CORN & WHEAT POST MULTI-MONTH HIGHS

MARKET UPDATE

I'm still getting used to making the video updates, so bare with me. Let me know if I should continue to make these or if you guys prefer the normal written versions.

You can still scroll to read the usual update as well.

(Chart Breakdowns Start at 5:44 min)

Prefer to Listen? Audio Version

Futures Prices Close

Overview

Corn & wheat both make multi-month highs.

As corn traded to it's highest levels since June 28th, and wheat was at it's highest levels since July 8th.

Soybeans lagged behind with some harvest pressure & profit taking. As well as rain in the forecasts for Brazil.

Wheat led the way higher following war escalation in the Middle East, as well as some areas of Russia declaring a state of emergency due to drought.

But the big news today was the war.

Iran had a missle attack on Israel and officially declared a state of war against Israel.

This of course led to a rally in crude oil and offered some additional support to the grain markets as well.

This is the largest escalation we have seen since this conflict began.

According to the odd makers at Polymarket, they think there is a 76% chance these tensions increase by the end of the week via Israel responding to the attacks.

The Israel Government also told CNN:

"We have plans, and we will operate at the place and time we decide. It will be significant.".

Now does this effect the grain markets?

Well, yes and no.

The Middle East is not a producer of grain. So it does not directly impact our supply & demand like it would if this was Russia & Ukraine, or a war in Brazil for instance.

But a war headline always spooks the markets. The funds are still holding short positions in the grains, so news like this can lead to the funds kind of saying "I want out" of their short positions due to the uncertainty it brings. And can give them a bigger appetite for commodities in general, as commodities such as oil are directly impacted.

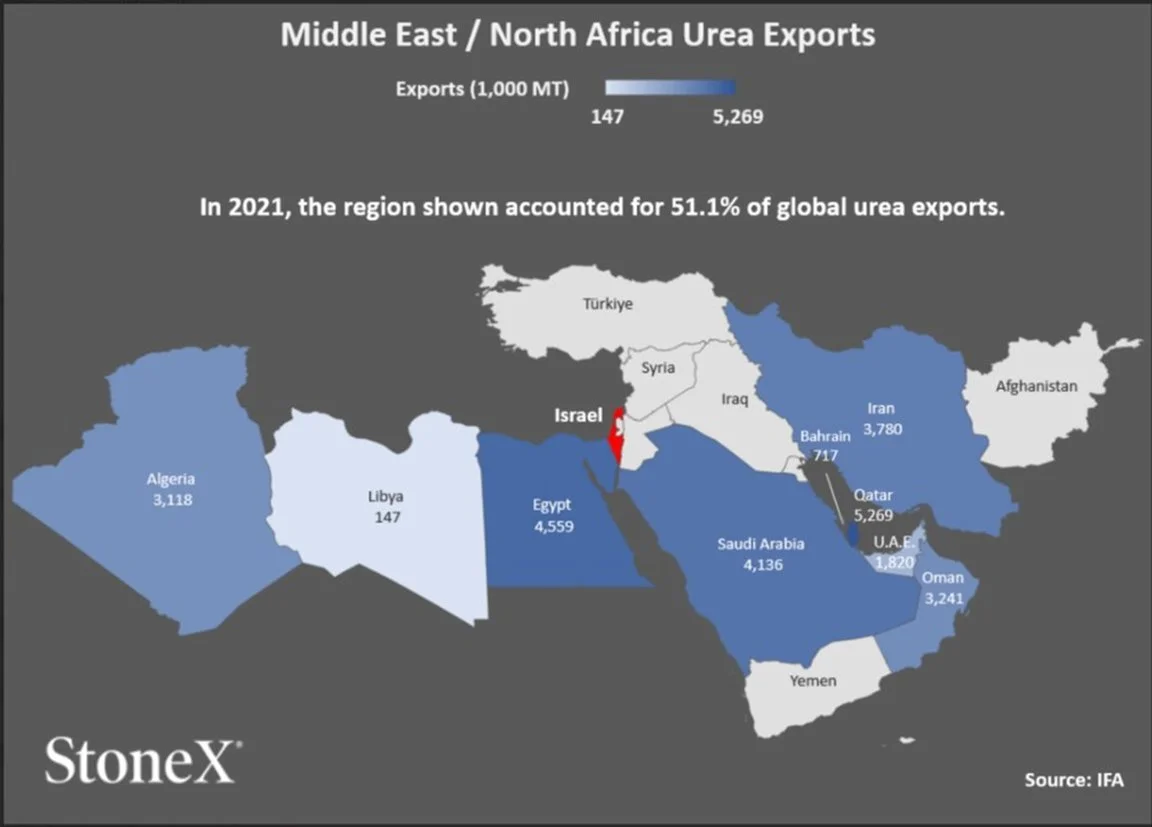

What this war can have an effect on is fertilizer.

1 out of every 2 tons of urea exported around the world comes from the Middle East.

If this escalates, it could potentially lead to higher fertilizer.

Yesterdays USDA Report

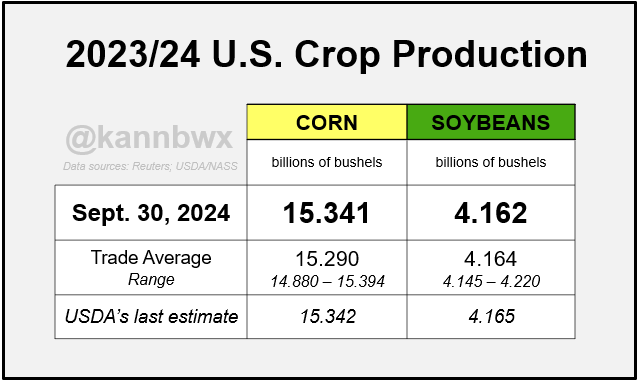

Outside of war headlines, corn also saw some follow through strength from the report.

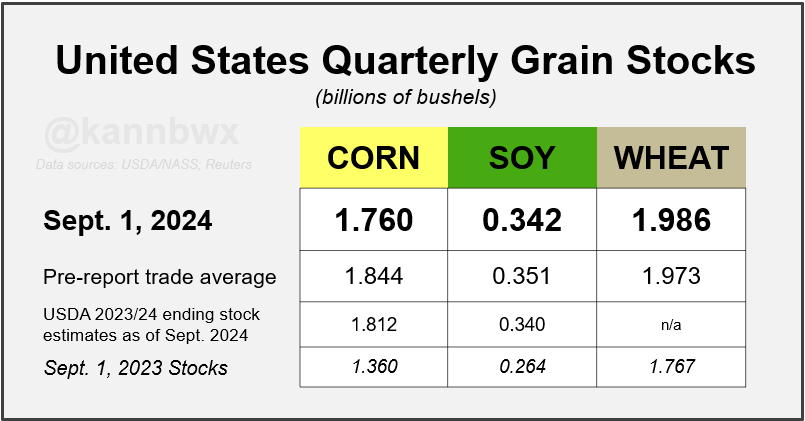

The USDA was bullish corn as Quarterly Stocks came in at 1.760 vs estimates of 1.844 billion bushels.

