large acres and record yields, to go along with the funds controlling the market.

The slow second crop corn planting is still one of the main headlines surrounding corn, but the news didn't help support the market as of recent. Nonetheless, we do continue to see Brazil estimates lowered due to the slow progress. As Dr. Cordonnier cut his corn estimates by another 4 million metric tons this week. This will likely continue to become a bigger issue down the road, as a vast majority of their crop is now being planted outside of their ideal growing window.

On this sell-off, we haven’t really seen anything change fundamentally the past few days. Bulls just ran out of wind and headlines to continue supporting the markets higher. Which led to the funds taking over and people pointing at the weaker demand and bigger production which were already things the market knew about when we were near our recent highs.

Going forward, there are still plenty of things that can push this thing higher from levels. We have an entire weather season coming here in the U.S., the definite possibility for more weather scares in South America, and there is still a war going on. So ultimately I think we are close to bottom if we aren’t already there.

Taking a look at the charts, we broke two key levels of support on the recent sell-off. This morning we tested the long-term uptrend but bounced and are looking to test resistance at the $6.37 range.

Corn May-23

Soybeans

Beans got smacked hard yesterday on this sell off across the grains, now roughly 60 cents off their highs just a few days ago.

Beans have been pressured by the overall down trending market, as they were the last to fall on this sell off. We also have seen some improved weather forecasts for South America and improved outlook for rain in Argentina.

Harvest progress in Brazil is still one of the biggest points of discussion. Brazil was 33% complete with their top growing state Mato Grosso showing decent progress, sitting at 76% complete. Most think we will see Brazil harvest reach 50% by the end of the week. With first reports of yields showing a decent crop. So while the rains can still keep delaying this thing, there isn’t a ton for bulls to chew on.

Argentina's crop is a complete different story. We all know how poor this crop this. But we just have to wonder how much of this is already priced in. Nonetheless, Argentina harvest is a ways off and there is talk that it might not be done for another 60 days until we see Argentina hit 50% harvested. So we will likely continue to keep seeing Argentina production estimates lowered, and should see a pretty large cut when Wednesday's USDA comes. In the last report, saw them cut their estimate from 45.5 to 41 million metric tons. Now the question is just how low will we see this crop come in at. There is plenty of people calling for a number below 35 million, with some even throwing out 30 million or lower guesses.

Going forward, there is definitely a possibility we see a new-crop bullish story to help push us higher, but this story isn’t one that will probably happen relatively soon. Outside of that, the markets will continue to watch South America's harvest, and question just how much of the poor Argentina crop and production is baked in already. Currently one would assume a lot of it is, but the current estimate is 41 million, if this number comes in far smaller than expected, I don’t think the market has a 30 million crop priced in. Chinese demand and appetite will also be something to keep an eye on.

Soybeans May-23

Soymeal

Soymeal May-23

Wheat

Wheat futures continue to fall, as they reach 17-month lows yesterday. Finding some strength today.

U.S. weather is starting to gain more attention from the trade, and everyone is still waiting for a final decision to be made surrounding the Russia & Ukraine grain corridor deal.

