BULLISH & BEARISH FACTORS DRIVING GRAINS

Overview

Great close today in the grains as both corn and beans close higher.

Soybeans rallied +15 cents off their lows after trading down double digits to start the day and posted a new high close for this move.

Wheat on the other hand continues to struggle, nearly posting a new low close.

Weekly Price Changes:

Corn: -4 cents

Beans: +12 1/4 cents

Chicago Wheat: -9 1/2 cents

KC Wheat: -23 3/4 cents

MPLS Wheat: -17 cents

Initially corn and beans saw pressure from some recent Brazil rain that is expected to fall into the weekend.

Corn got a little boost from a USDA flash sale of 125k MT to unknown this morning. This adds on to yesterday's 100k MT sale to Mexico yesterday.

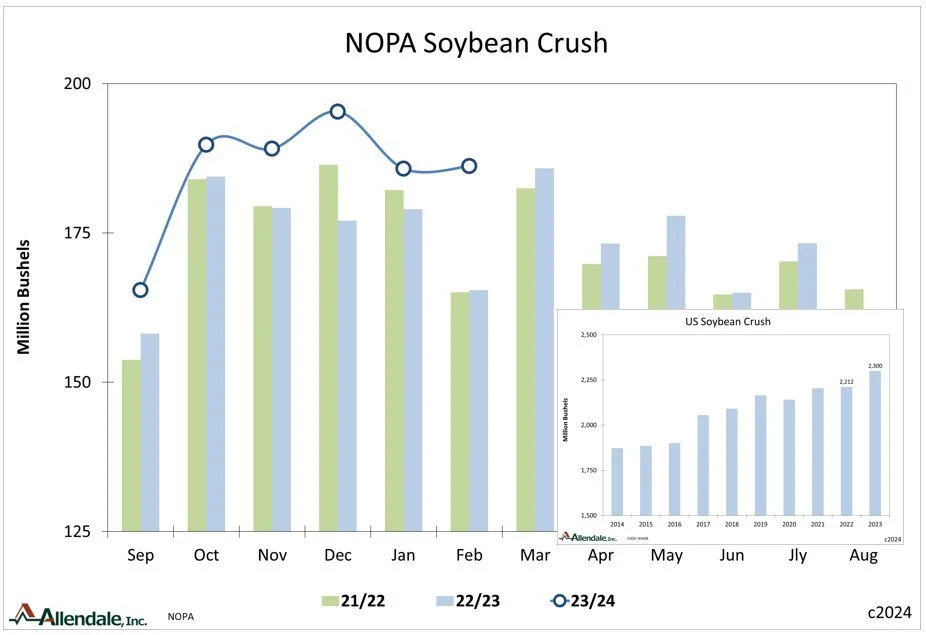

The NOPA crush report today was huge and sharply higher than expected. A record for the month. Coming in at 186.19 million bushels, far above the 178.1 estimates. A +12.6% increase from last year's 165.4.

