KC WHEAT CONTINUES ITS RALLY

Overview

A little bit of a mixed bag here to start the week. Where Chicago leads us on the downside while KC leads us to the upside, and July beans end the day -13 cents off their highs.

As for the Black Sea agreement. There was no meeting Friday, as Russia showed zero interest in extending the deal. Ukraine says Russia has effectively stopped the deal. The deal expires at the end of next week. We also saw some more attacks on Ukraine over the weekend.

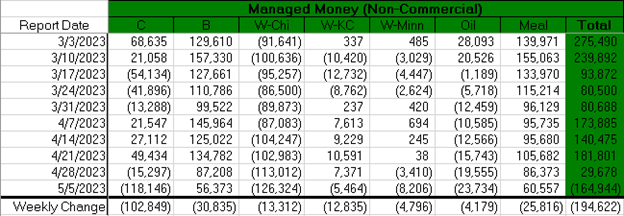

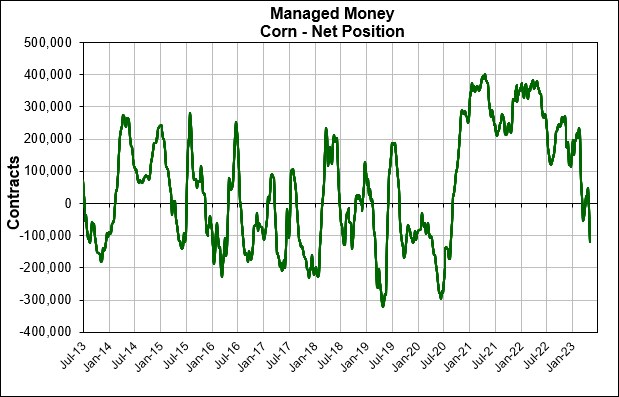

Friday's commitment of traders showed some massive selling. Where it showed the funds are short over 100k contracts of corn, on one of their largest net-selling weeks in history. While the funds approach a near record short position in Chicago wheat. One has to imagine if we get some additional weather scares this could lead to more short covering. The big question is, do they really want to be that short going into growing season and with plenty of wild cards left in the deck?