This change was due to an increase in feed & residual use as the USDA did leave the 2023 crop unchanged.

So the USDA was 50 million too light on feed & residual.. what if the USDA is too low on feed & residual this year? It would drop our carryout below 2 billion.

The numbers were not so bullish to the point where they alone can carry prices significantly higher. But they did show stronger demand than expected, so it could provide a base under corn if yield doesn’t wind up crawling higher.

For soybeans & wheat, the report was a non factor. As there were no surprises.

Charts from Karen Braun

Harvest & US Weather

Harvest is ahead of pace for both corn & soybeans.

Corn: 21% vs 18% avg

Bean: 26% vs 18% avg

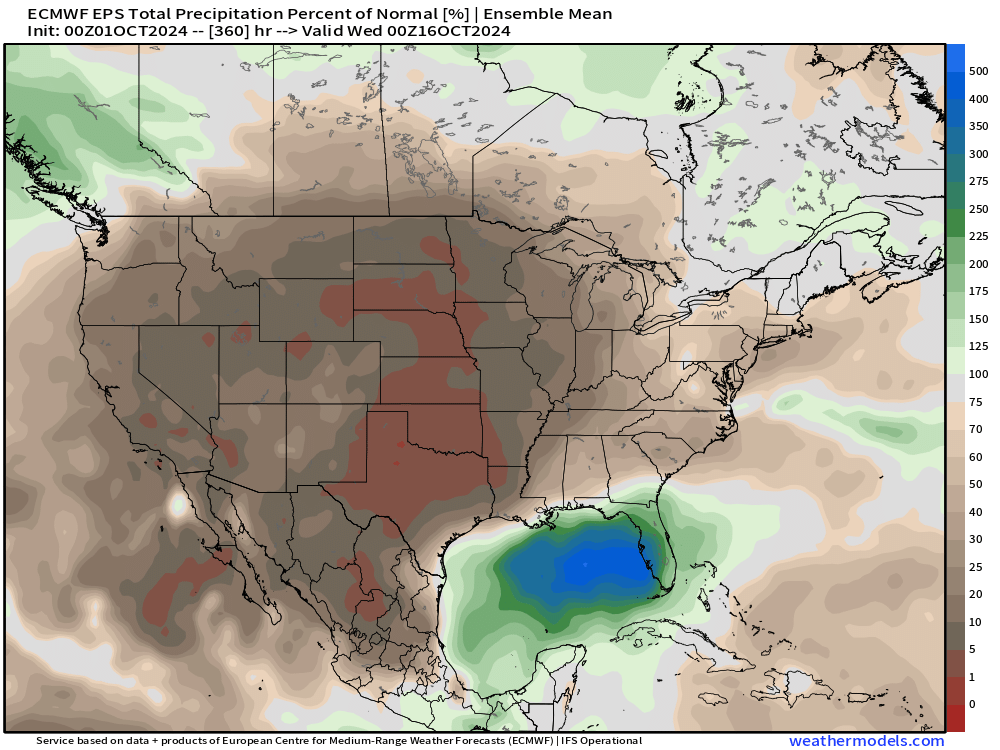

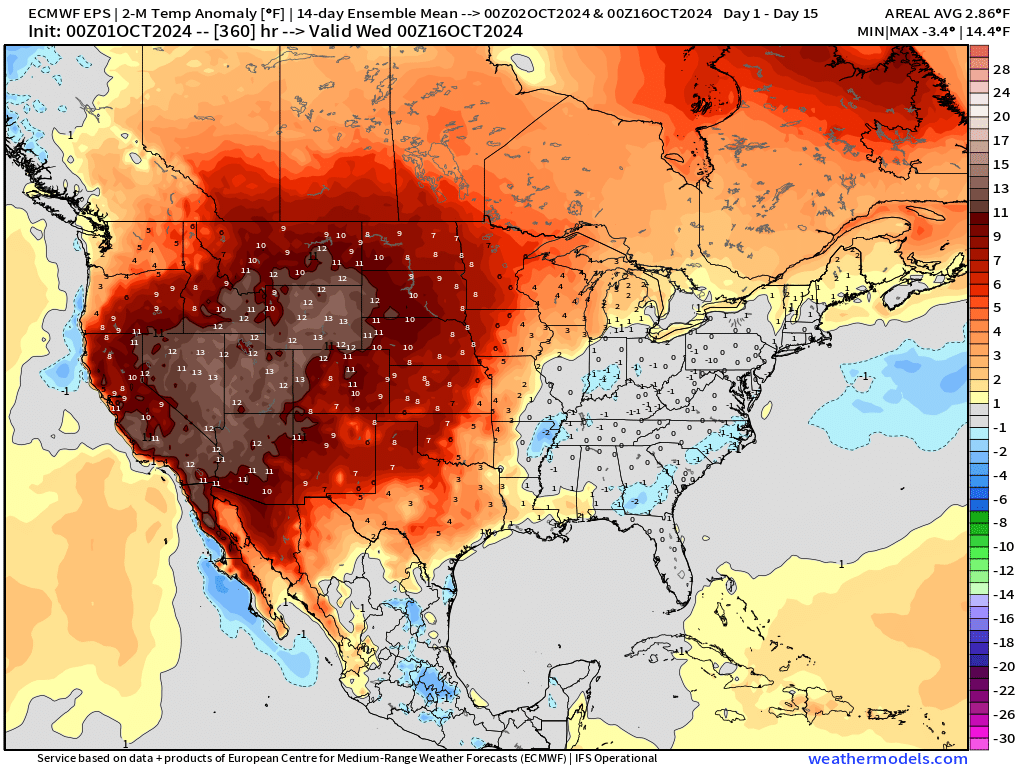

The corn belt looks like it will be about as dry as it can get for the next two weeks.

So harvest should continue to move along at a faster than average pace.

A fast harvest means a lot of supply is going to be hitting the markets at the same time, so this could potentially add some harvest pressure.

However, over the past 5 years our markets haven’t seen much "harvest pressure" during this time. Probably because it's mostly priced in. But this could put a damper on local basis.

Here is a very good quote from Angie Setzer as to why prices could potentially be poised to move higher after harvest.