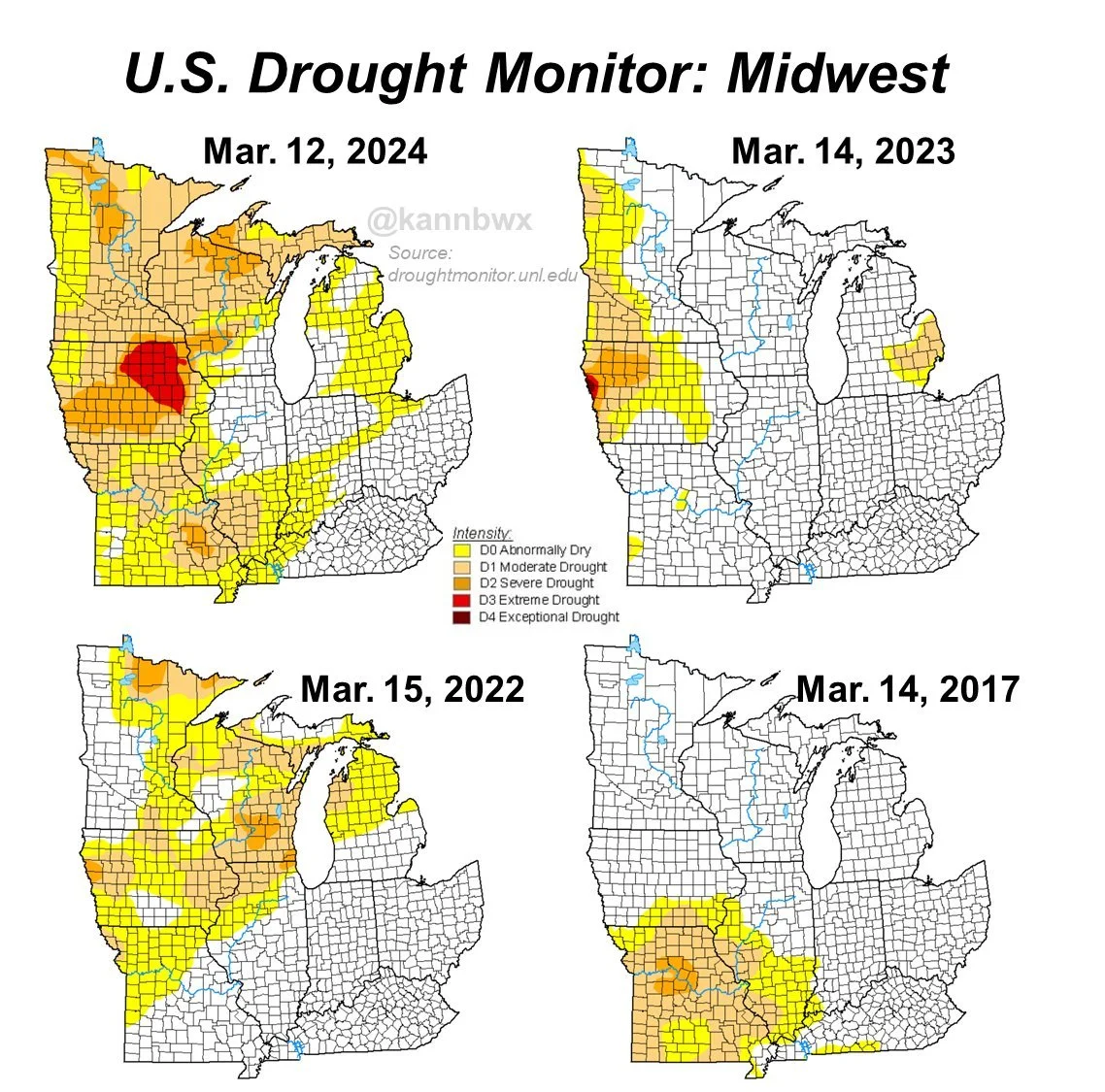

Chart Credit: Karen Braun

After this warmest winter on record that came along with very little precipitation, the Midwest is expected too see some cooler temps along with some rain over the next two weeks.

Allendale released their farmer survey for US plantings:

Corn: 93.5 million acres. Down -1.2% from 2023. The USDA has 91 million.

Soybeans: 85.8 million acres. Up 2.7% from last year. The USDA has 87.5 million.

Wheat: 47.6 million acres. Down -3.9% from last year. The USDA has 47 million.

In two weeks on March 28th we get that big report that includes the stocks report and acreage report. There is some talk that the acres could be high.

Today's Main Takeaways

Corn

A decent day for corn, as we clawed back some of the losses from yesterday. Ending the week down just a few cents. Still sitting nearly +30 cents off the first notice day lows.

Yesterday's losses was mostly technical selling and was simply this rally taking a breather in my opinion. These markets do not go straight up unless it is a supply or weather scare driven rally.

Corn Factors:

