SEASONALS, CATTLE HEDGE, CHARTS & DROUGHT?

MARKET UPDATE

You can scroll to read the usual update as well. As the written version is the exact same as the video.

Timestamps for video:

Drought & Forecasts: 0:30min

Cattle: 3:40min

Corn: 4:30min

Soybeans: 7:30min

Wheat: 9:30min

Want to talk about your situation?

(605)295-3100

Futures Prices Close

Overview

Poor price action for all the grains today.

Not a huge news filled day, but here is what is going on,

Trump News:

Trump & Putin visited today.

Trump said the call went really well. He said that Putin has agreed to halt attacks on Ukraine and that they will negotiate a full ceasefire and permanent peace deal. So a peace deal looks likely.

Trump said that he plans on meeting with China's President in the near future.

If a trade war deal gets worked out it would be very beneficial for the grains especially soybeans.

Winter Wheat & Corn Drought Concerns?

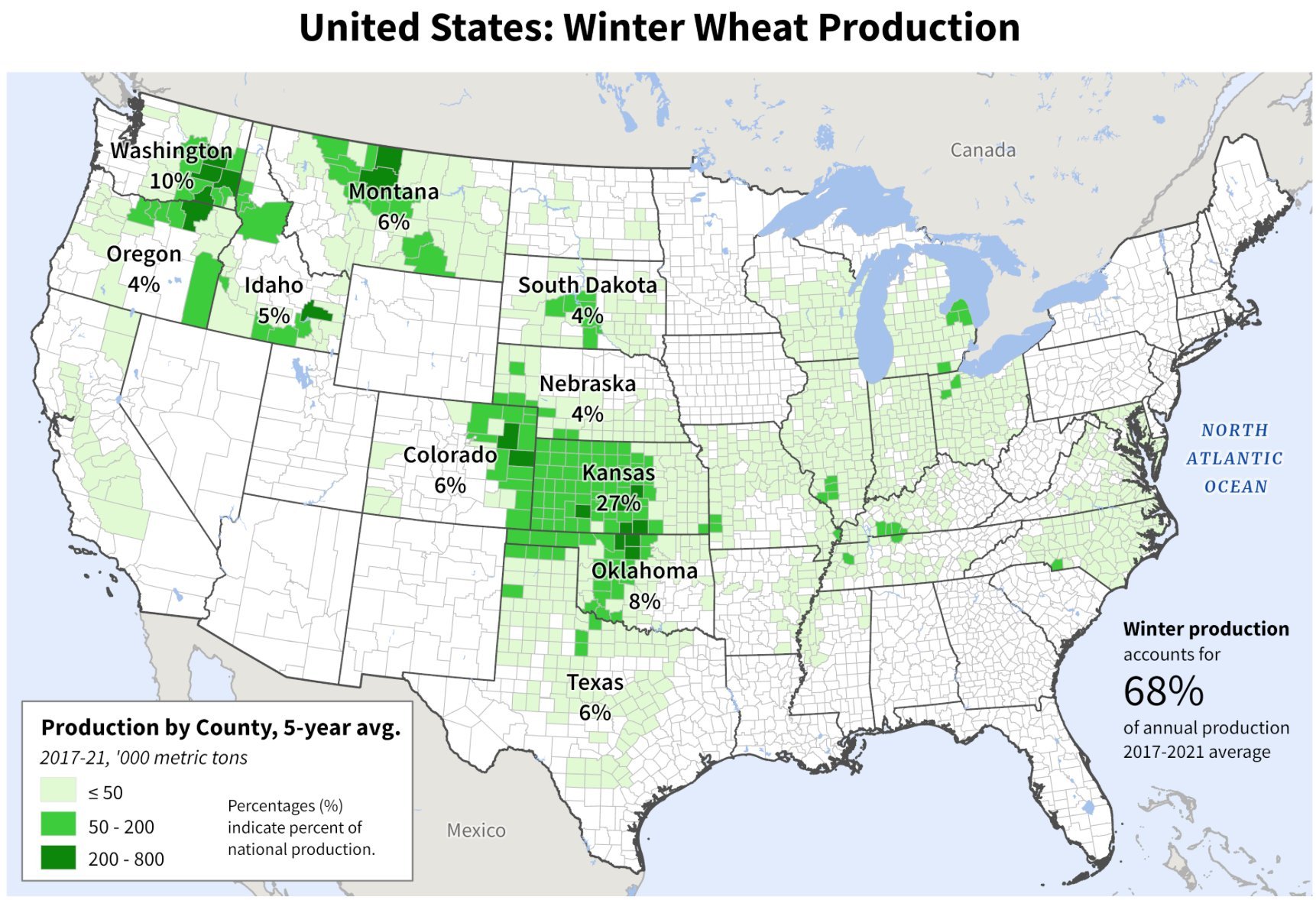

The wheat market has rallied on weather concerns in the plains.

As there was severe storms that included damaging wind and tornados. The effect of this is unknown, but there is also concerns about the dryness in the plains.

Is this dryness a big deal?

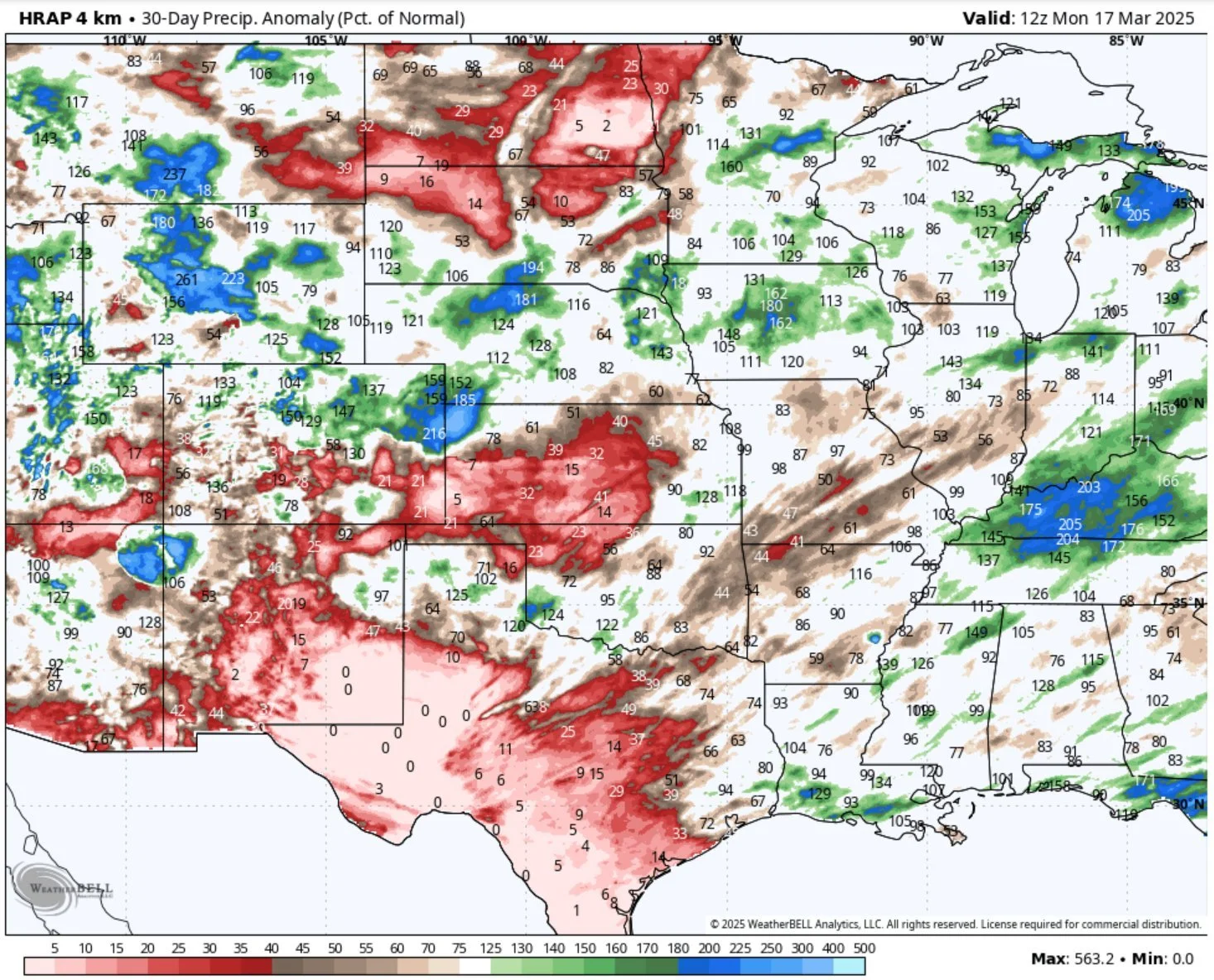

Here is the past 30 days of precip anomaly. It's been really dryness in the key Kansas region.