She said:

I think the most important thing to ask yourself when trying to evaluate whether prices are poised to move higher or lower is whether it is getting easier or harder for the world end user to source supplies?

At this point, with harvest getting rolling it should not be difficult to get whatever your needs are in the short term covered. However, as the farmer in the Northern Hemisphere puts crops away and we look at uncertainty both north and south of the equator, I would argue it is likely to get much harder for the end user to source supplies once the US wraps up harvest. What this means for price will be interesting to see as the narrative of too much supply and limited demand runs into air pockets in the pipeline.

Brazil

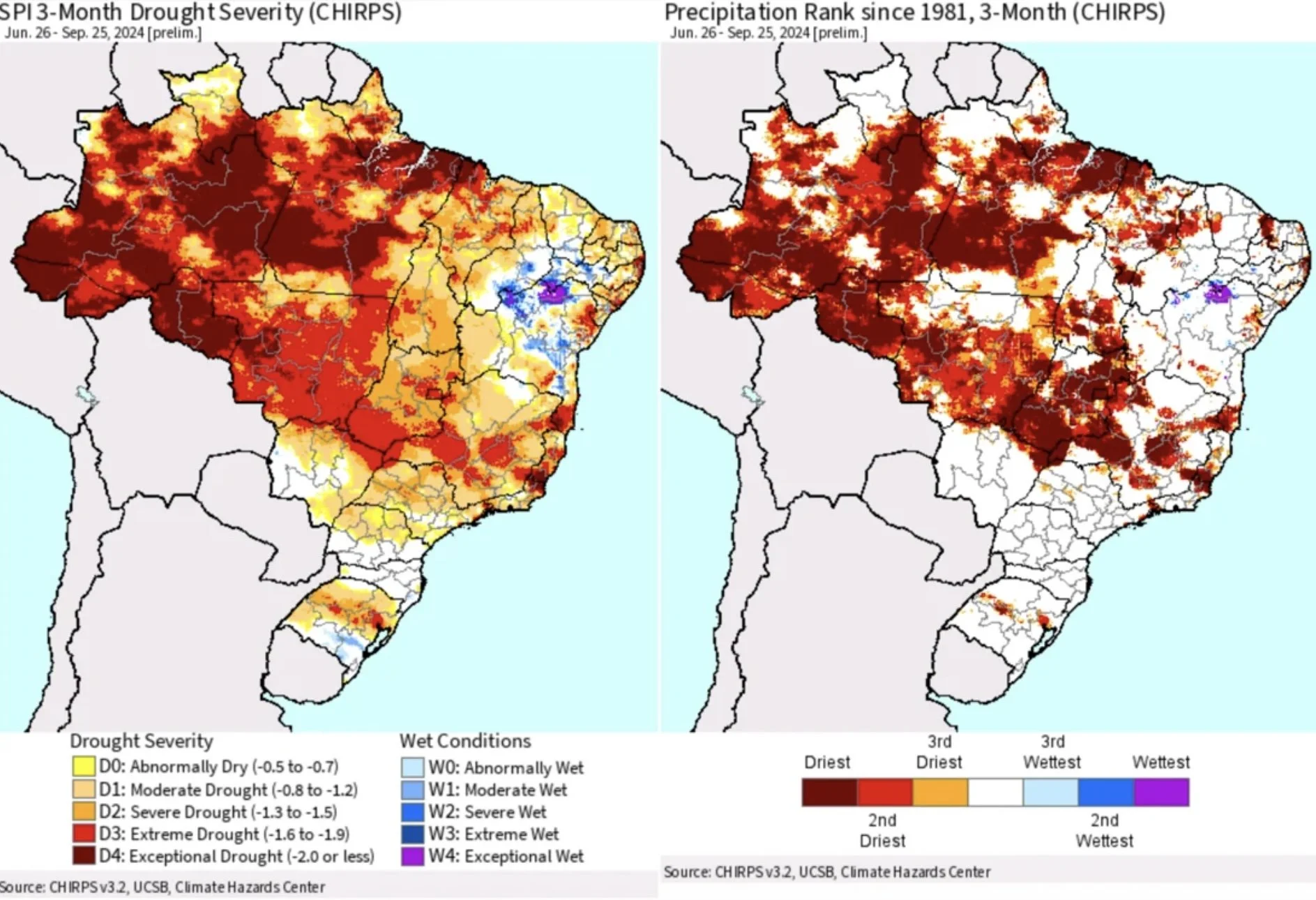

Brazil bean planting is behind pace at 2% complete vs last years 5%. As the hot & dry weather continues to slow the start of planting.