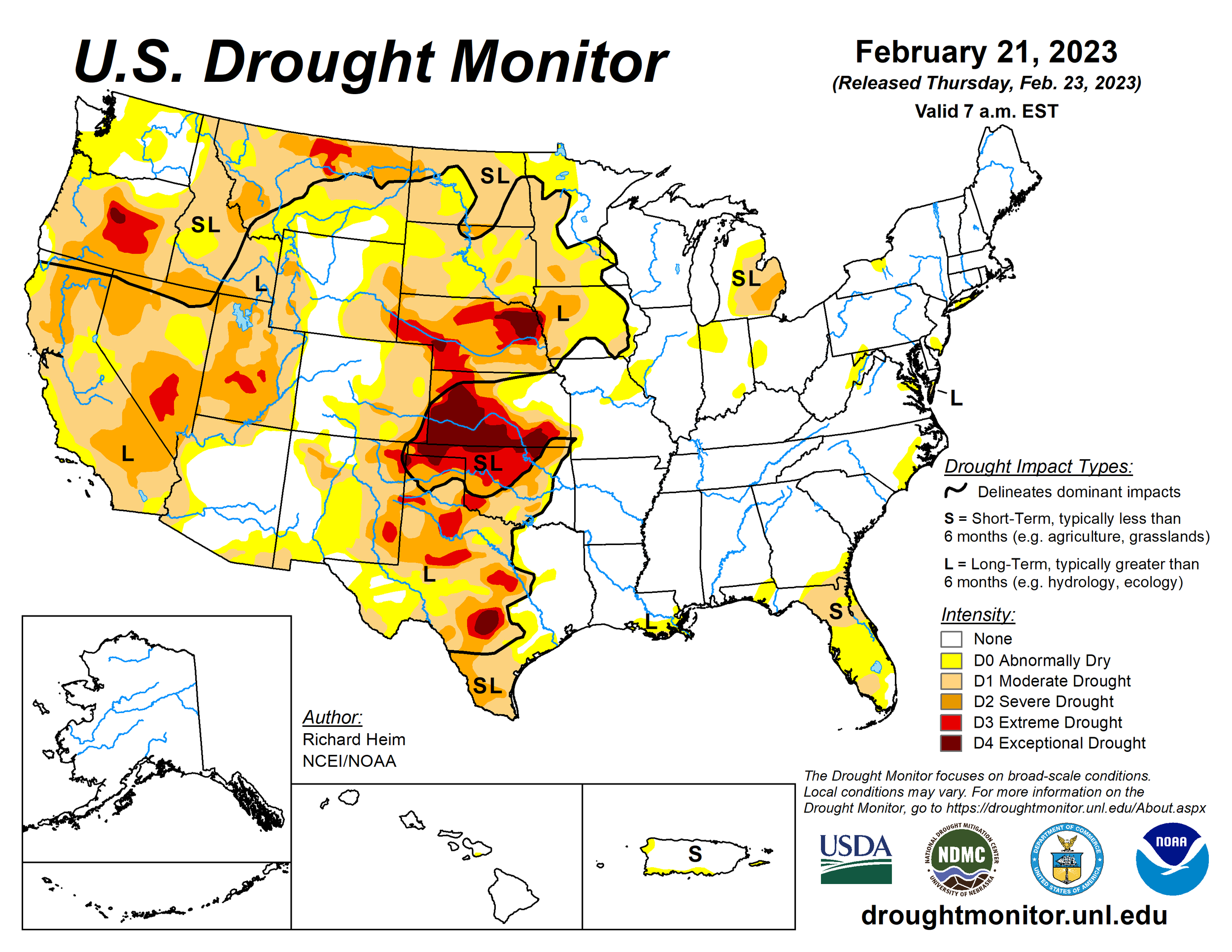

Despite this large sell off, we saw many key production states see further deterioration to their crops. With states like Kansas, Texas, and Nebraska continuing to see poorer crop conditions.

To add on to the U.S. weather headlines, we have some slightly worries for weather in Europe as well, with India weather also being something watched closely as they are expected to see very hot temps across key growing areas from March through May. All of which have the potential to continue to support the wheat market.

Adding pressure, we've seen the dollar start a nice rally and have recently started seeing more fear surrounding recession concerns.

The funds have wanted to do anything but buy wheat, and they are still short as they have been for months, sure they don’t have a ton of reason to get out of this short position if prices continue to fall without any bullish headlines. But I think at these levels we eventually see funds start to shift into buyers. Especially if we get a war headline, they will scatter and cause a short covering rally. The latest data available showed the funds were net short around 65k contracts. But this data is several weeks out of date, so one can imagine this number is a lot larger. Typically if we see funds reach 150k that's the bottom.

The grain corridor deal expires on March 17th, and although I think we do ultimately see the deal renewed, we might see Russia make some statements between now and then that push us higher.