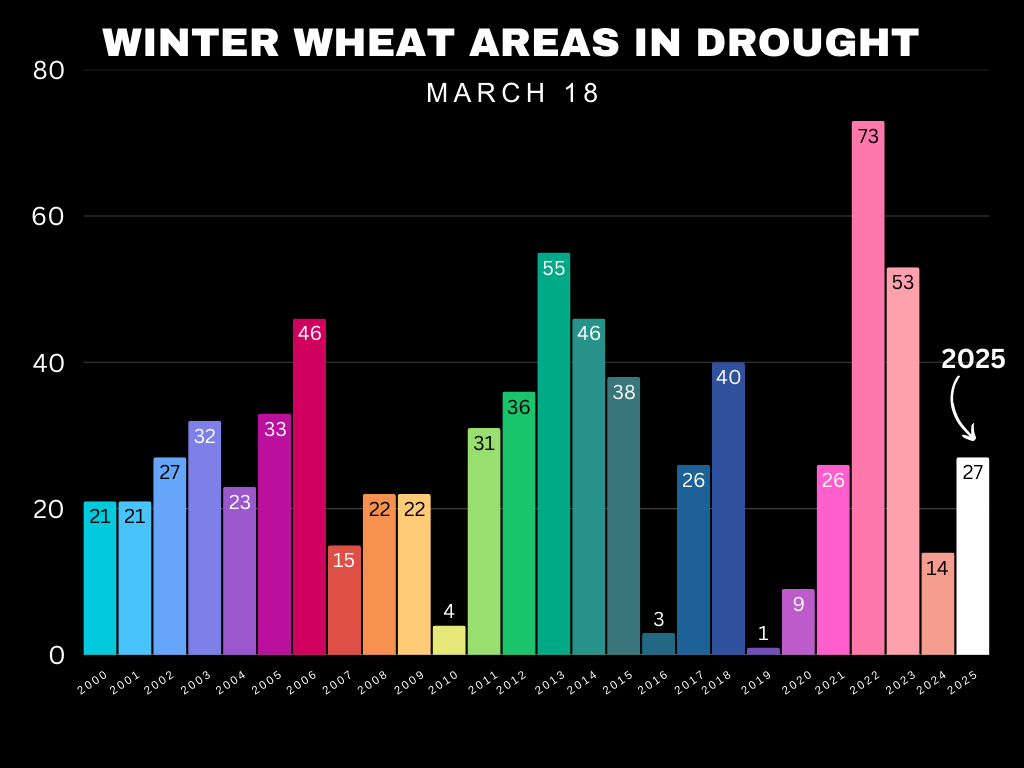

Currently 27% of winter wheat is in a drought.

Is this a lot?

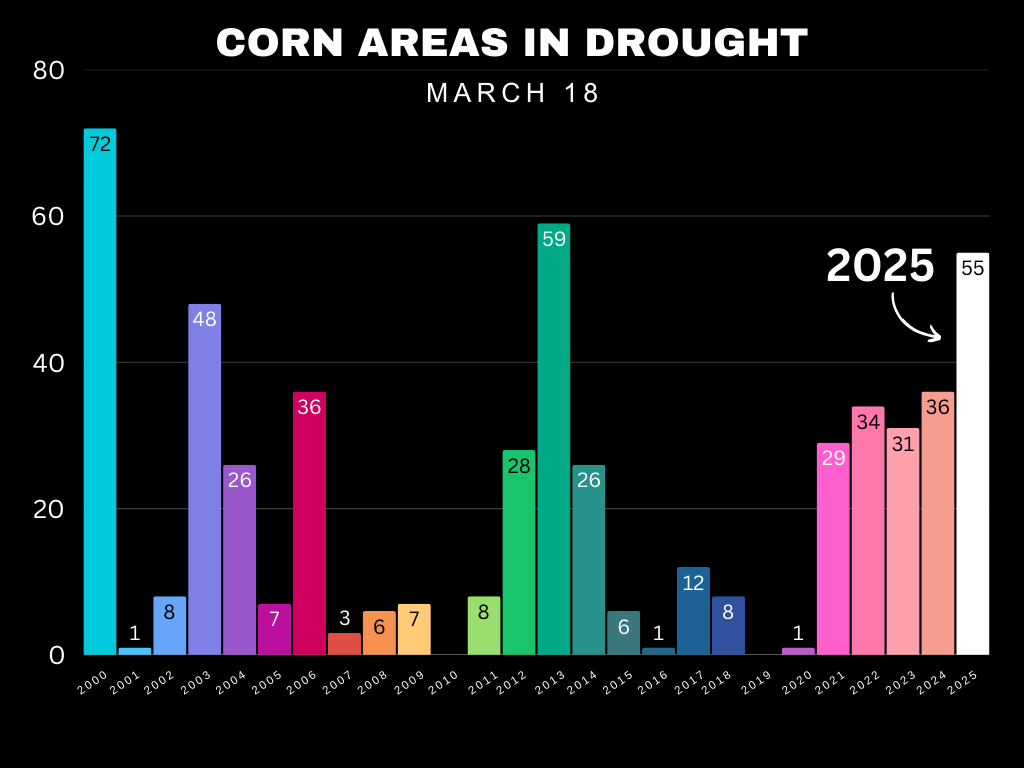

Here is how this drought ranks vs past years.

Really nothing too concerning yet, as we are right in the middle of the pack.

Corn on the other hand paints a different story.

Corn drought is the 3rd highest of the century. Only behind 2000 and 2013.

No this does not mean we will have some crazy drought this summer, this just means we are going into planting with light soil moisture so it makes us more septic to drought if one comes.

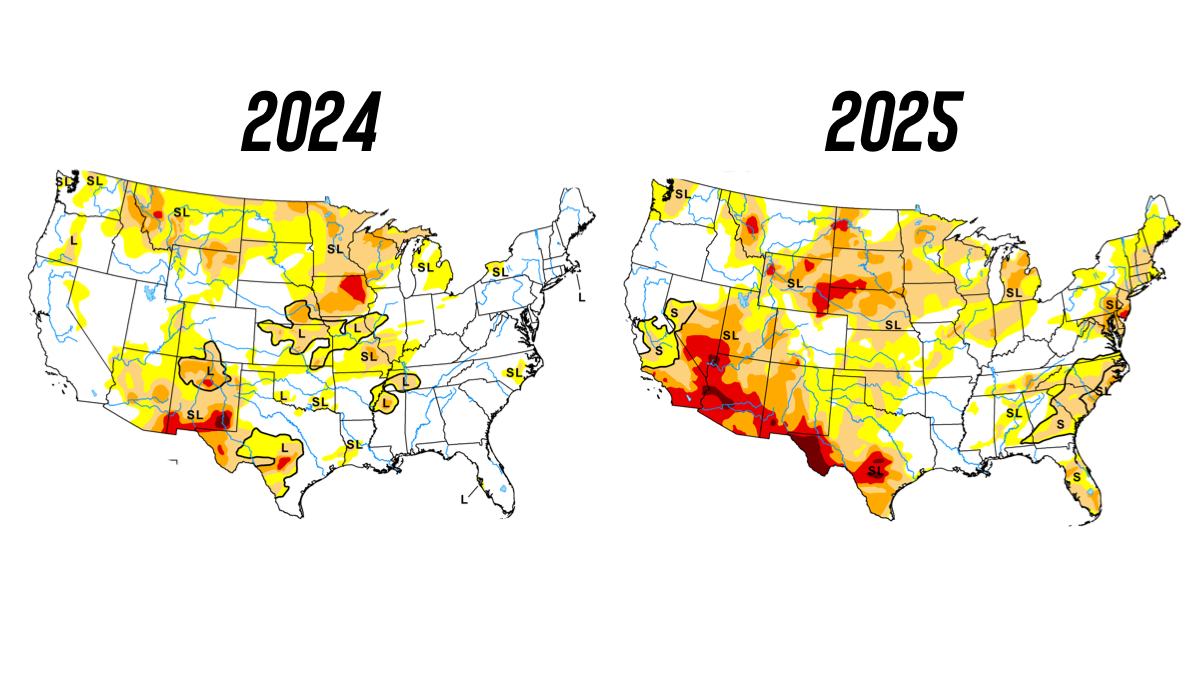

Here is the current drought monitor vs last year.

A lot more drought especially in the upper plains.

This isn’t a huge concern yet, but definitely something to keep on the radar.