Bullish 📈

1.) Brazil Second Crop Corn

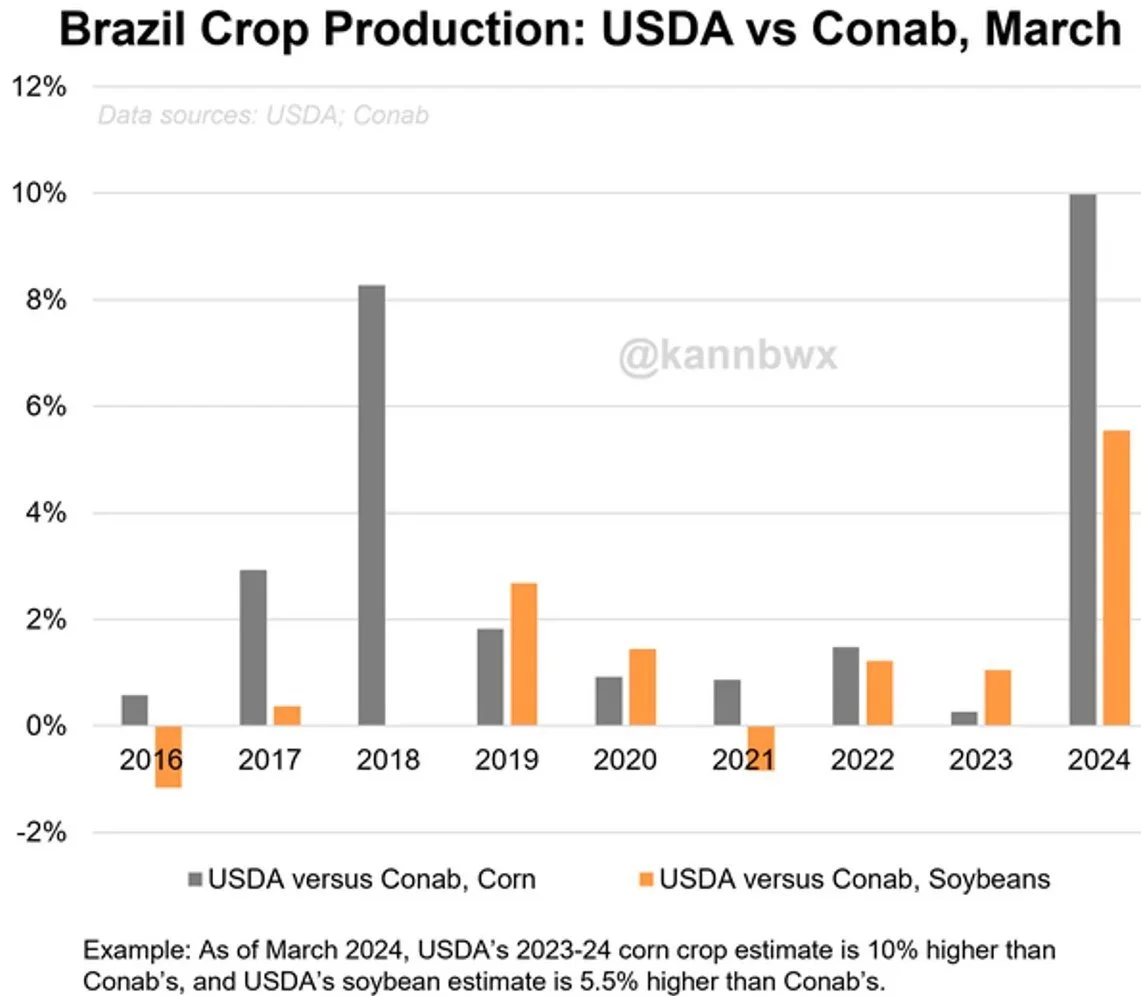

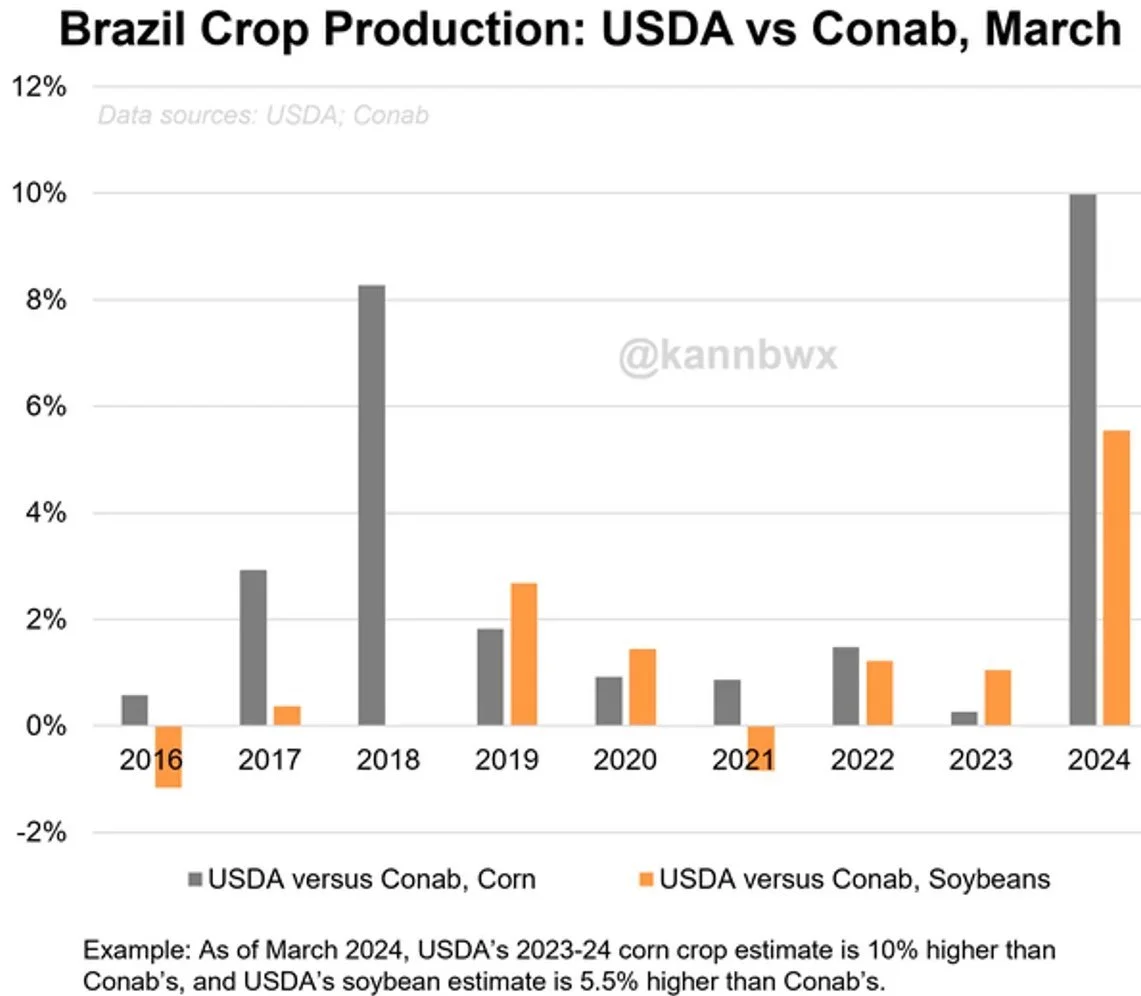

Below is a chart of the historical difference between the USDA and CONAB numbers.

The current numbers have the largest difference ever.

A massive 10% swing.

Chart Credit: Karen Braun

So perhaps the USDA is late to the game, or maybe they never wind up coming close to the CONAB numbers. Either way, this crop is getting smaller not bigger and the trend shows that.