If the grain corridor deal goes ahead and does get extended, I wouldn’t be too surprised to see a little more pressure to the markets short term. But I still think this market is oversold, and I think we see these short positions blown out. Of course one headline that rocket wheat higher is war, as there is still plenty of uncertainty and possible bullish headlines there. But we also have winter wheat conditions at some historically low levels. So going forward, weather and war will be the biggest factors.

From a technical standpoint, we made new lows and broke some support, now sitting right below resistance at the $7.13 level.

Chicago March-23

KC March-23

MPLS March-23

If You Are Considering Panic Selling

From Wright on the Market

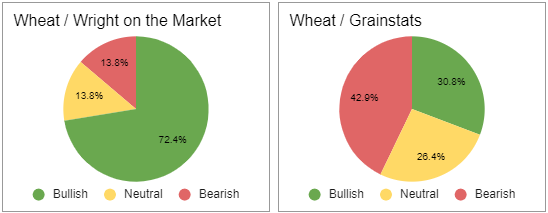

For those of you who are still trying to decide if you should panic sell all your bushels, consider this information:

Last year, Brazil’s safrinha corn crop was planted 10 to 14 days earlier than normal whereas this year’s is 10 to 14 days later than normal. It quits raining in May, so Brazil will produce 20 to 25 million fewer mts of corn this year and it all comes off their.exports.

Consensus is growing that Ukraine’s 2023 planted corn acres will be down as much as 50% from a year ago. If so, take another 500 million bushels out of the world’s new crop corn export supplies.

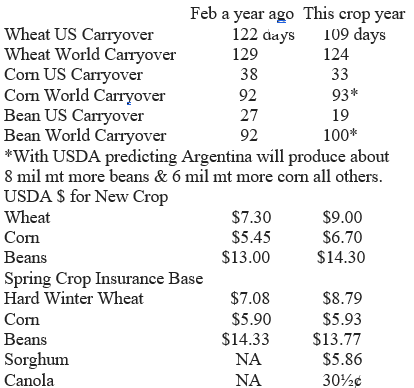

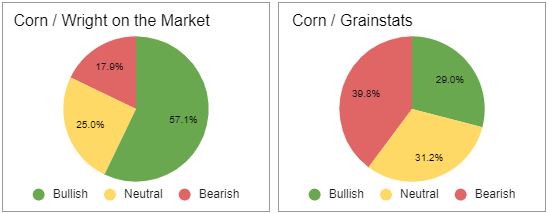

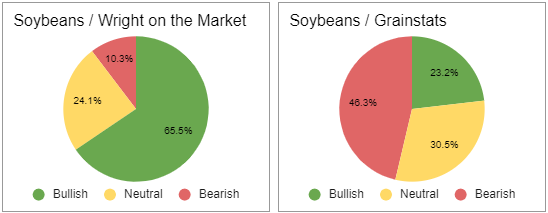

Bullish vs Bearish Consensus

The following pie charts are voted on by Wright on the Market and GrainStats audiences.

Highlights & News

Ukraine urges the UN and Turkey to start grain deal extension talks.

Australia's La Nina wet weather system is nearing an end according to Australian Bureau.

India is expecting heat waves between March and May.

Brazil cuts fuel prices to offset tax resumption.

Livestock

Live Cattle down -0.350 to 165.125

Feeder Cattle down -1.225 to 193.850

Feeder Cattle

Live Cattle

Check Out Past Updates & Audio

Here are a few of our past updates in case you missed them

2/28/23 - Audio

Now Is Not The Time to Panic Sell

2/26/23 - Weekly Grain Newsletter

Is China Trying to Steal Grain Again?

2/24/23 - Market Update

Black Sea Agreement Pressures Wheat

2/23/23 - Audio

Is Next Years Corn Crop Already Record Yield?

South America Weather

Argentina 4-7 Precipitation

Argentina 8-15 Precipitation

Argentina 15-Day Percent of Normal Precipitation Forecast

Brazil 8-15 Precipitation

U.S. Weather

Source: National Weather Service