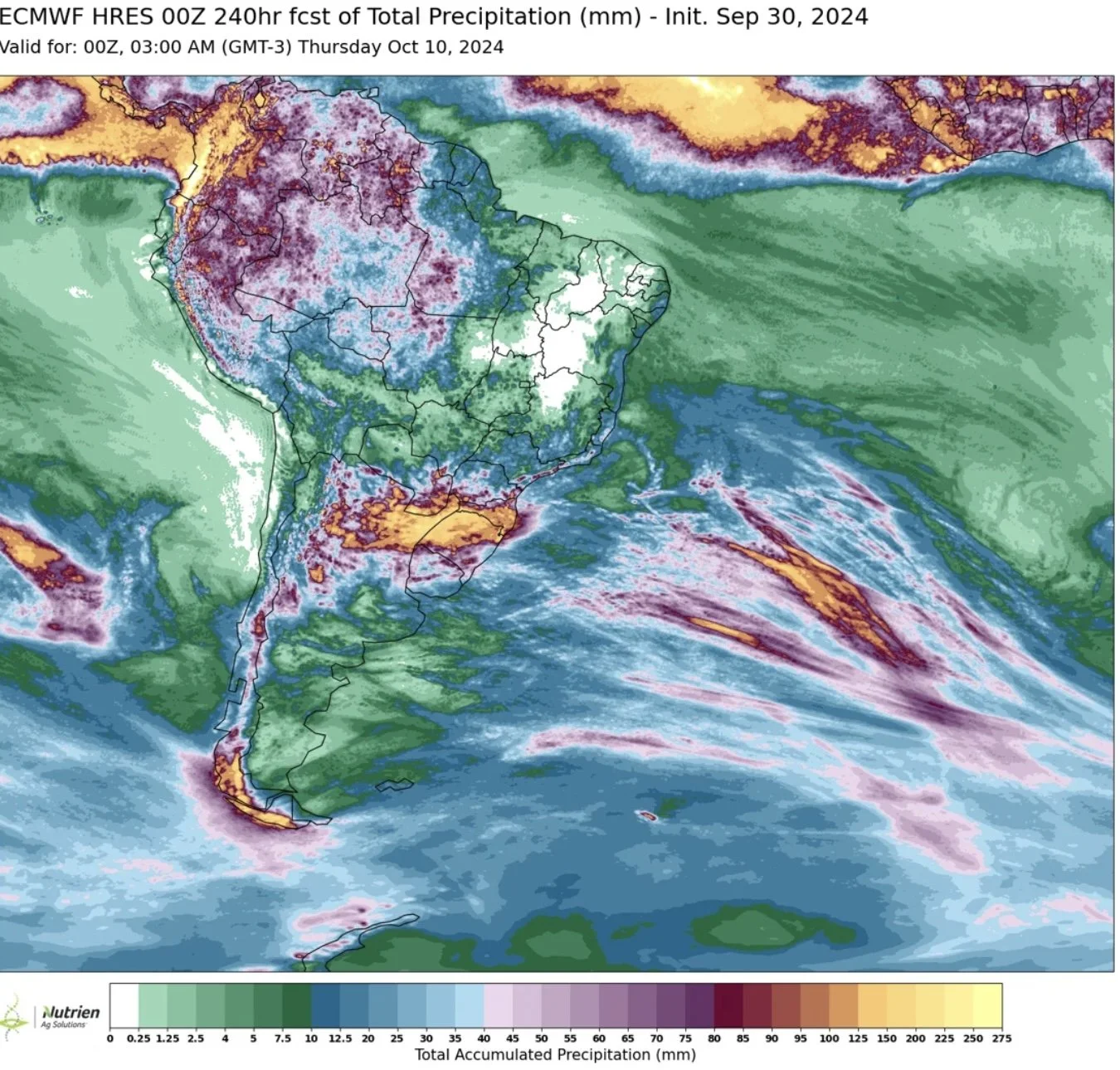

Forecasts the next 10 days are mixed, but suppose to really pick up some rain in the 2nd week of October.

Does the dry weather matter yet?

Yes, and no.

Dry weather now does not directly impact the actual crop. However it can negatively effect planting. Delayed planting can push the crop into a less than ideal growing window later in the season.

Farmers have until about the first week of November until the optimal bean planting window is gone.

The soybean market has a little weather premium built in. So if those mid-October monsoon rains do hit, it will be bearish at least short term when it happens.

If the rains disappoint, then we have a lot more weather premium to add.

But for now, almost every forecast does call for good rains 2 weeks from now.