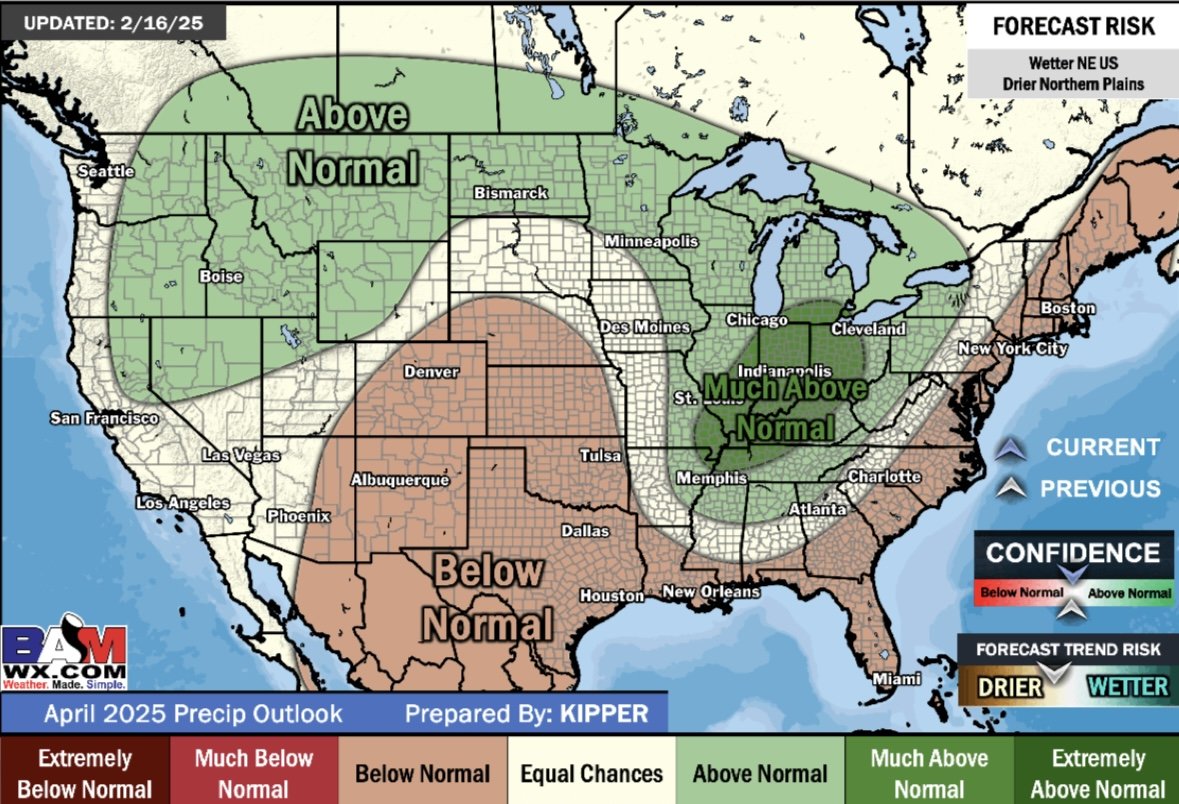

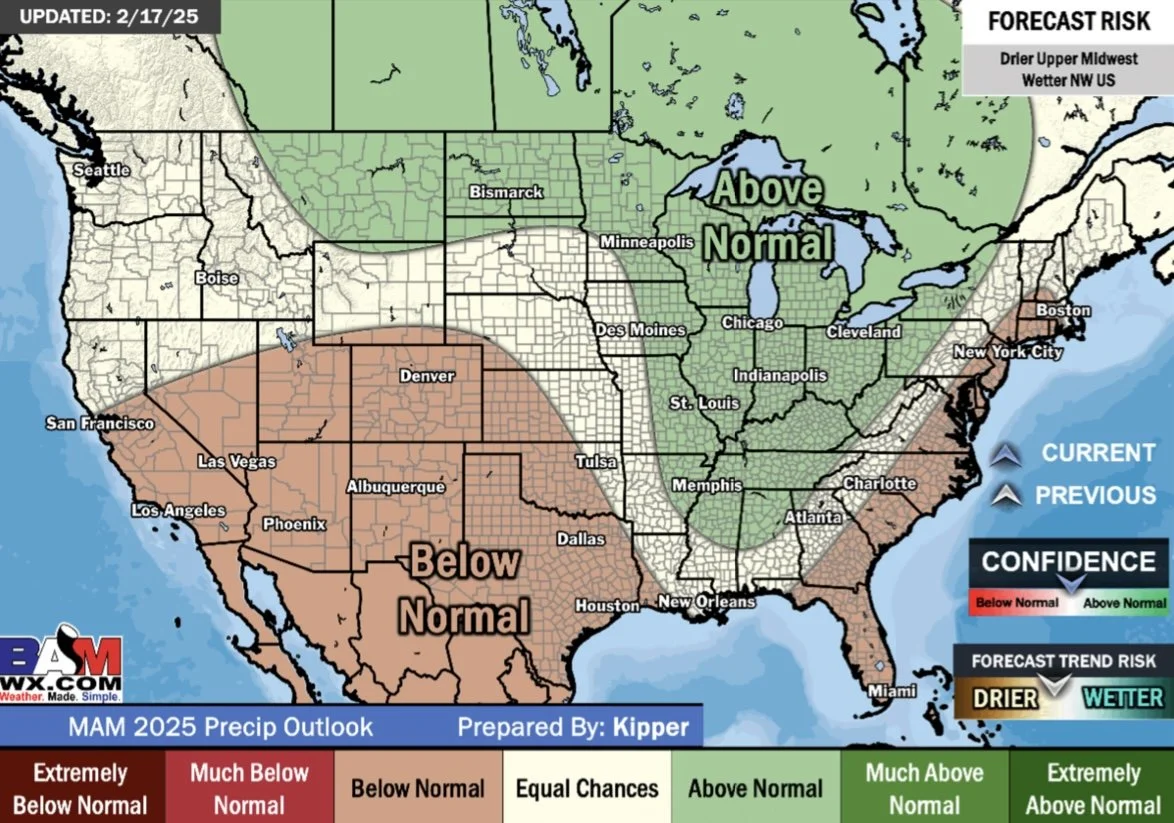

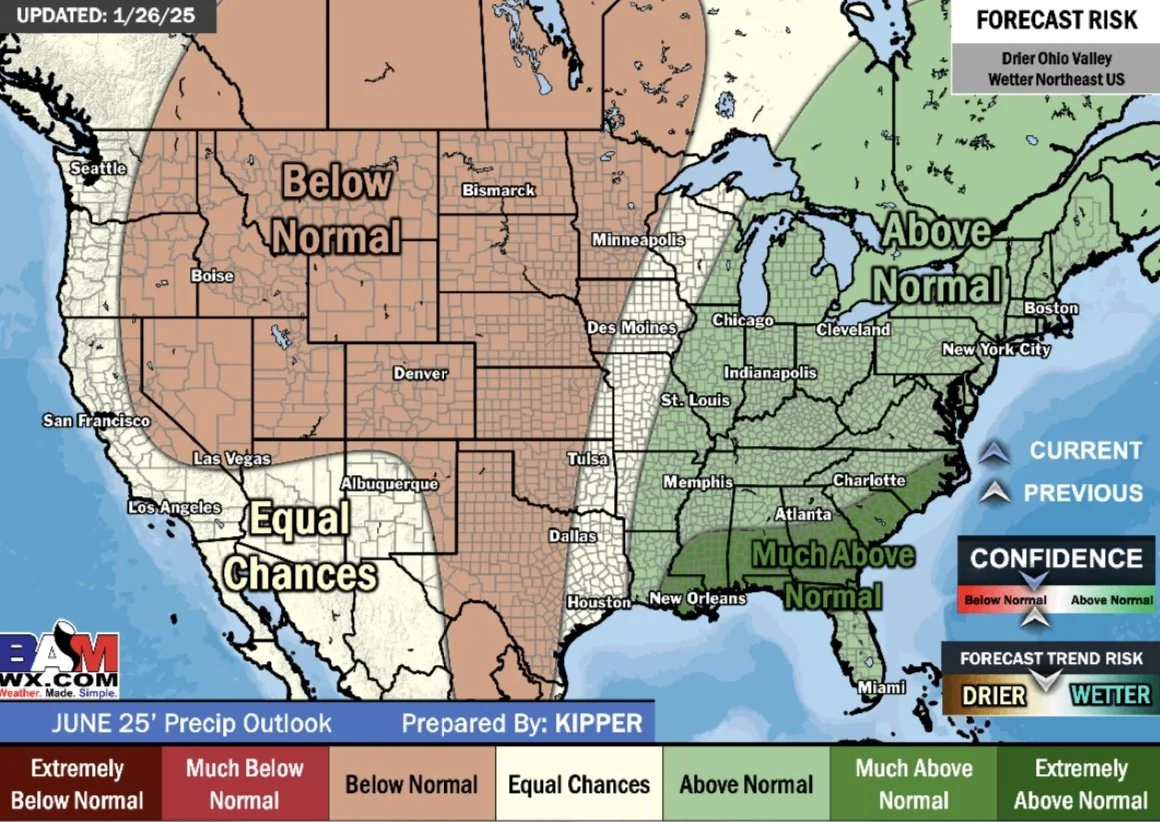

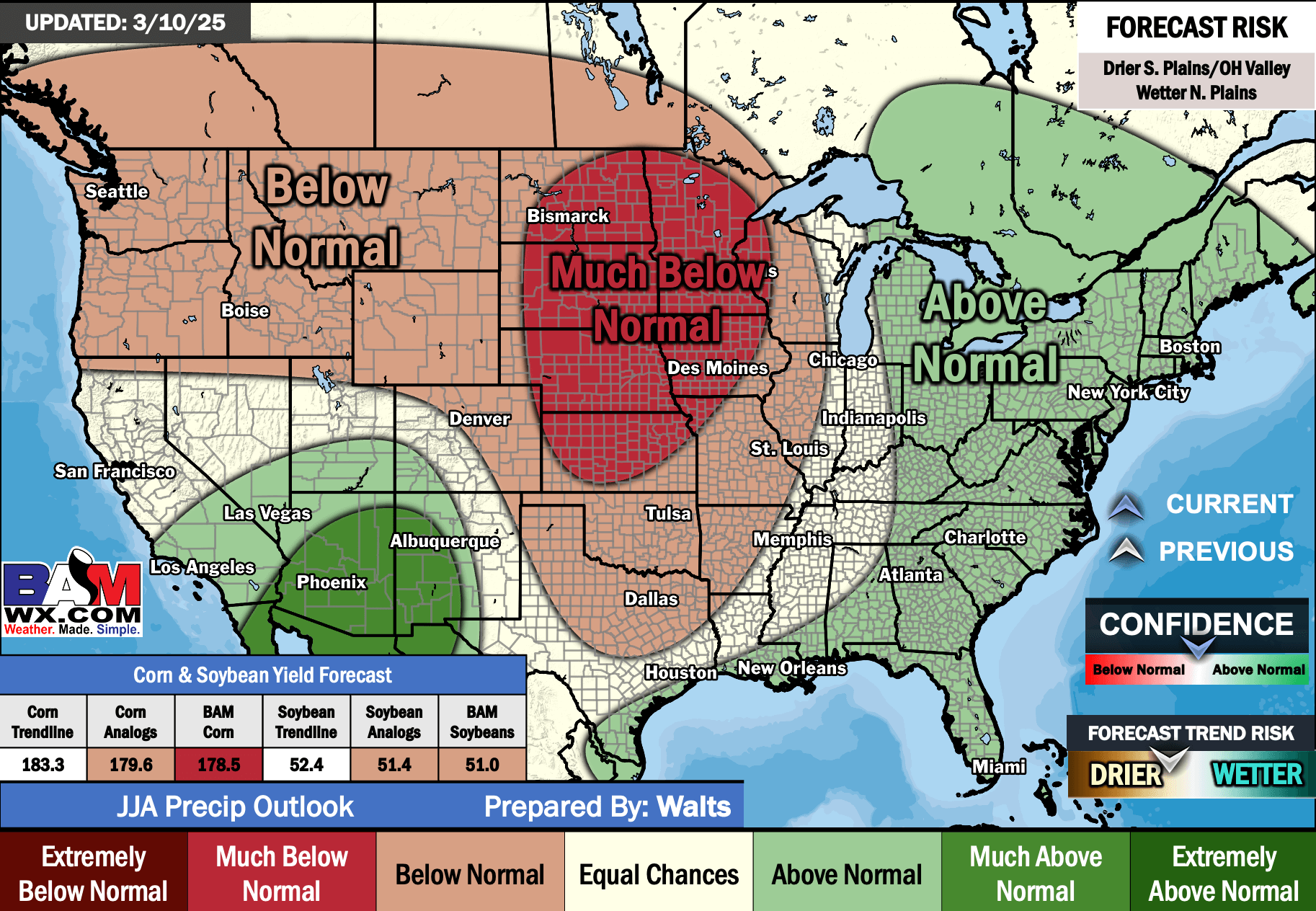

Looking at the future forecasts, here is the outlook from now until August from BAM Weather.

For winter wheat country, it is very dry for several months. So this winter wheat drought story could develop into something bigger.

For corn country, areas such as Iowa, Minnesota, North Dakota, and Wisconsin all are expected to be wet in April. But by June those areas turn dry. While Illinois, Ohio and the rest of the eastern corn belt stays wet until June.

Then BAM's June, July, and August outlook shifts very dry especially for Iowa, South Dakota, North Dakota, Minnesota, Nebraska, and Kansas. Even Illinois shifts dry for this time frame. Leaving the rain confined to just the far eastern corn belt.