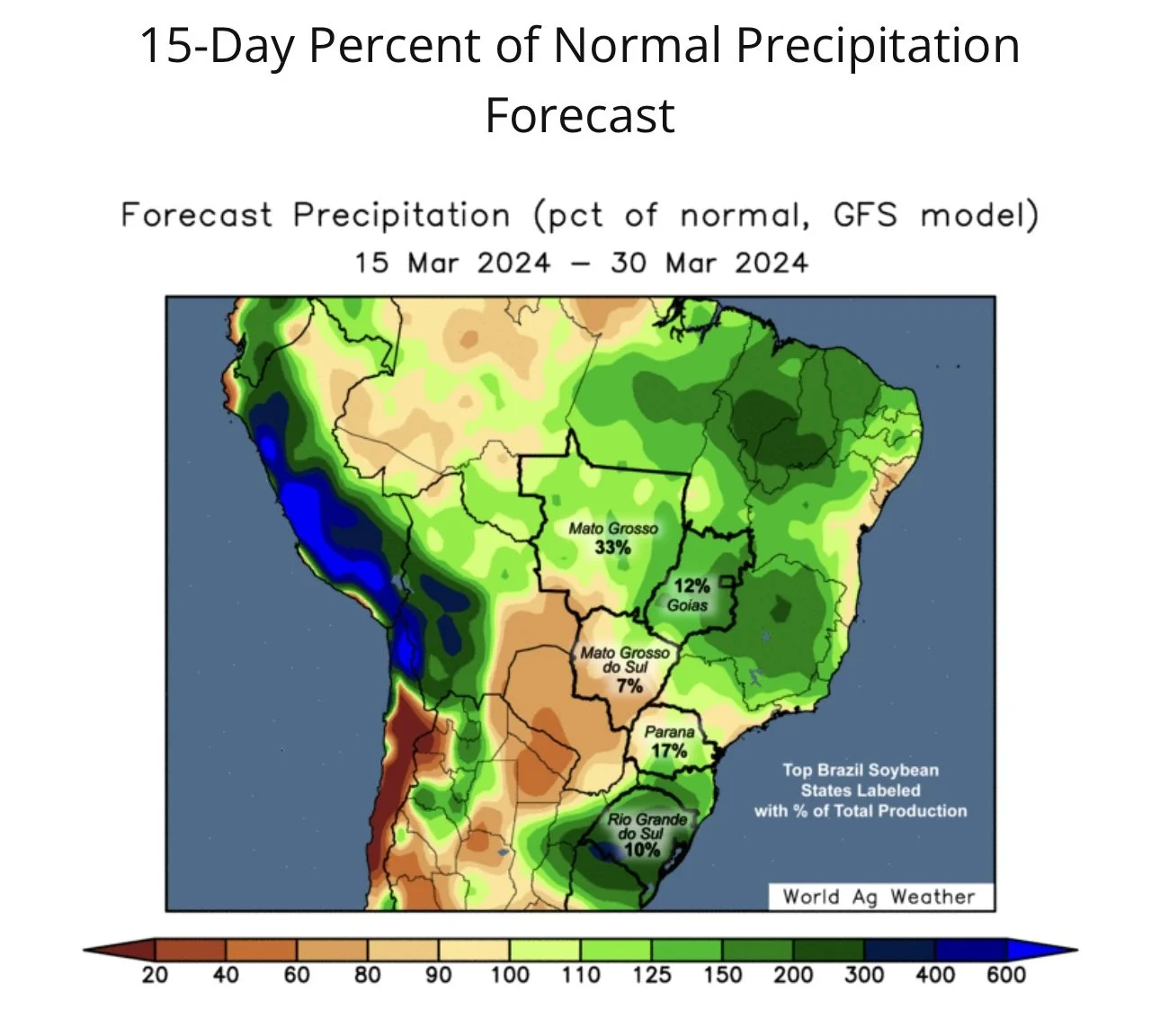

The forecasts do however show rain in the next two weeks now.