10-Day Euro Precip

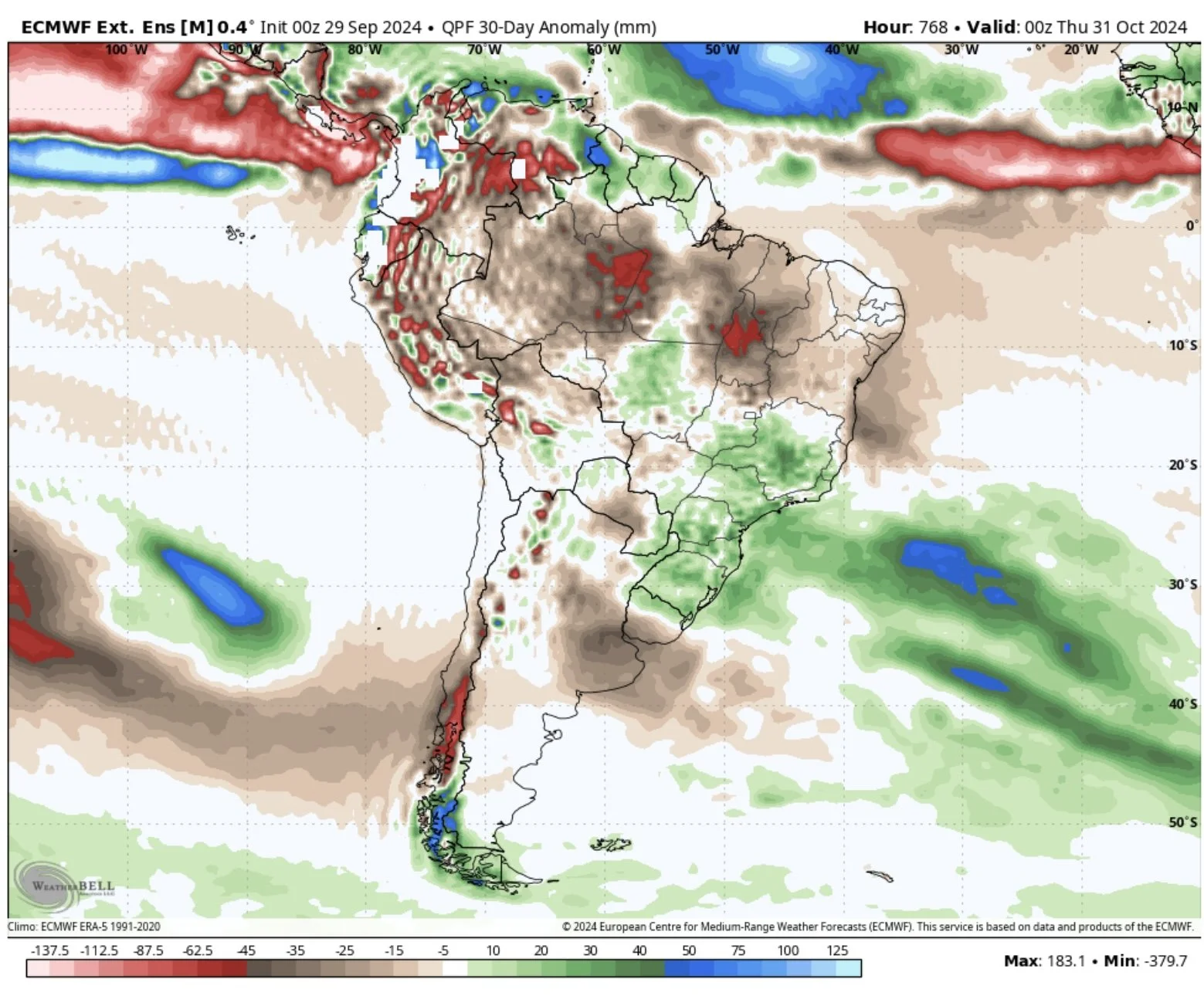

30-Day Oct Precip Anomaly

Last 3 Months Precip Anomalies

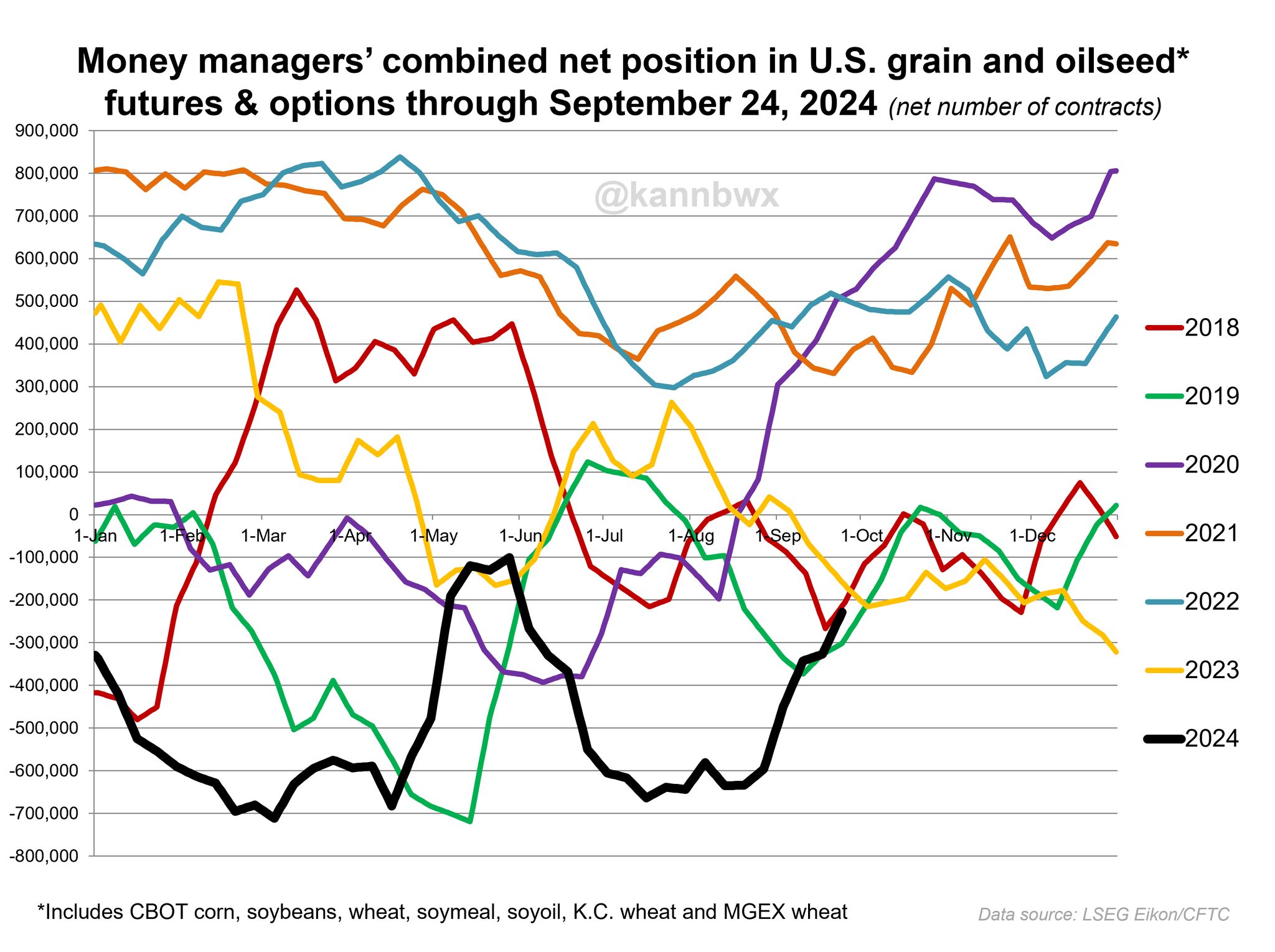

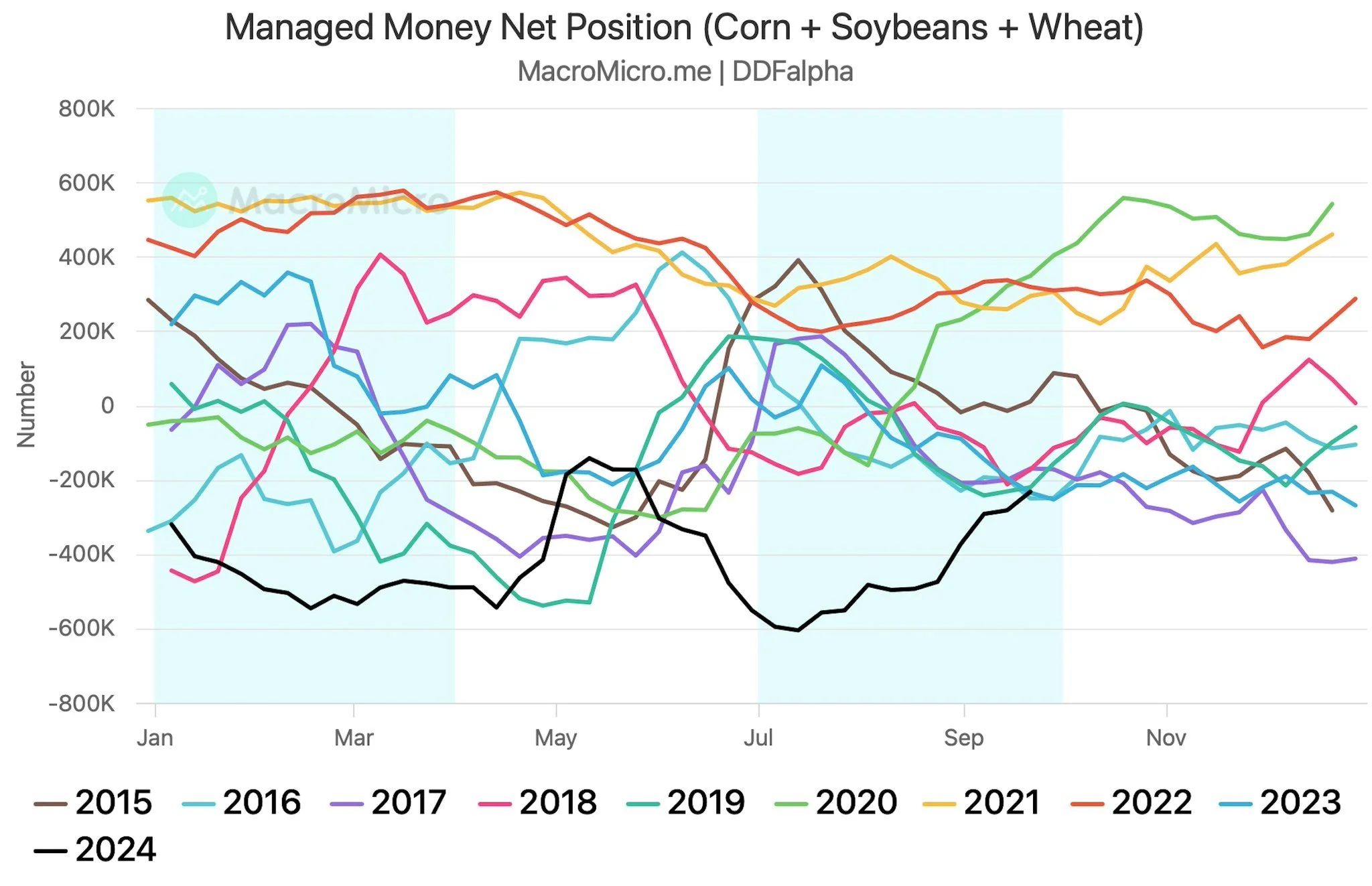

The Funds

The funds have been one of the bigger driving factors on this rally. They decided to finally take their foot off the grains throat.

The funds were at one point short a record 350k contracts of corn just a few months ago. They are now only short 100k.

The funds are now only short 55k beans vs the 185k record not long ago.

So it appears like the funds have finally got an appetite for the grains.

Chart from Karen Braun

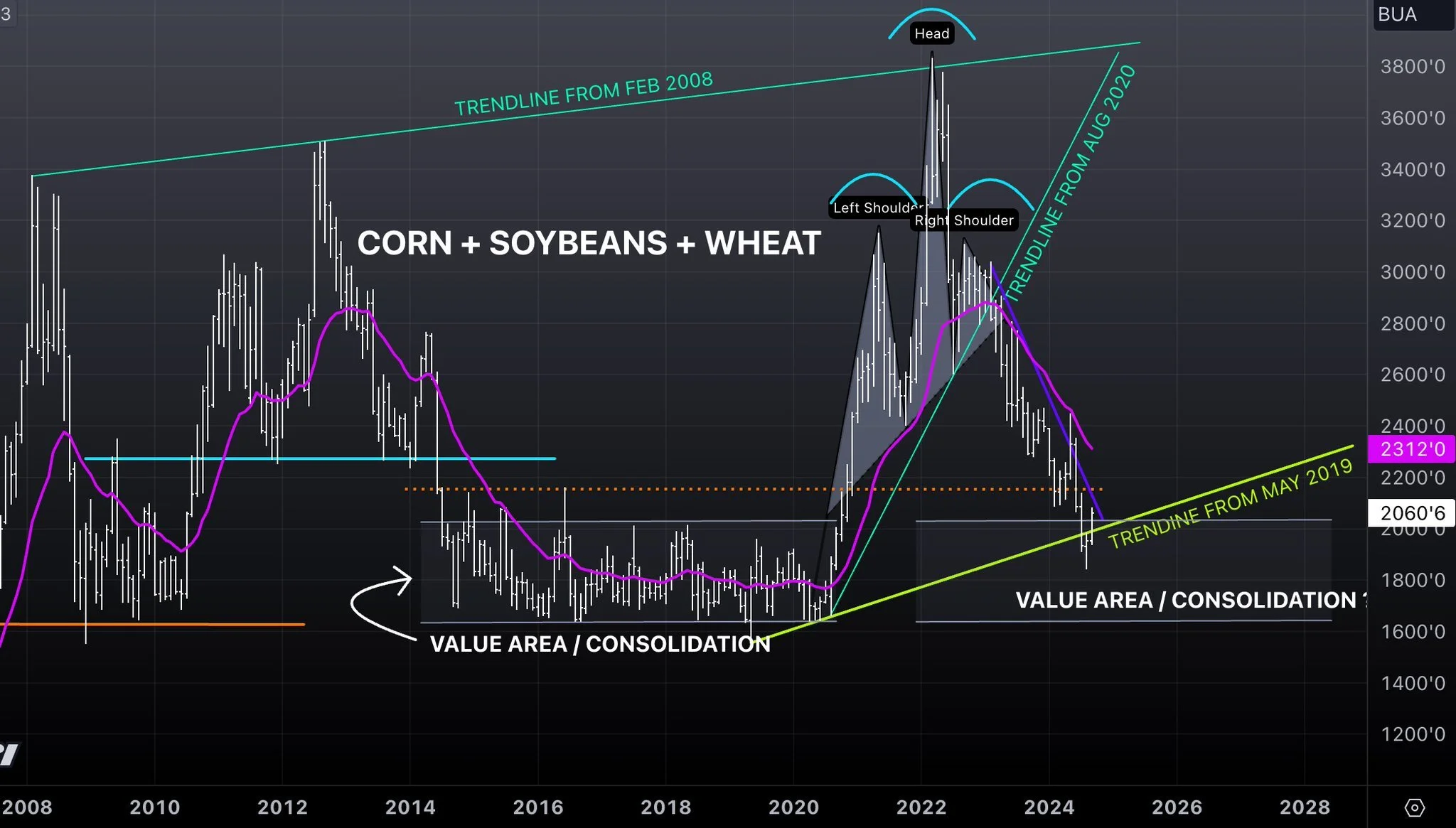

From Darrin Fessler:

The combined corn + beans + wheat short position has been reduced by over 370k contracts since July. The combined rally since the lows is $2.20 or 12% combined. Value & consolidation area confirming the lows are in? I certainly think so."

Charts from Darrin Fessler:

Today's Main Takeaways

Corn

Corn posts it's highest close in months at $4.29.

However we did close -3 1/2 cents off our highs.

Short term, I could see us take a breather.

But looking a little longer term over the next few weeks, the charts look very strong.

Looking at this first chart. I had been mentioning this for months. We closed above this significant resistance line.

We also broke above that key $4.23 to $4.26 level, which was our July highs & implied move from our bull flag.

So we broke 2 very key levels, which gives me reason to believe we can go higher.

My next target is the $4.41 to $4.46 level.

$4.41 is our 50% retracement from our May highs.

$4.46 is our February lows and next major resistance.

Due to the heavy sell off in June, we really do not have a ton of resistance until that area.

Now just because I think we can go higher, does NOT mean some of you shouldn’t be rewarding this rally or defending this area in some manner.

Yesterday we alerted a protection recommendation.

"If you have corn you need to move off the combine in the next 30 days we advise considering buying $4.20 Nov corn puts.

Give us a call or text for questions or if you want specific recommendations. (605)295-3100.

Looking at the chart, we are at our July highs. This has been an area of interest to take some risk off the table for a while. This area could provide some strong resistance.