April

May

March-April-May

June

June-July-August

Cattle

Feeder cattle posted yet another contract high.

We are getting very close to my target of 286.97 (this target is simply 161.8% of the rally from 266 to 279, known as the golden fib extension for the 2nd move).

Many of you should be considering taking some risk off the table.

Call us if you have questions: (605)295-3100

Live cattle is approaching those highs for those that feel like you missed out the first go around.

This thing could keep running, but ask yourself..

Would I be more mad if I did nothing and we collapsed..? Or if I sold now and the rally continued..?

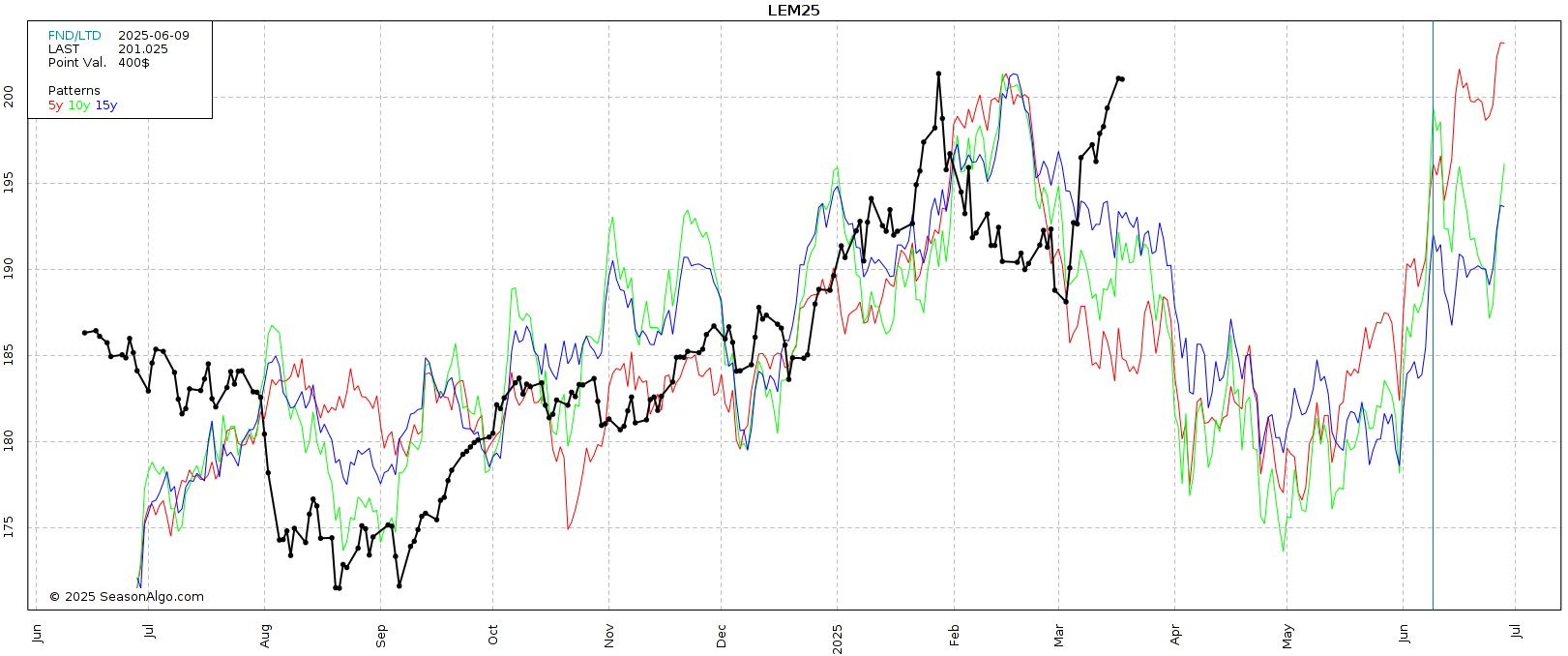

Here is the June live cattle seasonal.