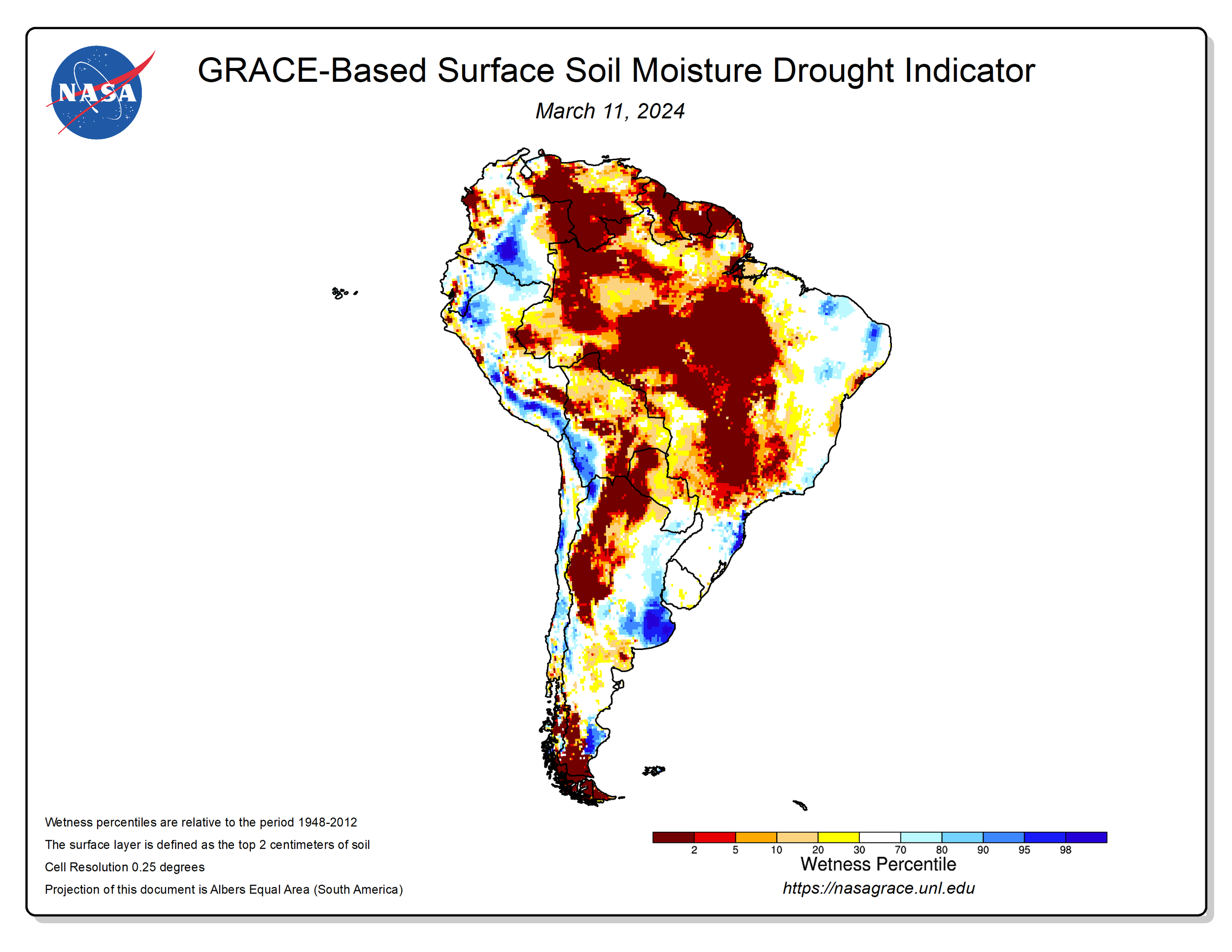

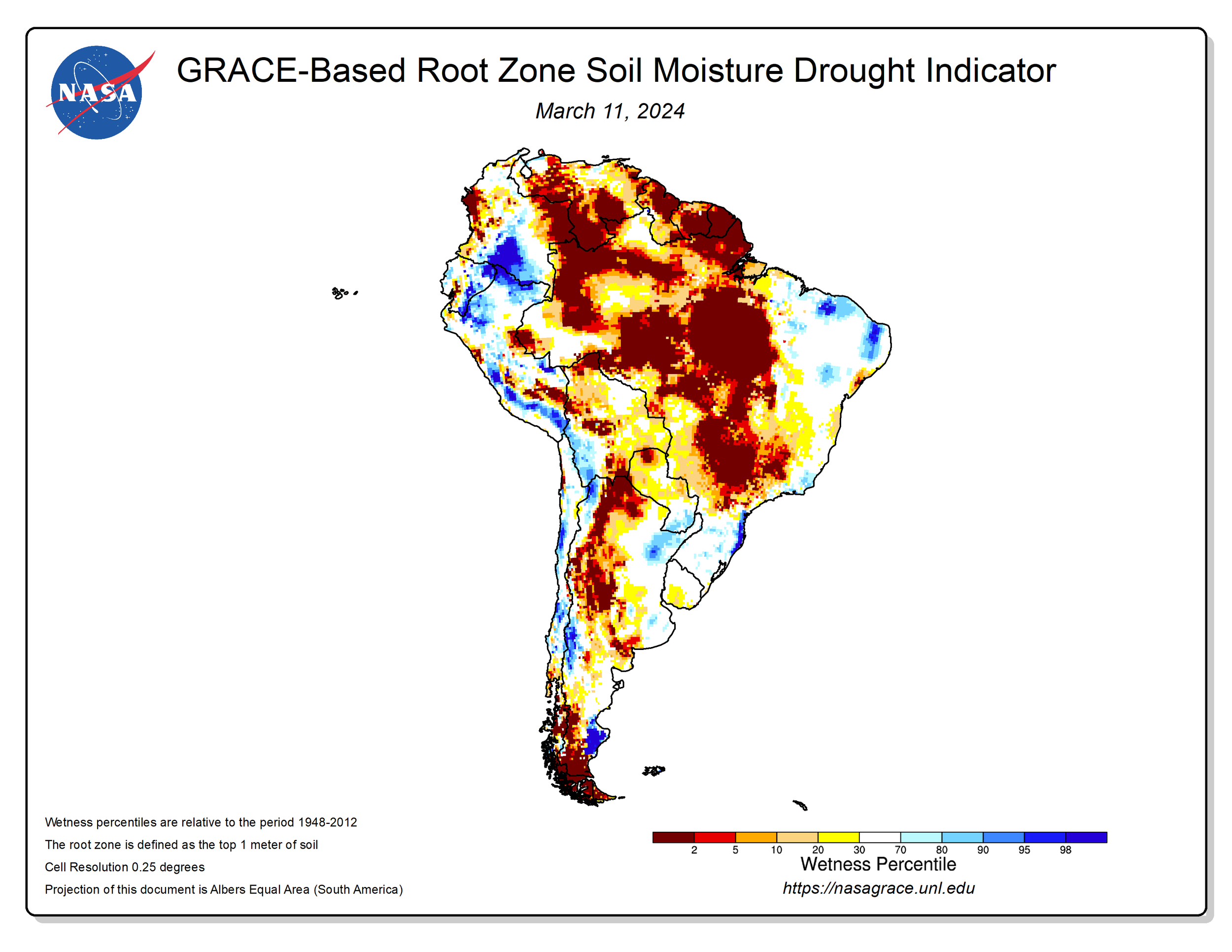

But will it be enough to make up for their already very poor soil moisture?

From 247 Ag:

"Brazil's monsoon season is forecasted to end 4-weeks early. That would be a death blow to the Safrinha crop."

Personally, I think this corn crop is a lot smaller than the USDA currently suggests.

Here is their soil moisture:

Remember in 2016, the last time Brazil faced a drought.

The market did not come to realization until April. As we made our lows in April before rallying nearly $1.00

I am not saying we will rally a dollar. No two years are the same. But there is definitely potential for this to have a positive impact on prices.