I think we have more room to run higher, but manage your risk. You'd be kicking yourself later if we gave this entire rally back and you did nothing.

Worst case with puts is you lose what you bought. When you buy puts you hope they go worthless so you can make a good cash sale."

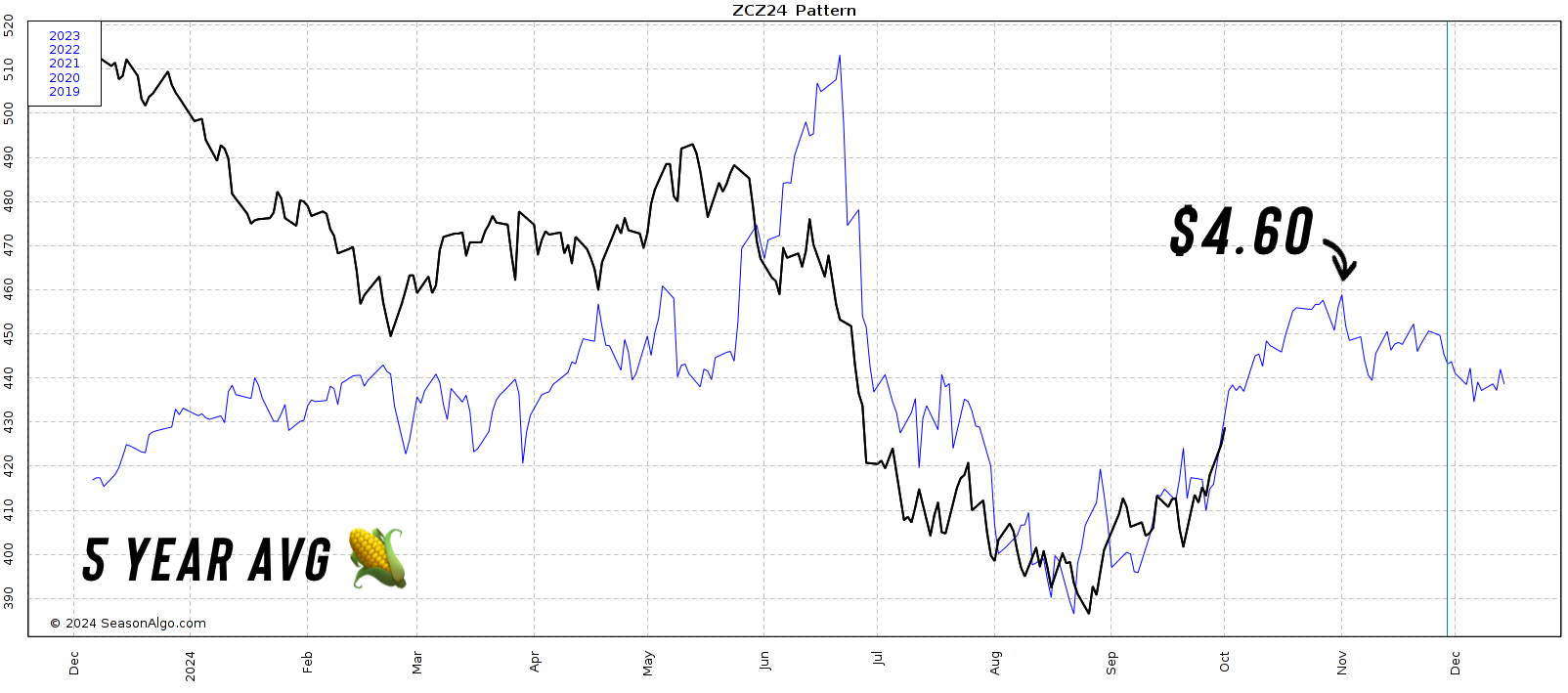

Bottom line, I do think we can go higher from here. Seasonally, October has been a very strong month for grains. As we've traded higher the past 8/10 years.

I don’t think the government wants to write extra checks, as October is insurance pricing.

The funds have started buying.

If yield winds up closer to 180 rather than 183, our carryout will likely drop below 2 billion.

Demand isn’t bearish as some say it is. In the past year the USDA increased corn demand by 1/2 a billion bushels. Our crop has gotten bigger, yet carryout has dropped the last few reports. These lower prices also help create more demand.

Lastly, the technical charts have finally turned around.

My little longer term target is still potentially $4.60

As I have mentioned in my last several updates, we have a volume gap up to $4.60.

$4.60 is support from March to June, where we bounce several times. (scroll up and look at the last chart)

Our 5 year seasonal average also tops out at $4.60

Dec Weekly Corn

Soybeans

Soybeans intially ran into some harvest pressure and saw some weakness with the Brazil rains in the forecasts. But bounced back after the war headlines, following corn & wheat higher.

Like I've mentioned since Friday, this $10.65 to $10.80 area is going to offer quiet a bit of resistance. Which is exactly what's happening.

We also completed the implied move for the bull flag.

Now if we can clear this green box, our next target is $10.97 to $11.00 (purple line)

As that would be considered a "trend changing" level.

It is essentially when the entire meltdown started. As we dropped nearly $1.00 in about a week back in early July.

Dropping that fast also means there was little volume created.

Thus leaving a volume gap up to $11.00 if we break $10.70

Weekly Nov Beans

Bottom line, I do think we will be going higher. But there are plenty of unknowns still.

Brazil is going to be the biggest wild card. This alone can swing the soybean market $1.00 higher or lower in the coming months.

The other wild card is Chinese demand.

There is the potential for the China economy story to wind up being a big bullish bonus factor.

Unlike the US and our inflation, China has actually suffered from deflation. Which means less consumer spending because people think everything will get cheaper later on.

But China is artificially trying to boost their economy. Which could definitely lead to more demand especially for soybeans.

Take a look at these headlines. China is literally trying to create their own bull market which is leading to people pouring in money to their markets.

Wheat

Wheat stole the show today with the war headlines.

Another factor that not many were talking about was the Russia drought headlines.