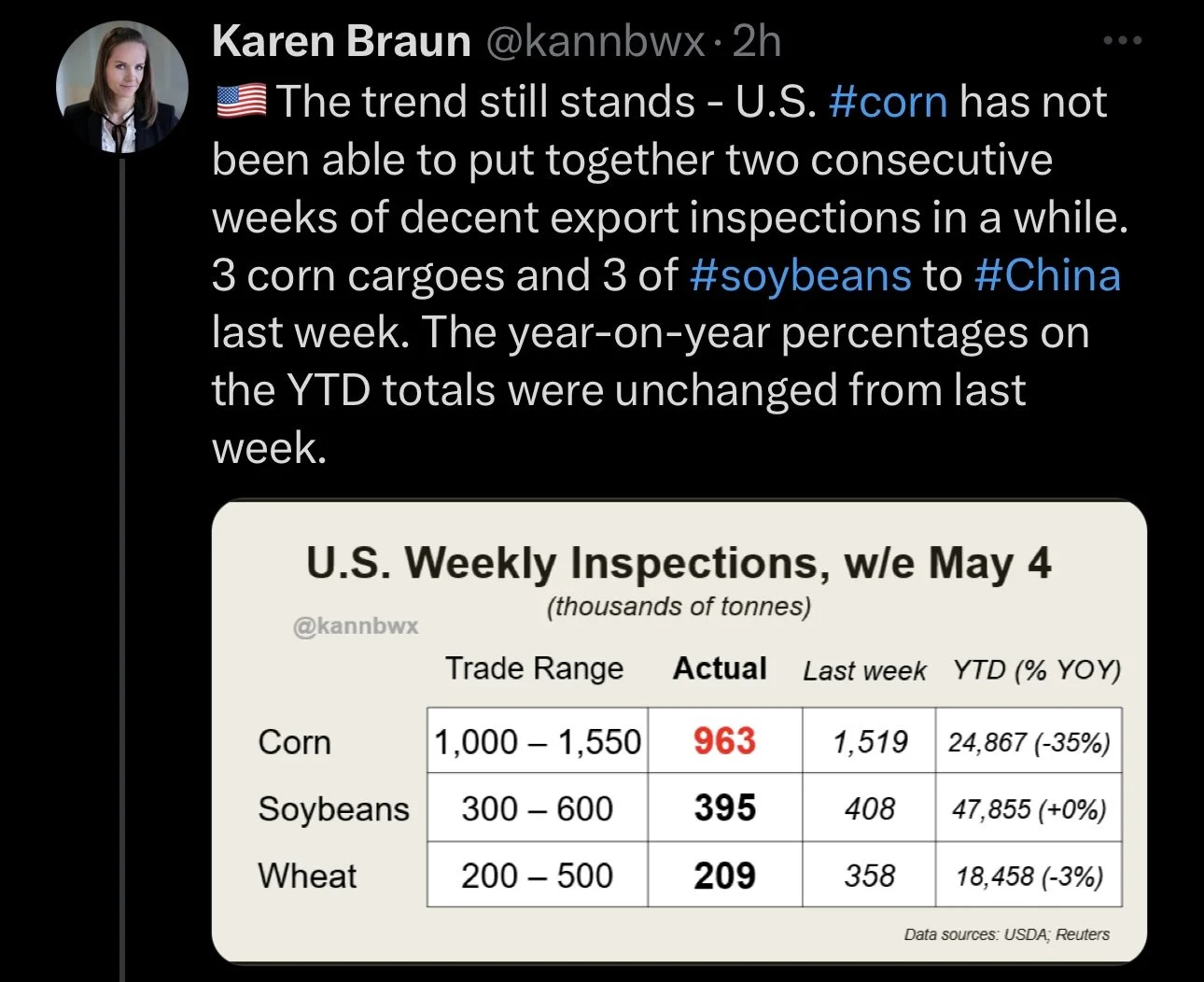

Export sales this morning were pretty disappointing, as corn continues it's recent trend. Failing to string together two good weeks in a row.