Seasonally, we start to fall off here.

Something to keep in mind.

Today's Main Takeaways

Corn

Fundamentals:

The corn story is still friendly.

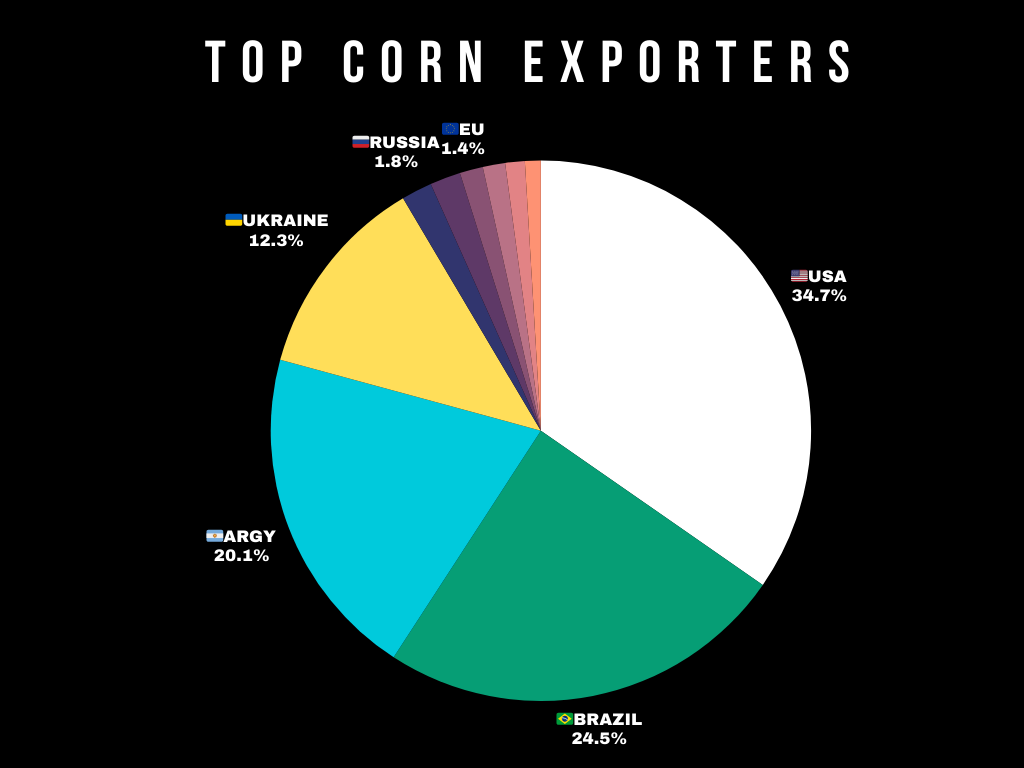

Here is the stocks to use ratio just for major global exporters.

(USA, Brazil, Argy, and Ukraine. As these are the only ones who really export any corn)

This is the 3rd tightest of all-time. Only behind 2020/21 and 2011/12.

The world situation being this tight means the world cannot afford any issues with the US crop. Because if we do, world corn gets extremely tight.

A year like this one is where a drought scare could really escalate things.

Seasonals:

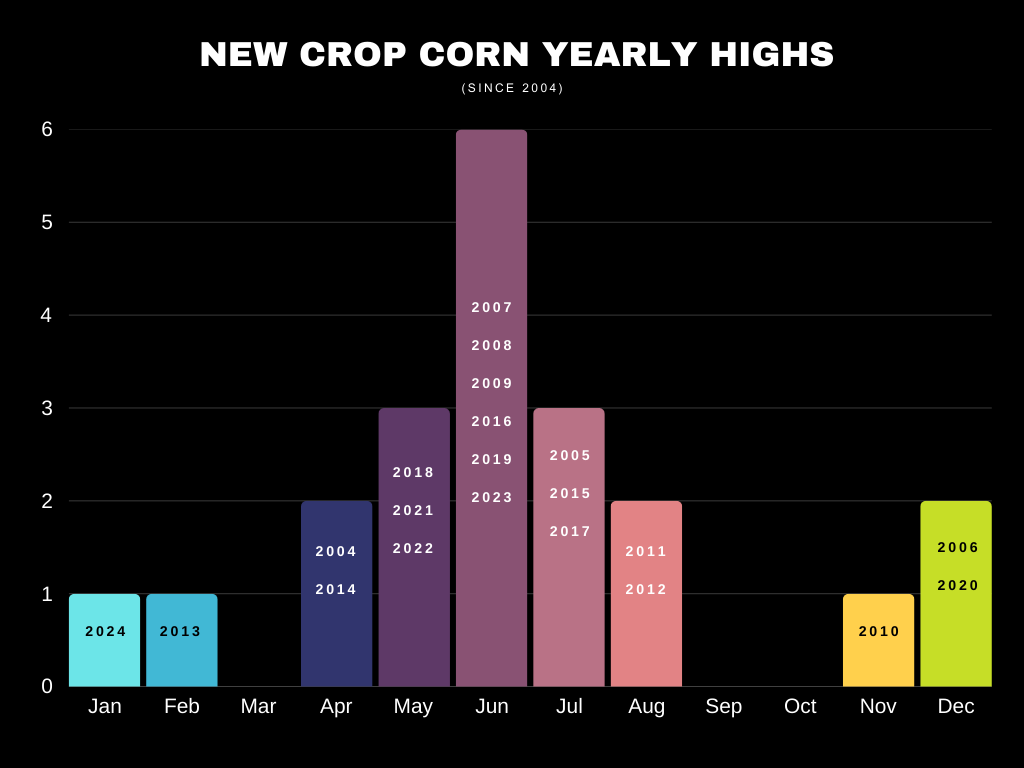

I showed this recently, but corn has only topped in February one time (2013).

Usually making our highs in that May to July period on production concerns.

Doesn’t mean 2025 can’t be the 2nd time, but data suggests it's not likely.

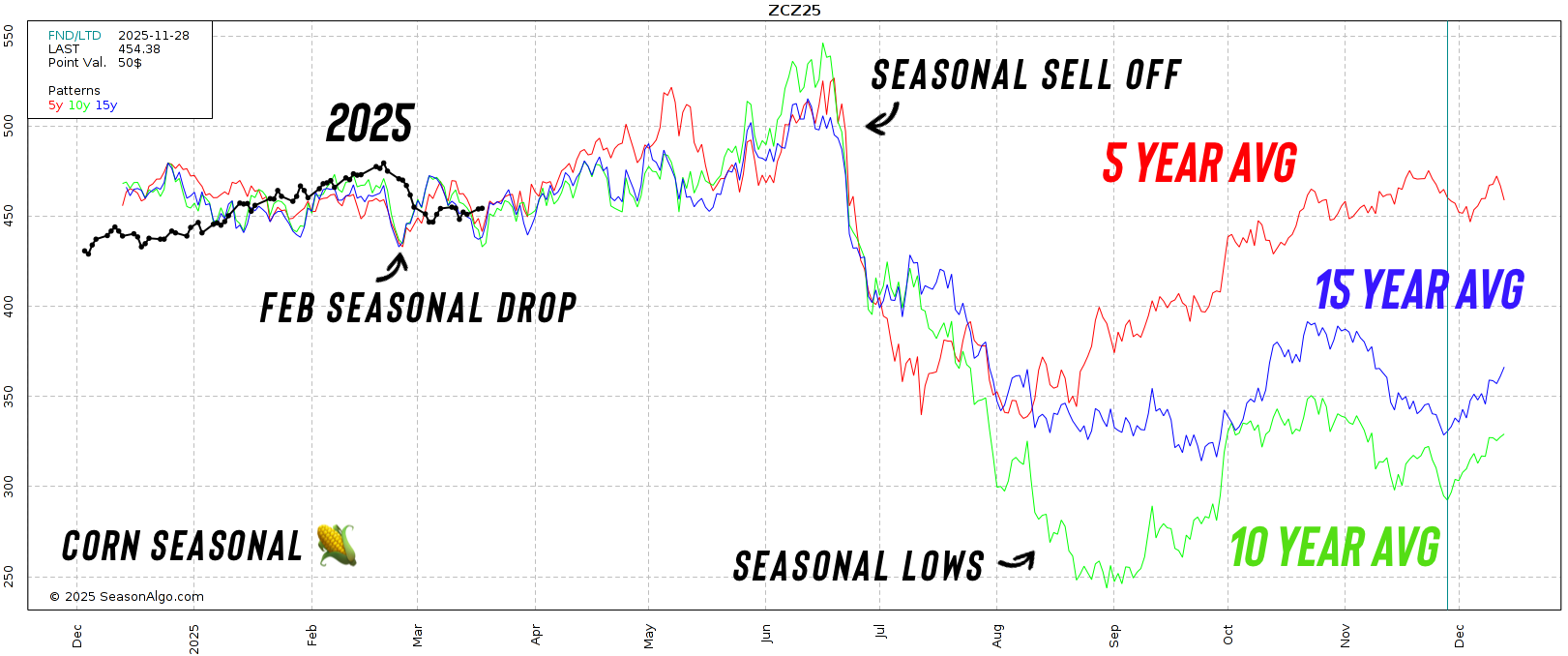

Seasonally we do struggle here before finding a bottom in April to May then getting that opportunity in June before getting a brutal sell off.