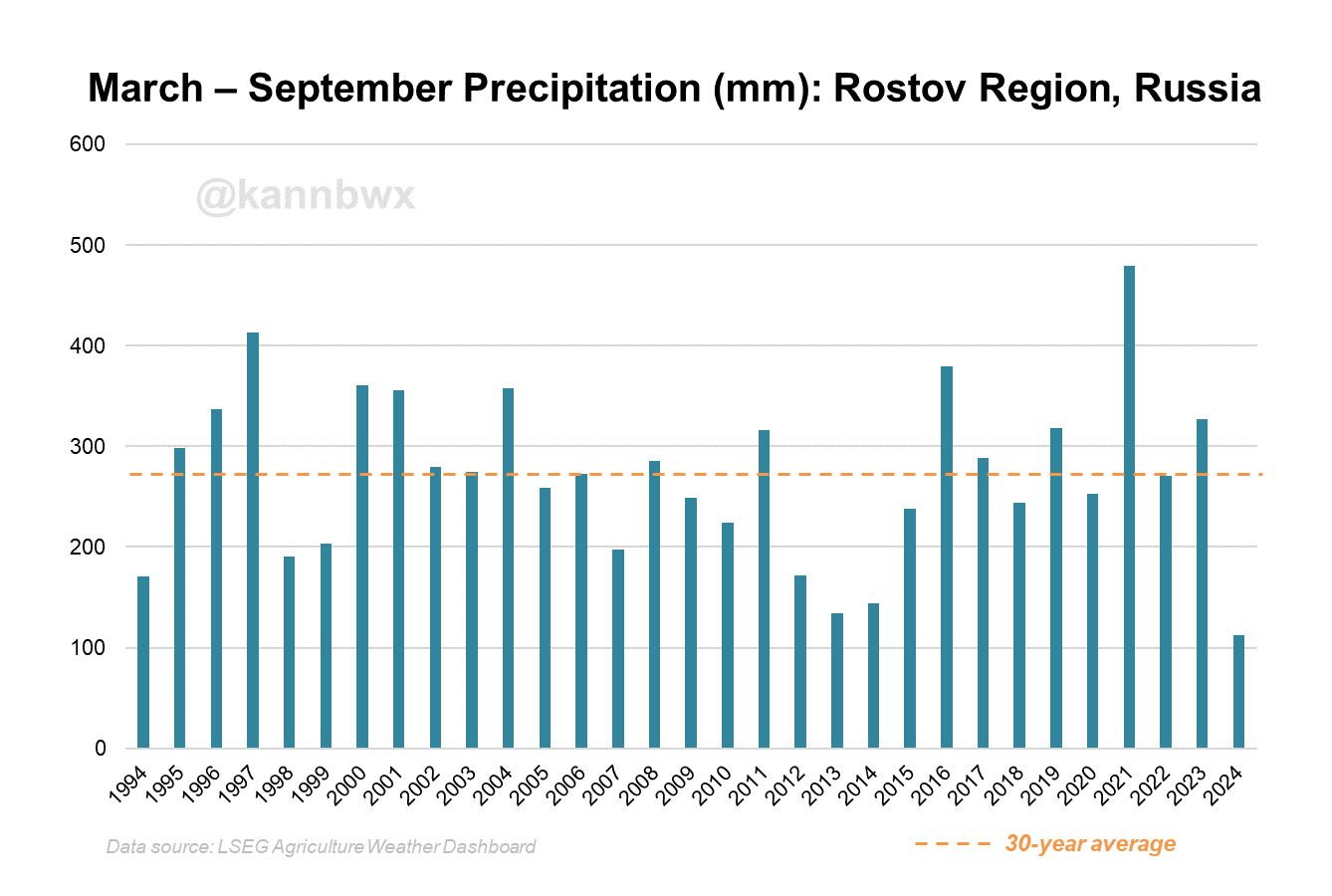

Rostov, Russia's leading winter wheat producing region had 60% below average precip over the past 7 months. The driest period in 30 years. The forecasts also offer zero rain through October. Not a good outlook for their planting.

Chart from Karen Braun

Producer.com:

"Winter wheat planting is progressing slowly int he worlds largest exporting region. Russian farmers have only managed to seed 20.8 million acres. Which is 11% behind last year & slowest in 11 years."

Andrey Sizov, Black Sea guru believes that the current weather issues are priced in, but warns that without meaningful rain in October, the market could rise further.

Russia's 5th leading producing wheat region declared a state of emergency due to drought

Looking at the chart, we got a small break through on the new downward resistance, while making new highs.

HOWEVER, we did not close above those recent highs. We closed right at them.

So I am slightly skeptical if today's action was a "one day wonder" due to the war headlines.

War headline rallies often don’t last.

But, it does look like this wasn’t the last we will see from the war headlines.

Nonetheless, the chart is either on the verge of a breakout, or today was a bull trap. We will know very soon.

If we get one more push out of here, I think we can see $6.12 which is my first target.

If things get even crazier, my second target is still $6.40.

Wheat is going to be fighting for acres in the US. There are production issues globally. The world's leading exporter is still in a major drought. Global wheat stocks continue to fall year over year. I just lean towards us seeing higher prices from here, but that doesn’t mean it has to happen as fast as one would like.

Want to Talk?

Our phones are open 24/7 for you guys if you ever need anything or want to discuss your operation.

Hedge Account

Interested in a hedge account? Use the link below to set up an account or shoot Jeremey a call at (605)295-3100.

Check Out Past Updates

9/30/24

BULLISH USDA FOR CORN: RECOMMENDATION

9/27/24

UP-TOBER? SELL SIGNAL, TARGETS, & FACTORS

9/27/24

BEAN SELL SIGNAL

9/26/24

NEW HIGHS BUT CONCERNING CLOSE

9/25/24

HIGHEST CLOSES SINCE JULY. UPSIDE & SALES CONSIDERATION

9/24/24

GREAT START TO THE DAY, AWFUL FINISH

9/23/24

MASSIVE DAY FOR THE GRAINS

9/22/24

EARLY YIELD TALK, DROUGHT, BRAZIL, SEASONAL LOWS & MORE

9/19/24

GRAINS SEE TECHNICAL SELLING

9/18/24

FED DROPS RATES, BRAZIL STORY, 2025 SALES?

9/17/24

TARGETS & WHAT TO DO IF YOU BOUGHT PROTECTION

9/16/24

WAS TODAY HEALTHY CORRECTION BEFORE GRAIN RALLY RESUMES?

9/13/24

CORN & WHEAT BREAK OUT: EVERYTHING YOU NEED TO KNOW

9/12/24

USDA RAISES YIELD BUT REPORT WASN’T ALL THAT BEARISH

9/11/24

USDA TOMORROW. MAKE OR BREAK SPOT ON CHARTS

9/10/24

USDA THURSDAY

9/9/24

LOWS ARE IN UNLESS SOMETHING FUNDAMENTALLY CHANGES?

9/6/24

GRAINS WEAK. OUTSIDE DOWN DAY ON CHARTS

9/5/24

GRAINS GET HEALTHY CORRECTION. GETTING READY TO PROTECT DOWNSIDE

9/4/24

GRAINS CONTINUE RUN. WAYS TO PLAY THE MARKET. WHAT’S YOUR SITUATION?

9/3/24