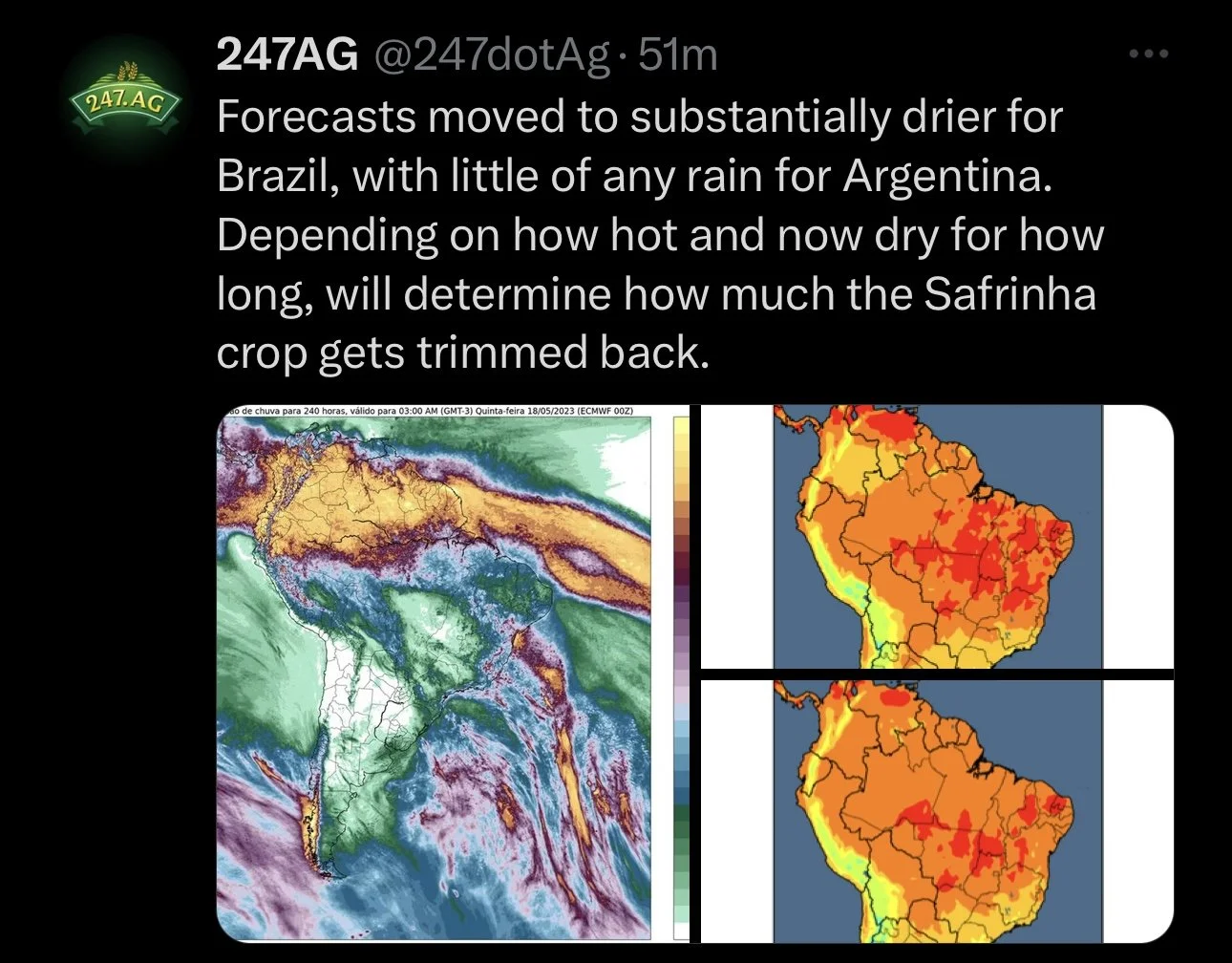

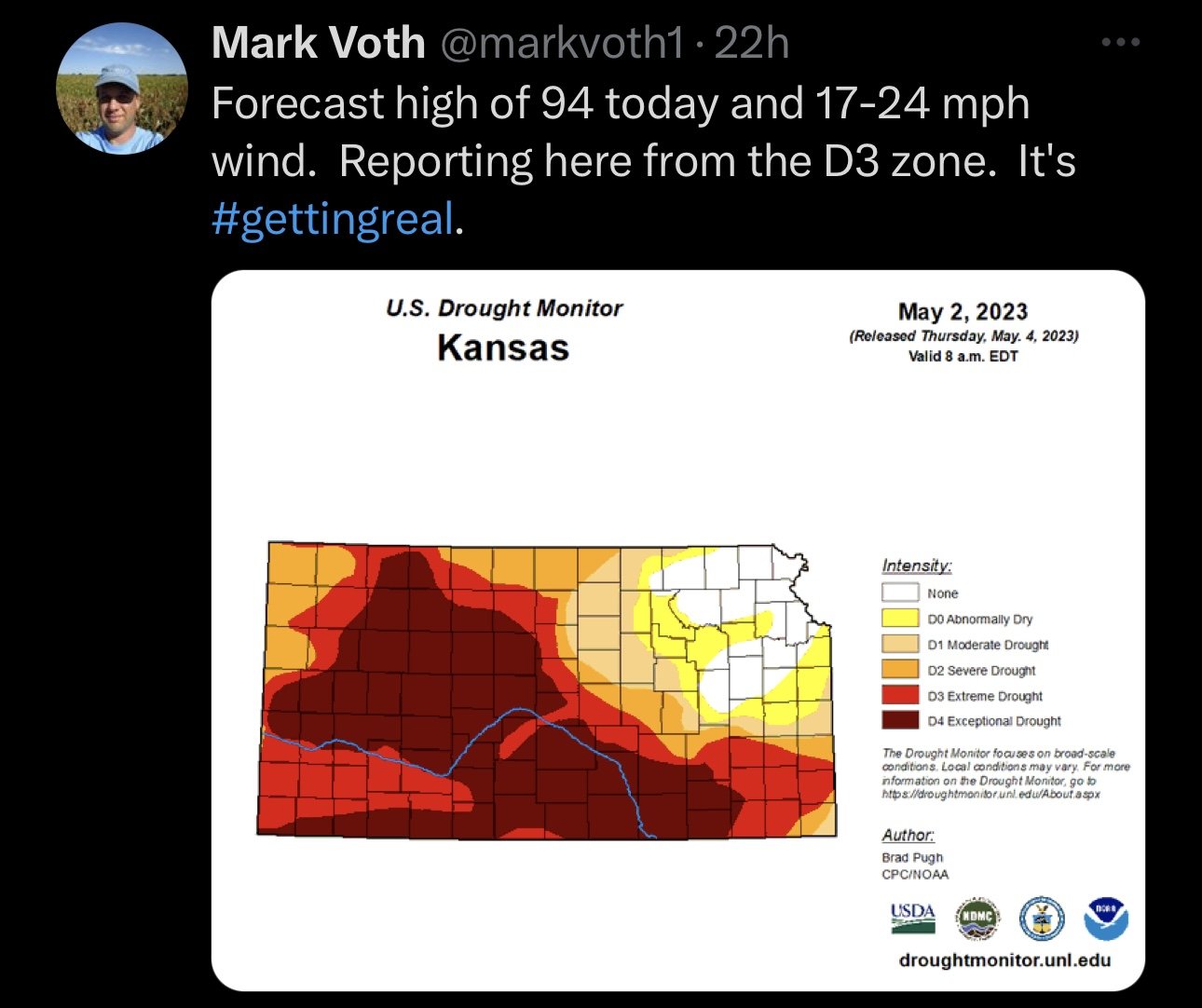

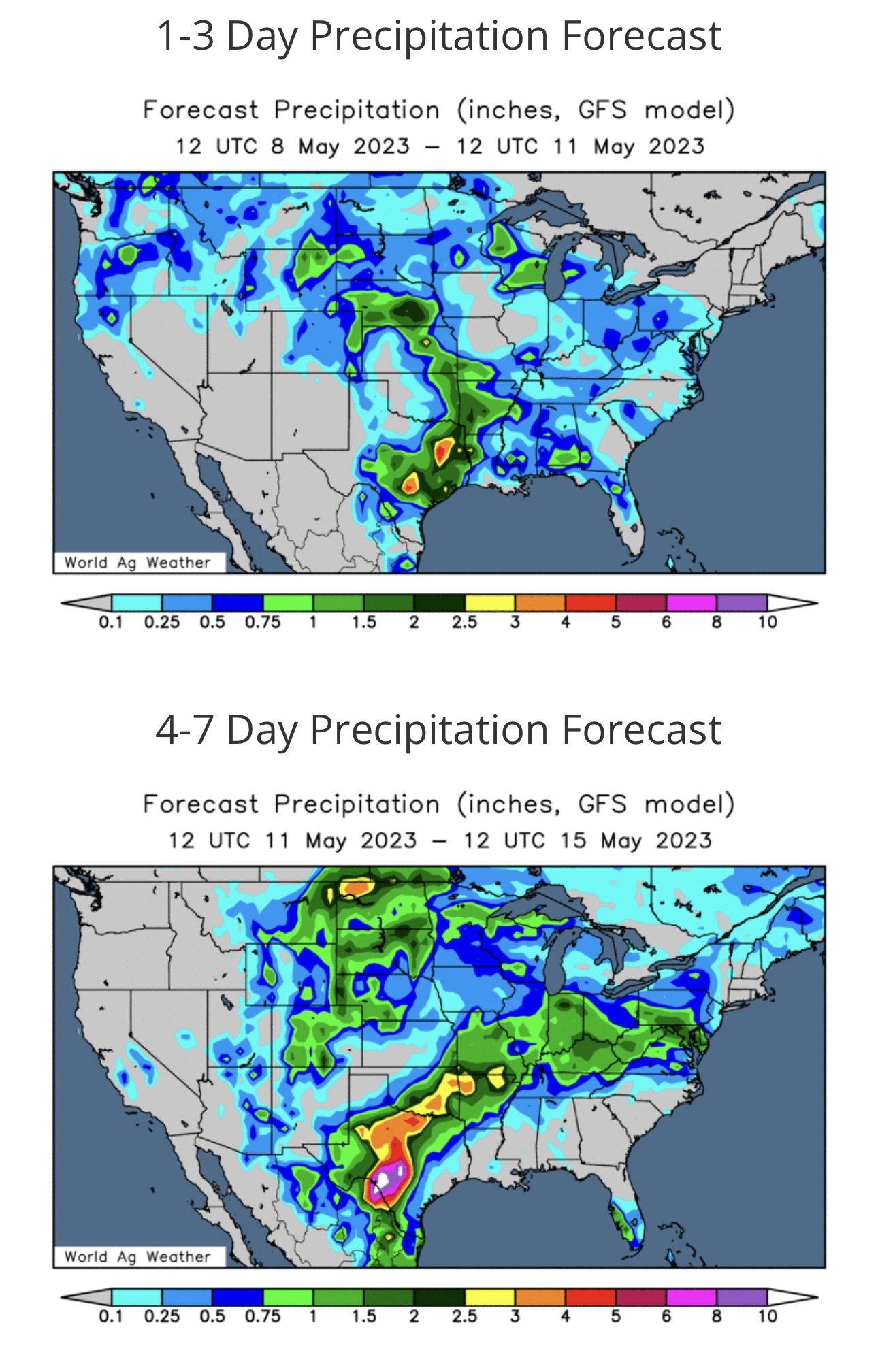

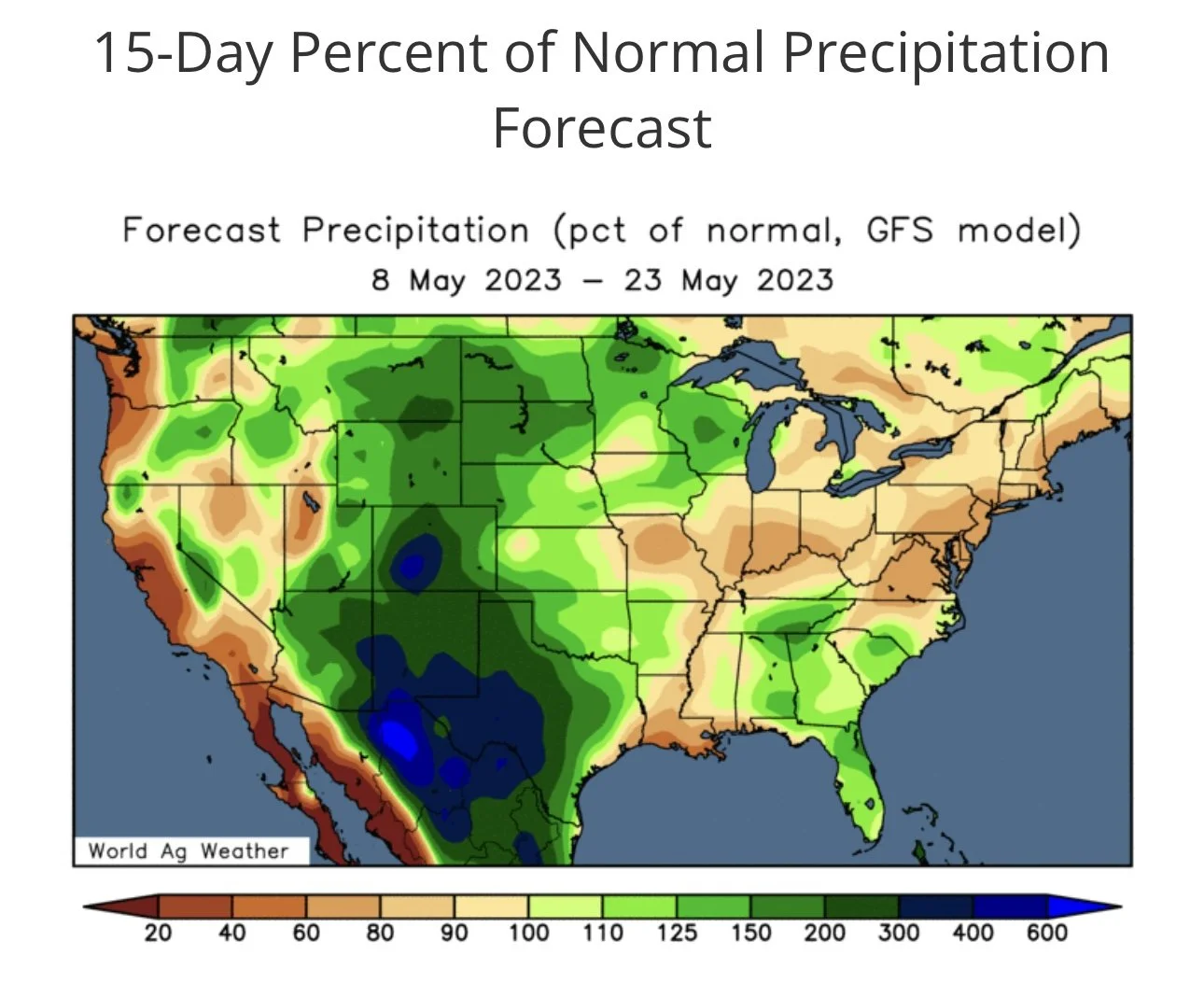

Weather looks mixed. Some areas are looking to get some favorable rains, but rains in the northern plains could slow some spring wheat planting. Texas and Oklahoma are also expected to receive some rains, but Kansas again looks like it might miss out, especially in the dry areas.

This week it all comes down to what the funds want to do. Will they defend their position or create some more short covering. A big portion of this decision will come down to weather and their positioning ahead of the report Friday.

Crop Progress & Conditions

Corn 🌽

Planted 49% (Trade 48%

Last Week 26%

Last Year 21%

Average 42%

Beans 🌱

Planted 35% (Trade 34%)

Last Week 19%

Last Year 11%

Average 21%

Spring Wheat 🌾

Planted 24% (Trade 28%)

Last Week 12%

Last Year 26%

Average 38%

Winter Wheat 🌾

Good/Excellent 29% (Trade 30%)

Last Week 28%

Last Year 29%

Poor to Very Poor 44% (Worst for the week since 1996)

Last Year 39%

Last Week 42%

Today's Main Takeaways

Corn

Corn is now 30 cents off it’s lows from last Wednesday, but ultimately ended the day today unchanged in a tight 7 cent trading range.

The commitment of traders data from Friday showed us heavy selling. As it showed the funds holding a massive short position of over 100k contracts, which is their shortest position since August of 2020. The funds sold over 100k contracts over the week, making it just the 4th time in history they have done so.