Here is July corn.

Here is Dec corn to show you that sell off.

Technicals:

I still think corn "should" hold this level.

It makes sense. Here is why:

1) $4.54 is the 61.8% retracement of the entire rally from $4.14 to $5.14. That is a standard correction. (yellow line on big red box)

2) $4.56 is the 61.8% retracement of this mini rally from $4.42 to $4.77. Again a standard correction. (yellow line on small green box)

3) This level was major old resistance. We rejected here on our highs in Oct, Nov, and Dec. It makes sense we would consolidate above here and turn it into new support.

4) The 200-day MA was an absolute lid for corn futures for 2 years.

Old resistance becomes new support.

We broke above it in late December for the first time since 2023.

It makes sense that we would simply come back to re-check it as support.

We have bounced off of it several times now the past few days.

Not much to update on Dec corn.

Still holding the golden zone box (red box: 50-61.8% of the entire rally from $4.28 to $4.80)

For Dec corn, next objective is $4.60 to $4.65 (blue box: 50-61.8% of the sell off).

Soybeans

Fundamentals:

Soybeans do not have as strong of a bull case as corn or wheat, but at the same time soybeans have already endured every bear headline.

The market has already traded every factor out there that is being talked about. The monster Brazil crop, the 2nd most bearish global balance sheet of all-time. it's all already known.

Which means if beans were going to $9 we would’ve been there by now.

(The wild card is of course China and the trade war).

The silver lining for soybeans is less acres.

We are guaranteed going to see less acres. This change in acres could very realistically make the US bean situation very tight if we do not get a trendline yield.

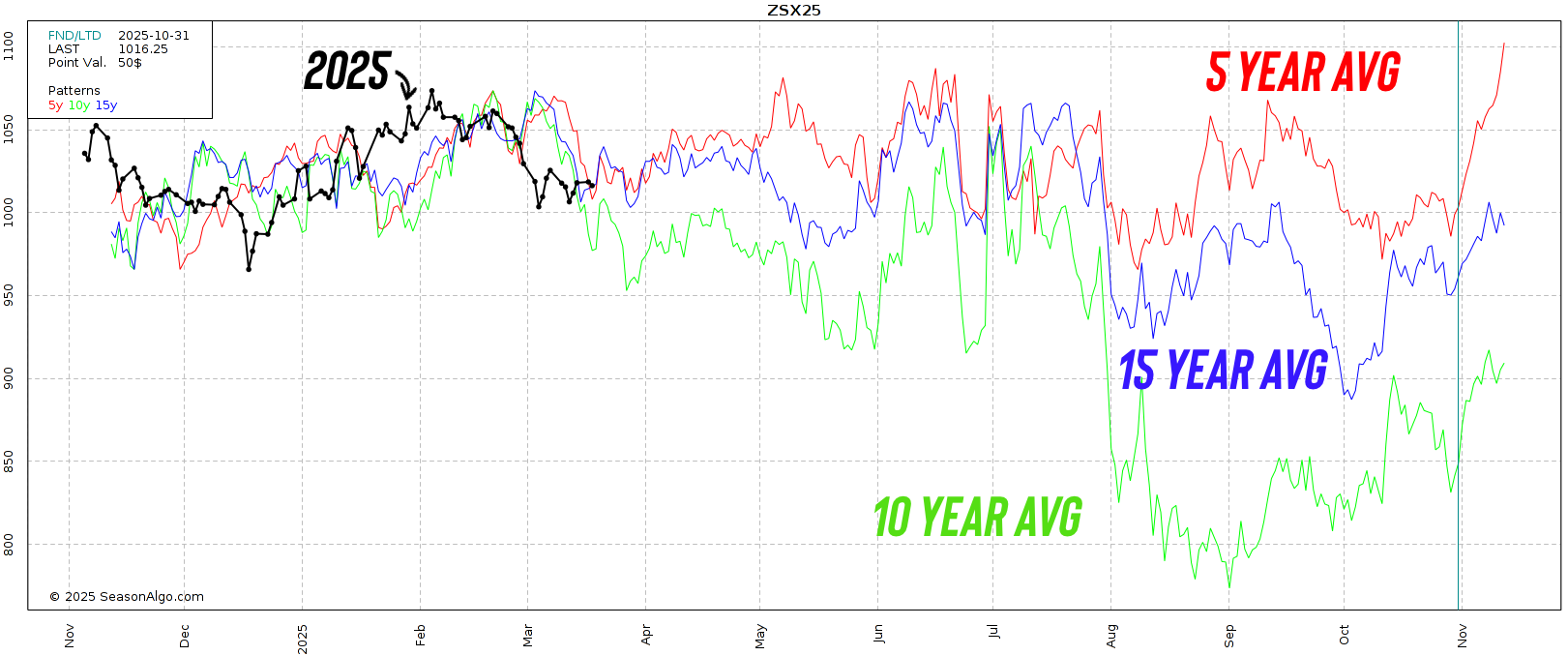

Seasonals:

Seasonals don’t work as well for beans as corn. While the US dominates the corn market, soybeans revolve around more than one harvest (Brazil).

Brazil has more recently taken over the top spot, so the seasonals have changed. We used to get that same harvest low in beans as corn, now the effect is more minimal.

Our highs for the year are usually posted in the summer or off an end of year rally into the new year.

Technicals:

The chart for beans is simple. Only 2 things to watch:

1) The major support beneath us.

This is crucial support we have tested several times since August. We need to hold here, or the next support is contract lows.

This level also happens to be the 61.8% retracement of the entire rally from $9.50 to $10.90. A standard correction.

2) The 100-day MA (purple line)

It has acted as key resistance countless times. Bulls need to break above it to claim we have put in a bottom.

Same set up in Nov beans.

Wheat

Fundamentals:

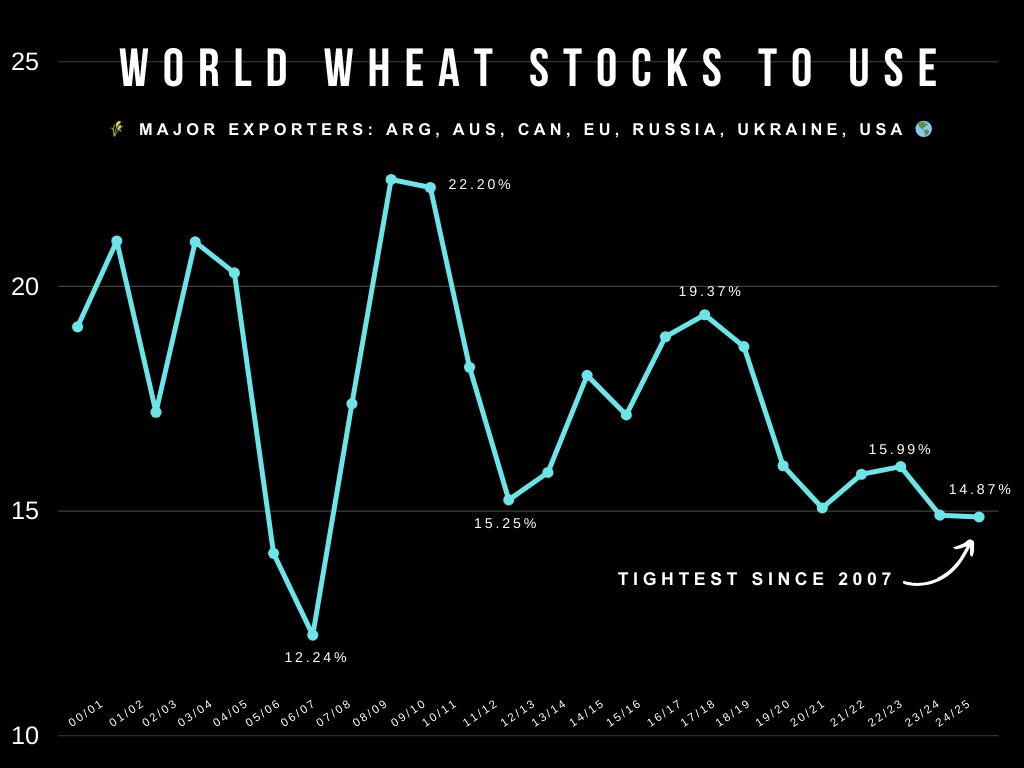

Just like corn, the global situation for wheat is very friendly.