2.) Heavily Short Funds

The funds are still short around -250k contracts or more of corn.

More shorts means more room to cover. It is kind of like a rubber band.. the harder you pull, the more it snaps back.

Bearish 🐻

1.) Potential Early Planting

This has been something we have been talking about for a few weeks.

It is still far too early to make any wild guesses, but right now the forecasts as well as past weather do suggest we could have an early planting.

This means more acres and lowers the chance of a planting scare we sometimes see.

Short term, this could heavily pressure the markets. There is a chance it could even push us to new lows come spring.

More on this in the wild card section..

2.) Already Large Carryout in US

We do already have a massive carryout over +2 billion bushels.

If we were to raise a bumper crop here in the US, this would only grow.

This is more of a long term factor, but could possibly be a very negative factor if it shakes out that way. This would be one possible way we see trading in the $3's later this year.

Wild Cards 🃏

1.) Chinese Demand

We got some sale announcements this morning, but this is something bulls really need to see.

If the Brazil crop winds up being smaller than realized, it would tremendously help our exports and demand.

2.) Early Planting & Summer Drought

We touched on potential early planting being a bearish factor.

The wild card is what if it stays hot and dry after planting?

We had a dry harvest last year and a dry winter.

If it does wind up raining after we get this crop in the ground, it could be very negative for prices.

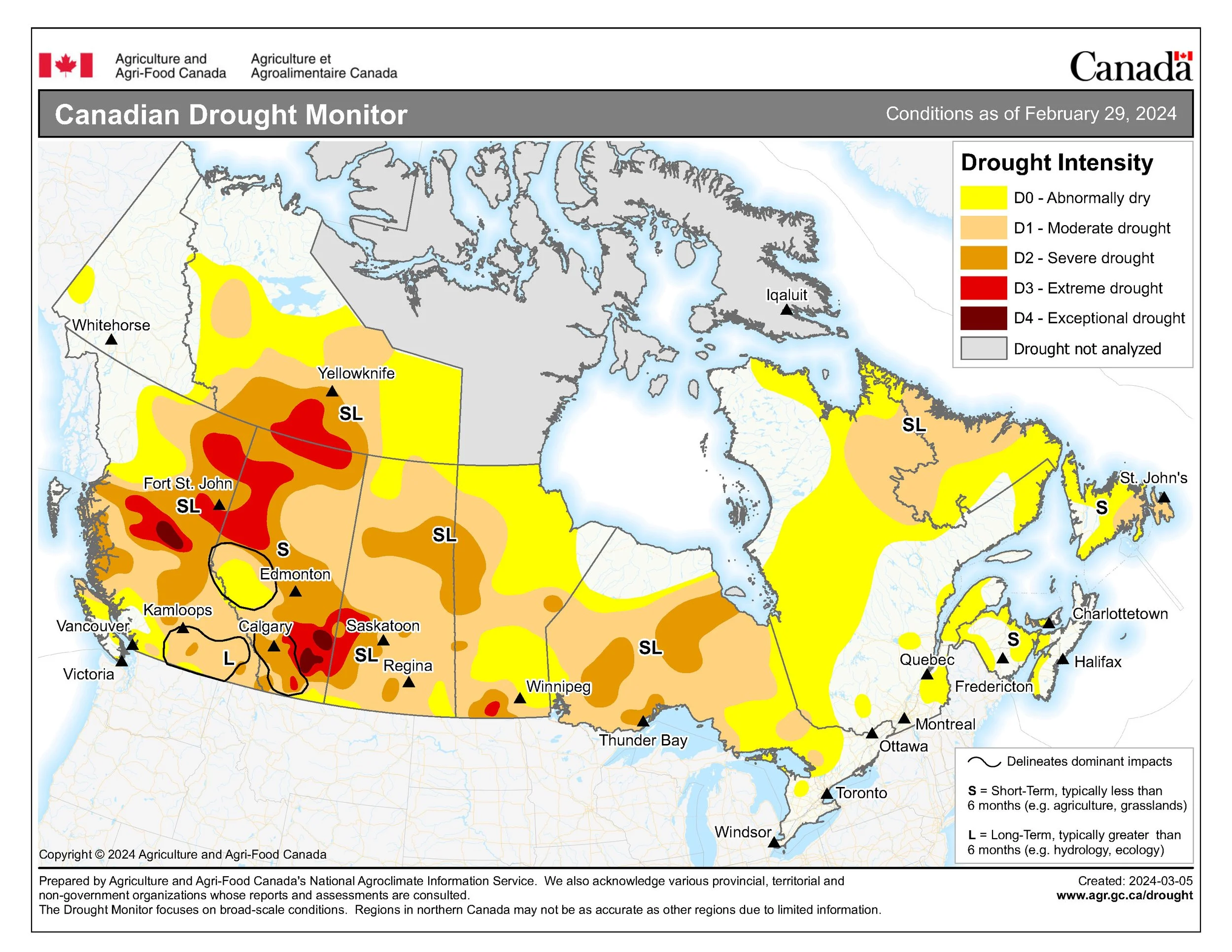

If it does not rain, took a look at how drought stricken the I-states are this year already.

This could be the difference between $3 or $6 corn later this year.

Final Thoughts:

Personally, I am not making sales here. However, if you are someone who knows you will be having to make sales in the next 1-2 months there is absolutely nothing wrong with rewarding this rally.

For some of you courage calls still make sense. For others, you should be locking in a floor with puts.