However, we did see some short covering mid-week which helped us rally off those lows. So the question now is, do we see the funds continue to get rid of that short position and help us rally, or do they defend their position. It will all come down to weather and what they are thinking for positioning ahead of the report. But if we get some unforeseen or unfavorable weather, we could again see them create a short covering rally.

Do you want to be that short going into the growing season? One wouldn’t think so. Even if we do get a slightly bearish report Friday, I think they could be quick to buy the break.

Taking a look at South America. We still have the obvious problems in Argentina. Brazil's corn is also just too dry, which could look to add support, but some argue that their crop is getting larger not smaller.

As mentioned, the optimism that the Black Sea deal will be renewed is slowly dwindling as Russia essentially said they want nothing to do with an extension. We still have until the end of next week for a conclusion, so we will have to see how that plays out. But if the deal does indeed not get renewed, this will likely add some support.

Friday we will get one of the more important USDA reports of the year, as it will give us our first official look at the new-crop balance sheets. It’s still early to make any major changes to production, so the trade will be focusing on the demand estimates.

Bears are arguing that we see the USDA lower its US export estimate. It will be interesting given the recent cancellations from China and their willingness to buy from other countries such as Brazil. With this, bears argue we see more competition for US exports down the road.

It will also be interesting to see if the USDA brings down it’s initial yield of 181. Bulls would like to see that number come in closer to the 178 range.

Going forward, this week is going to be all about weather, war, and what the funds decide to do ahead of the report. This report could definitely come in on the bearish side. But if it does, I think we ultimately see the break eventually bought. Was last week's low our bottom? It’s tough to say with the upcoming report. But we still think we see our lows made by the end of the month and we think this will again be a year where we make our highs come June, July, August.

Is A Summer Corn Rally In Place?

Technical Analysis from Vince Irlbeck,

Listen Here

He said:

December corn hit an important support line that has been set in place since the 2020 lows. By the Elliot wave rules I subscribe to, we should retest the highs by June or July. It may not break old highs but it should put on a good run.

If for instance we break old highs, it would be a five-point star topping formation like Cattle had, and would be considered a blow-off top. That is something to consider in the future and not something set in stone. Needless to say, we should have a healthy rally into June or July.

We had exceeded the 50% retracement only by 15 cents but considering the support line was 15 cents under it, I would consider it completed. The weekly RSI dropped down to the oversold status while the daily RSI hit good divergence. It’s time to rally.

Corn July-23

Soybeans

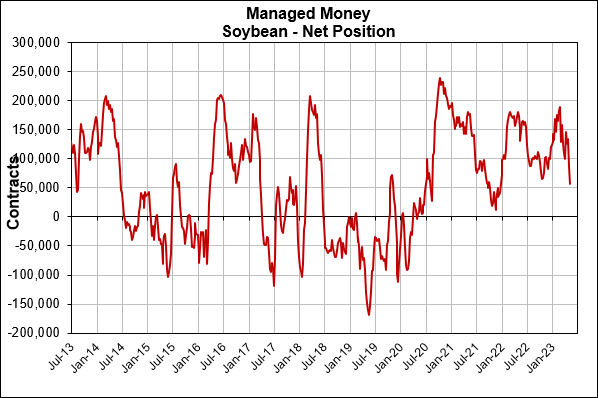

Beans were able to find support mid-week last week, and are now 40 cents off their lows from Wednesday. Today July beans were initially looking strong, trading 10 cents higher but ultimately ran into some selling, ending the start to the week down 2 3/4 cents.

While the funds hold heavy short positions in both corn and wheat, Friday's data showed the funds were still long around 60k contracts of beans and meal.

Bulls could make the argument that if we see a corn and wheat short covering rally led by weather or war, we could ultimately see soybeans follow along.

But currently, it is still a little early for us to get any real weather premium built in for beans here in the US. Bears also continue to look at the record crop in Brazil, which will further create competition for US exports.

As mentioned, Friday we will get the USDA's first look at an updated new-crop balance sheet. Bears argue that we see need to see the USDA lower old-crop exports anywhere from 10 to 25 million bushels.

Most are anticipating that we see old-crop domestic crush opted to be left unchanged. Bulls do suggest that we perhaps need to see this moved higher down the line.

The current yield the USDA has is set at 52 bushels per acre. Many think this number is far too high and will ultimately come in lower.

Lastly, for new-crop ending stocks, it is looking like most think we see a number in the 280 to 320 million bushel range. If we get a number above 300 million that could add some pressure and potentially limit a rally.