Wheat arguably has the most bullish possible path of all the grains.

Here is the stocks to use ratio for major global exporters.

It is the tightest since 2007 and could get tighter with the poor Russian crop.

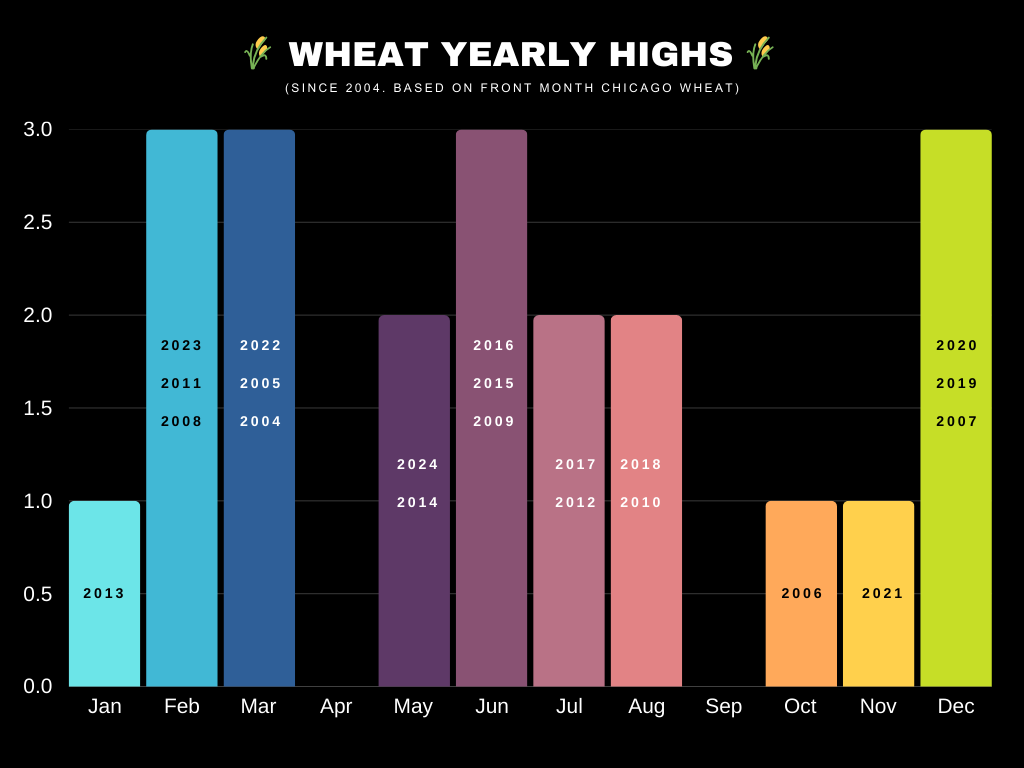

Seasonals:

Like soybeans, wheat seasonals do not always work the best. As there are other major players such as Russia.

If we look at when we post our yearly highs, there is zero correlation. Completely random aside from never posting a high in April or September.

But if we look at the seasonals, we usually continue higher into May then trickle lower until fall.

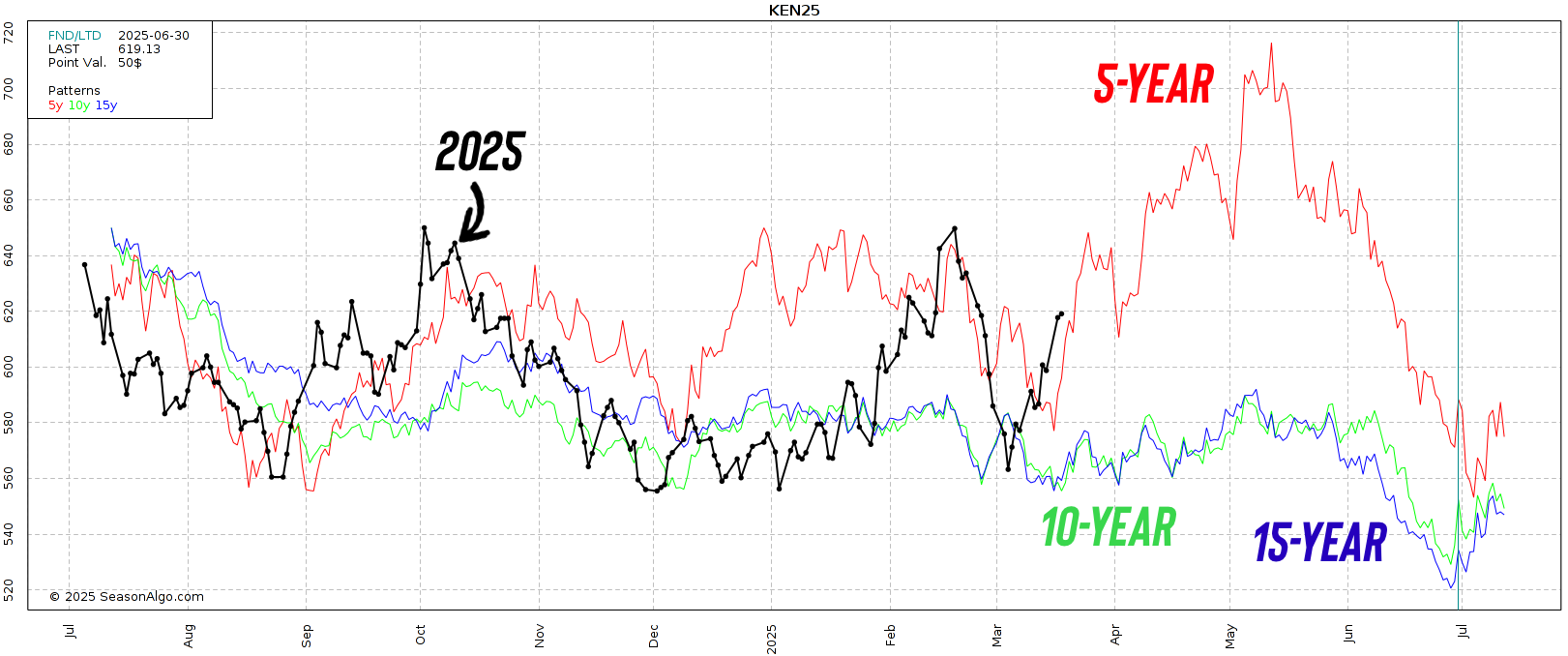

This is Dec Chicago wheat.

Now this is July KC wheat.

We are somewhat following this 5 year seasonal that also has us topping out in May.

Technicals:

KC bounced exactly where it needed to after our buy signal. That big support box we have held for several months.

Next upside objective is $6.35

We topped out there on both the October and February rallies.

After that I have targets at $6.50, $6.90, and $7.30

Which is each retracement level to those May 2024 highs.

We have a potential triple bottom in place, the implied move for this pattern brings us right to that $7.30 target as well while also being the 78.6% level of the May highs.

If we get a correction here I am looking for a bounce between $5.79 and $5.70 (50-61.8% of this recent rally).

May wheat simply trapped in this channel.

Next objective is another test of the top of the channel.