Give us a call if you want to discuss what strategy would be best for you. Marketing is not one size fits all.

Jeremey: (605)295-3100

Wade: (605)870-0091

The way I still see prices shaking out this year are as follows:

We grind higher for a few weeks. If planting gets going early with no problems we take it on the chin pretty hard. Then the market realizes we are planting fast and early because it is dry. This could very well bring drought talk and a weather scare rally. What prices do after that will come down to if the drought sticks or if we get rain.

Technicals:

The corn chart still looks somewhat friendly. We broke that downtrend from June and have now created a short term uptrend.

Corn May-24

Soybeans

What looked like would be an ugly day for soybeans, turned into a great day.

We only closed up +3 cents, but we rallied +15 cents off the early lows. Posting a new high close for this rally.

Soybean Factors:

Bullish 📈

1.) NOPA Crush

As mentioned, this blew out expectations. Setting a new record for the month.

This was a whopping +12.6% increase from last year.

The YTD pace is +6% higher than the USDA's current view.

If this continues we could exceed the USDA's goal by 48 to 69 million bushels.

2.) Uncertainty in South America

As we pointed out the other day, the CONAB's Brazil bean estimate is a massive 8.1 MMT lower than the USDA's.

146.9 vs 155

This discrepancy is nearly the size of our entire US carryout.

The USDA and CONAB do not always agree. But this is more than double the next closest difference.

Nonetheless, the trend for this crop is smaller.

Here is the chart again.

3.) US Carryout

We already have a fairly tight balance sheet here in the US unlike we do in corn.

If we have a sub-par crop this year, this would only escalate.

4.) SAF (Sustainable Aviation Fuel)

This is more of a long term factor, that may not even make much of a difference this year. But looking long term could be a very friendly factor.

Our crush has been setting a new record month after month and I look for this to continue to grow.

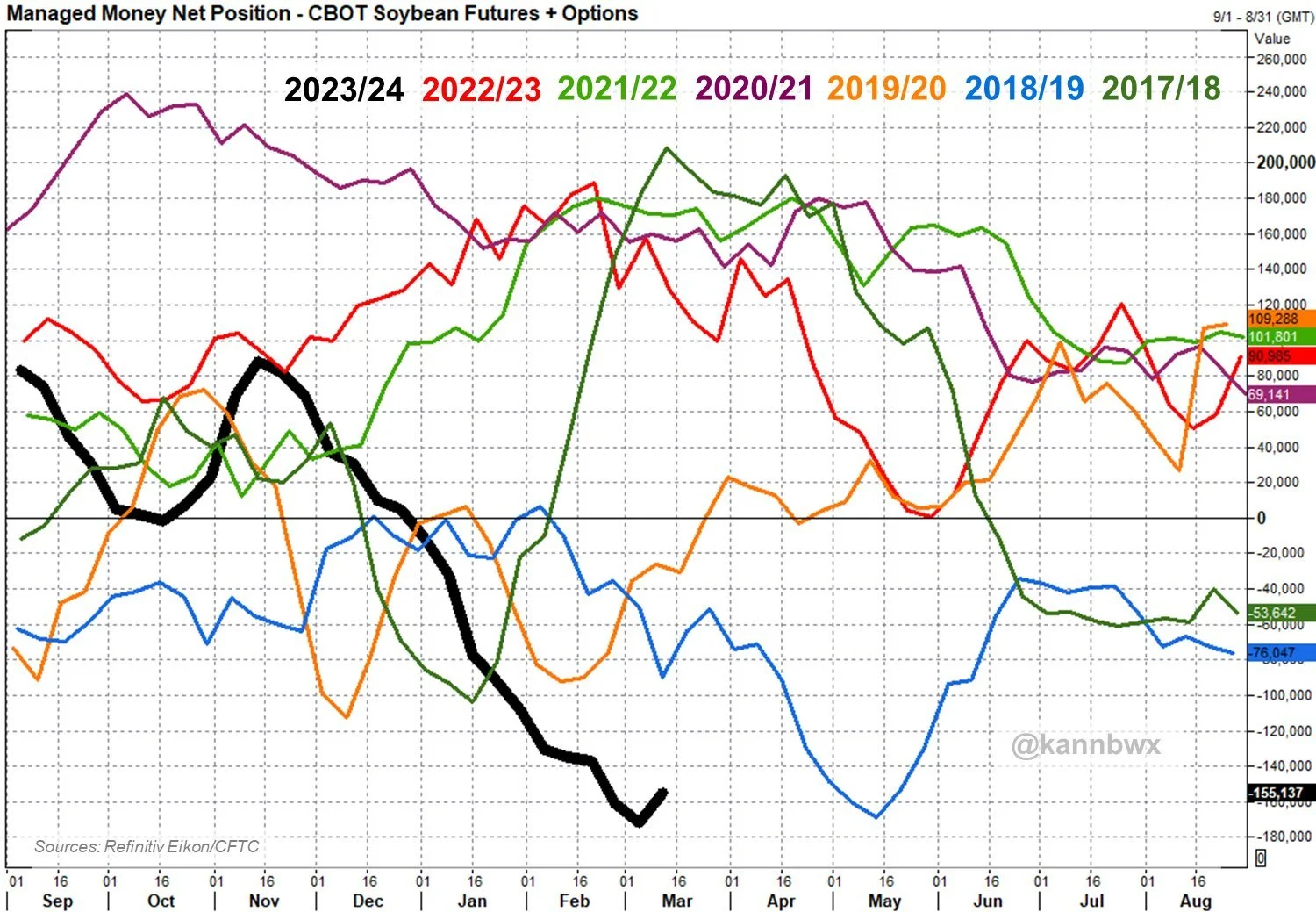

5.) The Funds

Just like in corn, the funds just held the largest short position of ALL-TIME in soybeans.