Soybeans July-23

Wheat

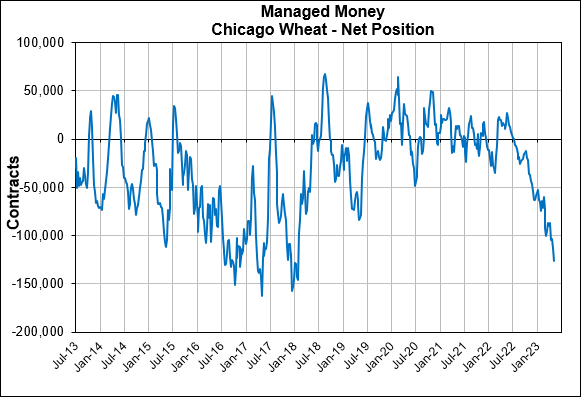

A mixed bag from the wheat markets today. Chicago wheat led the grains on the downside, while KC led us on the upside.

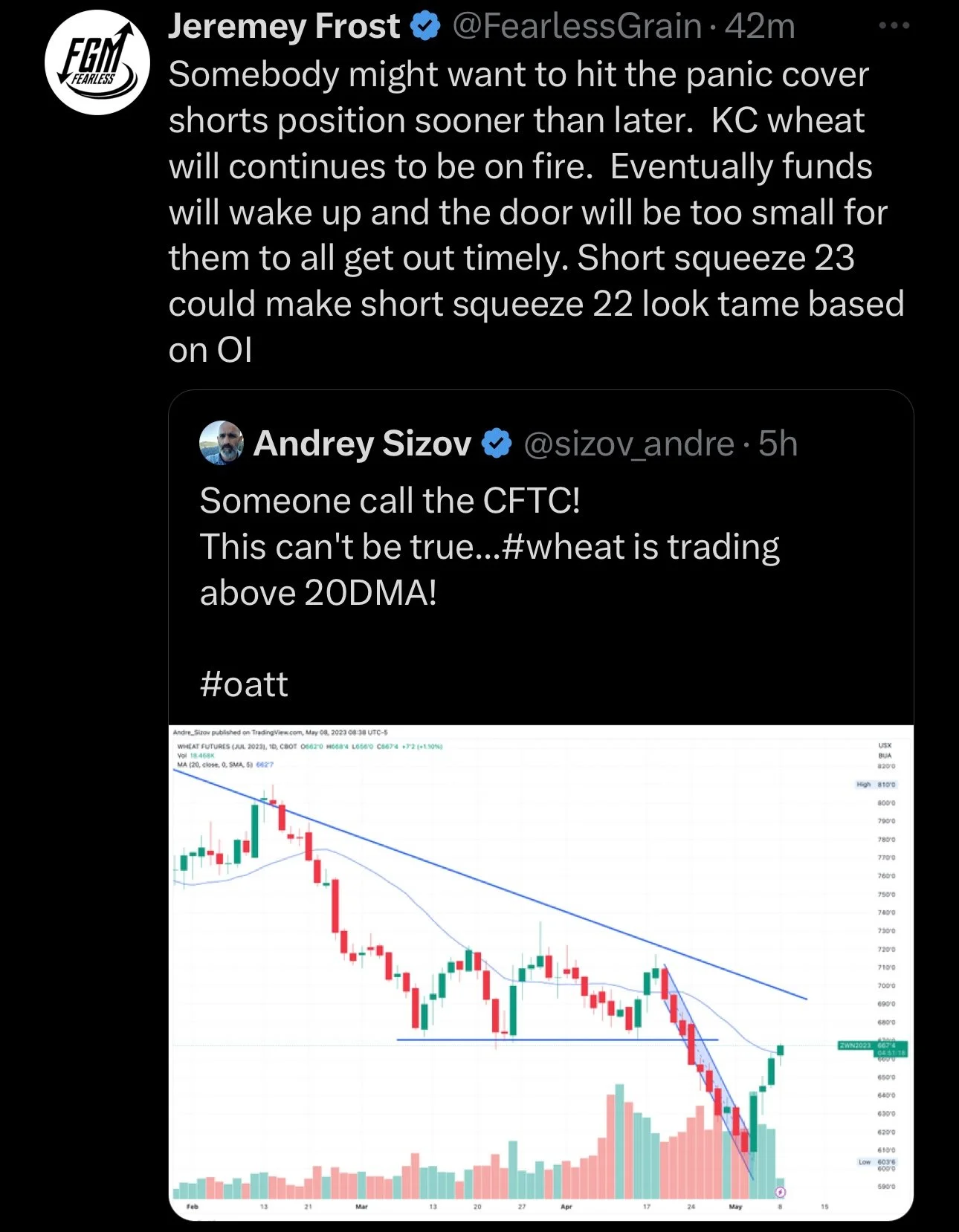

Last week we again hit new lows, as Chicago traded at 2-year lows. But with the late week rally we actually managed to close higher on the week. KC wheat on the other hand is now over a full $1 off our lows from last week as it continues it’s rally. I said early last week that I didn’t think anyone should be short KC wheat given how poor the crop here in the US is, and I still don’t think these rains will make much of a difference.