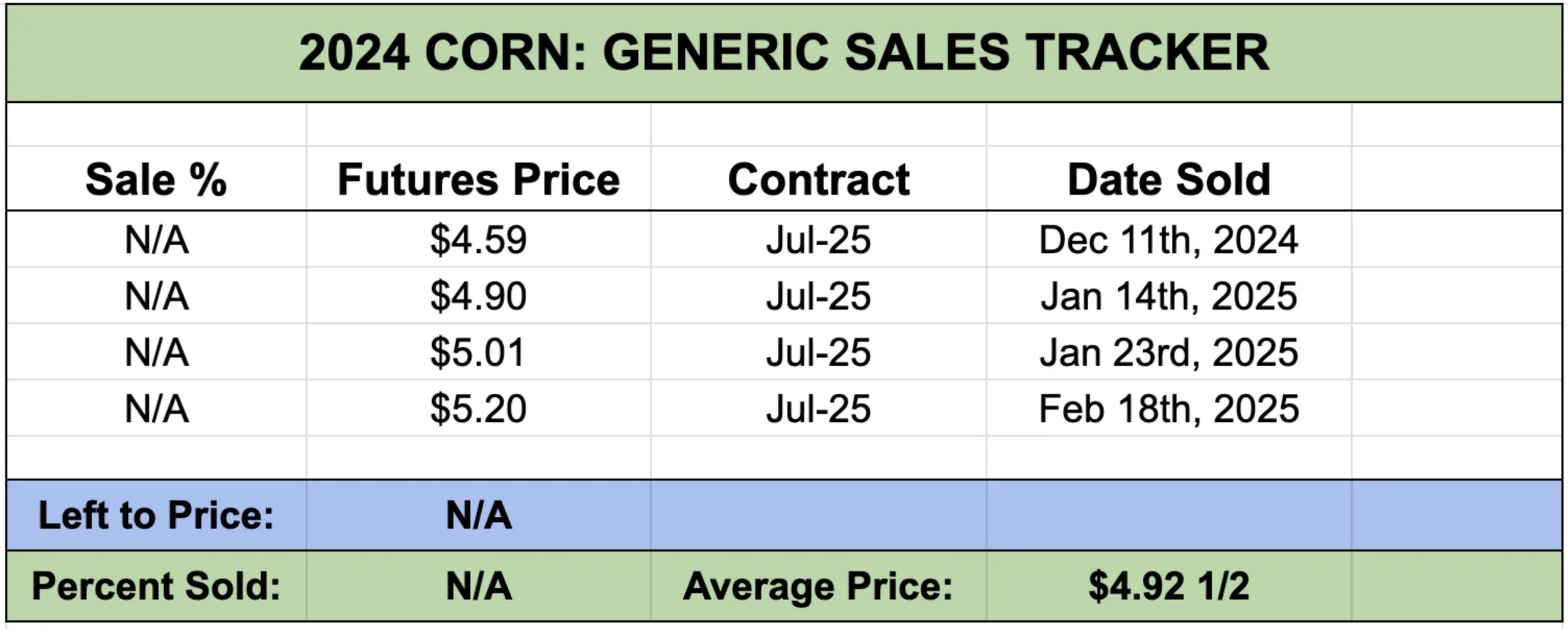

Generic Cash Sales Tracker

Due to requests here is our generic cash sales trackers.

This does not include any hedge recommendations etc. Simply cash.

This is futures prices.

For old crop there is no percentages as we only recently started tracking our generic sell signals. Future new crop sales will have percentages as we continue to make sales.

This will be included at the bottom of every update.

Past Sell or Protection Signals

We recently incorporated these. Here are our past signals.

Feb 18th: 🌽 🌾

Old crop KC wheat & old crop corn signal.

Jan 23rd: 🌽 🌱

Corn & beans old crop sell signal.

CLICK HERE TO VIEW

Jan 15th: 🌽 🌱

Corn & beans hedge alert/sell signal.

Jan 2nd: 🐮

Cattle hedge alert at new all-time highs & target.

Dec 11th: 🌽

Corn sell signal at $4.51 200-day MA

CLICK HERE TO VIEW

Oct 2nd: 🌾

Wheat sell signal at $6.12 target

Sep 30th: 🌽

Corn protection signal at $4.23-26

Sep 27th: 🌱

Soybean sell & protection signal at $10.65

Sep 13th: 🌾

Wheat sell signal at $5.98

May 22nd: 🌾

Wheat sell signal when wheat traded +$7.00

Want to Talk?

Our phones are open 24/7 for you guys if you ever need anything or want to discuss your operation.

Hedge Account

Interested in a hedge account? Use the link below to set up an account or shoot Jeremey a call at (605)295-3100.

Check Out Past Updates

3/17/25

WHEAT RALLIES. DON’T GET BACKED INTO A CORNER

3/14/25

MARCH 31ST REPORT THOUGHTS & WHAT’S NEXT FOR GRAINS

3/13/25

EXPLAINING RE-OWNERSHIP VS COURAGE CALLS

3/12/25

TARIFF FEARS. EU, CANADA, & ETHANOL

3/11/25

USDA SNOOZE. RECORD FUND SELLING A CONCERN?

3/10/25

USDA TOMORROW. GETTING COMFORTABLE IN MARKETING

3/7/25

HOW TIGHT IS THE WORLD & US SITUATION?

3/6/25

TARIFFS PUSHED BACK. FUTURE OPPORTUNITIES?

3/5/25

IS GRAINS BIGGEST RISK WEAK CRUDE & DEFLATION?

3/4/25

TRADE WAR BEGINS. 8TH DAY OF PAIN FOR GRAINS

3/3/25

TARIFFS ON TOMORROW. BUY SIGNAL

3/3/25

BUY SIGNAL

2/28/25

WHEN WILL THE BLEEDING STOP?

2/27/25

CORN AT CRITICAL SPOT. USDA ACRE REPORT. WAY TOO EARLY DROUGHT TALK

2/26/25

HISTORY SUGGESTS CORN TOP ISN’T IN? ACRE OUTLOOK TOMORROW

2/25/25

POSITIVE CLOSE. WHAT TO KNOW ABOUT USDA OUTLOOK

2/24/25

USDA OUTLOOK, FIRST NOTICE DAY & BRAZIL

2/21/25

WHAT TO EXPECT MOVING FORWARD IN GRAINS

2/20/25

FIRST NOTICE DAY CONCERNS. MASSIVE CORN ACRES OR NOT?

2/19/25

HOW TIGHT IS THE CORN SITUATION?

2/18/25

MORE DETAILS ON TODAYS SELL SIGNAL

2/18/25

OLD CROP KC WHEAT & CORN SELL SIGNAL

2/14/25

WHEAT BREAKING OUT ON WEATHER RISK. TECHNICALS & FUNDAMENTALS

2/12/25

GLOBAL GRAIN SITUATION, ACRE TALK, CHARTS & MORE

2/11/25

USDA: NOT A BEARISH REPORT. DISAPPOINTING PRICE ACTION

2/10/25

USDA TOMORROW. LONG TERM PATH FOR SUB 10% CORN STOCKS TO USE?

2/7/25

WHY WOULD THE FUNDS EXIT THEIR LONGS?

2/6/25

WHEAT FINALLY CATCHING A BID

2/5/25

COMPLETE THOUGHTS ON MARKETS: BACK & FORTH DISCUSSION

2/4/25

STRONG JANUARY LEAD TO STRONG YEAR? TARIFFS, CHARTS & MORE

2/3/25

TARIFFS PUSHED BACK

1/31/25

TARIFF NEWS ALL OVER THE PLACE. ARE YOU PREPARED FOR POSSIBILITIES?

1/30/25

WHEAT BULL ARGUMENT. TRUMP ADDS TARIFFS

1/29/25

CORN APPROACHES $5.00

1/28/25

TARIFFS, CORN FUNDS, SOUTH AMERICA & MORE

1/27/25

HEALTHY CORRECTION WE TALKED ABOUT & TARIFF NEWS

1/24/25

GRAINS DUE FOR SHORT TERM CORRECTION?

1/23/25

OUR ENTIRE NEW CROP SALES THOUGHTS & OLD CROP SELL SIGNAL

1/22/25

GRAINS TAKE A BREATHER. IS CORN IN A BULL OR BEAR MARKET?

1/21/25

HUGE DAY IN GRAINS. WHAT TO DO WITH OLD CROP VS NEW CROP

Read More

1/20/25

VIDEO CHART UPDATE

1/17/25

TRUMP, CHINA, ARGY & USING THE SPREADS INVERSE

1/16/25

OLD CROP LEADS US LOWER. MARKETING THOUGHTS

1/15/25

SIGNAL & HEDGE ALERT QUESTIONS EXPLAINED. IS $6 CORN EVEN POSSIBLE?

1/14/25

MORE DETAILS ON TODAYS HEDGE ALERT & SELL SIGNAL

1/14/25

CORN & SOYBEANS HEDGE ALERT/SELL SIGNAL

1/13/25

USDA GAME CHANGER OR NOT?

1/10/25

BULLISH USDA FOR CORN & BEANS

1/9/25

USDA OUT TOMORROW

1/8/25

2 DAYS UNTIL USDA. BE PREPARED

1/7/25

THE HISTORY OF THE JAN USDA & MORE

1/6/25

MAJOR USDA REPORT FRIDAY

Read More

1/3/25

UGLY DAY ACROSS THE GRAINS

1/2/25