They are still short plenty, which gives them all the more power and room to buy.

The record fund selling in beans came to an end this week.

They were buyers for the first time in 17 weeks.

They covered just 17k contracts of their 172k shorts, and prices rebounded +70 cents.

Chart Credit: Karen Braun

Bearish 🐻

1.) More Potential Acres in US

The early survey from the USDA Outlook showed a little more bean acres and less corn acres.

The survey had 86.7 vs 83.6 last year.

Wild Cards 🃏

1.) Chinese Demand

Just like for corn, this is something bulls need to see.

If the crop is indeed smaller than realized in Brazil, this could lead to more business for the US.

China is however expected to import more soybeans than ever this year. Hopefully we can grab the business.

Final Thoughts:

There is absolutely nothing wrong with rewarding a +70 cent rally. Especially if you know you are going to have to move something soon.

I still believe we have a lot of upside potential in this market and now is not the time to be typically making sales.

Give us a call if you have questions about marketing, adding floors, or anything else. (605)295-3100.

Technicals:

The soybean chart still looks pretty good. We have cleary broken the downtrend. We are sitting right at that $11.98 retracement level I have been talking about. Often times these levels act as magnets. However, if we can get a clean close above $12 the next upside target is $12.40 (our next retracement level). Remember, soybeans hate trading in the $11's.

Soybeans May-24

Wheat

Disappointing day for wheat as we nearly make a new low close. Closing right at our previous lowest close of $5.28 1/2.

We opened higher, but right when the funds started buying beans they started selling wheat. As we closed -9 cents off the highs.

China cancelled over 500k MT of US winter wheat purchases. They also canceled wheat purchases from the EU and Australia.

Why?

The talk is that they are planning on buying a lot of Russian wheat this summer and have enough to get by until Russian harvest starts in July.

Wheat Factors:

Bullish 📈

1) World Carryout & Consumption

In the last USDA report the world carryout for wheat was the lowest in 8 years.

This is also the 4th year in a row where the world has consumed more wheat than it has produced. How long can this trend continue before it makes a difference?

2.) Canada Drought

This is still something to keep an eye on.

3.) Spring Wheat Acres

Spring wheat is probably losing some acres versus other commodities. Another thing to keep an eye on.

We are in a time where sometimes commodity prices will move to try to draw in acres, right now it doesn't look like spring wheat acres are gaining any acres over cotton.

Here is the cotton chart.

Bearish 🐻

1.) Russia Supply

Russia is still sitting on a stockpile of cheap grain. With expectations that they will have another large crop.

This has been the number one thing keeping a lid on wheat.

2.) Better Winter Wheat in US

The crops are a lot letter than they were last year, and it's not really close.

Wild Cards 🃏

1.) War in the Bread Basket of the World

Even though this is mostly a nonexistent factor these days. Always still has the potential to shake things up.

Final Thoughts:

We are still in a time frame where there just simply isn’t a lot of factors or news surrounding the wheat market. Sometimes a lack of news leads to lackluster price action.

This wheat market is still a sleeper. I am not saying prices have to go up on your time table next week, next month, or even a few months from now. But looking long term there will be a catalyst that provides a pricing opportunity. Until then I'm remaining patient.

Technicals:

After posting a key reversal early in the week, the technicals do not look good. We posted a new low close, which could bring in more technical selling if we don’t bounce soon.

May-24 Chicago

May-24 KC

Cattle

Not much new for the cattle market.

Rally looks to be stalling. Feeder cattle broke the upward trendline while live cattle is sitting right above it looking to test. Some "potential" signs of a top but I haven’t seen any confirmation yet.

As I have been saying for a few weeks, I like taking risk off the table here. We could certainly go higher but it's smart risk management.

If you want to discuss different strategies to use please give us a call (605)295-3100.

Live Cattle

Feeder Cattle

Want to Talk?

Our phones are open 24/7 for you guys if you ever need anything or want to discuss your operation.

Hedge Account

Interested in a hedge account? Use the link below to set up an account or shoot Jeremey a call at (605)295-3100 or Wade at (605)870-0091

Check Out Past Updates

3/14/24

ARE YOU COMFORTABLE WITH THIS VOLATILITY?

3/13/24

RALLY TAKES A PAUSE

3/12/24

CONAB A LOT SMARTER & SMALLER THAN USDA

3/11/24

CORN 4TH DAY HIGHER & KEY REVERSAL IN WHEAT

3/8/24

USDA RECAP: POOR REPORT, GREAT REACTION

3/7/24

CORN TECHNICALS TURNING BULLISH. PREPARING FOR USDA REPORT

3/6/24

CHINA CANCELS WHEAT? RUSSIA SELLING WHEAT TO FUND WAR

3/5/24

NEW LOWS IN WHEAT & USDA BRAZIL ESTIMATES

3/4/24

IS CHINA HUNGRY FOR CHEAP GRAIN?

3/1/24

FIRST HIGHER WEEK IN MONTHS

2/29/24

HOW TO USE TARGETS VS TRIGGERS

2/28/24

BIGGEST 3 DAYS IN CORN SINCE AUGUST

2/27/24

DID CHINA BUY CORN YESTERDAY?

2/26/24