The funds are now holding their largest short position in Chicago wheat since January 2018, as they are approaching a record short position. Imagine a sub-optimal finish to the growing season. That is a lot of volume to undo.

One of the biggest headlines we got was from the Black Sea deal as mentioned. Reports are saying that Russia has pretty much entirely stopped talks about extending the deal and has zero intentions to move forward. We still have some time for Russia to change their mind so we will have to see how it shakes out.

Wheat continues to find support from the early US wheat crop tours. Where last week we saw just how poor Oklahoma's results were. As the crop came in at the smallest since the 1950's and the crop is just half the size of last year’s. I just wonder how poor the Kansas tours will be. I can’t imagine that the results don’t add support to the market. I had a feeling it was just a matter of time before the market finally realized the extent of how poor our crop is here.

As for the USDA report Friday. There isn’t expected to be any major changes to the old-crop balance sheet, but we definitely could see some curveballs on the new-crop balance sheet.

This will also be our first look at the field based data from US winter wheat. There is plenty of people who are arguing that this will be the worst crop in 50 years, and they could be right. There is also a big debate surrounding how many acres get harvested and how many ultimately get abandoned.

The average abandonment for winter wheat in Kansas for the last 104 years is 11.6%, some are expecting more than 25% this year. The last time this happened was in 1996.

Looking ahead of the report, I wouldn’t be too surprised to see the funds give back some of this $1 rally we saw in KC, but long-term I think bulls have their eyes set on $9. In yesterday's write-up, ChatGPT gave us a target of $9.50

Going forward it is going to be all about weather and war for the wheat market as it has been for some time. With the funds massive short position, it still makes me wonder just how big of a rally we'd see if they get some crazy weather or war headline and have no other choice but to cover.

Taking a look at the chart, July Chicago is flirting with that very long term downward resistance from last May. A break above and we could look to test the resistance from October.

Chicago July-23

July KC broke that downtrend from October and smashed through out 20-day moving average.

KC July-23

MPLS July-23

Factors in the Market

From Jon Scheve at Wright on the Market,

With old crop corn bouncing 30 cents off the lows from earlier this week, the following summarizes some market factors contributing to current price movement.

Ukraine Uncertainty

Some of the rally is likely due to the Ukraine grain corridor discussions and whether Russia will be renewing the deal. Russia’s deadline for a decision is May 18th, debates as to if it will continue will occur until then, and likely well after that date too regardless of the outcome.

Wheat Production Issues

Another reason for the rally may be severe reductions in hard red winter wheat yields in the southern plains. If Kansas City wheat prices could continue to trade higher the next few weeks, it likely keeping wheat from replacing corn in feed rations.

Recession?

Some financial analysts this past week were suggesting the recent economic data shows a recession may be becoming less likely and a “soft landing” is possible. If so, funds may either stop selling, look to cover some of their short positions, or even go long again. But, with the third bank failure this week, funds may not want to be buyers of anything yet.

Exports

China’s recent corn purchase cancellations have been contributing to price declines as well. If export pace does not stay the course or increase, then it is very difficult for prices to rally.

Other Reasons Prices Could Rally

From a technical standpoint corn is oversold and needs to bounce higher.

While May corn is in delivery, it is gaining on the July contract. This suggests corn should not be delivered and it is worth more than the market is suggesting on futures.

Basis values throughout the US turned higher this week. This is likely because farmers have no interest in selling at these values. It is unlikely farmers will sell much until after the July 4th weekend, because they are unsure what summer weather conditions will be.

May 12th USDA Report

This will be the first look at demand for next year. Last month’s acreage report combined with trendline yields and using a 3-year average usage would seem to mean a potentially bearish report coming up for the new crop. However, the market may now have this “bearishness” factored in already, and a report that meets expectations could turn out to be bullish instead.

~

Jon Scheve

Superior Feed Ingredients, LLC

Funds Positions

Chart Credit Roach Ag

Check Out Past Updates

5/7/23 - Weekly Grain Newsletter

AI Thinks We Are Going Higher. Do You?

5/5/23 - Audio Commentary

If This Was Short Covering, Why Didn’t Chicago Lead Us Higher?

5/4/23 - Market Update

Grains Rally Off Lows

5/3/23 - Audio Commentary

Wheat Prices Catch Fire

5/2/23 - Market Update

Grains Fade of Highs

5/1/23 - Market Update

Wheat Continues to Fall

4/30/23 - Weekly Grain Newsletter